Executive Summary

The growing dependence on sophisticated technology and systems in every walk of life has increased the incidence of risk on various commercial and public utility activities. This has necessitated the development of various analytical tools and techniques to assess the potential impact of such risk in creating losses or gains to the project or other activity being assessed. The current research attempts to explore the basics of risk analysis and assessment and examines the effectiveness of some of the existing risk assessment techniques. Through the qualitative research method of a case study of open cut coal mine rehabilitation, the study concludes that the risk assessment techniques have an inherent quality in providing a subjective assessment as they are more qualitative in nature providing quantitative predictions of potential losses arising out of the associated risks only to a certain extent. The research also concludes that the risk assessment techniques are more suited for providing information for making informed decisions on public expenditure projects on the basis of benefit-cost analysis.

Introduction

The word risk originates from the Italian word risicare meaning ‘to dare’. Webster’s Dictionary (1989) defines the word risk to:

- means exposure to the chance of injury or loss

- a hazard or dangerous chance

- the hazard or chance of loss

- the degree of probability of such loss

The understanding of risk, measuring it, and analyzing its consequences has made risk-taking one of the drivers of modern Western industrial development. Economic growth, improved quality of life, and technological advancements – all have been the positive outcomes of risk-taking. In the traditional setting, codes, predetermined standards, and fixed hardware requirements guided the carrying out of hazardous activities. In the modern world, there is a complete change in the focus wherewith the functional orientation what is interesting is the result to achieve, rather than the solutions or guidelines to achieve the desired end. In such a functional system the ability to address risk becomes the key element. Therefore, identifying and categorizing risks is of critical importance for providing decision support for making suitable choices of arrangements and measures to achieve what is planned.

Risk Analysis – an Overview

While risk is the potential loss that occurs because of natural or human activities, the potential losses are “the adverse consequences of such activities in the form of loss of human life, adverse health effects, loss of property, and damage to the natural environment”. (Modarres, 2006) Risk analysis, therefore, is a process that characterizes, manages, and informs others about the existence, nature, magnitude, and prevalence of potential losses in any situation. The process also describes and cautions on the contributing factors and uncertainties connected with such potential losses. In engineering systems comprising of hardware, software, and human organizations potential losses due to the associated risks may arise externally to the system or losses caused by the system to the humans, organization, assets, and/or environment. The loss may also occur internally resulting in damages to the system only. From an engineering perspective, the risk or potential loss results in exposure of recipients to hazards, and such hazards normally extend to “injury or loss of life, reconstruction cost, loss of economic activity and environmental losses”. In engineering systems, risk analysis is undertaken to measure the extent of the potential loss as well as to identify the elements of the system which are most responsible for causing such losses.

A risk management system thus signifies the ability to define the probable future course of events, making closer to a realistic assessment of the associated risks and uncertainties and enabling decision-making among the available alternatives. Risk management extends the decision-making ability to a number of varied social, economic, business and political issues. Based on an evaluation of several quantitative and qualitative factors interconnected with the issues under consideration, the best alternative giving the highest probability needs to be selected in any decision-making process. In business situations, choosing a specific alternative depends on the consideration of associated costs and other key performance measures as well as a careful assessment of risk and uncertainties to ensure positive outcomes. However, it cannot be ruled out that there might also result in some negative outcomes; but positive outcomes should be visualized as the overall outcomes. This is the essence of risk assessment and the process of risk management.

Risk analysis has its intellectual roots traced back to hundred years, yet this discipline is developed into an organized body of knowledge only within the past two decades. Risk analysis is undertaken to serve several purposes such as determination of environmental and health hazards associated with a number of activities or substances or for comparing new and existing technologies or for determining the effectiveness of different control and mitigation techniques designed to reduce risks (Cohrssen & Covello, 1999). Risk analysis is also undertaken to set the priorities of the management in choosing one among several activities for regulatory or corrective action. Risk assessment on the other hand is the technical assessment of the nature and magnitude of risk. Both the terms risk analysis and risk assessment are mostly used synonymously. Risk management uses information and data gathered from risk assessment and analysis and assimilate such information with information on technical resources, social, economic, and political values to choose the control or response options. Risk management is resorted to determine means of reducing the risk or eliminating the risk. The difference between risk management and risk assessment is subject to wider debates and is not within the purview of this report. However, risk perceptions have a large influence on both risk management and risk assessment. People have different perceptions about risks and such perceptions are affected by different elements such as the persons or things likely to be affected, nature, familiarity, and magnitude of perceived effects. The perceptions are often also based on the likely benefits to accrue from acceptance of the risks. Because risk is ubiquitous, risk analysis techniques are used to analyze a number of phenomena having different magnitudes. Risk analysis makes use of a wide variety of techniques that can be used in situations where the solutions are not explicitly available and where the information on the potential losses is ambiguous and uncertain. Risk analysis uses various disciplines like science, engineering, and statistics for analyzing the risk-related information and for making estimation and evaluation of the probability and magnitude of the associated risks.

Objectives

This research aims to present an analytical report on risk analysis and techniques of risk analysis with respect to engineering systems. In order to achieve this aim, the research makes an in-depth study of risk analysis and assessment in general, elements and types of risk analysis, and the application of risk analysis tools. The research also extends to economic methods in risk analysis.

Research Hypothesis

- The research on risk assessment is expected to provide theoretical support to the following research questions.

- To what extent do risk analysis techniques extend the knowledge on the potential losses associated with any project?

- Is the application of risk analysis techniques effective in bringing about the extent of potential losses in any risk situation?

- To what extent do the limitations on risk analysis tools prevent the full gathering of information pertaining to the risks?

The research finds theoretical support to the above research questions and checks the veracity of the following hypothesis.

Risk assessment techniques are vital to the determination of the extent of potential losses arising out of a given risk situation.

Despite the limitations of the risk analysis tools and techniques, risk assessment procedures are important in assessing the potential hazards from any risk incidents.

Significance of the Research

In the present-day competitive business environment, it becomes important for each organization to precisely arrive at the level of their responsibilities both for control and performance. This requires a careful assessment of all potential losses that may occur as a result of the business activities undertaken by the organization. Risk assessment becomes handy in protecting the workers, the business and for complying with the legal requirements. Risk assessment helps organizations to focus on the risks that really matter in any organization. Wide-ranging information is required for controlling the potential losses and unless a well-designed risk assessment is performed the organization may not be able to gather the required information. From this point of view extension of the knowledge on risk assessment in general and risk assessment techniques in specific becomes significant. This study aims to extend the knowledge in this direction and hence assumes significance.

Structure

In order to present a comprehensive and analytical report on risk assessment and the associated techniques, this study is structured to have different chapters. The first chapter introduces the subject matter of risk analysis and details the objectives of the study. A detailed review of the available literature is presented in chapter two to extend the knowledge on the topic of risk assessment. Chapter three presents a brief overview of the research method used by the study followed by chapter four which presents an analysis of the findings of the research. Chapter five contains concluding remarks summarizing the issues discussed in the paper and few suggestions for future research on the field of risk assessment.

Literature Review

Introduction

Risk is pervasive in all projects and business ventures entered into by individuals or organizations irrespective of the size and nature of such ventures. The time and place of execution of the ventures do not matter with respect to the incidence of risks. Risk is present in different forms and levels and the risks could result in significant “budget overruns, delivery delays, failures, financial losses, environmental damages and even injury and loss of life.”

