Introduction

Before making any capital decision a capital must choose various projects because of limited capital. This is because the company needs are many but has scarce resources at a given time. Capital budgeting ensures that we do not always get the things we desire, but instead we work and do whatever is necessary to possess them. This is the same case with businesses while making capital budgeting decisions. And that success is only possible with the aid of right decision, hard work, perseverance, faith, and belief in oneself (Graham and Harvey, 2001, 190).

The long-term budgeting begins at this point because it is at this point one decides how much he will be willing to part with monthly for maintenance and other costs. One would opt to undertake those projects which maximize their benefits in the long run. They can also rank the proposals according to the predetermined criterion and choose the best depending on their returns. In this case one needs to consider these factors. Capital investment and budgets thus form a vital ingredient to business success. The past few decades have seen major theoretical developments in capital budgeting in corporate practices (Klammer, 1993, p. 38). Companies usually have projects that require more resources than they can afford. Some projects can be mutually exclusive while others are inclusive.

Capital budgeting is the process through which businesses determine the relative strengths and merits of alternatives available. Since availability of capital is usually limited, careful evaluation of the alternative routes for productive investment is essential for meeting business objectives. Qualitative and quantitative analysis become necessary elements of capital investment decisions (Pike, 1996, p.72-90).

In capital budgeting, various tools are used in evaluating projects some of them include, Discounted Cash Flow techniques and non-discounted cash flow techniques. Some studies suggest that businesses employ non-financial measures to understand the factors that go into success of a venture (Klammer, 1993, p. 40).

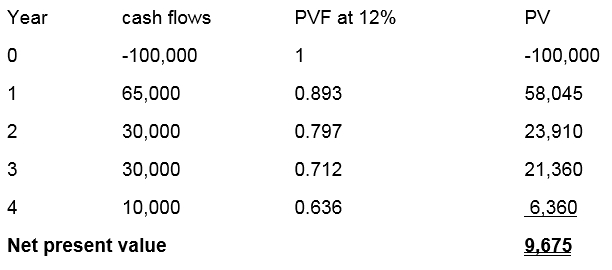

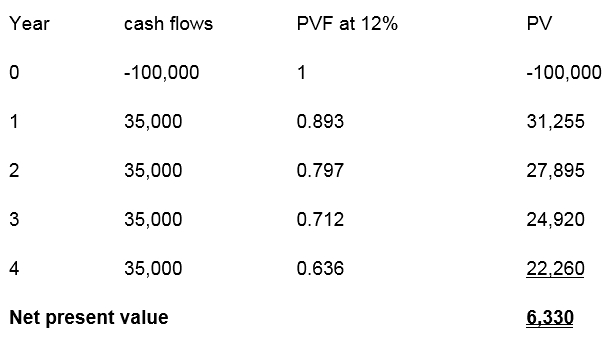

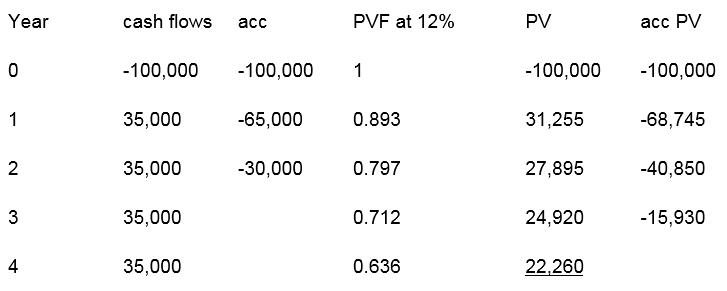

Net present value for the proposed projects

This method considers time value for money. It is calculated as shown below.Net present value = present value of cash inflows – net investments

The criteria for accepting rejecting the project are if NPV ≥ 0 accepts the project otherwise rejecting the project. The project is accepted when the NPV ≥ 0 is because it will increase the shareholder’s wealth (Haka, 1987, p. 45-48).

You cannot rank projects using net present value because of time value for money. In considering time value for money, the differential periods in which money is received change in the decisions made (Shank and Govindarajan, 1992, p. 42-60).

The quantitative method that is used in this case is the net present value. It considers the cost of capital, inflation and other factors(Graham and Harvey, 2001, 188-200). It is calculated by the following formula.

In this case we are given cash flows we need to change them to present values:

Note:

This analysis is based on the following assumptions:

- Project will not be sold at the end of year 4

- Inflation was disregarded

- The Accounts receivable and Accounts payable were disregarded because it does not state from which activities this value comes. It was assumed that it was not generated by the project itself and would therefore be irrelevant for the decision whether to undertake the project or not.

- Discount rate tables were used to estimate the adequate Discount rate for WACC of 12%.

From this criteria project A is chosen as it gives higher NPV as compared to project B. However, there are also criteria’s that do not make use of the numerical assessment because there are other components in the success of a business that has nothing to do with numbers of any kind at all. These qualities are intangible or qualitative. They simply can’t be measured by using numbers but rather by reason and experience or sometimes using self-prediction (Klammer, 1993, p. 39).

The disadvantage of the NPV calculation is the fact that the decision-making is highly dependent on the rate of return that the calculation makes use of. The rate used is the opinion of the analyst or the researcher of the future growth rate that the company might be able to achieve. There is no such thing as sure-fire way to foretell the future (Graham and Harvey, 2001, 190). It is almost guaranteed on the other hand that the prediction will be proved false by a very wide margin of error. Although the reasoning behind the use of the NPV’s formula is useful for comparison, it is not immune to a fatal flaw in the design of its model’s computation. It does have the ability to clearly compare options for approval if they are good investments or not. The researcher will be able to present in numbers the exact degree of profitability that a business might have. On the other hand, all of the calculations are simply based on the rate at which the business is supposed to grow. This is the reason why the calculations can go off the true path by a very wide margin. This is also the reason why NPV is not a very good measure of an investment’s soundness or chance for success (Haka, 1987, p. 41-46).It can’t accommodate the intangible things business needs to survive and succeed.

