Introduction

Social responsibility is the main concern of corporate today. Companies today, no longer make decisions based on profit-making purpose and maximizing stockholder value. They rather aim to act as socially responsible entities and help in optimizing stakeholder value. As a pharmaceutical company, Abbott is socially responsible for many cases especially the health hazards that its products might cause to its consumers, its environment, employees, communities, and the stockholders. The Supreme Court of the United States recognizes a corporate as an individual with full rights and responsibilities.

Therefore, according to that right bestowed upon the company by constitution implies that the first course of the company is to act responsibly and care for ‘others’. It is believed that good governance, increased corporate social responsibility (CSR), ethical business practices, and transparent supply chain are more important today. This is most important for a pharmaceutical company engaged in health care as their business activity binds them socially. However, the degree of ethical and socially responsible conduct of Abbott is blurred, as there has been numerous monopolization, price discretion, antitrust, and health hazard lawsuits against the company.

In 2001, the Supreme Court named Abbott among ten worst companies. According to the Harris Poll conducted in the US, only 11% of the population believes that pharmaceutical companies are trustworthy and truthful, and less than 11% believe in Abbott’s trustworthiness (Mokhiber and Weissman 10). Clearly, not many believe that Abbott is an honest company even though they operate in health care industry. Evidently, the society does not feel so. With respect to its stakeholders, Abbott Laboratories does not act in an ethical and socially responsible manner.

Background of Abbott

Abbott Laboratories (Abbott) is a diversified healthcare company concentrating of discovery, development, manufacturing and selling of pharmaceutical and medical products. It has its operations in more than 130 countries and it’s headquarter is in Abbott Park, Illinois (Datamonitor 2). The company has more than 72000 employees as on January 2010 (Abbott).

Abbott holds a 50% joint venture with Japanese company Takeda called TAP Pharmaceutical Products (MarketWatch 19). The company has its operations in four segments: pharmaceutical, diagnostic, nutritional, and vascular products. In the pharmaceutical product line, Abbott produces adult and pediatric products. The diagnostic segment products include “diagnostic systems and blood bank tests” (MarketWatch 19).

Nutritional foods include adult and pediatric nutritional food. Vascular products are related to coronary, endovascular, and vessel closing devices. Apart from marketing and selling these products worldwide, TAP produces pharmaceutical products primarily for the US market.

Abbott posted revenue of $292527.6 million in 2008, which was an increase by 13.9% over 2007 (Datamonitor 4). The operating profit of the company in 2008 increased by 24.4% since 2007, and net profit increased 35.3% during the period (Datamonitor 4).

Abbott has recently faced a lot of litigation and allegation regarding monopolization and price discrimination claims apart from possible health hazards from its products. In the following section, these issues are elaborated and they are analyzed based on stakeholder perspective.

Abbott’s Stakeholders

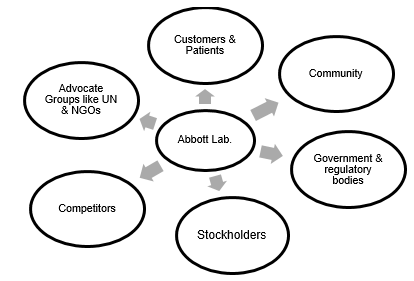

Who are the company’s stakeholders affecting the policies and strategies of the company? According to stakeholder theory, organizations have relationships with many individual or group of individuals that it can endanger and try to support the concern of these groups by balancing their strategies and interests (Freeman). In other words, stakeholder theory advocates the management to keep the relations with stakeholders balanced so that the stakeholders are not aggrieved.

Otherwise, the stakeholders have the capacity to jeopardize the existence of the organization (Freeman 136). However, stakeholder theory also advocates that management usually pay more attention to important or dominant stakeholders. In case of Abbott, the stakeholders are employees, stockholders, customers, and communities. Apart from these, the other stakeholders that the company has are competitors, government, and the Advocate Groups.

These stakeholders are identified by the stakeholder mapping done by Freeman (25). Stakeholders are important as they are influenced by the operations, and have the power to influence the functioning of the company. Given these six stakeholders, it is important to understand how ethical and socially responsible the company is in its operations.