Despite the potential hazards and losses risks are undertaken because of the “potential benefits, rewards, survival or future return on investment.” The concept of risk can be associated with uncertainties embedded in the events. Within the context of the execution of a project, risk can be connected with an uncertain event or condition which if occurs would result in a positive or negative effect on the objectives of the project. In order to measure the risk, it is necessary to assess the defining components with an assessment of the chances of occurrence of an event, its negativity and potential rewards and benefits of such occurrence. “Estimation of the risk is usually based on the expected result of the conditional probability of the event occurring multiplied by the consequence of the event given that it has occurred”.

Elements of Risk

Risk is a measure used to describe the probability that an event may occur leading to particular consequences. The risk may be applied to a number of complex situations. Consequently, there are several implications associated with risks, such as the existence of a hazard and the hazard becoming an event. It also includes the implication of such an event causing potential losses or transforming into a disaster. Generally, a risk emanates from the happening of an event or a series of events in which case it is referred to as a scenario. Therefore, an event or scenario happens to be the cause of a risk and if the event or scenario occurs, it results in its severe consequences. The events may be found to happen within the project environment which may lead to the success or failure of the project through the carrying out of the management practices or alternatively, the event may stay in the place of external partners or subcontractors.

In general, the extent of damages by risk is calculated by “multiplying the quantitative scores of individual hazard probabilities and the potential level of impact”. Risk priorities are often determined based on risk estimates. Various factors influence the accurate prediction of probabilities in the process of risk assessment. Literature has identified several factors and variables that need to be taken into account at the conceptual, logistical, and operational levels while undertaking any risk assessment process in order to improve the accuracy of predictions.

They are:

- clear definition of risk and terms associated with the specific risk

- clear definition and detail of the potential situations

- identification of the systems at risk

- identification of the characters of the hazards and events

- selection of proper risk assessment methodology

Process of Risk Management

Risk is pervasive in every human activity (Dey & Ogunlana, 2004; (Poh & Tah, 2006). Therefore, risk identification and management become important for the success or failure of any project. According to Mills, (2001) risks associated with a project impacts all the aspects of the respective project including the cost. Edwards & Bowen, (1998) have identified risk assessment and management as an important tool to cope up with risks in projects especially construction projects. Baker et al., (1999) argue that risk management is important for maximizing the profits of a project by enabling timely completion and by safeguarding against potential losses. A number of definitions of risk management have been evolved by previous studies and research (Chapman & Ward, 1997; Edwards & Bowen, 1998; Hastak & Shaked, 2000; Lyons & Skitmore, 2004; Project Risk Management Handbook, 2003; Gray & Larson, 2005). The process of risk management includes various steps. Risk identification, risk analysis, and risk response are some of the important steps of this process. The following sections briefly describe these steps involved in the risk management process.

Risk identification has been identified to be the first important process in the risk management process (Hayes et al., 1986; Williams, 1995). According to Dawood, (1998), risk management when undertaken systematically will enable early detection of associated risks. This process operates to eliminate the need for evolving contingency plans in handling larger projects. Flangan & Norman, (1993) observe that a risk when identified becomes no longer a risk but a clear management issue to be tackled. Consequences and impact of risk along with types of risks are also identified in the process of risk identification.

Risk allocation is a process where the identified risks are safeguarded by shifting or sharing the potential losses of an event. Kartam & Kartam, (2001) is of the view that the responsibility for all potential losses arising from any risk stays with the owner of the project and when allocated, such allocation should be supported by fair compensation for the risk of bearing the losses on behalf of the owner.

Risk handling is the way to lessen the impact of risk and is one of the critical components in the risk management process. The managers must make a careful assessment of all the contents and effects of all alternatives before arriving at any decision on the strategies for risk handling (Wang & Chou, 2003). Baker et al (1999) define risk handling as the first step in the risk management process. Kim & Bajaj, (2000) identify risk handling/response as the way in which the potential losses of risk can be shifted or shared. Flanagan and Norman (1993) risk handling is the process of managing risks by transferring the potential losses to another party or by retaining the chances of incurring such losses. Risk-retention, risk reduction, risk transfer, and risk avoidance are the categories of risk-handling principles (Raftery, 1994; Dey, 2001).

Importance of Risk Analysis

The importance of risk analysis can be found in dealing with increasingly complex engineering systems. For example, in transportation and energy systems a number of technological developments take place almost daily which enlarges the public risk in these fields. The complexity gets enhanced as a natural evolution process, although it is not a universal phenomenon. For instance, with sophisticated information and communication techniques, terrorists make water or energy sources less secure requiring additional layers of protection, prevention and safeguarding. As a concurrent development, with the increase in information and knowledge of the public, there is the demand and need for higher levels of safety, health, and security requirements because of the increased complexity of the systems. Therefore, in a democratic society, it becomes important for the government and the private enterprises to understand and meet the public demand by making their policies consistent with such demands. In recent periods risk analysis is one important and powerful tool to address these public issues and to develop sound and safety policies and design strategies.

Thus, political and organizational challenges, technical uncertainties, and difficult value trade-offs among competing, goals have made it difficult to arrive at a consensus on the policies to be followed to manage the potential hazards, dangers and losses to humans as well as other inanimate things. However, suitable policies must be developed and implemented to achieve the desired outcomes in the matter of protecting the health or assets. It is therefore important that the use of risk analysis to improve risk management decisions and policies resorts.

For instance, in the public health area, risk analysis provides a framework for the systematic identification of the factors and processes that have an impact on human health. By using appropriate risk analysis models, avoidance of health risks can be attempted. The component modules and sub modules of a quantitative risk assessment model would be able to provide an overall picture of the potential health hazard for predicting and/or explaining the probable human health impacts of different risk management interventions. “Validated risk assessment models can also be used to help identify risk management policies and interventions that correspond to desirable predicted risk profiles – those with relatively high human health benefits and low human health losses.” (Cox, 2006) Even though such risk analysis information on its own cannot solve the political and coordination problems of any public health issue, the analysis provides the necessary technical information for identifying the type of interventions that will be effective in protecting against devastating public health issues and which are least likely to provide such protection.

Demand for Risk Analysis

The demand for risk analysis can be seen from the significance of eliminating all risks associated with an activity. Risks must be weighed in terms of (i) risks of alternative activities to that which is being considered and (ii) tradeoffs between the benefits likely to accrue from the incremental efforts taken to mitigate the particular risks and the cost of such efforts in getting the resultant benefits. Here lies the demand for risk analysis. Risk analysis provides the information needed to weigh the alternatives and analyzing the tradeoffs between costs and benefits. This is more so when there is ambiguity surrounding the available information and the information is uncertain and not obvious to make a decision. Risk assessment techniques become handy in providing a means of presenting the relevant information in an organized way and estimating the impact of adverse consequences. However, the analysis conducted using risk assessment techniques may be able to provide precision to the information only to a certain degree, because of the tentative nature of the underlying assumptions and uncertainties which are inherent in the risk assessment. The demand for risk assessment arises due to the conflict between underlying societal and individual values. This conflict makes the tradeoff process highly controversial. For example, balancing the benefits of pollution reduction against the availability of additional employment opportunities may prove to be a controversial one. In the eyes of the public production and selling of desirable products at affordable prices and increase in the employment opportunities because of enlarged production are desirable. The higher employment opportunities also provide security through steady employment and income. However, controlling pollution might enhance the cost of the products and sometimes may require the closure of some production facilities to the detriment of society. In such cases there is a demand for risk analysis and efforts may be taken to arrive at a balance by considering what constitutes acceptable risk by using any risk assessment tools. Thus to meet the demand for risk analysis, individuals and corporate decision-makers identify levels of risk that are within the tolerance limit in the light of several other factors like cost of risk reduction, perceived risks, and benefits of the technology applied, activity or substance that poses the risk and the available alternatives for the activity or substance (Cavello et al 1986; Travis et al 1987; Travis and Hattermer-Frey, 1988).

