Executive Summary

The banking sector is experiencing revolutionary changes in terms of the products they offer and how customers are served. One of the major changes in this sector is the introduction of Islamic finance. Dubai Islamic Bank came up with the concept in 1975, and it has since gained massive popularity in the Middle East and North Africa region. The concept has spread to parts of Europe and North America. In this research, the focus was to analyze accounting differences in commercial banks and Islamic financial institutions. It was also important to understand the objectives of financial accounting in Islamic financial institutions.

The study also analyzed concepts of financial accounting in Islamic financial institutions. Data was collected from various sources. Books, journal articles, and reliable online sources were used. The researcher also collected further information from a section of employees of the three financial institutions (Emirates NBD Bank, Emirates Islamic Bank, and Dubai Islamic Bank). The study provides the current challenges that Islamic financial institutions face when offering products in line with Islamic teachings. It also provides recommendations on how these firms can achieve success in the market.

Introduction

Islamic banking is increasingly becoming popular in the Middle East, North Africa, and parts of Europe as the demand for these services continues to increase. According to Kabir and Lewis, the banking sector plays a critical role in modern society (11). Businesses cannot operate without having bank accounts. Conventional banks have played a critical role in providing a variety of products.

In the Middle East and North Africa (MENA) region, conventional banks have thrived over the past five decades. However, Merah notes that stakeholders in the banking sector within this region, which is dominated by Muslims, have always been concerned about products and principles used by conventional banks (12). Shariah defines in clear terms, social practices that Muslims should follow. It prohibits the concept of interest on loans, which it refers to as riba (Farizal 34).

The main source of income for financial institutions is interest charged on the loans extended to customers. Most of the Islamic scholars and accounting professionals noted the conflict of interest between principles of conventional banks and the teaching of Shariah. It was the basis upon which the concept of Islamic finance was introduced. According to Sarea and Hanifah, Islamic finance seeks to develop financial products that are in line with Islamic law (51). It seeks to ensure that financial institutions can still extend loans to customers but in a way that does not go against Islamic law. Islamic accounting, governance of the financial institutions, auditing, and ethics, must be based on Shari’ah standards.

The researcher selected this topic because of the growing popularity of Islamic finance in the MENA region and other parts of the world. Muslims are increasingly embracing the concept of Islamic finance because it enables them to access financial products without breaking the teaching of the Quran. In the past, many of these customers were forced to ignore Islamic principles whenever they wanted banking services.

However, that is no longer the case as many Islamic finance concepts and products continue to emerge. This topic is important because of the emerging conflicts between Islamic principles and commercial forces. The fact that some of the Islamic principles make it impossible to allow market forces to define the pricing of products in the market, some businessmen complain that it complicates some business practices in the market.

This paper will look at how these issues are addressed in the settings that strongly embrace Islamic finance. In this paper, the focus is to determine the difference between commercial banks and Islamic banks and to define the concept of financial accounting. Emirates NBD, Emirates Islamic Bank, and Dubai Islamic Bank will be used in the analysis to compare and contrast financial practices. The following are the objectives of the study:

- Accounting differences between commercial banks (NBD Bank) and Islamic banks (Emirates Islamic Bank & Dubai Islamic Bank).

- Objectives of financial accounting in Islamic financial institutions (Emirates Islamic Bank & Dubai Islamic Bank).

- Concepts of financial accounting in Islamic financial institutions (Emirates Islamic Bank & Dubai Islamic Bank).

Analysis and Discussions

The world’s first Islamic bank opened its doors in 1975 in the city of Dubai, and it had a revolutionary impact on the banking sector around the world (Merah 26). It was a new down for Muslims who for a long time we’re forced to use conventional banks for all the financial products that they needed. For the first time, Muslims in Dubai could access financial products that were in strict adherence to Islamic teachings and principles.

The new concept gained popularity in cities within the MENA region in the 1980s and 1990s. Currently, Kabir and Lewis observe that Islamic banks are all over the world, from Asia and Africa to North America and Europe (27). Although conventional banks still play a critical role in the United Arab Emirates and the region, Islamic financial institutions are considered more relevant among locals because of the nature of the products that they offer. It is important to look at the difference between the principles of Islamic finance and the conventional banking system.

