Introduction

Companies that have a bright future will do anything to ensure their operations continue to generate profits and sustain their activities. However, some unfortunate companies decide to exit industries that are perceived to be competitive and unfavorable for them. Mergers occur when two companies believe that they can perform better and conquer their competitors by pooling their resources (Smith, 2015). Acquisitions occur when a company has no future; therefore, it decides to sell its assets to another similar operator and exit the industry. This report presents an analysis of Kraft’s acquisition of Cadbury and how it changed this process.

Reasons Why Kraft Is Considered Entrepreneurial

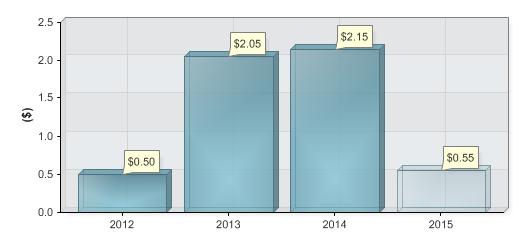

Kraft is an entrepreneurial company that has surpassed the negative expectations of critics and passed the tests of economic uncertainties to become the second-largest confectionery in the world (Strine, 2012). The following reasons make this company unique and give it the power to venture into new and emerging markets without incurring substantial losses. 2010 was a significant year in the history of Kraft Company when it realized its new products were not performing as expected. Barry Calpine was responsible for many entrepreneurial projects that transformed this company (Netter, 2011). First, its product diversification and innovation skills enabled it to remain relevant and command significant markets. The company stopped launching a string of new products and focused on investing in the existing ones. The formation of a three-tier system enabled the company to focus on issues that affect the value of its products. The recent new product sales hit $100 million because of the innovations that transformed the production and marketing strategies of this company. Kraft focused on Mio, Oscar Mayor selects, and Velveeta Cheese as its primary products that were expected to generate high profits. In addition, it designed new approaches for producing K-Cups and Gevalia to be unique from their competitors. Its current strategy involves redesigning Kraft Singles American Cheese using healthy ingredients. Its recent investment and exploration of Philadelphia Soft Cream Cheese will help this company to produce products that have a soft texture and more nutrients from fruits. In addition, it redesigned the packaging and graphics of most of its products to attract customers’ fruit (Callaghan, 2015). The production of market-specific products helped this company to diversify its markets. The graph below shows the growth of annual dividends since 2012 after Kraft launched its three-tier product promotion system (Callaghan, 2015).

Value addition to its existing products is Kraft’s major entrepreneurial skill. Job creation and the making of a unique world has been guiding principle that propels this company to achieve greater success (Savitz, 2012). The closure of its subsidiary (Somerdale) in the United Kingdom after acquiring Cadbury was perceived as a significant loss of job opportunities in this country. However, the capital injected into Cadbury, and the experienced human resource and high-end technologies created more jobs than those that were wasted. This company appreciates the roles it plays in improving the lives of its customers and offering employment opportunities to local communities (Baker, 2012). In addition, its corporate social responsibility initiatives reflect the need to promote sustainable use of the environment.

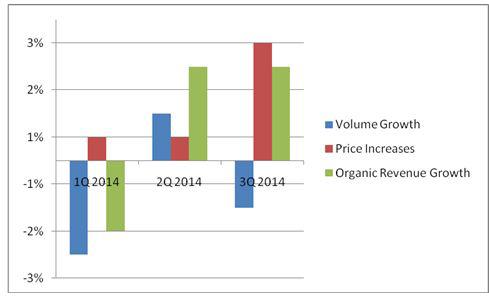

Lastly, Kraft invests in unique products and uses customer preferences to produce high-quality goods. It has left a legacy that no other company is likely to beat (Stahl, 2013). The company has maintained a positive performance record despite the economic challenges that affected multinationals. Economists argue that this acquisition was easier than expected, and the process worried United Kingdom’s investors who thought that Cadbury had set a dangerous precedent (Appelbaum, 2013). The diversification of product lines, creation of job opportunities, and stable income for families of employees and suppliers are some of the achievements that make this company entrepreneurial. The graph below shows Kraft’s performance after innovating new products.

