Introduction

Consulting firms are facing rapid changes regarding service delivery and the nature of knowledge management systems operated by their clients. To cope with the changes occurring in the information technology and to be able to serve their customers well, knowledge management system must be in place. The use of information technology will improve and increase service delivery to the customers.

Knowledge management is the implicit, explicit and systematic organization of important and shareable information within and with external environment of an organization. It involves organizing information, finding and investigating, selecting necessary information, filtering and presenting to groups, individuals or to entities with an aim of improving understanding of specific areas of business interest. Therefore knowledge management involves the process of converting personal knowledge whether acquired in learning process or obtained at any quarters into knowledge for others through the organization of information in the firm. Knowledge management focuses on two objectives that are enabling knowledge sharing within the organization and using knowledge to run communities and institutions. Some knowledge management activities that have been implemented by business organizations have helped them to focus on acquiring, storing, and utilizing knowledge for such things as problem solving, dynamic learning, strategic planning and decision making ( Graduate School of Business, University of Texas at Austin,2000 and Blue Ridge Academic Health Group. 2000).

Knowledge sharing among employees is recognized as an asset give the company sustainable competitive advantage, corporate value and economic growth (Sandra Vera-Mun˜ , Joanna and Chee 2006) although the sharing of knowledge may be limited within organizations (Szulanski 2000, 1994; Nonaka and Takeuchi 1995; von Hippel 1994).

What is Knowledge?

From a dictionary, knowledge is the awareness and understanding of facts, truths, or information gained through reasoning in the form of experience or learning. Therefore Knowledge can be an appreciation of interconnected details that, in isolation, are of lesser value and Researchers use diverse expressions to define knowledge (argued Sandra Vera-Mun˜, Joanna and Chee 2006). (Nonaka) (1994) Commented that knowledge consists of justified true belief, Starbuck (1992) defined knowledge as stock of expertise and Elliott and O’Dell (1999) as information in action.

Sharing Knowledge

Knowledge is divided into explicit and tacit, Polanyi (1966). Explicit Knowledge is ‘‘know-what,’’ which can be captured, codified, categorized, and stored, and is transmittable (, Stenmark 2000). Tacit knowledge is the ‘‘know-how,’’ knowledge which as a result of the habitual practices and mental models of individuals ( Polanyi 1997; Nonaka and Takeuchi 1995). Ambrosini and Bowman (2001) summed up that tacit knowledge can not be easily be articulated because it is subconsciously understood and applied, and it resides in people’s minds as intuitions, insights, beliefs, or values. Bonner (2000) and Lee (2000) added that Knowledge in most organizations is embedded and synthesized in people’s minds.

Sandra Vera-Mun˜, Joanna and Chee (2006) in their article enhancing knowledge sharing in Public Accounting firms they argue that “Explicit knowledge can be shared through verbal or written communication and, thus, passed on to other members of the organization, who in turn must convert it into tacit knowledge before they can use it. On the other hand, tacit knowledge is typically shared through socialization, such as highly interactive conversations, apprenticeship (e.g., observation), storytelling, analogies, and shared experiences and activities ( Stenmark 2000, 10; Zack 1999b, 46; Nonaka and Takeuchi 1995; Nonaka 1994, 1991). Thus, tacit knowledge is effectively shared by allowing the recipient maximum possible opportunities to work alongside the source of the knowledge.” End of the quote.

From quote and discussion we learn that knowledge sharing, whether explicit or tacit, is vital in the organization and it requires efforts from both the individuals and enabling environment from the organization.

Johnson and Associates

Johnson and Associates is firm of public accountants which was established in 1978 and has grown to a major service provider in three continents. The firm is divided into functional divisions to accommodate expertise in receivership, management, insolvency, auditing, accounting and bookkeeping. Each functional division has a number of staff members and materials for working procedures.

The business objectives, mission and strategy

The firm’s main objective is to add more branches that in the remaining three continents and increasing their staff members to approximately 59,000 from 42,000.this calls for a comprehensive knowledge management solution that provided new branches and staff members with crucial resources as well as orientation and reference information. Easy access to information would help the firm deliver better and consistent services to their customers.

