Company Case

The case of Nissan’s resilience during a major catastrophe is an outstanding example of a rapid and efficient response to a crisis. It is important to understand that the company was struck heavily on all fronts, but the management was competent enough to carry Nissan through these challenges. The crisis was not manifested in a single form but rather had three primary elements, such as earthquake, tsunami, and nuclear threat. Many of Nissan’s facilities took a toll on all three natural disasters, which heavily damaged the company’s operations, marketing, and finances (Simchi-Levi & Schmidt, 2013). Being an automobile manufacturing company, Nissan possesses a complex supply chain network from both distributors and suppliers. Therefore, input and output streamlines were shaken significantly, which hindered the company’s processing power and transformation process approaches.

Operations management principles allow Nissan to evaluate the general characteristics of successful process-based organizations. Having assessed the current state of the company according to these principles, leaders will be able to determine the state of the company, establish which actions and strategic decisions of the process management will bring the company closer to more complete and straightforward process management practices. Before launching operational improvement projects, organizations need to determine how well the company works in specific areas, taking into account both its strengths and weaknesses.

In addition, one needs to determine what the ideal future state of the organization should be. Only then can company leaders make a map of the transition from the current state to the ideal one, guided by the above principles of process management (Reid & Sanders, 2015).

Having assessed the capabilities of the organization according to these principles, one needs to determine the actions that ensure the effective operation of the intended process, and prioritize them. It is necessary to make sure that these actions and their consequences correspond to strategic goals and objectives, that is, they carry out a “reconciliation with reality”, which ensures that there are no contradictions between the process management plans and other business initiatives and projects. Before developing the company’s processes, it is necessary to determine how process-oriented it is.

