A flat-rate tax is a kind of tax system that uses a constant tax rate. Under this system, household income and corporate profits are taxed at one marginal rate. Unlike progressive taxes which vary depending on factors such as income and usage levels, this tax system usually offers a simple and clear tax code. This simple tax code increases compliance and reduces administration costs. There are very many benefits that the United States economy would derive by adopting the flat-rate tax system.

The current United States tax system has a lot of loopholes. The Americans are paying very high taxes. The tax system is very complicated and has several inequities such as punishing married people by making them pay more taxes than single people. It also encompasses death tax where the tax claims a considerable portion of the deceased estate. There is an urgent need for the United States to change the current unfair tax code with a simple fair flat-rate tax that will guarantee a low rate of taxation without deductions or loopholes (Forbes S 2005).

There is a need for low tax rates at the state, federal and local levels. The tax system should have tax exemption for household income that is below a certain level. The tax should be proportional. On the other hand, a flat tax rate is simple, fair, and encourages the growth of the economy. This tax rate system requires only two forms the size of a postcard. These two forms are for labor income and business and capital income.

This tax system does not discriminate against the taxpayers. It treats them uniformly and equally unlike the progressive tax system that discriminates against taxpayers on the basis of the source, use, and level of income while punishing the taxpayers who contribute to the nation’s wealth. A progressive tax is complicated and hinders the growth of the economy. It allows the politically well-linked people to maneuver the tax system to allow themselves special tax breaks which are not permitted to ordinary people and businesses (Hall R & Rabushka 1995).

A flat tax rate system has a low marginal tax rate and is without bias against savings and investment which in turn leads to higher economic growth and better performance in a competitive global economy. By implementing the flat-rate tax system, the United States will be able to attract jobs and enhance capital flow within the global competitive economy. A flat tax system is fairer than other systems because everybody pays equal proportions of tax to their incomes.

A flat tax system removes economic discouragement and promotes economic growth which brings about increased incomes and increased tax incomes. This results in taxpayers paying the same or lower rate than in the progressive tax system increasing both output and promoting equality and fairness to taxpayers resulting in social justice. As the income of the taxpayer increases the excused income continually decreases in the percentage of the total income.

Due to the simplicity of the flat tax system, it reduces the tax to everybody whether the person is poor or rich, and by stimulating growth in the economy, the government’s revenue increases which is used in programs that benefit the poor. The flat tax system taxes all income at its source once. The system does not give room to creation of tax shelters and tax avoidance. In this system, companies periodically make a single payment to tax authorities to cater for the tax liabilities of their workers and tax attributable to the company profit. The system also reduces the number of households, individuals and business units required to submit returns to the tax department. Under this system, the cost incurred by the government for processing tax returns is considerably low as the tax department is quite small (Anthony J. & Evans 2005}.

A flat tax system makes the tax easier and simple to administer as it gets rid of all the deductions, exemptions and other complicated rules. The flat rate tax system for individuals contains a single rate which is usually less than 20%. This assists in removing the high marginal tax rates by lowering fines imposed to productive behavior associated with work, taking of risks and free enterprise. It also eliminates the provision of the tax code that allows special tax preferences on certain activities. It is less complex as it removes deductions and exemptions that allows for loopholes by allowing taxpayers to submit their tax returns on a postcard size form.

It removes double taxation on savings and investments as it removes taxation on areas such as death tax, capital gain tax, double taxation on savings and on dividends as well as wealth or assets taxation. These factors make this tax system easier to manage and encouraging employment creation and capital formation. On the other hand, the flat rate taxation system operates based on territorial taxation. The tax authorities only tax income that is earned within the country allowing the taxpayers of that country the privilege of comparing themselves with other countries (Mitchell Daniel 2003).

This tax system is family-friendly as it takes into consideration of the family size and its income before taxation. This tax is considered consumption-based as it does not discriminate against savings and investment and is levied once on income as it is earned or spent. Under this tax system, individuals pay tax on their incomes using a simple household postcard. The individuals do not care about their dividends, interest, or any other business income as these incomes are taxed at the business level, and hence no need to tax them at household levels as this would amount to double taxation. Since the system uses a small postcard size form, it becomes simple for anybody to fill returns in a very short period.

The household uses line one to report wages, salaries, and pension incomes. Lines two to five are for calculating personal allowances based on family size. To determine the taxable income, the personal allowance is subtracted from line one and the results are indicated inline-six.

The payable tax is calculated in line seven, which upon its calculations is compared with the amount of tax withheld on line eight. The result on line eight either gives the amount of tax to be paid on line nine or the amount to be refunded on line ten (see appendix form 1). Under this tax system, all business units that are; sole proprietorships, partnerships, and companies whether owned by United States Company or foreign companies would pay taxes under the same rules that require they pay tax on the income earned within the United States (Hall R, & Rabushka A, 2005).

The business unit paying the tax would indicate its total income on line one. Lines two and three would be used to record their input costs, labor costs, and investment costs. Lines four indicates taxable income which is got from subtracting the total costs from the gross receipts. Line five shows the amount of tax to be paid. Lines six to ten helps the company to indicate whether it had losses from the previous trading period and now has the ability to pay that tax or if the company makes losses in the current year and needs to carry the losses to the next trading year (see the appendix 1, form 2).

