Introduction

The present report aims at providing a proposal for Volkswagen Group in terms of a strategic acquisition in the automotive industry. The central segments of the global automobile industry are commercial and passenger vehicles. The automotive market is expected to experiences a significant drop in sales in 2020 due to the COVID-19 outbreak. According to Wagner (2020), global sales of passenger cars are expected to decline to 60.5 million units in 2020, down from a peak of 79.6 million sales in 2017. Before the virus outbreak, the industry had already been experiencing difficulties. Therefore, a significant number of smaller companies will be unable to cope with the market recession, which will provide large companies with opportunities to make beneficial acquisitions.

Volkswagen

Company Overview

Volkswagen Group is a significant player in the automotive industry, with revenues of over $279 billion in 2019 (Volkswagen AG, 2020). The Volkswagen group consists of several brands, including Volkswagen Passenger Cars, Audi, ŠKODA, Bentley, Porsche Automotive, Volkswagen Commercial Vehicles, Scania Vehicles and Services, MAN Commercial Vehicles, and other companies that provide financial services (Volkswagen AG, 2020).

Despite the volatility of the industry, the company has strong growth potential and solid financial strength. The net income of the company has been growing steadily for the past five years (Volkswagen AG, 2020). In 2019, net income increased by more than 14% from $11.83 billion in 2018 to $13.89 billion in 2019 (Volkswagen AG, 2020). After experiencing a considerable drop in the stock market, hitting the lowest price of $101.5 per share on March 18, the company recovered to $128.3 per share on April 9 (Yahoo Finance, 2020d). The company is expected to recover as soon as the virus outbreak starts to decline.

Volkswagen and EV Market

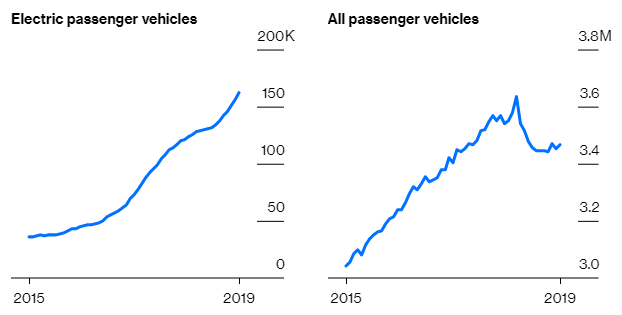

The electric vehicle (EV) industry is a rapidly growing market that attracts many automobile manufacturers around the globe. While the all passenger car market was trailing at 3.5 million sales per month in the previous year, EV sales are growing steadily from 125,000 to 162,000 a month (Bullard, 2019). Figure 1 provides a better understanding of the EV market by juxtaposing it to global passenger vehicle sales. Experts forecast further growth of the market from $129,671.56 million in 2018 to $359,854.56 million by the end of 2025 at a Compound Annual Growth Rate of 15.69% (Valuates Reports, 2019). In other words, the EV market is booming, providing start-ups and well-known vehicle manufacturers to find new ways of serving customers.

German and Chinese manufacturers are competing for being the leaders of the industry, and China is currently winning the race (Bullard, 2019). Volkswagen realizes the current trend of the EV market and plans to adapt its business model to the new realities approaching. The company plans to dominate the market in the nearest future by investing more than $30 billion in EV R&D and production, which equals its combined profits for the last three years (Matousek, 2019). In China alone, it aims at producing 600,000 units a year by 2022, while Tesla plans to build only 150,000 vehicles (Hanley, 2019). Therefore, the central goal of the Volkswagen Group is to increase its presence in the EV market gradually.

Potential Candidates for Acquisition

General Considerations

The candidates for potential acquisition need to adhere to several criteria to be compatible with the Volkswagen Group. First, the acquired company should have the potential to bring value (Salter & Weinhold, 1981). Second, the potential candidate should address the individual needs of Volkswagen (Salter & Weinhold, 1981). Finally, the acquired company should help to achieve strategic goals (Salter & Weinhold, 1981).

Considering Volkswagen’s ambition to become the world’s leading EV producer and the development of the EV market overviewed in the previous section, it can benefit from the horizontal acquisition of EV manufacturers in China. Such acquisitions will bring value to the Volkswagen group by increasing its presence in the region to produce 600,000 EVs by 2022. At the same time, since China was hit considerably by the COVID-19 outbreak, the current financial performance of the automotive companies in the region is expected to be low.

The acquisition should be paid in cash and financed using debt. Volkswagen’s current debt to assets (D/E) ratio is 0.837 (€ 187,092 million of total liabilities by €223,536 of total assets), which is very high (Volkswagen AG, 2020).

Even though the D/E ratio in 2019 decreased from 0.839 in 2018 (Volkswagen AG, 2020), the change is inconsiderable, and in normal circumstances, it would be more beneficial to finance the acquisition with issuing additional shares. However, Volkswagen should consider the situation with COVID -19 and its possible outcomes. According to Russel Investments (2020), central banks in the US, Europe, and the UK are expected to implement unprecedented stimulus measures, which often includes reducing the key interest rate (Russel Investments, 2020). Therefore, the Volkswagen Group will be able to benefit from possibly the lowest interest rate in the 2000s. Consequently, it is preferable to pay for the acquisition with the borrowed cash.

