Introduction and background information

In the period after the Second World War, the most promising economic giant in Asia was thought to be the Philippines and not current Japan. The country had a stable political environment with major homogeneity in race and language. It also had warm relations with the US. However, years of mismanagement, corruption and neglect characterized the subsequent years. The country became one of the poorest in the region. During the 1960s Thailand’s economic development could not match that of the Philippines. The situation is now almost perfectly reversed. The Philippines ‘ per capita income is just above half that of Thailand. Past regimes have misappropriated immense national wealth.

With employment opportunities low in the country Philipinos seek work in foreign countries and the exercise is encouraged by the government. Close to 10% of the country’s GDP is as a result of remittances as over 11% of the population live and work abroad. A million citizens leave the country each year in search of jobs abroad through a government-backed overseas employment program. In recent years, new growth frontiers such as the business process outsourcing (bpo) have offered opportunities for the highly literate Philippines. More growth in the services sector is expected with government planners determined to take up 10% of the 130 billion worth outsourcing industry by the year 2010. This is making the economy emerge as a major powerhouse with immense potential to catch up with countries like Thailand.

Agriculture is still the most prominent contributor to the country’s GDP. The sector employs about 40% of the entire workforce. It contributes 14.7% of the GDP yet the vast farms are owned by a small number of families. This shows the height of inequality prevalent in the nation. The industrial sector contributes about 31.6% of the GDP while the biggest and fastest-growing sector contributes 53.7% according to year 2008 estimates The country operates a mixed economic system due to government involvement in some key sectors such as the economy (Villegas, p7).

The Fiscal policy

The government plays an important role in the growth and development of a country’s economy. It can either slow down the economic growth or revive it depending on the nation’s current economic performance. An economy may be too active when there is excessive demand from consumers which pushes up production. Prices soar which leads to inflation. Under this condition, the government may step in by increasing tax rates which drains the money from the hands of consumers and producers. On the other hand, an economy may become inactive when investment, production, and individual consumption are low. The government steps in again by reducing tax rates which encourages more spending and production. The government may also make use of revenues it earned from taxes to keep the economy going by spending on public services such as infrastructure (Bureau of Treasury, Par 5).

The use of government spending and revenue collection to influence a country’s economy is known as fiscal policy. Knowing a country’s fiscal performance is not only important in knowing whether its economy is doing well but also in knowing how the government obtains and makes use of its budget. When government consumption exceeds its budget resulting in a budget deficit, the government resorts to borrowing to finance this excessive spending. A balanced budget is ideal in that it ensures the public that the government was able to maximize all of its resources and that there is zero surplus or deficit. This still depends on how the government distributed its budget among different sectors of the economy.

Past regimes in the Philippines were conservative in the use of fiscal activities. By the 1970s, less than 10% of the Gross National Product was as a result of tax and government expenditure. Under Marcos’s reign, the percentage of government activity grew to about 17% of the GNP mainly due to increased capital expenditures and consequently the need to service loans (Bureau of Treasury, Par 6).

The issue regarding the increasing national government debt has always been a major concern in the growth and development of our country’s economy. The Marcos and Aquino eras saw extensive borrowing both internationally and locally. These actions largely contributed to the continually increasing deficits which require more borrowing hence more repayments. In 1991, the huge deficit led to the development of a special agreement between the IMF and the government.

Faced with problems such as declining revenues and increasing budget deficit, the current president Gloria Macapagal-Arroyo began her administration with the resolution to address these issues by limiting government spending and key fiscal and economic reforms. The current government’s aim is to attain a balanced budget by 2010 by pursuing legislative and administrative measures to correct the structural defects in the tax system, generate P80 billion through tax measures and generate earnings or savings of around P100 billion from administrative measures (Bureau of Treasury, Par 9).

Latest trends show that the government almost attained its goal in the year 2007 when the budget deficit was about -0.2%. However the global economic crisis and inflation in food prices led to some deterioration in the year 2008 as shown by the table below.

