Respondent’s demographic profile

The researcher intended to obtain the view of customer focus from the Emirates NBD’s employees and customers. Subsequently, the researcher gathered data from 20 employees and 50 customers using the questionnaire illustrated in appendix 1. The research respondents considered were from diverse demographic characteristics with regard to gender, age, income levels.

Table 1: distribution of respondents’ age group.

Furthermore, the researcher collected data from customers belonging to diverse income groups as illustrated by the chart below.

Table 2: distribution of respondents based on income level.

The study recognises that the respondents belong to diverse occupations. Subsequently, the study took into account the respondents’ occupation as illustrated in the table below.

Table 3: distribution of respondents based on occupation.

The respondents interviewed also belonged to different levels of education as summarised below.

Table 4: distribution of respondents based on level of education.

Respondents’ perception on quality

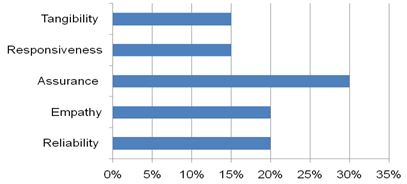

The study intended to understand the quality of customer service at Emirates NBD. In a bid to achieve this goal, the researcher sought to understand the customers’ perception on customer service aspects. The researcher focused on a number of customer service aspects, which include reliability, assurance, empathy, responsiveness, and tangibility.

The customers were of diverse opinions. Fifteen per cent (15%) of the customers interviewed cited the level of responsiveness of the services offered in their banking service. Twenty per cent (20%) of the respondents interviewed argued that their focus is the extent to which the bank is empathetic in its operations, while 15% of the customers cited the bank’s responsiveness. On the other hand, 30% of the respondents argued that they were concerned with the level of assurance received from the banks in the UAE.

A further 15% cited the level of tangibility integrated into the bank’s operations as their core concern in their banking process. Moreover, 20% cited the level of reliability offered by the bank. The chart below illustrates a summary of the respondents’ perception on the customer service.

Table 5.

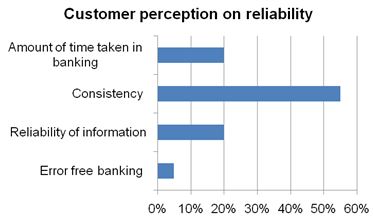

When asked why they were concerned with reliability, the respondents argued that they are interested in the time taken to access banking services. On the other hand, 5% of the respondents were concerned with error free banking services. Twenty per cent (20%) of the respondents were concerned with the level of reliability of information at Emirates NBD.

Fifty five per cent (55%) of the respondents were concerned with the level of consistency of customer service at Emirates NBD, while 20% of the respondents were concerned with the amount of time taken in banking. The chart below shows a summary of the respondents’ perception with regard to the level of reliability.

Table 6.

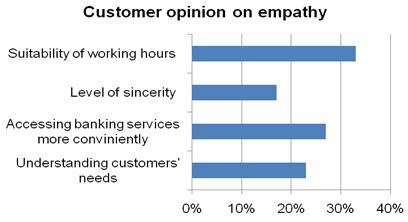

When asked why they were concerned with the level of empathy, the respondents provided different response. Twenty-three per cent (23%) of the respondents argued that they were concerned with the extent to which the bank’s management team and staff understand their needs.

On the other hand, 27% of the respondents cited the extent to which they can access banking services conveniently. A further 17% of the respondents cited the level of sincerity in the delivery of services. Thirty-three per cent (33%) of the respondents were concerned with the suitability of banks working hours. The table below illustrates a summary of the respondents’ opinion with regard to the level of empathy.

Table 7

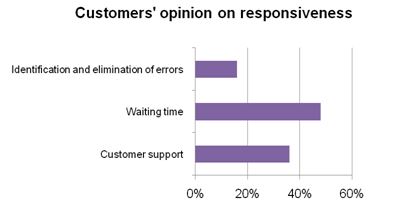

The researcher intended to understand what the respondents meant by responsiveness. Subsequently, the researcher asked the respondents to explain further. The response obtained differed.

