Kmart: The Business Context

I will talk about the challenges Kmart, a large brick-and-mortar retailer, faces in the current economic situation in the retail industry, the factors behind its existing problems, and the possible solutions. I will use two charts which contain data which will be crucial for understanding the retailer’s current position and its struggles. Yet, first, I will begin by introducing the business context of Kmart, of its competitors, and of the retail industry in general.

It does not come as a surprise that in recent years Kmart has been experiencing a significant decline in sales and the number of customers. One of the major reasons behind the company’s lack of success is the economic recession of 2008 and the subsequent drop in consumer demand. Today, in 2017, Kmart still has not recovered fully from the damage inflicted by the crisis which occurred nine years ago.

In 2015, the retailer registered $12.1 billion, which indicated a 67% decrease compared to 2000 when the company managed to accrue $37 billion in sales (Egan, 2015). Such statistics clearly demonstrate that Kmart pursued wrong strategies, and the management could not help the company reach its goals and subsequently failed to deliver on the task of increasing value for shareholders.

Moreover, the retailer’s response to the problems was closing hundreds of stores and making thousands of workers redundant, which in an attempt to counter the debt which has reached $8 billion since 2011 (Reindl, 2016). Yet, this trend is not limited strictly to Kmart; companies such as Verizon, Nordstrom, and Ralph Lauren, with the only exception of Walmart, cut their jobs in 2016 (Boyd, 2017). This shows that the retail industry as whole experiences considerable issues which become difficult to ignore and need to be addressed immediately.

Levels of Salaries of The U.S. Workers In Different Retail Branches

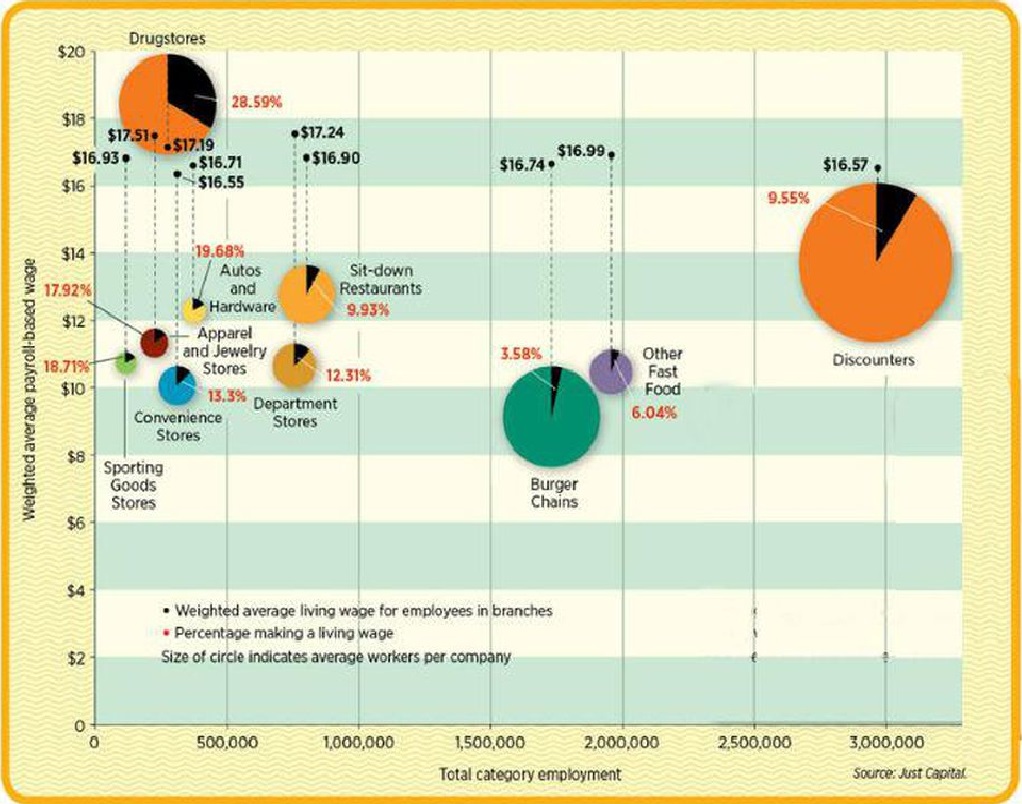

The first graph, which will be subject to a thorough study, demonstrates information about the level of salaries among U.S. employees working in various branches of the retail industry. The graph itself is a scatter plot which depicts two variables, namely, the total category employment and the weighted average payroll-based wage. Additionally, the graph features data on the percentage of workers who earn a weighted average living wage for workers in respect to their particular retail branch.