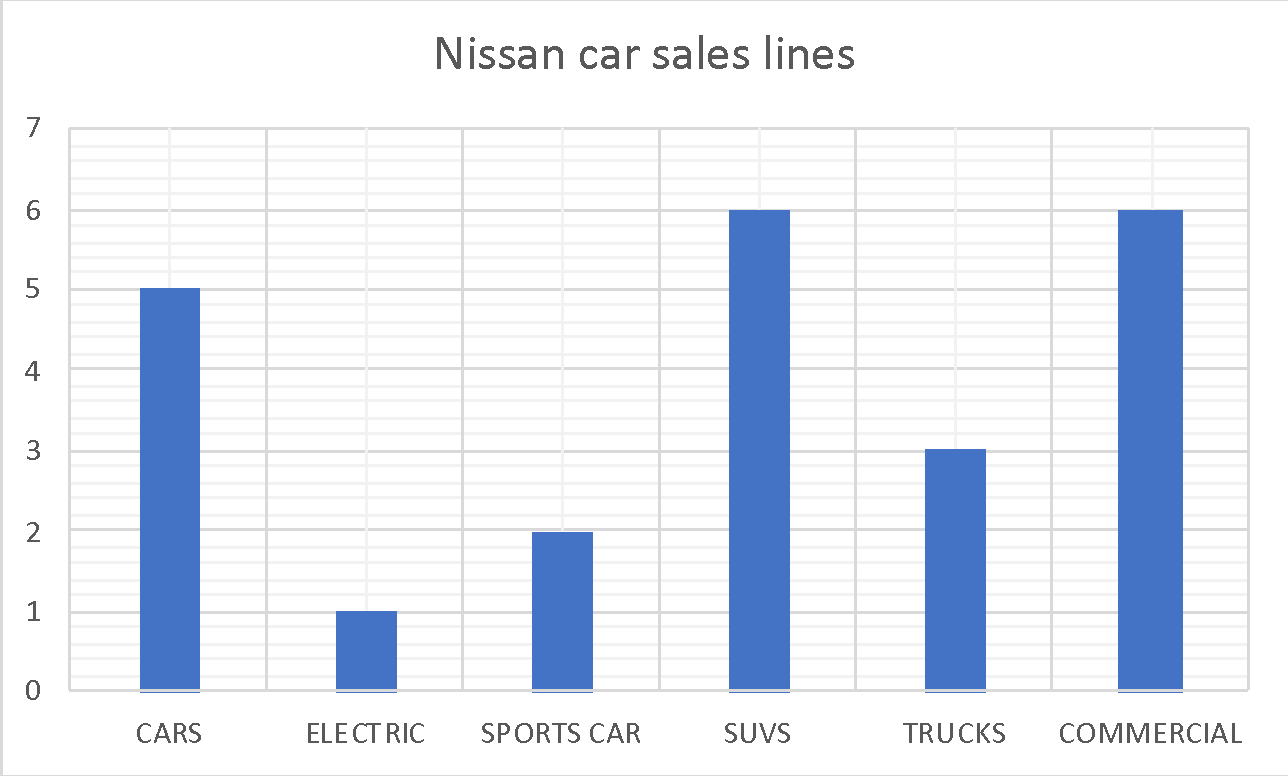

It is important to note that Nissan primarily offers products to its customers, such as automobiles (Fig. 1). The company was at the forefront of mass manufacturing, which is designed to maximize the quantity of production without much investment. After the disaster occurred, Nissan was able to enhance its agility by being flexible and ready for major risk factors (Simchi-Levi & Schmidt, 2013).

The company quickly shifted towards lean manufacturing, where it primarily focused on the most profitable and demanded product lines. It successfully terminated less popular and profitable automobiles in order to minimize the financial aspect of the damage. In regards to the decision-making process at Nissan, it primarily implemented performance metrics and trade-offs. The company was in a crisis situation, which meant that it needed to maximize outputs with a minimum amount of inputs. In addition, Nissan preserved its corporate social responsibility by being able to remain ethical. This was achieved by sharing information regarding the response protocol with its suppliers and distributors (Simchi-Levi & Schmidt, 2013). Such an approach was critical to ensure that both company and its cooperating parties were able to survive and recover in a minimum period of time.

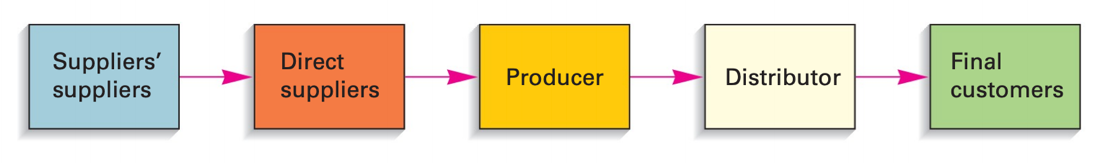

In organizations with process thinking, some groups are perceived as processes, and there is a desire to understand how these processes interact within the company, accepting something at the input and producing products, services, and profits. Process thinking leads to the formulation of definitions and documentation of processes, but not enough to fully integrate these definitions and the process into the business culture. At Nissan, work should begin with interaction with the customer and ends with the delivery of products or services, for example, the process from procurement to payment as shown in Figure 2. It also should start with the customer’s request for product services and ends with invoicing the customer. The process needs to fully integrate finance, sales, and supply chains.

The company’s management needs to be able to decide which type is most suitable for the implementation of its tasks, and this decision depends on the company’s customers. Not every organization needs to become process-based because many organizations work according to a matrix management model, in which process-based management is superimposed on existing functional or product infrastructures (Stevenson, 2017). In the functional-process matrix, functions or departments should be listed horizontally, and value chains or business processes vertically, it is clear which process what functions are involved. Organizations may prefer matrix management, and then the movement towards the formation of processes can become their goal.

In conclusion, Nissan was highly competent in properly responding to the crisis through the resilience of its operations management. The company was quick at shifting from mass customization to a lean manufacturing style of production, where only the most demanded and profitable product lines were manufactured. In addition, the company was successful at remaining ethical and adhering to its corporate social responsibility. The latter was achieved by sharing information with third parties in order to allow them to use holistic approaches to derive the most plausible course of action (Reid & Sanders, 2015).

Nissan’s decision-making approach was also effective at choosing the right strategy in response to the threat. The company used a performance metrics approach to proceed to lean manufacturing, where it identified the most valuable product lines. In addition, Nissan aggressively used a trade-off approach to eliminate unnecessary aspects of operations, which was paramount during the presence of an overwhelming number of risk factors.