Categories of Risk

Because of the prevalence of risk in any activity or business venture, risk has been categorized in different ways. Different disciplines have categorized risk using different terms such as hazards or risk exposures. Causes of the risk and the nature of consequential loss may form the basis of the categorization of risks. Risk, in general, has been defined to mean the potential for loss. The potential loss may be expressed in terms of economic loss and therefore risk is viewed as a potential economic loss. However, it is possible to make a more appropriate categorization based on five different categories in which potential loss may occur. These risk categories are:

- Health risk analysis – presenting information on potential disease and losses of life which affect the lives of humans, animals and plants

- Safety risk analysis – involving the estimation of potential harms caused by disastrous events occurring due to natural events like changes in climatic conditions, floods, earthquakes, forest fires. Such risk may also arise from human made products, technologies, and systems like aircraft crashes, chemical plant explosions and technology obsolescence or failure

- Security risk analysis – includes the analysis of risks of access and harm caused by acts of war, terrorism, crime and misappropriation of information as in the case of leakage of national security information, intellectual property

- Financial risk analysis – is the most common one which involves estimation of potential individual, institutional and societal losses in financial terms such as currency fluctuations, changes in interest rates, movements in share market prices, project losses, accounting and other financial frauds and damages to property and assets

- Environmental risk analysis – involving estimation of losses due to noise, contamination and pollution in ecosystem and in space

Risk analysis may study the interrelationship between any of these categories of risk. For instance environmental risk may as well lead to financial risk.

Trends in the Use of Risk Analysis Methods in Engineering

Risk analysis in engineering systems traditionally has been undertaken by designing or regulating the systems in a conservative manner so that the incidence of risk could be avoided to the maximum extent. An example may be found in the nuclear industry where the application of the philosophy of defense-in-depth takes place which includes “multiple safety barriers, large safety margins, quality control, and frequent inspections”. However, studies have proved that though this philosophy is able to assure safety at a reasonable level, it often leads to the establishment of expensive systems, procedures, and technologies that neither the society nor the market could afford cost-wise. It is observed that some of the designs and regulations adopted on a conservative basis at exorbitant costs to reduce the risk of complex engineering systems do not serve the purpose as they may not be able to assure enough safety and protection. In recognition of these problems, industries in modern times have resorted to formal risk analysis techniques in order to evaluate different factors contributing to risk and to improve the safety of engineering systems used in practice. The latest trends indicate the nuclear industry, as well as industries in the fields of transportation, space, and food safety, is making greater use of risk analysis in assessing their operations and decision-making in policy matters. It is also observed that risk analysis is being used in all stages of production like design, development, construction, and operation of the engineering systems.

Elements and Types of Risk Analysis

Risk analysis concerns estimating the potential and magnitude of any loss and ways to control the potential loss. If there are adequate historical data available on the estimation of such losses, then it becomes possible to directly estimate the actual loss from the historical figures. This approach is useful in cases where statistical data is readily available as in the case of car accidents, cancer deaths, and consequences of natural events such as storms and earthquakes. In other cases where there is no data available on actual losses, the loss is modeled in the risk analysis and the potential loss estimated. However, in cases of complex engineering systems data on losses are small or they may not even be available. In these cases, the analyst should necessarily model the loss and make a reasonable prediction of the risk.

Irrespective of the types of risks being considered all risk assessments generally include the following elements:

- Identifying the threats that could harm and adversely affect critical operations and assets. Such threats include actions of intruders, criminals, disgruntled employees, threats and natural disasters

- Estimating the likelihood that the threats will materialize based on historical data available and judgment of knowledgeable individuals

- “Identifying and ranking the value, sensitivity, and criticality of the operations and assets that could be affected should a threat materialize in order to determine which operations and assets are the most important.” (General Accounting Office, 1998)

- Estimating the potential losses or damages which would result in the threat materializing especially in the case of most critical and sensitive assets and operations. The potential loss would include recovery costs also

- Identifying cost-effective measures in order to mitigate the associated risk. Such measures may include the implementation of new organizational systems and procedures and the institution of technical or physical controls.

Risk analysis is used to measure the magnitude of the losses associated with the complex engineering systems by adopting risk evaluation, risk reduction, and control policies. Generally, there are three types of risk analysis are used. They are (i) quantitative, (ii) qualitative, and (iii) a combination of the two types.

Quantitative Risk Analysis

The quantitative risk analysis method is used to analyze numerically the effect of potential losses of a risk on achieving the desired outcome of a project or any other event. The objective of quantitative risk analysis is to determine the probability of achieving desired objectives and to identify the risks that require immediate and most attention by establishing the quantitative effect of their relative contribution to the project risks. Quantitative risk analysis helps identify realistic and achievable costs and to complete the tasks within the scheduled time and quantifying project outcomes and the probabilities of their achievement. With quantitative risk analysis techniques, project management decisions can be guided under conditions of uncertainty by enabling the organization to determine the size of contingency.

Inputs to quantitative risk analysis include organizational and environmental process assets giving information from past projects, studies of similar projects and risk databases. Risk management plans consisting of major elements like roles and responsibilities of individuals and agencies connected with the activities, budgets, and schedule for risk management activities, risk categories, and definitions of probability and impact.

There are different tools and techniques used for engaging quantitative risk analysis methods. These include data gathering and representation techniques such as interviewing, documenting and expert judgment. Sensitivity analysis is another technique used in quantitative risk analysis which is used to determine the risks which have the most potential impact on the project or other activity. Expected monetary value analysis is another method that considers the probability of each possible outcome. It is also used to determine the average value of all outcomes. Decision tree analysis is a diagrammatic method that describes a decision under consideration and the implication of choosing one of the available alternatives. In the decision tree analysis probabilities of risks and the cost or rewards of each event and the cost impact of all future decisions are considered in analyzing the risks involved in each of the alternatives. Quantitative risk analysis uses the simulation method in analyzing the impact of risks which translates the uncertainties specified at a detailed level to their potential impact on achieving the objectives of the project or the other intended activity. The Monte Carlo technique is one of the popular methods used in the process of simulation. Work Breakdown Structure (WBS) is a model which is used in simulating projects for a cost risk analysis. For analyzing the time of completion the Critical Path Method (CPM) is used. Outputs of quantitative risk analysis include the risk register which reflects the result from the quantitative risk analysis in the form of probabilistic analysis. The results broadly indicate the probability of achieving the project cost and time objectives, priority of the quantified risks, and trends in quantitative risk analysis results (Batman, 2009). The quantitative risk analysis method is “complicated, time-consuming and expensive”.

Qualitative Risk Analysis

Qualitative risk analysis enables quicker identification of potential risks as well as assets and resources which are vulnerable to the risks. Because of its ability to make the analysis quickly, this method is the preferred method of risk analysis. The qualitative analysis analyzes and reports on the effectiveness of the safety measures which are already in use. The method also exhibits the measures which would be useful in mitigating the potential risks when implemented. The objective of qualitative risk analysis is to embark on a degree of risk protection that is acceptable and will also enable the analyst and the managers to become increasingly aware of the risk protection possibilities. The qualitative risk analysis makes use of basic data and information which are readily available and does not need the values of all assets in question for analysis. Qualitative risk analysis adopts a highly subjective process (Exforsys, 2000). This method uses linguistic scales such as low, medium, and high for estimating the potential loss from any risk. In the qualitative risk analysis method to report the impact of potential loss a matrix is formed which represents the risk n the form of frequency of the loss versus the potential amount of loss. The loss is expressed in qualitative terms. Policy and risk management decisions are made based on the information gathered from this matrix. The analysis under this method is far simple as there is no need to rely on actual data and probabilistic treatment of such data. This makes the method easier to use and understand, despite its subjective nature. The qualitative risk analysis method is employed for making risk management decisions on “single product safety, simple physical security and straightforward processes”.

