Executive Summary

Scope, Aim, and Topic of the Report

The project report highlights the market entry strategies used by a multinational corporation. It indicates how the company has managed to succeed and the challenges encountered. The report focuses on the non-alcoholic beverage and narrows down to the Coca-Cola Company in India. With a presence in more than 200 countries, Coca-Cola provides the best example of a company that has employed successful market entry strategies. The topic of the report is “determining the success of the Coca-Cola international marketing entry strategy, the case of India.”

International Business Selection

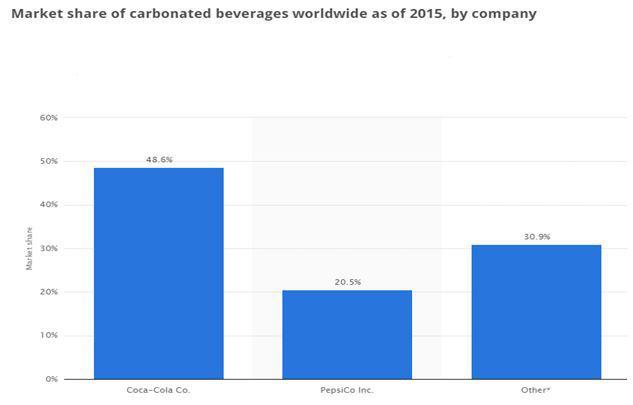

The report focuses on the Asia Pacific region and specifically on India. The selected multinational business is the Coca-Cola Company. It manufactures soft drinks in more than 200 countries. Currently, Coca-Cola occupies the largest market share in the soft drinks industry. The company manages to maximize profits while ensuring it adheres to the described vision and mission.

Data Collection Sources and Analytical Methods

The primary data collection sources include Statista, the company’s annual reports, and the World Bank. Further, the report introduces Michael Porter’s Five Force Model. The model analyses the economics and attractiveness of the beverage industry in India. The first component of the model is the threat of new entrants which indicates the ease of entry of new companies into the industry. The second one is the threat of substitutes which shows how the presence of alternatives can hinder the sales of Coca-Cola. The third component is the bargaining power of customers. It shows the power the customers possess in controlling the products offered by the company. The third part of the model is the bargaining power of the suppliers and deals with the influence of the company’s suppliers. The last component of Porter’s model is industry rivalry which indicates the main competitors to the Coca-Cola Company in India.

Findings

The threat of new entrants is low because the Coca-Cola Company and other existing players have dominated the market making it challenging for new entrants to access the market. The threat of substitutes is high because of the availability of a variety of similar products. The consumers have bargaining power because they can quickly change to the products offered by the competitors. However, the suppliers have low bargaining power since the company can access more suppliers. The main rival in the Indian market is PepsiCo Inc.

Recommendations

The Coca-Cola Company should focus on producing more non-carbonated drinks to meet the growing demand for healthy soft drinks. Moreover, the company should embrace innovation to meet the needs of beverage consumers. It should also customize advertisements to reach specific segments of the market. Lastly, the company should empower retailers and distributors to maintain a strong distribution chain.

Scope, Aim, and Topic of the Report

The scope of the Report

The project report outlines the global market entry strategies for a multinational company. It aims to show how the company has succeeded in accessing international markets. The report focuses on the strategy employed by the company to ensure the success of its products worldwide. The chosen industry for the report is non-alcoholic beverages. These drinks are consumed widely across the world with various companies manufacturing them. Despite the availability of a significant number of companies producing beverages, the Coca-Cola Company is the selected firm for this report. The Coca-Cola Company has operations in more than 200 nations worldwide. The project report highlights the market entry in the Asia Pacific region specifically in India.

The aim of the project report

To determine the market entry strategies in the beverage industry in India; the case of the Coca-Cola Company. The report seeks to outline the strategies employed by the Coca-Cola Company to succeed in its international marketing with a focus on the Indian market.

The topic of the report

Determining the success of the Coca-Cola international marketing entry strategy, the case of India. The topic was selected to demonstrate multinational companies can apply various entry strategies to secure a huge market in India.

