KPMG is a for-profit organization that works on helping other companies mitigate their risks and seek new opportunities in the market. It provides services to a broad range of clients, ranging from governments to non-profit organizations. The company is committed to reaching high quality in its services as well as reaching consistency across a global network of companies. KPMG was formed in 1987 as a result of a merging of Peat Marwick International and Klynveld Main Goerdeler along with respective member firms.

KPMG has member-firms operating in 147 countries and employing 219 thousand employees with different levels of expertise altogether. In order to provide top-quality services to its clients, the company invests in the improvement of workforce quality through training. The main goal of the organization is to improve the functioning of global capital markets through supporting reforms that could strengthen the credibility of markets. Besides, KPMG works on helping clients reach the desired levels of corporate social responsibility to extend their professionalism and making a positive contribution to society.

In Saudi Arabia, KPMG was created in 1992 through the member-firm Al Fozan and Partners. Therefore, the company has had an early commitment to expanding its operations in the Saudi Arabian market and contributed to building industry experience. Such a practice has been reflected in KPMG Saudi Arabia, acquiring prestigious companies as their key clients. As the country has been closely engaging with the global economy and international companies have been entering the national market, the need for KPMG services has been widely increasing.

Services in Saudi Arabia

In Saudi Arabia, the full range of services offered by KPMG is available.

In the area of audit and assurance, the company offers high-quality financial statement audits. It also provides tax and legal services in the context of the changing environment associated with the attitudes toward tax and accounting. As an advisory firm, it works in the areas of management consulting, deal advisory, risk consulting, and others.

For enterprises, it possible to use the services of KPMG in order to drive the success of organizations through excelling at every step of the process.

KPMG has based its mission statement and purpose on the value proposition offered to companies-clients. The firm has positioned itself as the key provider of audit and advisory services. Its mission is concerned with being the best company in everything it does, turning out experience and industry knowledge into value for clients. The recommended mission should include the mentioning of the company’s expertise and understanding of the industry.

PESTle Analysis

PESTLE Analysis represents a framework for analyzing key factors, such as political, economic, technological, legal, and environmental, which impact an organization from the outside perspective. Political factors have a moderate influence on KPMG and include the high levels of taxation in Saudi Arabia, cases of corruption in the government, as well as political stability. Economic factors have high influence and include a high investment rate in Saudi Arabia, the fact that the country has hit the lowest interest rate of 1%.

While social factors have a high impact on retail businesses, KPMG does not experience a significant effect on social factors. Relevant social factors include the patriarchal system, the clear breakdown of social classes, as well as the overall high standards for healthcare and general living. Since KPMG does not deal with technologies directly, technological factors have a moderate influence. They include the positive global context for technological advancement in the country as well as the government’s support for developments in strategic areas.

As an advisory firm, KPMG experiences significant influence from legal factors. In Saudi Arabia, the legal system is based on the principles of Sharia law, which is derived from the religious framework of Islamic traditions. Recently, there have been some developments in the way legal principles are approached.

Environmental factors have a profound influence on the company. However, in Saudi Arabia, the environmental conditions have deteriorated due to intense fossil fuel usage. Air pollution, urbanization, as well as the over-consumption of natural resources, have significantly worsened the environment in the country.

SWOT Matrix

The SWOT matrix is a framework used for evaluating the competitive position of a company and develop a proposal for strategic planning.

The general strengths and weaknesses point to the internal characteristics, while opportunities and threats are concerned with the external aspects.

KPMG has a highly skilled workforce and a strong brand portfolio as its key strengths. On the other hand, it has a low investment in research and development.

The company’s opportunities include new customer behavior trends, while the main threat is no regular supply of innovation.

A more detailed exploration of the strengths and weaknesses.

For example, KPMG has a highly skilled workforce achieved through successful learning programs, training, and investment of KPMG into resources for talent development. It has a reliable distribution network that can reach the majority of the target market as well as a successful track record of integrating firms through mergers and acquisitions. The company has a strong brand portfolio of loyal customers who receive advisory and other services from KPMG.

In terms of weaknesses, the company has limited success outside core industries due to challenges in moving to new product segments. It also has a small market share in niche categories due to challenges presented by new entrants to the market. KPMG has a low investment in Research & Development and the inability to compete with other firms in terms of innovation. The company’s financial planning is done inefficiently, as indicated by the current asset ration and the liquid asset ratio.

KPMG’s opportunities include market development leading to the decreased advantage of competitors, and elevate KPMG. Also, the reduced inflation rates bring more market stability, enabling credit at a lower interest rate. New trends in consumer behavior may open new markets for the company, while the increased customers are spending as an opportunity to capture new clients.

The threats include changing consumer behaviors to engage more in online channels as a threat to the existing infrastructure. The company has no regular supply of innovative products that could bring competitive advantage. Besides, the growing strength of local companies as they receive higher margins limits KPMG’s competitiveness. The intense competition in the market over the last few years is also threatening.