Mixed Method of Risk Analysis

While certain serious risk assessments use a purely qualitative approach because of its limited usefulness, some of the assessments make use of a mixed method in which both quantitative and qualitative assessments are combined to enhance the usefulness of the comparative results. These methods may be predominantly qualitative but they have a quantitative foundation applied to either the frequency variable or the consequence variable or sometimes even both. This approach makes use of a 4 x 4 matrix with broad quantitative scales for frequency of the risks and purely qualitative descriptions for the consequence axis. The risks are categorized into acceptable, marginal and unacceptable. Even though the frequency of the risk is expressed in quantitative terms, the resulting risk for each region in the matrix is a mixed product of numerical range and qualitative description of low, medium or high. However there can be no direct comparisons possible between the risks of some regions. This method has the same rules of comparison as being adopted in qualitative risk analysis method. There is no objective logical way to compare the risks from different regions unless they are connected directly by a chain of links from lower to higher risks. It is possible to make designations such as acceptable, marginal and unacceptable on a purely subjective basis after placing all the risks in the matrix (Altenbach, 1995).

Risk Analysis Tools

Different tools are being used to estimate the probabilities of risk-taking place. These tools categorize risks according to their level of intensity and the harm they can cause. The tools which are able to estimate the losses precisely are considered better ones. The financial indicators used by them for arriving at the cost of protection against risks and the probable return on investment also decide their superiority. Risk analysis tools should possess the capability to measure the potential for loss that a possible threat can cause to the organization or entity. The computer-based software tools are the modern practices for risk assessment. The use of these tools depends largely on the extensive database consisting of all possible threats and consequences which are associated with probabilistic estimates of all future events. This facility with the computerized software tools reduces the time taken to research on the basic information needed for risk analysis and to this extent these tools can be considered more sophisticated in carrying out risk analysis. However, care must be taken in deciding a risk mitigation strategy based on the results provided by these tools as all these tools may not provide information sufficient to reach the decision. Another problem with the software tools is that they are developed by software programmers and not risk experts. The software programmers may not have extensive knowledge and skill in recommending risk mitigation strategies and therefore most of the time their recommendations may not meet the required professional standards. In some cases, the software tool selected may just be a checklist of regulations in which case the tool may not serve the intended purpose (Schreider, 2009). Some of the risk analysis tools that are traditionally in use are discussed in this section.

Sensitivity Analysis

Sensitivity analysis shows the extent to which the viability of a project can be vitiated by variations in major quantifiable variables relating to the project. Sensitivity analysis as a risk analysis technique investigates the impact of changes occurring in different variables associates with any project. “The purpose of sensitivity analysis is: (i) to help identify the key variables which influence the project cost and benefit streams. In WSPs, key variables to be normally included in sensitivity analysis include water demand, investment cost; O&M cost, financial revenues, economic benefits, financial benefits, water tariffs, availability of raw water and discount rates. (ii) to investigate the consequences of likely adverse changes in these key variables; (iii) to assess whether project decisions are likely to be affected by such changes; and, (iv) to identify actions that could mitigate possible adverse effects on the project.” (Water Supply Project, 1999)

There are some definite advantages in using sensitivity analysis in engineering economic applications. The first advantage is that it shows the significance of any given input variable in determining the economic worth of a project. Second, this method is ideal in anticipating and preparing solutions in ‘what if’ situations in presenting and defending a project. Third, this technique does not require a probability analysis. Fourth, it is possible to use sensitivity analysis for any measure of project worth. Finally, this technique becomes handy where the information, time and resources are inadequate to employ other sophisticated techniques (Marshall, 1995).

The major disadvantage of sensitivity analysis is that there is no explicit probabilistic measure of risk exposure which is fundamental in any risk analysis exercise. Although this technique may bring out several positive and negative scenarios in connection with the project, it suffers from the limitation that it does not possess an explicit measure of the respective likelihood of such scenarios (Marshall, 1995).

Decision Tree Model

The decision tree model is useful in evaluating various optional courses of action. The decision tree proves to be an effective model which facilitated the exploration of various options and to examines the likely consequences of selecting any one option. Decision trees enable to arrive at a balanced picture of the risks and rewards associated with each possible course of action which makes the model suitable for deciding between strategies, project investment opportunities especially where there are only limited resources available at the disposal (Mindtools, 1995). This technique is superior to sensitivity analysis as it carries the advantage of laying out the problem clearly to enable the analyst to challenge all the options. Further, this tool helps the analyst to take into account all the possible consequences of any course of action. This tool also enables the formation of a system based on which the values of outcomes can be quantified and the chances of accomplishing them. The tool facilitates decision-making based on available pieces of information and guesstimates (Arsham, 1994). This tool suffers from some basic limitations. The excessive dependence on quantification and numerical approach may not produce the desired effect of evaluation because the tool emphasizes quantifiable factors and does not consider the qualitative aspects of any decision variable. The toll discounts small probabilities and to that extent, the predictions of losses may not be accurate. The tool has another limitation of inadequately considering the risk tolerance level of the clients which makes the tool unrealistic in some instances.

Simulation

The simulation technique is used as a risk analysis tool in evaluating various investment projects, the returns from which are subjected to a high level of uncertainty. “Here probability distributions are attached to a number of non-controllable exogenous variables which determine annual net cash flows, and synthetic sampling from these distributions is carried out in the computer so as to generate the probability distributions of one or more financial performance criteria.” (Dayananda, 2002) The analyst or decision-maker takes a look at this overall distribution in deciding to accept or reject a project proposal based on the net present value or internal rate of return of the project. This technique is known as risk analysis, venture analysis, risk simulation and Monte Carlo Simulation.

The simulation model can be considered better than sensitivity analysis in that this technique not only takes into account the range of possible outcomes but also the probabilities of such outcomes. This technique allows the variables attached to a project simultaneously so that the resulting probability distribution represents the overall performance of the project which is a distinct advantage of this technique. This makes it possible to obtain a more comprehensive measure of risk. This technique provides the decision-maker an idea f the overall range within which the financial performance of the project would lie. The decision-maker can also assess the probability occurrences for various sub-ranges of project performance. The largest limitation of this technique is that there is the need for more volume of information to carry out a risk analysis which sometimes hinders the progress of the evaluation process and computer modeling of simulation techniques is more demanding. The simulation outputs from the computer are complex to read and understand and this is a serious drawback for managers who are not computer savvy (Dayananda, 2002).

Economic Methods of Risk Analysis

Economic and non-economic methodologies are the two classes of decision-making with respect to risk analysis. Economic methodologies make the decisions based on the actual measurable monetary value assigned to risk. “Risks are controlled (through risk aversion) by reducing the frequency that specific risk scenarios will occur or by limiting the consequences by averting or limiting exposure pathways.” There is the need for a risk assessment model which helps in applying the method for reducing the frequency or consequence. In the economic-based approach, the decision to apply the risk control method depends on the economic viability of the proposed risk-controlling approach. The economic-based methods for selecting a specific risk-controlling approach are based on the net gains in terms of the amount of risk reduction expressed in monetary terms. The fact that whether such gains are adequate, desirable and practical is also taken into account in deciding the risk controlling approach.

