Executive Summary

Secret Recipe is one of the most successful restaurant chains in Malaysia that throughout the last twenty years, has expanded into seven countries in East and Southeast Asia. The company does not plan to tame its ambitions, and the next market to be swayed by this popular lifestyle brand is likely to be Australia. This paper outlines the major tendencies in the global foodservice industry and shows that while it displays steady growth, customers’ needs and preferences are becoming more sophisticated. Due to its highly fragmented foodservice market, Australia offers plenty of opportunities to newcomers; however, they have to stand the fierce competition and strike a chord with Australian customers that are quite spoiled for choice. The present paper summarizes the challenges that Secret Recipe will have to overcome in the country down under and provides recommendations regarding the market entry mode and cross-cultural management.

Introduction

Founded in 1997, Malaysia’s Secret Recipe is a restaurant chain known for its extensive range of high-quality, gourmet cakes. In 23 years since its emergence, Secret Recipe has proven to be one of the fastest-growing cake and cafe chains in East Asia with more than 400 outlets in Malaysia and beyond to date (“Our story”, n.d.). Secret Recipe “cakes & cafés” are found primarily in vibrant urban locations and shopping malls. Table 1 contains some of the key facts about the Malaysian restaurant chain.

Tab. 1. Secret Recipe: key facts (“Our Story”, n.d.; Matrade, 2017)

Secret Recipe is not a stranger to international expansion and global management: since 2001, it has opened outlets in seven countries: Singapore, Indonesia, Thailand, China, Brunei, Maldives, and Bangladesh (“Our Story”, n.d.). Swaying the Australian market would mean entering the strange world of anglophone, low-context culture. This feat might be challenging for Secret Recipe that has so far only operated in high-context cultures similar to the one on its domestic market in Malaysia. This paper critically evaluates the threats and opportunities that Secret Recipe will have to encounter on the Australian market and describes viable management responses to cross-cultural challenges.

Literature Review

Potential opportunities and risks of doing business

Environmental scanning techniques: High context vs Low context cultural environments

One of the major challenges that Secret Recipe will face while expanding to the South is a switch between the high-context cultures of its domestic and operating countries and the low-context culture of Australia. These two notions form one of the approaches to intercultural communication, i.e. a form of communication that entails sharing information across two or more cultures. A high-context culture relies on the unspoken: unwritten rules, non-verbal cues, and implicit communication (Halverson, 1993). Today, Asian (Malaysian included), African, Arab, central European, and Latin American cultures are seen to be high-context cultures, though to different degrees. Low-context cultures, such as Australia, on the other hand, prioritize direct communication that is based on explicitly stated rules (Halverson, 1993). The information in the message is typically exhaustively clear, and the participants of communication do not have to look for hidden clues (Halverson, 1993). Table 1 contains the most common tendencies in high-context and low-context cultures respectively.

Table 3. High context and low-context cultural tendencies (Halverson, 1993)

Opportunities: Why go international?

As opposed to a firm that only operates domestically, an international company faces unique costs and challenges associated with entering foreign markets. A company that is on its way to becoming a multinational enterprise has to solve issues such as having to work with different languages, time zones, and legal structures. Given all these struggles, the question arises as to what it is in going international that outweighs the disadvantages. In general, companies that go international are incentivized by the opportunity of growth and expansion of their operations. If they successfully build their presence in foreign markets, they have chances to increase their revenue, compete for new sales, and diversify their products. Apart from that, going international often means an opportunity to reduce costs and recruit new talent.

However, one may still be wondering as to why invest so much effort into internationalization when there are alternative ways of entering or otherwise interacting with foreign markets. For instance, a company can become a supplier for third parties or outsource their production. One of the most prominent frameworks that explain the need for internationalization is the OLI paradigm, which stands for ownership-location-internalization (Sharmiladevi, 2017). Its author, Dunning, opined that the location advantage of moving production overseas lies in sparing paying tariffs and shipping costs. Besides, labor costs in some third-world countries are extremely low, which allows a company to further race to the bottom. The internalization and ownership advantages mean that a company retains full ownership over its blueprints and patents and protects them from being illegally copied.

