Introduction

Nintendo Company limited is a Japanese multinational corporation headquartered in Kyoto, Japan (Gamble & Thompson, 2010). Over the years, the company has developed into an influential video game console and software developing firm that produces and sales hardware and software for its video game systems (Liebeskind, 2003). The video gaming industry is dominated by Microsoft, Sony and Nintendo. The three companies have battled for market supremacy since the late 1990s.

The renewed battle, specifically in the console segment came in 2006 when Sony and Nintendo launched their latest generation consoles to compete with the Xbox 360 which had been launched a year earlier (Gamble & Thompson, 2010).

The Sony Playstation 3 (PS3) had similar features with the Xbox 360; it came with a 3.2 GHz microprocessor, 550 MHz graphics card, 1080p HD resolution, Wi-Fi capabilities, a 60 GB hard drive (Mulcaster, 2009). The only differentiating feature was the HD blu-ray optical drive which was far much superior compared to the Xbox’s standard optical DVD drive (Gamble & Thompson, 2010). The PS3 was however very expensive, retailing between $499 and $599 at launch.

The Nintendo’s Wii that was launched at about the same time was technologically inferior to both the Xbox 360 and the PS3. Many industry analysts dismissed the Wii as a joke for its poor graphics, bad name and lack of DVD playback (Gamble & Thompson, 2010).

According to them, the Wii was going to worsen Nintendo’s problems that had begun with the entry of Sony in the video gaming industry. The Wii had been designed to be simple in order to appeal to the larger segment of casual gamers. The device had a completely new and distinct video game controller as its major attraction. The strategy worked well for the company as it sold all the Wii’s in 2007 and 2008. By 2009, Nintendo’s cumulative sales of Wii units had surpassed those of the Playstation 3 and the Xbox 360.

Strategic Issue

The video game industry is dominated by Sony, Microsoft and Nintendo. The three firms are fiercely competing to outdo each other. Their strategies mainly revolve around innovation, pricing and adoption of the latest technologies. Nintendo has been the market leader for a long time but was outdone with the entry of Sony’s which produced more advanced gaming consoles which extended the gaming age bracket (Gamble & Thompson, 2010).

Since the entry of Sony, the three major video gaming companies have relied much on new technology to build their customer numbers. For Example, Sony’s progression from Playstation to Playststion 2 and then Playstation 3, and Microsoft’s progression from the initial Xbox console to the Xbox 360 (Nag, Hambrick, & Chen, 2007).

This can be seen with the generational progression of the gaming devices produced by the three major firms. This strategy has proven to be too costly to the point the firms make losses on the consoles segment hoping to recoup the lost revenues from software sales.

Seemingly fed up with the technology race Nintendo’s management devised a newer strategy that would ensure that their gaming consoles appeal more to casual gamers and people who had not played video games before (Moncrief, 2004). The company wanted to stop concentrating on hardcore gamers who were mainly targeted by its rivals. Thus, the latest of its gaming consoles, the Wii had no significant improvement or did not much other same generation gaming consoles from the two main rivals.

The Wii console was expected to be less intimidating and thus appeal to a wider variety of consumers. The strategy therefore focused on an innovative and distinctively different controller that would change the gaming experience. The strategy did pay off as the company sold more Wii units than Sony’s PS3 and Microsoft’s Xbox 360 consoles. The Wii units produced in 2006 and 2007 were completely sold off and the cumulative sales by 2009 were much higher compared to the other two major firms in the video gaming industry.

However, the overall company sales begun to fall in the first quarter of 2009 (Gamble & Thompson, 2010). The decline was in both handheld devices such as the Nintendo DS and also in the video console segment. Analysts attributed the fall to decreased spending by households that was due to the ripple effects of global recession and rising fuel prices (Nag, Hambrick, & Chen, 2007).

The recession and rising fuel costs adversely affected the US and other developed nations that were the main markets for the video gaming devices. Nintendo however decided to proceed on with its innovative strategies to consolidate its presence in the market.

