Introduction

Many benefits accrue from the successive and failed concessions through M5 and M1. At the moment there is a maximum usage of the capacity of M1 AND M5 roads in Hungary. The European road network that is being used in Hungary today is being utilized and the full benefits for the road are being utilized in Hungary. The main purpose of M5 and M1 contracts in Hungary is to provide the transport system with information that will increase road usage more effectively, efficiently, and safely to the road usage. This will put Hungary on the world map as one of the best-managed transport systems. The project concession M5 and M1, main aim was to provide information to road users on the situation on the road ahead on real-time basis. The system was to provide also information to the ministry in order for them to coordinate their activities with a lot of easiness and ensure that communication was possible.

It also aimed at ensuring that there was corporation between the private companies and the government in financing the project. This is because of its benefits of increasing safety, efficiency, effectiveness and provision of information to road users. This system was to be compatible with the European transport system in place.

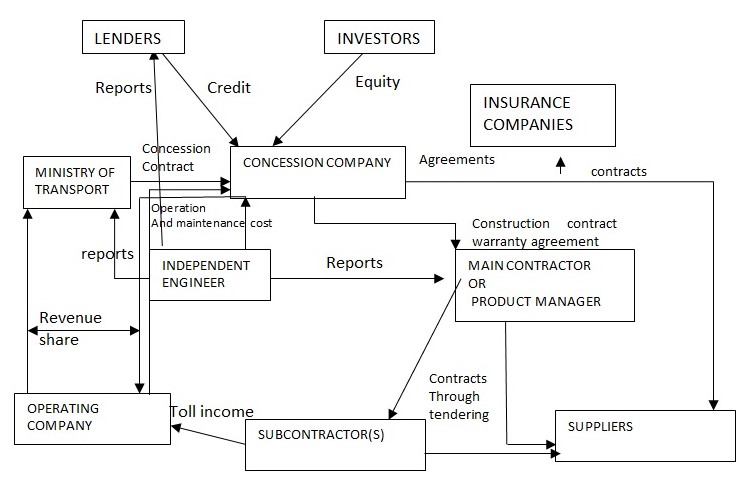

Looking at the concessional diagram used above to finance projects M1 and M5 a number of issues are noted that there are investors renders and the ministry who are involved in ensuring that this project succeeds renders, give credit to the project and investors who are involved in private roads put their money into the project and this money are made into the concession company which is involved in supplying the necessary resources to the construction to the road network. The involvement of the private sector in this road construction business increases the countries competitiveness in terms of economics. The country’s competitiveness is increased because funds are available to construct transport network that will ensure success of economic growth. Although, it is assumed that such infrastructures are public goods in which no one can exclude the private sector earns income through Toll income and this income is enough to make the private sector motivated to invest in the sector. The responsibility of the state is to ensure that the project succeeds and the private sector is motivated to put their money into the project.

If the transport network is not providing competitiveness through stimulating local production, increasing cooperation and providing social capital the economy will be consumption sighted rather than production sighted.

The failed concessions in this instance require some mechanism where risks are mitigated through renegotiation to ensure the future of such concessions does not fail. This is done through an arrangement on how risks should be shared between the government lenders and investors. This will ensure that future such projects are sponsored by both investors and lenders. It is better for a project to be renegotiated once it has failed rather than counseling the project because it will not create confidence among the stakeholders in the funding of the projects. It is the duty of the government to ensure that the project is negotiated once they have failed in order for the risks and benefits to be mitigated. The government should be able to understand the project and at what times should negotiations start. This is done thoroughly clearly defining the role to be played by each party to the concession. The role of the government should be clearly defined as well as the role to be played by lenders and investors. There should be arbitrators who are identified to assist in the negotiation process in case something goes into a mess. This is done through, defining the ownership structure, drafting negotiation/agreements and searching matters.

Financing

The concession should have the ownership structure on how the concession should be owned and the owner should be based on the financing provided by each stakeholder. However there should be a clear indication of who the principal owner of the project is and how long the concession runs. Take for example, the Hungary failed concession because of renegotiation of sharing arrangements. There was no clear agreement on ownership and the project failed. There should be no renegotiation if proper structures have not been put in place, of ownership, benefits, and sharing of the benefits. The project of Hungary had shifted traffic risk to the private sector because after the project was completed it was found out that the amount expected to be collected from the project was lower than the expectation. This was due to the fact there were a number of roads which were to be used by the traffic to avoid the tolls. This posed a problem in raising the required revenue for the project. Regardless of this problem the project raised an important role in easing traffic on the road of Budapest. Another problem was that most users were unwilling to pay for using the tolls this makes it difficult to raise the revenue, this is why a public transport network being a social good the government should be clear on the role and strategy of the private sector. The private sector will be more than unwilling to invest in a transport system that has parallel roads if given an okay to collect revenue. Being a long-term project the government should take responsibility to ensure that the project succeeds.

