Introduction

Home Depot Inc. is the leading home improvement retailer in the United States. In its expansion strategy, the management decided to explore the Chinese market. According to Mahbubani, China offers an attractive growth opportunity for numerous American companies because of its large population, cheap labor, and the growing size of the middle class (78).

Home Depot Inc. decided to take advantage of the opportunities in this country. However, the case study shows that the firm has been facing various challenges since it opened its branches in China in 2006. The company has tried to employ various strategies to deal with these problems but it is apparent that it cannot use strategies that are successful in the United States in this new market. In this paper, the focus is to analyze the do-it-for-me culture in China and determine alternative strategies that Home Depot Inc. can use to achieve success in the market.

Defining the Issue

When Home Depot Inc. made an entry into China, the focus was to use the same successful model that it had used in the United States to deliver its products to customers. It made available a wide range of home construction and improvement products. The company had learned that in the United States, there was a strong do-it- yourself ethos where customers would purchase these products and install them (Burkitt 2).

The high cost of labor in the home market promoted a culture where most of the middle class members of the society tried to install these home improvement products on their own, unless it was necessary to have an expert to do the job. When the firm came to China, it made the assumption that Chinese also value the do-it-yourself attitude. However, it soon emerged that the country embraces the complete opposite belief. In China, the majority of the population leans towards do-it-for-me culture.

Chinese prefer having professionals to be responsible for fitting the home improvement products, primarily because of the cheap cost of labor (Chevalier and Gutsatz 35). The consumer culture in China is also significantly different from that in the United States. Although the country has the second-largest economy in the world, the purchasing power of individual consumers is relatively low compared with that in the United States and other developed economies. The management of Home Depot Inc. has been struggling to operate in the country, but it is apparent that it has been difficult redefining its model of operation. As a result, the company has been forced to close a number of its stores, which has led to loss in revenue and payment of numerous charges in line with local laws and regulations.

Analyzing the Case Data

In the year 2006, Home Depot Inc. made an entry into the Chinese market by acquiring 12 stores across the country. The management was keen on increasing this number significantly, as it was keen on registering rapid growth. Unfortunately, this has not been the case as shown in the recent financial reports (Mahbubani 45). Six years after the entry, the company was forced to close seven of its 12 stores.

The closure will affect 850 associates that have been working for the organization. The decision, though unavoidable and economically advisable based on the financial analysis of the firm’s operations, has consequences. Home Depot Inc. will have to take a $ 160 million after-tax charge (Burkitt 3). The move will directly affect the income of the entity, which will in turn affect the company’s share prices in the capital market. The management has made a decision to retain 170 staff to work in its specialty stores in the cities of Shenzhen and Shanghai as it tries to restructure its business model in the country.

SWOT Analysis

The management of Home Depot Inc. is keen on redefining its operations in China to help it achieve growth and profitability in this foreign market. The case study demonstrates that ethos in the Chinese community is significantly different from that in the United States. As such, it is not possible for this firm to retain its traditional business model and still achieve success in this market. Using SWOT analysis, the management of this company can understand steps that it can take to achieve the desired success in the market.

The main strength of this organization is its strongbrand. Home Depot massive popularity in the United States and abroad. It can use its favorable image to attract customers in this competitive market. The company also has a significant financial muscle that can enable it to conduct further research in China to understand the most effective approach of delivering its products to customers. Its team of highly skilled workers can help it redefine the current business model so that it develops one that is in line with the local forces in the country.

It is important to admit that Home Depot Inc. has some fundamental weaknesses that may significantly affect its operations in the foreign country. The case study shows that one of the major issues of this business entity is its inability to study and understand the environment in a new country. When making their entry into the Chinese market, it used the business model that had been successful in the United States without taking into consideration the local culture (Burkitt 1). This shortcomig has been the major reason why it is still struggling in the market. Another major weakness is the management’s unwillingness to engage locals in its research when it first made an entry into China.

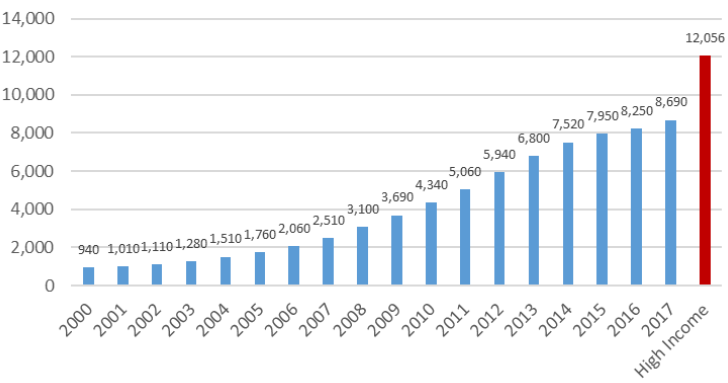

China presents opportunities that the management of Home Depot Inc. should capitalize on as it seeks to remain operational in the country. As shown in figure 1 below, China’s per capita gross national income has been consistently rising over the last 20 years. In 2000, the per capita in China was $ 940. By 2017, that figure had increased almost tenfold, to 8,690. The growing purchasing power of people in China offers an opportunity for companies to improve their sales.