External environment

The console segment of the Video game industry has continued to lead since 2006. The current competitive environment in the Video gaming industry was set off in 2006 when Sony and Nintendo launched their console segment devices to compete with Microsoft’s Xbox 360 that had been launched in 2005 (Gamble & Thompson, 2010).

The Sony PS3 received positive reception among websites, magazines and industry analysts due to its advanced technological features. Sony had been successful with its previous console segment video gaming devices such as the PS2 which had badly aged out Nintendo’s Game cube and Microsoft’s Xbox.

So the Wii that was launched by Nintendo in 2006 was intended to totally influence the market’s perception on video gaming by providing an entirely different video game playing experience that would be less intimidating to casual gamers and to other people who had not played video games (Gamble & Thompson, 2010). The strategy paid off and Nintendo quickly sold its Wii devices produced in 2006 and 2007. Nintendo effectively assumed market leadership in the sale of the seventh generation video game consoles (Gamble & Thompson, 2010).

Microsoft and Sony staged a counter attack in 2008 and early 2009 which included new controllers and software releases that were targeted at the casual gamers (Moncrief, 2004). They also cut down their prices to ensure that the conditions were very similar to those provided by the Nintendo’s Wii.

The data provided indicate that the video gaming industry is still growing. Total revenues earned by Nintendo from 2005 through to 2009 show an upward trend which confirms that the industry is still growing. However, the momentum slowed down between 2008 and 2009 and this can be attributed to the rising fuel costs and recession that was witnessed.

Macro-environment

The video game industry had escaped the initial effects the global financial crisis that begun in 2007. However, the financial crisis remained a big threat to the industry (Mulcaster, 2009). The industry remained untouched until mid 2009 when it became evident that the video game console and software sells were declining.

The industry recorded $ 1.2 billion sales revenue in the month of June 2009. This was a 31% drop in comparison to the $1.7 billion dollars that had been realized in the year 2008. This quarterly decline was the worst to hit the industry since 2000. The console segment was the worst affected by recession. Consoles sales dropped by 38% from $ 617.3 million in June 2008 to 382.6 in June 2009 (Gamble & Thompson, 2010).

The sales of video game consoles, software and other accessories reached a record high in 2008. The sales registered $ 23.1 billion in revenues representing a 19% rise from the revenues registered in 2007.

The increased sales were mainly attributed to the sales of the new console devices of the three most influential companies in the video game industry. At launch, the Xbox had retailed between $299 and $399, and the PS3 between $499 and $599 while the Wii was at $249 (Gamble & Thompson, 2010). The Wii sold more units than its rivals across the globe.

It’s evident that there were various market factors that were driving the innovation craze in the gaming industry. The consumer came out to the most powerful force and thus the industry players had to ensure that their efforts attract numbers to their respective sides.

The video gaming industry is also subject to the prevailing societal values and legislative frameworks for instance the video games are required to promote good values in the society. It’s illegal to produce games that encourage violence in the users and this factor also played a role.

Industry Analysis

Driving forces

The video game industry is composed of players from a wide range of businesses, including computer software publishing firms, video game software and hardware companies, publishing houses, television production companies, motion picture companies and education content providers (Mulcaster, 2009). Beneath this complex structure is a substructure of smaller companies that offer software development services, product designing and distribution of products to retail outlets.

All these participants are involved in strategic activities that are aimed at increasing the sales of their final video gaming devices (Liebeskind, 2003). This implies that the video game market is highly dynamic and strongly subject to corporate changes and technology development collaborations (Mulcaster, 2009).

The industry is constantly evolving through adoption of newer technologies to ensure that the final products are much more enhanced and magnified. These measures are vital for the players to remain relevant in the rapidly changing entertainment industry.

The video game phenomenon was established in the 1980’s and has been growing steadily since then. The video game users have evolved along the technological advances and have significantly shied away from “passive” entertainment products characteristic of TV broadcasts and audio CD entertainment (Mulcaster, 2009). Consumers are still yearning for devices that can respond to real time inputs and the major players in the industry such as Sony, Microsoft and Nintendo are constantly upgrading their devices.