Thirty six per cent (36%) of the respondents were concerned with the level of customer support received while 48% of the respondents were concerned with the waiting time. Sixteen per cent (16%) of the respondents were concerned with the effectiveness with which the bank identifies and eliminates errors in the customers’ accounts. The table below illustrates a summary of the respondents’ opinion on responsiveness.

Table 8.

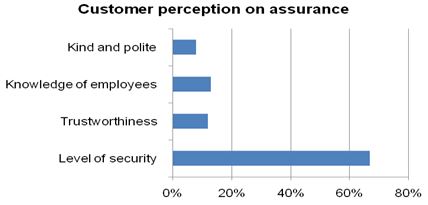

During the process of collecting data, the researcher recognised the fact that consumers are concerned with the level of assurance in purchasing goods and services. Subsequently, the researcher intended to understand the respondents’ opinion on assurance. The response gathered varied. Sixty seven per cent (67%) of the respondents were concerned with the level of security in consuming bank services, while 13% of the respondents cited knowledgeable employees.

Additionally, 8% of the respondents cited the extent to which the bank’s employees were kind and polite in dealing with customers. Twelve per cent (12%) of the respondents cited the level of trustworthiness amongst bank employees. The chart below illustrates the various assurance parameters as cited by the respondents.

Table 9.

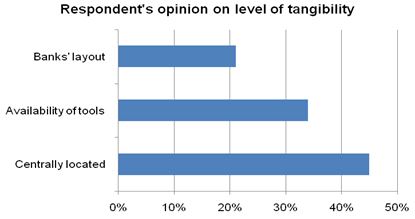

The respondents cited different aspects in an effort to explain thier opinion on the tangibility. Forty-five per cent (45%) of the respondents were concerned with the effectiveness with which the bank and its branches are located centrally. Twenty-four per cent (24%) of the respondents were concerned with the effectiveness with which the bank is equipped with tools, equipments, and materials necesary to serve customers optimally.

Furthermore, Twenty-one per cent (21%) of the respondents were concerned with the bank’s commitment to creating an atractive layout. The chart below illustrates a summary of the respodents’ opinion on the level of tangibility.

Table 10.

Data analysis

The data obtained from the field shows that consumers are increasingly focusing on the quality of service offered by banks. This assertion is well illustrated by the various dimensions of the customers’ perception on the quality of services offered, which relate to level of reliability, assurance, tangibility, responsiveness, and empathy. The average score on these service quality dimensions is 20% as illustrated in the chart below.

Table 11.

The average score on the various customer perception dimensions is 20% as illustrated by table 11 above.

Assurance

The results above illustrate a number of aspects that the Emirates NBD’s management team should take into account in its strategic management practices. First, the study shows that customers are concerned with achieving a high level of assurance in consuming different banking services.

One of the assurance issues that customers are strongly concerned with relates to the level of security (67%) as illustrated above. Furthermore, the study shows that consumers prefer employees with adequate information about the products and services offered by the organisation. This aspect shows a strong and positive correlation between the level of satisfaction amongst customers and assurance.

Currently, customers are increasingly being concerned with the level of security in the banking service. This trend has arisen from the high rate at which banks are experiencing fraud from internal and external stakeholders. The high rate of technological advancement has motivated most banks to adopt electronic commerce concepts such as mobile and online banking. Despite this aspect, banks are experiencing a threat arising from an increment in the rate of hacking and cracking on banks’ websites.

This aspect explains why consumers are concerned with a high level of assurance in their banking process. A study conducted in the UAE shows that most banks and customers in the UAE are doubtful of the level of security despite adopting electronic commerce concepts in their operation (Sambidge 2013). This realisation explains why customers are concerned with assurance.

