Introduction

Corporate risk management is an exercise in coordinating risk acknowledgment, risk appraisal, risk management systems, and the moderation of administrative assets. This paper describes various steps of risk management decisions. As events such as the financial crisis have fundamentally changed conditions, the times of focusing on operational and strategic risk are long gone. Thus, key risk management decisions helps chief executives to understand the negative effects of corporate risk. Consequently, management decisions will help investors to understand the risk process. It also helps analysts to understand how corporate risk influences its partners (including workers, corporate leaders, and investors).

Finally, risk management decisions help investors to evaluate administrative choices. In financial administration, supervisors are required to distribute capital among various undertakings to spread corporate risk. However, in capital planning, corporate risk management becomes noticeable when investment choices are made. For financial operators, including managers, downside risk quantifies the vulnerability of investment returns. This paper will also evaluate direct and indirect costs and benefits of risk management decisions.

Risk Management Decisions

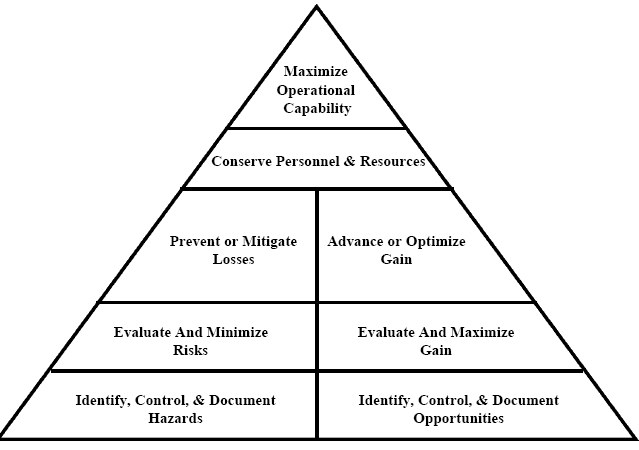

A risk management decision is a continuous process that improves the operations and performance of an organisation. Therefore, risk management decision should address dangers related to operations and objectives. There is the potential for events that constitute opportunities, dangers, or an expanded level of vulnerability (Aldred 2013). Some contend that for corporate risk management, the results are always negative, so risk control should concentrate on anticipation and prevention. Therefore, it is important that risk managers create assessment gauges, which is a winning strategy for the organisation. Key risk management decisions begin with an awareness program (Kaplan & Mikes 2016). Some customary approaches to risk administration focus on dangers originating from physical or natural causes (catastrophic events or disasters). Budgetary risk procedure concentrates on the danger of utilising financial instruments. The goal of risk administration is to diminish the hazard stemming from management decisions to an acceptable level. Corporate risk is influenced by market conditions, innovation, and governmental policy (Terje 2016).

Risk Recognition Process

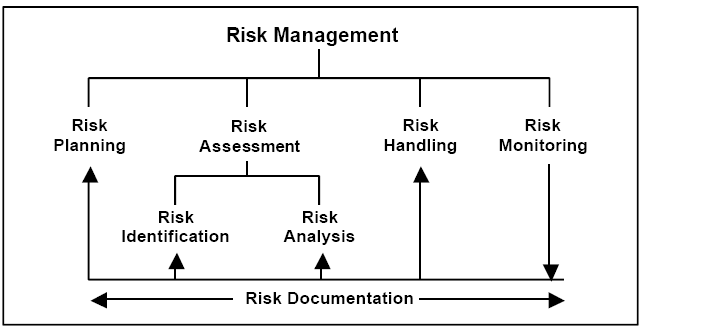

Risk administration should be incorporated into organisational culture to prevent and mitigate incidents. Risk recognition processes include obligation, initiative, and the commitment of management. These decisions transform risk methods into strategic, operational targets, and assign prevention duties throughout the organisation. It should bolster responsibility, assessment of operations, and reward, while advancing operational productivity at all levels (Aven 2015). Achieving an effective risk culture can be promoted through instituting a proper design system and associated conventions. In light of the goal to execute, encourage, and support the management process, risk management decision-making is a vital component of business investment. ISO 31000 refers to this structure as the risk administration framework. Figure 1 outlines an appropriate structure for risk design, procedure, and conventions, and identifies the highlights of each component (Terje 2016).

