PepsiCo, Inc. is a leading multinational corporation in the food and beverage industry. The company is based in the United States, with its headquarters in Purchase, New York. PepsiCo operates across over 200 countries and territories where it produces, markets, distributes, and sells over 500 different products and brands [3]. The merchandises include beverages, convenient food, and a complementary range of items, such as Aquafina, Bare, Cheetos, Doritos, Gatorade, Lays, Mountain Dew, Pepsi-Cola, Quaker, Simba, and SodaStream, among many others.

Company History

PepsiCo was formed from a merger between Pepsi-Cola Company and Frito-Lay, Inc. in 1965. Pepsi-Cola Company was incorporated in 1902 following the market success of Pepsi-Cola, a sweet cola-flavored carbonated beverage developed by a pharmacist called Caleb D. Bradham. Bradham launched his product to the market in 1898 to rival the successful cola beverage by the Coca-Cola Company [3]. Frito-Lay, Inc. mainly focused on producing convenient food items, including Lay’s potato chips, Doritos, Fritos, and Rold Gold pretzels. The newly formed PepsiCo would become one of the world’s leading food and beverage companies.

Over the years, PepsiCo has continued to expand through diversification and acquisitions. In 1977, 1978, and 1986 PepsiCo acquired four companies, including three restaurant chains; Pizza Hut, Inc., Taco Bell Inc., Kentucky Fried Chicken Corp. (present-day KFC), and Seven-Up International, respectively. In 1997, PepsiCo established a new company called Tricon Global Restaurants, Inc. that took charge of the operations in the restaurant business.

In addition, PepsiCo acquired Tropicana and Dole juice brands in 1998 from the Seagram Company. In 2001, it formed a merger with the Quaker Oats company through which a new division labeled Quaker Foods and Beverages was formed. The latest acquisitions and mergers were intended to introduce new product offerings considered healthier to meet the shifting consumer needs and preferences and regulatory requirements [3]. The company further changed the sweetener in Pepsi Diet in 2012 before rebranding the soft drink in 2013. However, the new formula faced opposition in the market as people expressed their discontent through online platforms forcing PepsiCo to introduce the aspartame formula, which was fully adopted in 2018.

Mission, vision, and objectives

PepsiCo’s mission is to “Create more smiles with every sip and every bite” [5]. The company has further developed mission statements for the consumers, customers, associates and communities, planet, and shareholders. The company’s missions for the parties are providing joyful moments, the best partnership, meaningful opportunities, nature conservation, and delivering sustainability. PepsiCo’s vision provides direction and guidance by incorporating its strong focus, competitive drive, and shared values. The company’s vision is to “Be the Global Leader in Beverages and Convenient Foods by Winning with PepsiCo Positive (pep+)” [5]. The mission statements reflect how the company can attain its vision within a specific set time limit. The vision and mission of PepsiCo complement each other to push the company to the top position in the global food and beverage industry.

Overview of Operations, Locations, and Customers

PepsiCo’s operations are spread across different locations where it serves many customers. The company’s operations, locations, and customers are organized under seven reportable segments or business divisions. The first three divisions exclusively serve the United States and Canada. The first division is Frito-Lay North America (FLNA), which covers the United States and Canada, and principally includes the company’s branded convenience food businesses. Under the second division, Quaker Foods North America (QFNA), PepsiCo manages the branded convenient food businesses, particularly cereals and other trademarked food items in the United States and Canada. The third division, PepsiCo Beverages North America (PBNA), encompasses the company’s beverage businesses in the United States and Canada.

The following four divisions cover the company’s operations outside the United States and Canada. The fourth division covers Latin America (LatAm), where PepsiCo provides all products for the beverage and convenience food businesses in Latin America. The fifth division covers Europe under all ranges of the company’s beverage and convenience food businesses. The sixth division is Africa, the Middle East, and South Asia (AMESA); it deals with all the company’s beverage and convenience food businesses in Africa, the Middle East, and South Asia.

The seventh and last business division is Asia Pacific, Australia and New Zealand, and China Region (APAC), which covers the Asia Pacific region, China, and spans across the ocean to New Zealand and Australia where the company offers beverage and convenient food products. Across all the seven customer segments, PepsiCo conducts its operations of making, marketing, distributing, and selling its products and brands autonomously or in partnership with third parties.

