Introduction

The prosperity of every country depends on its social, political, and economic development. It equally refers to both developed and developing states, with Kuwait representing the latter group. Located in the Middle East, this state has a small but relatively wealthy economy. The country is located in a desert, and its economy benefits from oil deposits and oil sales (Mohaddes & Pesaran, 2017).

According to Burney, Mohaddes, Alawadhi, and Al-Musallam (2018), however, domestic political shocks minimize the advantages of the oil deposits for the state economy. In addition to that, appropriate weather conditions are also said to influence Kuwait’s economy negatively (Cashin, Mohaddes, & Raissi, 2017). One can note that the information above has resulted in the fact that the economy “was not able to progress as fast as it could” (Hassan, Shriaan, & Al-Mutairi, 2017, p. 24). Thus, a more detailed analysis of the country’s GDP, interest rate, inflation and CPI, unemployment rate, and foreign direct investments is needed to estimate the Kuwait economy accurately.

GDP

GDP is one of the principal indicators that show the state of any economy. It means that an increase in GDP will inevitably lead to some economic improvements for a whole nation. Over its history, Kuwait could not impress with stable GDP because its ratio depends on many phenomena, and oil prices are said to be the most crucial among them. As Arslan, Bozgeyik, and Al-Azaki (2019) state, between 50% and 60% of Kuwait’s GDP is represented by oil revenues (p. 688). That is why any changes in oil prices influence the economy of this country appropriately.

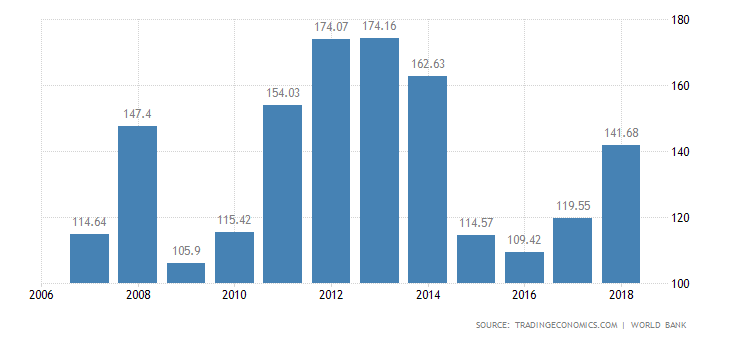

The information above explains the fluctuations in GDP ratio throughout state history. For example, Kuwait entered a phase of continual development in 2009 since every following year saw an increase in GDP (Almujamed, Tahat, Omran, & Dunne, 2017). However, the collapse of oil prices in mid-2014 resulted in the fact that GDP started decreasing. As a result, Figure 1 shows that it reached a minimum of 109.42 USD Billion in 2016 (Trading Economics, 2019c). This situation meant that the country needed to look for alternative sources of revenue to avoid such collapses in the future. Figure 1 stipulates that Kuwait has coped with this task because GDP started increasing in 2017.

Interest Rate

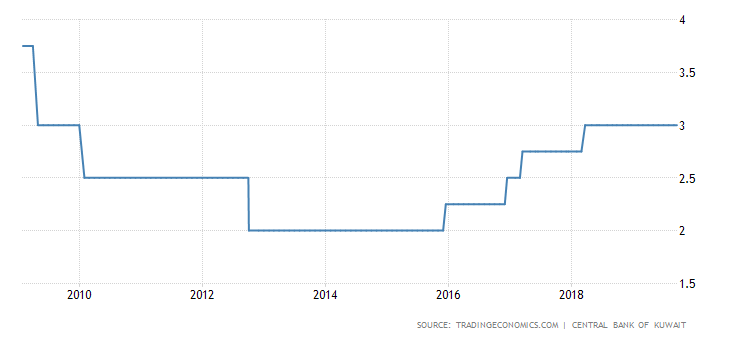

Interest rate is an economic indicator that is significant and perceptible for ordinary citizens. The government understands, and the Central Bank of Kuwait (CBK) tries to keep it low even though it can be a difficult task in some cases. It refers to the fact that higher oil prices are said to increase the interest rate (Kisswani & Elian, 2017). The CBK combats this fact by linking its dinar to a basket of currencies rather than to the dollar alone (NBK Economic Research Department, 2019). This flexibility makes it possible to respond to changing economic conditions and control the interest rate. As a result, the CBK manages to keep this economic indicator relatively low and stable since it changed from 2% in 2015 to 3% in 2018 (NBK Economic Research Department, 2019, p. 4). This state of affairs is supported by Figure 2 (Trading Economics, 2019e).

