Introduction

The term “market failure” in economics conveys a special meaning, which refers to a situation when the market left on its own does not allocate resources efficiently. This market failure would lead to loss of economic efficiency. Market failure is identified to exist “when the competitive outcome of markets is not efficient from the point of view of the economy as a whole” (Tutor2U, n.d.). The market failure situation exists when the benefits that the market provides to the individuals or firms carrying out any particular business diverge from providing any benefit to the community as a whole. Where there is a market failure, the government can play a potential role, to improve the economic performance of the market for the betterment of the community, the environment and the economy as a whole. There may be the intervention of the government to change the behavior of the business or the individuals concerned so that the situation of market failure may be corrected for benefiting the society. However, it may not be necessary that the government has to intervene in every instance of market failure. In some cases, the private sector involved in the market itself may find a suitable solution to remedy the market failure. Economists have identified four different types of market failure each having its own characteristic features. Each of these market failure situations requires different types of reactions from the policymakers to correct them. Therefore, it is important to identify the right type of market failure before any corrective action is taken. This paper presents a review of the different kinds of market failures. The paper analyzes the operation of oil cartel in the Middle East to assess whether the operation represents a market failure.

Causes of Market Failure

When the individuals or firms carrying out an activity indulge in doing it to a sub-optimal extent in such a way that the returns from such activity diverge from the returns to the society, the situation is identified as a market failure. In cases where the individual or firm is not able to assimilate sufficient information for recognizing the returns by resorting to certain action, market failure is said to occur. The market failure is bound to happen where there are externalities causing private and social costs and/or benefits to diverge. If there is an imperfect competition, there is the likelihood that market failure may occur. In addition, market dominance and abuse of monopoly power may also result in creating market failure situations. Where there is factor immobility and equity (fairness) issues like the generation of an unequal and unacceptable generation and distribution of income and wealth causing distorted social developments.

Public Goods

Public goods are one with benefits that people cannot be excluded from enjoying regardless of who pays for the goods (Wonnacott & Wonnacott, 1979). Public goods are therefore considered as “non-excludable” and “non-rival”. Freeriding is a problem associated with public goods as once the goods are made available, since it is non-excludable everybody can enjoy the benefits. Examples of public goods may be found in national defense, lighthouse, clean air and streetlights. Usually the pure public goods are provided by the government or the government may find an intervention in funding private provision. However, such intervention is warranted only when it is ascertained that the market would not be able to find its own solution to this market failure.

Common Property Resources is one where everyone has free access to renewable resources – for example, lake, forest – where there can also arise the question of market failure. With an improperly defined or undefined property right and lack of economic incentives in the form of profits, resources in this particular type of goodwill are subjected to overexploitation until the resources reach the point of depletion. One example of this phenomenon is frequently confronted is the fisheries industry.

Externalities

“Externalities are costs or benefits arising from an economic transaction received by parties not involved in the transaction” (Better Regulation, n.d.). Externalities may take the form of positive externalities where external benefits result or negative externalities where external costs occur. The effect of the existence of externalities may be found in the production of either too much or too little of goods and services. The consumption of such goods and services may also be economically efficient. For instance, when the cost of producing a particular product or service does not take into account the damage it creates to the environment, a negative externality is said to arise. The externalities may be addressed by the government by resorting to regulatory measures or by persuading the manufacturers of goods and services (for example through advertising campaigns). The government may also resort to establishing property rights in the externality and penalize the entities for polluting the environment.

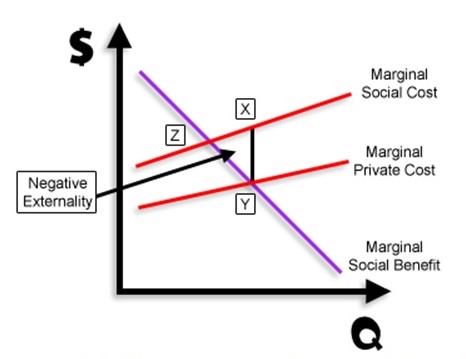

A negative externality occurs when the social cost is observed to be greater than the private cost. Such a negative externality results in the product being excess-produced (and under priced) (Mr.Wood.com.au, n.d.).The following diagram illustrates this point.