Benefit-Cost Analysis

The benefit-cost analysis method is used to assess the financial viability of any project proposed to be undertaken. This method reports whether the proposed project is financially attractive from the organization’s point of view. In this method, the unit of analysis is the project and the method does not consider the implications on the entire economy. This method focuses on the additional financial benefits and costs to the proposed project by calculating the annual project net revenues based on the annual revenues and costs (Water Supply Project, 1999). Estimates of these financial variables are made based on constant price levels without considering any significant changes in the costs. The method is adopted more in evaluating public expenditures. Under this method, the overall economic efficiency of the proposed public expenditure is considered primary and the feasibility of efficient use of resources is one of the important goals of the evaluation. “The benefit and cost of a risk control alternative may be measured in terms of real dollars or by using the so-called utility functions.” (Modarres, 2006)

Cost-Effectiveness Analysis

Cost-effectiveness analysis (CEA) is a tool that is used to evaluate the efficiency in the use of investment resources in such sectors where it is difficult to value. This analytical tool is used for the selection of alternative projects having the same objectives which are quantified in physical terms. Effectiveness analysis has the ability to identify the alternative which for a given output level result in the minimum value of costs. Alternatively, this tool identifies that alternative which for a given cost produces the maximum output level. “CEA is used when a measurement of benefits in monetary terms is impossible, or the information required is difficult to determine or in any other case when any attempt to make a precise monetary measurement of benefits would be tricky or open to considerable dispute.” (Sourcebook, 2003) This tool does not take into account subjective judgments and cannot evaluate projects having multiple objectives. Where the projects having multiple objectives are to be evaluated, a sophisticated version of the tool which gives weights to different objectives is used. Cost-effectiveness analysis takes into account the cost of mitigating the risk and compares it with the benefits from the project and to this extent, this method resembles the use of the technique of Value for Money Assessment.

Summary

The review of the available literature extended the existing knowledge on risk analysis, risk assessment and risk management. The review presented the basic features of quantitative and qualitative risk analysis techniques and touched upon a mixed quantitative and qualitative method of risk analysis. Some of the important risk analysis tools along with their advantages and limitations are discussed in the chapter.

Research Methodology

Introduction

Social science research follows several research methods to collect information and data relating to the issue under study. The methodological questions decide how the researcher can proceed to find out what he or she believes that can be known about the existing things in the world. The research methods generally follow (i) experimental, (ii) correlation, (iii) natural observation, (iv) survey and (v) case study methods.

Research Methodology

The researcher must evolve a suitable research design for completing the study. In choosing the particular research method, the researcher has to take into account a variety of variables like the subject matter under research, and the range of interests of the researcher, difficulties involved in accumulating the time and resources, and other funding issues. The major classification of the research methods takes the form of qualitative and quantitative research methods.

During the process of examination, the research will extend to analyzing the salient features of different risk analysis techniques. The likely changes in different variables connected to any project or activity will have a serious impact on the outcomes of the project both positively and negatively. Such possible outcomes require close scrutiny on the financial prospects of the organizations because any decision to proceed with the carrying out of the activity or project may adversely affect the performance of the entity as a whole. A qualitative research method of ‘case study’ will be able to provide an extended knowledge on the application of risk analysis techniques.

Research Design

For any research in the realm of social science, research design provides the bondage that keeps the research project together (Web center for Research Methods, 2006). The research design is expected to attribute a formal structure to the research. This is accomplished by exhibiting how different components of the research project will proceed to deal with the central research question. The research design may take the form of a randomized or true experiment, quasi-experiment, or non-experiment (Web center for Research Methods, 2006). The internal validity of the research findings is enhanced with this three-way categorization of the research design. In general, although the randomized experimental basis is the strongest for establishing a cause and effect relationship since the current research adopts a qualitative research method and is non-experimental in nature it adopts a non-experimental research design for conducting the research. The research involves the examination of the extent to which different risk analysis techniques extend the knowledge on the potential losses associated with any project and the effectiveness of such techniques in enabling the analysts to assess potential losses in any risk situation.

Qualitative Research Methods

Qualitative research methods are employed to help the researchers to make an extensive study into various aspects covering social and cultural issues. Action research and case study are some of the techniques being used by the qualitative method. According to Creswel, (1994) qualitative research is an inquiry process that is undertaken to analyse the issues connected with social or human behavior. The success of the inquiry process under the qualitative method depends on the viewpoints of various informants to the research who express their views in a natural setting. The impressions, viewpoints, and expressions of the researcher would also be a part of the data source. Byrne (2001) believes that defining qualitative research using a single definition is not at all practical because the term qualitative itself is a broad term. In addition, inferential statistics which is usually applied to data that is generated from quantitative researches is not used for qualitative research.

Since the research aims to examine the effectiveness of risk analysis techniques in estimating the potential loss in any real-life situation it is considered appropriate to employ the qualitative research method of case study for completing the research.

For the study of the effectiveness of risk analysis techniques in a specific setting, the case study method was considered suitable.

Case Study

Several researchers have used case studies as a research methodology. “Case study is an ideal methodology when a holistic, in-depth investigation is needed” (Feagin et al., 1991). Various investigations particularly in sociological studies have used the case study as a prominent research method to gather pertinent knowledge about the subjects studied. When the case study procedure is followed the researcher will naturally be following the methods which were well developed and tested for any kind of investigation. “Whether the study is experimental or quasi-experimental, the data collection and analysis methods are known to hide some details”. (Stake, 1995) But the case studies on the other hand are capable of bringing out more details from different viewpoints based on multiple sources of data. Different types of case studies have been established to be used in varying circumstances. They are ‘Exploratory, Explanatory, and Descriptive’. Stake, (1995) included three others: “Intrinsic – when the researcher has an interest in the case; Instrumental – when the case is used to understand more than what is obvious to the observer; Collective – when a group of cases is studied”. Case study research cannot be considered sampling research. However, the selection of the cases is of crucial importance so that the maximum information can be gathered for the completion of the study within the time available. “The issue of generalization has appeared in the literature with regularity. It is a frequent criticism of case study research that the results are not widely applicable in real life. Yin in particular refuted that criticism by presenting a well-constructed explanation of the difference between analytic generalization and statistical generalization “In analytic generalization, a previously developed theory is used as a template against which to compare the empirical results of the case study.” (Yin, 1984) Case study has been chosen as the research method for the current study, because of the ability of the method to assist in the investigation of the variables with an empirical approach by the use of different evidence possibilities which are present in the real-life situations. A case study is found out to be the effective research method that allows contextual realities to be investigated. A case study also enables the study of differences between what was planned and what has actually occurred. Since the case study focuses on one particular issue rather than on the whole organization this method was considered suitable for research on the risk analysis techniques being adopted for assessing the potential hazards. By engaging the qualitative research method of case study, the researcher is able to assimilate the complete information on the issue under study or an array of events associated with the research. Since many sources of evidence are being used, a case study provides a whole picture. “Another advantage is that case study can be useful in capturing the emergent and immanent properties of life in organizations and the ebb and flow of organizational activity, especially where it is changing very fast”. (Hartely, 1994) These distinct advantages of the case study method prompted the use of this research method.

The process of this research engages the methodology primarily involving a collection of the required data. The collection process is followed by the activities of organizing and integrating the data collected. The major step in the process of this research is the collection of data from the informants and the success of the research depends largely on the data collection process. An efficient data collection process ensures and leads the researcher to valid and credible findings from the research. This research will be founded on a case study on the application of risk analysis techniques to different real-life situations. The collection of primary data using the case study method will provide the base for a firsthand experience of the researcher.

Following the case study method, the data was collected using the available literature on the topic of risk analysis in general and various tools and techniques used in the process of risk evaluation. The data and information collected were analyzed to make a comprehensive presentation of the report on the efficacy of risk assessment tools.

