Executive Summary

Most companies that manufacture personal computers have shifted to design, production, and distribution of portable PCs such as laptops. The current market is now filled with some companies that portray neck-to-neck completion for customers. The leading multinationals that produce laptops include the Apple Inc., Dell Inc., Hewlett-Packard, Acer Inc., Lenovo Corp., and the Toshiba Company among others. Advanced technology in the computer industry has led to increased competition amongst the players of the industry. This situation has greatly influenced the spending patterns of consumers and product cycle among others.

Most of the laptops that survive in this competitive market have a notable profitability that depends on the vast and efficient supply chains. Some of these companies also manage to beat their competitors through frequent release of new products that are unique. Others companies rely on a large and extended marketing advantage owing to excellent budgeting, and efficient sales and manufacturing channels among other factors.

Currently, a core shift in diversification of products is experienced in the companies that produce laptops. Various innovations have improved the technology of tablets, notebook-tablet hybrids, and clamshell laptops among other devices. Such devices have become extremely versatile, super-light, and come in a variety of shapes and sizes. The current trends in the laptop industry indicate an increase in the retail chain. The overall increase of laptops in the retail industry was approximately 27-percent in 2014. The growth of the laptop industry is attributed to various success strategies and competition parameters that are adopted different by companies.

Introduction

A laptop pc is a small computer that can be carried and placed on an individual’s lap. The first laptop (Osborne 1) was launched in 1981. The second generations of laptops became immense in the 1990s due to the increased availability of hardware and software utilities that can be easily used to run such computers. The laptop market is still broadening due to increased price ratios, affordability, and globalization regardless of its large size. Above all, dynamic technology has led to innovation of superior products that are characterized by increased performance. Such devices have integrated high-speed processors such as the Intel and AMD Turion among others.

Consumer preferences and the durability of the products among other factors also influence the size of the computer market. The industrial analysis is aimed at determining the features of the laptop industry. It will focus on the brand names, existing integrations, R&D suitability, PC models, production and marketing strategies, and market prices among others. Another aspect that will be examined in details includes the SWOT analysis of the various laptop industries that will highlight their competitive positions, strengths, and range of products that they offer.

Laptop Industry Dominant Economic Characteristics

Scope of Competition and Rivalry

The global computer market has increasingly become competitive to the existence of a number of rival companies such as the HP Corp., Dell Inc., Acer Corp., Lenovo Corp., Toshiba Inc., and the Apple Inc. among others. Shah and Dalal reveal that these companies account for about 60-percent of the market share based on shipment per unit (4).

A crucial factor that has enabled the various laptop companies to dominate the computer market is the development of brand reputations, customer loyalty, and frequent innovation (Shah and Dalal 3). For instance, the Hewlett-Packard (HP) Company is a giant multinational in the personal computer industry that achieved about 19.6 percent market volume in 2009. The Acer Inc., whose global market share rose to approximately 12.6-percent in the same year, took the second position (Datamonitor 13)

Market size

Presently, the personal computer market is growing fast due to factors such as demand and shifting technology and globalization among others. This situation accounts for the increased market size. For instance, in 2013, approximately 80-percent of the US families had either a laptop or desktop computers. This fact was underpinned by the increased use of internet in about 74-percent of the households (File and Ryan 2). The retail market size in the global scenario is fragmented. Small retail companies also dominate it. Shah and Dalal attest that a threat of increased popularity and introduction of tablets among other component products will lead to stiff competition in the near future (1). This situation is likely to congest the market; hence, it will reduce the share for individual companies.

Distribution Channels

The distribution process that is mostly adopted in the laptop industry is based on direct retailers that utilize internet and physical channels as well as distribution partners (Shah and Dalal 4). An example is the HP Company that utilizes partners and retail distributors. Shah and Dalal also reveal that the Apple Company primarily uses both online and retail stores in different geographic regions worldwide (2).