Accounting Differences Between Commercial Banks and Islamic Banks

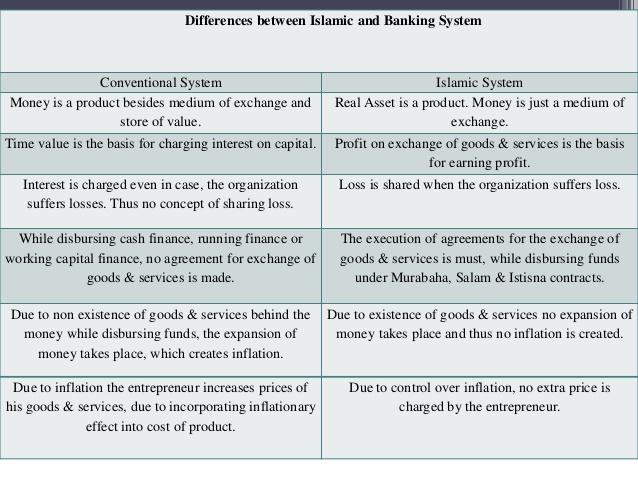

The need for Islamic banking emerged out of the desire to have a financial institution that follows the principles and teachings of the Quran. The Shariah principles are strict on issues of lending and borrowing of money. Usury is now allowed under these laws. It means that a financial institution that lends money at interest and its customers that purchase such products go against Islamic teachings. Islamic finance was meant to address the conflict. It means that there are fundamental differences between principles and practices practiced in conventional commercial banks and that of Islamic banks. The following are the fundamental differences:

Principles

The principles used in Islamic Banking are significantly different from that of conventional banks. According to Farizal, conventional banks use commercial principles that primarily focus on benefiting financial institutions (36). The guiding principle in commercial banks is to make profits. As such, these institutions have come up with various products to ensure that they maximize their returns.

On the other hand, Islamic banks are run under strict Shariah law. The Islamic principles prohibit banks from engaging in business activities that only benefit them at the expense of their customers. For instance, the charging of interests on loans is prohibited in Islamic finance. It means that several products available for commercial banks cannot be made available in Islamic banks because of the Shariah law. Merah notes that customers using Islamic banks enjoy better protection and are less likely to be exploited than those using conventional banks (32).

Source of Earning

According to Kabir and Lewis, the goal of every business is to get attractive returns that can sustain its operations and facilitate its growth (31). Banking institutions must have a reliable source of income to enable them to achieve success in the market. Both commercial banks and Islamic banks have different ways of maintaining a steady flow of income. In commercial banks, the main source of income is the interest charged on loans that they give to their customers.

Depositors who have their money in banks are often given a relatively small interest as a way of encouraging them to save their money with these institutions. Their savings are lent to businesses and individuals who need cash, but at a higher interest rate. The difference between interest charged on loans and that given to depositors is the profit that commercial banks earn.

Foreign exchange (Forex) is another important source of income for commercial banks. Those who want to change the local currency to a foreign one and vice versa are given rates that benefit the banks. Banks also charge their customers varying fees for the service of keeping important documents or items such as precious metal. On the other hand, Islamic banks have a unique way of maintaining a steady flow of revenues.

These institutions share profits with their customers that take a loan from them. The amount of benefit that these banks get depend on the profit made out of the money they gave to their customers. Sarea and Hanifah explain that consultation fee is another important source of revenue for these institutions is consultancy (55). They offer expert guidance to their customers on how to invest their money. Islamic banks also offer services such as Forex, the keeping of important documents and items, and money transfers.

Sharing of Risks

As Merah notes, it is normal for a business entity to make a loss when investing money borrowed from banks (30). It is not a guarantee that the borrowed money will yield profits. In commercial banks, risks are fully transferred from the financial institutions to customers. A borrower can’t share risks associated with investments for which money was borrowed from commercial banks. It explains why these banks always demand collateral before extending any loan to customers.

The collateral acts as a guarantee that these institutions can always get their money back. In case the borrower suffers a loss and is unable to pay the sum borrowed plus the interest, the collateral will be used to enable the bank to recover. In Islamic banking, the practice is completely different. Kabir and Lewis explain that Shariah-based banks always embrace the principle of profit and loss sharing (43). The principle makes it possible for banks and their customers to share risks arising from investments made. The borrower is assured of the support of the bank in case their investment does not go as per the original plan.

Religious Attachments

When comparing commercial banks and Islamic banks, it is necessary to look at the religious attachment that distinguishes the operations of the two institutions. Commercial banks have no religious attachments. They can serve any customer and it is based on laws and regulations set by the government through various departments and institutions. On the other hand, Islamic banks are under the strict control of Shariah.