Overview of Strategy

In the current environment, the task of generating a return on investment for firms such as KPMG has become highly challenging. Because of this, the company has to become more efficient and agile and gain better control over its strategy and operations.

The company’s strategy is concerned with creating value for customers and increasing financial performance and returns on investment with innovation and risks.

KPMG should align with the dynamics of value creation and protection against risks as well as engage with market participants to gain new points of view.

Strategy

In terms of the strategic management of the company, KPMG is dedicated to developing innovative strategies for clients in Saudi Arabia. The company is focused on customer-centricity and operational excellence and close collaboration with its clients.

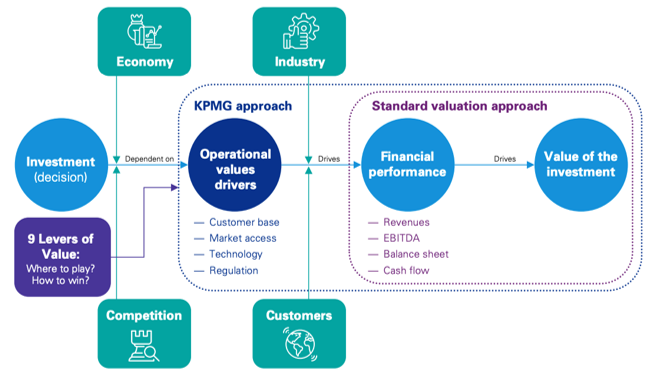

With the help of the Nine Levels of Value approach, KPMG develops its strategic management framework. The proposal aims at forming the financial, business, operating model and is used by executives when designing and implementing key strategies. Furthermore, the model is pragmatic and can offer increased visibility and control through planning.

The Nine Levels of Value approach considers the question of where the company should play and how it can win when making a decision.

The competition and economic factors are considered when making the decision due to the possibility of revealing the importance of operational value drivers. These include the customer base, market access, technology, and regulation. When coming up with the functional value drivers, the model combines information about the industry and customers.

These factors are necessary to come to a conclusion about financial performance. It includes the cash flow, the balance sheet, revenue, and the earnings before interest, taxes, depreciation, and amortization. The results of the financial performance assessment would point to the value of the investment that KPMG is making.

The 9LoV strategy is beneficial for KPMG because it offers a holistic approach to due diligence. With the help of the approach, the company can attain a clear picture of the strategy and the brand’s positioning in the market. Moreover, it helps to understand how the goals can be reached.

In addition, the strategy uses data and platforms that result in action that leads to a purpose-built framework based on insight-driven data.

The importance of the approach is also related to exceeding the issue of short-term problems and ensuring a clear view of what the organization is planning to achieve.

Finally, the 9LoV strategy allows the company to determine value creation opportunities, which lead to utilizing the power of proprietary benchmarks and using functional expertise.

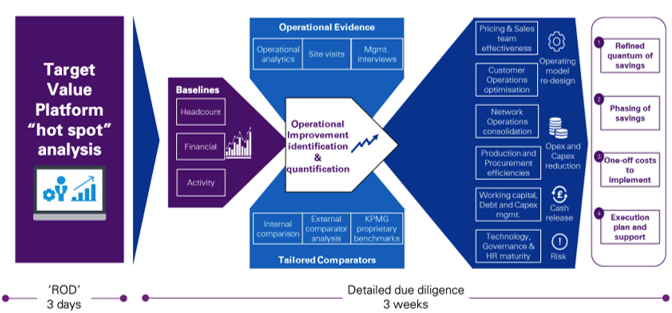

It provides a point of view on operational improvements and actions necessary for delivering them. In addition, the “hot spot” analysis is implemented for identifying key areas for refining strategic opportunities.

Hot spot analysis considers the following aspects of KPMG’s strategic management:

- Baselines: headcount, activity, financial data;

- Operational evidence: site visits, management interviews, operational analytics;

- Tailored comparators: internal comparison, external comparator analysis, KPMG proprietary benchmarks;

- Operating model re-design, risk, cash release, Opex and Capex reduction.

Hot spot analysis has shown to be beneficial to get from innovation to tangible results. It can drive internal efficiency and collaboration of workers and facilitate important related opportunities.

Furthermore, the model is instrumental for building up insight and enabling scaled investment on a long-term basis. One opportunity brought by the approach leads to new ones, thus creating multiple routes for achieving organizational targets.

KPMG’s aim to get from innovation to results is important for guiding the way in which the management approaches strategic planning.

For example, diversified opportunities work as a basis for achieving targets and mitigating setbacks. Because of this, when one idea falters, the overall platform remains stable and can proceed with further development.

Besides, it is important to have a realistic plan for skillsets and talent which is developing on a continuous basis.