Product Characteristics

Many laptops that are released to the market vary in characteristics among different strategic groups. However, Shah and Dalal confirm that such PCs exhibit some similarities in internal design and software features (4).

Characteristics of Economies of Scale in the Industry

The laptop companies boast of the economies of scale due to dynamic technology that has led to amplified production and distribution of more laptops worldwide. The costs of production are also lowered due to the advantages of mass production (Shah and Dalal 4). Therefore, productivity efficiency is improved; hence, relatively higher profits are realized. The frequent reduction of the average production costs in the companies has also ensured their exploitation of the economies of scale in their internal business environment (Shah and Dalal 3). The long-run cost average of most companies in the laptop industry is always reduced due to the increased output.

Therefore, improved economies of scale are realized. For instance, the HP and Apple Companies opted for the least-cost means of production for a longer period. These companies have to move down the long-run average cost to ensure a larger scale of operation. The laptop companies have also benefitted from the economies of scale in production due to proliferation of tablet PCs in the market (Shah and Dalal 1).

History of Profitability

In the recent past, low profit margins have been exhibited among the various companies due to the introduction of tablets together with laptops in the market. Companies such as the Apple Company that have gained market shares due to tablet sales will experience increased returns due to the sale of secondary products (Bagchi and Udo 46). In the recent past, Bennett reveals that companies such as the Apple Company have constantly maintained health profit margins (5). However, the Dell Inc. has been dominating the profitability margin. The profit margins realized by the Apple Company are relatively low due higher expenses. In summary, the overall profit margins of leading laptop companies have been decreasing since 2004.

Table 1: Gross profit margin summary in percentage from 2000 to 2004.

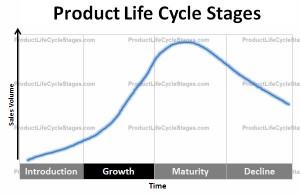

Growth Rate and Life Cycle

Shah and Dalal reveal that the laptop industry has tremendously experienced a higher growth rate in the past decade due to amplified technological advancement and high consumer demands that have compelled the firms to reduce the prices of their devices (2). The industry is currently under a consolidation stage where the growth is not relatively faster than the existing economy. Nonetheless, there is a tremendous change in the models that suit the emerging high-end markets in developing nations such as India and China due to the immense technology improvement.

Various challenges that the industry faces include increased competition, reduced prices for the laptops, and varied market approaches among others (Shah and Dalal 1). The benefits include cost reduction through the various economies of scale and efficient channels of distribution. There is also an increase in consumer awareness of their needs and increased profits in the industry.

Price and brand recognition

Shah and Dalal reveal that many laptop companies offer similar prices due to strategic groupings. This state of affairs has resulted in utilization of the available opportunities in a comparable manner (4). For instance, the Apple Inc. and the Sony Inc. have adopted a strategy that is based on pricing. The companies also have an advantage of strong brand image. The only difference is seen in the branding approaches that are used by both companies.

The Sony Corp. adopts umbrella branding that enables it to use both the product brand and name simultaneously as evident in the Sony Vaio. The umbrella technique enables the company’s products to position themselves in the market whilst maintaining their identity. Although such factors are important in market setting, both the Sony Corp. and the Apple Company base performance on constant innovation, marketing, and product differentiation (Shah and Dalal 4). The market niche for both companies is vital for the production of a variety of higher quality products that are unique and different from those of the rival companies that also rely on price-based competition.

Robust price-based differentiation and market positioning techniques have been implemented in companies such as the HP Corp., IBM Inc., and Dell Inc. among others with a view of gaining a competitive advantage over other players in the industry (Shah and Dalal 3). The competition depends on price modeling, quality of products, and identity of brands rather than diversification. Other factors include integration that is based on horizontal techniques owing to the prevalence of high skills and concentrated market.