In addition, the company’s customers are spread across retail platforms, wholesale businesses, and production and distribution agents. The company’s retail and wholesale customers are spread across different stores, including membership, drugs, grocery, discount/dollar, and convenience stores. Additional customers include e-commerce retailers, stores, mass merchandisers, hard discounters, and approved independent bottlers. The grants the independent bottlers limited rights to produce and sell specific beverage products bearing the Pepsi emblems that apply to specific geographic locations. PepsiCo retains the rights to charge independent bottlers for Aquafina royalties, concentrates, and finished products. PepsiCo provides specifications on the manufacturing process to guarantee uniform product quality. The independent bottlers are granted rights to distribute PepsiCo products within their defined geographical area.

Financials

PepsiCo reported its 2021 overall revenue mix based on the market segments (the United States and outside the United States) and the two major product offerings (convenient food and beverages). As indicated by figure 1 below, convenient foods contributed 55% of the net revenue, while beverages contributed 45% [4]. Figure 2 indicates that 56% of the net revenue was derived from the United States, while 44% was derived from outside the United States.

The company also reported the 2021 financials relating to the net revenue and operating profit for each of the seven business divisions discussed above. Table 1 below shows the percentage of net revenue and operating profit in 2021 derived from each of the seven business divisions. The results indicate that the PBNA segment contributed the most significant chunk of the net revenue at 32%. However, the FLNA generated the highest share of operating profit at 44%. QFNA contributed the least share of net revenue and operating profit at 3% and 4%, respectively.

Table 1: Division Net Revenue and Operating Profit Percentages for all the Seven PepsiCo Business Divisions for the year 2021

Furthermore, the business segments reported impressive growth in revenue for the year 2021. PepsiCo’s international operations generated an 11% growth in organic revenue for 2021, the strongest growth in organic revenue in over five years [4]. The PepsiCo Beverages North America (PBNA) divisions posted the second-strongest growth in organic revenue at 10%, representing the segment’s quickest rate of organic revenue growth on an annual basis in over five years [4].

Lastly, the Frito-Lay North America (FLNA) business segment delivered a 7% growth in organic revenue growth in 2021, supported by an upsurge in the sales volume and realization of positive net profits. In addition, the company realized an 8% surge in core operating profit even as the advertising and marketing expenses increased by double [4]. The data shows an improved performance attained by the company based on successful business strategies.

Marketing and distribution

PepsiCo majorly sells its products through customer warehouses and direct-store delivery (DSD). Customer warehouses are considered less costly and primarily work best for perishable, less fragile products and lower gross revenue. DSDs are operated by independent bottlers, an approach the company considers effective in attaining maximum product visibility and appeal. In addition, the technique perfectly suits the company’s products that require frequent restocking and respond well to in-store promotion and marketing. The company further ensures that the products reach the consumer through e-commerce, digital platforms, and retailers.

The distribution of the product offerings is facilitated through different networks, depending on the local trade patterns, customer needs, and product characteristics. For most, distribution is conducted by third parties whom the company considers effective in covering more extensive areas. They can carry an assortment of products on the delivery vehicles. For instance, third-party distributors can effectively distribute food services, beverages, and convenient foods to businesses, restaurants, colleges, and stadiums. Further distribution is carried by independent bottlers who deliver beverages and convenient foods straight to retail stores. The merchandise is then sold by PepsiCo employees or those working under independent bottlers.

Industry and Competitors

PepsiCo operates within the food and beverage industry, which is characterized by high competition across the different industry categories. The competitors operate in the international beverage market and provide convenient food services similar to PepsiCo in many geographies. The competition spans regional, local, private-label manufacturing, and low-cost brands. In addition, the company has to compete with smaller companies that develop and sell micro-brands straight to consumers through retailers, e-commerce, digital platforms, and local people. The Coca-Cola Company is the main competitor, but several other competitors offer convenient food and beverage products [4].

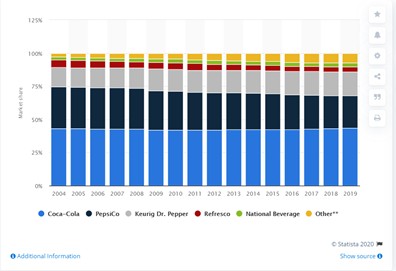

Some of these companies include Campbell Soup Company, Conagra Brands, Inc., Hormel Foods Corporation, Kellogg Company, Keurig Dr. Pepper Inc., Kraft Heinz Company, Link Snacks, Inc., Mondelēz International, Inc., Monster Beverage Corporation, Nestlé S.A., Red Bull GmbH, Unilever, and Utz Brands, Inc. Figure 4 below shows the market share of the top competitors for the period 2004 – 2019.