Analysis of reasons for failure

A critical analysis of the benefits of the projects should be accurately accessed based on available rates, reasonable toll rates and how the government intends to cover the differences in the revenue that will be collected and revenue expected by the private sector. In that essence, the private sector will be more than willing to enter into such concessions because their money will be protected. Otherwise the failures in the Hungary case may discourage private sector from putting their investments into such an investment of public goods.

There should be an elimination of parallel roads without tolls and if they exist there should not be an option for some motorists especially public transport and transportation of goods. This is where the government’s role is required to ensure that they take additional risks of ensuring that the private sector is able to put money into infrastructure. The parliament should ensure that there is a stable constitution that ensures there is a proper transition from one leader to another. And the transition should not be in a manner that the new leader comes up with his own projects disregarding other projects from the previous governments. This will avoid unstable political environment which will discourage international investors into the economy.

A failed concession ensured that the government had lost income which was going to stimulate growth through public goods. And the international investors will have a played an important role in stimulating economic growth of the country.

In light of the above, various measures should be taken to ensure such important activity or concession does not fail in future and what should be done to ensure there is a reduced risk on the part of the private sector for them to sponsor infrastructure. The public should be sensitized to the importance of the project and who are the investors. This will be done by educating them as stakeholders that after some time the project will get out of the hand of investors. However if this is not taken into consideration, the local community, NGOs of the other people will resist the implementation of the project and eventually the payment of the toll thus considering the failure of the concession.

Awarding of concession

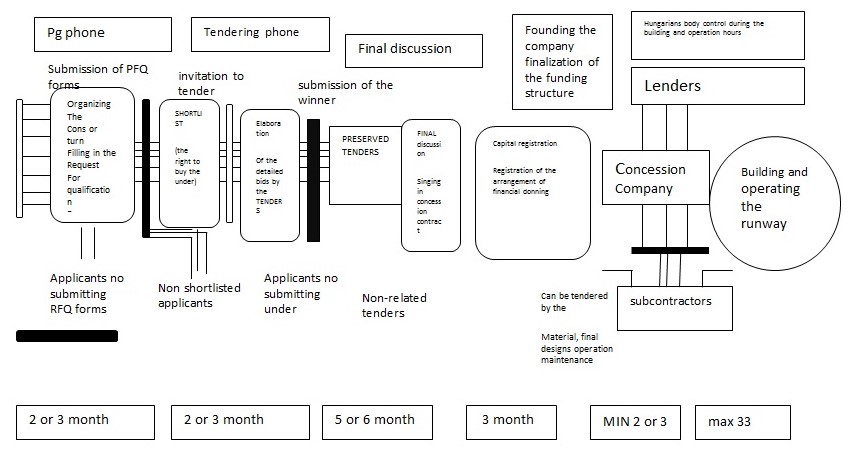

The awarding process of the concession should also be looked into to avoid conflict among parties who may contribute to the failure of the project by constant bickering over favoritism and non-transparent process used. If the concession is awarded according to what is advertised, without favoritism and objectively, then, the project will not have resistance from competitors because the process of awarding was free and transparent. There should be fair competition among parties both local and international for the projects to have the best concessionaire and this will increase competition among the parties.

There should be proper registration in relation to concessions to ensure that the governance of any concession is in place and in order.

Take the following, the awarding process in the Hungary failed project.

From the above Hungary case, the preparation of the concession awarding procedure lacks a number of ingredients that will make it acceptable by private financiers in near future. The visibility study carried out was properly followed and appropriate financing was sought for an appropriate financing institution in the name of private equity and private debts. private equity expects equity while private debts expect the principal amount and interest. However, the Hungarian case did no provide alternatives for failures. Therefore the government did not take possible steps to improve the project’s viability through cost reduction and revenue increase. Cost reduction will be used in this project by identifying the activities within the project which need to be dealt with. However there were no costs reduction procedures on the side of the public funds that were invested. Although there were some measures that reduced construction cost, financial cost as well as commercial costs some sections of the system were not cost-effective. For example the system failed because there were parallel roads. This includes the maintenance costs of the roads which are not being used to generate revenue. A viable project should be able to generate revenue that is acceptable to the government and the private sector investors.

The Hungarian projects were the first to explore international concessions from the country. In the first case 43 kilometers of the section of the road was not completed and in M15, a section of the road was not completed. These roads which were to be completed were not completed because of failures by the government to come up with concession and how costs were to be taken care of in case of escalation of costs. However the private sector contributed as requested. Actually 11 commercial banks participated as requested. Equity financiers represented 17 percent while long-term debt was 81%. The project generated 2% of the cost of the project. This form of financing was very risky because most of the capital was from long-term debts, whose main aim is to interest which must be paid. The financing costs amounted to 15% which indeed was very expensive. The Hungarians learned a lot from these failures from M1 and M15.

