Introduction

This is also known as profit and loss account, an income statement is a financial document which shows the conclusive summary of an organizations revenues (what the entity earned from sales of products and services ) and expenses (what was deducted to earn this revenue ) to earn this revenue for a specific accounting period that the business operated. This can be in a year, quarterly i.e. in 3 month periods, monthly or maybe in weeks but , not less than four weeks.The figures which are normally indicated on the income statement from revenues and expenses are usually obtained from journal entries which are usually the primary records. This shows how the various transactions, such as sales and how they were affected. At the end of the journal a balancing figure is usually indicated which either appears as debit (DR) or credit entry (CR) in relation to the revenues and expenses (Justicejee, 2002).

A financial statement as said before usually has a time frame of operation. It is very important to indicate the time period in which the operations were carried out in the heading of the income statement for example, Income statement for the six months means that the period from January 1st to the period it ended which was in June 31st recorded. This is the period the financial transactions were carried out.

Importance of studying income statements

An income statement is a financial statement; it is the most official way to show what took place in the transactions. Hence, the income statement is highly regarded as an essential record.Its major importance’s are it service of several purposes such as to focus on the main operations that result in revenues and expenses (MacKay, 2006). It can also be useful for analyzing change in revenue data over a period of time.It is also considered by most people as a very essential financial document because it shows whether an entity was achieved and its profitability targets i.e. whether it achieved an acceptable target.

Most importantly it is the primary means of communicating financial information to parties outside the business organization. The parties can be the consumers’ shareholders or stake holders’ potential investors and also the government who determine the taxation capacity (Elmaleh, 2005).

Aims of studying financial statements

There are several aims of studying income statements most importantly. This is because it is the main record to show how the profitability of the company or how the loss of the company was arrived at. One may study income statements as a part of their module of final financial statements so as to be able to ascertain the loss or the profitability of the business which is basically arrived at as the difference between revenue and expenditure. Through this may be able to arrive at some of the most important decisions depending on the nature of his position as a government, shareholder, management i.e. director and many more. For one as a company it enables one to compare with competing businesses in the industry as a whole and through this they will be able to know how competitive they are in the markets (Itelson, 1998).

Also in one studying the income statements one may be able to know if the profit earned by the business is able to sustain the entity in the coming periods since most entities measure their continuity in the industry or will be making decisions that will be determining the company’s solvent nature in relation to its performance. Through studying of income statements one might be at a position of a lender i.e. a bank or any other financial institution and will be able to understand a firm’s ability in a timely manner which ultimately depends in the organizations profitability.

When one studies income statements, one may at one time find themselves in a position of management hence, will be able to use the income statement to make a variety of decisions for example managers will constantly review the prices they set for the firms product and services depending on the firm’s financial performance which is clearly determined from income statements and decision questions such as to hire or to fire. This is well understood by determining the firms positioning terms of profitability or loss mainly understood by studying income statements (Kuria, 2011). Additionally by studying income statements, one will be able to understand extra performance measures of growth that will reflect a firm’s success in its quest to expanding its local or global market and additionally reaching out to growth opportunities, which it will able to serve.

The body of study

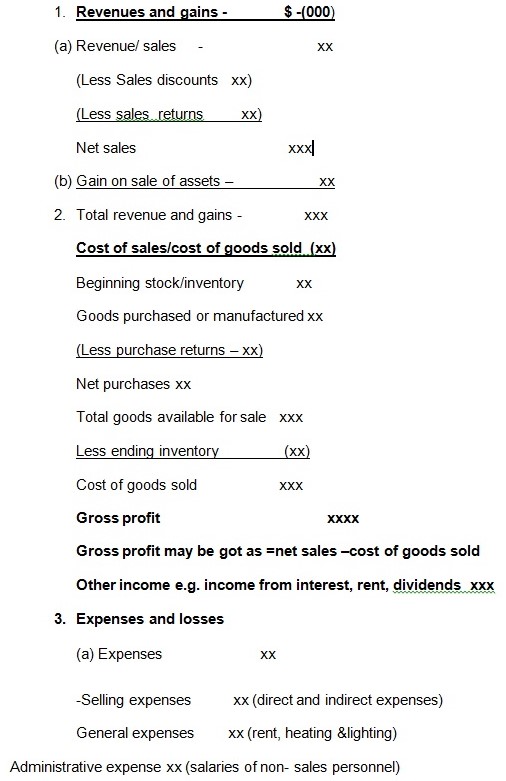

Generally an income statement is usually presented as follows:

- Chris Adela associates –name of entity

- Income statement –title of statement

- For the year ended October 30th 2011 –specific date that the accounting period ended

The income statement is divided into three major categories-gains, expenses, net income/profits and revenues.