The dream of widespread portable gaming became a reality in 1989 when Nintendo released the gameBoy (Nag, Hambrick, & Chen, 2007). Before the playstation was launched by Sony, the handheld gaming industry was dominated by Nintendo. Statistics indicate that Nintendo’s market dominance begun to decline upon the release of the playStation by Sony.

Formerly, the video gaming industry was dominated by male adolescents who commanded a bigger share of the lucrative market. However, the introduction of newer and more advanced devices such as the PSP broadened the age bracket to up to “forty-somethings” (Mulcaster, 2009, p. 45). The competition between the major companies has mainly been in the console segment of the video game industry.

Rivalry was sparked by the introduction of the PS3 and the Wii in the market by Sony and Nintendo respectively. Nintendo released to the Wii to try and beat of the significant competition it was facing from Microsoft’s Xbox 360 that had been released in 2006. Nintendo’s Wii was targeted at a completely different market segment.

The Wii retailed at a cheaper price of about $250 and it sold more units than other competing devices across the globe (Gamble & Thompson, 2010). Nintendo sold many units of the Wii, more than the Xbox 360 and the PS3 in the United States during the first half of 2007. The Wii outsold its fellow seventh generation consoles by factors 2:1 and 6:1 nearly every week from its launch until November 2007 (Mulcaster, 2009).

A long term analysis showed that both Sony and Microsoft were getting loses from the sale of video consoles and they had hoped to gain significantly from software sales. Financial analysts estimated that the PS3 was generating a loss of $250 with each unit sold (Mulcaster, 2009). However, the Wii was earning profits per unit sale. The profits were approximated to be around $13 in Japan, $50 in the United States and $79 in some parts of Europe (Gamble & Thompson, 2010). The Wii’s huge profit margins were due to its low cost of production.

Nintendo also gained from the increased in sales in other consoles such as the Nintendo DS and games. The Nintendo DS was launched in 2004 to help combat increased competition in hand held video gaming console market segment (Gamble & Thompson, 2010). By 2007, the company had sold more than 50 million Nintendo DS consoles.

A redesigned version of the DS, DS lite was introduced in 2006, the same year the Nintendo Wii was launched and it too was a success (Moncrief, 2004).

By August 2009, Nintendo had sold off more than 107 million DS game systems and more than 500 million copies of video games for the Nintendo DS game systems (Gamble & Thompson, 2010).

Apart from the consumer needs and rivalry, the video gaming industry is also benefiting from increasing globalization and emergence of new internet capabilities. More and more users are now able to participate and identify with different games that otherwise could have been limited to certain geographical areas.

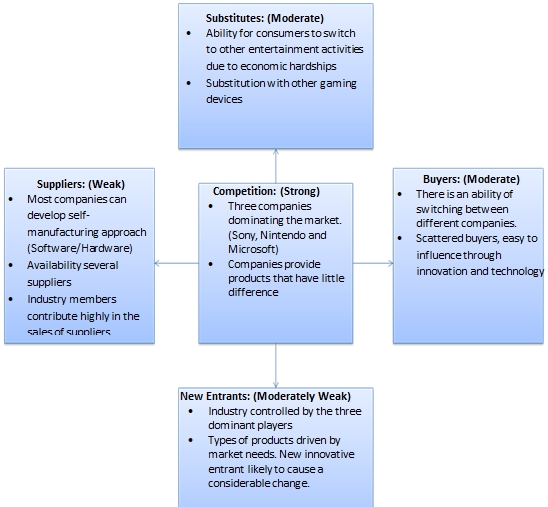

Five forces model

The Porter’s five forces tool can be regarded to be a simple but nevertheless powerful tool that helps one to understand where power les in any business situation (Liebeskind, 2003). The five forces model can be regarded as one of the earliest models that have been used to examine industry economics and attractiveness.

It basically provides a framework of five forces that determine how profitable an industry is. The tool is often used to “understand whether new products, services or businesses have the potential to be profitable” (Mulcaster 2009, p. 33). It also used to understand the balance of power in certain scenarios. “The five forces model makes an assumption that there are five significant forces that determine competitive power in any given business situation” (Mulcaster, 2009, p. 5). These forces include:

The supplier power – The primary concern of the supplier power is to identify how the suppliers of different commodities can drive up the prices. “This aspect is driven by the number of suppliers for each important input, the uniqueness of their product or service and their strength and control over the business or industry” (Moncrief 2004, p. 2).

