Introduction

Productivity is the ability of a company to maximize on its profits while reducing costs during a production process (Begg and Ward 2003). While the production process includes factoring of labor, land, and capital, productivity concentrates on the gains a firm achieves in business. Normally, in the short-run, one factor of production between labor and cost remains fixed, while in the long-run economy all factors of production vary. The only difference is the way costs of production alternate with the expected output causing a shift in economic paradigms. Both capital and labor are the factors that influence the production of a firm in the short run or the short run with other external factors disregarded.

Productivity in the Short-run and Long-run Economy

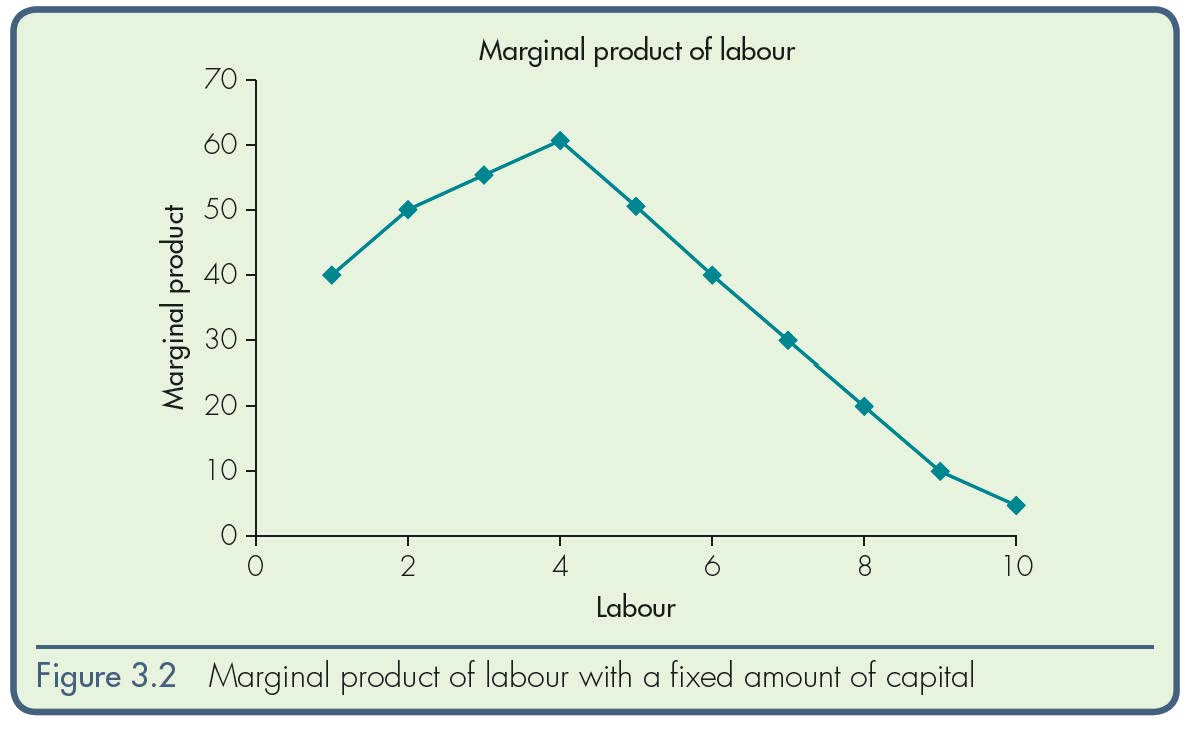

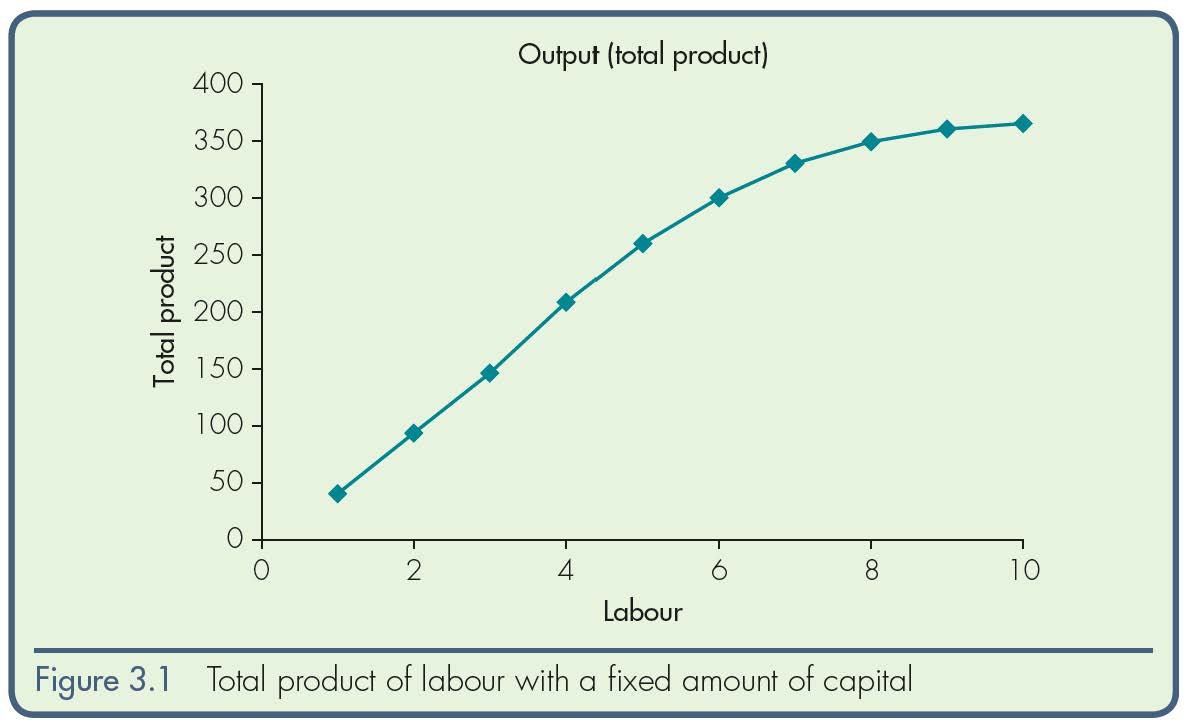

The long run is the period it takes a firm to undergo changes in productivity; company managers make important decisions that include the size of a firm, production methods and a timeline for producing. The decisions firms make also include either a reduction or increment in the number of employees. Although more common in smaller companies than in the large firms, the short-run companies reduce the number of workers with an intention to reduce overall productivity cost. Meanwhile the short run is the period when only fixed factors of production prevail with only labor being the variable factor. While labor remains variable with capital and other factors are fixed in the short run, the long run allows a scenario where capital, labor and other productivity factors are changeable. The law of diminishing marginal returns explains how firms in the short run can influence their productivity by varying the factors of production. Because land and capital are in the short run remain fixed, the firm only changes the quantity of labor within its ranks. If a firm decides to increase the number of workers, the marginal production of labor will reduce significantly. Consequently, the law of diminishing marginal returns has a huge impact on the costs of production of a firm in the short run. The productivity of the workers determines the costs of production of a firm because when labor productivity increases, the costs reduce but when the productivity of workers declines, the firm realizes an increase in the costs. Diminishing marginal returns leads to an overall decline in the firm’s revenue collection with costs of labor and running the company becoming expensive. Factors of production like capital and labor are not perfect substitutes for each other according to economists. The relationship between productivity and cost of producing goods is negative therefore when costs of production rises, the productivity and profits of the firm decline significantly (Begg and Ward 2003).

