Introduction

Theoretical frameworks are aimed at presenting courses of actions for countries faced with various economic situations. However, there may be a number of challenges and limits to practical applications of macroeconomic policy. This report will seek to investigate Argentina’s monetary policy during a recession period and derive lessons to economic decision-making from this historical event. The paper will cover the concepts of currency devaluation and the financial climate in the country post the crisis. In the Argentinian economic crisis, expansionary macroeconomic policies would have been an appropriate measure if applied at the correct time with significant stabilizing factors and targeted at specific sectors.

Case Overview

After being hit by a series of economic crises leading up to 1991, Argentina was faced with the continuous fall of its GDP and hyperinflation. With any attempts at intervention by the government failing, it was decided to tie the Argentinian peso to the U.S. dollar at the conversion rate of 1:1 with the strict oversight of a currency board. It had a positive stabilizing effect on the economy leading to growth. However, by 1998, the U.S. dollar (therefore the Argentinian peso) grew significantly in comparison to the Brazilian real. As a result, the trade relationship began to hurt Argentina, facing difficulty with exports due to the substantial difference in the conversion rate. Argentinian industry and firms could not compete with the advantages of a devalued real, causing the eventual decline.

Argentina saw a loss of its markets as well as the decline of the GDP by 4-5%. However, due to its commitment to anti-inflation policies, the peso was not allowed to move from its 1:1 US dollar conversion rate. The country was faced with a difficult choice of releasing the peso from the forced conversion rate or practice expansionary fiscal policy by increasing government spending and decreasing taxes. However, the tight federal budget prevented an increase in spending while the currency devaluation would have compromised the country’s monetary integrity and commitment, which might have led to capital outflow and higher government debt.

Currency Devaluation

Rapid currency devaluation experienced by the Argentinian peso in the last several years has detrimental effects. First, it leads to rapid inflation as there is significant distrust for the peso, and everyone attempts to convert it to other currencies. The supply of pesos increases exponentially while the foreign reserves held by the Argentinian Central Bank are depleted. Furthermore, it undercuts the validity of the government’s reputation for foreign borrowing and strongly decreases the value of government bonds. Finally, rising inflation leads to a decrease in quality of life. Any savings that citizens or businesses may hold in pesos lose value. Meanwhile, prices on essential commodities and food continue to increase by as much as 21% (Gillespie, 2017).

Financial Situation

The country remains in an unfavorable economic situation. Its GDP growth is decelerating to a forecasted 2.5% in 2018 while the account deficit remains higher at 3-4% of the GDP. Inflation is estimated to be at 17% in 2018, and the unemployment rate is around 9%. A new presidential administration is taking a new approach by lifting restrictions on currency transactions and the exchange rate. This led to the extreme growth of inflation in the country and the devaluation of the peso by almost 40% in 2017. There is a critical need for structural reform and shifts to macroeconomic policy (Weltman, 2017).

A series of governance and policy errors led to the default of 2014 and subsequent problems in Argentina that stem from the currency manipulation of the 2001 crisis. The government manipulated statistics to misrepresent the consumer price index, which reflected inflation rates. Official statistics were significantly lower than realistic estimations by private investors. Furthermore, the dirty float exchange rate was intentionally kept lower than inflation, causing the appreciation of the real exchange rate. The government increased spending at a 5.2% annual growth, causing fiscal deficits, while the tax incidence rate gradually climbed to over 50% of the GDP. During the period of economic growth, Argentina used price caps on sectors such as energy production, which led to the misappropriation of resources. The economy was not prepared as there was little investment in infrastructure and technology, causing the country to become an importer instead of an exporter in many sectors. All these aspects created significant financial burdens economic imbalances which the country is unable to efficiently manage (Thomas & Cachanosky, 2016).

Expansionary Macroeconomic Policies

Evidence suggests that expansionary macroeconomic policies are procyclical in developing countries, utilized during growth rather than a recession when it could provide a more significant boost. Developing countries do not have proper fiscal stabilizers in place to dampen aggregate fluctuations during downturns. Argentina chose to implement expansionary policies during its economic boom, leaving the government with no revenue and the need to use a fiscal contraction. Developing countries risk losing anti-inflationary credibility through monetary policy and lack of domestic borrowing power to finance fiscal policy.