International Business Selection

According to Albert, Werhane, and Rolph (2013), the Coca-Cola Company is the biggest beverage manufacturer in the world. The American corporation manufactures, retails, and markets nonalcoholic beverages and syrups. According to Stewart (2014), a majority of individuals know the Coca-Cola Company because of its flagship product Coke. The company is headquartered in Atlanta, Georgia, and has operated a franchised system since 1889 (Coca-Cola Company, 2018). The company manufactures the syrup concentrate and then sells it to the bottlers distributed in the various parts of the world (Change Solutions 2016).

Currently, the company operates in countries distributed among all the continents. A report by Statista (2018) indicates that the global share of the carbonated beverages in 2015 was estimated at $341.6 billion, where the Coca-Cola Company dominated with a market share of 48.6 percent. PepsiCo Inc. followed with 20.5 percent while other companies accounted for the remaining 30.9 percent. The main reason for selecting the Coca-Cola Company is because it has managed to sustain its share in the global market despite the stiff competition. The company has managed to understand and meet the different and ever-changing refreshment needs and desires of the consumers. Moreover, the ability of the company to operate in more than 200 countries makes it interesting to study its marketing strategies.

Like other multinationals, The Coca-Cola Company aims to maximize profits while ensuring sustainable growth in the beverage industry. According to the Coca-Cola Company (2018), the mission statement of the company is to refresh the world, to inspire moments of optimism and happiness, and to create value and make a difference. To achieve the outlined vision, the firm has developed a set of goals (The Coca-Cola Company 2018). It aims at inspiring the employees and providing the best place to work. The company believes in delivering drinks that anticipate and satisfy the needs and desires of the consumers. Regarding partnerships, the company believes in cultivating a winning network and establishing shared loyalty. Profit maximization is essential while minding the overall duties. The company values productivity and believes in being an operational and fast-moving firm. The Coca-Cola Company has employed alliances to access the Indian market. It has formed the alliances through more than 250 bottling partners across the various countries (The Coca-Cola Company 2017). It does not possess or control all the bottling associates. The company produces and sells concentrates and syrups to the bottling partners who process, bottle, and distribute the ultimate branded merchandise to the consumers. The company possesses trademarks and undertakes consumer brand promotion activities.

Data Collection Sources and Analytical Methods

The utilized sources of secondary data and their justification

The Analytical Technique

The employed analytical technique is Porter’s model. It is one of the most basic models utilized to scrutinize industry economics and attraction (Dälken 2014). The model was chosen to understand the forces that shape competition in the beverage industry in India. The model was also used to indicate how the company can adjust its strategy to cope up with the competitive environment.

Porter suggests five main forces that determine industry attractiveness.

The threat of new entrants

On the one hand, there is a low barrier to entry in the beverage industry in India. There is access to inputs required to manufacture and package beverages in India. Items like a cane, corn syrup, concentrated fruit juice, glass, plastic, and aluminum are readily available. New entrants can easily access these inputs and begin producing beverage products. The industry know-how is low, and the industrial process is not complex. The learning process for new companies is short. Hence, new companies can enter the market due to the low entry barriers. On the other hand, the existing companies have made it difficult for new entrants to access the Indian market (Singh, Tegegne and Ekenem 2012). Coca-Cola and PepsiCo dominate the market with strong brands and excellent distribution channels, with Coca-Cola having a bigger share. One barrier is that soft drinks are very saturated which makes new growth very small.

It is difficult for new and unknown entrants to compete effectively with the already established brands. The other barrier to entry is the high cost of investment required to enter the industry. The costs associated with warehousing, trucks, and labor are high which discourages new entrants who do not have the required capital. The new entrants who manage to raise the initial cost find it impossible to compete on price because they do not have the advantage of economies of scale. Moreover, access to distribution is blocked by Coca-Cola and the other major players. The company has established efficient distribution systems across India through the various bottling partners (The Coca-Cola Company 2013). The availability of an efficient distribution system makes it easy for the company to reach more consumers. New entrants to the market cannot establish an efficient distribution system as Coca-Cola has done. Hence, access to distribution by the company is a high barrier to entry for new competitors.

Further, considerable investment is required to build a brand in the beverage industry. The Coca-Cola Company has made massive investments over the years to build a strong brand and foster customer loyalty. The company spends a lot on advertisements and promotions aimed at ensuring it does not lose its customers to the competitors. A new entrant to the industry must first invest in establishing a brand as the company has done. Such a move requires a substantial investment, and a majority of the new entrants may not have adequate resources (Yannopoulos 2011). Hence, the inability of other companies to establish a strong brand in India presents a high barrier to entry. Additionally, new entrants will need to adhere to unique packaging and image.