Innovations

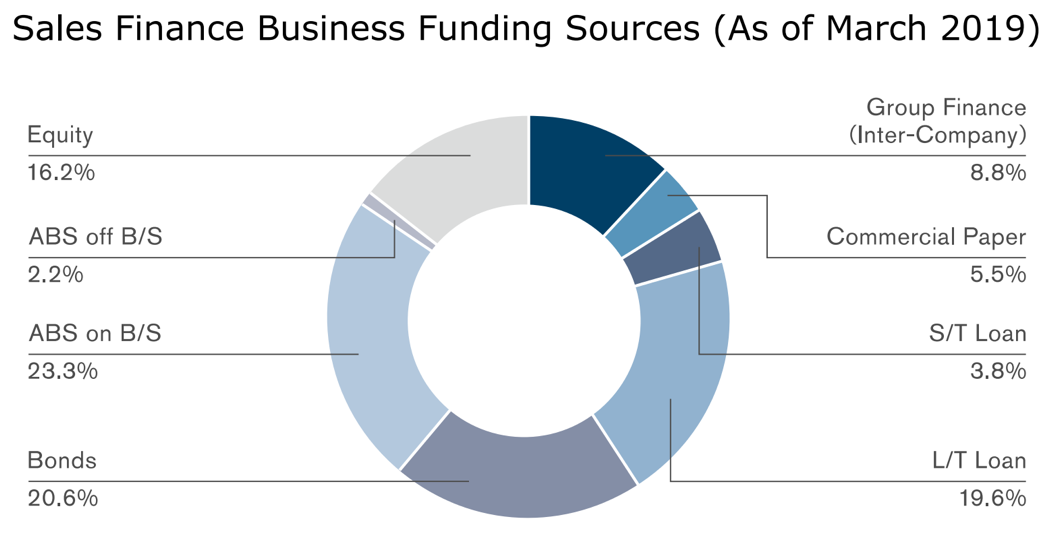

The given case of Nissan is an illustration of a company being innovative and experienced in being able to respond to crisis situations. The company realized from early on that proper risk management and flexibility plays a central role in increasing survival chances. In 1999 Nissan underwent major financial difficulties that were resolved through cooperation measures with Renault as illustrated in Figure 3 (Simchi-Levi & Schmidt, 2013). This heavily influenced Nissan’s overall strategy regarding its risk management philosophy, which was focused on identifying risk as early as possible. However, the biggest blueprint of the company innovativeness emerged during its financial action empowering measures the variety of which is shown in Figure 4.

Nissan was highly flexible in changing the previous processing procedures by eliminating any lengthy analysis and bureaucracy revolving around decision-making (Reid & Sanders, 2015). Such an approach allowed the company to be highly self-sufficient and proactive in undertaking major challenges and resolving them in quick succession.

It is important to point out that a significant part of innovation at Nissan came after the disaster, where the company decided to increase the local production of the cars. The management stated that it wanted 90% of Nissan cars to be manufactured in the Americas, which was at 70% pre-crisis (Simchi-Levi & Schmidt, 2013). Another important aspect of Nissan is the fact that it implemented changes both radically during the disaster and incrementally before it. During the crisis, Nissan quickly shut down the production in a highly targeted manner.

This is an example of lean manufacturing, where a specific set of products will be produced, and other unimportant ones will be terminated. In addition, the company was quick at allocating supplies according to customers’ needs. For example, Nissan, despite undergoing major challenges integrated GPS technology in its cars, but the low-end models did not receive it (Simchi-Levi & Schmidt, 2013). This is an illustration of a company being resourceful and resilient at the same time.

In order to ensure economic stability in a market environment characterized by financial stability, the competitiveness of products and technology, production, and sales efficiency, large enterprises carry out reactive and strategic innovations due to the reaction to the transformation of competitors and environmental changes. Reactive innovations are adaptive, while strategic innovations are proactive since their implementation will lead to significant competitive advantages in the future. Innovation activity is a systematic type of activity aimed at creating and implementing innovations in public practice.