This also includes the cost of switching from one supplier to another. Thus the lesser the number of suppliers, the more the business depends on them and the more the power they possess. The video gaming industry utilizes hardware, software and other accessories to run. Some of these components such as game consoles and software are developed by the companies but many others are also provided by third party companies. More than 80% of the products marketed by Nintendo are sourced from third party providers (Mulcaster, 2009).

The company also gets hardware components from other suppliers. For instance, Nintendo sources parts of the Wii console from other companies. The graphics components are sourced from ATI, processors from IBM and batteries from Panasonic among others. All these suppliers have some power but as of now, the power is in the hands of Nintendo and other leaders in the industry who can source these products from a variety of providers eager to ride on their success.

Buyer Power – Here the question revolves around the ability of buyers to drive prices down. This is also determined by the number of buyers per business establishment and the respective importance of each individual buyer to the business (Liebeskind, 2003). Thus if a business has a few powerful buyers they these buyers are in a greater position to control the business.

The video gaming industry is very competitive. The major three companies are fighting for a bigger market share. Many strategies have been advanced but it’s apparent that the buyer has the power to drive prices down. The affordability of Nintendo’s Wii saw other market players cutting their prices to compete.

The buyer power has also seen an innovation and technology race by the top three companies in the Video game industry. The company’s are constantly enhancing the capabilities of their products in order to attract more sales. Video gaming belongs to the larger entertainment industry. These companies must also fight to keep their share in the entertainment industry.

The industry produces non essential products which have to appeal to the consumer for consideration. Thus as far as the video gaming industry is concerned the customer has more power than the company.

Competitive rivalry – This pertains to the number and capability of the different competitors that are operating in the same industry. “If a business has many competitors who offer products that are similar, then each of them will have little power because the buyers and suppliers are likely to switch if your deal is not good enough” (Nag, Hambrick, & Chen, 2007, p. 65).

As described above, there is no one company in the video gaming industry that has absolute power. The industry has a very healthy competition that benefits the consumer. Market performance by any of the three companies depends on how their gaming devices appeal to the consumer.

Nintendo has had success through unique innovation that has seen its rivals playing catch up. Competition has shifted away from scrambling for the video game market dominated by adolescents, hardcore gamers to expanding the age bracket and getting more casual gamers n board. The competition is very strong among the top three companies whose products are more similar.

Threat of substitution – This pertains to the ability of the customers to establish a different way of getting the services you offer. For instance if you are in the business of transporting passengers from point to another using passenger jets, customers may decide to use speed trains to get to the same destination. In the Video gaming industry, the threat of substitution is always present. Video gaming is a form of entertainment which can easily be substituted by other forms of entertainment. However, this factor will affect all companies involved in the video gaming industry. This threat can also exist within the industry due to the various ranges of products provided. If the customers can get the same satisfaction with a different product they will go for it (Gamble & Thompson, 2010). There are different segments designed for different gaming experiences which can attract a significant amount of substitution within the industry.

Threat of new entry – “The balance of power in any business situation is also affected by the ability of new players to enter the business” (Mulcaster, 2009, p. 6). If its costs less time and money for any playconser to enter the market and compete effectively or if there is less “protection for your technologies then competitors can quickly enter the market and weaken the positions held by the existing industry players” (Nag, Hambrick, & Chen, 2007, p. 56). The threat of new entry is always present in the Video gaming industry. Nintendo had been a market leader for a long time since the 1980’s but its fortunes declined with the entry of Sony’s playStation. Therefore the threat of new entry is significant as long as newer technologies are still being developed. However the top three companies have now held tightly on the industry and this may pose a considerable challenge to new entrants.