A secret formula is required to make a similar product to the company. However, the Coca-Cola Company has kept the method for manufacturing the Coca-Cola drink secret (Kottasova 2014). It is impossible for a new entrant to duplicate the product and become a major competitor to the company. The inability of new companies to access the secret formula for Coca-Cola drink presents a barrier to entry. It discourages new companies from getting into the lucrative beverage industry in India. Coca-Cola has solidified long-term partnerships with its retailers and distributors in India. Such a scenario makes it challenging for new entrants to use discounts and other tactics targeting the retailers and distributors. The retailers and distributors have developed a high level of trust with the Coca-Cola bottlers which makes it problematic to enter into agreements with new entrants in the beverage industry. The new entrants have to take time to establish a good relationship with the retailers and distributors which often discourages them. They also must invest in the development of new distribution systems which is costly. As a result, Coca-Cola can maintain its share without the risk of new entrants shrinking the market.

Threat of substitutes

Substitute products refer to those merchandise that seem to be diverse but can be used to fulfill the same need as another item. The presence of alternatives limits the returns in the industry because they put a ceiling on the maximum prices the companies in the industry can profitably charge. A majority of substitutes for Coca-Cola products are beverages manufactured by PepsiCo, fruit juices, bottled water, sports drinks, coffee, and tea. The sports drinks and bottled water are increasingly becoming popular in India with the trend where consumers are moving towards healthy consumption. According to a report by the Euromonitor (2018), these are advertised as healthier than the soft drinks offered by Coca-Cola. Both tea and coffee competitive substitutes since they provide caffeine and consumers can use them instead of the Coca-Cola products. Indian consumers are increasingly consuming specialty coffee as evident due to the increasing coffee stores offering different flavors to appeal to the customers. It is easier for consumers to switch from Coca-Cola products to the substitutes by health issues (Galande 2017). The availability of products from major competitors like PepsiCo indicates that consumers have a wide variety of choices. Moreover, the availability of close substitutes which are healthier means consumers can quickly switch from the Coca-Cola products to the substitutes.

Bargaining power of customers

Buyers are critical in the industry because they can force the prices down, bargain for higher quality products, and play the competitors against each other. Buyers are particularly powerful where they purchase a significant proportion of the manufacturer’s products or services (Harvard Business Review 2018). Customers are also influential where alternative suppliers are plentiful. The buyers of Coca-Cola products in India are mainly large groceries, restaurants, and discount stores. The company distributes the beverage to these stores for distribution to the consumers. The buyers usually purchase drinks in large quantities, which enables them to purchase at relatively lower prices. They have higher negotiating power because they are buying in large quantities. They are in a position to bargain for more discounts compared to those who buy in small amounts. The final consumers usually purchase the beverages in small amounts which decreases their bargaining power. The consumers are not concentrated in specific markets in India which makes it impossible for them to yield a more extensive influence on the products.

However, the level of differentiation between Coca-Cola and PepsiCo is low since the two sale almost similar flavors (Gandhi 2014). Hence, it is possible for consumers to switch from Coca-Cola products to those of their competitors. It is not possible for the customers or even the large-scale retailers to do the backward integration of the Coca-Cola products which leaves the company with more control of the product. However, with the number of individuals in India taking Coca-Cola beverages reducing, the bargaining power of the customers could increase because of the decreasing demand. The shift in buyer demand is due to the emphasis on the consumption of healthy products and the availability of substitutes that offer particular beverages. A report by Duff and Phelps (2016) indicates that more consumers are purchasing healthy drinks from high-end specialty stores. The phenomenon is attributable to the health and wellness campaigns taking place not only in the country but also across the globe. As a result, more consumers are shifting from their consumption of cola carbonates to low-calorie carbonates and other healthy drinks.