Risk analysis techniques used by an international business

SWOT Analysis

The strategy analysis for Secret Recipe in Australia will be conducted using the SWOT framework. SWOT stands for strengths, weaknesses, opportunities, and threats; the framework allows for providing a weighted view on a company’s chances to stand in competition (Grant, 2016). Below is a SWOT analysis of Secret Recipe on the Australian market:

- Strengths (internal advantages):

Secret Recipe has a working business model and its own unique identity that has allowed the brand to stay afloat for more than twenty years. The Malaysian restaurant chain markets itself as a lifestyle brand: it highlights that the experience of visiting its outlets goes beyond mere food consumption. Secret Recipe puts an emphasis on creating a modern and cozy ambiance and providing customers with high-quality food at moderate prices (“Our story”, n.d.). Its “cakes & cafés” are a safe respite for spending quality time with friends and family, or associates after a long day at work (see Image 1). The Malaysian brand has extensive experience of doing business abroad and can apply its knowledge to yet another market. Being a big company, Secret Recipe has resources galore for training staff and developing new solutions. Aside from that, the company has a franchising model that has served it well for years and found application in numerous countries.

- Weaknesses (internal disadvantages)

Firstly, Secret Recipe has never operated in a country with a low-context culture, therefore, the experience of entering Australia will bring about new challenges. Secondly, the restaurant chain might be unprepared for serving customers that are accustomed to online services such as delivery and booking. In Malaysia and some other Asian countries, only 1 to 5% of food retail is done online, which is why companies do not feel incentivized to implement new technologies. In Australia, Secret Recipe might find itself being outpaced by restaurant chains that refined their online platforms and applications.

- Opportunities (external advantages):

According to Mordor Intelligence (2019), the foodservice market in Australia will reach $80.7 billion by 2025. The data provided by the bureau implies a CAGR (capped annual growth rate) of 5.1% during the forecast period from 2020 through 2025. Mordor Intelligence (2019) concludes that the Australian foodservice market presents many opportunities for international players. During the study period, the bureau has discovered that Australian customers have a taste for both fast-food chains and specialty niche products in the market. They fancy foreign food: Mordor Intelligence (2019) names Italian, Chinese, Thai, Indian, Vietnamese, Japanese, Korean, and Mexican cuisines among the most popular with Australians.

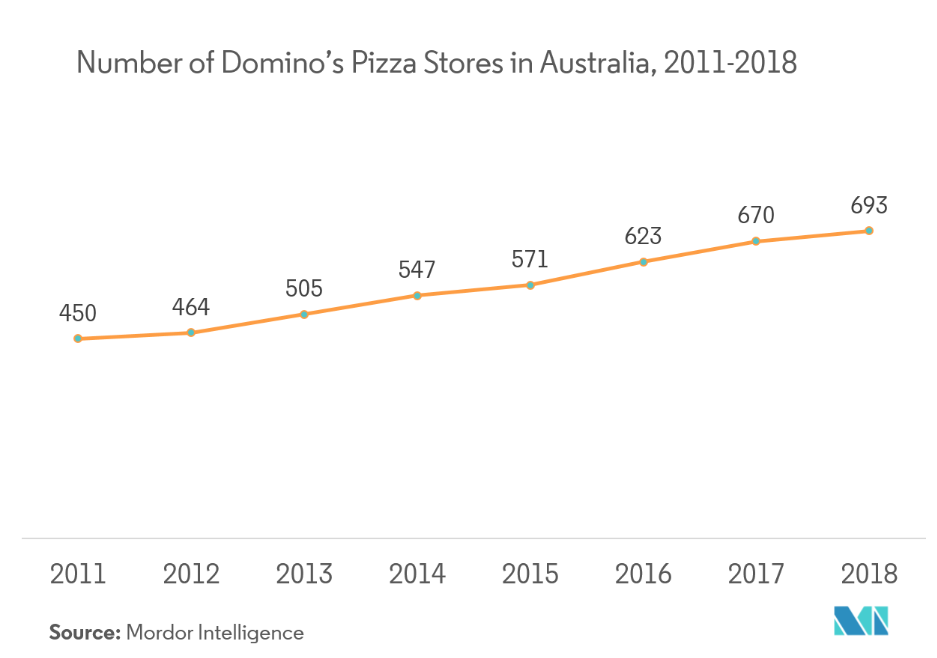

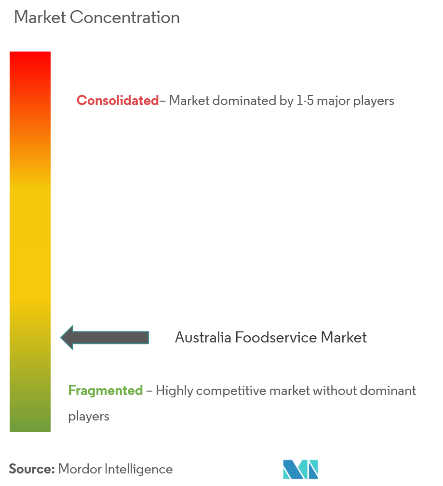

Moreover, Australians are known for their love for coffee. Research and Markets (2019) reports that the Australian coffee market is projected to grow at 5% annually during the forecast period from 2019 through 2024. The factors that fuel the market are its steady growth and sophistication, customers’ willingness to pay more for quality goods and services. Chained food operators such as Domino’s Pizza are showing a steady rise and are expected to continue their growth (see Graph 1). The Australian market is highly fragmented: it does not have major players and is characterized by a high degree of competitiveness (see Graph 2).