In order to deal with security challenges, it is imperative for the Emirates NBD’s management team to consider the most effective strategies to deal with the security challenges.

Responsiveness

Consumers are increasingly being concerned with the effectiveness with which organisations respond to their needs. Therefore, responsiveness is a key component in offering quality services. However, most respondents were of the opinion that they would prefer dealing with machines rather than individuals. This assertion arises from the view that machines give immediate feedback. The response time in human beings is subject to various factors such as emotions, thus leading to a low level of productivity.

One of the factors that can affect the level of responsiveness in machines relates to machine failure or breakdown. Mehrabi, Nasiripour, and Delgoshaei (2008) argue that consumers are cognisant of the fact that machine failure can occur.

However, it is essential for banks’ management staff to ensure that customers are informed adequately on the failure. Furthermore, it is relatively easier for an organisation to improve the response time in machines as compared to human beings. Therefore, the likelihood of achieving consistency in the service delivery process is relatively high.

Empathy

The study shows that a weak correlation between the level of customer satisfaction and the extent to which the bank is empathetic in its operation. The extent to which customers are concerned about empathy is illustrated by the view that some customers are forced to adopt conventional methods in obtaining banking services as illustrated by queues in banking halls. Some customers prefer these queues in order to have a face-to-face conversation with bank tellers during the working hours.

Furthermore, previous studies show that customers expect to be respected in their purchasing processes. Subsequently, one can argue that technology only provides a platform through which banks can improve their operational efficiency by minimising workload and errors. Despite this personal contact, the banking staff members are significant in the operation of firms in the banking industry.

Tangibility

The study indicates a strong correlation between the level of tangibility in a bank’s operation and the level of customer satisfaction. For example, customers are concerned with the effectiveness with which they can easily access banking services.

This observation is well illustrated by the high percentage of respodndents (45%) who cited the location of the banks and availablity of tools and equipments (34%) in the bank’s operation. On the other hand, the number of respondents who cited the ambience in the banking premises is relatively small (21%), whcih shows that the degree of correlation between customer satisafaction and the level of customer loyalty developed is relatively low.

In an effort to increaase the level of tangibility in their operation, banks are increasingly focusing on improving their ATM networks and establishing additional branches. Moreover, the study shows that the adoption of effective tools and equipments is a significant component in irmproving the effeciency with whcih customers are optimally served.

Sambidge (2013) argues that machines such as cash and cheque deposit machines, ATMs, and technologies such as the Internet are critical in improving the level of tangibility in banks’ operations. For example, implementing new technology improves the effectiveness with whcih customers access banking services in the comfort of their homes.

In order to achieve a high competitive advantage by attracting and retaining customers, it is essential for customers to enhance the level of their tangibility. In addition to the above strategies, it is imperative for Emirates NBD to consider improving its competitive advantage by adopting agency banking. This goal can be achieveved by opening retail agents in well established retail stores and shopping malls. Incorporating these changes will play a fundamental role in the Emirates NBD’s efforts to attract and retain a large customerbase.

Reliability

The study shows that consumers are increasingly being concerned with the degree of excellence and accuracy in the delivery of banking services. In an effort to improve the level of reliability, banks are increasingly adopting new technologies. Some of these technologies enable customers to access various bank services such as credit transfer, cash withdrawal, bank-account update, and cash credit conveniently.

The adoption of the Internet banking has played a significant role in enhancing the level of the banks’ reliability in their service delivery. Previous studies conducted show that consumers are increasingly being attracted to the types of machines implemented by banks. In order to improve its effectiveness with regard to the level of reliability, it is imperative for the Emirates NBD’s management team to integrate new technologies in its service delivery processes.

Discussion

The study shows that customers have increased their dimensions in the consumption of goods and services. Currently, customers are not only being concerned on the product or service, but also on how the service is delivered. Subsequently, it is imperative for the organisations’ management team to develop a comprehensive understanding of the customers’ needs and expectations by improving quality management practices.