Industry Analysis and Trend

There has been a quick and aggressive growth of the laptop market in last ten years. The number of households that use laptops has tremendously increased. This situation has resulted in more consumer demands. The affordability of laptops has been made easier due to a drop in prices in the retail outlets (Datamonitor 15).

Laptop Market PEST Analysis

Political Factors

The governments of these countries play a critical role in ensuring increased development of different types of infrastructures that amplify the need for computers. This move is viewed in terms of policies that favor the growth rate of the computer markets. Government policies such as removal of duties can enhance the development of the laptop industry in these countries. An example is seen in India where the government waived the import duty on laptops and related devices in 2005. This situation resulted in the growth of the laptop industry in the country by about 90 percent (Schmid et al. 5).

Political factors are also deemed to increment the prices of laptop products. Various environmental regulations address the impact of dumped electronic gadgets on the surroundings. This situation has heightened sensitization to certification laws by the RoHS and WEEE. Due to these regulations, producers also experience low profitability in the laptop industry (Schmid et al. 5).

Economic Factors

According to Schmid et al., a dwindling economy in the global interface has led to a reduction of business operations owing to inadequate capital and declining demand for products in some parts of the globe among other factors (5). Shah and Dalal posit that there will be reduced spending on laptops and related devices in the near future (2). However, there is also a possibility of a slow increase in sales owing to saturation of similar products in the PC market (Schmid et al. 5). The decline is noted in market values. It is noted that companies such as the Dell, HP, Acer, Lenovo, and the Apple Inc. will be affected due to their vast retail chains in different parts of the world. The change in currency value of other countries where the retail shops are located based on the US dollar is highly considered (Schmid et al. 5). Laptop multinationals that have retail locations in countries such as China, Brazil, India and the Latin America will benefit significantly from the improved growth rates in their economies (Schmid et al. 5).

Social Factors

The PC market is also influenced by societal landscapes. They compel various laptop companies to design explicit criteria of operations in different localities (Schmid et al. 6). For instance, education is known to influence the perceptions of laptop brands. The income levels of different consumers also determine the ability to purchase a laptop. Most companies that take into consideration such factors are currently commanding the laptop market (Schmid et al. 6). For instance, the Apple Company has adopted a premium pricing strategy that has increased its command of the laptop market.

The level of education also determines the demand for computers. Educated consumers are conversant with the current technology. As a result, they are fond of purchasing gadgets that are supported by versatile applications such as laptops and tablets (Schmid et al. 6).

Furthermore, the cultures of different communities also influence the performance of laptop industries in various markets. In this case, back-to-school and festive seasons among different cultures influence the demand of laptops, especially in the USA; hence, most companies expect greater sales (Schmid et al. 6).

Technology Advancement

Technology has significantly contributed to the growth of the computer industry. This situation has also affected the market share of many laptop companies. Most of the firms are currently developing laptops that have higher processors and standardized operating systems among others that are relatively affordable to consumers. There has been an improvement in the development of efficient networks due to technology. As a result, more consumers can buy laptops. The networks have facilitated online transactions without the physical presence of consumers in most laptop companies (Bresnahan and Shane 40).

Laptop Market & Porter’s Six Forces Model

Threat of New Entrants

Most of the new entrants in the laptop industry face problems of pricing and initial cost. To feature well in such scenario, a company that can manage to the entry and maintain the competition must have a well based financial resource investment. Investment criteria must be factored in highly skilled personnel, R&D among others for effective management of these enterprises (Porter 28).

The entrants majorly succeed in the market through innovation of new products due to dynamic technology that exist. The companies can receive funds or capital from donors and/or investors upon inventing new and use-friendly gadgets. This situation favors entry into new markets. For instance, ASUSTek introduced the netbook in 2007. This gadget penetrated the market because of increased consumer demands at the time. Furthermore, the new product had not featured in the market earlier. The netbooks enabled the ASUSTek Computer Inc. to gain a growth rate of about 103 percent by 2008 (Porter 27).

