Executive Summary

The credit crisis, which has been in existence since the year 2007, has seen many companies incur big losses in their investments as well as money lent out to borrowers. Many companies folded under this weight with some being taken over by others as a way of rescuing them. Governments of America and Europe stepped in to save some of the big companies whose fall would have paralyzed the economy by bailing them out with cash and other incentives. Many have viewed the construction and the finance industry as the sources of these problems. Thus, they were the hardest hit. Therefore, many of them had to restructure and change their modes of operation. One of the major players in this industry was the Wolseley Company, which too had to take drastic measures to ensure its survival. Wolseley employed a raft of measures that saw it come out of the period battered but alive. It had to put in place harsh measures that would see it retrench staff in a cut out of some businesses. This situation enabled it to survive to see the day.

The Credit Crisis of 2007-2012

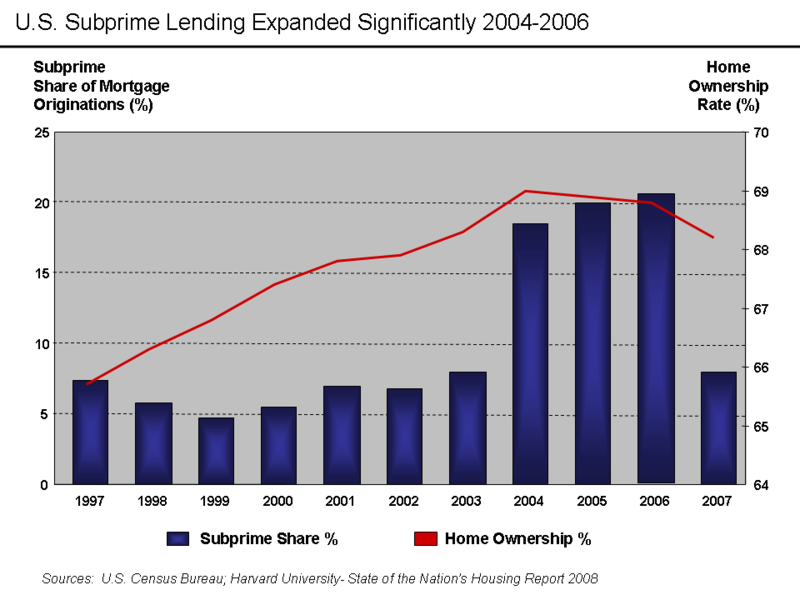

The credit crisis is a situation whereby various financial institutions in different regions across the globe issue high-risk loans to their clients and at the same time sell the same to investors who put in their money expecting the money to earn them interest. The problem occurs when the borrowers of this money start to default in the payment of the loans leading to massive losses to the financial institutions that gave out the money further leading to devaluation of shares of investors in the different institutions that had borrowed money from investors. This slump in share prices leads to massive losses in terms of investment capital and due to the volumes of money involved. It further leads to economic meltdowns that have negative effects on the economies of the countries involved (Strahan 2012, p.79). The most recent and biggest economic crisis happened between the year 2007 and the year 2008 when most borrowers of money from banks could not repay their loans either on time or at all due to various reasons. Some of the reasons included banks giving out too many credit facilities due to the availability of cash to lend out, financial institutions selling loans to borrowers without finding out their backgrounds, or the stability of their income. They also included overbuilding of houses due to a housing boom that led to the decline of house prices, which left many people paying much more money for the value of their houses thus leading to defaults and foreclosures. This condition led to recession in the different parts of the world due to cross-investing by international investors who provided the money and hence an economic meltdown in most countries. In the United States of America, 69% of the people owned houses due to the availability of loans to buy them (Nick 2006, p.56). Therefore, the industry made a forecast showing that the demand for housing will be on the rise for a long period thus encouraging inventors to invest in the housing sector and with the help of the government. The government came up with a policy that made borrowing easy. This case led to an over-evaluation of subprime loans, which led to borrowers paying much more than the value they were supposed to pay. An increase in mortgage fraud also led to massive losses with the banks trying as much as possible to make profits from their huge losses. The financial crisis led to further negative effects on the economy, which included an increase in world food prices, oil prices around the globe, and losses of jobs in many sectors of the economy especially the financial sector. All these factors led to recession with companies in most countries struggling to survive amid the credit crunch. It has taken time for most companies to come out of this financial hole. Thus, financial institutions have come up with stringent borrowing measures that will reduce losses.