A case study involves a fairly intensive examination of the effectiveness of risk measurement techniques measuring the potential loss in any chosen application. In the case of the chosen application, all the available information from several books, journal articles, and relevant websites are collected. In the next stage, the information and data collected were arranged chronologically to assess the development over the period. This process was the crucial one in the entire process of research, as a volume of literature has to be organized and serially numbered for identification.

The next in the process was the elimination of sources that offered repetitive and irrelevant information. This process also took considerable time as in the case study method, it is important to consider every information or data. An individual source in many instances had been found to be unique and therefore had to be included in the reporting. The analysis of the information collected was an important step since the case study method arises essentially from two situations. The first one is the reason that the case study method addresses the descriptive question of the ways of deployment of risk analysis techniques by the entities and secondly the purpose of the study was to get close or to get a first-hand understanding of the effectiveness of risk analysis techniques in estimating potential losses. This has necessitated a closer look at all the information sources collected.

In most of the case studies, it may be possible to do data collection and data analysis together. Several analysis techniques can be employed in the case study method. One of the analytical techniques is pattern-matching where the researcher decides some pattern of findings at the outset of the case study. The current research followed this technique for analyzing the information collected from various resources. The information and data which followed the pattern of contributing to assessing the engagement of risk assessment tools and techniques were included in the case study report. This enhances the validity of the information as the information and data are subject to close scrutiny to check whether they follow the predetermined pattern.

Summary

This chapter presented a comprehensive description of the research method adopted for completing the current study and the justification for using a case study as the research method. The next chapter deals with the case study on the application of risk analysis techniques in different real-life situations in evaluating the benefit-cost of different projects.

Case Study

Introduction

Risk basically has two dimensions of likelihood and consequence and the term ‘risk’ describes the chances of actual harm occurring at a certain future date. The term ‘hazard’ is also used in the risk analysis field which denotes a potential cause of harm. Risk analysis is undertaken to enable the quantification of different options and estimating the likelihood, consequences, and costs of failure on the cost and benefits of a particular project or activity. There are several techniques and tools used in analyzing the risk. This case study deals with the risk assessment of open-cut coal mine spoil rehabilitation in Bowen Basin open-cut coal mine areas in Australia. A qualitative risk ranking exercise is done to evaluate whether the success or otherwise of the agreed land-use will serve the purposes of achieving mine lease surrender. The key factors considered are landform instability, surface water impact, groundwater impact, vegetation failure, animal failure, poor perception, and negative socio-economic impact.

Background

The open-cut mining and processing of black coal strive to achieve certain desired objectives and this necessitates the carrying out of the activity in a cost-effective manner. However, no consensus could be reached on the objectives for rehabilitating the spoil areas. This has given rise to a perception that rehabilitation of the spoil areas is an added cost, but there is the need for recognizing the spoil rehabilitation as an integral part of the open-cut mining operation to enable the operation to be carried out cost-effectively. The case study is based on the risk assessment and ranking of the rehabilitation options for spoil areas in coal mine areas. The risk assessment uses a qualitative Fault/Event Tree method. One of the features that need to be taken into account is that it is not possible to consider the open-cut coal mine alone. The use of surrounding unmined land also has to be taken into account as it also has an equal impact on the environment. When the land-use capability in a post-mining scenario can be established through the risk assessment method, it can justify the surrender of the mine lease. In making the risk assessment a number of alternative land uses like cropping, leaving the land idle, developing forestry, cattle grazing, and native habitat in both mined and surrounding unmined land areas are considered. The likely risk factors that may affect the use of land are instability in landform, impact on downstream water quality, the volume of downstream water availability, groundwater impact, failure of vegetation, animal failure, poor public response, and negative socio-economic impact. The possible land use in unmined and post-mining areas can be tabulated as below:

Method

The method adopted for risk assessment includes the “collection of available data on the engineering, erosional, ecological, sociological, legislative and cost parameters” from the designated coal mine spoil areas. These data were necessary for assessing the cost and risk effectiveness of different rehabilitation approaches and future land-uses for the chosen spoil areas. The next step is the development of a risk-based and cost-effectiveness model applied to the intended spoil rehabilitation purposes and future land-use purposes outlined above. Collection of the viewpoints of different stakeholders concerned with spoil rehabilitation. These stakeholders included mine owners and operators, local contractors, power utilities, regulators and local and state government, township and rural neighbors, and the broader community as a whole. The objective of the risk assessment is to demonstrate the effectiveness of the risk-based management approach to spoil rehabilitation and future land use at the sites of a number of mines participating in the analysis.

Findings

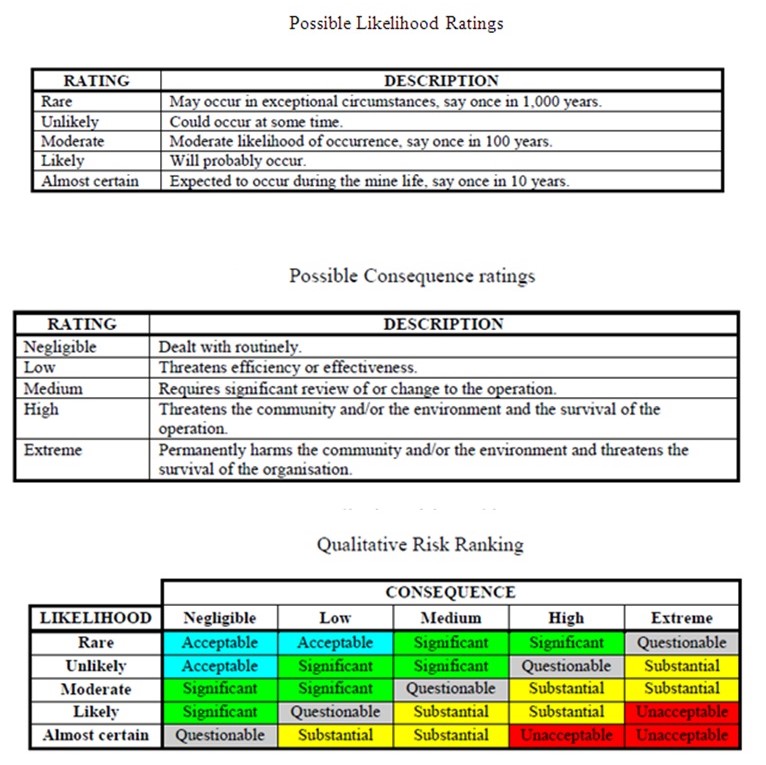

The risk ranking is expressed in the form of a matrix of likelihood and consequence either quantitatively or qualitatively as shown in the following table. The objective is to identify the acceptability or otherwise of a particular hazard. The elements in the Fault/Event Tree which attract a high-risk ranking will be identified as the target for remedial work in order to reduce the overall risk of the agreed land use becoming unsuccessful.

The comparison of the results for different land-use scenarios for the given mine domain will reveal the acceptability of the alternative land-use which ultimately will lead to the surrender of mine lease.