Let me begin by introducing the staff members of the accounting and bookkeeping department. In the accounting firm they are the most important they interact with the customers of the firm. When you deliver books of accounts to the firm, the staff members are the recipients and they the same people who handles the job. There are many other types of bookkeeping and accounting staff, they include accounts clerks, accounts assistants, accountants, audit clerks, auditors, senior accountants, senior auditors and audit managers. There are many characteristics of this form department: They have well designed job descriptions and specification, There is extensive interaction between themselves and members of their profession with an aim of sharing information and new changes in the accounting standards, They have hierarchical management structure, ranging from partners to branch managers audit managers, managers, through to section heads, and then finally to audit clerks. The flow of information follows the hierarchic, majority of the staff members of this department are degree and professional certificate holders and the staff of this department need continual training and updates of professional standards changes, government legislation affecting the profession and other related changes that affect the profession. The main goal in of this department is consistence, prudence, keeping with change and accuracy.

Factors Affecting Knowledge Sharing in Johnson and Associates

The firm makes efforts to gather, sort, transform, record, and share the collective knowledge of their employees. However, knowledge is the minds of their staff members are shred through consultation that is informal and formal interactions other knowledge is shared using information technology.

Information Technology

Johnson and Associates use information technology system. Accounting firms use IT for capturing and retrieving data, information, and knowledge argued Banker et al. (2002). IT also staff members to access professional practices best practices, surveys, statistics, expert knowledge for specific problems, and point-to-point knowledge added Silvi (2002).

According to Sandra Vera-Mun˜, Joanna and Chee (2006) “These systems provide auditors at all levels with access to external expertise contained in third-party databases as well as internal expertise. In addition, firms use the ‘‘codifying of experiences’’ model, which consists of making the audit teams’ research, experiences, processes, and working papers available to the rest of the organization through keyword searches in knowledge bases. For example, Ernst & Young’s PowerPacks consist of customized compilations of best practices information that is constantly updated and made available globally over KnowledgeWeb (Head 2001).7 Individual professionals worldwide can download this collective information onto their computers. The firm counts how often PowerPacks are accessed, and the counts indicate the freshness and value of the knowledge in the PowerPacks. Owing to this platform, employees do not have to ‘‘reinvent the wheel’’ every time a common problem arises. Thus, by facilitating processes like these and providing the means for electronic collaboration, IT enables knowledge sharing. Information technology systems enhance access to important materials and documents throughout the company, which should improve efficiency and decision making. For instance, computer-mediated communication tools, such as group support systems (e.g., Lotus Notes and similar web-based systems), combine communication, computer, and decision technologies to support group decision-making and related tasks (Jessup et al. 1990). These systems also enable auditors to work in ‘‘virtual teams’’ that are not bound by time and distance constraints; they also support electronic meetings (Murthy and Kerr 2004, 141).

Thus, the use of Lotus Notes, electronic mail, instant messaging, and video conferencing allowed teams in Europe and the United States to collaborate in real-time on the VivendiUniversal SA Sarbanes-Oxley 302 Certification project that PricewaterhouseCoopers led in 2002. Also, technological advancements allow auditors on engagement teams to conduct electronic reviews of clients’ work papers while in their offices or from remote locations (Brazel et al. 2004)’’.from this extract on accounting firms use information systems we realize that other leading accounting firms had adapted systems that were enabling them to share knowledge in the organization.