Bargaining power of suppliers

Suppliers can impact an industry by their capacity to increase the prices or minimize the value of products and services purchased (Peng 2008). The major suppliers include the bottling equipment manufacturers and secondary packaging suppliers and ingredient suppliers. In India, the number of suppliers for the major ingredients and other required items is moderate. These have limited power over the company. Further, sugar and other chemicals are commodity items hence they do not require specific suppliers. The suppliers do not matter as long as they can meet the specifications of the commodity items. Additionally, the suppliers do not have adequate resources to forward integrate into the beverage industry. However, the industry is favorable to the suppliers. They can access financial services to expand and upgrade their activities. As the suppliers expand their operations, they increase their bargaining power. Moreover, suppliers do not require highly skilled labor. In India, the workforce is readily available at a lower cost which labor-intensive companies to thrive in the country (Narain 2016). The equipment suppliers to the company are offering similar products. Since the number of tool suppliers is not in shortage, the company can easily switch suppliers.

Industry rivalry

According to Rais, Acharya, and Sharma (2013), the market for aerated beverages in the country worth $1.5 billion, while the one for juice-based products contributes $250 million. The massive pressure from the rivals accounts for the greatest competition that the company encounters in the beverage industry in India. The Coca-Cola Company, PepsiCo Inc., and Parle Bisleri Ltd are the major players in the Indian market. In 2010, the three companies accounted for a combined market share of 71.7 percent in India (Statista 2018). Although the Coca-Cola Company had the largest share of 33.7 percent, PepsiCo Inc. followed closely with a market share of 28.3 percent in 2010. PepsiCo Inc. remains the primary competitor of the Coca-Cola Company, and the two firms have been in a superiority fight in the country for a long.

Findings

Results of the analysis

The threat of new entrants

A report by the World Bank (2018) indicates that India has a population of about 1.3 billion people. With such a population, companies would like to enter the market and take advantage of the available market. However, the Coca-Cola Company, PepsiCo Inc., and Parle Bisleri Ltd have dominated the market which has made it impossible for smaller companies to succeed. The three companies control about 71.7 percent of the market leaving only 28.3 percent of the rest of the companies (Statista 2018). With the Coca-Cola Company controlling the majority of the market, it has made it impossible for new entrants to enjoy success in the beverage industry. The company has managed to build a strong brand over the years in India. A majority of the beverage consumers are loyal to the Coca-Cola brand. The company has spent a lot of resources on advertising in the Indian market. Due to its global presence, the Coca-Cola Company manages to promote its products at relatively lower costs. New entrants have to invest a lot of money to develop such loyalty. These companies may not have such resources at their disposal. As a result, the Coca-Cola Company has managed to enter the Indian market due to customer loyalty it has developed.

Moreover, the beverage industry requires a robust distribution system. The manufacturers need to establish a strong chain of distribution to enable the products to reach consumers. The distribution usually involves small, and large-scale retailers they distribute to the consumers (Oxfam America 2016). The Coca-Cola Company has developed a good relationship with its retailers and distributors. It has managed to create a strong chain that allows the products to reach the final consumers efficiently and at affordable prices. For new entrants to distribute their beverages, they must invest in developing a distribution channel. They should have large trucks, warehouses, and labor to allow them to compete with the Coca-Cola products. Such investment is beyond the reach of most of the new entrants. The remaining option for the new players is to use existing retailers and distributors. However, a good relationship exists between the Coca-Cola Company and the existing retailers and distributors. Hence, is challenging for the retailers and distributors to trust the new entrants.

Threat of substitutes

The competitors of the Coca-Cola Company in India have managed to manufacture close replacements for the products offered by the company. Moreover, there is a range of substitutes that are becoming popular in the country. The emphasis on consuming healthy soft drinks can decrease the market occupied by the company. More Indians are becoming aware of the need to consume products that are healthy (Canadean 2013). Additionally, more Indians are consuming tea and coffee instead of carbonated drinks (Sundaresan 2018). The availability of these substitutes decreases the sale of the Coca-Cola products in the country. With the consumers in a position to switch from the Coca-Cola products to the substitutes, the threat of substitutes is very strong.

