Introduction

Asia, the economic tiger of the globe has recorded an annual growth of 5-10% for the previous decade until 1997. The western as well as US investors were driving their investment in the Asian countries. The donor agencies influenced the Asian countries to create more flexibility and openness in their economy to ensure the interest of US investors rather then local development. In practice, the Asian countries followed their advice and opened their economy to FDI; capital streams, overseas products and services, and become more and more dependant on the United States dollar for foreign currency reserve. At the same time, their export market turned to US to soak up their exports. In order to create a center of attention overseas investments and to assist capital surge they kept their exchange rates of currency in reasonably close up alliance with the US dollar otherwise US dollar dominated basket of currencies and faced crisis of 1997-98.

Background of 1997-98 Crises

According to Dick K. Nanto (1998, pp.1) the two rounds of currency depreciation in 1997 was liable for the then economic crisis in Asia. The Governments of countries (Philippines, Thailand, and Indonesia etc.) had countered weakness in their currencies by selling foreign exchange reserves and raising the interest-rates that resulted in a downturn in economic growth and prioritized the interest-bearing securities than equities. These phenomena also weakened the banking and financial institutions and resulted in an economic crisis. He also added four fundamental dilemmas for the Asian crisis of 1997-98. These are the value of currencies & equities in those Asian countries to fall noticeably due to a scarcity of foreign exchange; enlargement of monetary sectors and system for allocating capital in the distressed Asian economies were in danger and inadequate; extent of effects of the crisis on the US and world economy; and roles of IMF.

Effects on Interest Rate, Unemployment, and Exchange Rate

The crisis had phenomenal effects on interest rates and caused it to increase further. There was a strong increase in the real interest rates because of the rise in the inflation rate. According to International Financial Statistics as cited by G. S. Gupta, (2003, pp. 13), the inflation rate of Japan increased to 1.7% in 1997 from 1% of 1996 because of their weakened economy of then time. Though there was a decline in the inflation rate in some countries in 1997, the real interest rates was increasing due to the instability in exchange rates and buying credibility of money of these (the most affected) countries declined. Then lack of credit and hence high interest rates were considered as one of the main reason for business failure of then time.

The unemployment was increased though not substantially in then period as per there was a statement of low scale increase in the unemployment rate. According to International Financial Statistics (as cited by G. S. Gupta, pp. 12) the unemployment rates of countries under distress are as following:

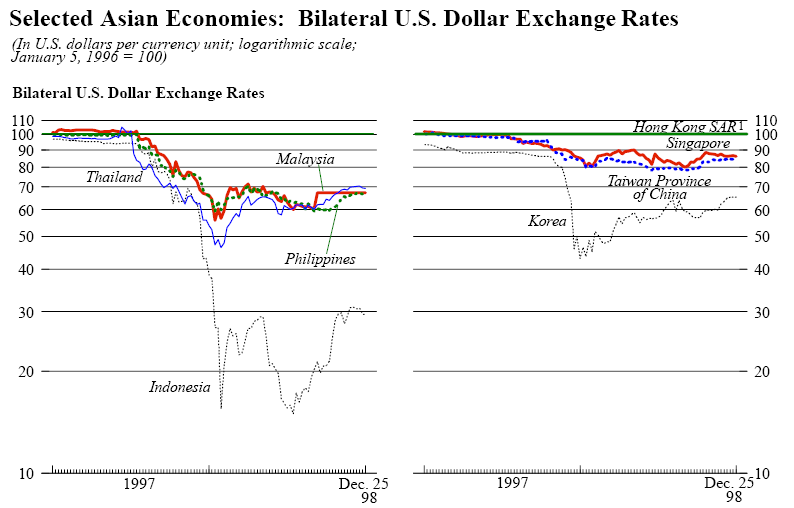

From the above table it is clear that such a crisis had inclined the unemployment rates of the major distressed countries. The same picture is true for Hong-Kong, Philippines etc. In Japan, the unemployment occurred most phenomenally, causing lots of people of the labor force to become unemployed. One of the reasons behind the cause was the inefficiency of handling foreign trade and restraining the foreign investments and thus less income possibility for the labor force. This situation was more horrifying because most of the unemployed were young and thus instability in the social security might get hampered for such frustration and lack of job opportunity. The exchange rates of that time were rising because of the lack of confidence in the economies and the Government was selling of foreign exchange reserves, however, the following table depicts the exchange rate depreciation of then period:

Figure 02: Extent of Exchange rate depreciation 1997-98

From the information stated it is clear that there was a substantial rise in the exchange rates of the distressed countries that shows the clear inefficiency of handling foreign trade and balance of payment. Due to the loss in confidence in the local currency, there were the potentials present for a run on the foreign exchange reserve of a country with a fixed exchange rate by its own residents. There was also a rapid outflow of foreign investment present to make the scenario further difficult.