Although, the existence of information technology system does not mean that Johnson and Associates share information with easy. Other limitations stand on the way. Most accounting firms have a difficult in documenting their work or practices, because there is a large gap between what a task looks like in a process manual and how it is deployed in reality and the gap between what people think they do and what they really do argues Sandra Vera-Mun˜, Joanna and Chee (2006). most of the work of accounting firms is tacit improvisations that the employees who use them will have difficulties in articulating. Tacit knowledge is part of total job-relevant knowledge (Schmidt and Hunter 1993), and can be observed and recognized through professional interactions

Johnson and associates like many accounting firms collects and codifies an extensive array of knowledge, Sandra Vera-Mun˜, Joanna and Chee (2006) in their article they argued that “ individual auditors still need to sort through the available databases and to exercise judgment about which pieces are applicable to the situation at hand. Doing so efficiently and effectively requires continuous education and training (Banker et al. 2002). Third, anecdotal evidence (Head 2001; Power 2000) and field-based research (Irmer et al. 2002) suggest that knowledge sharing using IT-based expert knowledge systems is not automatically embraced by everyone in an organization. Finally, a recent study suggests that professional employees who experience evaluation apprehension are less likely to share knowledge. Importantly, this research suggests that evaluation apprehension is greater when knowledge is shared via collective database-related technologies (e.g., a firm’s intranet) than via informal interpersonal contexts, due to the number and characteristics of people with access to the knowledge and the permanency of the record”

In nutshell, Information technology assists in collecting, codifying and distribution. However the issue of knowledge sharing organizational issue because its success depends ultimately on people, their practices, and their know-how (Salisbury 2003, and Douglas 2002).

Formal and Informal Interactions among Auditors

Knowledge sharing in Johnson and Associates through personal interactions among auditors and professional colleagues, formally or informally. Formal groups in Johnson and associates include auditors, audit clerks, audit managers working in the same department or from other department as mentioned earlier. Their sharing of knowledge involves interactions office meetings audit manager, partners or other persons of senior position. This inputs new procedures of work and any other emerging issue in their profession formally. While in these firm informal groups include associations of employees from some section of the world, get together teams with the aim of assisting each other at times of difficulty. Their interactions is on social terms that is in the process of handling their informal meeting professional knowledge may be passed. This occurs with without the other person realizing thus no negotiation of terms and without knowledge of whether or when the other will reciprocate’’ (Molm 2000).

Factors affecting knowledge sharing in formal and informal interactions for accounting firms include. (1) Organizational Culture this includes practices, unspoken norms, beliefs and shared values. This can be summarized as those things that determine the patterns and qualities of interactions between employees at different hierarchical levels (Sadler 1988, 118).

Brown and Starkey (1994) argued that culture of an organization is an important factor affecting attitudes toward communication and communication processes and systems. Many practitioners share this view former vice-president of strategic planning and knowledge management at the American Institute of Certified Public Accountants (AICPA), John Hudson, equipped that the obstacle to knowledge sharing is not technology, but a business culture that rewards keeping what you know close to your vest. Meaning that whatever you know should be kept away from your peers so that you can have competitive advantage over others in terms of salary and advantages. This means that individuals’ employees are encouraged not to share what they know. (Stimpson 1999, 38–39).Accounting firms should encouraged having culture encourage knowledge sharing and eliminate cultures of rewarding employees of does not embraced teamwork. If an employee is good but does not share knowledge fire him. Thus cultures and practices that encourage openness and teamwork are a source successive knowledge sharing in accounting firms. Thus, if partners demonstrate accessibility and openness to discussing sensitive topics, then auditors at lower ranks are less likely to experience evaluation apprehension, in turn increasing their willingness to proactively seek and share knowledge (Sandra Vera-Mun˜, Joanna and Chee 2006).

The criteria used in solving and decision making in organization also affects sharing of information. All business engagements, explanations, decisions and expectations should be seen to be fair to all. Individuals involved in decision-Making, issue of opinions, their assumptions and ideas being recognized by asking for their opinions and allowing them to refute the merits of one another’s assumptions and ideas. Decisions made should have an explanation to help individuals understand the reasons and thus create faith in management intentions. Sandra Vera-Mun˜, Joanna and Chee (2006) argued that “expectation clarity means making explicit the rules of the game”. Studies have linked processes, attitudes, and behavior. In the research carried out it was found out that “executives in their sample were frustrated by the uncooperative behavior of the senior managers of their local subsidiaries. In particular, the senior local managers often failed to share knowledge and ideas with the top executives. Managers who believed the company’s processes were fair displayed a high level of trust and commitment, which, in turn, engendered active cooperation. Conversely, when managers felt that a fair process was absent, they hoarded knowledge and ideas and dragged their feet in making decisions and executing them. Procedural justice research suggests that to achieve a fair process, the specifics of the new rules and policies matter less than that they are clearly understood. Further, people care as much about the fairness of the process through which an outcome is produced as they do about the outcome itself. In general, a fair process builds trust and commitment and they, in turn, produce voluntary cooperation. Voluntary cooperation drives performance, thus leading people to go beyond the call of duty by sharing their knowledge and applying their creativity” Sandra Vera-Mun˜, Joanna and Chee (2006).