Wolseley Business Activities and Geographical Sectors

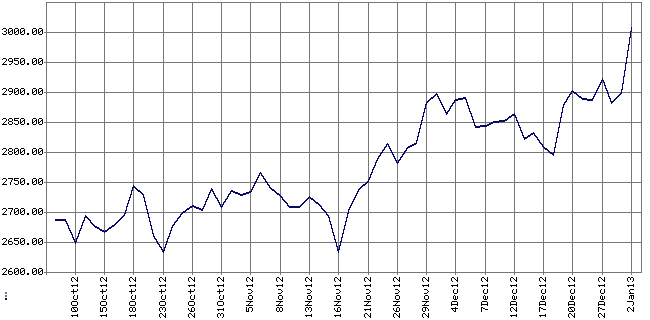

Wolseley is a company in the housing construction industry that has interests in six geographical regions of the world to which it is a major supplier of construction materials and the world-leading distributor of plumbing and heating products. Wolseley’s six geographical regions are the United States of America, the United Kingdom, Canada, France, and the Nordic regions. Wolseley has cut a niche for itself in the industry in which it operates. Its brands are some of the leading in the market. Wolseley serves over 100000 vendors in the regions in which it supplies its goods, which translate to a clientele base of about 1000000 who buy the good annually in different volumes. Wolseley has average group revenue of about 12.716 billion pounds and a trading profit of about a 658million pounds. It has a gross profit of about a 3.9billion pounds. Wolseley stands out in the market due to its ability to come out as a leading player in a market that is so fragmented with so many players (Doyle 2012, p. 36). Its regions have many contributions towards its revenues. The USA has a revenue base of about 6.168 billion pounds. Canada contributes about an 850million pounds to the total revenue. The United Kingdom contributes 1670million pounds while the Nordics region contributes 2.062 billion pounds. In addition, central Europe contributes 714 million pounds while France contributes about 1.252 billion pounds to the total revenue of the company. Wolseley is also a big employer in the countries it operates in with an average of about 5000 employees in each country, therefore, making it a big player in the economies of the countries. The credit crunch that started in the year 2008 had a negative effect on Wolseley with regard to its operations as well as profit margins in the market especially the United States of America market, which is its largest as well as one that was most affected by the credit crunch. The United States of America, which is its biggest revenue base at 40% of its total market share, saw a pre-tax profit slump from 258million pounds to 79million pounds in the year 2008 over a six months period. It pushed the company towards cutting its global workforce by 10000 people blaming it on a slump in its earnings. The credit crunch led to its operating profits of 2008 slump by 58% to 146million pounds, which was attributed to the slump in performance of the stock exchange, which was the driving factor in the supply of new residential housing market (Jonas 2010, p. 35). At some point in 2008, Wolseley’s shares fell by 49p to 483.5p. By the year 2009, Wolseley had cut its workforce from about 80000 by 30000 as a cost-cutting measure to enable it to balance its books. The credit crunch forced it to sell its non-core businesses and scaled back its international operations.

Wolseley Debt to Equity Swap over Five-Year Period (2008-2012)