Total revenues have increased by almost half a trillion pesos since the year 2003. This can be attributed to the fiscal and economic measures that the Arroyo Administration approved and implemented. Although the Philippine economy significantly slowed down in 2008 due to the global economic crisis after achieving a stronger fiscal position in 2007, the economy still remained generally resilient. The reforms set by the government earlier in 2004 were able to cushion our economy from the impact of the crisis.

Deliberate government measures backed by political goodwill have seen the recent turnaround in the management of the Philippine economy. Earlier administrations sunk the economy to very low levels hampering the efforts being employed by the later regimes in trying to turn around the economies.

Between the years 2003 to 2007, the deficit percentage fell by about 5% and again grew by 1% in the year 2008 as illustrated by the graph below.

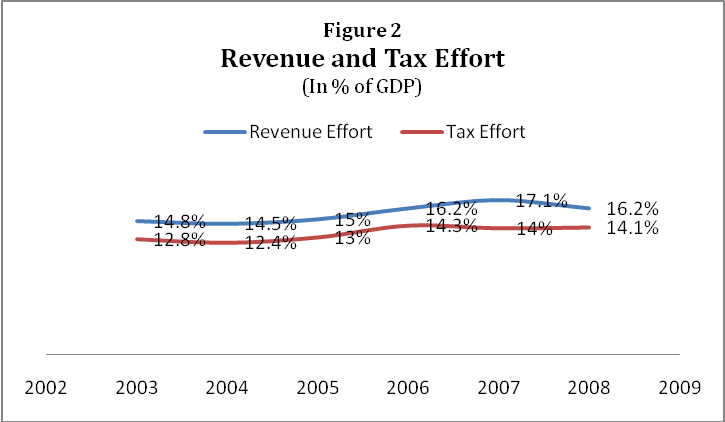

Again, the gradual rise in the tax revenues and government spending as a percentage of GDP has been witnessed. The tax revenue effort focuses on the measurement of the public sector’s ability to collect various tax revenues for use in backing up both the recurrent expenditures as well as the development needs of the economy. The tax effort is calculated as the ratio of total government revenues (both tax and non-tax) to GDP at current prices. From 14.5% in 2004, the revenue effort was able to increase by 3% in 2007 (Department of Finance, Par 4-6).

President Arroyo introduced three major legislative reforms which successfully led to huge rise in tax revenues collected by the administration. The first one was Republic Act (RA) 9334 also called the Rationalization of the Excise Tax. It targeted products like Alcohol, Cigarettes and other Tobacco Products. The reform was effective from December 20, 2004. The legislation focused on raising the excise tax rates for fermented liquor, cigarettes, and alcohol. Excise tax is a levy charged on any goods produced within the country. It focuses on production and not sale. Due to the nature of the goods targeted by the tax, the excise taxes became to be called sin taxes. By extension the exemption for taxes and duties on imported alcohol and tobacco products was lifted, except for Duty-Free products. This saw a drastic rise in levels of revenue while maintaining healthy political ratings since the taxed goods were considered as vices in society.

Another was RA 9335 or the Lateral Attrition Law, signed on January 25, 2005. It developed a system of rewards in the form of both punishments and incentives for those working in the Bureau of Customs (BOC) and Bureau of Internal Revenues (BIR) at all levels of service. The aim was to ensure efficient tax collection which is free from corruption.

The tax reform element known to have the highest significance in terms of ability to raise tax revenues was the RA 9337 or the Reformed Value-Added Tax (RVAT) Law. It was effective from May 24, 2005. It focused on casting the net wider for VAT. This was done by doing away with numerous meaningless exemptions, especially in petroleum products. The VAT rate was also increased by 2% (from 10% to 12%). VAT is a type of indirect tax, particularly a sales tax, which is imposed on the good itself that was produced and is being sold. Other products affected by the reforms included: services offered by doctors and lawyers, power, non-food agricultural products, domestic air and sea travel, works of art, indigenous fuels and electric cooperatives, literary works, and musical compositions. This tax is a tax for the producers and sellers but the money is remitted from consumers who buy their products (Department of Finance, Par 5).