The product offered and the method used in offering it should be in line with principles set in the Quran. In 2002, Dubai Islamic Bank opened its first women-only branch in Dubai and various other cities in the region. Many other Islamic financial institutions have followed the same practice of having male and female banking halls. It may not make sense to non-Muslim customers. However, it is an important move that is also in line with Shariah.

Muslim women are prohibited from making physical contact with men who are not their spouses (Farizal and Fahmi 419). In the past, it was very challenging for women to queue in the bank alongside men because of the possibility of making physical contacts. However, the problem is addressed by having female banking halls. In these female bank branches, most of the attendants are women. It eradicates the problem that women faced in banking halls frequented by men. Some of the products offered (or not offered) in Islamic banks may not be realistic to non-Muslim customers. These practices are not common at Emirates Emirates NBD Bank.

Impact of Inflation

Inflation is a common occurrence in any economy. Farizal explains sometimes inflation may have serious consequences on loans that earn interests (38). Financial institutions are at liberty of adjusting the interest rates on loans based on inflation (Kabir and Lewis 41). The policy ensures that banks get the exact value for their loans irrespective of turbulence in the economy. When earnings of a borrower are not adjusted upwards to reflect the inflation in the economy, he may find serious challenges repaying the loan within the right time. Such punitive practices are not embraced in Islamic banking.

When the economy is hit with inflation, the only primary focus of the bank and the borrower is the profit earned from the investment. Sharing of the profit, as opposed to paying interests, eliminates the need for just the repayment plan to reflect the economic changes. It is beneficial to the lender and the borrower. Table 1 below is a summary table that outlines the above and other differences that exist between Islamic banks and commercial banks.

Objectives of Financial Accounting in Islamic Financial Institutions

Emirates Islamic Bank and Dubai Islamic Bank are some of the leading Islamic financial institutions in the United Arab Emirates (Farizal and Fahmi 421). In these financial institutions, the principle of financial accounting has to be applied to ensure that these institutions can be managed sustainably. Financial accounting is one of the areas of accounting, others being cost accounting, managerial accounting, and accounting for non-profit entities (Sameer and Nizami 6).

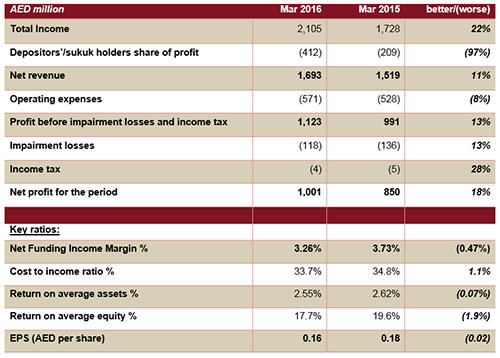

In this paper, the primary focus is on financial accounting. It is important to look at the objectives of financial accounting in Islamic financial institutions. According to Accounting and Auditing Organization for Islamic Financial Institutions, the fundamental objective of financial accounting offer periodic information about a company’s financial position, the results of its operations, and the cash flow to enable the management to make an informed decision.

The report that should be provided under financial accounting includes cash flow, income statement, and a balance sheet. These financial statements show the progress that a company is making in the market. It may indicate that the firm is making positive progress or not using the current strategies. When financial statements show slowing growth, it may be necessary for the management to reevaluate the current strategies. On the other hand, in case the financial statements show impressive economic growth, then the management may need to invest more in the current strategies to achieve greater success in the market. Tables 2 and 3 below show the financial statements of Emirates Islamic Bank and Dubai Islamic Bank.

These statements are critical not only to the management of the firm but also to the external stakeholders. The government uses these financial statements to determine the amount of tax that a given institution should pay based on the earned profits. Lenders would demand the financial statements of a firm before extending a loan. These statements enable creditors to determine the creditworthiness of a firm based on its assets, income statement, and cash flow. In case a firm is publicly traded in the capital market, investors will have to go through the financial statements of a firm to ensure that they make informed decisions.

According to Kabir and Lewis, financial accounting facilitates effective management by directing economic resources (56). The investment decisions that a company makes in each financial year defines its ability to achieve success in the market. Knowing which department and which new idea deserves greater investment is critical. A wrong investment decision may have a lasting consequence that may take some time to cover if proper measures are not taken.