The results show that the absolute majority of the workers involved in the U.S. retail industry do not receive enough money to guarantee themselves secure and stable living. Moreover, as seen in the graph, the situation gets worse as the size of the branch grows larger, which jeopardizes the well-being of millions of workers across the nation.

For example, the branch with the largest share of employees making a living wage, namely 28.59%, is the drugstores which also have the highest living wage of $17.51. Yet, a bigger problem lies in the fact that drugstores in the U.S. provide jobs for less than half a million people. The main retail employers in the country, burger chains, other fast food, and discounters, which Kmart represents, actually pay the living wage to fewer workers than the majority of other branches. The situation in the discounters’ branch is particularly challenging since only 9.55% of nearly three million workers receive a living wage of $16.57. Thus, the graph clearly illustrates the conditions faced by the workforce of the retail industry, which employs more than seven million people.

The Total Number of Patents Registered by Retail Companies

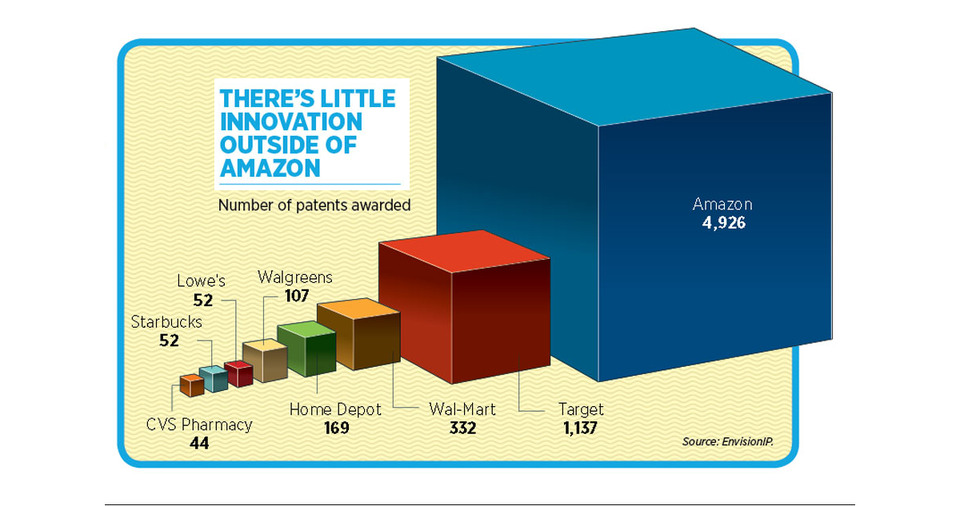

The second graph shows the rate of innovation of various companies in the retail industry by featuring the number of patents awarded to them over the years of their existence. This graph is essential for understanding the current developments in the market and for establishing the reasons why some companies fail, and others continue to advance further. Innovation has always been a key driver for retail companies since it provided them a competitive advantage which ultimately helped them be best in certain spheres such as customer service or supply chain management.

The graph only proves this notion by demonstrating that the number of patents significantly affects the probability of success in the retail industry. Amazon, one of the world’s biggest e-commerce players, has received 4,926 patents for its unique methods and technologies, which ensure the effectiveness and efficiency of the company’s operations. These may include special warehouse techniques and state-of-the-art solutions such as packages with built-in parachutes (Levy, 2017).

This fast pace of innovation propels Amazon forwards and allows it to be a leader in the retail industry. Yet, apart from Amazon, the graph also shows the number of patents registered over the years by brick-and-mortar retailers, and, compared to the e-commerce giant, the difference is immense. Amazon was more than four times more likely than Target to register patents. While Walmart, one of the oldest retailers in the U.S., has managed to receive only 352 patents over the time of its existence. Such data demonstrates that the traditional brick-and-mortar retailers find it difficult to compete with e-commerce companies such as Amazon in terms of innovation which hinders their performance and popularity among consumers.