The government claims the Expanded VAT or EVAT as the single largest contributor to the significant increase of total revenues since 2005. A total of P291 billion was raised through EVAT from November 2005 to December 2008. Total EVAT from oil alone during the year 2008 was P58.01 billion. Collected revenues from the EVAT were used to mitigate the effect of high oil prices and commodities on the poor, and subsidize lifeline electricity users, scholarships, hospital upgrading, elderly and school feeding, among others.

The significant decrease of debt-to-GDP ratio from 65.7% in 2001 to 56.9% in 2008 attributed to the gradual improvement in the national government’s tax efforts, actual expenditures consistent with the programs, and the adoption of prudent debt management and financing strategies in favor of domestic sources. Because the government could increase its revenues parallel to enforcing strict budgeting, it could focus more on developing infrastructure; pay for economic and social development, and at the same time pay off debts and interests (Bureau of Treasury, Par 4).

An aggressive privatization program initiated by Arroyo’s government also greatly raised the level of revenues. Transmission and energy generation companies like Genco, Malampaya Gas Field Project as well as the sale of government-owned equities in Philippine Telecommunications Investment Corp and Philippine National Bank (PNB). It is estimated that over 3 billion Pesos were generated.

Translation to GDP

The radical changes and the rationalization of operations adopted by the recent authorities have positively paid off. The years before 2003 saw the GDP grow at dismal rates. However, the period after 2003 saw an unprecedented continued growth level. In the financial year 2007, the GDP growth rate was at 7.1% the highest rate in three decades. The total GDP stood in 2008 at about $166,909 million with the growth rate declining to 3.8% due to the ongoing global economic crisis. During the same year, the per capita GDP was $3,200 with respect to purchasing power parity (Global Finance, Par 6).

The three dominant sectors named above are the main current drivers of the economy in the Philippines. The key sector is the services sector where a large number of people are employed in business process outsourcing. The manufacturing sector largely comprises food processing plants, garments, textiles and vehicle parts.

It is however notable that the country is also well endowed with other resources. The country has huge mineral deposits which include nickel, copper and chromite. There also exist natural gas reserves as well as coal. However, despite all these, the country leads in generation of renewable energies (Villegas, pp5-12).

Conclusion

Raising government revenues has proven to be a crucial element in managing the enormous debt burden shouldered by the country’s citizens. Observing fiscal discipline has eventually led to the current manageable budget deficit and is expected to lead to a balanced budget in the near future to ensure stability. Key fiscal and economic reforms such as the new sin taxes, EVAT, privatization programs, improved tax collection, and limited government spending were able to contribute to the increase of total revenues collected from 2004 to 2008, which resulted in the decrease of national government debts.

The Philippine economy can be said to have improved significantly during President Arroyo’s administration based on its fiscal performance. A significant decrease in budget deficit can be observed and the government almost attained a balanced budget by the year 2007. This was only interrupted because of the global recession which prompted an increase in spending on infrastructure and social services during 2008 to cushion the impact of the increase in oil and food prices.

The continued application of sound economic policies is capable of rapidly improving the country’s GDP levels to match those of countries like Thailand. Of great importance is the redistribution of incomes. This is because the country experiences some of the highest levels of inequality mainly due to the uptake of some colonial ideals on attaining independence.

Again the high level of literacy is said to be the highest among the neighboring nations. This advantage is increasingly being utilized in the emerging frontiers in the services sector. This will undoubtedly lead to the improved economic status of the entire population. With such considerations, economists are well informed in classifying the economy as one which is newly industrializing. Indeed, the Philippine economy was ranked as the 37th largest economy globally.

Works Cited

Bureau of Treasury. National government fiscal position: C.Y. 2000-2008 (In million pesos). 2009. Web.

Department of Finance. Revenue and tax effort: (In % of GDP). 2009. Web.

Department of Finance. The Philippines: Fiscal update. 2009. Web.

Global Finance. The Philippines Country Report: GDP data and GDP forecasts; economic, financial, and trade information; the best banks in The Philippines; country and population overview. 2009. Web.

Villegas, B. Guide to economics for Filipinos. Manila, Philippines: Sinag-Tala Publishers. 1977.