Introduction

Increasing needs for mobility and the need to save require individuals to become more innovative to achieve either or both of these. It becomes simpler if these are to be evolved from an established system, as is evident from this proposal. This proposal elaborates a service which utilizes the existent connectivity in mobile phones which has helped in mobility to aid savings. This is through M transfer, which is my very own innovation but has certain borrowed concepts from a similar outfit.. M-transfer is a service aimed at easing money transfer among individuals, in the current economic setup where money transfer is largely done by banks, and other related institutions which are highly physical and expensive. They require physical applications and will require the parties to a transaction to operate a bank account. If you aggregate time spent by individuals in banks making deposits, opening up accounts, withdrawing money and remitting money it adds up to thousands of man-hours. If one would find a way to reduce the time used in carrying out money transfer activities then he/she would do great justice to our economy. The assumption here is that the saved time would be directly input into productive activities which would help drive the economy forward. M-transfer represents this kind of service, designed to reduce the overall time spent carrying out money transfers activities.

The following part describes the various aspects of this service, and tries to explain the impact it’s likely to deliver within the participating industries and lastly its effects on the economy.

Service transformation

M-transfer is a borrowed concept from the existent communication industry around the world, in this proposal, we will examine how it works as well as why it is most likely to impact the future and rejuvenate the economy. Though it is developed based on an established idea it represents much of my thoughts and insights as far as its operability and effects are concerned. The technical part of it may be highly borrowed as the technology behind it is quite technical considering my field of study. This however should not be taken to mean the product fails in its operability and its ability to transform the financial and communication industry to some extent.

Suitability of the service

The M-transfer product is suitable for any economy considering the fact that money is now the most common medium of exchange. Billions of money change hands each day but the complexity of the current money transfer methodologies puts off millions of people around the world. Those who participate in the transfers oblige to situations or simply can not avoid it due to underlying needs. It is apparent that with a simpler means of money transfer a lot more money can change hands and this would be good for business which obviously will be good for the economy. Irrespective of this service being universally applicable its effects would considerably differ from one country to the other. Most countries with a poor banking infrastructure would benefit more than those with an already established system as in the latter the product would simply supplement but in the former, it would form an unrivaled system.

Service description

M-transfer as may have been mentioned is a money transfer methodology, what makes it more distinct from the existent money transfer systems is its use of mobile phones as the medium for money exchange. This concept is borrowed from a system operated in Kenya, a country in East Africa by Safaricom Limited which is the giant mobile phone operator in Kenya.

M-Transfer would utilize the mobile phone in its activities; this involves the creation of a menu within a phone SIM which would specially deal with the money transfer function. Once the M transfer menu is created within the SIM various activities such as withdrawal, transfer or payment is encrypted within the card. This would be uniformly done in all SIM cards Vaughan (2008). To accompany this the mobile phone operator would set up supporting software which identifies various commands as carried out by the mobile phone owner.

The functionality of the service

The service works as consequently described, if an individual wants to carry out a money transfer activity he will scroll to the M transfer menu, press the transfer icon, the mobile phone operator’s system picks up these instructions runs through the system to establish whether the individual has any funds deposited. If he has the system allows him to continue with the next step which may require him to state the subject amount, again the system counter-checks the outstanding amount and if available the system demands the ID of the party to whom the funds are to be transferred. This ID should be uniquely accorded to avoid cases of misdirected transfers. On typing in the ID, the party may be asked to confirm the details to ensure they are as intended, after confirmation he presses the send icon to close the transaction Vaughan (2008). On the other end, the holder of the identified ID receives a notification which for efficiency purposes may be a short message system informing him or her of a deposit made in his account. The system at the end of the day forms a full circuit made up of three parties, the sender, the mobile phone operator and the receiver. In this case the sender has to be a mobile phone user; the receiver may not necessarily be a mobile phone user but must have a code which distinctly identifies him/her or it. This makes the transfer system open, in the fact that you can either send to a mobile phone subscriber, a school, hospital bank or any party or entity as far as these have sought an identification code from the mobile phone operator and are supported by the operators system.