Kraft’s Acquisition of Cadbury (External Corporate Venturing)

Proper Management of Projects

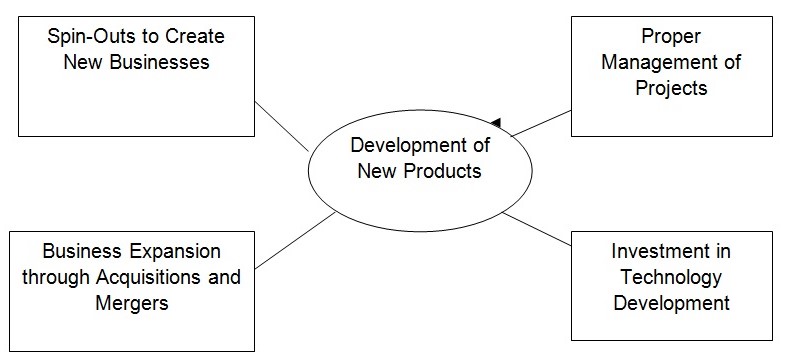

Spin-Outs to Create New Businesses Kraft’s acquisition of Cadbury was very controversial because of the issues that surrounded the ownership and valuation of the company. External corporate venturing motivated Kraft to expand its operations from grocery manufacturing and processing to confectioning. The acquisition process was not smooth because Kraft faced criticism and resistance from stakeholders based in the United Kingdom (Hitt, 2011). Economists argue that Kraft bought Cadbury’s shares intending to become the majority shareholder and then bought it at a throw-away price. They argue that there might be an insider who was interested in ensuring that Kraft acquires Cadbury without resistance. Secondly, Sir Rodger Karr, the chairman of Cadbury resisted the proposal and constituted a legal team to evaluate the intentions of Kraft before the takeover was allowed (George, 2014). It was reported that his efforts were thwarted by the nature of ownership of the company. Kraft owned 49% of the shares of Cadbury, and this means that it has an enormous influence on its decisions. The diagram below shows Kraft’s external corporate venturing.

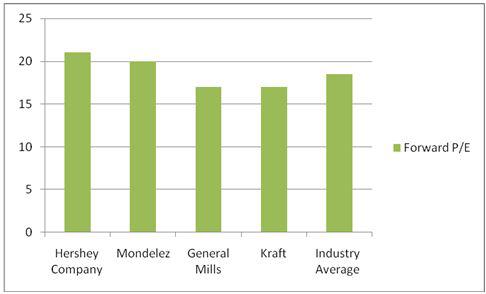

Secondly, Kraft undervalued the worth of Cadbury to ensure it acquired it at a cheaper price. The boardroom wrangles started when the majority shareholders began arguing that its 745 pence per share were unattractive (Barone, 2013). The debate that surrounded this acquisition led to significant changes in the ownership of multinationals and how they operated in the United Kingdom. Economists argue that the takeover was forceful because the United Kingdom did not appreciate how the process was conducted. In addition, the defensive advisory team, constituted by Sir Carr suggested that Kraft was not the best company to acquire Cadbury (Adams, 2013). The defensive advisory team believed that Kraft’s slow growth conglomerate would affect the reputation and performance of Cadbury, and the effects would be felt by other stakeholders in the United Kingdom (Erel, 2012). The aim was to create more value for its shareholders who were already impatient with its weak and slow growth. The graph below shows how Kraft’s external corporate venturing enables it to compete favorably with its peers.

Recommendations for Other Companies

The takeover of Cadbury by Kraft was a significant event that transformed the acquisition process in the United Kingdom and other countries. Other companies should learn the following valuable lessons and take the recommendations as mitigation measures in case of an inevitable acquisition.

First, Kraft uses different marketing and product innovation skills to ensure it remains relevant in the present market. This company has a keen eye and ear and pays attention to the changes in consumer demands and trends (Kalic, 2011). For instance, it developed an innovative system that ensures most of its products are processed without using preservatives. Suppliers of raw materials are expected to use healthy production methods to ensure their products are of high quality. Companies should not be rigid and use outdated systems in today’s markets. Kraft could not have succeeded if it had not changed the qualities of its products to meet the existing needs of its clients. In addition, diversification of product lines ensured this company had a string of unique products that targeted different markets. Other companies should understand that market segmentation and consumer tastes and preferences are important aspects that determine what they should produce.

Secondly, all investors should know that limited companies are owned by shareholders who have the last say when it comes to making critical decisions. Shareholders can influence the decisions of a company because they have the financial muscles to do so. Companies should not allow a shareholder to own more than a third of the total share because this means that the individual will have more power to influence the decisions of a business. There should be limits to the number of shares that an individual can own. Cadbury sold its soul to Kraft when it allowed it to be the majority shareholder yet it had a history of controversial acquisitions (Tsagas, 2014). It would have been impossible to sell Cadbury if local investors had more shares than Kraft. Therefore, companies should evaluate their public offers to ensure their stocks are not oversubscribed by individuals who may have different intentions. Further research should be done to discover why Kraft decided to acquire Cadbury yet it was not for sale.