Goods associated with positive externalities are referred to as “merit goods”. The government may intervene in such externalities by encouraging the increased consumption of such goods by resorting to subsidizing or by public provision of such goods (example may be found in free access to vaccinations). Sometimes the government may also mandate the consumption through regulation (example for this instance is compulsory schooling for children).

Information Asymmetry

Information asymmetry is said to happen when the information in possession of one party to the transactions is more or better than the other possesses. In typical situations, the seller usually carries more information than the buyer does but there may be cases where the converse is also true. The phenomenon of asymmetric information prevents the consumer from making decisions based on complete and full information. Usually the intervention for this kind of market failure is attempted to by regulating the information disclosure requirements or by applying restrictions on dangerous goods. For instance, when providing financial advice, financial service providers are mandated to provide full disclosure of potential benefits and risks and all other associated costs before the investor could take his own decision.

Missing Market

Missing market is a typical microeconomic situation in which a competitive market allows the exchange of a commodity but there is no such market really exists. There are various factors, which lead to missing markets. For instance, in the case of an externality like pollution the factory owner discharging polluted water into a river may not really have any incentive to consider the damages he is causing to the environment or to the society fetching drinking water from that river or other ecological damages he is causing. Coordination failure may also lead to missing markets.

Imperfect Competition and Market Power

Market power is said to exist “when one buyer or seller in a market has the ability to exert significant influence over quantity of goods or services traded or the price at which they are traded” (BetterRegulation, n.d.). It is to be noted that in perfectly competitive markets no market participant possesses an absolute market power. In the perfectly competitive market, the ability of a market participant to increase the price above the competitive limits is restricted by the presence of other competitors. The existence of market power could influence the economic efficiency (i) by allowing the firms to increase their prices without any corresponding decline in demand, or (ii) by restricting competition by creating barriers to entry by potential new entrants.

Examples of market power are monopolistic condition where there is only a single supplier controlling the price and demand and oligopoly where there is a small number of firms who have the control over the market operations. Where the market failure exists in the form of market power the government may intervene by correcting the operations of the market or alternatively set the prices at competitive levels.

Operation of Oil Cartel in the Middle East

A monopoly or even an oligopolistic market failure is the one that can be considered to comment whether the operations of the oil cartel in the Middle East does in fact represent a market failure. However, the Organization of Petroleum Exporting Countries (OPEC) if considered as a cartel operating in the Middle East has never been able to control the prices effectively. Even though the OPEC is often referred to as a cartel, it does not fit into the definition of a cartel. One of the primary mechanisms for a cartel to operate is the ability to enforce quota restrictions on the members. The only enforcement mechanism that the OPEC possessed was the spare production capacity of Saudi Arabia. With significant spare capacity for production and exploration of oil, Saudi Arabia at times was able to enlarge its production to such volumes to offset the loss in revenues due to low global petroleum prices. This was done to adjust its oil revenue resources. Saudi Arabia at times threatened to increase the production of its oil enough to crash the oil prices. However, this cannot be considered as an OPEC enforcement mechanism unless and until the goals of the OPEC, member nations coincide with those of Saudi Arabia. Therefore, there is no strength in the argument that the operation of an oil cartel in the Middle East can be perceived as an example of market failure.

Bibliography

Betterregulation, n.d. Appendix A: Types of Market Failure. [Online]. 2009. Web.

Mr.Wood.com.au, n.d. Market Failure. [Online]. 2009. Web.

Tutor2U, n.d. Definition of Market Failure. [Online]. 2009. Web.

Wonnacott, P. & Wonnacott, R., 1979. Economics. Tokyo: McGraw Hills Inc.