Managers should not make decisions based on what they like or not. Their decisions should be based on hard facts that explain how their decision will benefit the firm. Financial accounting provides that information. It breaks down the financial impacts of every decision both in the short and long terms. It makes it easy to identify the path that should be taken to achieve the most desired result. The top managers no longer have to make decisions based on their hearts’ desires. They are required to base their decisions on financial facts to eliminate undesirable consequences.

In Islamic finance, financial statements play additional roles in the above two primary roles. Farizal and Fahmi explain that one of the most important roles of financial statements in Islamic finance is to inform creditors about profits made by their debtors (422). As explained above, these financial institutions are not allowed to charge interest on their loans. They are required to share profits based on the loan extended to their customers.

It means that they will need to get income statements from these debtors to know how much profits they have made. Using these documents, creditors can easily know what to expect from their customers. Income statement and cash flow statement identify specific activities from which a firm generates its income and spends the resources. Islamic principles prohibit specific practices amongst their faithful.

For instance, Islamic finance prohibits trade in pork because the commodity is considered unholy. A firm that trades in prohibited products is not allowed to get financing from these institutions. The executives and the employees of these firms are also not expected to use such a firm’s resources in purchasing these unholy products or engaging in practices prohibited under the holy Quran (Amin). The financial statements are expected to reflect every income and expense of the firm. It becomes easy to know when a firm is engaging in activities that are categorized as unholy. Islamic banks, while relying on such financial documents, will have a strong basis to reject a request for finance from such institutions.

According to Sameer and Nizami, Islamic finance does not allow financial institutions to adjust the expected income from its customers based on inflation in the market (8). The principle of sharing profits is used in determining the returns that creditors get from loans extended to customers. Financial statements will always reflect changes made in the income of debtors before, during, and after inflation.

The information is used by creditors to determine their expected earnings in each of the three categories when inflation affects the economy. It avoids any misunderstanding between parties involved as to the amount of money that should go to the creditor in each period. Kabir and Lewis also note that financial accounting is critical in Islamic finance because they help in explaining the source of earnings for financial institutions (62). Islamic banks use these statements to confirm that their profits do not come from charging interest on their loans. It validates their commitment to following Islamic teaching in their business activities.

Concept of Financial Accounting in Islamic Financial Institutions

According to Merah, some of the fundamental principles of Islamic financial institutions vary significantly with those of commercial financial institutions (67). The fact that religious beliefs are placed at the center-stage in Islamic finance makes it necessary to develop accounting standards that may be slightly different from that of conventional banks. Accounting and Auditing Organization for Islamic Financial Institutions was established in 1991 to help in developing the financial concepts relevant to Islamic finance.

The institution was also expected to review the existing financial practices and standards and audit them in line with Islamic policies and concepts. To enable local firms to operate in the regional and international markets without having to restructure their financial statements, the local stakeholders have embraced generally accepted accounting principles (GAAP) which have been designed in a way that aligns them with Islamic principles (Farizal and Fahmi 423).

The local GAAP has been popular among institutions that operate in the regional and international markets. It is so because of the desire to have financial statements that can be interpreted easily by relevant local and international stakeholders, especially investors. Having to transform the financial statements from one form to another can be costly and time consuming for these firms. That is why they are embracing the international best practices but in strict adherence to Islamic teachings. The approach enables them to embrace the global image in their accounting standards but in a way that reflects local forces.

Ijarah is another popular concept in Islamic finance in defining rent contact. This concept is used in defining leasing contact that leads to purchase (Accounting and Auditing Organization for Islamic Financial Institutions). Gains made from market speculations are prohibited in Islamic finance. It is common for players in a given industry to come up with speculations that may drive up or down the costs of products in the market. One of the most affected areas is in the real estate industry.

The cost of land or houses may increase rapidly in the market because of events that are expected to happen. In such cases, customers will be forced to pay more for products than would be the case under normal circumstances. Ijarah eliminates such practices that are based on speculations. Purchases of items such as land, therefore, is based on historical costs. The buyer will be presented with the information about the original cost of the land, investments that have been made on it, and many other current factors that are directly or indirectly related to the cost of the land before the appropriate price is determined.

In such circumstances, speculative factors do not play any role in the determination of the price. The binding contract between the seller and the buyer forces them to embrace Islamic principles in drafting agreements (Kabir and Lewis 67). It means that none of the two parties are prohibited to make unfair gains at the expense of the other party.