Wolseley had to take measures to contain the situation caused by the financial crunch to remain in operation. Some of the solutions employed involved maximization of cash flow, cutting costs as much as possible, as well as an increase in its market share. Part of its cost-cutting measure included cutting its capital expenditure by 50million pounds in six months in the year 2008, which was the time when the credit crunch hit the economy hardest. This condition enabled it to commit more money towards its credit obligations without adversely affecting its general performance in its strong markets. The changes in the ratio of debt into equity is a process whereby a company offers some of its shares to its creditors in certain agreed terms as a way of meeting its credit obligations in a bid to relieve itself of the credit burden. Debt to equity conversion is a move that enables the company to maintain its liquidity equilibrium when it does not have enough money to pay its debts (Dooley 2008, p. 49). It is also used to save the company’s money to take care of other financial obligations in the case where the company will be strained if it had to pay its debts. By offering the debtors some of the shares, the company is able to continue operating with the cash it has at hand. Only the dividends will be affected as well as the new shareholding structures (Stulz 2010, p. 127). The company has a share plan that it uses in its quest to reduce debts through equity plans. The company encourages its shareholders to convert their dividends into shares as a way for the shareholders to increase their shareholding in the company. This strategy helps the shareholders to increase their investment in the company without the need to fork out more cash. At the same time, it helps the company to save on cash that it would have paid the shareholders in terms of equity. This step enables the company to have more cash floatation for meeting other obligations of its operation (Horn 2012, p. 28: Smith 2009, p. 4). The company was able to raise 1billion pounds in the year 2008 through its rights issue. This move enabled it to stabilize its financial base using the money and increasing its shareholders as a way of showing the world that the people still had confidence in it. The company’s share plan involving its executive was also used to convert the bonuses the company owed the executives into shares as a way of preserving its cash because the top management of the company receives a considerable amount of money in terms of bonuses. Thus, when the money is converted into equity, it saves the company so much. Employees too are entitled to bonuses. Therefore, they would be offered shares in exchange for the bonus thus increasing their shareholding in the firm instead of taking cash.

Wolseley Debt Reduction Strategy

Wolseley employed different strategies in its quest to reduce its debt structure. It sold off some of its stores as a way of saving money that would be used to run the stores for putting the money. In 2010, Wolseley replaced 2.8billion in borrowing facilities with a revolving credit facility. This credit facility totaling to 822million expires in 2016. This enabled Wolseley to cut the available credit facilities thus allowing it to reduce some of the obligations it had (Barrow 2009, p.282). It also allowed the company to stretch the credit facility items it had to a longer period by which the economy will have recovered. The change in the debt regimes allows the company to reorganize itself financially. Wolseley put in measures to cut its IT expenditures over a four-year period from a range of between 100million pounds to 150million pounds, and further from 75mliion pounds to 100million pounds. This strategy would enable it to cut some debts emanating from this section in a bid to save its money to run other sectors. Wolseley started on a program of closing down some of its stores that it felt were not performing well. It closed more than 147 stores in the different countries it was operating in out of the more than 4000 stores it had. Wolseley embarked on a campaign to reduce operating costs, which saw it lay off up to 30000 employees in the different stores. This move enabled the company to save wages by reducing the number of employees and freezing employment. It also saw the company save the money it would be obligated to pay to the employees’ pension fund. All these measures were being put in place to save the company’s money that it could commit to its credit obligations, which were being affected by the credit crunch. Wolseley reduced its construction loans receivables as a way of controlling the money going out into the turbulent industry. This claim is due to the uncertainties that had been brought about by the construction industry to avoid situations where debtors would default and jeopardize the financial stability of the company. The management decided to put a hold on this step altogether (Cris 2009, p. 13). Overall, Wolseley public limited company was able to survive the financial crisis though it battered against all odds that saw many companies fold.

References

Barrow, J 1999, ‘Notes on Optimal Debt Management’, Journal of applied Economics, vol. 2 no. 2, pp. 281-289.

Cris, S 2009, ‘Construction Industry’, Construction Europe, vol. 20 no. 8, pp. 13-14.

Dooley, P 2008, ‘Debt Management in Crisis’, Journal of Development Economics, vol. 63 no. 1, pp.45-58.

Doyle, C 2012, ‘Debt Management under Corporate and Personal Taxation’, The Journal of Finance, vol. 42 no. 5, pp. 34-39.

Horn, J 2012, ‘Debt Management and the Form of Business Financing’, Journal of Finance, vol. 29 no. 2, pp. 23-28.

Jonas, C 2010, Cautious Optimism at Wolseley, Investors Chronicle, vol. 1 no. 1, p. 35.

Nick, S 2006, ‘Activities Related to Real Estate’, Economic Affairs, vol. 26 no. 4, pp. 53-60.

Smith, H 2009, ‘Corporate Debt’, Fund Strategy, vol. 2 no. 1, p. 3-5.

Strahan, P 2012, ‘Liquidity Risk and Credit in the Financial Crisis’, Journal of Financial Economics, vol. 101 no. 2, pp. 78-81.

Stulz, M 2010, ‘Credit Default Swaps and the Credit Crisis’, Journal of Economic Perspectives, vol. 24 no. 1, pp. 126-128.