Sustainability of Economic Performance in this Region

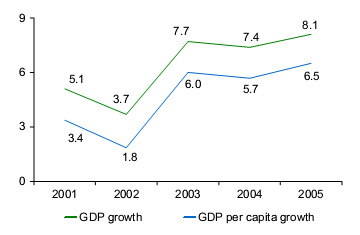

The rescue programs run by various organization, the IMF for example, and the Government itself were able to shift the country from such a down-turn but the growth rate of the economy was not shifted at a phenomenal rate. But in recent time, it is evolving towards rise and hence the sustainability became the major question. In recent period, the sign of sustainability emerges in this part of world. According to South Asia Economic Report of ADB (2006, pp.3) the South-Asia sustained the impressive economic performance having highest economic growth in 2005 and an average growth of GDP was 7.6% as the following figure depicts:

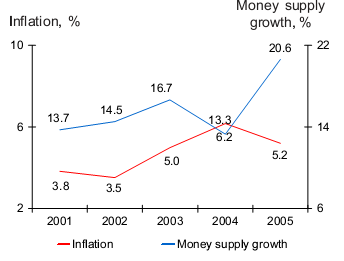

It also stated that the economies of the part also experienced significant reductions in the fiscal deficit amounting 6.7% in 2005 as a percentage of GDP. It also depicts that there are revolutionary developments in the share markets in the part of the world that has been attracting many investors and fortunately, many of such markets are not affected by the present economic downturn. The inflation and money supply growth of the same is also took place as following:

Reason of the Asian Financial Crisis

The Asian financial services sector in most of the countries is recently developing infrastructure and moving forward speedily with devoid of adequate regulation, supervision as well as government controls. Due liberalisation of capital markets the banks within these countries become authorised to borrow funds from abroad at a comparatively lower rate of interest and reallocate funds in a higher rate of interest among their country. For the previous few decades, this type of foreign borrowing by the private sector of those countries turned more predominance than public sector. The practical evidence was like that in seventies the Asian governments have borrowed for heavy infrastructural development from the ADB2 or World Bank, in the nineties the local private banks are directly borrowing from an US Bank.

The reasons and structural features causative for the financial crises are as follows:

- The private sectors debt tribulations as well as reduced loan quality,

- IMF & World Banks misinterpretation and misguide on the Asian economy,

- Lack of protest against the IMF & World Banks harmful prescriptions.

- The rising external liabilities in support of borrowing country

- The close up configuration among the local currency as well as U. S. dollar,

- The deteriorating economic performance and crisis of the balance of payments,

- The wrong currency speculation,

- The technical alteration in the financial markets,

- The reduced confidence on the governmental initiatives to face the crisis.

Role of IFM in Asian financial Crisis

The IMF3 has been the main performer in coordinate support packages for the distressed Asian economies and the most important goals of the IMF were to promote-stability, balanced growth of business, and enlargement, but due to the Asian down turns, it has deepened its actions in four directions. In order to recover from the extreme crisis, initially, IMF strengthened observation over East Asian countries’ strategies, helping to reinforce the function of financial-markets, and it provided policy-advice as well as financial assistance and finally it was helping to make sure that no nation is marginalized. The Asian financial down turn has raised numerous questions pertaining to IMF functions such as whether its resources are adequate to cope up the situation, whether rescue package creates any moral hazard or not, whether the contagion of financial crises can be stopped successfully, and whether it can changes the economic policy and whether it can increase accountability or not.