Service requirements

As noted the system does not involve any physical cash or movement of parties but is more representational the same concept with other money transfer methods. In order to get physical cash the mobile phone operator may set up arrangements with Banks which would share within the system to identify amounts held in every account within the system Vaughan (2008). Thus if these individuals want to make physical withdrawals they visit these outlets and withdraw their amounts. The bank then acts as the cash outlet; alternatively the mobile phone operator can set up outlet points and provide the operators of these outlets with hardware and software which accesses the overall system in order to determine amounts held in each account. Any subscriber within the operator would be able to make withdrawals from these outlets on presentation of the SIM number. These banks or outlets may also act as deposit centre for individuals’ willing to hold money in “soft form” or willing to make transfers to others. This service presents a convenient way of transferring money between two parties and though it may be accompanied by multiple technical aspects such as need for a clearing unit as is evident with banks it comes with convenience as in several years everybody will own a phone.

Service strengths

- It is based on an already existent network which is established mobile phone network.

- It uses cheap and readily available gadgets such as mobile phones and SIM tool kit.

- It is not limited by physical infrastructure such as maybe the case with banks which have to be set up where infrastructure is sound.

- The costs in transferring money may not be as high as is the case with money transfers through banks, Pay pal and other already established systems.

- Requires minimal technical know how as the instructions on the Menu may be availed in the native language.

- It allows people to hold “soft cash” which they can withdraw at their convenience, this ensures security.

Weaknesses

- It requires investment in a mobile phone which may be a toll order in some economies

- Requires a well elaborated technical and technological investment to wade off fraudsters and ensure efficiency.

Service Marketing

The service can be easily marketed by the mobile phone operators as a financial services aimed at easing money transfer. As part of the marketing campaign the operator should educate users on how to use the service as well as inform them of help centers incase they need any assistance. The following is a poster which would be useful in marketing and advertising the service.

M transfer utilizes a mobile phone to make money transfers

You can send money from any location interconnected by the mobile phone operator

Micro economic factors affecting the service

The product represents an idea which can be adopted by a mobile phone operator; however the operator need be careful of likely competition from institutions with the same functions such as banks. Banks obviously charge for money transfer and if this function is to be conveniently provided elsewhere then the banks would obviously wage war against the competitor with the aim of retaining part of its revenue earning functions. It is unfortunate that factors such as demand and supply may not have direct impact unless there are several mobile phone operators launching the product and who share the same market Dunne, et al (2006). In this scenario the subscribers would be the beneficiaries as the operators compete on cost bases, market presence as well as efficiency of the service.