The cost of capital can make the decision-makers say yes or no to the project. Inversely, the lower the cost of capital is the lower the rate of return. If there are two or more projects or investments that a decision-maker has to choose from, the one with the lower cost of capital will be disregarded since they are not as profitable as the one with a higher cost of capital. They are very useful tools for comparison. They show the researcher or the businessman the potential profits and the returns in numerical terms. Although it is also far from perfect, it nevertheless provides the kind of basis for a more intelligent decision rather than relying on just feeling alone. The cost of capital also gives investors a basis for their capital allocation decisions since the rate of return can be clearly compared to each other (Pike, 1996, p.72-90). All the other factors that they have evaluated are to be added in conjunction with the rate of return that a business has.

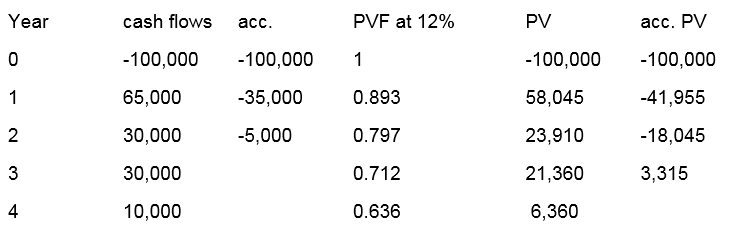

Payback period

Payback period is the number of years required to recover the net investment. This method measures the length of time it will take for a business to recover the investment made. The measure uses the initial cash investment made and the average annual net cash flow (cash inflow – cash outflow). Dividing the former by the latter, the result is a number that represents the cash payback period in number of years. It is normal to average the annual cash flow since it is usual to see that cash flows are not constant through the period of the active performance of the capital assets obtained through the investment made (Klammer, 1993, p. 42).

The adequacy of the payback period is dependant on the perceptions of the firm, the type of industry or service, and the macro and microeconomic conditions. The payback period is usually considered viable if it is between 2 and 3 years. In any case, the period has to be considerably less than the useful life of the asset. In some projects, in the initial period the cash flows fluctuate vastly and may even be negative at the start. In such cases, the cumulative net annual cash flow helps determine the time for recovery of the investment (Haka, 1987, p. 40).

This method suffers from the limitation that it does not factor in the differences in cash flows due to their timing or the time required for the execution of the project. For example, two projects may require the same investment and have the same payback period, but the timing of the cash flows may be quite different. In such a case, the project that yields quicker net cash flows is preferable over the other (Shank and Govindarajan, 1992, p. 52). The formula for average payback period is shown below:

Average payback period = net investment

Average annual cash inflows

Payback period using discounted cash flows is

2 years + (18045/21360) x 12 = 2years 10 moths

Payback period using undiscounted cash flows is

2 years + (5000/30000) x12 = 2 years 2 months

Payback period using discounted cash flows is

3 years + (15930/22260) x 12 = 3years 9 moths

Payback period using undiscounted cash flows is

2 years + (30000/35000) x12 = 2 years 10 months

From the payback period criteria project A is still favorable because its PBP is lower than that of project B, especially the discounted cash flows.

Recommendation

From the above analysis project is favorable using both NPV and PBP. However, it is important to be aware of the limitations of any NPV and PBP analysis. The calculations involve relying on estimates which can be difficult to predict, such as sales forecasts, prices and costs, tax rates, inflation, realizable values of assets and discount rates. In addition, forecasts are mostly prepared within a limited time horizon, such as in this case 4 years. Any costs and revenues beyond this period are ignored – even though they could potentially result in a higher NPV and PBP (Pike, 1996, p.72-90).

Further, the strategic importance of investment must also not be overlooked. There may be the potential to lead to further opportunities or investments and the value of these options could be estimated.

Conclusion

In capital budgeting, companies prefer cash flows as opposed to profits in evaluating investment projects. This is at times calculated using the net profits plus non-cash items. The annual rate of return method uses the projected income but does not recognize the time value of money. In addition, several factors influence the commercial viability of an investment that accounting methods do not recognize. At times, it would be extremely difficult to estimate cash flows or indeed future profits of knowledge-driven industries and no kind of financial projections can account for successes. Therefore, there is a need to understand an investment proposal from different angles to determine its viability and future economic performance (Shank and Govindarajan, 1992, p. 39-42).

Other subjective factors that should be considered before the investment decision is to be made, this should include, the possibility of a competitor opening a similar facility in the area thus affecting the market share. Another factor to be considered is changes in technology of the equipment. Lastly, the political or government regulations will be considered. This is because the government regulations will cut across many factors affecting the profitability of the firm. The government is responsible for diffusing inflationary tendencies at the same time regulating monetary policy

List of references

Graham, J. & Harvey C. (2001). ‘The theory and practice of corporate finance: Evidence from the field’. Journal of Financial Economics, vol. 60, pp. 187-243

Haka, S. (1987). Capital budgeting techniques and firm specific contingencies: A correlational analysis. Accounting, Organizations and Society 12, pp: 31–48

Klammer, T. (1993). Improving investment decisions. Management Accounting: 35–43.

Pike, R. (1996). A longitudinal survey on capital budgeting practices. Journal of Business Finance & Accounting 23, pp: 79–92.

Shank, J., & Govindarajan V. (1992). Strategic cost analysis of technological investments. Sloan Management Review, Fall: 39–51.