Current Strategy

PepsiCo’s current strategy is connected to the vision based on the pep+ mantra. Pep+ is the company’s tactical end-to-end transformation designed around PepsiCo’s human capital and sustainability. It is the core through which PepsiCo intends to create value and growth by conducting its operations within global margins and inspiring positive change for the earth and the people. The strategy was introduced in 2021 in recognition of the emerging business realities where consumers are becoming increasingly more concerned about the world’s and society’s future. The company continues to build upon the history and growth attained since its inception in 1965 and aspires to create a more robust footing for the coming days. According to [4], the attainment of the company’s vision requires the leadership to constantly challenge itself to turn out to be Faster, Stronger, and Better.

PepsiCo desires to become Faster by delivering a more robust and growing financial performance. The company desires to become Stronger through internal transformation and building new business competencies. PepsiCo leverages its Global Business Services, expanding Digital Hubs, eCommerce, Global Marketing, expanded productivity, new business ventures, strategic partnerships, and joint ventures. Moreover, PepsiCo is committed to becoming even Better by promoting Positive Agriculture as its source for the product ingredients and crops. The company is becoming better through a Positive Value Chain that is the circular and all-encompassing value chain. PepsiCo seeks to inspire Positive Choices by improving the product and brand portfolio of convenient food and beverages that are better for the world and society.

Growth and Market Share

PepsiCo’s products and services hold substantial leadership spots in the convenience food industry in the United States and globally. According to [4], the company and Coca-Cola Company control about 22% and 19%, respectively, of the liquid refreshment beverage market segment in the United States. The market share was based on the retail sales in measured channels through a study conducted by Information Resources, Inc. However, in the carbonated soft drink (CSD) market segment, the Coca-Cola Company controls a sizeable share of the market outside of the United States.

Situation Analysis

Competitive Analysis

Porter’s model is widely applied in analyzing the company’s competitive advantage in the industry. The model captures three main aspects of competition, including cost leadership, differentiation, and focus. PepsiCo has leveraged the three strategies to attain a competitive advantage in the global food and beverage industry. Cost leadership, differentiation, and focus are generic strategies for attaining competitive advantage. Hence, the company has implemented specific strategies to enhance its competitiveness in the market. PepsiCo has developed a strong brand recognition and loyalty strategy supported by the price, taste, value, variety, quality, innovation, packaging, distribution, advertising, and promotion of its products and services. The company has enhanced its capacity to get ahead and efficiently react to consumer preferences and trends [4]. In particular, PepsiCo has focused on enhanced consumer preference for a healthy lifestyle, wellness, and sustainability.

Furthermore, PepsiCo continues to adopt new selling channels, including the acceleration of e-commerce and mobile applications along with novel methods of product distribution. The company acknowledges that success in the competitive food and beverages industry depends heavily on actively promoting current products. PepsiCo further engages in the active development of new products and modification of existing products through amplified effectiveness in production methods. It effectively incorporates technology and digital tools across all business areas, from product packaging and pricing to advertising and marketing [4]. PepsiCo adopts modern retailing and supply equipment as well as brand and trademark formulation and protection. Most importantly, the company believes in the strength of its brands supported by the quality of the products and flexibility of the distribution network, which allows the company to compete successfully.

Value Chain Analysis

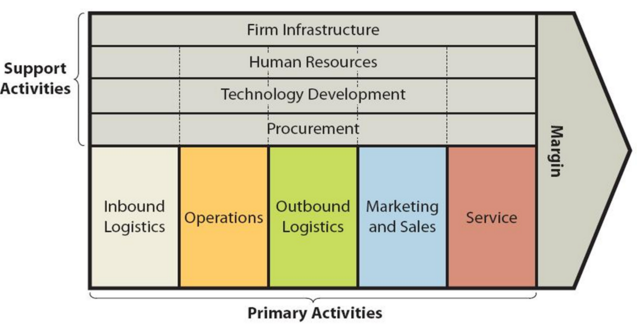

A value chain represents an array of actions a company is indispensable in creating products and or services. In general, PepsiCo’s value chain starts with the cultivation of crops by farmers and suppliers. The mature crop produce becomes raw materials the company uses to manufacture and package drinks and food [4]. The final products are distributed to different selling points from where customers buy and consume them, and the packaging material and other remnants are finally recycled or collected as waste. Figure 3 below shows the standard value chain processes related to a manufacturing company like PepsiCo.