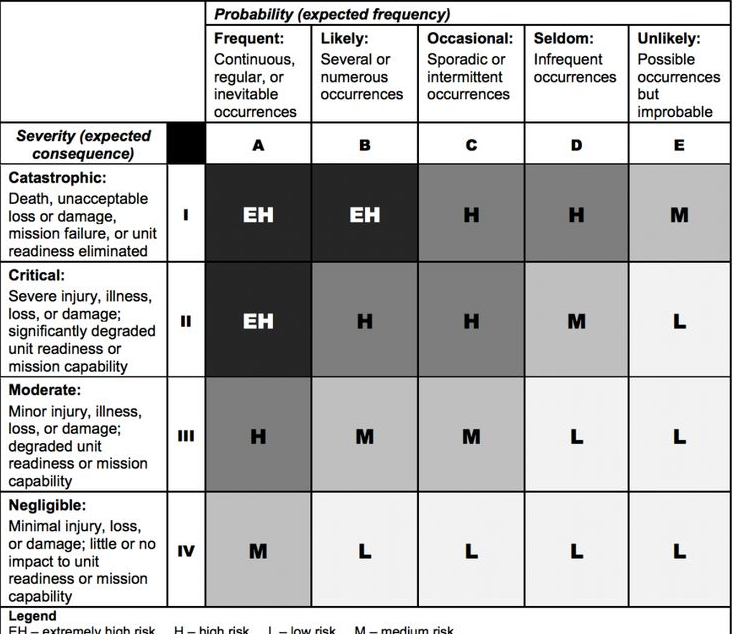

Table 1. Risk design framework.

Risk management activity can be described as a set of harmonised exercises. By implication, risk management decisions should address different components of an investment. The risk management process includes risk assessment, risk recognition, risk tolerance, risk transfer, resource control, mitigation plans, risk observation, risk review, risk monitoring, and risk reporting.

Risk Appraisal

Hazard appraisals investigate the exposure of the organisation to risk and vulnerability. This requires a close monitoring of the organisation, the market environment, and social and political condition and a comprehension of key operational goals. It should incorporate information on the variables that are critical for progress and potential risks identified with the accomplishment of goals (Harrington & Niehaus 2004). The outcome of risk appraisals can be utilised to create a risk profile that shows the severity of risk and provides an apparatus to organise activities. The significance of each distinguished risk becomes an indicator of an organisational success or failure. Thus, organisations can map vulnerabilities based on the business region, portray essential control components, and show where the level of interest in controls may be expanded, diminished, or redistributed (Vanem 2012).

A risk assessment plan enhances an organisation’s operations by recognising inherent risks that require consideration by management. This will encourage the establishment of risk management activities for the organisation’s benefit. An organisation may also choose to enhance the control conditions. As a result, control measures are enforced to enhance its operations. Risk treatment is a control system that improves risk management decisions.

Risk Treatment

Risk control is defined in ISO 31000 as the act of choosing and actualizing appropriate measures to change a risk (Cox 2012). As a result, risk treatment incorporates has as its components, risk exchange, risk financing and controls to prevent risk shirking. Therefore, an effective risk plan should have an internal control framework. The cost effectiveness of internal controls is identified with the cost of executing contingency plans, which is contrasted with the reduction in benefits.

Thus, agreement with laws and directions is not a choice as it controls business operations. An organisation must understand the laws and implement controls that enforce compliance. Thus, one method of supporting money-related insurance against the effect of risk is through financing. It should be noted that a few risks might be uninsurable, for example, damage expenses, work hazard, and the notoriety of the organisation. Risk management decisions include planning and designing. Therefore, the elements of risk engineering, procedure, and conventions should be recorded in the organisation’s policy framework. Many organisations issue a revision of their risk approach every year. This ensures that the risk administration approach follows the best practices. It gives the organisation a chance to concentrate on the proposed benefits for the coming year, recognise the hazard, and consider a risk’s probability. Therefore, administrative order and responsibility are vital and should be constant and prominent. Unless this command and responsibility are forthcoming, the risk management activity will be unsuccessful (Ben-Haim 2012). Keeping the risk strategy progressive shows that risk management is dynamic. The paper shows that effective risk management can improve employee performance (Figure. 2)

A risk management approach incorporates the following areas:

- Hazard administration and internal control goals (administration)

- Statement of the organisation on risk (risk procedure)

- Interpretation of the risk assessment culture or control condition

- Effective risk level

- Risk administration and course of action (the risk framework and design)

- Key techniques for risk acknowledgment and positioning (risk evaluation)

- Standards of documentation for monitoring and detailing hazard (risk conventions)

- Hazard moderation requirements and control systems (risk reaction)

- Assignment of risk administrative measures and obligations (risk management)

- Risk management themes and needs (risk evaluation)

- Standards for observing and benchmarking risk (risk monitoring)

- Assignment of assets to risk administration (risk procedure)

- Risk exercises and needs in the coming year (risk evaluation)

Table 2. Risk administration obligations.

