Introduction to doing business in china and why businesses do business in China

In November 2001, China officially joined the WTO (World Trade Organization), which caused its rapid growth in trade and foreign investment (Hedley 2011). As a member of the WTO, China has enjoyed reduced tariffs on agreed products, as well as a gradual phasing out of market access to a number of regulated industries (Campbell 2006). Consequently, various industrial sectors have been opened in the country in the last few years (Lardy 2002). China now enjoys a more open market, and this has attracted materials, technical know-how, and services.

The availability of cheap, along with rich manpower in the country, has transformed the country into a leading global manufacturer. Although foreign investors still have to face several challenges when doing business in China, the government appears to be committed to addressing some of these challenges as a way of encouraging foreign investment (Shi 2002). For instance, in the years 2000 and 2001, the Chinese government amended the ‘Law on Cooperative Joint Ventures’, the ‘Law on Wholly Foreign-owned Enterprises’, and the ‘Law on Equity Joint Ventures’, which made the Chinese government to relax its requirements on raw materials sourcing and foreign exchange balancing for FIEs (Foreign Investment Enterprises). As a result, FIEs do not have to prioritize on the local market while buying fuels, raw materials, and other materials (Rawski 2001).

Large sections of China’s economy have now become more market-oriented, and only a few products and sectors are still under administrative control. The current industrial policy stresses on strengthening infrastructure, transport, basic industries, and transport. The Chinese authorities continue to encourage foreign participation in various investment projects. Towards this end, the Chinese government has already taken measures to ensure a less bureaucratic and more favorable investment climate.

The local government is charged with the responsibility of approving many of the foreign investment projects in China, indicating the extent to which the Chinese government is willing to delegate some of its business-oriented responsibilities and, in the process, reduce bureaucracy (Scott. & Norris n.d). The Chinese government has also identified specific areas of priority, including protection, modern technology, water conservation, and energy. The Chinese government is also offering foreign investors incentives to start their businesses in China, and this has therefore led to an increase in the number of businesses willing to invest in China (Klein & Ozmucur 2002).

Introduction to challenges Faced by firms in China

At the moment, China is the world’s fastest-growing economy, with average annual GDP growth of approximately 8.3 percent (Hedley 2011, Wong 2010). The rapid economic growth has seen many foreign companies develop a growing interest in China as a viable market to invest. This, coupled with the country’s huge natural resources, will ensure the attractions of more companies for purposes of investment (Hedley 2011). Nonetheless, China is still regarded as a new market in comparison with the West, and, for this reason, many multinational companies are still skeptical about the Chinese market. In essence, the Chinese market appears frustrating and complicated to foreign businesses, but this may no longer be the case (Hedley 2011).

To start with, the Chinese culture is different from that of the western countries or the United States (Hedley 2011). In addition, business trends are carried out differently in China, and many foreign businesses may find this as a hindrance. As such, cultural differences still remain the root of disagreements and conflicts between the locals and foreign companies (Wu 2008). Foreign companies are also faced with the language barrier upon entering the Chinese market. Thus, foreign companies have no choice but to seek the help of translators and interpreters when communicating with the locals (Wu 2008).

Secondly, the Chinese attach a lot of value to the country’s history, and this is also reflected in the business world. As such, Chinese companies undertake their trade and business in line with these beliefs and values. This may be a challenge to foreign businesses because they are not got used to conducting businesses according to historic beliefs and values. If at all foreign businesses are to survive in the Chinese market, they need to establish cordial relationships with the market (Jayaraman 2009). Any bureaucratic or personal relationship in China is referred to as “guan xi” and Chinese companies will often work with individuals whom they are acquainted with because they can easily develop trust (Wu 2008).

This is a challenge for the foreign businesses because, in the absence of “guan xi”, they may not be aware of the knitty gritty paperwork, as well as establishing cordial relationships with a government official, thereby reducing any unnecessary delays and procedures (Wu 2008). The lack of a good network in China may also be another hindrance to foreign companies because it means that they cannot find reliable business partners to work with. A reliable business partner, preferably a local firm, would be suitable for foreign-based companies because besides helping to overcome the bureaucratic laws in China, it would also help the foreign-based company to win the trust of the locals.