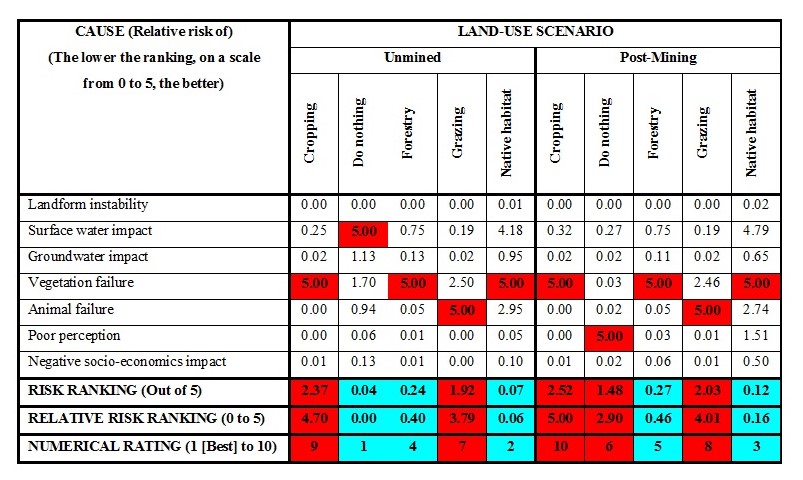

Application of Risk Analysis

The quantitative risk assessment model, in this case, is the one developed by Fussell, (1976) which was further refined by O’Connor, (1983) and Andrew & Moss, (1993). The key ‘Event’ in the rehabilitation of Bowen Basin open cut coal mine spoil areas is the ‘unsuccessful land-use’. Land-use and offsite water risks are the additional issues that need to be considered. Assessment is to be done on the availability of achievable and sustainable offsite water. Drawing up the Fault/Event Tree in a spreadsheet the probabilities can be assigned and calculated using the Fault Tree causes and sub-causes and events. Likelihoods and consequences are assigned a five-point scale and the risk-ranking of land-use failure is arrived at in the spreadsheet by multiplying the corresponding likelihoods and consequences of failure. These calculations produced the following results.

Based on the results presented in the above table, the following scenarios emerge: Low-risk land-use scenarios in order of increasing risks –

- Doing nothing with unmined land

- Using unmined land for native habitat

- Using spoil areas for native habitat

- Using unmined land for forestry and

- Using spoil areas for forestry.

High-risk land-use scenarios in order of decreasing risks:

- Cropping on spoil areas

- Cropping on unmined area

- Grazing on spoil areas

- Grazing on unmined land and

- Doing nothing with spoil areas

It can also be inferred from the table that (i) relative risk of vegetation failure is the relative contributor to failure in 6 out of the 10 cases and (ii) relative risk of animal failure in the two grazing cases and (iii) relative risk of surface water impact or poor perception in the remaining cases. With reference to the risk rankings in the table, it appears that developing native habitat or alternatively forestry may be regarded as the best option for rehabilitating Bowen Basin open cut coal mine spoil areas. The results indicate that cropping, grazing, and doing nothing with spoil areas are ranking poorly because of their relative risk ranking.

In the ideal situation, a cost-benefit analysis should be carried out for verifying the effectiveness of the risk assessment.

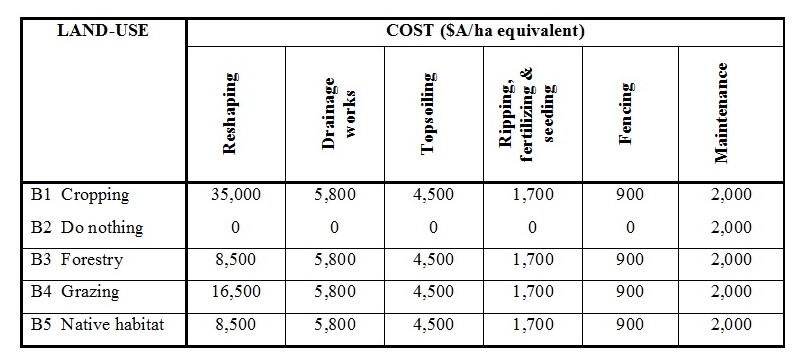

In the risk assessment of rehabilitation of open cut, mine spoils the intangible benefits and dis-benefits represented by the loss of amenity and aesthetic values cannot be costed objectively. However, different spoil rehabilitation strategies can be costed objectively. In this way, the effectiveness of the strategies can be measured in terms of the ability of the strategies to reduce the overall risk ranking.

The indicative cost of carrying out different operations is shown in the following table:

Based on the above indicative rates, the following cost can be worked out for the proposed land-use in the open-cut coal mine spoils of Bowen Basin.

From the cost table, it is observed that ‘Native Habitat’ has the optimum cost in terms of ranking. The ‘Do nothing’ option ranks second based on the assessment of cost. However, from a sociological point of view, it is not advisable to leave the spoil mine area without doing anything. Therefore, the next alternative of forestry can be considered as the best land-use. The results from the cost angle corroborate the qualitative assessment carried out above.

Analysis of the Findings

Quantitative and qualitative risk assessment techniques are useful in evaluating competing options for implementation in all kinds of activities including public expenditure projects. The findings of the case study on risk assessment of rehabilitation of coal mine spoil in the Bowen Basin area reveal that with an efficient risk assessment technique employed it would be a lot easier to provide information based on which policy decisions affecting a number of people can be taken.

The risk assessment in the instant case followed both qualitative and quantitative assessment methods to reach a decision on the ways of using the coal mine spoils. First, the qualitative risk assessment method was employed to narrow down the first and second-best options of land-use that will push the surrender of lease of the coal mines. The results from the qualitative risk assessment were subjected to verification by the economic method of risk assessment of benefit-cost where the relative cost of putting the land to different users is considered. The indicative cost per activity is gathered and by calculating the cost of land-use for different pre-determined activities the relative ranking as per the cost-effectiveness has arrived. The results based on the cost-effectiveness identified ‘Natural Habitat’ and ‘Forestry’ as the best options of land-use for the open coal mine spoils.

The results have proved the effectiveness of the risk assessment techniques in ranking different risks based on the potential losses likely to occur because of such risks. The calculation of risk factors may be attempted by multiplying the probability of an event by the cost of the event. The case study extends the knowledge on the different steps involved in the process of undertaking a risk assessment. Identification of threats happens to the first step where the threats may emanate from human actions, operational causes, reputation issues, failure of procedures, project-related issues like cost overruns, financial issues, technical issues, natural causes like an accident, political issues like changes in governments and other issues like market competition. There is the need to analyze all the threats involved because of the fact that in some of the cases the consideration of important threats may escape the attention of the analyst. Estimation of the risk is the second step in any risk assessment where the likelihood of the threat is worked out. Here the best approach is to make the best estimate of the probability of the event occurring. This can be multiplied by the amount that has to be spent for setting things straight in case the event happens. This represents the value of the risk. Managing risks is the next logical step in the risk assessment stream. It is possible to manage risks by using existing assets, by planning for contingent provisions, or by investing in new resources. These steps make the risk assessment process enable making informed decisions.

The review of the literature and the case study provides answers to the research questions by reporting that the risk analysis techniques extend the knowledge on the potential losses associated with any project and the application of risk analysis techniques are effective in informing about the extent of potential losses in any risk situation. However, the limitations on risk analysis tools prevent the full gathering of information pertaining to the risks in quantitative terms, though the techniques are effective in providing qualitative information, based on which informed decisions can be taken on investing in any project or public utility activities. The research finds theoretical support to the hypothesis that risk assessment techniques are vital to the determination of the extent of potential losses arising out of a given risk situation and despite the limitations of the risk analysis tools and techniques, risk assessment procedures are important in assessing the potential hazards from any risk incidents. On an overall analysis, this study reports that the risk assessment techniques are more qualitative in nature and are well suited to provide the basis for deciding on the public expenditure projects.