Risk Evaluations

An organisation can create benchmarks to determine the impact of a recognised risk. For money-related risks, cost implications can be utilised as the benchmark test of impact. However, for risks that cause operational disruptions, the length of interruption might be a reasonable test. It is important to recognise the attitude toward the risk and the strength of the organisation to withstand that hazard. Finally, the organisation can determine how to present the specific risk being reviewed. It is important to understand that internal and external elements influence corporate risk. Therefore, organisations can make decisions that cover all aspects of their operations. Risk management decision creates indicators to help recognise a risk event. Key measurement and risk estimation enhance the benefit of reporting and evaluation. Thus, risk management decisions provide the capacity to track changes in risk vulnerabilities or probability, conceivably offering platforms to update their risk profile. Risk management decisions allow a comprehensive perspective on the hazard. Conventional risk procedures concentrate on relief, acknowledgment, or, evasion.

The focus of any cost-related task is the evaluation of the costs and benefits of a decision. Many investigations endeavour to compute the aggregate cost of a project by assessing the immediate expenses of an intervention in a specific area (Borgonovo & Plischke 2015). These cost measurements can be contrasted with the current progress report. Decision framework can manage risk information and any elements involved. Risk management decisions can be given as a report, (stream sheets, and confirmation methods) or as a program. The report supports the decision-making process and ensures that the procedure is straightforward, reported, reproducible, and vigorous, providing a lucid system to investigate the available choices (Ben-Haim 2012). By implication, risk report provides vital information on all aspects of operations. Risk evaluation can be conducted using the report analysis. An “apparatus” is a record or program created to support the decision-making process. Cost-benefit techniques utilise an assortment of methods to support basic leadership identified with cost and benefit. Thus, the impact of external variables whose value is subjective is the most controversial issue in cost-benefit evaluation.

There are various comparative techniques for cost assessing, benefits, and risk related to a choice or design.

Cost/Benefit Assumptions

- Characterise or assess the arrangement/choice/process in its components by drawing a flowchart, exercises, and events.

- Compute, research, or gauge the cost and benefit related to each component (incorporate conceivable obligations, and monetary, and social expenses)

- Contrast the aggregate of expenses and benefits.

Benefit /Risk Assumptions

- Rank the components in a chain that mirrors the effect of its achievement

- Assign weighting values to each component.

- Gauge the probability of progress or risk of each component.

- Multiply the probability of accomplishment or disruption of each component by its weighting value.

- Evaluate the risk with the expenses and the advantages it bears.

Direct Cost and Benefit of These Decisions

Creating a Risk Centred Culture for an Organisation

Organisations that have actualized risk management decisions understand that increasing the emphasis on risk at the senior levels creates a risk awareness culture. A social strategy encourages managers to consider risk transparently and effectively. A risk dialogue is a standard part of an organisation. Therefore, risk assessment is an integral part of business operations. Correspondence and dialogue about risk are perceived as a procedure for providing information to administrators, and an approach to sharing risk data of the organisation (Brandenburg et al. 2014). It also promotes increased knowledge and fundamental leadership concerning risk. In summary, direct costs and benefits of risk management decisions covers the risk recognition, process, risk appraisal, risk treatment, and risk evaluation. These components of risk management framework directly affect the costs and benefits analysis of risk management decisions. Another direct costs and benefits analysis is institutionalised risk detailing.

Institutionalised Risk Detailing

Risk management decisions support better structures, reporting, and examination of risk. Institutionalised reports that track corporate risk can enhance the focus of heads and administrators by giving information that empowers better risk choices. The assortment of information (status of risk markers, moderation techniques, new, and developing dangers, to mention a few) enables management to understand essential areas of risk. These reports enable analysts to attain a superior understanding of risk appetite, risk limits, and resilience. Thus, the assessment of risk management decisions includes auspiciousness, succinctness, and adaptability of risk information. It provides the information that is expected to enhance basic leadership abilities at different layers of administration. Risk management decisions enable management to distinguish opportunities and allows for collaborative synergy and sharing corporate risk information and variables (Droguett & Mosleh 2013). Consequently, establishing risk framework, risk policy, and a risk implementation plan creates indirect costs and benefits analysis of risk management decisions.

Indirect Costs and Benefits of These Decisions

Risk management framework controls the decision-making process of an organisation. Therefore, risk assessment, risk recognition, risk tolerance, risk transfer, resource control, mitigation planning, risk observation, risk review, monitoring, and risk reporting influence both direct and indirect cost-benefit analysis. Indirect cost-benefit analysis cannot be measured based on expenses. However, they support and complement risk costs and benefits of risk management decisions.