Industry profile and attractiveness

The video gaming industry is a rapidly developing industry that is controlled by a number of factors. The industry is mostly affected by the technological changes which shape the needs of the consumers. The industry is also broadening its market by incorporating products for a variety of users such as seasoned gamers, casual gamers and older gamers.

The industry is also affected by the various forces within and outside the industry but the strongest forces are competitive and consumer powers. The industry is fiercely controlled by three dominant players (Sony, Nintendo and Microsoft) and this might be discouraging to new entrants. The video gaming industry can be described as being moderately attractive.

Company Situation

Nintendo had a successful year in 2008 with both the Nintendo DS handled game systems and the Wii, selling in record volumes (Gamble & Thompson, 2010). The company sold more than 31 million handheld game systems and nearly 26 million Wii consoles during that year (Nag, Hambrick, & Chen, 2007).

However, things started going wrong during the quarter ending June, 30, 2009. The Sales of the Nintendo Wii systems fell from 5.17 million units during the quarter ending June 30 2008 to 2.23 million during the quarter ending June 30, 2009 (Moncrief, 2004). There was also a corresponding fall in the sales of the Nintendo’s handheld game systems which came to roughly 14%. Following this development’s the company’s management was forced to analyze the situation in view of coming up with workable solutions.

A careful observation revealed a 40% year-over-year decline in quarterly revenues and a 61% year-over-year decline in quarterly profits (Nag, Hambrick, & Chen, 2007). The management had attributed the decline in quarterly revenues to the global financial crisis that had affected many developed countries. Part of the blame went to the company’s inability to launch new blockbuster games that would match Sony’s Playstation3 and Microsoft’s Xbox 360.

Industry analysts believed that recession had prompted consumers to cut spending on non-essential commodities such as video games. This was however not going to stop the company’s ambition to expand its customer base and defend the existing market from other rivals (Mulcaster, 2009).

Both Sony and Microsoft had announced their process in creating broader variety of was through users were going to interact with games on their respective systems and also to pursue the casual game market (Gamble & Thompson, 2010). Analysis carried out on the Wii console revealed no apparent weakness, it however concluded on a possible designer and user limitations. Nintendo was to go ahead with the production of innovative consoles such as the Wii Fit to boost the companies already expanded influence and presence in video gaming.

Financial analysis

The data provided indicates that Nintendo’s revenues declined slightly (by 1.18%) in one year period starting March 31, 2005 to March 31, 2006. However, the company’s revenues nearly doubled in the following year. The company registered a 98.3% growth in its total revenues between March 31, 2006 and March 31, 2007 (Gamble & Thompson, 2010).

This growth can be attributed to the successful launch of the Wii video console that sold all the units produced by the company in that year. The growth can also be partly attributed to increased sales in the Nintendo Dual Screen (DS) which had been introduced in 2004 to assist in combating the competition in handheld devices. Between March 31, 2007 and March 31, 2008 the company registered a 70.9 growth in the total revenue figures.

This growth shows the continued success of the Wii console segment and the industries defiance of the global recession. However, the growth momentum in total revenues was slowed between March 31, 2008 and March 31, 2009. The company registered a 20% growth during that period (Gamble & Thompson, 2010). This shows that the increasing oil prices and the global recession had begun to affect the video gaming industry.

Nintendo has managed to keep its liabilities down through cost effective mechanisms that reduces the company’s expenditure. For instance, in 2009, the company had its total assets at approximately $19 Billion while the total liabilities were at $5.6 billion. The company has maintained this trend through innovative strategies that keep the cost of production down while at the same time providing products that appeal to the consumers.

The above chart shows a steady growth in the profitability indices. The company has progressively increased its annual sales since 2005 due to successful strategies. The chart shows that the Net profit, operating profit and gross profit have all been on an upward trend. However, it can be seen that the momentum was slowed in 2009. This can be attributed to the rising fuel costs and the global financial crisis.

The above chart shows the cash and quick ratios of Nintendo. In 2008 the company was almost twice likely to pay its liabilities with the available cash but this diminished in 2009. This shows diminishing liquidation ability of the company. However, the company is still able to pay its current liabilities without having to sell any inventory. The diminished figure in 2009 can also be attributed to the economic change caused by financial crisis and increased fuel prices.