Merah says that this concept has faced criticism among a section of the business community because of its inability to allow forces of demand and supply to determine the price of products (78). Critics of this concept argue that it fails to take into consideration sudden changes in demand for products based on factors such as increasing population within a given region. For instance, Dubai’s current population is almost ten times what it was about two decades ago (Asian-Oceania Standard Setters Group 9).

That sudden increase in the local population means that the demand for land and related products in the real estate market has also increased significantly. Basing the products in this industry on historical prices can be very misleading and unfair to sellers. Some may avoid selling their land even if they cannot develop it because of the poor market price (Farizal and Fahmi 424). Such actions may limit an economic and infrastructural development of a region. However, these arguments against the concept of Ijarah do not mean it is a wrong principle. It is critical in eliminating unfair market practices where a small section of the players from coming up with speculative pricing for their benefit at the expense of the larger population.

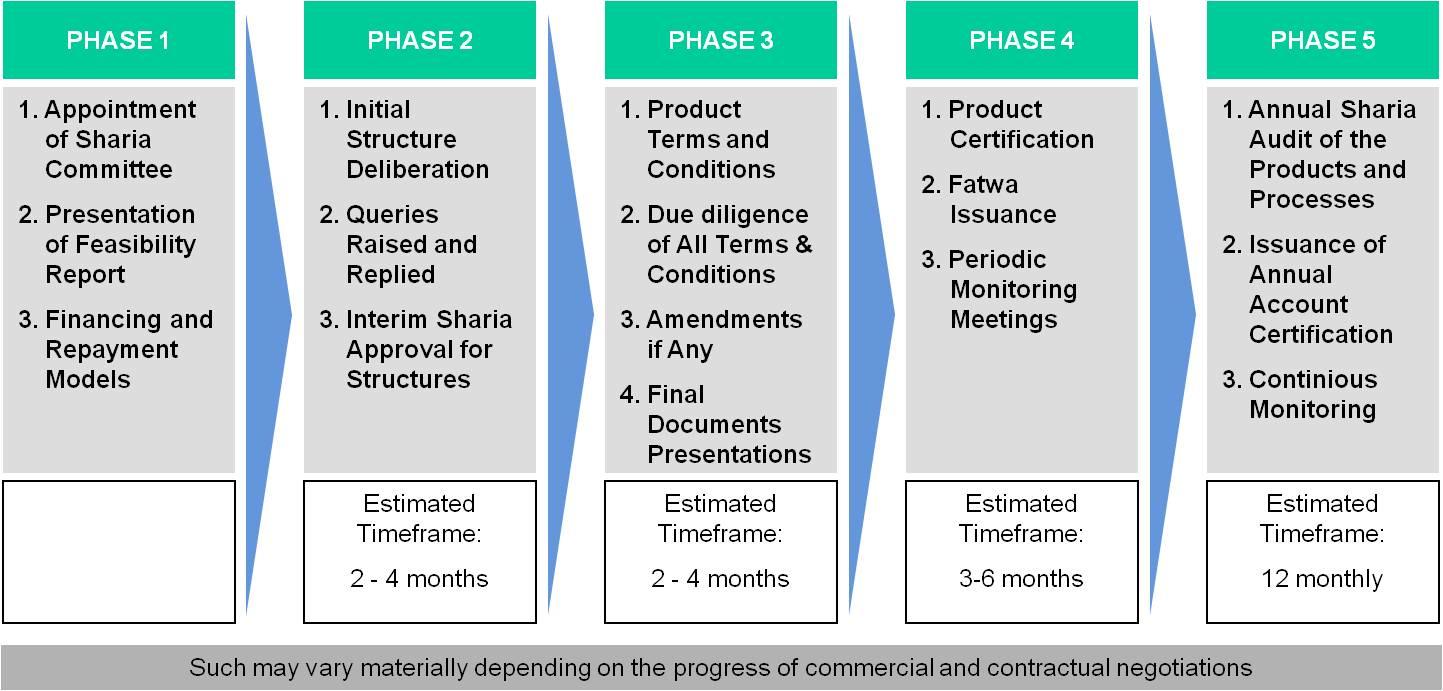

Murabaha is another Islamic accounting concept that is closely related to the mortgage concept popular in commercial banks. In this case, when a customer identifies a house or a property that he is willing to purchase but lacks the funds, he will approach the bank for financing. However, the nature of the financial arrangement between the customer and the bank is always complex in such cases. Islamic finance prohibits the concept of charging interest on products and instead favors the sharing of profits (Kabir and Lewis 78).