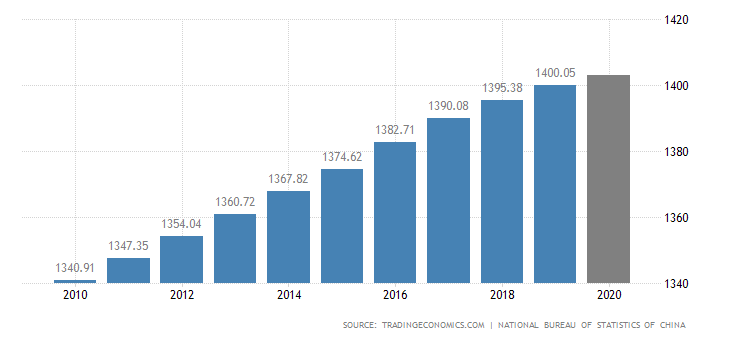

The population of the country has also been on the rise within the same period. As shown in figure 2 below, from 2010 to 2020, the Chinese population has increased from 1.34 billion to about 1.40 billion people. The number of those in the middle class has also been on the rise consistently. The growth offers this firm an opportunity to expand its market share. Cheap but adequately trained labor in China has attracted numerous American companies for the last decade. The management of Home Depot Inc. should take advantage of this opportunity to promote its growth in the market.

The study shows that the market presents some threats that may affect the effective growth of Home Depot Inc. The concept of ‘buy local build local’ is strong in China (Marchand 58). As such, the company may find itself in a situation where its potential clients prefer purchasing products from rival local firms. The rivalry in this industry is also getting stiff as local and international companies emerge in the market with similar products. The stiff competitionhas created an environment where customers are highly demanding because they know they have several alternatives whenever they want to purchase a specific product.

Generating Alternatives

The management of Home Depot Inc. must understand that its capacity to succeed in this Chinese market depends on the ability to identify and embrace an effective business model that is in line with the local culture. The firm cannot afford to continue spending more resources in a country that is not profitable. Through effective research, it should generate various alternatives that can be helpful in promoting sales. It should ensure that it upholds operational strategies capable of meeting expectations of its customers in the market. The following are the possible alternatives that the management can consider.

- To partner with a major local firm that is operating successfully in the market.

- To focus on specialty stores where it can offer unique products to customers in a unique way.

- To sell all its outlets in the Chinese market and exit, just as other major American firms Mattel Inc did.

Selecting Decision Criteria

The management of Home Depot Inc. is keen on remaining operational in China, but that depends on its ability to achieve sustainable growth and profitability. As such, all three alternatives are possible as the firm takes steps to address issues that it faces in the market. It has to make the right decision that will protect it from incurring further losses while at the same time assuring it of growth. The selection criteria should be based on the firm’s financial capacity, the size of its workforce, its understanding of the market, and external factors such as government policies, socio-economic and political forces, and competitiveness in China. The alternative should address both long term and short term goals of the company.

Analyzing and Evaluating Alternatives

Home Depot Inc. believed that China offers an attractive growth opportunity that can enable it to achieve growth in its global expansion. However, the study shows that the management did not conduct a thorough analysis of the market, a mistake that has proven costly for the firm. The three alternatives may offer this business entity a success opportunity in this country. It is necessary to discuss each option.

Partnering with a Local Company

One of the strategies that Home Depot Inc. can embrace as it seeks to redefine its business model in China is to partner with one of the most successful local rivals in this industry. As Wang observes, many Chinese companies are often willing to partner with American firms as a way of exploring the American market (57). Home Depot can select a company that understands the local culture and has a perfect business model that is in line with ethos of this community. This alternative would cushion the American organization against the buy-China build-China culture. It will not be viewed as a foreign firm that is only keen on taking away profits from the country. The move may also protect the company from any negative political interference in a country where the political class wields immense power. However, the entity has to be ready to share its profits with the partner both in China and other markets where they will make joint ventures.

Focusing on Specialty Stores

The second alternative is for the company to close all the general stores and only retain specialty stores. In this case, the firm will identify its popular products in this market and only focus on them. It will need to find a way of offering these specific products in the most effective way possible. It may be forced to have these products in rapidly developing urban centers in China such as Shenzhen where there is a huge demand. As Marchand observes, it will be essential for the marketing director to conduct regular and extensive research to enable it to develop an effective business model that meets locals’ needs (88). The biggest disadvantage of this strategy is that it involves spending much on research. The strategy may also fail to protect the firm against a culture where the Chinese prefer buying products from local companies. However, when successful, the alternative will grant it the freedom to define its mode of operations and to enjoy its profits.