Inflation and CPI

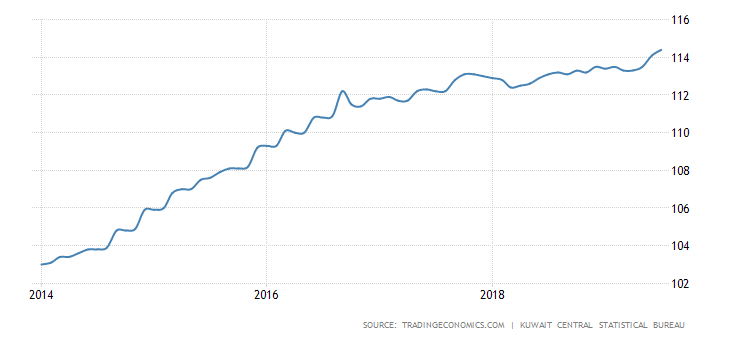

Inflation and CPI are in close connection because a consumer price index is used to measure inflation. The two indicators are significant for the economy and ordinary people because they introduce price changes, either positive or negative, over time. Figure 3 shows that CPI has been continually increasing since 2014 when it was 103 index points; it was 114.10 index points in June of 2019 (Trading Economics, 2019a).

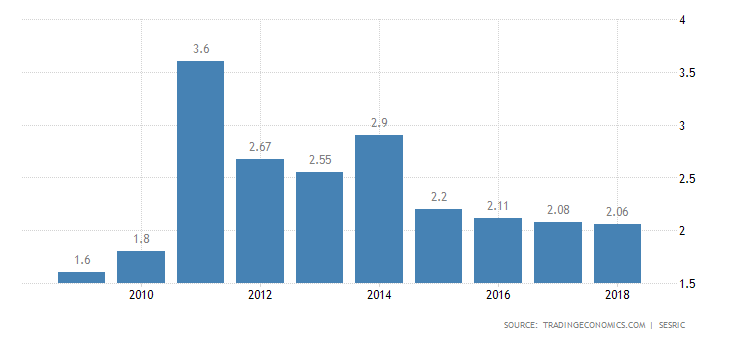

At the same time, Figure 4 indicates that inflation was showing the opposite tendency between 2016 and 2018 when it was approaching 0 (Trading Economics, 2019d). That change is considered positive because the inflation rate was 3.2% in 2016 (Fakir and Kanafani, 2017, p. 1). That decrease could be considered even more positively because lower inflation rates mean lower inflation uncertainty, which is good for both the economy and individuals (Zuhd & Saleh, 2017). At the same time, Paul, Ali, Soomro, Ali, and Abbas (2018) stipulate that a “one percent rise in inflation will increase the economic growth by 0.019%” (p. 161). Thus, it is possible to expect some positive consequences of the inflation rise to 1.2% in 2019 (Trading Economics, 2019d).

Unemployment Rate

This economic indicator shows a percentage of people who are not involved in labor activities. This phenomenon can be caused by either subjective or objective reasons. For example, a person does not work because either they do not want it, or they cannot find a job. Furthermore, Doğan and Erdoğan (2016) stipulate that Arab countries are interconnected. It means that if any country experiences some changes in the unemployment rate, its neighboring countries are said to face the same changes (Doğan & Erdoğan, 2016).

Thus, it is reasonable to analyze this economic indicator drawing attention to both domestic and foreign affairs of a state. As for Kuwait, it has always had relatively decent unemployment rate indicators showing 3.4% in 2011-2012 (Abdel-Khalek & Korayem, 2018). Thus, the country demonstrates an evident tendency to minimize the unemployment rate reaching 2.06% in 2018, and it is supported by Figure 5 (Trading Economics, 2019f).

Foreign Direct Investments

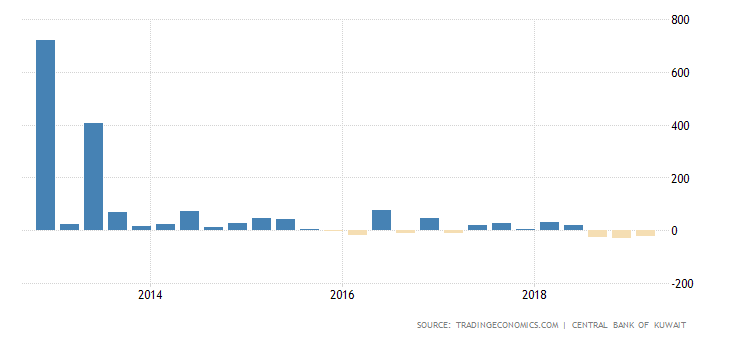

As has been mentioned, Kuwait has already suffered from the fact that its economy was based mainly on oil revenues. In this case, any decrease in oil prices created some problems for the state. That is why Kuwait needed to look for additional sources of income, and foreign direct investments were among them. This economic segment does not impress with stability because Kuwait’s FDI can change dramatically in a year, and it is proved by Figure 5 (Trading Economics, 2019b). Thus, it is indicated that the highest FDI ratio of 721 Million dinars was achieved in late 2012 (Trading Economics, 2019b).