(3.) Role Conflict and Role Ambiguity: Jackson and Schuler (1985) argued that Role conflict and role ambiguity can be sources of work relate stress and this may affect service delivery to the clients. This occurs when there is no proper definition. Most accountants and auditors expectation are derived from generally accepted accounting principle and other regulations. Sandra Vera-Mun˜, Joanna and Chee (2006) argues that boundaries on the scope of no audit services established by Sarbanes-Oxley may not be completely transparent to some controllers and corporate managers— particularly those of small companies—they may still view auditors as business advisers and, thus, continue to ask for their advice on non audit-related issues that may compromise auditor independence.” this that this act changed the role of auditors and thus role conflict may occur. Another issue of conflict is communication and authority, adaptability, and workflow coordination (Sandra Vera-Mun˜, Joanna and Chee 2006). The writers have written that “For example, proper time allocation is a persistent issue that frequently results in a conflict of expectations between a client and the auditor’s supervisor. This is because an auditor is typically assigned to multiple client engagements, thus requiring a careful and thoughtful coordination and management of engagement schedules. Often, unanticipated delays in completing audit assignments are unavoidable due to demands and circumstances beyond an auditor’s control, such as missed deadlines in receiving client information, unresponsiveness of client personnel, and the need for more research to address complex technical issues. A significant delay with a particular client engagement may cause auditors to miss important deadlines with other client engagements. Timely and accurate sharing of engagement progress reports among the auditors, clients, and audit supervisors are an integral component for aligning expectations between and among them” summarizing the role conflict in the formal and informal groups.

While role ambiguity is when in the job specification and description there is no clarity on job requirements. This is typical in accounting firms like Johnson and associates, auditors are assigned to multiple engagements and work for multiple supervisors with differing or sometimes conflicting management styles and directives Sandra Vera-Mun˜, Joanna and Chee (2006) argues. In this case conflict affects employees’ abilities to share knowledge with other members of the audit team and this may cost the firm in the terms of performance and service delivery.

(4)Supervision and Feedback: there should be proper supervision and a proper feedback on any issue raised this will enable sharing of information easier and acceptable. Sandra Vera-Mun˜, Joanna and Chee (2006) have argued “Supervision typically connotes downward communication in the form of advice about task-related matters, such as task instructions, objectives, constructive assessments of preliminary plans and the results of past decisions and provision of feedback. Auditing standards have long required supervision of audit team members”. This is contained in AICPA 1996, AU Section 311 which states that supervision should vary with the nature of the assignment (‘‘the complexity of the subject matter and the qualifications of persons performing the task’’).

Johnson and Associates problem statement

From my observations the current Knowledge management is not serving them well in terms of mapping, acquiring, capturing, creating, packaging, storing, applying, sharing, transferring, reusing, innovating, evolving and transforming Knowledge properly for the firm. This has led to the following tribulations:

- The current system has too much paper work resulting into large cabinets of records. It takes a lot of time to retrieve information from this pool of papers.

- The process of updating each record is tedious hence records lack consistency.

- The current system does not offer any summary reports that can be used to aid in decision making

- The current system does not offer any back-up services i.e. if something happened to the cabinet of files, then all information will be lost.

- The current system has very poor security services as the INFORMATION IS is distributed in real hard copies.

- Data duplication- This is where the information meant to be recorded for one transaction is recorded more than once leading to data redundancy

- Erroneous data entry: Since some of data is entered manually, cases of errors in the records will be frequent.