Most of the laptop companies have significant scales in consumer marketing, good supplies, and quality research personnel that enable them have upper hand economies of scale (Porter 27).

Gaining consumer loyalty is also hard for market entrants. Most of them spend a lot of money on advertisement to ensure good brand identity, higher quality services to consumers, and uniqueness of their various products. Various management regimes of the Apple Company between 1980s and 90s had implemented the techniques. The company earned $11 billion sales annually. The overall spending in advertisement also increased owing to its new products in the market (Porter 27).

The Apple Company boasts of a sizeable market share due to product customer loyalty, product differentiation, and superiority. Various products that the company launched in the market recently include the MacBook and MacBook Pro sub-brand that targeted professional consumers, consumers that value portability of products among others (Porter 27).

Another company is Sony whose bulk of budget was aimed at advertisement of products that aimed at targeting lifestyle consumers. The Vaio laptop that was introduced to the market by the company good features that were fashionable; hence, women consumers were fond of the company’s laptops (Porter 29).

Entrants also have a challenge of coping up with the undefined channels of distribution; in fact, most of them are unable to bare the higher costs in defining the best distribution channels for their products. Firms such as the Apple Inc. can only manage the problem of distribution to the vast global market by implementing or conducting direct sales to consumers via mails and virtual retail shops. The distribution methods and techniques are not static. Companies such as the Dell Inc. had to go to an extent of using third-party retail shops to distribute their products effectively (Porter 30). The main barriers for new entrants include economies of scale, the high financial base for capital, limited accessibilities to distribution channels, degree of product differentiation, and various policy boundaries in the market (Porter 30).

Substitute Products in the Market

Substitute commodities play a critical role in defining the prices of laptops. Various substitutes for laptops include smartphones, desktops, and tablets among others. The functionality of various phones is almost similar to that of the laptops (Porter 30).These gadgets are portable and can be utilized in diverse environmental settings. An advantage of a laptop over the phones is its ability to offer services of navigation in a website. The availability of the service is underpinned by a larger display, high-speed CPU, and memory system. A substitute that is currently threatening the laptops is the tablet. This device offers both functions of a PC and smartphones. However, its disadvantage is brought about by its fragility. They are also prone to malfunctioning when compared to a laptop (Porter 32).

Another threat that the laptop industry is currently facing is cloud computing. This technology leads to a reduction using high power computing in laptops. The advent of 3G and WiMax among others has diversified the use of smartphones; hence, completion is given to laptops due to the similarity in their abilities and functions (Porter 33).

Rivalry among existing Firms

A competitive rivalry is currently at its height based on pricing, introduction of new products, advertisement, and improved quality service delivery among others. The laptop industry is currently categorized under mature industry. There is a tendency whereby the prices of laptops reduce significantly. A downtrend in pricing thus will result consolidation to ensure coast development (Porter 36).

An issue of standardization of various product or laptop prices has ensured a slow shift of costs. The competition is based on the pricing strategies instead of focusing on product differentiation. Other laptop companies also face competition on differentiation of products; hence, they have to offer premium products rather than issuing lower laptop prices. Other companies have also followed a criterion of balancing the capacity and demand so that their prices remain at the same level for a longer time (Porter 36).

Different companies mostly offer hardware devices such as microprocessors, expandable memories, and graphics cards among others. Other companies such as the Microsoft Company have focused on development of computer software for a broad range of devices. In most cases, the prices of laptops are influenced by such companies due to various products and services that are put together to complete a laptop computer. For example, Intel Inc. manufactures wide-ranging computer chipsets. As a result, its pricing strategies significantly affect the cost of the final products since many PC companies use its products (Porter 30).

Buyers’ Power of Bargaining

Consumers have considerable bargaining powers over laptop manufacturers. Most laptop sales are a combination of volume purchases from businesses. These consumers also have a bargaining power since they play a crucial role in dictating the demands and buying techniques (Porter 30). The decisions of consumers are determined by the economic factors at the time of purchase. When the economy status is not favorable to most of the buyers, a decision not to buy laptops is likely to be made due to money constraints. This situation evidences that economic conditions influence the buying decisions of most consumers (Porter 33).