Enhanced Focus on Risk

Risk management decisions create indicators to help recognise a risk event. Key measurement and estimation of risk enhances the benefits of reporting and evaluation. Thus, risk management decisions provide the capacity to track changes in risk vulnerabilities or probability, conceivably giving warnings to organisations about changes in their risk profile. Risk management decisions allow for a comprehensive perspective on a hazard. Conventional risk procedures concentrate on relief, acknowledgment, or evasion. However, risk management decisions give management a system to assess risk by focusing on the positions and operational conditions (Brandtner 2013).

Effective Utilisation of Assets

In organisations without enterprise risk management, people might be assigned to supervise and detail risk. While building an enterprise program does not replace the requirement for daily risk assessment, it enhances the structure and tools used to initiate risk management decisions (Chichilnisky 2013). Ending redundant activities enhances productivity by allotting the appropriate assets to alleviate the risk.

Powerful Coordination of Administrative and Compliance Policy

Bond rating offices, financial inspectors, and administrative analysts inquire about risk assessment and utilise information from ERM programs. Since ERM information includes monitoring, checking controls, and relief endeavours, this data can lessen the effort and the cost of reviews and surveys (Droguett & Mosleh 2013).

Conclusion

Corporate risk management is an exercise, which coordinates risk acknowledgment, and risk appraisal systems to manage its occurrence and moderate administrative assets. Some customary approaches to risk administration focus on dangers originating from physical or natural causes. The budgetary risk administration concentrates on the danger caused by utilising financial instruments. Risk management activity can be viewed as a set of harmonised exercises. By implication, risk management decisions should address these processes. The risk management process includes risk assessment, risk recognition, risk tolerance, risk transfer, resource control, mitigation planning, risk observation, risk review, monitoring, and risk reporting. Organisations that have actualized risk management decisions understand that increasing the emphasis on risk at the senior levels creates a risk awareness culture at all levels.

A risk assessment plan enhances an organisation’s operations by recognising inherent risks that require consideration by management. This will encourage the establishment of risk management activities for the organisation’s benefit. An organisation may also choose to enhance the control conditions. The social move enables risk to be considered transparently and effectively. A risk discourse is a standard part of an organisation. Thus, operational heads understand that risk assessment is an integral part of its operations. The cost-benefit analysis of risk management decisions improves productivity. It is important to collect information before making recommendations for risk management decisions. Risk recognition processes include responsibility, initiative, and management commitment. These decisions transform risk methods into strategic operational targets, and assign prevention duties throughout the organisation. It should bolster responsibility, the assessment of operations, and reward, while advancing operational productivity at all levels.

Reference List

Aldred, J 2013, ‘Justifying precautionary policies: incommensurability and uncertainty’, Ecological Economics, vol. 96, no. 3, pp. 132–140.

Aven, T 2015, ‘On the allegations that small risks are treated out of proportion to their importance’, Reliability Engineering and System Safety, vol. 140, no. 2, pp. 116–121.

Ben-Haim, Y 2012, ‘Doing our best: optimization and the management of risk’, Risk Analysis, vol. 32, no. 8, pp. 1326–1331.

Borgonovo, E & Plischke, E 2015, ‘Sensitivity analysis: A review of recent advances’, European Journal of Operational Research, vol. 6, no. 1, pp. 1–19.

Brandenburg, M, Govindan, K, Sarkis, J & Seuring, S 2014, ‘Quantitative models for sustainable supply chain management: developments and directions’, European Journal of Operational Research, vol. 233, no. 2, pp. 299–312.

Brandtner, M 2013, ‘Conditional value-at-risk, spectral risk measures and (non-) diversification in portfolio selection problems: A comparison with mean–variance analysis, ‘ Journal of Banking and Finance, vol. 37, no. 2, pp. 5526–5537.

Chichilnisky, G 2013, ‘The foundations of statistics with black swans’, Mathematical Social Sciences, vol. 59, no. 3, pp. 184–192.

Cox, T 2012, ‘Confronting deep uncertainties in risk analysis’, Risk Analysis, vol. 32, no. 2, pp. 1607–1629.

Droguett, L & Mosleh, A 2013, ‘Integrated treatment of model and parameter uncertainties through a Bayesian approach’, Journal of Risk and Reliability, vol. 227, no. 1, pp. 41–54.

Harrington, S & Niehaus, G 2004, Risk management and insurance, Irwin, Inc., Manchester.

Kaplan, S & Mikes, A 2016, ‘Risk management: the revealing hand’, Journal of Applied Corporate Finance, vol. 28, no. 2, pp. 8–18.

Terje, A 2016, ‘Risk assessment and risk management: review of recent advances on their foundation’, European Journal of Operational Research, vol. 253, no. 1. pp. pp. 1-13.

Vanem, E 2012, ‘Ethics and fundamental principles of risk acceptance criteria’, Safety Science, vol. 50, no. 2, pp. 958–967.

Appendix 1

Appendix 2

Appendix 3