However, it is necessary for KPMG to embed the latest infrastructure and digital capabilities into the strategic management of the company. The management is expected to be aware of the time horizons and possibilities of risks in order to mitigate them as necessary.

Finally, the getting from innovation to results objective has worked for KPMG Saudi Arabia because of the possibility to ensure sustained growth in the sector.

The approach allows for the institutionalization of growth as a capability of the organization and its core strategy. The management can facilitate the establishment of new opportunities for growth and the development of a portfolio of investment with specific metrics that are measured on a consistent basis.

Overall, the company aims to maintain its momentum and ongoing progress through using innovation to get to tangible results. However, it should be mentioned that KPMG lacks investment into latest technological solutions.

Expert support to management

- Practitioners helping management accelerate efficiencies.

- Procurement: delivering rapid value improvement;

- Working capital: identify opportunities in excess of 10-15% of opening working capital;

- Back office: lean, agile, and responsive team of professionals (“Strategy”);

- Pricing: tried and tested frameworks and advanced analytical tools;

- Operations and supply chain: identify, design, and implement excess of savings.

Recommendations

As one of the critical weaknesses, the lack of technological advancement has shown to limit the strategic management of KPMG.

Because of this, it is recommended to increase the technological capacity to stand against competitors. The recommendation has been chosen because it can support the high-quality professional development of the organization and build advanced infrastructure and capacity.

Technologies are also necessary for carrying out innovative blended learning projects and delivering specialized learning courses for staff.

To cut costs on processing, KPMG can also invest in the latest technology solutions and automation.

Another recommendation associated with the company’s weaknesses is concerned with increasing investment in Research and Development (R&D) efforts.

R&D can help boost the productivity of new services and products and allow for adding new features to existing services and products.

It can also be connected to the key strategy and business plan of the organization.

New sciences embedded in R&D can be applied to the way in which the management operates the company and develops new goals and objectives. Finally, KPMG will also be able to launch completely new product cycles.

Since KPMG does not have a specific market niche that it can target in Saudi Arabia, the company should consider capturing a new market niche to gain more customers.

For example, the organization can start specializing in advisory services for Saudi Arabian innovation start-ups.

By doing so, it is possible to find ideal clients that have the potential of expansion in the local market that has shown extensive growth in the area of technologies.

KPMG can also drive the economic growth of the country through collaborating with local technologies as well as stand out as an experienced brand that supports innovation in Saudi Arabia.

Due to the increased focus on technologies and their use in strategic management, it is suggested to invest in personnel training to increase industry expertise.

This is necessary because new technologies (for example, Artificial Intelligence) require learning and advancement on the part of the organization’s personnel.

Personnel training is an overall positive recommendation because it can increase the company’s agility. In terms of employee satisfaction, new skill development is likely to make workers satisfied.

Furthermore, staff learning can provide a competitive advantage against market rivals. Besides, it is easier to cut excess costs when employees are highly trained.

Finally, it is recommended that KPMG aligns its financial planning efforts with the strategic management efforts.

It is important that the company diversifies assets in accordance with the amount of risk that it is willing to take up on both long- and short-term basis.

KPMG should also align costs with the tasks scheduled to be accomplished as well as parties responsible for them. This shows that financial planning should be integrated into the strategic management. Finally, relevant and accurate data should be used to make financial projections.

Conclusions

To conclude, KPMG has decades of experience as an advisory firm and has a strong presence in the Saudi Arabian market. In the context of the country, the company has captured a significant place in the advisory market. It is highly influenced by economic, technologic, and legal factors as suggested by the findings of PESTLE analysis.

The key strengths of the company include a strong distribution network and loyal customers that continuously collaborate with KPMG.

However, the main disadvantage of the firm in terms of the strategic management approach is the lack of investment in technology and R&D that prevents to stay competitive against rivals in the market.

The Nine Levels of Value is a strategic management model that helps KPMG to have a holistic approach toward planning.

Nevertheless, the company should take its strategic management efforts more seriously if it wants to stay relevant in the market as there is intense competition.

It has been recommended to invest in research and development to advance the capabilities of the company. It is also necessary to invest in the latest technologies to facilitate advanced capabilities and competitive advantage. Beyond the training of personnel to enhance their productivity, the company should also find a market niche in the Saudi Arabian context: collaborate with local firms.

Works Cited

“Corporate Strategy”. KPMG. Web.

“Creating Value in Private Equity”. KPMG, 2018. Web.

“KPMG in Saudi Arabia.” KPMG. Web.

Office of Ed Tech. “Building Capacity for the Effective Use of Technology: New Guidance on Student Support and Academic Enrichment Grants.” Medium. 2016. Web.

“Our Approach.” KPMG. Web.

“Strategy.” KPMG. Web.

“Value Proposition.” KPMG. Web.