The development of portable computers has led to a decreased demand for desktops. Customers are gradually changing their behavior. This situation can is likely to affect the computer markets significantly in the near future (Porter 33).Companies that offer laptop components such as software, microprocessors, and graphic cards among others have the bargaining power; hence, they can determine the prices of the final products (Porter 33).

Suppliers

Suppliers face competition amongst themselves in the event of gaining the market share. For example, there is an immense competition for market share between Intel and AMD. The Intel Company has a bit of competitive advantage over the AMD; hence, most laptops with the Intel products are seen to be more expensive as compare with those that have the AMD chipset. Other companies such as Samsung and Seagate among others have poor branding techniques. Most of the laptop companies have advantage of choosing from many suppliers. Therefore, it is upon the suppliers to regulate prices that are affordable to maintain their competitiveness (Porter 33). Suppliers only have bargaining power in the markets that they dominate. An example is the Microsoft Company that deals in the software system. It easily exercises its powers over the personal computer manufacturers by offering higher prices to its products (Porter 34).

Complementary Products

There has been increased design, development, and production of similar products in the computer industry. For instance, the Microsoft Windows has been facing software counterfeiting whereby various versions of the operating system have been developed. This situation has led to a decline in profits to not only the Microsoft Company but also the laptop industry. These goods lead to the increased pricing of laptops to the consumers due to their ability to offer more values and qualities to consumers (Porter 37).

Key Success Factors

The key success factors are the most important aspects that affect the industry. They determine the capacities of the industry players to command or perform better in the market. Some elements that a company must consider include strategies, product, features, available resources, competitive capabilities, and the outcome that proves increased returns. The key success factors are a loss to the guidelines that determine the victory or failure of a company (West 22).

The laptop industry also has some crucial success factors and their interactions. The interactions between technology and economic aspects among other aspects must be favorable to ensure a fair competition and performance of each company in the laptop industry (West 23).

For instance, suppliers favor an integration that is horizontally based to ensure that maximum control exists in the industry. These suppliers have enough resources to provide value; hence, such companies can fail to penetrate the PC market. An example is the HP Company that has enough resources to conduct its own business rather than to starting to manufacture microprocessors and graphic cards since the company is only a maker of laptops, but not a component manufacturer (West 23).

The Apple Company has strived to dominate market share due to its effective utilization of its brand name together with innovativeness, quality, lifecycle of its products, and development Apple RetinaTM screens that account for the company’s competitive position in the computer industry (West 23). An aspect of relationship also plays a critical role to the success of most laptop companies. The relationship provides room for horizontal integration due to the existence of immense skills among the personnel in the various companies. The issue of relationship also exists among the buyers that pile pressure on the prices of commodities thus can determine the profitability of the laptop industry (West 23).

The buyers’ dynamic needs together with constant change in technology and stiff competition have led to an increased rate of innovation and improved laptop products with latest technology versions. This situation is evident in the latest scene where most laptops currently possess the LED screens rather than the older version LCD monitors (West 22).

Laptop Industry Changes

Laptop industry at the global level has exhibited a tremendous change due to the following factors.

Competition for the Market Share

The PC market has been dominated by five giant companies namely HP, Dell, Acer, Lenovo, and Toshiba (listed in the order of decreasing shipment) that contribute to about 60 percent of the industry sales (Shah and Dalal 4). Other companies dwell on brand reputation and product quality that ensure customer loyalty instead of relying on shipment as a factor to dominate the market share. A good example is the Apple Company that relies on brand quality and reputation to woe its customers.