One of the things that were learned was that there should be effort to create private financiers confidentiality in such projects in order for them to succeed in future. it was also learned that it is important for the government to determine the minimum amount of equity financing that should be used for a project before advertising the concession. Equity financing is a cheaper source of finance in the long run because equity holders can do without dividends and they rarely affect the long-term survival of the organizations. This is unlike debt financing. The profitability or viability of the project, should also be determined on the basis of available sources of capital terms and conditions especially the maturity period of debt capital should be considered. The reliability of traffic should be pre-determined in order to find out the amount of revenue likely to be collected from the project. This will assist to determine the cash flow that is likely to be generated from the project once completed. Take for example if the creditors do not have a say in the collection of revenue they will find it difficult to accept such a project.

There should be conditions and warranties in the contract document for the financing part. This will ensure that the lenders have adequate information in relation to what should be done.

Various experiences were learned from this concession and some of the experiences worth highlighting was the shortfall of traffics. This as mentioned earlier was due to existence of other roads, lower traffic below the expected. In order for this to succeed a good policy should be put in place to ensure success. M5, Toll Motorway concession failed because of a section of the road it was not completed. It was not completed because the financing structure brought in new challenges that had to be considered in the project. it failed because most of the work like acquiring the land needed for construction of some sections of the road was actually the duty of the government. The sections that were going to be covered by M5 and used Toll were not in the tender document. This posed various challenges for the concessionaires to continue with the contract as stipulated. The existing section of roads which were needed to be connected with the new road did not appear in the contract. The following budget was used in the reconstruction of the road.

Sources of motorway construction in Hungary (current term, billion HUF):

From the information above it can be noted that concessions contributed over 45%, of the total costs that were used in the five years. The road fund within the government arm contributed 24%. From the state budget 14%, solving loans a European fair aid contributed 2% concessions which are the main source of construction costs was far below the expected because there was no proper sensitivity on the importance of sponsoring such programs within the government. Overall, looking at the happenings, the benefits, and other issues that are related to the project one is convinced that the failures

In conclusion various factors play into the success of concessions. Some of these factors are political commercial and general. The Hungary case failed and succeeded partly because there was a government that supported the project and nearly contributed over 50% of the amount of the projects. It failed because the project failed to have a top policy and a sound concession contract stipulated in the contractual document. Inflation differences in exchange rates between international currencies and Hungarian currency had a great impact on the concession. The cost of borrowing went up which increased the cost of the project. The existence of parallel route in the concession played another role in creating competition for the concession thus contributing to its failure.

Financing of a public infrastructure asset has many construction risks as compared to other projects because it is a public good which a member of the public can choose to take or avoid by choosing alternative route. Equity financing that is available for such kinds of projects can be either in the capital market or private placing in the domestic and international market. The common debt capital well known is Bonds for infrastructure unlike the business world where they can access various sources of debt capital. Some of the various reasons as stipulated above pose serious risks and necessary steps should be taken to ensure other is a balance between the factors.

References

Bracey N; (2007) Public-private partnerships: risks to the public and private sector – 6th Global conference on business and economics

Brenck, A Beckers, T Henrich, M and Von Hirschausen (2005). C public private partnership in new EU member countries of central and eastern Europe: An economic analysis with case studies from the highway sector.

Hammami Mona, Ruhashyankiko Jean Fracois and yehoue, Etiene B (2006) Determinants of public private partnership in infrastructure, IMF working paper.

Joosten R (1999) M1/M15 How a successful project ended unsuccessfully in tears Private finance international issue 179, pp 52-55

Kosztyo a and Maszaros F F (2005) political acceptability of privately financed motorways in Hungary, Transport engineering, volume 33, issue 1-2 pp 157-165

Markandy Anil and Sharma Raghuveer. (2004) case study on Tajistan Pamir power project, World Bank, conference on scaling up poverty management p 8-9

Muranyi Miklos, (1999) motorway financing in Hungary experience of the last 10 years: ministry of transport Hungary.

McDowall Evelyn (2005) risk Transfer in ppp projects, Facilities management, p 8-9

Muranyi Miklos & Melinda J, (1996) Both in motorway development; Hungarian experience – university of economics

Siposs a G (2002) motorway private financing in Hungary in the 90s PIARC developing counties seminar Havana.

Tacnzos K Kosziyo A and Meszaros F (2004) application of shared financing in road infrastructure development in Hungary, paper presented at the 3rd international conference on applied infrastructure research, Berlin.

Timar A (1996) appraising and awarding concessions (Chapter 70 in Tony Merna projects procured by privately financed concession volume 1, Asia law and practice.

World bank highways toolkit (2002) experience with motorway funding and PPP schemes in the central and eastern European region, world bank paper.