Corporate Social Responsibility

According to the Global Citizenship Reporting (Abbott) in 2008 of Abbott has reduced its consumption of energy by 1% in 2008, CO2 emission by 56%, and total water intake by 3% from 2007 to 2008. However, it has reported an increase in hazardous waste generation by 35% from 2007 to 2008. In matters related to health and security matters, the company reported a reduction in recorded injury or illness incident rate on employees by 10% from 2007 to 2008.

This has reduced from 1.17% in 2004 to 0.76% in 2008. However, there has been an increased number of litigations against Abbott due to its practice of monopolizing and price discrimination of certain products. Further there has been arguments regarding the health hazards that some of Abbott’s products may cause to its consumers. In the following section, these issues are discussed.

Abbott’s Monopolization

Genetic Systems sued Abbot and Red Cross in jointly trying to monopolize the blood test kit and blood supply market and violated the antitrust law (American Journal of Law and Medicine). The US District Court ruled out this argument and stated that the antitrust law did not recognize such interdependent activity due to insufficient reasoning.

In another case, consumers and advocacy group sued Abbott and filed litigation against the company due to its implied monopolistic stunt for its HIV medication (Harris). Abbott has used a legalized form of monopoly to raise the price of a product. Abbott has gained legalized monopoly over their product called Norvir, which acts as a “protease inhibitor” which acts as a booster for HIV drugs (Gullo).

Norvir is an important ingredient for HIV drugs made by its competitors and, therefore, increasing the price of Norvir actually raises the price of the competitor’s product. The company to increase the price of a critical drug was viewed as a deliberate attempt towards monopolization. According to the company, Abbott held the patent rights to sell Norvir, and so it could change the price of the product, since it was not impeding the law.

Amy R. Schofield studied the contemporary trend of the pharmaceutical companies abusing the government-funded inventions are ethical or not. Schofield pointed out that National Institute of Health provides a lot of fund for the development of new drugs (Schofield 777). In case of Abbott it has stated that even though Norvir was developed with complete aid from NIH, Abbott increased the prices of the drug in the US by 400%.

This resulted in an increase in the “cost of therapy for other boosted protease inhibitor regimes increased dramatically; five of the eight inhibitors on the market require two l00 mg boosts per day, while a sixth requires one such boost” (Schofield 778). Interesting issue related to this affair is that Abbott did not increase the price of Norvir for its own protease inhibitor, Kaletra (Harris; Schofield).

Before 1979, all government-funded drugs’ patent remained with the Government. However, the Bayh-Dole Act, which is the US government Patent Policy Act of 1980, changed and the right to patent of NIH funded inventions was given to the private sector. Critics argued that the act made the US citizens pay double tax due to this legislation. Therefore, in case of Abbott, the increase in the prices of HIV/AIDS drugs was “an unfair hardship on American taxpayers suffering from HIV/AIDS and improperly sought to shift market share to its own Kaletra product” (Schofield 779).

Further, it was argued that an increase in the price of Norvir, which was an essential invention, was a failure on part of the company to satisfy the safety and health needs of American citizens. Thus, by pricing Norvir high, Abbott was actually trying to deny optimized treatment availability to HIV/AIDS patients.

The increase of Norvir prices, adversely affected the customers and patients, competitors, and the community. Clearly, Abbott was using its proprietary right over Norvir to monopolize the market share of HIV drugs, and using it as an anti-competitive strategy:

“Abbott’s proprietary Kaletra regime is the only protease inhibitor regime exempted from the 400 percent NORVIR price increase in the United States. This suggests Abbott is exerting its NORVIR monopoly to drive market share toward its own products, a potentially anticompetitive strategy of the type the Act’s march-in provisions were designed to counter.” (Schofield 780)

Therefore, the competitors of Abbott were also adversely affected due to the so-called anti-competition strategy employed by the company. From a business point of view, Abbott’s increase of the price of Norvir to leverage the opportunity of patenting, was a legal act.

However, from an ethical point of view, this is not a socially responsible action. According to the utilitarian theory presented by Jeremy Bentham and John Stuart Mill, an action can be considered morally good if it provides greatest benefit to the maximum number of people. If the utilitarian view of the ethical conduct is adopted, then Abbott miserably failed in being socially responsible in case of the Norvir drug case.