Foreign businesses may also find the laws in China quiet frustrating and complex (Jayaraman 2009). This is because they are closely tied to the Chinese culture, and since not many foreigners are familiar with this culture, it can result in complexity. Lack of exposure to Chinese culture means that foreign businesses are ill-informed of the needs and preferences of Chinese consumers.

Challenges Western companies face when entering the Chinese market, How to overcome the challenges

Market behavior challenges

The Chinese market is one of the most complex and hard to understand in the world. Many western companies have tried to enter the market and failed (Jayaraman, 2009). This is because of the poor understanding of the Chinese market, which is usually based on culture, which means that an entrepreneur entering the Chinese market has to advertise and market in the Chinese way. The branding and marketing should be in a position to woe the Chinese consumers. Some of the companies that have tried and not succeeded include the Wal-Mart. Others that have failed to become market leaders are eBay and Google despite their success in other countries (Chow & Fung 2000). The solution to this is to localize in the Chinese markets by understanding the consumers demands (Jayaraman 2009).

The competition in the Chinese markets is usually head on. The Chinese companies heavily depend on prices as a competitive advantage (Jayaraman 2009). Therefore, western companies in China find it hard to operate given the low established prices. When western nations try to sell technological products at high prices, they are faced with competition as the local market has closer substitute to the same products. To solve the problem of pricing, the western companies try to operate at the same price as the Chinese companies, although it is hard given the costs incurred in production are extremely different.

Recruitment problems

Western companies entering the Chinese market have to encounter the recruitment problem. The annual employee turnover is very high in China, at 80 percent, while that of staff is at 25 percent. The reason behind this is that Chinese economies are extremely attached to the local companies, as opposed to foreign companies (Zhou & Witteloostuijn 2009). Thus, it may be quite hard for them to abandon local companies and join foreign based ones. However, the Chinese cultural values appear to be breaking down and due to interaction with the western culture, the society is also becoming more fluid. In addition, the Chinese government is also reforming its laws trying to encourage foreign investments (Jayaraman 2009). At the same time, multinational companies now prefer Chinese employees who have been trained in the west because they are bilingual and have the knowledge and experience of both cultures.

Finding partners

Finding a business partners is always a challenge for western countries that wish to enter into the Chinese market (Jayaraman 2009). In order to succeed in the Chinese market, foreign business must forge cordial relationships with other business partners in China, government officials, and suppliers. For the small foreign-based companies, it would be very hard to find a local firm willing to enter into a joint partnership because the new entrants are less likely to be taken seriously. However, Western businesses can now take advantage of international bodies that have a good reputation and knowledge of the business environment in China. An example of such a body is the China-Britain Business Council. Linking with such an organization will ensure that a business gets noticed.

Introduction to Economic Growth in China

After the initiation of 1979 economic reforms in China, the country has become a country with a fast growing economy (Morrison 2005). Its GDP has grown on an average of 9.6% annually since 1979. And there are speculations that China might be the next largest economy in the years to come (Morrison 2005). The country has been putting into place the policies that would ensure that the economy does not get hit hard by the current financial crisis. The policies have been able to stabilize the economy so far. For this reason, while other economies are putting measures to recover from the recession, the Chinese economy is growing stronger (Mittal 2011).

Financial experts warn that the Chinese economy will be the strongest and largest economy by 2016. Its growth per capita has been increasing in years. Last year, the per capita income of China had a record of 7.8 percent (Mittal 2011). This was for the urban resident while the urban resident’s per capita income was over 10 percent. Generally, China’s economic growth is positive.

Define an Economic Growth Theory (Adams Smith or Solow (Capital Widening or Capital deepening)

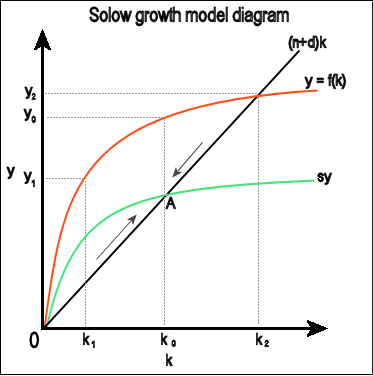

The Solow model of economic growth was developed by Robert Solow in 1950s (Whelan 2005). The assumption made using this model is that the production of GDP is dependent on the aggregate to the function of technology production. It also assumes that the accumulation of capital depends on savings which results from production (output).