SWOT Analysis

Strengths

Nintendo has various strengths that enable it to command a considerable market share in video gaming industry. First, the company has been in the industry for a long time. Secondly, the Nintendo’s video game devices and games are innovative and simple to use and are therefore attractive to the targeted market (Gamble & Thompson, 2010).

Thirdly, the company has a variety of video gaming products that are tailored to the gaming needs of people from diverse backgrounds and age groups. Most of the video gaming products are affordable and thus can be purchased by people from different economic classes and this has enabled the company to make huge profits even in times of financial hardships.

The company has an innovative team that has build devices that are able to turn tables in the market and so it should prioritize on innovating distinct products that will enhance the gaming experience.

Weakness

Nintendo’s major weakness is the overreliance on third party providers. The third party companies account for approximately 90% of Nintendo’s video game releases. The company sometimes finds itself in conflict with these third party providers. For instance, between 1996 and 2005 the company had an issue with these third party providers for limiting the release of certain types of games. The company was trying to cab video game related violence. Many of these issues have since been sorted out but their potentiality remains a big weakness to the company.

The company has had some setbacks in the past, for instance the failure of the GameCube and Nintendo 64 (Gamble & Thompson, 2010). The company has therefore tended to tread carefully but this affected it when it released the Nintendo Wii’s. The Wii’s was a success but the company had produced very few units that it failed to satisfy the demand.

The company has had successes with the DS and the Wii but it has concentrated on video gaming consoles that appeal only to the younger gamers segment of the market.

Nintendo’s uses a pricing strategy to cut niche in the market place but this strategy limits its opportunities to make more money. In as much as this makes its video games affordable, it also accounts for some limitations in revenue generation. For instance, the Nintendo’s Wii had a starting price of $250, and the Sony Playstation 3 that was released in the same month had a starting price of $599 (Gamble & Thompson, 2010).

Nintendo did sell more Wii devices than Sony’s Playstation 3 but there were some complaints in regard to Wii’s graphics (Liebeskind, 2003). The pricing strategy ensured that Nintendo cuts on production costs on Wii so as not to hurt profits. The Wii was installed with 64MB DDR3 graphics card which was way to low compared to the Sony Playstation 3’s 256 MB DDR3 (Nag, Hambrick, & Chen, 2007).

Opportunities

Nintendo has been in the market for long and has built a considerable loyal customer base. With its lower price, Nintendo has an opportunity to sell more units compared to other players in the industry such as Sony and Microsoft. This can be confirmed with the success that came with the company’s Wii video gaming console.

There is also an increased interest in video gaming from individuals of different age groups. This implies that the market is set to grow. Thus Nintendo has an opportunity to build on its past success to ensure that it gets a good share of the growing market. The Wii’s pioneering video game controller capabilities worked in favor of Nintendo as the company sold more Wii units than Sony’s PS3 and the Microsoft’s Xbox 360 (Mulcaster, 2009).

The company has an opportunity to penetrate the casual video gamers segment with it’s simple but innovative technologies.

Threats

A major threat to Nintendo comes from within the industry and notable from the other two major players, Sony and Microsoft. It’s important to note that Wii’s success was mainly due to the innovative game control mechanism strategy and the low price tag.

The strategy was much of a gamble as many industry analysts had predicted doom for the Nintendo’s Wii. That innovation has already been copied by the two major competitors. This puts the company in a tight spot because it has to come up with another innovation to boost the sales of its next device in the console segment.

The video gaming industry was not badly affected by the 2007-2008 recession period. However, some ripple effects have been observed in the year 2009 (Moncrief, 2004). The world economy has remained unbalanced due to several contributing factors such as rising oil prices. Many would be customers are experiencing difficulties in meeting their basic needs and therefore they are likely to stay away from leisure activities such as video gaming.

The rising cost of fuel means that it will be more expensive to transport video games devices to the retail outlets across the globe.

Already the company has registered a decline in sales volumes that can be linked to recession, increased fuel costs and the competitors (Mulcaster, 2009).