The innovation process is based on the innovative activities of society. The innovation process is a combination of intellectual labor to create a new labor product. A new product can be expressed in technical, manufacturing, and commercial specifications (Reid & Sanders, 2015). The innovation process involves the inclusion of new characteristics in technology, new qualitative parameters of the finished consumer product, as well as new technologies aimed at meeting social and personal needs.

It is critical to note that not all changes can be considered as innovation. The latter takes place only if it produces some form of entrepreneurial profit by generating more valuable outcomes. Nissan remained profitable during the crisis, making the company truly innovative. The subjects of innovative businesses include organizations and enterprises engaged in creative activities. In a market economy, the development of innovative entrepreneurship depends on the demand from consumers for innovation, the availability of developed scientific and technical potential of the national economy, the functioning of venture firms and investors financing risky, innovative activities (Stevenson, 2017).

The first innovative enterprises existed in such organizational forms as centers for the scientific and technical creativity of youth, unions of inventors and rationalizers, scientific and technical societies, and scientific and technical cooperatives. These enterprises used the material and technical base, scientific background, and human resources of state institutions. Due to the deterioration of the economic situation and a decrease in innovative demand, many of the organizational forms listed above have ceased their activity or changed their direction.

The evaluation of subjects of innovative activity involves consideration of what they are in a highly developed market economy, in what economic relations they are, and what functions they perform. Without an analysis of modern theoretical ideas about the nature and nature of innovative activities of economic entities in economically developed countries, it is impossible to identify and practically realize the priorities that should follow the processes of reforming the domestic innovation sphere (Reid & Sanders, 2015).

The most important function of innovative enterprises is to mediate between the scientific, technical, and industrial spheres, to ensure almost automatic economic exchange between them without any failures, in competitive conditions.

Innovative enterprises, such as Nissan, bring the product of scientific and technical activity to a state that allows it to be used in the manufacturing sector. In addition, they are looking for a commercial partner that can satisfy a new latent social need with a possible profit. Thus, innovative firms and enterprises arise as a consequence of the social need to reduce costs arising in the process of transforming a product created in the scientific and technical sphere into a product created in the economic sphere. Innovative enterprises can eliminate some of the costs and reduce production costs, that is, they act as an institutional form that ensures effective interaction of scientific and technical institutions and private business entities in the framework of market relations.

Nissan should be distinguished as an independent economic entity if its functioning reduces the costs that scientific and technical institutions and economic entities have to bear in connection with the creation of an innovative product or to bring scientific and technological innovations to the possibility of their commercial use. According to the substantive feature, innovations at Nissan should be divided into technical, economic, organizational, managerial, and social (Stevenson, 2017).

Analysis should be especially emphasized, since in many cases they are in the nature of fundamental research, which, as a rule, is organized and financed by the state. First of all, the results of fundamental research on their implementation in the national economy, and therefore its effectiveness, depending on how much the state organizes and finances scientific activities.