Potential Candidates

Overview

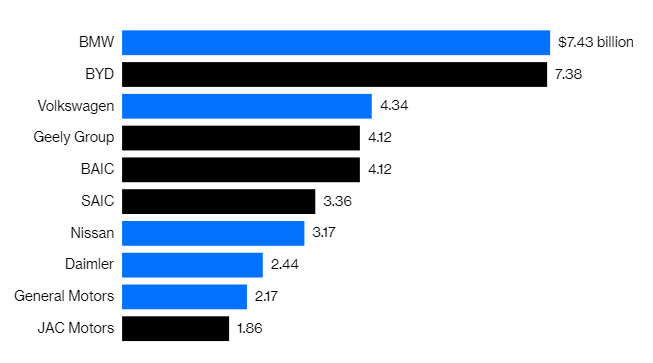

The potential candidates for acquisition should be Chinese automobile manufacturing companies that have been demonstrating steady performance in the EV market for the last three years. Figure 2 provides a list of companies competing in the sphere according to their revenues from electric passenger vehicle sales published by Bloomberg (Bullard, 2019). According to Figure 2, the most appropriate candidates for acquisition are BYD, Geely, BAIC, SAIC, and JAC Motors. The present report will include an evaluation of only three candidates, which are BYD, SAIC, and Geely.

BYD

BYD Company Limited is a Chinese company that operates in three segments, including Rechargeable Battery and Photovoltaic Business, Mobile Handset Components and Assembly Service, and Automobiles and Related Products (Yahoo Finance, 2020c). It offers a wide range of products and services, including lithium-ion batteries, mobile phones, electric tools, cars, buses, as well as property services (Yahoo Finance, 2020c).

In 2018, the company experienced a significant drop in net income to $2.82 billion from $4.07 billion in 2017 (Yahoo Finance, 2020a). Its performance in the stock market can be characterized by extreme volatility, which reflects its unstable financial performance (Yahoo Finance, 2020a). Even though Volkswagen AG can benefit from acquiring the company, BYD offers numerous side services that would require Volkswagen to gain expertise in additional spheres, which may be overburdening.

Geely

Geely Automobile Holdings Limited is an investment holding company that operates as an automobile manufacturer that operates in the People’s Republic of China (Yahoo Finance, 2020b). It produces and sells automobiles and automobile parts and provides after-sale services (Yahoo Finance, 2020b). It invests in research and development (R&D) of automobile engines and electric hybrid engines, which can be beneficial for Volkswagen to increase its R&D potential (Yahoo Finance, 2020b).

Net income of the company has been growing steadily for the past three years, reaching $12.55 billion in 2018; however, its stock market value has been decreasing steadily since March 2018, which implies that it can be bought at a relatively cheap price (Yahoo Finance, 2020b). Considering the company’s profile and performance, it can be a viable option for Volkswagen to purchase.

SAIC

SAIC Motor Corporation Limited is a Shanghai-based automobile manufacturer that provides a spectrum of products and services similar to Volkswagen. It manufactures and sells automobiles and parts and provides associated financing services (Yahoo Finance, 2020c). The company’s dynamic in financial performance is similar to its competitors, with a steady yearly increase in revenues for the past three years, reaching $36.01 billion in 2018 (Yahoo Finance, 2020c). Its performance on the stock market also follows the same pattern as Geely, demonstrating a steady decline since 2018 (Yahoo Finance, 2020c). Even though the company offers similar services, it is large and may overburden Volkswagen with additional debt.

Conclusion and Recommendation

Currently, the automotive industry experiences a significant decline due to the COVID-19 outbreak. The period of uncertainty may help Volkswagen make strategic acquisition of a Chinese automobile manufacturer to increase its presence in the region. Geely Automobile Holdings Limited seems to be the most appropriate option for Volkswagen as it will help Volkswagen gain value, reach its strategic goals, and address its needs. The acquisition should be paid for in cash with borrowed money because there is an increased opportunity to get low-interest rates on loans after the COVID-19 crisis has cleared.

References

Bullard, N. (2019). China is winning the race to dominate electric cars. Bloomberg. Web.

Hanley, S. (2019). Volkswagen plans to dominate electric vehicle manufacturing in China. Clean Technica. Web.

Matousek, M. (2019). Electric vehicles are a tiny piece of the global car market, but Volkswagen is making a huge bet on them. It doesn’t have a choice. Business Insider. Web.

Russel Investments. (2020). Global market outlook – Q2 update. Web.

Salter, M., & Weinhold, W. (1981). Choosing compatible acquisitions. Harvard Business Review. Web.

Valuates Reports. (2019). Electric Vehicle market overview. Web.

Volkswagen AG. (2020). Annual report 2020. Web.

Wagner, I. (2020). Automotive industry – Statistics & facts. Statista. Web.

Yahoo Finance. (2020a). BYD Company Limited. Web.

Yahoo Finance. (2020b). Geely Automobile Holdings Limited. Web.

Yahoo Finance. (2020c). SAIC Motor Corporation Limited. Web.

Yahoo Finance. (2020d). Volkswagen AG. Web.