Recommendations

Strategic Issue

The video gaming industry is dominated by Sony, Microsoft and Nintendo. The three firms are fiercely competing to outdo each other in the Video gaming industry. Their strategies mainly revolve around innovation, pricing and adoption of the latest technologies. Nintendo has been the market leader for a long time but was outdone with the entry of Sony’s Playstation which produced more advanced gaming consoles and thus extending the gaming age bracket.

Since the entry of Sony, the companies have relied much on new technology to build their customer numbers. For Example, Sony’s progression from Playstation to Playststion 2 and then Playstation 3, and Microsoft’s progression from the initial Xbox console to the Xbox 360 (Gamble & Thompson, 2010).

This can be seen with the generational progression of the gaming devices produced by the three major firms. This strategy has proven to be too costly to the point the firms make losses on the consoles segment hoping to recoup the lost revenues from software sales.

Seemingly fed up with the technology race Nintendo’s management devised a newer strategy that would ensure that their gaming consoles appeal more to casual gamers and people who had not played before. The company wanted to stop concentrating on hardcore gamers which were the main target of its rivals. Thus, the latest of its gaming consoles, the Wii had no significant improvement or did not much other same generation gaming consoles from the two main rivals (Gamble & Thompson, 2010).

The Wii console was expected to be less intimidating and thus appeal to a wider market. The strategy thus focused on an innovative and distinctively different controller that would change the gaming experience. The strategy did pay off as the company sold more Wii units than Sony’s PS3 and Microsoft’s Xbox 360 consoles.

The Wii’s produced in 2006 and 2007 were completely sold off and the cumulative sales by 2009 were much higher compared to the other two major firms in the video gaming industry. However, the overall company sales begun to fall in the first quarter of 2009 (Mulcaster, 2009).

The decline was in both handheld devices such as the Nintendo DS and also in the console segment. Analysts attributed the fall to decreased spending by households due to the ripple effects of global recession and rising fuel prices. The recession and rising fuel costs adversely affected the US and other developed nations that were the main markets for the video gaming devices. Nintendo however decided to proceed on with its innovative strategies to consolidate its presence in the market.

Strategic Recommendations

Based on the findings of this analysis Nintendo’s current situation can be blamed on external factors such as the financial recession and increasing oil prices. The two have led to decreased spending by households, especially on non essential products and services. This is the main reason for the falling sales volumes in the second quarter of 2009. Another reason could be that the market is already saturated with the gaming devices that were successful (Moncrief, 2004).

Grand and generic strategies

The company should adopt the following grand strategies: market development and product development. In market development the company should add more channels to distribute its video consoles and software (Mulcaster, 2009). It should also increase advertisement activities for its products to ensure that most of the potential buyers are informed.

Increased advertisement will ensure that awareness is created and strengthened in the target market. Advertisements can also change or increase the targets perception on Nintendo’s video gaming devices (Gamble & Thompson, 2010). Increased target perceptions could see the company bouncing back to its growth momentum. Advertisements for Nintendo products can be carried out in Movie theaters, on the web, print media and television (Nag, Hambrick, & Chen, 2007).

The company already has some promotional activities whereby it offers a free game with every purchase of a certain kind of a device (Nag, Hambrick, & Chen, 2007). For instance, the company offers a free game with every Wii unit purchased.

In product development, the company should create new innovative video gaming hardware and software that appeal to the targeted market segment.

For its generic strategy Nintendo should forge ahead with the cost leadership strategy (Gamble & Thompson, 2010). The company already has the lowest prices in the targeted market segment and should move on with this to ensure that it gains a larger share of the market (Moncrief, 2004). The strategy can be enhanced by spreading the fixed costs on a variety of units to lower the cost of production (Moncrief, 2004).

In order to effectively determine whether the strategies are paying of the company can use the traditional sales approach or offer rebates with free games and thus determine the number of people redeeming them (Mulcaster, 2009).

Objective

The company has had success with innovative devices that bring a whole new experience in the video gaming world. The company is currently being faced with declining sales, a situation that can be blamed on the global recession, soaring fuel prices and change of tactic by the main rivals.