Bargaining power of customers

The Coca-Cola Company has both small-scale and large-scale consumers. The large-scale buyers include the retailers and distributors who purchase products in large quantities. These have higher bargaining power and can negotiate the prices. However, the final consumers have less bargaining power since they buy the products in small quantities (Haucap et al. 2013). With the consumers distributed all over India, it is impossible for them to exercise their bargaining power to the company directly. However, the availability of substitutes means the consumers can easily consume products from the competitors (Cuellar-Healey & Gomez 2013). Hence, although the final consumers purchase in small quantities, they have some form of bargaining power because of the availability of substitutes. The consumers can switch for the soft drinks offered by the competitors. Hence, although the customers appear to have less purchasing power, the company can lose revenue if the clients decide to consume alternative products.

Bargaining power of suppliers

The Coca-Cola Company has managed to succeed in the beverage industry in India because the suppliers have low bargaining power. The suppliers of the company have minimum control over the operations of the company. Regarding the commodity items, the company can obtain them from numerous suppliers. These do not require particular suppliers since they are readily available in the market. The company also has alternative equipment suppliers which means it does not have to rely on specified suppliers. Although the suppliers can access financial services and expand their operations, they cannot have a larger bargaining power since the company had many alternatives. The company manages to exert its control over the suppliers because they cannot forward integrate into manufacturing the beverages (Dubas 2016). With the low bargaining power of the suppliers, the company can easily switch the suppliers to enable it to minimize its operating costs.

Industry rivalry

The beverage industry in India is lucrative amounting to $1.75 billion (Rais, Acharya, and Sharma 2013). Hence, the rivalry in the beverage industry in India is intense as the companies compete to control the market. The Coca-Cola Company faces stiff competition from PepsiCo Inc. and the Parle Bisleri Ltd. These companies offer almost similar products to the ones manufactured by the Coca-Cola Company. Although Coca-Cola is the market leader, PepsiCo Inc. closely follows. The companies compete for the thriving market and use different means to attract customers.

Interpretations of the findings

The low threat to new entrants in the Indian market implies that the Coca-Cola Company could continue dominating the soft drink market. The existing network of distribution and storage capabilities means the company has economies of scale which allow it to sell its products at affordable prices. The inability of new entrants to access the vast market implies that the Coca-Cola Company can maintain the existing market. After the company re-entered the Indian market in 1993, it has continued to build its brand (PWC 2013). The strong brand in the Indian market implies that the company enjoys loyalty from the consumers.

The considerable investment in marketing and promotion activities has allowed the company to create awareness of its products (Team 2016). Regarding the high threat of substitutes, the company could continue losing customers to its competitors. The emphasis on the consumption of healthy products could cause more consumers to take low-calorie carbonated drinks instead of the high-calorie carbonated drinks offered by the Coca-Cola Company. Moreover, the emergence of tea and coffee as alternative beverages for a significant number of people in India could shrink the soft drink market and lead to a loss of revenue for the major beverage manufacturers. The move could adversely affect the sales of the company and eventually reduce income.

Although the bargaining power of the final consumers has remained low in India, the emergence of alternative products especially tea and coffee presents a huge threat to the company. These substitutes increase the bargaining power of the consumers who can easily switch to these products where the company does not listen to them. Moreover, the availability of alternative products offered by the competitors gives the consumers a wide range of products. The consumers have a wide choice of soft drinks which increases their bargaining power. The company must address the issues raised by the consumers to avoid losing them to the competitors and the other substitute products.

Regarding the suppliers, the low bargaining power means the company can acquire raw materials and other ingredients at relatively lower costs. The availability of numerous suppliers means the company can switch between the suppliers to obtain high-quality supplies at cost-effective prices. The rivalry remains high in the soft drink industry. Although the Coca-Cola Company controls a significant share of the market, it faces stiff competition from other companies that offer similar products. The survival of the company depends on its ability to maintain the market share while devising ways to attract more customers. It is essential to recognize the increasing pressure posed by the leading competitors especially PepsiCo Inc. and Parle Bisleri Ltd. The stiff competition implies the need for the company to respond swiftly to the needs of the consumers. It is vital for Coca-Cola to remain in touch with consumers to make it possible to address their issues.

Recommendations

According to Taneja, Girdhar, and Gupta (2012), India is one of the most promising and growing economies in the world. The country has a large consumer base with a significant amount of spending power. The opening of the Indian markets has allowed the entry of multinational companies. The potential in the beverage industry in the country implies that more companies will attempt to enter the market and take advantage of the huge consumer base. The Coca-Cola Company occupies less than 40 percent of the market in soft drinks. Furthermore, Coca-Cola and PepsiCo Inc. have been losing their market share to the local rivals in the aerated-beverages segment (Malviya 2017). The following three recommendations would assist the company to increase its share in the Indian market.