In addition to that, Figure 5 suggests that the following years witnessed more mediocre investments, which can be explained by uncertain oil prices (World Investment Report, 2015). Haque, Patnaik, and Hashmi (2016) mention that such foreign direct investments result in “a positive contribution to the economic flourishing of the country” (p. 14). However, poor results of 2018 with negative FDI mean that Kuwait should reconsider its approach toward this economic segment.

Conclusion

Kuwait is an example of a developing country in the Middle East. Thanks to its geographical position, the country has extensive oil deposits to develop its economy fast and effectively. However, various political shocks, both foreign and domestic, prevent Kuwait from achieving significant economic results. At the same time, the country does its best to improve many segments of its economy, including GDP, interest rate, inflation and CPI, unemployment rate, and foreign direct investments.

References

Abdel-Khalek, A. M., & Korayem, A. S. (2018). The relationship between happiness, income, and unemployment rate in Arab and Western countries. Mankind Quarterly, 59(2), 242-254.

Almujamed, H., Tahat, Y., Omran, M., & Dunne, T. (2017). Development of accounting regulations and practices in Kuwait: An analytical review. Journal of Corporate Accounting & Finance, 28(6), 14-28.

Al-Fakir, D., & Kanafani, N. (2017). Kuwait: Inflation stable at 3.5% in December; averaged 3.2% in 2016. Web.

Al-Zuhd, T. A. H., & Saleh, M. H. (2017). Inflation and inflation uncertainty nexus in Kuwait: A generalized autoregressive conditional heteroscedasticity modeling approach. International Journal of Economics and Financial Issues, 7(5), 198-203.

Arslan, I., Bozgeyik, Y., & Al-Azaki, Z. (2019). The role of bank credit in Kuwait economic growth. International Journal of Academic Research in Business and Social Sciences, 9(2), 686-700.

Burney, N. A., Mohaddes, K., Alawadhi, A., & Al-Musallam, M. (2018). The dynamics and determinants of Kuwait’s long-run economic growth. Economic Modelling, 71, 289-304.

Cashin, P., Mohaddes, K, & Raissi, M. (2017). Fair weather or foul? The macroeconomic effects of El Niño. Journal of International Economics 106, 37-54.

Doğan, C., & Erdoğan, S. (2016). An empirical analyses of unemployment hysteresis and natural rate of unemployment approaches for MENA countries. Optimum Journal of Economics and Management Sciences, 3(2), 41-50.

Haque, A., Patnaik, A. K., & Hashmi, S. Z. (2016). Foreign direct investment and growth: A study in the context of Kuwait. International Journal of Financial Research, 8(1), 9-15.

Hassan, M., Shriaan, A. A., & Al-Mutairi, A. k. (2017). An analysis of Kuwait economy 1995-2015. Asian Social Science, 13(12), 24-34.

Kisswani, K. M., & Elian, M. I. (2017). Exploring the nexus between oil prices and sectoral stock prices: Nonlinear evidence from Kuwait stock exchange. Cogent Economics & Finance, 5(1), 1-17.

Mohaddes, K., & Pesaran, M. H. (2017). Oil prices and the global economy: Is it different this time around? Energy Economics 65, 315-325.

NBK Economic Research Department (2019). Non-oil growth seen at 3% in 2019, and fiscal position remains manageable. Web.

Paul, F. H., Ali, S. R., Soomro, R., Ali, Q., & Abbas, S. K. (2018). Exchange rate volatility and economic growth: Evidence from Kuwait. Eurasian Journal of Analytical Chemistry, 13(6), 158-163.

Trading Economics (2019a). Kuwait consumer price index CPI. [Graph]. Web.

Trading Economics (2019b). Kuwait foreign direct investments. [Graph]. Web.

Trading Economics (2019c). Kuwait GDP. [Graph]. Web.

Trading Economics (2019d). Kuwait inflation rate. [Graph]. Web.

Trading Economics (2019e). Kuwait interest rate. [Graph]. Web.

Trading Economics (2019f). Kuwait unemployment rate. [Graph]. Web.

World Investment Report (2015). United Nations conference on trade and development (UNCTAD). Web.