- Threats (external disadvantages):

While more people than ever are incorporating eating out into their lives, their needs and wants are becoming more challenging to meet. Finances Online (2020) points out that around half of customers (45%) expect restaurants to have online delivery and booking options. Some 70% of people are adepts of so-called conscious dining: they prefer restaurants that have healthy options on the menu (“The restaurant industry — a global perspective”, 2018). The Australian foodservice market and especially its coffee subset is extremely fragmented. Because of the sophisticated restaurant culture reigning on the country’s foodservice market, the residents are bombarded with overwhelming supply and diverse offerings. As a result, Australians are quite spoiled for choice: they know what should constitute a good coffeehouse or restaurant experience. If the Australian Customer does not like something, they will switch to alternatives galore available in any town (Square, 2018).

Recommendations

Economic Environment

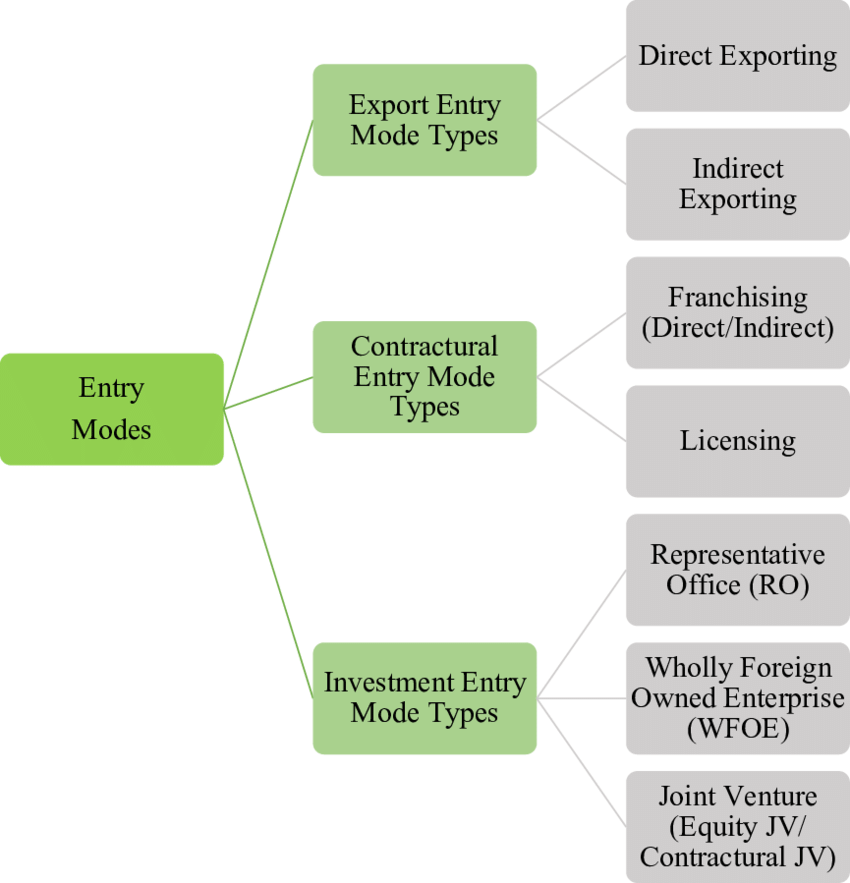

In Australia, it makes sense for Secret Recipe to adhere to franchising as its preferred method of foreign market entry for several reasons. Secret Recipe already has extensive expertise in franchising its outlets (iFranchise Malaysia, n.d.). Its franchising model is quite attractive for entrepreneurs because Secret Recipe provides advertising and promotion support as well as continuous training and advice (iFranchise Malaysia, n.d.). Apart from that, Secret Recipe’s franchisees enjoy help with research and development, field agent visits, and site and design suggestions. Secondly, while sticking to the original concept of the lifestyle brand, Australian franchisees will diversify its ambiance and make it more unique. Local business owners are likely to know what customers seek in a good casual restaurant and will make adjustments accordingly.

Trade Environment

Australia is rated among some of the most open and friendly business environments in the world. Today, the country ranks fifth in the Index of Economic Freedom ranking due to its effective governance that allows multinationals to enjoy safety and security (Australian Government, 2015). As for the ease of doing business, Australia is ranked 15th out of 190 economies when judged by this criterion (Australian Government, 2015). This means that Secret Recipe will not have to fight trade barriers when entering Australia.