Costs of Production

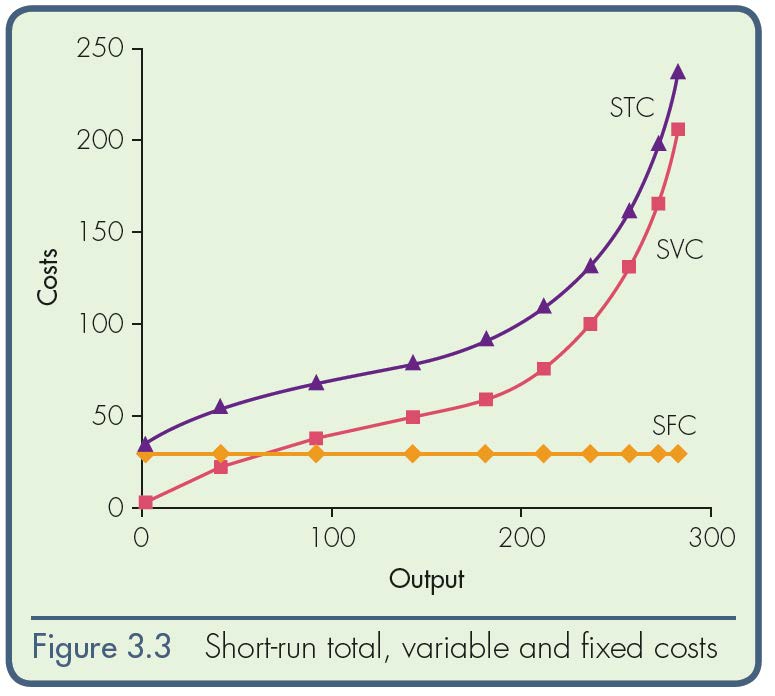

Costs are the resources a firm uses during production of goods with a goal of making profits out of them. Normally, in the short run, companies incur both fixed costs and variable production expenses. When the level of a firm’s output or profit does not depend directly on the resource input than it is a fixed cost. Fixed costs may include rent, insurance covers, employee salaries, advertising, and depreciation on company assets (Begg and Ward 2003).While the variable costs directly influence company outputs in such a way that as productivity of a firm grows, it will need more workers and a larger resource base. In the long-run, costs of production steadily alternate because all the factors of production can change. If the firm invests more in company equipment and other assets, its average total cost reduces.

Economies of Scale

In the long-run, if the cost of production reduces while profit increases, economists refer to such a scenario as economies of scale. They are simply the benefits that a firm receives when it expands (Begg and Ward 2003). In most cases, economies of scale happen when a firm purchases large quantities of material inputs through long-term engagements as well as pays low-interest rates on loans. Other sources include spreading costs incurred on advertising and the ability to manage a financial reserve with specialized management. As the factors of economies of scale tend to limit the Average Cost of production in the long-run, costs of production in the short run reduces as well. Diseconomy of scale happens if the costs of a firm increase. The increase in the company size with its long run effect on the average cost escalates proportionally to the increase in output. Because managing large firms is harder than managing small ones, companies incur extra operational costs that eventually contribute to economies of scale. Not only do large firms face increased input and operational costs, they also face high labor costs that prompt diseconomies of scale. Despite the challenges, large firms have an advantage of dealing with the issue of regulations as compared to small firms.

The law of diminishing marginal returns implies that when labor, a variable input, increases in cost, which in the short run remains unchanged, the marginal returns on the input reduce. Long run concept of production brings about flexibility in decision making whereby the management can easily alter labor levels and the capacity of a firm. In addition, in the short run production, firms continue to pay rent and other fixed factors that do not affect production directly therefore they do not feature in calculation of a firm’s productivity. Meanwhile in the long-run economy, the firm may opt to purchase new company land or invest in equipment therefore all these factors influence the output of the firm. Interest on loans remain fixed during a short run economy, therefore firms are unable to include costs incurred on loans to the productivity of a firm.

There are always many differences between small and large firms with the most obvious ones being capital input and scale of employees. While large firms employ more staff than smaller companies, workers of smaller firms enjoy better working conditions because of low pressure levels. Because of large profits and company size, larger firms offer their workers better salaries and endless opportunities to grow. Subsequently, low pressure levels in small companies enable workers to enjoy freedom and safety, because the management of smaller firms never lays off employees more often (Begg and Ward 2003).

Conclusion

Productivity is an important goal in an organization because it is the ultimate determinant of the performance of all variable and instruments of production whether in the short run or long run. Besides, it is the sole reason why firms are in business. Meanwhile, costs are the necessary barriers to maximum productivity because firms have to incur costs to facilitate production. Therefore, productivity and cost have an inverse relationship whereby either an increment or decline in costs of production determines the productivity of firm in corresponding circumstances. Firms should strive to maximize their productivity by reducing significantly costs that they incur on labor and other variable factors of production.

Reference

Begg, D & Ward, D 2003, Economics for business, McGraw-Hill, London.