The two major benefits the United States economy would derive from adopting this tax system would be growth and fairness in tax administration. The progressive tax system suppresses economic growth, increases unemployment rate, lowers individual and corporate incomes, and discriminates savings and investment. This tax system however eliminates all these vices and hence boosts the economy’s growth rate.

Due to the fairness aspect of this tax system, the taxpayer is spared the tedious work of filling out complicated documents and various complicated forms. This transition would spare the Americans the time wasted and costs incurred while struggling with filing of tax forms. The flat rate tax system would benefit the country through faster economic growth through increased work, savings and investments through the government enticement to participate in productive economic behavior which even though at a lower rate, would increase the long term growth rate of the economy, which cannot be achieved under the current progressive tax system (Dale W. & Jorgenson 2005).

By adopting this system, the United States as a whole would realize instant wealth creation. These tax reforms would increase national wealth by almost $5 trillion. This would be realized from a rise in value of all income generating assets from increased after tax income so generated. Due to the simplicity of this system, flat tax is not associated with complex hidden taxes that comprise the cost of tax preparation, payment to lawyers, accountants and all other charges associated with the internal revenue code.

The current complex revenue code wastes a lot of time to an approximate 6.6 billion hours every year compiling tax returns. Due to the mother complexity of the system, even after dedicating all that time, the tax experts do make mistakes. Flat rate tax system would greatly simplify the procedures which in turn would reduce the compliance costs significantly. The flat tax system provides equity and fairness in tax payment by treating the taxpayers equally. Wealthy people pay more than poor people. People pay taxes proportional to their incomes. Under the flat tax system, rich individuals and households pay more tax than the poor.

It does not punish those individuals and corporations that donate more to the nation’s economic growth like the progressive tax system do (see appendix 2). The flat tax is a bit fairer as it eliminates all forms of marriage penalties and hence under it is not possible for one’s income to push a family into a higher tax bracket. Under this system family-based allowance is two times higher than for a single person and hence the marriage penalty does not exist The flat tax system brings to an end the era of micromanaging and political favoritism as it has no deductions, exclusion from payment, and loopholes.

The politically well-connected individuals would no longer have the privilege to be picked as winners and the politicians would no longer be able to punish their political enemies in form of high taxes. This would in turn end the rampant political corruption and also release the company’s mass spending while lobbying for politicians’ favors or making uncalled of investments so as to obtain a lenient tax treatment (Dalrymple M, 2005).

The flat rate tax system removes most of the conflict sources between the tax payers and the government. It takes into account the taxpayer’s civil liberties by reducing the rates of interference on liberty and privacy as the government would not be in a position to know the inner private details of the taxpayer’s or business financial assets. Adopting the flat tax would make the United States economy compete favorably within the global economy coupled with other positive free-market reforms the tax system would greatly improve the economic growth of the entire nation’s economy. This is evidenced by the high rate Hong Kong’s economy grew after adopting a flat-rate tax system.

Its economy flourished, and government revenues increased since tax evasion and avoidance were significantly reduced. With the competitive global economy, it is becoming easier for investors and experts to escape those countries that are charging high tax rates in favor of those nations charging low taxes. This means that a country with a good tax policy will yield more revenue than before as it will be able to woo investors hence increasing its capital base.

This has called for abolishing the policy tax system and reforming their tax systems to adopt lower tax rates. A flat-rate tax system would make the United States a giant economy as it would attract many investors who would, in turn, create job opportunities and thus solving the problem of unemployment. In conclusion, it can be argued that the current United States tax system is retrogressive and bad for the economy. It entails more compliance costs on taxpayers making the United States economy less competitive and hence unfavorable for investors. A flat rate would address these vices and reduce the tax department’s power of dictating the economic growth (Dale W. & Jorgenson, 2005).

Work cited

Forbes S, Flat Tax Revolution. Washington: Regnery Publishing. ISBN 0-89526-040-9. 2005.

Hall R & Rabushka A, The Flat Tax. Hoover Institution Press. 1995.

Anthony J. & Evans, “Ideas and Interests: The Flat Tax” Open Republic 1(1), 2005.

Mitchell Daniel. “If a Flat Tax is good for Iraq, How About America?” Heritage foundation, 2003.

Hall R, & Rabushka A, The Flat Tax, 2nd ed. Stanford, Calif.: Hoover Institution Press, 1995. Web.

Dale W. & Jorgenson, “Efficient Taxation of Income,” Harvard Magazine, 2002. Web.

Dalrymple M, “Americans Spend 6.6 Billion Hours on Taxes,” Associated Press, 2005. Web.

Appendix 1

Post card size form used in flat rate tax system, form 1 for households and form 2 for companies.

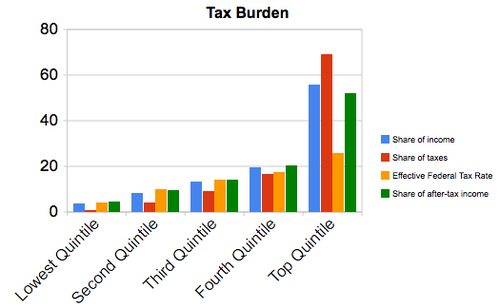

Appendix 2

Graph showing progressive tax burden in different income earning groups.