The model is based on capital deepening meaning, which depends on the capital stock produced in one hour (Mankiw 2006). Capital deepening is used to illustrate an economy that is characterized by an increase in the capital per worker (Whelan 2005). In this scenario, the economy is bound to expand the production as a result of an individual worker production increases.

However, based on the Solow Model, the expansion of economy is not bound to continue indefinitely as a result of capital deepening. This is as a result of the depreciation of capital stock and the diminishing returns (Whelan 2005). For capital to increase based on the efforts of each worker, investment is required. This increases the capital- labour ratio.

According to the Solow growth model, a country that has a greater saving rate is expected to have a faster economic growth. However, technological investments have a greater impact on economic growth than the long term capital accumulation because capital depends on diminished returns. It is also based on the assumption that if the stock is fixed, then accumulated capital will be smaller (Whelan 2005).

Graphical representation of the model

The model technology is the ultimate solutions and the driver of economic growth. This is because it encourages innovation that leads to investments. Investment creates employment making an economy labor intensive.

Application of Solow Model and China’s economic Growth rate

Based on past study on the economy of China and application of the Solow model, the augmented Solow model can predict the economic growth rate of China very well (Ding &Knight n.d). The rapid expansion of the Chinese economy can be attributed to the some determinants that have played a great role. The economy of china is based on capital formation which according to Solow models leads to economic growth. The China’s economy is investment driven (Ding &Knight n.d, p.2) which has its foundation on the neoclassical growth theory. The country has become a large producer of industrial commodities which has boosted its economy. This was one of the agendas in the 1978 economic reforms that have seen the country’s economic growth rate increases at a steady rate of 9.6% annually.

The restrictive measures taken to control the population growth rate that has also contributed to the rapid growth rate of China. Through the low level of population growth rate, the country can monitor the rate and estimate the consumption and government spending (Ding &Knight n.d). This is unlikely as in other emerging economies. The augmented version of the Solow model explains the growth rate more precisely. For example, the high performance e and growth rate has been attributed to the high investment rate (Ding &Knight n.d).

Solow model investment leads to capital deepening as more capital is produced as a result of labour based production per worker. The country has also undergone industrialization which is a part of the technological progress (Ding &Knight 2008). Technological progress leads to more capital formation which pushes economic growth rate. The input of human capital with high technical levels raises individual productivity (Ding &Knight n.d.).

The growth rate can also be expounded based on the Solow model relative to other countries of the same economic group. For instance, a cross sectional research carried showed disparity in international incomes. This can explain diminishing returns to capital and exogenous technology giving the difference in capital formation (Ding &Knight 2008). The argument is that technology function is boosted through capital injection which leads to capital accumulations. Therefore, China’s capital formation is deepening as its technological progress and investment make the country capital intensity.

Can growth can be sustained by China or not

Numerous arguments have been made on whether the economic growth of China is sustainable. China has emerged as one of the largest and fast growing economies in the world. Although china has many problems, its economy has been growing since 1978 at a rate of almost 10%. So far, it can be argued that China growth has been sustainable (Naughton 2006). The issue that is at hand is whether the growth will be sustainable in the next year. However, given that China has strong policies on economic growth like the one policy that checks population growth rate, the growth would be sustainable.

The economy of China is investment driven leaving imbalances in its economy (Zheng, Bigsten & Hu 2009). However, stabilization measures have been taken as a precautionary measure to ensure that the economy growth does not fail. The firms at low level have invested little in technology but with the advancement in technology there is probability of China investing more in technology. This would stimulate technological progress leading to capital intensity. The measures and policies may have a short term effect on the total factor productivity although it is believed that the effects would not be long run (Zheng, Bigsten & Hu 2009).