Political And Legal Environment

Multinational companies have a responsibility of obeying the laws of each host country. Sometimes legal structures are contradictory or downright inconvenient to adhere to, which requires companies to refine their legal practices. When entering the Australian market, Secret Recipe needs to address potential problem areas sooner rather than later. The company needs to request that its legal department do preventive research to locate problem areas, raise awareness, and suggest solutions. Since Secret Recipe already has experience expanding abroad, it can derive best practices for Australia from what kinds of policies have worked in the past. The key sources of knowledge may be position papers, in-service education programs, and the advice of senior legal staff.

Organization

Another challenge that Secret Recipe will have to face in Australia is the high fragmentation of the country’s foodservice market. There is a threat that the Malaysian brand will blend into the background if it does not find its voice and creates a valuable message for its Australian customers. Firstly, Secret Recipe needs to avoid coming off as too corporate: Australian like the unique vibe and design of small cafes and restaurants. Secondly, it would make a lot of sense if Secret Recipe would emphasize the health aspect of its menu. Like the rest of the world, Australians are growing conscious of their eating habits, and a restaurant that delivers healthy food would stand out among numerous fast food outlets. Lastly, Secret Recipe could appease customers by offering them easy-to-use, fast online services such as delivery and booking.

Leadership Styles

Entering a new market can usher a company into a stressful period where the management can be tempted to tighten its grip and take control over all business aspects. However, poor leadership that leans toward autocracy can create a toxic atmosphere and demotivate the foreign staff from achieving the common goal. Secret Recipe needs to find a middle ground between autocracy that is more common in the Asian business environment and the laissez-faire attitude that is more characteristic in anglophone cultures.

Communication

Apart from that, the cultural aspect of Secret Recipe’s penetration of the Australian market is not to be dismissed. There are no doubts that the company will benefit from cross-cultural training, but the question arises as to whom it should target in the first place. Given that Secret Recipe will continue franchising its outlets, the franchisees are likely to hire Australian residents. In this case, the cultural difference between the employees and the customers will be minimal to non-existent. Therefore, the group of individuals that do need cultural training is the company’s management: those are the people who are going to be negotiating with Australians. The training should be problem-based as this approach stimulates engagement and participation and teaches independent use of information.

Conclusion

The Malaysian restaurant chain Secret Recipe is an example of a successful brand that has found its own identity, stayed afloat for two decades, and won the hearts of customers in seven countries. Australia might be the brand’s next conquest; however, entering the highly fragmented and competitive Australian market comes with its own set of challenges. The foodservice market in Australia is on the rise, and the customer seems to be friendly to newcomers. Yet, Secret Recipe still has to make itself stand out among hundreds of contenders by emphasizing the health aspect of its products and prioritizing innovation and technology. It makes sense for the Malaysian company to continue applying its franchising model and conducting cross-cultural training among its management.

Reference List

- Asia Import News 2019, Asia-pacific food service market size.

- Australian Government 2015, Business.

- Calvelli, A & Cannavale, C 2019, ‘Market entry strategy’, in Internationalizing firms, Palgrave Macmillan, Cham, New York City, pp. 59-110.

- Finances Online 2020, 75 significant restaurant statistics: 2020 analysis of data & market share.

- Grant, RM 2016, Contemporary strategy analysis: text and cases edition, John Wiley & Sons, New York City.

- Halverson, CB 1993, ‘Cultural-context inventory: the effects of culture on behavior and work style’, Annual Developing Human Resources, pp. 131-131.

- Hussain, D, Sreckovic, M and Windsperger, J 2018, ‘An organizational capability perspective on multi-unit franchising’, Small Business Economics, vol. 50, no. 4, 717-727.

- iFranchise Malaysia n.d., Secret Recipe Franchise Business Opportunity.

- Matrade 2017, Secret recipe.

- Mordor Intelligence 2019, Australia foodservice market – growth, trends, and forecast 2020 – 2025).

- Our story n.d.

- Research and Markets 2019, Australia coffee market – growth, trends and forecasts (2019 – 2024).

- Sharmiladevi, JC 2017, ‘Understanding Dunning’s OLI paradigm’, Indian Journal of Commerce and Management Studies, vol. 8, no. 3, p. 47.

- Square 2018, The 2018 Square Australian coffee report.

- The restaurant industry — a global perspective 2018.

Bibliography

- Jogaratnam, G 2018, Human capital, organizational orientations and performance: evidence from the restaurant industry, International Journal of Hospitality & Tourism Administration, vol. 19, no. 4, pp. 416-439.

- Keegan, WJ 2017, Global marketing management, Pearson India, Delhi.