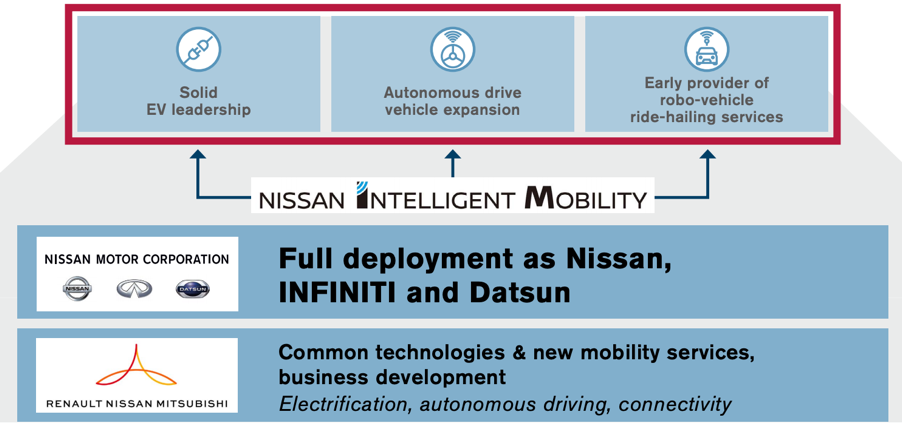

In conclusion, Nissan was not merely reactionary during the nationwide crisis because it was highly proactive and effective at handling major challenges. The company’s innovativeness came in three forms, which utilized both incremental and radical changes. An incremental aspect can be observed during post-1999 financial troubles at Nissan, where the company made gradual changes in its risk management philosophy.

Nissan decided to be flexible and identify risk factors early on, which meant that it was always on alert. A radical change occurred during the crisis when the company rapidly terminated the least valuable product lines and allocated resources according to the customers’ needs. In addition, Nissan quickly decided to increase its local production rates in the Americas in order to be less reliant on the Japanese geopolitical state.

Overall Business Model

Nissan’s overall business model is complex and multi-layered due to the sheer amount of details involved in the process of car manufacturing. Therefore, such a complexity directly influences the general degree of operations management. However, Nissan was always at the forefront of flexibility and resilience regarding its business model and value management (Simchi-Levi & Schmidt, 2013).

It is important to note that identifying the most valuable aspects of business operations in a highly complex context can be a challenging task. The overall structure includes three main components, such as suppliers of parts, manufacturing or production, and distributors. The company rarely sells its cars directly to customers, but rather works with car dealers, who operate with customers directly. It is important to note that the suppliers of Nissan are numerous, and each delivers a specific part of the car. In addition, the delivery rate, amount, and timing differences, which mean that the process must be properly coordinated and managed.

The concept of a firm’s business model is a step towards a comprehensive theory of the enterprise as a value creation system. It is also a component of the new methodology of enterprise economics, which has become necessary in the context of the transition from the paradigm of economic growth to the paradigm of balanced economic development.

Value is a relative value obtained in comparison with the spent resources, innovation in terms of efficiency as a change in the amount of value extracted from the resources, are the concepts that underlie the new concept of the enterprise. The innovation of business models is carried out on the basis of historical and dynamic analysis, taking into account the system of restrictions in the form of routines, that is, established industry practices (Reid & Sanders, 2015). A new business model or value creation principle is based on a new concept of value.

A business model is a description of an enterprise as a complex system with a given accuracy. As part of the business model, all objects, processes, rules for performing operations, the existing development strategy, as well as criteria for evaluating the effectiveness of the functioning of the system, are displayed. The presentation form of the business model and its level of detail are determined by the objectives of the simulation and the accepted point of view. The process of generating a business model involves value creation systems, such as the value supply chain and the external value given to the customers. In addition, assets that the company uses to create value can be used (Stevenson, 2017). The model of financial elements of a company determines both the methods of making a profit and the structure of its costs.

There is a common tendency of misunderstanding a business model, where people confuse the term with strategy. The latter defines the course of action, whereas a business model outlines the overall structure of an enterprise. This confusion is caused by the fact that the business model is closely related to the strategy, but not identical to the strategy. The relationship between the business model and strategy can be illustrated using the value equation proposed. This approach implies that the company should determine the best business models for implementing the strategy and, based on them, deploy and implement its strategy aimed at creating value for customers and other interested parties.

The business model of Nissan should be conceptualized as the basis for the formation of the company’s strategy. In order to explain the strategy and its specific qualities to interested parties, especially participants in the financial market, the description should provide a clear and distinct idea of how the company creates value and how operational and tactical strategies interact with each other (Stevenson, 2017). The different structures of business models can be distinguished according to whether they relate to descriptions of only basic business concepts, or are they more specific and detailed in the descriptions.

Table 1. The composition of assets typical of Nissan.