China has invested heavily in education system, narrowing the technological divide, increased labor and employment in agricultural sector, and stimulated total factor productivity which has led to the economic growth. China has also continued to invest heavily in manufacturing industry with the aim of stimulating economic growth (Wyne 2007).

Based on the Solow model of the economic growth, long term economic growth relies heavily of technological innovation (Wayne 2007). China is at the epitome of its economic growth and based on the circumstances it is not clear whether the growth would be sustainable. But based on the current state of China and hoping the policies and other measures are put into place, and then the China’s growth would be sustainable.

Ways to sustain growth by China

Chinese economic growth rate has been rapid and question of its sustainability has faced heated debates. There are claims that China cannot continue with its policies as they would lead to capital accumulation which, according to the Solow model, does not sustain economic growth. China should invest heavily on technology and the manufacturing sector. Technology has the capacity to stimulate an economy thus sustaining economic growth. It can also lessen some of the regulations and policies to ensure encouraging foreign investment. The currency of China has been undervalued, thus it can try to adjust its currency to ensure more foreign investments in the country.

Conclusion

The economy of China has been growing well since the reforms that were carried in 1978. The economy has been sustaining the growth, although questions on its sustainability still raise a heated debate. Despite the attractive business scene in China, there are numerous challenges that western investors find hard to cope with. Many companies have tried investing in the country but ended up in fail. This has been necessitated by the market behaviors, the culture, and the demands from the Chinese markets by the consumers. However, with the policies that the government has been putting into place, the country will receive heavy investors.

Reference List

Campbell, A., 2006. ‘Selling to the Chinese Market’. Small Business Trends. Web.

Chow, C., & Fung, M., 2000. ‘Small businesses and liquidity constraints in financing business investment: Evidence from shanghai’s manufacturing sector’. Journal of Business Venturing, Vol. 15, No. 4, pp. 363-383

Ding, S., & Knight, J. 2008. ‘Can the augmented Solow model explain China’s economic growth?‘. A cross-country panel data analysis. Web.

Headley, M. 2011. White paper: entering Chinese business-to-business markets: the challenges & opportunities. Web.

Jayaraman, K. 2009. ‘Doing business in China: A risk analysis’, Journal of Emerging Knowledge on Emerging Markets. vol.1 no.1, pp.55-62.

Klein, L. R., & Ozmucur, S., 2002. ‘The Estimation of China’s Economic Growth Rate’. Seminar Paper presented at the Singapore Management University in May 2002.

Lardy, N., 2002. ‘China Will Keep On Growing’. The Asian Wall Street Journal.

Mankiw N.G. 2006. Macroeconomics. Oxford: Palgrave Macmillan.

Mittal, L, 2011, China Economy 2011: What Is China Per Capita Income And GDP?. Web.

Morrison, W.M, 2005, ‘China’s Economic Conditions‘. Web.

Naughton, B. 2006. ‘Reframing China policy: The Carnegie debates.’ Web.

Rawski, T.G., 2001. ‘What is Happening to China’s GDP Statistics’. China Economic Review, Vol. 12, No. 4, pp. 347-354.

Scott, N. & Norris, J. T. n.d. ‘Business ethics and social responsibility in contemporary China’. Journal of Academic and Business Ethics, pp.1-9.

Shi, L. P. 2002. China’s GDP Statistics Are Credible. Beijing Review.

Whelan, K. 2005. The Solow Model of Economic Growth. Web.

Wyne, A. 2007. ‘Is China’s economic growth sustainable?’. MURJ 15, pp. 16-18.

Wu, J. ‘An analysis of business challenges faced by foreign multinationals operating the Chinese market’, International Journal of Business and Management, Vol. 3, No. 12, pp.169-174.

Wong, C. 2010. Is China’s Growth Sustainable?. Web.

Zheng, J., Bigsten, A., & Hu. A. 2009, ‘Can China’s Growth be Sustained? A Productivity Perspective’. World Development, Vol. 37, No. 4, pp. 874–888.

Zhou, C. H., & Witteloostuijn, A., 2009. ‘Institutional constraints and ecological processes: Evolution of foreign- invested enterprises in the Chinese construction industry,1993–2006’. Journal of International Business Studies. Web.