Introduction

The stock market exchange has a critical role in the economic development of any given state. It serves as an effective tool for mobilizing financial resources to aid in economic growth and promote the efficient distribution of resources. The stock exchange market serves various investors, including retail, corporate and individual traders. Institutional investors are the biggest beneficiaries of stock market activities because of higher risk-adjusted returns relative to individual or retail investors. Financial institutions, insurance firms, publicly traded companies and hedge fund managers are some of the major players in a stock exchange market.

This report focuses on the Malaysian Stock Exchange or Bursa Malaysia under the Kuala Lumpur Composite Index (KLCI). It will explore key features that define and influence Bursa Malaysia.

Bursa Malaysia (Kuala Lumpur Composite Index) Performance

Kuala Lumpur Composite Index (KLCI) is among the world’s largest stock exchanges. KLCI is also important because it represents an emerging market in Asia. Consequently, it has received attention from investors and academics. A study conducted by Cheong (2008) showed that the Malaysian sectoral stock markets were “weak-form inefficient (except the property index) under the structural change” (p. 1291). The study involved the weak-from market efficiency based on data from 1996 to 2006. A weak-form efficient concept is a condition in which one can determine “the current prices by relying on historical data of a given asset” (Cheong, 2008, p. 1291). There were several cases of mean-reverting processes while other sectoral stock markets were weak-form inefficient. Therefore, it was difficult to understand the behaviors of the Malaysian stock exchange (Cheong, 2008).

The Malaysian Stock Market is traded under the Bursa Malaysia. Formerly, it was the KLSE. Trading activities in the Malaysian Stock Exchange commenced in the 1930s by traders from Singapore Stockbrokers. Over the years, the stock exchange has experienced several changes in terms of growth and transformation related to rebranding and renaming. Since 2004, it is referred to as Bursa Malaysia.

Previous research has established that Bursa Malaysia experiences a higher rate of price volatility (Cheong, 2008). Since the economic crisis of Asia in 1997, the Malaysian Stock Market experienced a steady decline in growth until 1998. However, the price volatility persisted until the first quarter of the year 2000. Many indicators were related to the instability in the Malaysian Stock Market during its volatile period. First, the government pegging regulation on the Malaysian ringgit affected the market. In addition, there was a widespread withdrawal from trading as investors reacted to economic shock in Asia. It is imperative to note that the government aimed to stabilize the market through the pegging policy.

Between 1999 and 2000 in the second quarter, the Malaysian Stock Market performed well. This period proved that pegging indeed reduced volatility in the stock market. Consequently, prices moved toward stability with a slight improvement in trading patterns. Although there was a slight improvement in pricing and market stability, the crash of the dot-com era and the exit of some of the multinational firms affected Malaysian trading activities. After the slight decline between the years 2000 and 2001, the Malaysian Stock Exchange gained an accelerated growth until the year 2006, but with noticeable instability. The accelerated growth resulted from the pegging policy. The policy ensured a stable supply of funds and increased national earnings. The positive changes experienced in different macroeconomic indicators helped in facilitating growth and price in the stock exchange.

Although data on stock market activities are available to the public, not many people show interest in stock market investments. The public can use such data to evaluate the performance of stock markets and make informed investment decisions. Consequently, Bursa Malaysia strives to provide reliable data and update its trading platforms. Thus, it is imperative to understand how stock markets operate because they act as indicators of the economic performance of a country.

One can look at the relative performances of the Malaysian Stock Exchange in different periods to understand possible future performances. Although stock markets are highly volatile, it is possible to understand future performances in an efficient market. Therefore, any investor may work with specific best-performing stocks. On the other hand, a poorly performing stock market also highlights specific stocks, which investors should avoid because such performances may persist into the future.

Financial instruments used in a given state have critical impacts on stock market performances. Thus, financial instruments and fiscal policies could affect volatility and growth in stock markets. Generally, policies about inflation, money supply, exchange rates, and lending rates have significant impacts on investors. When these policies do not create favorable conditions for stock markets, investors are likely to slow down on trading activities. For instance, if Malaysia has unfavorable policies on foreign exchange and transfers, foreign investors may avoid the market and exit altogether because of difficulties in money exchange and transfer.

Recent Trends of Bursa Malaysia

Stock markets are prone to unfavorable predictions. For instance, in January 2014, the World Bank reviewed its growth projections downwards for the global economy. This affected trading activities in many countries, including Malaysia. The announcement affected emerging economies and volatile markets. Investors restricted the market activities because they believed that such markets would turn bearish and result in massive losses.

Another instance that affected Bursa Malaysia occurred on March 10, 2008. Following the mortgage crisis in the US and the political instability due to a general election in Malaysia, “trading was suspended for one hour because the composite index fell by more than 10 percent or 130 points to 1166.32 points” (FactualWorld, 2014). Traders noted that the move resulted from overreactions to political activities. Bursa Malaysia also suffered a hardware breakdown, which resulted in a whole day suspension of trading activities (FactualWorld, 2014).

This series of events shows that any stock market, including Bursa Malaysia, is prone to external and internal influences, which may cause losses to dealers. However, it is difficult to anticipate both internal and external factors and their subsequent effects on the stock market. In most cases, any negative news causes a decline in the KLCI. Such news may affect a given sector or the entire stock market while investors’ reactions could differ significantly.

There are also foreign investors in Bursa Malaysia. In some instances, they account for the largest volumes of trade. Hence, they are net sellers with significant impacts. This implies that Malaysia must continue to create favorable trading environments for such investors to spur its economic activities.