Historically, expansionary policies are not adequate for developing countries during economic recessions. However, if proper measures are taken, and the scope of the macroeconomic policies is limited to specific sectors, then it is possible to use expansionary tactics. A country must adopt countercyclical fiscal measures, particularly during periods of economic growth. The expansionary policy should focus on two distinct aspects. Social safety nets should be implemented to protect vulnerable populations from impacts of a recession, thus improving automatic stabilizers, which are effective at maintaining balance. Furthermore, an increase of spending should focus on industry and infrastructure which promote long-term growth and can support a country’s economic stability (Kraay & Serven, 2013).

Conclusion

An examination of the Argentinian economy over the last two decades shows the powerful impact of the macroeconomic policy. It indicates that a balance should be maintained between monetary and fiscal policy. Furthermore, the procyclical and politically manipulated policies are short-sighted and cause a prolonged economic recession in the country. Lessons learned from this include that expansionary macroeconomic policy is applicable in developing countries at a limited scope with proper preparation during periods of growth. Furthermore, the strict conversion policy utilized by Argentina in the 1990’s is unsustainable with public debt dynamics. The mismanagement of macroeconomic policies eventually outweighed the benefits of the convertibility system, thus forcing the economy into crisis in order to balance the exchange rate.

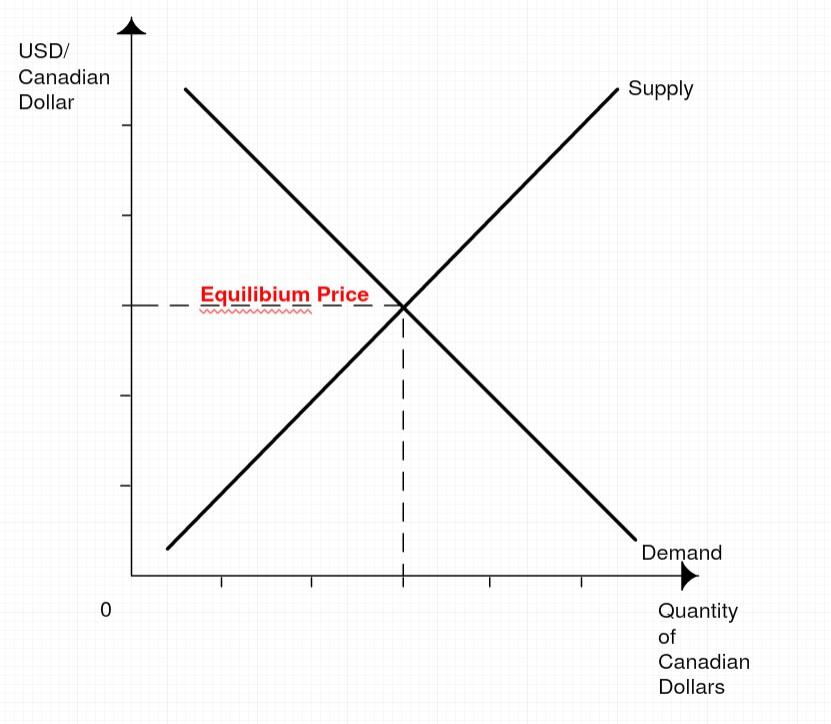

Quantitative Analysis

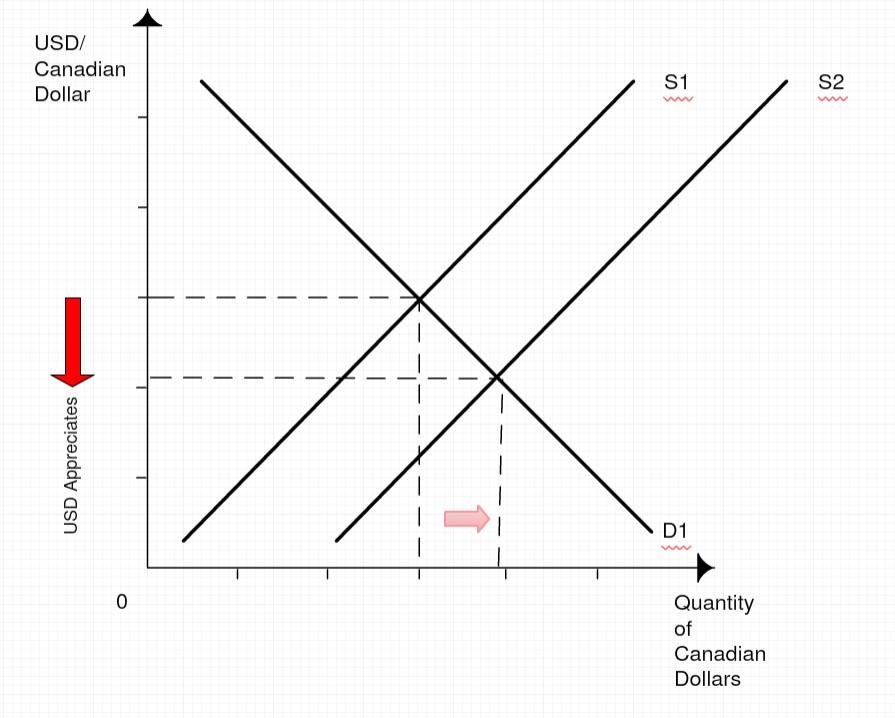

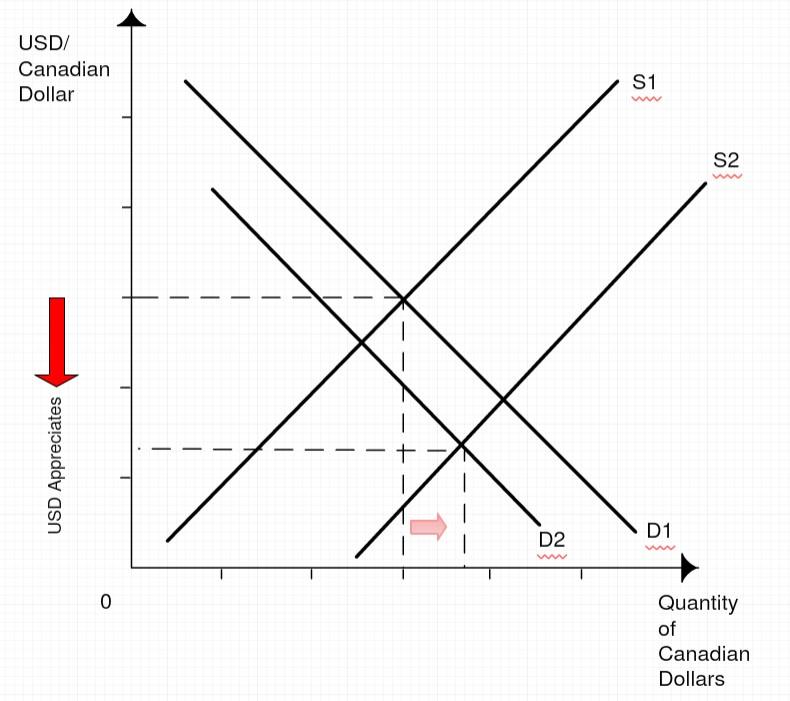

If Canada experiences rapid economic growth over the United States, it would indicate that a higher rate of income increase. This would most likely lead to higher demand for U.S. products which would require the purchase of US dollars. As the demand for USD grows, so does the supply of Canadian dollars due to the ongoing exchange, shifting the quantity supply curve to the right. Meanwhile, the value of USD appreciates due to the demand. This effect will last for a medium time since economic growth occurs in cycles.