These companies also scramble for market share at the global level based on increment in volumes. An example is the HP company that dominate the market by 18.9 percent in the year 2008 followed by Dell with 16 percent in the same year. Improved innovation of new products in the market has also enabled other companies such as ASUSTek and MSI to increase their market share by introducing netbooks. The Apple Company is currently increasing the market shares due to the invention of the Mac series among others thus its boom emanated in the recent years (Bresnahan and Shane 40). The following table shows global PC shipments in 2011.

Table 1: Showing the Market Share Distribution in terms of Shipment in 2011.

Lean production and good distribution

Most of the laptop companies have realized that too much cost is incurred in the production process. The costs of production have been reduced through the improved procurement patterns and processes and the supply systems. Most companies have benefitted from this situation through mass production and distribution networks that are efficient and favorable.

Technology advancement and innovation

Change in technology together with the ever-changing consumer needs and preferences have made most of the managers of laptop companies to think outside the box. Various companies are currently inventing new laptops with features that suit consumer needs as well as surpassing their expectations. Technology and innovation have also enabled these laptop companies to design some unique techniques such as consolidation that has enabled the expansion of larger enterprises further (Shah and Dalal 4).

Laptop Market SWOT Analysis

The analysis of the laptop companies at this section is broadly viewed on various strategic groupings. Companies such as HP, Dell, and IBM are stable because of the set boundaries that are minimal and limited. Establishment of limited operational frameworks has led to development of a stable market. These companies due to their rigidity in not enabling the boundaries to be limitless face a bigger problem in terms of barrier that exists (Bridwell and Chun-Jui 116).

The companies incur higher costs in terms of movement from one group to another or when changing their position in a market set up (Bridwell and Chun-Jui 116). To change positions in market, the companies have to incur expenses in pend on advertisement, making brand portfolios and products, laying strategies that can work establishment of a market niche, and producing higher quality products among others (Bridwell and Chun-Jui 117).

Various companies in the computer industry have adopted different means of competing. For instance, due to research and innovation, the Apple Company introduced a Macintosh LC that had an expansion slot for the Apple IIe card to enable people to use the Macintosh series, laptops with software systems that are professional, high quality retina screen, creative designs, quality in brand image, and identity of brands (Bayus and Robert 204). Sony has focused on umbrella branding strategy that allows for a shift in brands and identity to new products among others. Both companies have a global geographical area where they operate. The Dell Inc., being a computer maker rather than a manufacturer, has an advantage of focusing on marketing and logistics. However, a disadvantage is experienced when the company encounters a difficulty in switching its dealers due to its tendency of relying on one supplier (Bridwell and Chun-Jui 116).

Due to high competition in the market, the laptop companies have strived to modify ways to remain competitive in the market (Capgemini, 26). The underpinning factor is the ability to ensure that the overall production cost is reduced through efficient procurement, production, and supply procedures. This practice is achieved through the utilization of the mass production benefit such as bargaining power, good distributional networks, and affordable production plants in various countries. According to Shah and Dalal most firms are currently practicing consolidation (Shah and Dalal 4).

Most of the laptop companies have similar strengths in the market. However, the Apple Company is slightly different since it enjoys the market shares due to product differentiation, premium pricing, customer loyalty, and well defined products. Most of the laptop companies practice commoditization of their laptops. Although various companies experience increase in growth in the market segment due to netbooks, an issue of profit margin is currently realized; hence, one can predict that demand of the netbooks will not last longer. The companies will have to cope with other techniques to such as offering quality services to the customers to maintain growth.

Laptop Industry Attractiveness & Success factors

The perception whether the laptop industry is still attractive or not primarily relies on the nature of competition. The companies that strive to enter the market adhere to various crucial success factors and the porter’s six forces analysis (Bridwell and Chun-Jui 116). The competitiveness in the industry will also increase among the various companies that offer similar laptops and their features. This situation will be noted within the companies that have specific group strategies. The uniqueness of new brands and other techniques will enable the various companies to retain competitive advantages in the market (Abetti 529).