However, this strategy helped the company gain greater market for the drug, which led to greater profit, thus, making the stakeholders happy. Was Abbott unethical in this issue? Michael Porter and Mark R. Kramer believe that in most cases corporate that face aggressive charges of CSR violation, they adopt “cosmetic” measures to appease the stakeholders rather taking any constructive measure (79-80).

In case of Abbott, they used the law (Bayh-Dole Act, 1980), public relations, and CSR reports to become more “socially responsible”. Such strategy is definitely not useful for the company or the society (Porter and Kramer 79). However, the interdependency with Red Cross was a strategy that could have imparted greater good to greater number of people, and therefore was ethically correct.

Price Discrimination

Many lawsuits against Abbott have been lodged by Advocate bodies (American Journal of Law & Medicine) and protests (Nelson) have been observed. Drug companies have always been accused of price discrimination. Price discrimination charges a different price to different group or people, or geographical area, or different price for different units sold. In case of Abbot, in the case against Jefferson Country Pharmaceutical Association, the company had been accused of selling products at a cheaper rate to government buyers than to private purchasers. This directly affected the well being of the customers.

This was held to be discrimination by the court even if it was in favor of the government. Thus, the company, although tried to help the government, failed to benefit the other customers, and their interest was hampered.

Abbott priced Norvir higher in the US than what it charged in other countries: “They shouldn’t be charging US consumers 10 times the amount of what the drug costs in other countries.” (Nelson 1369) Such discrimination affected many – the patients, customers, Advocacy organizations like AIDS Healthcare Foundation, and community. Such price discrimination leads to dividing the market and is done to increase the profit margin of the company and thus increase shareholder value. However, the other societal stakeholders along with the customers are affected adversely.

Health Hazards

Many health related products have been found to be hazardous like the Xience V heart stent by Abbott as it is believed to cause blood clot (Feder) or urokinase a drug used to dissolve blood clot in dead human new born and fetuses under the brand name Abbokinase (Health Hazard). The US Food and Drug Administration (FDA) banned the Abbokinase in 1990s. However, Abbott contracted another company named BioWhittaker to produce the drug for them in 1998.

The FDA found that Abbott was not “doing enough to remove potential viruses from the organic material used for the drug” (26). The product was again stopped by FDA due to fear of contamination. However, the product returned to the market in 2003 with claims from Abbott that “all kidney cells are now sourced from exclusively from dead babies (birth to 28 days) in the US” (26).

In another instance, FDA had found industrial chemical melamine in baby food (Lowy and Pritchard). Further, in another instance Abbot had been marketing generic baby food that was nothing more than the regular baby food (Brick). However, pediatricians believe that even though there are no apparent health hazards, the sweetness in these formulas are slightly higher than that of other traditional formulas which makes them an instant liking for infants.

However, this may cause tooth and gum problem for infants. Further, this may cause infant obesity as babies may overeat due to the sweet taste. Apart from this, sweet formulas are a hindrance of the child’s acceptance of many vegetables and fruits as they are less sweet. Even though Abbott was not legally wrong in marketing and selling baby food, but this definitely has a health hazard for infants. Therefore, from the social point of view this strategy adopted by the company, is definitely unethical as it indirectly affected the health of the baby adversely.

Is Abbott’s CSR Enough?

Like many other companies, Abbott’s CSR is restricted to philanthropic activities and publishing the CSR report annually (Abbott). Is this enough to provide greatest good for greatest number of people? Porter and Kramer believe it is not (78) Abbott has given enormous philanthropic donations to AIDS foundations in Africa (O’Brien and Clark), and has helped the earthquake victims in Haiti (Abbott), but it is apparent that these are just “cosmetic” measures taken by the company to appear socially responsible. These philanthropic actions provide great benefit to human development, but at a cost.