This study underscores the importance of Emirates NBD integrating effective customer satisfaction strategies. It is imperative for the firm’s management team to refrain from considering the institution as a firm in the finance industry, but a service-oriented entity.

Therefore, the firm should diversify its source of competitive advantage from its financial prowess to service quality. Additionally, the firm should ensure that its financial human resource, systems, time, and other resources are not only dedicated to managing the firm’s assets, but also in managing its service quality and customers.

One of the issues that the firm’s management team should focus on is customer focus. Mehrabi, Nasiripour, and Delgoshaei (2008) assert that the customers’ perception is a critical component in improving an organisation’s market share.

Furthermore, investing in customer focus strategies will enable Emirates NBD to develop sufficient competitive advantage in the UAE’s banking industry, which is characterised by diverse challenges such as intense competition, security challenges, rapid technological changes, and high level of customer dissatisfaction on the quality of banking services offered.

Adopting customer focus strategies will enable Emirates NBD to improve the level of satisfaction amongst its customers. Some of the areas that the firm should take into account in its customer service management entail managing customer satisfaction with regard to the service quality perceptions identified in this study. Some of these aspects include level of reliability, assurance, customer responsiveness, empathy, and tangibility.

In a bid to implement customer focus strategies effectively, it is imperative for Emirates NBD to be concerned with the quality of service delivered. This goal can only be achieved if the bank’s management team and the lower level employees are focused at the service delivery process. First, Emirates NBD should ensure that it understands the customers’ needs and expectations on different issues. Therefore, the firm should develop a culture of conducting consumer market research in order to understand their needs.

The findings obtained from the market should form the basis of improving service quality. This study highlights the importance of reliability, assurance, responsiveness, tangibility, and empathy in the operation of firms in the financial services sector. Therefore, Emirates NBD should integrate these aspects in its competitive strategies. For example, focusing on assurance will enable the firm to understand the customers’ security needs. Subsequently, the firm will be in a position to improve the security of the customers’ accounts.

One of the ways through which the bank can address the security challenges successfully is by implementing emerging technologies such as biometric technology. Mehrabi, Nasiripour, and Delgoshaei (2008) assert that the biometric technology improves the level of security in a bank’s effort to achieve distributional efficiency by establishing an extensive network of ATMs. Furthermore, adopting biometric penetration will enhance the effectiveness with which Emirates NBD penetrates the market.

This assertion arises from the view that the bank will be in a position to curb the likelihood of ATM fraud. For example, Emirates NBD will be in a position to prevent ATM fraud through theft of personal identification number.

Moreover, it is critical for Emirates NBD to innovate its information communication systems and databases continuously in order to curb with the ever-present threat to information communication technologies. Subsequently, improving the level of assurance amongst its customers can enhance the Emirates NBD’s competitiveness, as customers will develop the perception that the bank is concerned with the level of security in consuming diverse bank services.

Conclusion

This research shows that consumers no longer anchor their level of satisfaction on the product or service, but also on how the service is delivered. Consequently, there is a strong correlation between the level of customer satisfaction and the level of loyalty developed. Findings obtained from the field shows that customers are increasingly shifting towards the quality of service received in consuming products and services.

Consumers are increasingly considering the quality of service as a critical determinant in their desire to achieve a unique experience by consuming products and services. This trend is common across different consumers of banking services irrespective of their demographic characteristics.

Therefore, it is imperative for Emirates NBD to consider improving its service delivery processes. However, this goal can only be achieved if the firm develops a comprehensive understanding of the customers’ needs and expectations. Such understanding will allow Emirates NBD to improve the level of customer satisfaction by adopting effective customer focus strategies.

Recommendations

In a bid to position itself as a customer-focused organisation, Emirates NBD should take into account a number of aspects as outlined below.