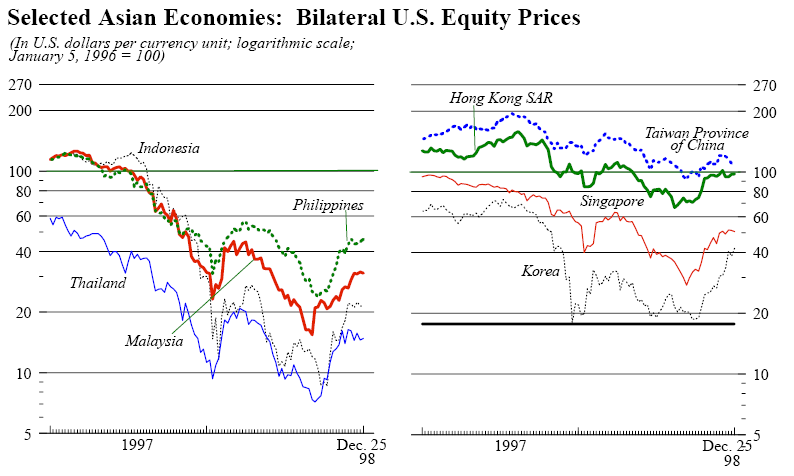

The following figure demonstrates the Asian economies in 1997-98 where it was found that how the exchange rate and equity price was decreasing dramatically.

- Indonesia, Korea, and Thailand were seriously affected in 1997-98 financial downturns; therefore, IMF took instantaneous initiatives of economic stabilization and reformed financial plans in order to restore their confidence.

- IMF has approved several rescue packages and the amount was more than US$ 112 billion for these three countries.

- It has worked for both inside and outside of the recessionary area and take necessary steps because recession could spread out all over the world.

- Finally, it had proposed several plans for instance monetary and fiscal policy, economic growth-rate, administration of weak institutions.

- In addition, IMF has formed SRF4, to conquer the difficult conditions, however, besides IMF, The World Bank and ADB5 has take measure for affected country.

Though, IMF has contributed in Asian recessionary period but its few initiatives was controversial such as IMF’s high-interest-rate recommendation in the Asian turmoil was notorious as it should paid up to 60% interest rate which is high in normal economic condition. Moreover, IMF’s response in Asian economic crisis is also matter of controversy because a lot of local industries & governments had taken out loans in US dollars, which rapidly became extremely expensive relative to the local-currency for inflation; therefore, many companies had collapsed due to repay their creditors. Asian financial crisis has longer for such irresponsible activities of IMF, as a result these countries has tolerated permanent currency-devaluations, huge bankruptcies, collapses entire economies, property rights, unable to pay mortgage, increase unemployment rate and social unrest.

Learning Outcomes for Global Policy Makers

Rude C., (1998, p.6) argued that from 1980s it was assumed that savings, investment, education all of the right components for financial accomplishment were present therefore, powerful economic performance & increasing asset-prices inspired investors, commentators and economists.

- US has learned that bailouts are necessary in initial stage of a recession to protect capital outflow, otherwise it may create a more horrible situation in national economy.

- This crisis has not occurred automatically or arbitrary but it happened for due to over-investment by international bankers and other ventures’ therefore, it should differentiate between long-term secular improvements, the medium-term financial conjuncture.

- Economic markets seem inherently irrational, as a result, it has no boundary, once the infection began to spread, and then it pursued an intrinsic-logic of its own.

Conclusion

The global lender looking for the last alternative is required to assist to overcome the crisis and return the economy to its normal stage. The Asian financial crisis hits the currency markets first; nevertheless, the exchange rate volatility has been grounded primarily by troubles in the banking sectors of those countries. For financial crisis management, the donor agencies like IMF & World Bank are required to work with more integrity with expertise and human resource development to vigorous financial systems.

Bibliography

ADB, 2006, South Asia Economic Report of ADB, Publication Stock No. 100706, Web.

Crispin, S. W., 2008, Southeast Asian Memo to Wall St: On Financial Implosion, Web.

Das, D. K. 2000, Asian Crisis: Distilling Critical Lessons, United Nations Conference on Trade and Development (UNCTAD), Geneva, Switzerland, Paper No. 152, Web.

Fischer, S. 2000, On the need for an international lender of last resort, 2nd edition, Publisher: Princeton, N.J.: Princeton University, ISBN: 0881651273 9780881651270

G. S. Gupta, 2003, Economic Fluctuations and Stabilization Policies, Indian Institute of Management, Web.

IMF, 2009, The IMF’s Response to the Asian Crisis, Web.

Johnson, S., & Boone, P., 1999, Corporate Governance in the Asian Financial Crisis, Web.

Nanto, D. K., The 1997-98 Asian Financial Crisis, Web.

Rude, C., The 1997-98 East Asian Financial Crisis: A New York Market-Informed View, Web.

Vickery, J., 2005, Banking relationships and the credit cycle: Evidence from the Asian financial crisis, Web.