The objective of these recommendations is to identify ways through which the negative effects can be reversed. The strategic recommendations will therefore aim at increasing revenues cost cutting activities and expanding the market share through the continued production of innovative video gaming devices and software.

The company can expand its market share through the production of video consoles and software that are tailor-made for the different market segments such as the young, the older, hardcore gamers and casual gamers. Marketing activities can also be used to boost the sales. Such marketing activities may include: advertisements on TV, the Web; and promotional activities such as free games.

Strategy Justification

Nintendo has regained a fairly large segment of the video gaming market that it had lost to Sony and Microsoft. However, strategies need to be in place to ensure that the growth is not stalled or concentrated on a certain segment of the market. The traditional video gaming systems that were produced by Nintendo were targeted at the younger market (5- 22) (Mulcaster, 2009).

The Nintendo Wii showed the first signs of the company’s attempt to expand into other age brackets. The company should continue to focus on the production of more innovative gaming consoles and software that will effectively attract gamers from other age groups.

While trying to build trying to expand the market the company should also develop strategies to ensure that they do not lose the younger segment of the market. Thus there should be games and gaming consoles that are specifically dedicated to the younger age group.

The Wii was a success due to its redesigned and unique controllers that seem to naturalize the gaming experience (Gamble & Thompson, 2010). The addition of motion sensitivity sensors and ports to facilitate more add-ons was a winning strategy for Nintendo (Gamble & Thompson, 2010).

The company should however ensure that the quality of their products is not compromised. For instance, the poor graphics and lack of a standard DVD rom on the Wii cost significant jitters from the industry analysts. This implies that a significant number of consumers who preferred better displays were left out. The company should therefore come up with ways of ensuring that up to date technologies are adopted without inflating the costs.

With the advent of the ripple effects linked to the global financial crisis and the increase in fuel prices the company should implement the most cost effective mechanisms to tame spending. However, the company is better off compared to other players in the market as it had embarked on cost cutting strategies long before the financial crisis.

The available data shows that Nintendo’s total revenues grew at a slowed momentum during the first and second quarters of 2009. Threats posed by the ripple effects due the global financial crisis and the rising fuel prices are particularly hard deal with as they are beyond the industry’s control. However, other strategies such as increased marketing activities and reduced capacity can actually have both a short and long term effects.

Summary

Nintendo had dominated the video gaming industry from its inception until Sony came on board with its Playstation (Gamble & Thompson, 2010). The wildly popular playstation ensured market dominance by Sony and dwindling fortunes for Nintendo. With time Nintendo adapted to the rules of competition through implementation of new technologies and unique innovations.

The company’s Nintendo DS, DS lite and the Wii are examples of success through innovative, cost effective strategies and wise adoption of newer technologies. The Wii in particular sold many units that ensured maximum profits for Nintendo. It outpaced Microsoft’s Xbox 360 and Sony PS3 in spite of their greater capabilities (Gamble & Thompson, 2010).

The company registered growth in sales during the years 2006, 2007, 2008 and the first quarter of 2009. The drop in sales growth during the second quarter of 2009 was most likely due to recession and increased fuel prices.

The SWOT analysis has shown that the company has what it takes to bounce back and will only need to cut on expenditure, continue producing innovative video gaming consoles and software, and enhance its marketing activities.

References

Gamble, J., & Thompson, A. (2010). Essentials of Strategic Management. Alabama: University of Alabama.

Liebeskind, J. (2003). Knowledge Strategy and the theory of the firm. Strategic Management Journal , 17: 345-356.

Moncrief, J. (2004). Is strategy making a difference. Long Range Planning reveiw , 32 (2): 273- 276.

Mulcaster, W. (2009). Three Strategic Frameworks. Business Strategy Series , 10(1): 68-78.

Nag, R., Hambrick, D., & Chen, M. (2007). What is strategic management, really? Inductive derivation of the Consensus definition field. Strategic Management Journal , 28(9): 935- 955.

Appendix

Figure 1: Market share for seventh generation consoles

Figure3: SWOT Analysis