The problem is that the property may not be meant for profit-making as the customer may be purchasing it for residential purposes. It means that it is not possible to determine the profit made from such an investment. In such complex cases, Murabaha comes with a possible solution to the problem. The Islamic financial institution will purchase the product and then lease it to the customer to finally sell it.

The rent-to-own concept allows the customer to be a tenant in the facility until such a time that the full value of the house is paid. The price of the house, after it is purchased by the bank, will be based on historical costs and other charges that the firm had to incur. The following framework (figure 1) shows stages that should be followed when an Islamic bank is planning to extend such a benefit to its customers:

Cost Analysis

Islamic banks, just like commercial banks, must make profits in the market to ensure that their operations are sustainable. However, the profits must be earned in a way that is in line with Islamic principles. In the cost analysis, the researcher will focus on how these Islamic financial institutions operate to ensure that customers get returns for their investment. In Islamic finance, shareholders must be assured that the benefits that they get are not obtained from activities that infringe Islamic law (Kabir and Lewis 98).

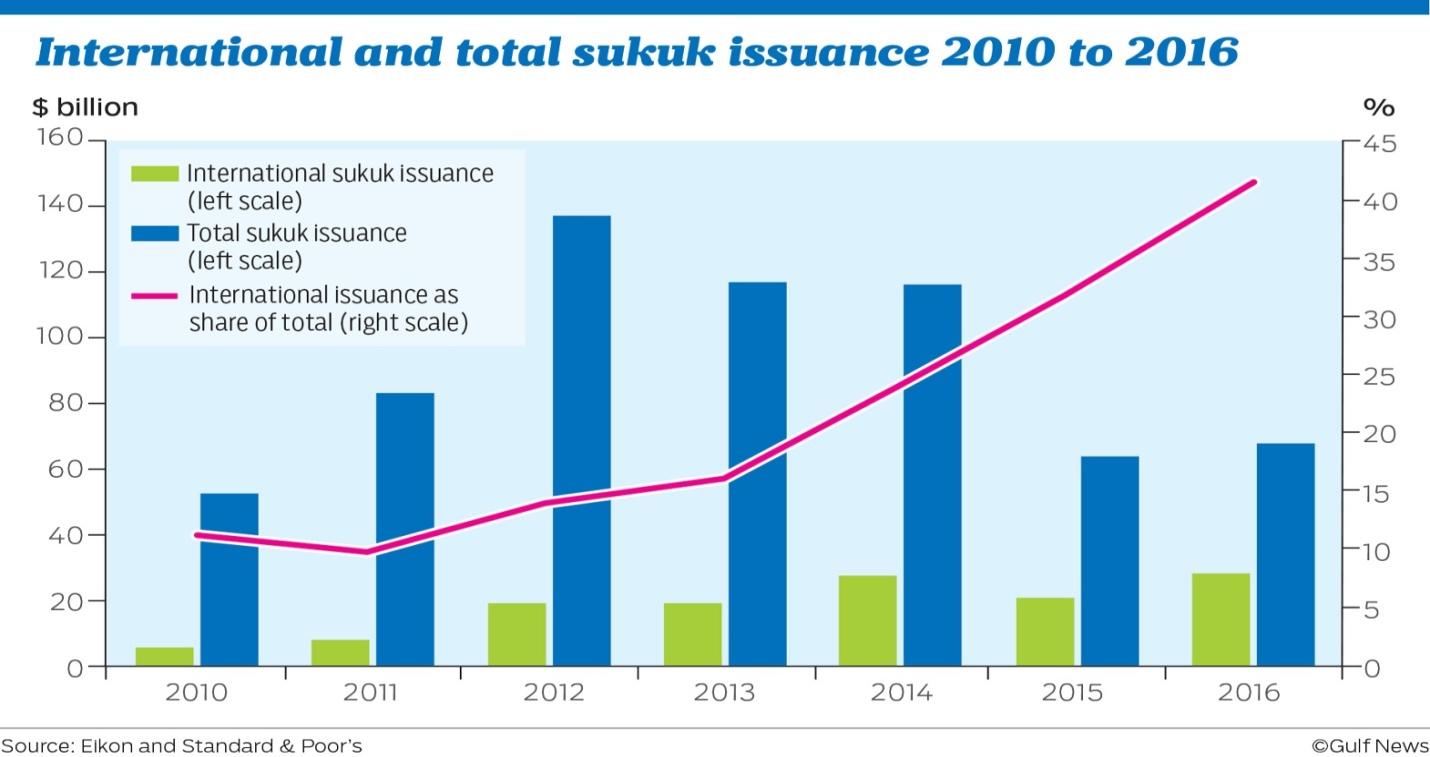

As such, Sukuk (Islamic bonds) have become very popular in determining the benefits that shareholders would get from their investment. According to Farizal, Sukuk issuance in the international market has been on the rise because it is one of the products that assurances investors of attractive returns without breaking laws stipulated in the Holy Quran (35). Figure 2 below shows Sukuk issuance in the global market from 2010 to 2016:

The table shows that the issuance of Sukuk in the regional and international market is growing rapidly. Muslims around the world are currently offered a perfect opportunity to invest their money on projects that are aligned with Shariah principles. Some of these returns are just as impressive as what is offered in commercial banks.

Competitive Features

Competition in the financial market is very stiff, and companies are under pressure to come up with ways of attracting and retaining a pool of customers. As such, both commercial and Islamic banks have come up with ways of ensuring that they maintain a pool of loyal customers. On the one hand, commercial banks are keen on attracting customers based on the lucrative benefits that may not be available in Islamic banks.

On the other hand, Islamic banks are keen on developing religion-based products that offer their customers superior value based on their beliefs. Analysis of the websites of Emirates NBD (a commercial bank) and Emirates Islamic Bank (an Islamic bank) will help in elaborating on the competitive features of the two products in the current market. Figure 3 below is the website of Emirates NBD Bank:

The website shows that although Emirates NBD Bank is a commercial financial institution, it majorly targets Muslims because of its location. Although the bank is completely silent when it comes to Islamic principles, its products are designed to meet the local demands of its customers. For instance, individual customers can select personal banking, priority banking, or private banking based on their personal needs.