- Poor management and administration- This is very evident since the information produced by the current system is untimely and inaccurate due to human error in manual computation hence cannot be used to make very accurate and timely decisions for administrative purposes example controlling projects.

- Some of the branches do not have proper communication channels with the head office.

Proposed KM Johnson and Associates: portal

To have portal we need to understand and follow some steps and methodology which includes definition the site’s purpose, identify the site’s content, classify and organize the content, identify and codify knowledge objects, definition of the site’s organizational and navigational schemes, create maintenance plan, test the system for user friendly, provide a feedback and have the plan for implementation.

Knowledge goals ————→ Knowledge identification ——-→ Knowledge acquisition —–→ Knowledge development —–→ Knowledge sharing—→ Knowledge utilization—→ Knowledge retention —–→ Knowledge retention then feedback —-→ Knowledge goals

For the project to succeed in Johnson and associates to succeed the following hypothesis is in place; should be Knowledge-oriented culture, should have technical and organizational infrastructure, supported by the management, add value to the firm, be process oriented, have clear vision and understandable language, have knowledge structure and transfer channels.

Methodology

The best methodology applying to this project is prototyping since it’s incremental, has a learning process and involves interaction.

Advantages

- It yields better results because users are involved during the whole process.

- End users adapt more quickly to systems developed using prototyping as they are easier to navigate through.

- It helps in identification of real requirements and also eliminating unnecessary requirements.

- Prototyping clarifies vague requirements reducing ambiguity and improving communication between the developer and the user.

- Prototype systems are easily modified because they are in a constant interactive process.

Disadvantages

- Prototyping can lead to false expectations to a user since he sees what appears to be a fully working system when in actual fact is a partially working model.

- Prototyping leads to poorly designed systems due to its rapid development. Which leads to a design composed of a series of layers without consideration of the integration of all other components.

- Due to its rapid development, It leads to implementation and maintenance problems.

- Prototyping is time consuming since the needs keep on changing.