Inbound logistics is where the raw materials are delivered to the company by farmers and suppliers spread across the globe. The operations entail the handling of the raw material and the process of transformation into finished products. Outbound logistics involves the outflow of the final products handled through the company’s distribution systems, including the DSD, customer warehouse, e-commerce, and third-party distributors. Under marketing and sales, PepsiCo spent over $5 billion in 2021 in advertising and other marketing activities, while the cost of offering the services in terms of shipping and handling was $13.7 billion in 2021 [4]. PepsiCo has identified the value chain as an integral part of enabling it to become even Better. The Positive Value Chain is one of the company’s three pillars through which it can realize its pep+ vision. The company is committed to taking direct action to be able to scale down the impact of its operations on the environment.

The primary value chain activities are supported by having an appropriate firm infrastructure, human capital, research and development, and procurement. PepsiCo employs over 309,000 people worldwide, including 129,000 people within the United States as of December 25, 2021 [4]. The company supports human capital management and has implemented measures to attract, develop and retain a high-quality labor force required for its long-term success. In addition, PepsiCo has invested extensively in research and development to promote innovation globally to meet the changing customer and consumer needs and accelerate its growth. The company engages experts who help in the procurement process to secure enough provisions required in its operations.

Strategy Critique and Recommendations

PepsiCo continues to identify business strategies to solidify its position as one of the leading companies in the global food and beverages industry. In 2021 the company introduced a new strategic direction labeled prep+ to capture to recent appeal for sustainable business operations for the good of the planet and global society [4]. However, PepsiCo lags behind the Coca-Cola Company, which controls a more considerable portion of the global market share in the industry. Therefore, there is a need for the leadership and management to continually adopt different strategies to continue growing the market share and compete effectively.

The first significant step for the company is to increase marketing activities through advertising and product promotion in regions outside the United States. PepsiCo should concentrate on the AMESA and APAC regions because they contribute single-digit percentages to the net revenue. Currently, the United States constitutes the primary market for PepsiCo, which is already saturated and is characterized by stiff competition from rival companies. In the short term, PepsiCo can focus on strengthening its regional distribution networks to boost its product visibility and availability. In the long term, the company can grow its research centers in these markets and conduct experiments to identify convenient foods and beverages that suit the needs of the local population.

In addition, PepsiCo should continue promoting healthy snacks and food items across all the business regions to meet changing consumer preferences in favor of products considered better in the diet. The strategy can be realized using several short-term measures, such as introducing additional options for healthier, convenient foods and beverages. The objective can be attained after a keen evaluation of the existing and desired healthy products to establish the ingredients and raw materials that would be required. The company can also promote openness by including calorie and energy components on all products’ labels to allow consumers to pick their preferences. In the long-term, PepsiCo can develop brand repositioning strategies to change consumer perspectives regarding most of the company’s products that are generally considered unhealthy, especially carbonated drinks. These measures will enable PepsiCo to increase its market share and make the most out of the growing preference for a healthy lifestyle.

Finally, PepsiCo should focus on developing low-cost and sustainable means of production to help in cost management and attract additional investment. There is a need to manage the operational expenses that will enable the company to lower its product prices and offer promotions. The cost savings will further reflect a stronger balance sheet and income statement. The strategy can be realized by increasing efficiency across the production plants and independent bottlers through procurement, distribution, and sales. In the long term, PepsiCo can invest in promoting a lean culture and invest in establishing inexpensive production processes.

Reference List

J. Conway, “Soft Drink Market Share in the U.S. 2018.” Statista. 2020. Web.

J. Dudovskiy, (2016). “PepsiCo Value Chain Analysis.” Research-Methodology. Web.

PepsiCo, About PepsiCo. n.d. Web.

PepsiCo, “Annual Report 2021: Winning with PepsiCo Positive (pep+). 2021. Web.

PepsiCo, “Mission & Vision.” 2022. Web.