The effect of currency exchange may also affect trading activities, especially foreign investors more so if the Malaysian ringgit gains against the dollar and affects foreign traders. It is imperative to note that any significant event with a regional outlook in Bursa Malaysia may also affect trading activities in other Asian countries.

Trading Economics indicates that the Malaysia Stock Market has gained and achieved “1852.69 Index points in April from 1850.73 Index points in March of 2014” (Trading Economics, 2013). On average, Bursa Malaysia has gained 740.87 Index points between 1977 and 2014 (Trading Economics, 2013). It achieved an Index point of 1872.52 in December 2013, which was the highest in history. On the other hand, Bursa Malaysia has also recorded a low Index point of 89.04 in April 1977.

Investors may gain data from the Kuala Lumpur Composite. It keeps a track of over 30 big firms based on their market capitalization shown on the Main Board of Bursa Malaysia (Trading Economics, 2013).

Economic Growth in Malaysia

The gross domestic product (GDP) has significant influences on a country’s stock market. The GDP shows the national income of a country. It indicates the aggregate market value of any country within a given fiscal year. It is important to note that economic growth and additional liquidity are fundamental and major indicators of stock market growth. Stock market liquidity and the economic progress of a country are the main indicators of the positive performance of a stock market.

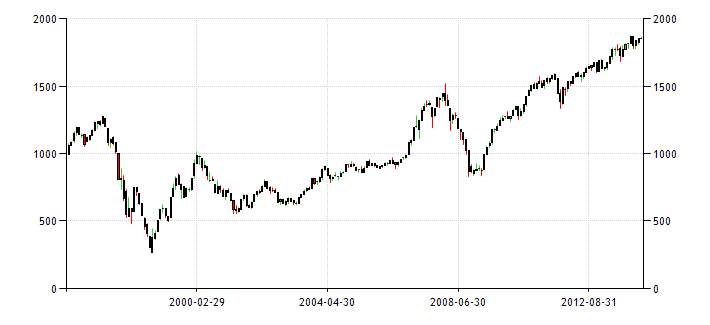

Figure (1) above indicates the growth of the Malaysian Stock Exchange between 1997 and 2014. On the other hand, figure 2 indicates the country’s GDP from 1997 to 2014.

One can observe the correlation between the growth in the GDP and growth in the stock market. Both figures show stable growth with changes. However, it is imperative to recognize that the GDP is an indicator of economic growth across all sectors and it may not be prone to adverse effects of short-term changes. On the contrary, the stock market is highly volatile and susceptible to even speculations. The economic crisis that affected the Malaysian Stock Market also had a similar impact on its GDP.

In short, high and stable economic growth has positive impacts on the stock market of a country. Thus, countries with high GDP also have stable and vibrant stock markets. This has happened in Malaysia from the year 2001 to the present time.

Palm Oil Futures and the Malaysian Stock Exchange

It is important to understand the significance of the palm oil market in the Malaysian Stock Exchange. Since the 1980s, the Malaysian Stock Exchange has been the world’s largest trading hub for palm oil futures. Today, Bursa Malaysia has introduced an electronic platform for trading in the crude palm oil market. The FCPO is the world’s benchmark for palm oil futures (FactualWorld, 2014). Over the years, the Bursa Malaysia management team has strived to improve the Malaysian palm oil trading platform to enhance its position as the world’s leader in the palm oil market. While Malaysian FCPO remains the global pricing standard for crude palm oil, the team introduced OCPO as an extension of the FCPO. It shows the highly developed Malaysian derivatives market. The FCPO is a form of a contract that helps traders to manage risks in hedging activities.

However, external factors also influence trading in palm oil. For instance, Afonso and Poole (2013) noted that during the past election, the palm oil stocks and ringgit fell. In other words, during elections, investors may “avoid holding ringgit-denominated assets for fear of political risks” (Afonso and Poole, 2013). In some cases, traders have cut their projections and average selling prices because they claim that crude palm oil may experience a gradual price appreciation and poor growth in inventory alongside other uncertain issues in the global economy. Other factors related to Ramadan might also result in increased export of palm oil. However, the market volatility occasioned by unbalanced developments in the global economy, palm oil stock, bird flu in China, and the clean energy policy implementation has continued to influence market forecasts and pricing strategies.

However, many investors believe that the Malaysian Stock Exchange provides better opportunities for trading due to readily available information regarding the market and improved insights on the global crude palm oil activities.

Conclusion

A stock exchange has a fundamental role in the economic development of any given state. A vibrant stock market shows a country’s economic development. The Malaysian Stock Exchange is among the world’s active stock exchanges. Moreover, Bursa Malaysia’s position as a trading platform in an emerging economy makes it interesting to both investors and academics alike.

Between 1997 and 2014, the Malaysian Stock Exchange has experienced growth coupled with market volatility. Such growth patterns correlate with the growth in the country’s GDP. The Malaysian Stock Exchange has defined and set a benchmark in the world’s crude palm oil market for many years.

In some instances, it has become difficult to predict future activities of the stock market. This study shows that government monetary policies, political activities and sentiments, and other external factors, such as the global financial crisis have major impacts on stock exchange trading patterns. Therefore, it is imperative for governments to understand how policies and other factors affect stock markets.

References

Afonso, S., and Poole, J. (2013). Palm Oil Declines as Malaysian Stocks, Ringgit Drop on Elections. Bloomberg. Web.

Cheong, C. W. (2008). A Sectoral Efficiency Analysis of Malaysian Stock Exchange Under Structural Break. American Journal of Applied Sciences, 5(10), 1291-1295.

FactualWorld. (2014). Bursa Malaysia. Web.

Trading Economics. (2013). Malaysia Stock Market (FTSE KLCI). Web.