Purpose

Salesforce is a leviathan, a real force within the CRM sector, but it can ill afford to become complacent and risk becoming the Nokia of CRM world.

The purpose of this report is to crystallise the challenges that Salesforce faces in remaining relevant and garnering new business; to identify whether a strategic model for addressing its challenges could also help create and take advantage of emerging opportunities. Gartner predicts that the CR industry will be a $36 billion market by 2017 and is expected to keep growing.

For SalesForce to remain a key and relevant player in that market, it needs to be on-trend and taking full advantage of the opportunities these trends mean for the market. Better integration of technology, Marketing, Sales and Customer Service is the key theme of the future of CRM. The former factor is particularly critical – according to recent research, the efficiency of CRM depends largely on the successful implementation of IT resources (Crnkovic 2013).

The trends all point in the same direction and the opportunities with the synergies that can be gained with even just marginally better integration in these areas represents a glimpse of the brass ring that CRM solutions have been reaching for since their inception.

Salesforce.com Background

Salesforce is the global leader in the cloud CRM based in San Francisco, California, founded in 1999. They specialize in cloud platform services for sales, service, marketing, community, analytics, and apps. Salesforce has successfully positioned itself as a SaaS CRM platform, realizing industry-beating revenue growth to take an absolute leader in terms of SaaS CRM revenues, customer acquisitions, and user subscriptions and is the fastest-growing top 10 software company worldwide, listed on the New York Stock Exchange, and S&P 500.

Source: Gartner (May 2016)

Table 1 above, shows “CRM software Spending by Vendor, Total Software Revenue Worldwide, 2015 (Millions of Dollars)”

Salesforce’ success has been largely driven by their exclusive focus CRM. Early on, they focused on small businesses with simple pricing and low-risk implementations, following the “Innovator’s Dilemma” style by disrupting the great companies from below. Additionally, some experts emphasize their ability to integrate effective technologies (Cusumano 2010). Salesforce has well known and significant challenges, like the poor integration of its marketing products, poor business intelligence solutions and limited options for the small business segment.

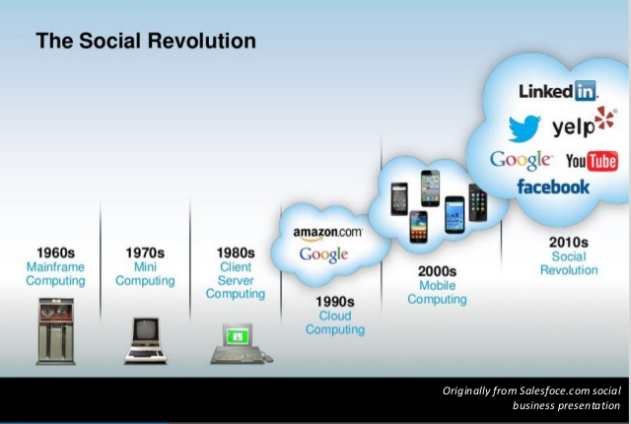

The Social Revolution

With customer relationship at the top of Salesforce priorities, the company embraced social media to make it easier for their users to connect with people and information they care most about. In 2009, Salesforce created Salesforce Chatter as a brand new way to collaborate at work. From the CRM perspective, it appears to be an effective approach to converging new communication facilities into enterprise performance(Mathiesen & Fielt 2013).

As defined by Salesforce: “Social selling uses social media, such as LinkedIn, Facebook, blogs, forums and Twitter, to identify opportunities, get insight into prospects, earn the first engagements and deepen relationships.” The purpose of the social revolution is to help users swiftly grab new opportunities, open conversations and successfully convert the opportunities into a real business.

Porter’s Five Forces Analysis

The Threat of New Entrants

The threat level of new entrants for incumbent CRM companies, like Microsoft, SAP, Oracle and Salesforce, is relatively low, as penetration will require a multifaceted and all-encompassing approach, due to the establishment of very high-value brands which influence buyers’ decisions and willingness to trust.