Among the assets involved at Nissan, four main types need to be distinguished, such as physical, financial, intangible, and human assets (Table 1). Physical assets are durable goods and non-durable goods. Financial assets include cash and other assets, such as stocks, bonds, and insurance policies, which give their owners rights to future income. Intangible assets include legally protected intellectual property, as well as intangible assets such as knowledge, reputation, and brand. Human assets include the time of people and the effort required to carry out various work. Evidently, people are not assets in an accounting sense and cannot be bought and sold, but their time and knowledge can be leased for a fee. These assets make up the first dimension used to classify business models.

The second dimension is the right to sell assets, where one of the fundamental aspects of a business is what legal rights are awarded to a customer after a transaction is completed. The first and most obvious right that a business can sell is ownership of the asset. Customers who buy ownership can use the asset at their discretion where they can sell it, destroy it, or dispose of it. Customers purchase the right to use the asset in certain ways for a certain period of time, but the owner of the asset retains ownership and may limit the way in which the asset is used. After a certain time, the rights are returned to the owner.

In conclusion, Nissan’s overall business model revolves around being flexible and adjustable to potential disruptions. The latter change was integrated into the company’s operations management due to their past financial issues in 1999. The first change occurred in Nissan’s risk management strategy, which was manifested in creating a self-reliant supply chain network. During the crisis, the company deliberately altered its existing operation management and business model as a whole to focus on the targeted products and car models with the highest demand.

Process Technology and Capacity Planning

Both process technology and capacity planning are an essential part of Nissan’s operation management processes, which involve outlining the company’s comparative advantage, outsourcing power, process design, and forecasting. Process technology at Nissan revolves around its ability to integrate key machinery to assemble the major parts of an automobile, which are later combined to produce a fully functional car, as shown in Figure 5 (Simchi-Levi & Schmidt, 2013). In addition, capacity planning at the company is a centerpiece of achieving maximum efficiency both in terms of finances and operations.

This step involves thorough analysis through forecasting measures, which can be implemented in a number of ways. The naïve method is a simplistic forecasting approach designed to make quick estimations based on the previous capacity values. The average method is a slightly more complex approach for forecasting capacity plan requirements, which revolves around calculating the average value or mean of past ones.

The company’s process design goes in conjunction with process technology, which is manifested in the fact that Nissan needs to create an efficient and high-yielding processing streamline of assembly. It is also important to understand the relevance of comparative advantage, which is a company’s ability to produce better products at lower opportunity costs. This means that Nissan’s strategy of being flexible and responsive to potential disruption was an outstanding strategy due to the cost of unpreparedness that would result in the company’s downfall.

The modern theory of comparative advantage also includes the method of new factors of production, the theory of dynamic advantages, the theory of the protection of trading activities. All these theories of comparative advantage emphasize the variability of comparative advantage and affect the volatile nature and variety of production or input factors of production. An important place in the production and foreign trade policy put forward by the state is occupied by the support of the emerging potential for the development and emerging industry of external effects (Stevenson, 2017). In order to improve the structure of production and change the comparative advantages, the competitiveness of the state is strengthened. The modern theory of comparative advantage is of great guiding importance for the analysis of current problems in trade.

One of the major tasks of production planning includes forming a production protocol or program, which outlines the volume and range of the products and their components. Such a protocol is a critical part of the business model regarding operations management, and it can be considered as a pre-determined algorithm for a company’s business processes. As part of the planning of the production program, product quality is also established. The task of quality planning is to determine whether the available factors of production will ensure the production of products with the required quality. If this is not possible, then it is necessary either to purchase the missing economic resources or to change the properties of the products.

The objective of assortment planning is to ensure trade-offs between sales, which are interested in manufacturing a wide range of products, and production, which are not interested in a wide range since they require special equipment, frequent changes, which leads to higher costs (Reid & Sanders, 2015). A compromise is to simplify the assortment through aggregation since, with a certain degree of diversity, numerous components of product types are unified. The output is also a decrease in its own share in the value of the final product.

The objectives of forecasting the volume of output are to coordinate the volume of production and sales volume of products. The complexity of planning the amount of production largely depends on whether a company is an enterprise that produces one type of product or several. In the first option, the volume of output must be adapted to sales (Hyndman & Athanasopoulos, 2018). Only an insurance stock of finished products is needed in case of a production stop.