The laptop industry is likely to grow further due to the immense innovation of new products. For instance, the Apple Company is planning to launch a smart watch by the end of 2015. The watch will be used in communication with close iPhones and telephones. Its retina will have display to enhance clarity. It will also possess touch technology that senses press and taps. There is also likelihood that other companies will invent new products (Abetti 529).

The success prospects and long-term profitability in this industry especially by the already existing companies in this sector is more likely due to their quick response to dynamic market, provision of complete product lines, the affordable prices, high product qualities, and the product performance, the quality of services delivered, as well as the financial bases that they possess. Numerous companies in the industry possess the success factors; hence, the survival of each company is feasible. The profitability is also driven by a variety of innovations, commoditization, and new products (Abetti 529). This situation will enhance the profitability of the various companies even though pricing is currently noted to be falling.

Various companies in the laptop industry will be able to counter the issue of unattractive behaviors fair competition based on quality, variety, and gain in consumer loyalty among others. More lucrative firms such as the HP Inc., Dell Inc., Apple Inc., and Lenovo Company will enjoy the market will include the because of their ability to command market share in terms of shipment, brand identity and consumer loyalty among others. The industry is thus attractive to participate even though the issue of stiff competition is noted (Abetti 530).

Conclusion

The essay has highlighted various analyses such as the PEST and Porters’ six forces. The outcome is that the industry is attractive with a fair intense completion in the market. The industry’s future is observed to be lucrative due to the success factors that have been highlighted. These success factors have been realized to be across most of the organizations. Some companies have gained competitive advantages over others. Their operations vary in terms of product quality and portfolio among others. This situation creates unequal share of the PC market. Nonetheless, it is predicted that the industry’s future is feasible. Ceaseless technological developments are likely to create more competition in the market as the industry players seek to offer the most up-to-date and versatile PCs.

References

Abetti, Pier. “Informal corporate entrepreneurship: implications from the failure of the Concorde alloy foundry and the success of the Toshiba laptop.” International Journal of Entrepreneurship and Innovation Management 4.6(2004): 529-545. Print.

Bagchi, Kallol and Godwin Udo. “An analysis of the growth of computer and Internet security breaches.” Communications of the Association for Information Systems 12.1(2003): 46. Print.

Bayus, Barry, Gary Erickson and Robert Jacobson. “The financial rewards of new product introductions in the personal computer industry.” Management Science 49.2(2003): 197-210. Print.

Bennett, Jon. Industry Analysis: Attractiveness of the Personal Computer Manufacturing Industry in the United States, 2009. Web.

Bresnahan, Timothy and Shane Greenstein. “Technological competition and the structure of the computer industry.” The Journal of Industrial Economics 47.1(1999): 1-40. Print.

Bridwell, Larry and Chun-Jui Kuo. “An analysis of the computer industry in China and Taiwan using Michael Porter’s determinants of national competitive advantage.” Competitiveness Review: An International Business Journal 15.2(2005): 116-120. Print.

Capgemini. The Changing Dynamics of the Global High Tech Industry: An analysis of key segments and trends. Schiller Park, IL: High Tech Manufacturing, 2011. Print.

Datamonitor, Pcs Industry Profile: Global Datamonitor Plc, 2010. Web.

File, Thom and Camille Ryan. Computer and Internet Use in the United States, 2013. Web.

Porter, Michael. “The five competitive forces that shape strategy.” Harvard business review 86.1(2008): 25-40. Print.

Schmid, Natalie, Sabine Kelber, Sabine Behrend and Maresa Krasel. The Dell Company-A Strategic Analysis, Munich: Grin Verlag, 2005. Print.

Shah, Aditya and Abhinav Dalal. The Global Laptop Industry, 2009. Web.

West, Joel. “Apple Computer: The iCEO seizes the Internet.” Center for Research on Information Technology and Organizations 1.1(2002): 19-23. Print.