Exiting the Chinese Market

The third alternative is for Home Depot Inc. to exit the China, just as many other firms have done in the past. Tesco PLC and Wal-Mart are some of the largest retailers in the global market. However, they have both struggled in this country and have reduced their number of stores significantly, which means that they can easily consider exiting the market. Mattel Inc realized that its operations in China were no longer profitable, and as such, it made an exit (Burkitt 3). Home Depot can also make the same decision and close all its Chinese branches and sell its assets. This should be the last alternative when the management is sure that it cannot use any other strategy in the country to ensure that its operations are successful.

Selecting the Preferred Alternative

The management of Home Depot Inc. will need to select the most appropriate alternative that will ensure that its operations in the country are sustainable. It is important to note that each of the three alternatives may be effective depending on external forces that the company faces in China. The criteria for selecting the most appropriate alternative have been discussed above. Of the three alternatives, the management should consider partnering with local companies in China to achieve growth. Wal-Mart has been successful in most of the foreign markets that it has explored. It expected to realize the same level of success in China, but it has failed. The same is the case with Tesco PLC, which is still struggling to achieve success.

Home Depot Inc. should consider a new approach that these other giant retailers had ignored, which is a partnership with a local company. The strategy will involve this American entity providing relevant resources while the local firm using its knowledge of local forces to take advantage of the huge market in China. It will make its products more acceptable. Although the two partners will have to share profits based on predetermined terms, this alternative also reduces each company’s expenses on regular extensive and intensive research. This alternative was chosen because it will help to reduce the level of competition in the market.

Developing an Action/Implementation Plan

Home Depot Inc. can achieve great success in China if it adopts appropriate strategies of operation in line with local forces. The study proposes that the appropriate approach is to partner with a Chinese firm in the same industry to avoid numerous challenges that many other foreign companies, especially those from western countries, have faced. The following are the steps that should be taken to implement the plan

Evaluate various potential partners for a joint venture

The first step is to assess various potential local partners in the industry that Home Depot Inc. can work with effectively in the country. These entities should be successful organizations with similar goals in the market and willing to work with this American company.

Select the preferred partner

Once a pool of potential companies is identified, the next step is to identify one that meets the expectation of this American entity. The selected firm should have a strong presence in China, especially in major cities considered most attractive markets. The partner should have a strong brand that is known in the country. It should also be willing to work with Home Depot Inc. under fair terms.

Prepare a local strategy for exploring the market

The management of the two companies should then work as a unit to prepare a local strategy for exploring the market. Home Depot Inc. will bring its experience in international operations while the partner will share its knowledge of local forces. The two companies will then develop a local policy that can help them achieve rapid growth despite the stiff competition.

Train staff

When the strategy has been defined, the next step in the implementation plan is to train staff on what is expected of them in their respective workplaces. They have to understand how to respond to needs of customers in the market in the most effective way possible.

Evaluate performance

The management of the two entities should conduct regular evaluations of their performance. The primary goal is to identify areas of weaknesses and make necessary adjustments to achieve the intended goals.

Financial resources needed and timeline

The plan should cost this company $ 1,560,000 that will be spent on training of employees, opening a few additional stores, and promoting the new brand after the agreement. Evaluation should be conducted every six months and the partnership should last as long as financially viable.

Summary and Conclusion

Home Depot Inc. is currently the dominant retailer of home improvement products in the United States. However, its decision to make an entry into the Chinese market has not been as successful as the management had expected. The management will need to redefine its operations, especially its business model, in the country to achieve a sustainable growth. The study suggests that this American firm should form a partnership with a local Chinese company to overcome numerous challenges discussed in the case study.

Works Cited

Burkitt, Laurie. Home Depot Learns Chinese Prefer ‘Do-It-for-Me.” The Wall Street Journal, vol. 9, no. 30, 2012, pp. 1-3.

Chevalier, Michel, and Gutsatz Michel. Luxury Retail Management: Developing Customer Experience in a Digital World. John Wiley & Sons, 2019. Web.

Congressional Research Service. China’s Economic Rise: History, Trends, Challenges, and Implications for the United States. Members and Committees of Congress, 2019.

Marchand, Suzanne. Porcelain: A History from the Heart of Europe. Princeton University Press, 2020. Web.

Mahbubani, Kishore. HasChina Won: The Chinese Challenge to American Primacy. Public Affairs, 2020. Web.

Wang, Ming-Feng. Cultural Realism and Virtualism Design Model. Springer, 2020. Web.