In the second option, the coordination of the volume of production and sales must be borne in mind that individual products can be produced in different batches, almost all equipment can be involved in the manufacture of all types of products, there may be significant differences in the time of manufacturing of different types of products on different equipment. This greatly complicates the implementation of the coordination of production and demand. If the company in such a situation seeks to maximize profits, then it should produce more of those types of products that load a smaller amount of various equipment.

In each case, the formation of the production program of the enterprise is individual, since often products that bring maximum profit require more intensive use of equipment (Hyndman & Athanasopoulos, 2018). However, in any case, in a market economy, the production plan of the enterprise should be market-oriented, that is, take into account the demand for products.

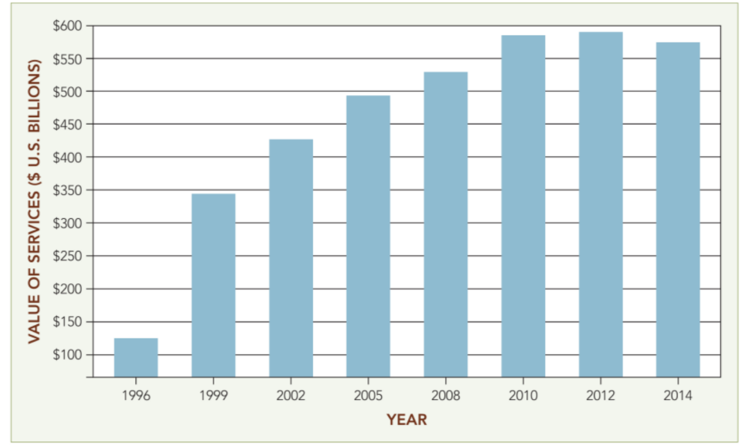

The company should outsource challenging and efficiency-reducing tasks, such as car part manufacturing, to its suppliers, which will allow the company to be more focused on assembly processes. Outsourcing is a means of achieving the strategic development goals of the company. The use of outsourcing can allow a company, such as Nissan, to reduce the number of factories in industrialized countries and completely transfer the production of the models that are in great global demand to other countries, especially since the American outsourcing market has grown significantly over the last twenty years (Fig.6). In accordance with the concept of opportunity cost, the costs of implementing an outsourcing project should always be compared with the cost of implementing the project on its own.

The economic feasibility of outsourcing should be fully defined and justified. Relations associated with the implementation of outsourcing should be beneficial to both the contracting company and the contractor. As the number of transactions increases, the market price tends to average profitability for all participants in the transaction. Of course, individual contracts may be more beneficial to one of the parties.

Contracts for delegation of management are advisable in cases where the cost of an outsourcer is at least lower than the current expenses of the customer company, and the average duration of the contract is a long period of time. Many companies practice contracts that cover the full range of financial management services, including receivables and payables, payroll, financial reporting, tax payments, and accounting for depreciation of fixed assets.

In conclusion, Nissan’s approach to its capacity planning and process technology revolves around using the latest forecasting measures alongside process design techniques. These steps are paramount to ensure efficiency and flexibility, which are especially important during crisis situations. In addition, setting up such effective production procedures allows the company to gain a comparative advantage, which means that better products are produced at a lower opportunity cost. Nissan also outsources meticulous tasks of producing each car part in order to maximize its assembly and manufacturing processes.

References

Annual report. (2018). Web.

Hyndman, R. J., & Athanasopoulos, G. (2018). Forecasting: Principles and practice. OTexts.

Nissan USA. (n.d.). Nissan. Web.

Reid, R. D., & Sanders, N. R. (2015). Operations management: An integrated approach. Wiley.

Renault-Nissan-Mitsubishi alliance may get stronger with upcoming mergers. (2019). MarketsandMarkets. Web.

Risk management at Nissan. (2019). Web.

Simchi-Levi, D., & Schmidt, W. (2013). Nissan Motor Company Ltd.: Building operational resiliency. MIT Management Sloan School.

Stevenson, W. J. (2017). Operations management. McGraw-Hill Higher Education.