Conclusion and Recommendations

Conclusion

The purpose of the current study is to examine the concept of risk analysis and risk assessment leading to an elaborated analytical report on various risk assessment tools and techniques. The focus of the study is to address the issues of how risk is being expressed and to discuss the meaning of probability and risk. In practice risk assessment is being attempted using several quantitative and qualitative risk assessment techniques. Despite the limitation of being subjective qualitative risk analysis methods are preferred because of the reason of simplicity and ease in adaptation. In some specific circumstances, the use of mixed quantitative and qualitative risk assessment techniques is being applied to arrive at meaningful and informed decisions on following a particular course of action. Several risk assessment techniques like sensitivity analysis, decision tree models, and simulation are used for estimating the probability of risks and their potential impact on competing proposals. The feasibility of undertaking public expenditure projects is analyzed using a benefit-cost method which is an economic-based risk assessment model. The cost-effectiveness risk assessment method is yet another method of working out the adaptability of different projects based on the economic impact of the project proposals. The study through the case study of the application of a qualitative risk assessment model to the rehabilitation of open cut coal mine spoil areas strives to find theoretical support to the research questions established. Based on the analysis from the findings of the case study the research concludes that most of the risk assessment models though effective in providing subjective guidance on the probability of risk events impacting the activities are not in a position to precisely provide an assertive evaluation of potential impacts in a quantitative angle. This applies to even the quantitative risk assessment tools functioning with the assistance of sophisticated software tools. Therefore at best the risk assessment tools could be considered predominantly as a qualitative assessment with a quantitative base when it involves some numerical inputs. This goes to prove the very nature of the term ‘risk’ as it is only the ‘likelihood’ to happen and not an expected happening. The study further concludes that the so-called risk assessment tools may be more effective when used to determine the adaptability of projects undertaken in the public interest.

Recommendations

Based on the review of the literature and the findings from the case study the current research recommends an empirical study of a project assessed using a quantitative risk assessment tool. A comparison of the project findings in quantitative terms made prior to undertaking the project and the results after the execution of the project would provide more knowledge on the effectiveness of such risk assessment tools. A study on the effectiveness of the software-based risk assessment tools and their utility in different settings is another area that will be interesting to pursue in this field of study.

References

Altenbach, T.J., 1995. A Comparison of Risk Assessment Techniques from Qualitative to Quantitative. [Online] 2009. Web.

Andrew, J.D. & Moss, T.R., 1993. Reliability and Risk Assessment. Harlow UK: Longman.

Arsham, H., 1994. Tools for Decision Analysis. [Online] 2009. Web.

Baker, S., Ponniah, D. & Smith, S., 1999. Survey of risk management in major U.K. companies. Journal of Professional Issues in Engineering Education, 125(3), pp.94-102.

Batman, J., 2009. Quantitative Risk Analysis. [Online] Web.

Chapman, C. & Ward, S., 1997. Estimation and evaluation of uncertainty: a minimalist first pass approach. International Journal of Project Management, 18(6), pp.369-83.

Cohrssen, J.J. & Covello, V.T., 1999. Risk Analysis: A Guide to Principles and Methods for Analyzing Health and Environmental Risks. New York: Diane Publishing.

Cox, L.A., 2006. Quantitative health risk analysis methods: modeling the human health impacts of antibiotics used in food animals. USA: Birkhauser.

Creswel, J., 1994. Research Design: Quantitative & Qualitative Approaches. Thousand Oaks NJ: Sage Publications.

Dawood, N., 1998. Estimating project and activity duration: a risk management approach using network analysis. Construction Management and Economics, 16(1), pp.41-48.

Dayananda, D., 2002. Capital budgeting: financial appraisal of investment projects. London: Cambridge University Press.

Dey, P.K., 2001. Decision support system for risk management: A case study. Management Decision, 39(8), pp.634-49.

Dey, P.K. & Ogunlana, S.O., 2004. Selection and application of risk management tools and techniques for build-operate-transfer projects. Industrial Management & Data Systems, 104(4), pp.334-46.

Edwards, P.J. & Bowen, P.A., 1998. Risk and risk management in construction: review and future directions for research. Engineering Construction and Architectural Management, 5(4), pp.339-49.

Exforsys, 2000. Qualitative Risk Analysis Methdology. [Online] 2009. Web.

Feagin, J., Orum, A. & Sjoberg, G., 1991. A Case for Case Study. Chapel Hill NC: University of North Carolina Press.

Flangan, R. & Norman, G., 1993. Risk Management and Construction. Oxford: Blackwell Science Ltd.

Fussell, J.B., 1976. Fault Tree Analysis – Concepts and Techniques In Generic Techniques in Systems Reliability 133-162. London UK: NATO Advanced Institute Noordhoof-Leydon.

GeneralAccountingOffice, 1998. Information Security Risk Assessment Practices of Leading Organizations. [Online] 2009. Web.

Gray, C.F. & Larson, E.W., 2005. Project Management: The Project Management Process. 3rd ed. New York: McGraw Hill.

Hartely, J., 1994. Case Studies in Organizational Research in Casell and Symon 1994 Qualitative Methods in Organizational Research. London: Sage Publication.

Hastak, M. & Shaked, A., 2000. ICRAM-Model for international construction risk assessment. Journal of Management in Engineering, 16(1), pp.59-69.

Hayes, R., Perry, J. & Thompson, J., 1986. Risk Management in Engineering Construction: A Guide to Project Risk Analysis and Risk Management. London: Thomas Telford.

Kartam, N.A. & Kartam, S.A., 2001. Risk and its management in the Kuwaiti construction industry: a contractors perspective. International Journal of Project Management, 19(6), pp.325-35.

Kim, S. & Bajaj, D., 2000. Risk management in construction: an approach for contractors in South Korea. Cost Engineering, 42(1), pp.38-44.

Lyons, T. & Skitmore, M., 2004. Project risk management in Queensland engineering construction industry: a survey. International Journal of Project Management, 22(1), pp.51-61.

Marshall, H.E., 1995. Senstivity Analysis- Section 28 in The Engineering Handbook. New York: CRC Press.

Mills, A., 2001. A systematic approach to risk management for construction. Sturctural Survey, 19(5), pp.245-52.

Mindtools, 1995. Decision Tree Analysis. [Online] 2009. Web.

Modarres, M., 2006. Risk Analysis in Engineering: Techniques, Tools and Trends. New York: CRC Press.

O’Connor, P.D.T., 1983. Practical Reliability Engineering. Heydon: London.

Poh, Y.P. & Tah, J.H.M., 2006. Integrated duration-cost influence network for modelling risk impacts on construction tasks. Construction Management and Economics, 24(8), pp.861-68.

ProjectRiskManagementHandbook, 2003. California Department of Transportation. [Online] 2009. Web.

Raftery, J., 1994. Risk Analysis in Project Management. London: E&F N Spon.

Schreider, T., 2009. Risk Assessment Tools: A Primer. [Online] Web.

Sourcebook, 2003. Cost Effectiveness Analysis. [Online] 2009. Web.

Stake, R., 1995. The Art of Case Research. Newbury Park: Sage Publications.

Wang, M.T. & Chou, H.Y., 2003. Risk allocation and risk handling of highway projects in Taiwan. Journal of Management in Engineering, 19(2), pp.60-68.

WaterSupplyProject, 1999. Handbook for the Economic Analysis of Water Supply Projects. [Online] 2009. Web.

WebcenterforResearchMethods, 2006. Research Methods Knowledge Base. [Online] 2009. Web.

Williams, D.J. & Golding, B., 2001. Wrap-Up Presentation of Risk Assessment and Cost Effectivness Tool. Golder Associates ACARP Projct C8039.

Williams, D.J., Gowan, M.J. & Golding, B., 2001. Risk Assessment Approach to Open Cut Coal Mine Spoil Rehabilitation. Skelleftea Sweden: Proceedings of International Conference on Mining and the Environment Securing the Future.

Williams, P., 1995. A regulation, evaluation system: a decision support system for the Builders code of Australia. Construction Management and Economics, 3(3), pp.1125-35.

Yin, R., 1984. Case Study Research: Design and Methods. Beverly Hills CA: Sage Publishing.