Corporate entities can use business banking, corporate banking, and investment banking based on their personal needs. Customers need to understand their unique needs based on various factors and select products that meet them in the best way possible. The variety of products offered by this commercial bank has made it popular among local customers, most of whom are Christians. Figure 4 below shows the websites of Emirates Islamic Bank, one of the major market rivals of Emirates NBD Bank:

The analysis of the website indicates that this Islamic bank is keen on gaining a competitive edge over its market rivals based on its religious nature. A prayer time and an Islamic calendar are some of the basic features on the website. It means that its customers are constantly reminded when they should stop what they are doing and pray if they are regular visitors to the website. The calendar reminds them of important Islamic events that they should not forget.

These are features that are not available on websites of commercial banks in the country. Other than these Islamic-based services, the bank also has financial products needed by their customers, just like the commercial banks. The bank offers some of the emerging products in the banking industry. The website shows that at Emirates Islamic Bank, customers are offered mobile banking services. It also has modern Flex-Cards to improve the shopping experience of its customers. These improved features are meant to ensure that the bank attracts and retains a large pool of loyal customers.

Implementation

When implementing Islamic principles in the financial sector, it is important to ensure that international best practices are not ignored. According to Merah, most of the regional Islamic financial institutions have embraced GAAP standards, especially when preparing financial statements (96). However, that may need to change because of the market trends witnessed in the recent past. Dubai is currently one of the leading global business hubs that attract both regional and international investors.

Local companies are also spreading their operations beyond the MENA region. For instance, Emirates NBD Bank has a branch in London. Some of the accounting principles and practices that it uses in the United Arab Emirates may not be applicable in the United Kingdom. It explains why the International Financial Reporting Standards (IFRS) are becoming popular in most of the local companies with a regional and international presence. It means that when Islamic banks are implementing Islamic principles in Islamic finance, they should not ignore some of the international best practices.

Whenever there is a practice that is prohibited by Shariah, it is necessary to find alternative practices that would offer similar or related products with acceptable ones under the Quran. For instance, the concept of replacing mortgages with Murabaha was a perfect way of ensuring that banks could help their customers to acquire homes or property in a way that benefits both the customer and the bank, but in a way that avoids interests which are prohibited under Shariah (Kabir and Lewis 112). Such delicate balancing in implementing principles and policies of Islamic finance enables both customers and banks to have access to relevant products needed to facilitate activities in the banking sector.