Customer relationship management – Emirates NBD should formulate and implement a comprehensive customer-relationship management strategy. One of the ways through which the firm can improve the effectiveness of its CRM is by implementing effective external communication technologies. For example, the firm should implement effective customer-relationship management software that will enable it to interact with customers effectively.

The software should assist the firm in developing a database on the customers’ opinion, complains, and complements on the quality of its services. Furthermore, the firm should consider improving the quality of its services by utilising emerging communication technologies such as social networks. These platforms will enable Emirates NBD to interact with current and potential customers effectively and efficiently, hence understanding their needs and expectations. Subsequently, the firm will improve the customers’ perception on reliability and trust.

Employee training – the bank should formulate a comprehensive customer service training program. The core objective of the program should be to assist employees develop a customer-focus culture. Some of the issues that the firm should integrate into its training program relate to customer perception on responsiveness and empathy.

Training will also improve the level of employee knowledge on the products and services offered by the firm. Additionally, employee training will improve the effectiveness and efficiency with which customers are served.

Distribution network – Emirates NBD should also focus on improving its presence within the UAE market by improving its distribution network via adopting the concept of agency banking. This move will improve the level of market penetration in the bank’s operations.

Furthermore, the bank should adopt emerging technologies such as mobile and online banking in order to reach a large number of customers. Adopting these technologies will improve the effectiveness with which the customers access diverse banking services hence improving the level of customer satisfaction. However, the firm should ensure that adequate security measures are implemented in its distribution network in order to improve the level of assurance amongst customers.

Reference List

Mehrabi, F., Nasiripour, A & Delgoshaei, B 2008, ‘Customer focus level following implementation of quality improvement model in Tehran social security hospitals’, International Journal of Health Care Quality Assurance, vol. 21 no. 6, pp. 562-568.

Sambidge, A. 2013, 53% of UAE bank customers want to switch-poll. Web.

Appendix – Questionnaire

Dear sir/ madam

I …………………………. intends to carry conduct a study on the relationship between customer focus and achieving competitive advantage in the banking industry. This study will focus on enabling Emirates NBD improve its competitive advantage in the banking UAE banking industry. I hereby seek your assistance in gathering data that will aid in successful completion of the study. The data obtained will be solely be used for academic purpose. Furthermore, the researcher will ensure that the confidentiality of the respondent is observed.

Part 1: Personal information

Please tick appropriately.

- Age [Years]

- 8-30;

- 31-35;

- 36-40;

- 41-45;

- 46-50;

- Above 50.

- Educational background

- High school;

- University;

- College;

- Have never attended school.

- Occupation

- Student;

- Retired;

- Business;

- Professional.

- Income level

- AED 10,000-AED15,000;

- AED 15,001-AED 20,000;

- AED 20,001-AED 25,000;

- AED 20,001-AED 25,000.

Part 2: General questions

- What is your perception on the quality of service received at Emirates NBD?

- Very effective;

- Relatively effective;

- Ineffective;

- Very ineffective.

- Do you consider the following aspects to be important in consuming banking services?

- Tangibility;

- Responsiveness;

- Reliability;

- Assurance;

- Empathy.

- If your answer in 2 above is tangibility, what specific aspects of tangibility do you take into account?

- If your response in 2 above is responsiveness, what aspects do you consider more important in determining the level of responsiveness in Emirates NBD service delivery?

- Do you consider Emirates NBD to observe reliability in service customers?

- Yes;

- No.

- If your answer in (5) above is yes, what aspects of reliability are you mostly concerned about?

- What aspect of assurance do you mostly consider important in consuming banking services at Emirates NBD?

- Do you consider respect, courtesy, honesty and justice to be important in seeking banking services from your banker?

- Yes.

- No.

- If your answer in 8 above is yes, what is your opinion on the level of empathy amongst Emirates NBD employees?

- Very high.

- High.

- Low.

- Very low.

- In your opinion, what should Emirates NBD do in order to improve the quality of its service delivery?