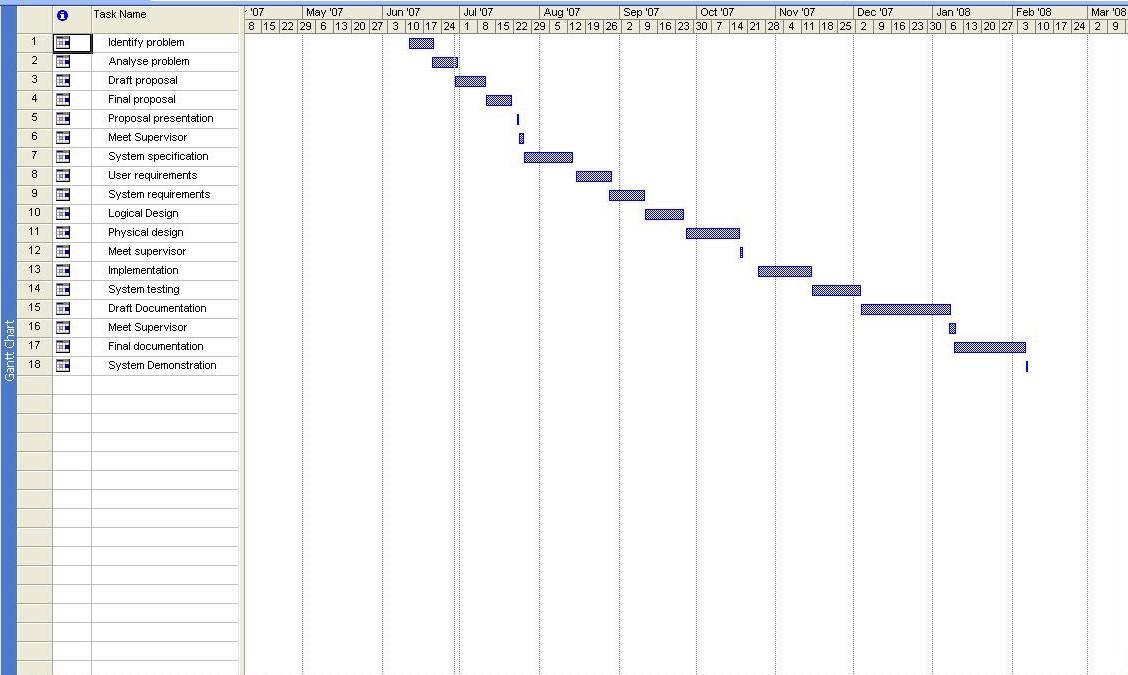

The plan for implementation of the proposed portal will be as follows using Gantt chart.

Benefits accrued to Johnson and Associates if implements KM

There are many very real benefits to be gained by Johnson and associates if they implement knowledge management this includes; improving client service and satisfaction, increasing efficiency, improving consistency in methods used and information, reducing auditing costs, reducing professional misconduct among the juniors thus reducing legal exposure and risk, improving staff knowledge acquisition and job satisfaction, reduces staff training costs , improves staff retention to avoid regular recruitment because of staff turnover, improves know how on the current issues of the profession and keeping of knowledge at times of staff leaving.

There are more benefits and implication to accounting firms which are not shown in the discussion above. But were highlighted by Sandra Vera-Mun˜, Joanna and Chee (2006) their article relating to implications wrote that most large business firms have spends more man-hours to comply with the Sarbanes-Oxley Act of 2002 and this shows if a firm effectively implements knowledge management system will reduce time wasting and costs associated with new laws like training, acquiring the knowledge and other costs..

Conclusion

From the discussions, the proposed knowledge management portal system, benefits highlighted and other issues. Johnson and associates benefits and stands to benefit from the KM system.

References

Graduate School of Business, University of Texas at Austin. KM Answers to Frequently Asked Questions about Knowledge Management. 2003. Web.

Blue Ridge Academic Health Group. 2000. Blue Ridge Academic Health Groups Report 3. Into the 21st Century: Academic Health Centers as Knowledge Leaders.

Sandra C. Vera-Mun˜ oz, Joanna L. Ho, and Chee W. Chow, (2006). Enhancing Knowledge Sharing in Public Accounting Firms Accounting Horizons Vol. 20, No. 2 pp. 133–155.

Nonaka, I. 1991. The knowledge-creating company. Harvard Business Review 69: 96–104.

Szulanski, G. 2000. The process of knowledge transfer: A diachronic analysis of stickiness. Organizational Behavior and Human Decision Processes 82 (May): 9–27.

Szulanski, G. 1994. Intra-Firm Transfer of Best Practice Project: Executive Summary of the Findings. Report. Houston, TX: American Productivity & Quality Center.

Stenmark, D. 2000. Leveraging tacit organizational knowledge. Journal of Management Information Systems 17 (Winter): 9–24.

Sternberg, R. 1994. Tacit knowledge and job success. In Assessment and Selection in Organizations:Methods and Practice for Recruitment and Appraisal, edited by N. Anderson, and P. Herriot,27–39. London, U.K.: John Wiley.

Stimpson, J. 1999. In the know. Practical Accountant 32 (June): 34–39.

Ambrosini, V., and C. Bowman. 2001. Tacit knowledge: Some suggestions for operationalization.Journal of Management Studies 38: 811–829.

Bonner, D. 2000. Knowledge: From theory to practice to golden opportunity. American Society for Training & Development: 12–13.

Bonner, S., and N. Pennington. 1991. Cognitive processes and knowledge Douglas, P. 2002. Information technology is out—Knowledge sharing is in. The Journal of Corporate Accounting & Finance: 73–77.

Murthy, U., and D. Kerr. 2004. Comparing audit team effectiveness via alternative modes of computer mediated communication. Auditing: A Journal of Practice & Theory: 141–152.

Salisbury, M. 2003. Putting theory into practice to build knowledge management systems. Journal of Knowledge Management 7: 128–141.

Polanyi, M. 1966. The Tacit Dimension. London, U.K.: Routledge and Kegan Paul.