Applying Graphical Data to Kmart’s Business Context

The information presented in the two previously described graphs grants an opportunity to assess Kmart’s current position in the industry and find appropriate solutions for achieving success. As it was mentioned earlier, currently, the company faces significant challenges, especially in terms of sales and the number of active customers, which force the business to close stores and lay off hundreds of workers. One of the primary assumptions which can be made based on the analysis of the first graph is that the retail industry and Kmart, as its part, cannot solve its financial issues by cutting wages. The situation with the employees’ incomes is already quite dire, with the absolute majority not receiving the living wage of their branch.

Decreasing the pay even lower will result in numerous negative consequences such as the loss of competent and most professional workers and general dissatisfaction with the job among employees. Both of these scenarios must be prevented because otherwise, the business will experience problems which are even more severe. Today, the job market is on the rise, and the unemployment rate is projected to keep falling in the next few months (Gould, 2017).

This creates numerous opportunities for low-paid retail workers with substantial experience and useful skills to switch their company and apply for a position in the business where they will be paid more. Kmart should commit to increasing the percentage of workers receiving the living wage of the discounters’ branch at least to a level which would be slightly above the average of 9.55%. This will help the company retain the most valuable and competent employees who play an important role in ensuring strong organizational performance.

As indicated by the first graph, the majority of the companies in the retail industry pay their workers less money than the living wage. At the same time, it is clear that retail businesses are going through a difficult period and are forced to close many of their brick-and-mortar facilities because they become unprofitable. Thus, it is possible to establish a possible link between these two phenomena and attempt to make an assumption that low wages negatively affect organizational performance and entail high costs. Moreover, increasing the wages of employees can yield positive results for companies and provide them with new opportunities.

According to Cascio (2006), the cost of replacing a worker who decides to leave their company is usually 1.5 to 2.5 times the annual salary of this employee. Therefore, it is essential for companies to employ all methods available to them and which are economically sound to retain their workers in order to avoid larger financial losses. Moreover, Wolfers and Zilinsky (2015) from Peterson Institute for International Economics conducted research and discovered numerous studies which showed the positive effects of raising wages for low-income workers. The findings which are particularly relevant for Kmart are the improvement of quality of customer service, decreased rates of employee turnover, and the subsequent reductions in terms of costs of hiring and training new workers.

There are also actual examples of the key players in the industry, such as Walmart, which increased wages for workers as part of its strategy (Irwin, 2016). A 16% raise in wages allowed the company to reach its goals in customer-service ratings and stimulate sales growth.

As the second graph demonstrates, the majority of retail companies do not register as many patents as Amazon, which indicates that there is a lack of innovation in the industry which also affects sales. Additionally, it shows that many retailers are not willing to introduce changes to their business models, fearing that it may lead to unfavorable situations such as loss of customers. Yet, this approach to innovation can ultimately cost companies even their relative stability enjoyed by them at the moment. Therefore, Kmart must focus on developing new strategies and technological processes to improve all areas of the business.

Amazon is the best example of a company which did not stop progressing and chose evolution over stagnation, the approach which is responsible for its continuous expansion and success. For instance, in a short period of time, the company managed to introduce its membership program Prime, to launch fulfillment centers which use the latest robotics technology, and to start operating its own fleet of cargo planes (Robischon¸ 2017). This method of conducting business helps Amazon reach its strategic goals, which is evidenced by the fact that the company’s stock price increased by 300% from 2012-2017. Kmart must follow the example of Amazon and invest in discovering and designing new technologies and strategies which can assist the company in improving its operations and increasing sales.

References

Anders, G. (2017). The looming retail bailout. Forbes. Web.

Boyd, K. (2017). Walmart maintains market domination while Its competitors stumble. Observer. Web.

Cascio, W. F. (2006). The high cost of low wages. Harvard Business Review. Web.

Egan, M. (2015). Kmart’s sales have fallen off a gigantic cliff. CNN. Web.

Gould, E. (2017). Why unemployment will keep dropping in 2017. Economic Policy Institute. Web.

Irwin, N. (2016). How did Walmart get cleaner stores and higher sales? It paid Its people more. The New York Times. Web.

Levy, N. (2017). Amazon patents a shipping label with built-in parachute for dropping packages from drones. GeekWire. Web.

Reindl, J. (2016). Bankruptcy again for Kmart? Detroit Free Press. Web.

Robischon, N. (2017). Why Amazon is the world’s most innovative company of 2017. Fast Company. Web.

Wolfers, J., & Zilinsky, J. (2015). Higher wages for low-income workers lead to higher productivity. Peterson Institute for International Economics. Web.