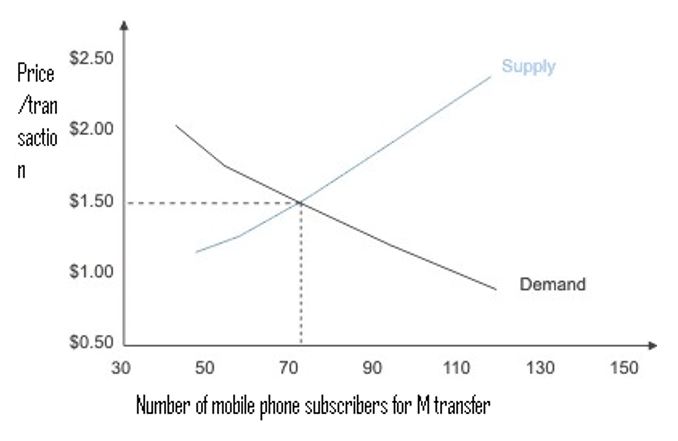

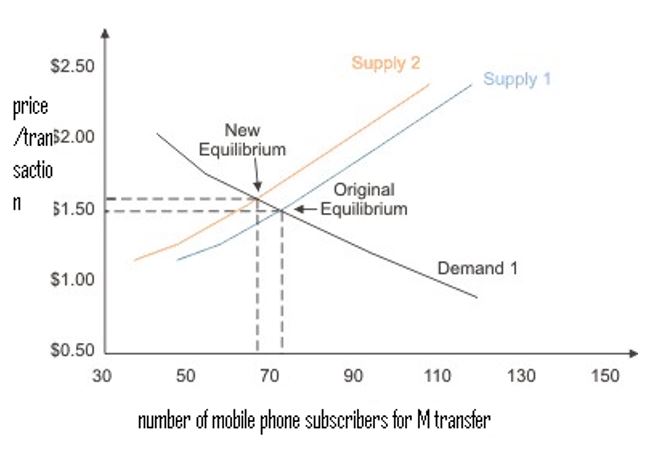

Result of increased mobile phone operators on price per transaction

Just like with any other service if supply increases and more people own mobile phones the overall cost per transaction decreases as shown by the supply curve. If there is one mobile phone operator and people want to subscribe in order to access M transfer the cost per transaction goes up, as illustrated by the demand curve. Other factors such as improved technology and government regulation would lead to a shift in the supply curve as shown in the graph below. This would benefit the subscribers due to lower transaction costs.

M-transfer can thrive in any kind of market as the basic medium of exchange in all markets worldwide is cash; this makes it easily adaptable to all markets with the only determinant being the level of technology within a country.

In regard to cultural and environmental issues the service represents one of the most sellable ideas in terms of environmental friendliness it has negligible effects on the environment. Interference with the ecosystem may only come at the system installation phases as this may require excavations for cable laying or setting up of musts for information broadcast or wave enhancement. Culturally it has absolutely no impact as it does not disrupt existent values and beliefs for any people around the world as most communities and races are now open to change brought about by technology as witnessed with the current penetration and acceptance levels of mobile phones which have helped in integrating people.

Economic benefits

The greatest impact for this service would be felt economically. This service would ease money transfer which goes a long way in improving cash liquidity levels. High liquidity levels are associated with a robust economy thus this would improve the economy of the country in which the service is adopted. Secondly the time spent in queues waiting to initiate transfers would be used in carrying out other economically stimulating activities which at the long run helps drive the economy forward. Finally this service would be looked at as a way of diversifying investments made by mobile phone operators, this at the end of the day would mean more employment and earnings which would help improve the economic status of the people, this is translated to the overall economy of a country Dunne, et al (2006).

Conclusion

Encouraging and supporting innovations is an integral part of an economies growth, as evident from this proposal multiple ideas which can transform people’s ways of doing things are existent. M transfer represents such an idea which would save individuals a lot of resources used in initiating money transfers. Besides the mobile phone operators would also generate extra revenue by including M transfer as a service within their established services. The aggregate results for consumer savings would be multiple expenditures into other sectors within the economy; this would drive up growth and would help revitalize the economy of the country where M transfer is adopted. For mobile phone operators increased revenue would mean other investments which would create jobs for the unemployed people. This would put them at a better position economically, and would increase their disposable income which would be used to boost other sectors of the economy. Thus M transfer would not only transform the financial industry but would also help improve the economy. This though will be dependent on an economy’s support of innovative ideas as well as the willingness of Communication firms to adopt diverse sources of income. Support of this idea from in terms of investment an further research would not only achieve the outlined benefits for an economy’s people but would also create a channel for development and adaptation of similar o even better ideas in economies around the world.

References

Dunne, J. Bradford, J, and Mark, J.2006. Producer Dynamics: New Evidence from Micro Data. University of Chicago Press.

Vaughan, P. 2008. Providing the Unbanked with Access to Financial Services: The Case of M-PESA in Kenya. Presentation given during the Mobile Banking & Financial Services Africa conference in Johannesburg, South Africa.