Conclusion

Islamic finance has gained massive popularity in many countries that have a significant population of Muslims. It offers them a unique opportunity to access various financial products that are designed in line with Islamic principles. Murabaha, Sukuk, and Ijarah are some of the common products that are available in Islamic banking. These products are designed to meet the financial needs of customers and to earn Islamic bank’s profits, but in ways that do not go against Islamic principles.

The banking sector is increasingly becoming competitive not only in the United Arab Emirates but across the world. Financial institutions operating in this industry, whether they are commercial banks of Islamic financial entities, must find ways of offering unique products to their customers in superior ways. Clients must feel that these firms understand their needs in the modern dynamic financial marketplace.

Findings from the review of literature and information collected from some of the employees of these institutions show that Islamic banking is becoming popular, but that does not mean commercial banks have lost their appeal in the market. It means that the ability of a firm to achieve success in the market depends on its ability to understand customers’ needs and offer it in the best way possible. Therefore, offering Islamic banking services in the local market is not an automatic way of achieving success in the United Arab Emirates.

Future Outlook

The banking sector has undergone a massive transformation over the past two decades as companies try to attract customers in the market. The emergence of Islamic banking is part of that transformation as products are being designed to meet personal needs. The future of Islamic banking is very bright, especially in countries that have a significant population of Muslims. Some of these Islamic banks are coming with products that attract even non-Muslim clients.

As Merah (99) notes, the fundamental goal of these financial institutions is to offer products that are in line with the emerging needs. The analysis also indicates that local financial institutions should not ignore international best practices. Although GAAP standards are popular among local financial institutions, the study shows that local firms may need to embrace IFRS because of the globalization effects.

The study also suggests that Islamic banks will be forced to find a compromise in terms of managing the demand for products that benefit depositors. Kabir and Lewis (119) note that some of the depositors often prefer having standard revenue from their deposits. The profit mechanism may not be very clear to some of the depositors. Having an alternative product that will assure depositors of regular returns on their money in the bank may make Islamic financial institutions more competitive than they are currently.

Recommendations

Dubai Islamic Bank made a major break in the banking sector when it started the first Islamic ban in 1975. Since then, Islamic finance has become popular in the MENA region and other parts of the world that have a significant proportion of Muslims. These institutions are keen on offering products in line with the teaching of the Quran. In the current competitive business environment, these firms may need to consider the following recommendations to achieve success in the market.

- Islamic financial institutions should consider developing more products based on the emerging market needs both locally and internationally. New products should target both Muslims and non-Muslim customers.

- The local financial institutions should embrace international financial reporting standards (IFRS) instead of the local generally accepted accounting principles (GAAP). The new international principles are very beneficial to firms operating in the regional and international markets.

- Stakeholders should create awareness amongst the target customers to dispel the perception that Islamic financial institutions are specifically meant for Muslims.

Works Cited

Accounting and Auditing Organization for Islamic Financial Institutions. “Objectives of Financial Accounting for Islamic Banks and IFIs and Objective and Principles of Auditing”. AAOIFI, 2009. Web.

Amin, Mohammed. “Islamic Financial Institutions and the Implications of Accounting under IFRS”. AAOIFI, 2012. Web.

Asian-Oceania Standard Setters Group. “Financial Reporting by Islamic Financial Institutions a Study of Financial Statements of Islamic Financial Institutions.” AOSSG, 2015. Web.

Farizal, Mohammed. “Accounting Standards and Islamic Financial Institutions: The Malaysian Experience.” Journal of Islamic Banking and Finance, vol. 4, no. 1, 2016, pp. 33-38.

Farizal, Mohammed, and Fadzlina Fahmi. “The Influence of AAOIFI Accounting Standards in Reporting Islamic Financial Institutions in Malaysia.” Procedia Economics and Finance, vol. 31, no. 1, 2015, 418-424.

Kabir, Hassan, and Mervyn Lewis. Handbook of Islamic Banking. Edward Elgar Publishing, 2007.

Merah, Hassan. Shariah Standards: Accounting and Auditing Organization for Islamic Financial Institutions. AAOIFI, 2015.

Sameer, Ahmed, and Farhan Nizami. “Accounting Standards for Islamic Financial Institutions in United Kingdom and Indonesia.” Contabilidadw e Controladoria no Seculo, vol. 29, no. 31, 2015, 1-14.

Sarea, Mohammed, and Mohd Hanefah. “The Need of Accounting Standards for Islamic Financial Institutions.” International Management Review, vol. 9, no. 2, 2013, 50-58.