References

Abbasi H 2017, Marketing strategies of Coke: an overview, KAAV International Journal of Economics, vol. 4, no. 2, pp. 194-199.

Albert PJ, Werhane P and Rolph T. (eds) 2013, Global poverty alleviation: a case book, Springer Science and Business Media, Berlin, Germany.

Canadean, 2013, The Indian soft drinks market: what consumers drink and why? Canadean, London, United Kingdom.

Change Solutions, 2016, Breaking down the chain: a guide to the soft drink industry, Change Solutions.

Cuellar-Healey S and Gomez M 2013, Marketing module 4: competitor analysis, Cornell University, New York, NY

Dälken F 2014, Are Porter’s five competive forces still applicable? A critical examination concerning the relevance for today’s business, Semantic Scholar, Washington, DC

Dubas MF 2016, Cola wars-case study, UNSW School of Mechanical Engineering, Sydney, Australia.

Duff and Phelps, 2016. Industry insights: food retail industry insights, Duff and Phelps, New York, NY.

Euromonitor, 2018. Soft drinks in India. Web.

Galande S 2017, The analytical study of decline in sales of Coca-Cola based on customer’s inclination towards the product, International Journal of Engineering Technology Science and Research, vol. 4, no. 8, pp. 1001-1110.

Gandhi K 2014, A study on brand personality of Coca-Cola and Pepsi: a comparative analysis in the Indian market. International Journal of Conceptions on Management and Social Sciences, vol. 2, no. 2, pp. 2357-2787.

Harvard Business Review 2018, How competitive forces shape strategy. Web.

Haucap J, Heimeshoff U, Klein GJ, Rickert D, Wey C 2013, Bargaining power in manufacturer-retailer relationships, Dusseldorf Institute for Competition Economics, Düsseldorf, Germany.

Kottasova I 2014, Does formula mystery help keep Coke afloat? Web.

Malviya S 2017. Local rivals eat into market share of Coca-Cola and PepsiCo. Web.

Mayureshnikam T and Patil VV 2018, Marketing strategy of Coca Cola. IOSR Journal of Business and Management, vol 3, no. 8, pp. 77-85.

Narain A. 2016. Electronics in South Asia,The World Bank Group, Washington, DC

NASDAQ 2017. How Coca-Cola is focusing on India, Web.

Oxfam America. 2016. Exploring the links between international business and poverty reduction, Oxfam, Oxford, United Kingdom.

Peng MW 2008, Global strategy, Cengage Learning, Massachusetts, MA.

PWC 2013, Through the looking glass: what successful businesses find in India, PWC, Bangalore, India.

Rais M, Acharya S and Sharma N 2013, Food processing industry in India, S&T Capability, Skills and Employment, Food Processing Technology, vol. 4, no. 9, pp. 18-27.

Singh SP, Tegegne F and Ekenem E 2012, The food processing industry in India, Challenges and Opportunities, Journal of Food Distribution Research, vol. 43, no. 1, pp. 81-90.

Statista 2018. Market share of carbonated beverages worldwide as of 2015. Web.

Sundaresan R 2018. Tea cafes: revolutionising tea drinking in India. Web.

Taneja G, Girdhar R and Gupta N 2012, Marketing strategies of global brands in Indian markets. Journal of Arts, Science & Commerce, vol. 3, no. 3, pp. 71-78.

Team T 2016. Coca-Cola’s advertising and marketing efforts are helping it to stay on top. Web.

Team T 2017. How Coca-Cola plans to make India its third largest market. Web.

The Coca-Cola Company 2013. 2012 annual report. The Coca-Cola Company, Georgia, GA.

The Coca-Cola Company 2017. 2016 sustainable report. The Coca-Cola Company, Georgia, GA.

The Coca-Cola Company 2018. Our company. Web.

The World Bank 2018. Population total. Web.

Yannopoulos P 2011. Defensive and offensive strategies. International Journal of Business and Social Science, vol. 2, no. 13, pp. 5-12.