When illustrated further may include:

- Bad debts

- Advertising

- Depreciation

- Commissions

- Employee benefits

- Insurance

- Furniture and equipment

- Maintenance and repairs

- Rent

- Office supplies

- Salaries and wages

- Research and development

- Software

- Travel

- Utilities

- Webhosting and documents

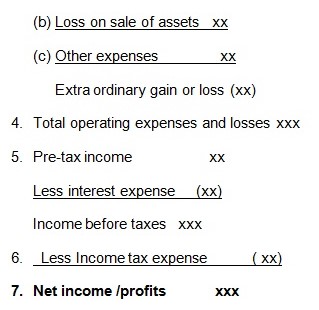

Sample Income Statement

Now let’s take a look at a sample income statement for company Chris Adela for FY ending 2008 and 2009.

Illustration 2

Having looked at the composition of an income statement, we can see from the example above that between the years 2010 and 2011, Company CHRIS ADELA managed to increase sales by about 54%, while cost of sales was reduced from about 23% to about 19% of sales. As a result, gross income in 2011 increased significantly, which is a huge gain for the entities profitability. In addition, general operating expenses have been kept under conflict control, increasing by a modest $25,000. In 2010, the company’s operating expenses reflected15.7% of sales, while in 2009 they amounted to only 13%. This is extremely favorable in observation of the large sales increment.

As a consequence, net income for the company in 2010 has increased from $605,000 in 2010 to $885,000 in 2011. The optimistic inter-annual trends in all the income statement components both earnings and expenditure have raised the company’s net income/net sales (profit margin). This increased from 40% to 44% – again exceedingly positive.

Conclusion

As indicated in the study above with the income statement, when an investor / an individual understands the income statement ,particularly the income/revenue and the expenses part he or she will be able to know what makes up a company’s profitability.In the case the company ADELA ,it experienced a major increment in sales for the interlude reviewed. It was also able to manage the expenditure side of its business, which is a very efficient sign of its management.

Through the study of the income statement one being in the position of a shareholder will be able to understand the performance of the company and won’t be a victim of consuming false information which has been a case in the past were some company’s which have been performing poorly may give false information to its share holders but when a share holder understands the income statement he or she will understand the revenues in relation to the incomes

Therefore, the income statement would to a large extent show the quality and growth of a company’s earnings that could as a result drive its stock price in the stock money market/stock exchange. It is important that investors understand the indicators used to measure profitability. The income statement is the principal document to show such profitability analysis, which is prepared either on monthly, quarterly or on yearly basis and reveals the trend and changes in a company’s earnings profile.

Companies prepare the income statements in relation to the nature of their industry which may include manufacturing, merchandising and service industries. Public companies are usually obligated to publish their financial statements in the news papers, which includes the income statement and is one of the indicators of a company’s performance and is one of the ways of communicating to the shareholders on how their investments are fairing. While in private company’s the management is not obliged to publish its financial reports in the news papers since the investors are sent the reports to their respective mails or receive the reports during the annual general meetings. So generally the study of income statements is quite essential and is usually controlled by the international accounting standards.

When you hear financial analysts or read related financial articles e.g. in the wall street journal, you will hear the experts insist on the importance of reviewing financial reports before investing in a company. In relation to these investors analysis should be deeply dealt with in the company’s financial statements i.e. the income statement include and analyze everything from the auditor’s report to the footnotes for a better judgment.In cash flow, profits are not the best way of showing the company’s financial flows but, best ways of viewing financial movements (Elmaleh, 2005).

Reference List

Elmaleh, S. M. (2005). Financial Accounting: Brief Introduction. California: Epiphany Communications.

Itelson, T. R. (1998). Step by step guide to creating Financial Report. Oklahoma: Career Pr Inc.

Justicejee, J. A. (2002). Accounting for College. Texas, Oxford University Press.

Kuria, N. (2011). Analysis of Income Statement. New Jersey, NJ: Pronsil Pub.

MacKay, J. (2006). Accounting Principles. Financial Wisdom Journal, 5.