A rise in interest rates in the United States would lead to increase investment into the US economy by Canada. The supply of the Canadian dollar would increase, shifting the supply curve to the right. Since the investment would be going into the American currency, the demand for Canadian dollars would fall as well. An increasing quantity of Canadian dollars would allow USD to appreciate. This is a short-term effect since currency fluctuations based on interest rates are incredibly volatile and federal interest rates may change rapidly.

If the price of goods in Canada is more expensive, then it would be cheaper to import from the US. To purchase US goods, the demand for USD would increase proportionately leading to the conversion of Canadian dollars and increase their supply. Increased quantity of Canadian dollars would lead to an appreciation of USD value. It is a potentially long-term phenomenon since the purchasing parity theory that is applied here would take time to stabilize.

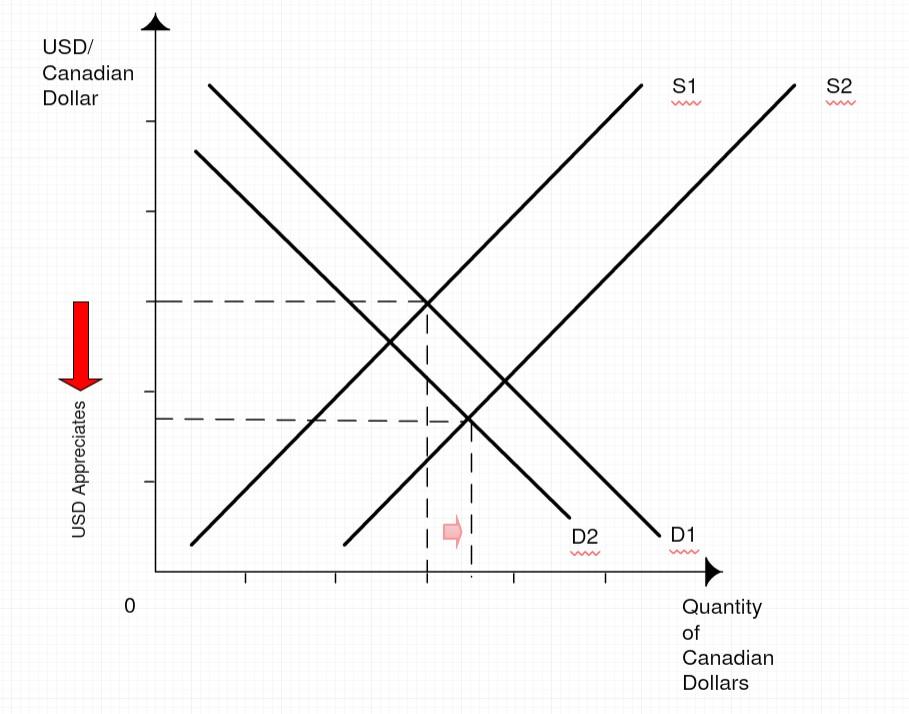

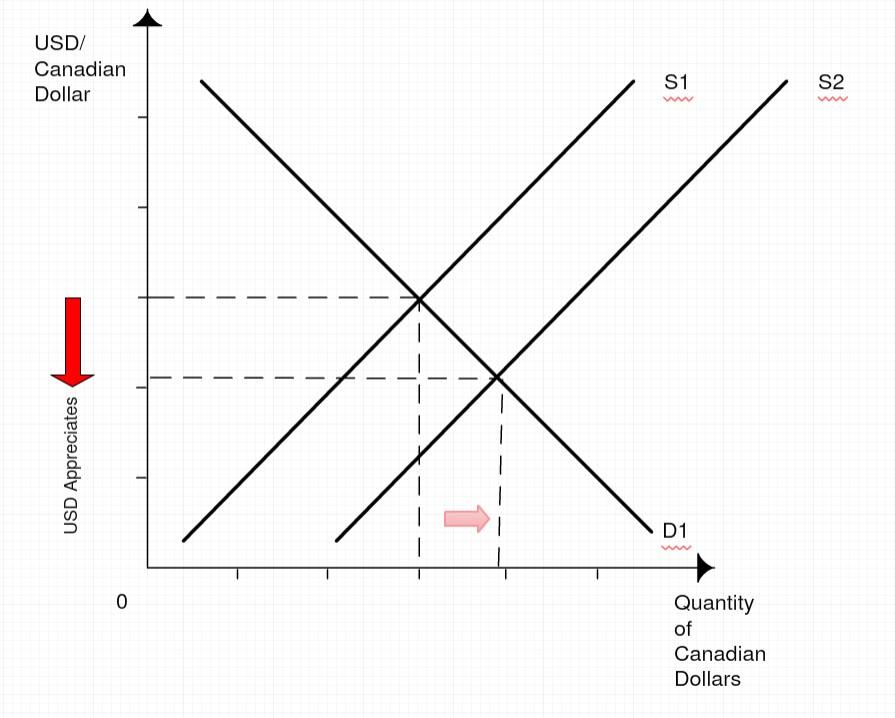

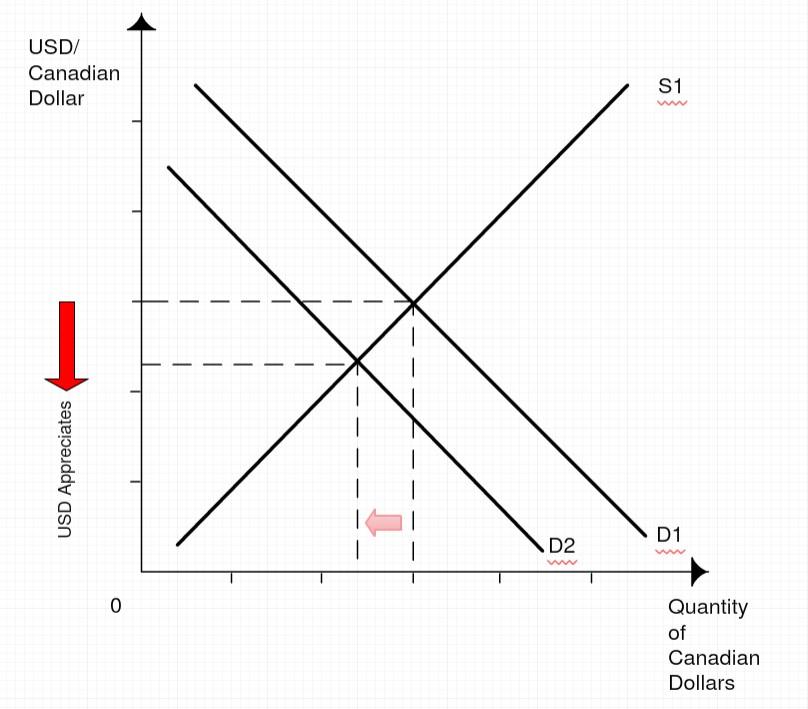

A recession in the United States would result in decreased purchasing demand (therefore imports) from Canada. The demand for Canadian dollars will fall because of this trend, shifting the curve to the left while the supply remains the same. The decreased quantity of Canadian dollars on the US market will lead to the appreciation of USD. Recessions are frequent in the economic cycle which would make this a medium length effect.

If there is an expected depreciation of the Canadian dollar, then it would automatically lead a decrease in the demand for the currency on the market as investors would avoid purchasing it. Furthermore, there will be a rapid conversion of the Canadian dollar to the USD, significantly increase the supply. The decreased demand and increased supply of the Canadian dollar would lead to a loss of its value, thus causing an appreciation of USD. Given no other factors, it is most likely a short-term effect based on volatile currency speculation.

References

Gillespie, P. (2017). Argentina’s currency nosedives again this year. CNN. Web.

Kraay, A., & Serven, L. (2013). Fiscal policy as a tool for stabilization in developing countries. Web.

Thomas, C., & Cachanosky, N. (2016). Argentina’s post-2001 economy and the 2014 default. The Quarterly Review of Economics and Finance, 60, 70-80. Web.

Weltman, J. (2017). Macri’s election success is no cure-all for Argentina’s structural issues. Web.