According to the stakeholder theory, the aspects of Abbott that have been analyzed, show that the stockholders of the company are happy, as the company has registered a 13.9% growth in overall business that definitely satisfied the stockholder’s interests. The company’s financials has registered strong financials (Abbott). Abbott has acquired a new company called Solvay (Young and Ramesh 9). This strategy has helped Abbott to strengthen it ophthalmology and vascular intervention segment. This aspect must have kept the stockholders happy, as this will help the company face the growing pressure from the prescription drug market. Abbott summed its social responsibility effort for 2009:

“Our success creates economic benefits for stakeholders around the world. We spent approximately $13.5 billion with suppliers during the year; paid $772 million in income taxes; paid our employees $7.5 billion; reinvested $2.7 billion in research and development; and returned $2.2 billion in dividends to investors. We also contributed more than $460 million in philanthropic grants and product donations from Abbott and the Abbott Fund. We have declared 341 consecutive quarterly dividends to shareholders since 1924. In 2008, our stock again outperformed the S&P 500 and the S&P Health Index.” (Abbott)

The employees of the company have no apparent complaint, as they seem to be satisfied with the general workings of the company (Abbott). However, the other stakeholders, i.e. the patients and customers, government, community and environment, advocate groups, and competitors are not happy for the company’s monopolization and anti-competitive, and price discrimination strategy.

Further, health hazards that the company’s products may cause to the patients incite concern for many, especially the government, advocate groups, and community. Further, the company website reports that the company has increased its excretion of hazardous waste material, which may become a cause of problem for the environment, as well as the community.

Conclusion

Abbott is an ethical company from the popular point of view of the “cosmetic” presence of social responsibility schemes adopted by the company. Abbott has a dedicated section in its website, which shows the socially responsible work, which includes donations, philanthropic activities, CSR reporting, etc., that the company has done. This, according to many, increases transparency which itself indicates ethical conduct.

Nevertheless, can the price increase of Norvir or sweeter baby food be considered ethical? As a socially responsible organization, Abbott must become ethical in its business practices and not a philanthropist or transparent organization. Socially responsible business practices are the means of doing business ethically, and not as a way to hide the company’s misdoings. Abbott, although a highly philanthropic organization, cannot be considered an ethical or socially responsible organization.

Work Cited

Abbott. “Global Citizenship.” Abbott Laboratories. 2010. Web.

American Journal of Law & Medicine. “Price Discrimination–Pharmaceuticals–Jefferson County Pharmaceutical Association v. Abbott Laboratories.” American Journal of Law & Medicine Vol. 9 No. 2, 1983: 249.

American Journal of Law and Medicine. “Monopolization – Equipment Supplier-Genetic Sys. Corp. v. Abbott Labaratories.” American Journal of Law and Medicine Vol. XIV No. 2-3, 1988: 294-295.

Datamonitor. Abbott Laboratories. Company Profile, New York: Datamonitor, 2009.

Feder, Barnaby J. “Keeping Arteries Cleared and the Courts Clogged“. New York Times. 2007. Web.

Freeman, R.E. “A Stakeholder Theory of the Modern Corporation.” In The Corporation and its Stakeholders: Classic and Contemporary Readings, by M.B.E. Clarkson, 125–138. Toronto: University of Toronto Press, 1998.

—. Strategic Management: A Stakeholder Approach. Boston: Pitman, 1984.

Gullo, Karen. “How a Monopoly Over an HIV Drug Resulted in Lower Sales.” Bloomberg Press. 2009. Web.

Harris, Gardiner. “Price of AIDS Drug Intensifies Debate On Legal Imports.” Nork York Times. 2004. Web.

MarketWatch. COMPANY SPOTLIGHT – Abbott Laboratories. Company Spotlight, New York: Datamonitor, 2008.

Mokhiber, Russell, and Robert Weissman. “Neither Honest Nor Trustworthy.” Multinational Monitor Vol. 28, 2007: 10-30.

Nelson, Roxanne. “Debate over ritonavir price increase gains momentum.” Lancet Vol. 363 No. 9418 , 2004: 1369.

New Internationalist No. 62. “Health Hazard.” 2003: 26-27.

Porter, Michael, and Mark R. Kramer. “Strategy and society: the link between competitive advantage and corporate social responsibility.” Harvard Business Review Vol. 84 No. 12 , 2006: 78-92.

Schofield, Amy R. “Currents in Contemporary Ethics International And Comparative Health Law And Ethics: A 25-Year Retrospective.” The Journal Of Law, Medicine & Ethics Vol. 32 No. 4, 2004: 777-783.