Lastly, Kraft expanded its operations by merging or acquiring other companies and using external corporate venturing approaches (Cefis, 2014). Therefore, this company has gained vast experience in acquiring and merging with others. However, the process and time used to acquire Cadbury raise concern over the legitimacy and interests of Kraft in buying its shares at the initial stages (Wintoki, 2014). The report presented by Sir Carr and his team revealed that Kraft had over the years raised its shares to become the majority shareholder to acquire it. For instance, Company ‘A’ may acquire company “B” if both are involved in similar activities and thus they are competitors. However, the case of Cadbury and Kraft points at a different issue surrounding acquisitions by multinational companies. Companies willing to float their shares should study the practices of willing buyers before accepting their bids. It is surprising that Cadbury accepted Kraft’s bids and never cautioned its motives yet they are not in the same production sector. Kraft could have acquired other smaller companies based in the United States, but since it had hidden interests it decided to explore other options in the United Kingdom.

Conclusion

The acquisition of Cadbury by Kraft was a monumental event that shaped the rules that governed the ownership and transfer of limited and public companies. Kraft is an entrepreneurial company because the approach it employed in ensuring its dominance in Cadbury was unquestionable. The transfer of ownership faced criticism from other shareholders and the public, but Kraft’s power was vested in its financial dominance in Cadbury’s shares. Other companies willing to offer their shares or merge with others should use this case as an example to cushion themselves from unexpected and forceful takeovers. Companies decide to sell their property when if they are unable to finance their bills and compete effectively. However, some acquisitions are not helpful to companies that decide to sell their property to others. Investors should ensure they understand the economic impacts of acquisitions before selling their companies.

References

Adams, W (2013), Dangerous Pursuits: Mergers and Acquisitions in the Age of Wall Street. Beard Books, New York.

Appelbaum, E (2013), ‘Implications of financial capitalism for employment relations research: Evidence from the breach of trust and implicit contracts in private equity buyouts’, British Journal of Industrial Relations, vol. 51, no. 3, pp. 498-518.

Baker, M (2012), ‘The effect of reference point prices on mergers and acquisitions’, Journal of Financial Economics, vol. 106, no. 1, pp. 49-71.

Barone, E (2013), ‘A Habermasian model of stakeholder (non) engagement and corporate (ir) responsibility reporting’, Accounting Forum vol. 37, no. 3, pp. 163-181.

Callaghan, H (2015), ‘Who cares about financialization? Self-reinforcing feedback, issue salience, and increasing acquiescence to market enabling takeover rules’, Socio-Economic Review, vol. 19, pp. 49.

Cefis, N P (2014), ‘Crossing the innovation threshold through mergers and acquisitions’, Research Policy vol. 19, pp. 37.

Erel, I (2012), ‘Determinants of cross‐border mergers and acquisitions’, The Journal of Finance, vol. 67, no. 3. pp. 1045-1082.

George, B (2014), ‘How to Outsmart Activist Investors’, Harvard Business Review, vol. 38, pp. 3-9.

Hitt, M A (2011), Mergers & Acquisitions: A Guide to Creating Value for Stakeholders. Oxford University Press, Oxford.

Kalic, M (2011), ‘Kraft’s acquisition of Cadbury,’ Ekonomski Pogledi, vol. 1, pp. 173-195.

Netter, J (2011), ‘Implications of data screens on merger and acquisition analysis: A large sample study of mergers and acquisitions from 1992 to 2009’, Review of Financial Studies, vol. 29, pp. 51.

Savitz, A (2012), The Triple Bottom Line: How Today’s Best-Run Companies are Achieving Economic, Social and Environmental Success, and How You Can Too, John Wiley & Sons, New York.

Smith, H (2015), ‘Cadbury’s” Chocolate Wars: From Cadbury to Kraft: 200 Years of Sweet Success and Bitter Rivalry’, Quaker Studies, vol.16, no. 2, pp. 8.

Stahl, G K (2013), ‘Sociocultural integration in mergers and acquisitions: Unresolved paradoxes and directions for future research’, Thunderbird International Business Review, vol. 55, no. 4, pp. 333-356.

Strine, L E (2012), ‘Our Continuing Struggle with the Idea that For-Profit Corporations Seek Profit’, Wake Forest Law Review, vol. 47, pp. 135.

Tsagas, G (2014), ‘Tug of War between an open market for corporate control and a long-term vision for UK Firms: Reconsidering target directors’ advisory role post the takeover of Cadbury’s plc’, Journal of Corporate Law Studies, vol. 3, pp. 33-36.

Wintoki, M B (2014), ‘A Long-Term Vision for UK Firms? Revisiting the Target Director’s Advisory Role since the Takeover of Cadbury’s plc’, Journal of Corporate Law Studies, vol. 14, no. 1, pp. 241-275.