Secondly, with the experience gained since their inception, these big players can not only maintain their position in the industry but also can change its shape, expand it and identify new directions and trends. However, their all-encompassing nature can work against them too and product differentiation is also becoming difficult for them and is highly correlated with development and improvement of new technologies. From this perspective, smaller companies have a competitive advantage as they have more opportunities to perform product differentiation (Zilber & de Araújo 2012).

The Bargaining Power of Suppliers

The suppliers in CRM can be determined as high skill individuals, researchers or consulting agencies that generate ideas and then sell them to big players.

In CRM, the company pays high skilled employees to develop software systems or in some cases, they integrate other software systems that are developed by other partner companies. A recurrent theme in Silicon Valley was the difficulty of finding and keeping highly skilled technical staff. The bargaining power of suppliers in this domain is moderate. As a result, low suppliers’ resistance implies the chance of imposing the company’s own rules (Moatti et al. 2014).

The Bargaining Power of Buyers

As in every industry sales in CRM can be classified into two groups: Business-to-Business (B2B) and Business-to-Consumer (B2C). Nowadays, customers can better determine and articulate what they need and which software systems are more suitable for them. Moreover, the number of suppliers in the application software industry increased enormously. These two factors give freedom and choice to consumers and increase their bargaining power. Powerful consumers, in their turn, imply additional difficulties for the company’s strategic planning as their interests cannot be neglected (Moatti et al. 2014).

The Threat of Substitute Products

This is high as other products can substitute software packages.

One of the determinants threat levels is the switching costs, which refers to monetary or non-monetary efforts the customers have to incur to change the suppliers or products. Switching costs in software industry especially in its CRM Segment is very high and it is not only because of financial reasons but also for non-monetary costs like adaptation period of employees to the new system, training process, restoring and customizing the existing data in the new system. To avoid the relevant threat, the management needs to eliminate all the difficulties associated with employees’ adaptation (Sinha & Iyer 2013).

However for those new to CRM, especially at the small business level, there are myriad, even free, options, especially if the company is specialized.As the major players become more similar in capability and scalability, differentiators are at a premium, meaning the focus on CRM differentiation will have to move away from features, functions and platform and refocus on three key elements: Native mobility, Cost and Integration.

The Threat of Established Rivals

Rivalry in the software industry is ever increasing. In the last few years, several companies from developing countries entered the industry and obtained good positions in local markets. The increase in the competitive tension might be explained by the fact that modern market shows high awareness of the prospects of software solutions (Mathiesen & Fielt 2013).

Target Industry Segments

Facing steep competition in all market segments from Oracle, Microsoft, and SAP at the enterprise level and the midrange levels it faces Sage CRM, GoldMine, and RightNow, in the small-business market Salesforce goes head-to-head with Zoho, Nimble, Highrise, Insight.ly, but instructively the Salesforce customer base is predominantly B2B. It means that the company’s performance is particularly dependent on the reliability of its partners (Agnihotri et al. 2016).

The CRM Universe (A Functional View)

Trends in the CRM market and the challenges and opportunities they represent, and recommendations for Salesforce

Social Media

Social Media is both a force and a resource that Salesforce needs to capture and deploy as a tool for driving the delight of their customers and just as importantly, help them to highlight areas for concern and improvement. Research shows that this tool is particularly applicable to B2B format companies (Agnihotri et al. 2016).

Utilising new modes and communications channels in the opportunities offered by both smartphones and social media. Social CRM, as it is known is based upon the shrewd use of social media techniques in doing what CRM customarily does, which is to help engage the business’s customer base. As modes of interaction with the customers and potential customers pivot, it can be seen that Social CRM, though arguably in its infancy, could be powerful and must be harnessed correctly to position and propel Salesforce to the foremost place in this bitterly contested space, because of its Social CRM strategy.

The adoption of a customer-centric approach to the provision of product support and service and the opportunities that exist in those heretofore unexciting and vanilla activities to raise the profile of the brand, market products and create a community that propagates that loop, should not be overlooked. It is risky but early adoption and management of the channel can reduce those risks.

A proactive and enterprising strategy to the judicious use of Social CRM can utilise the interaction with the customer as the golden opportunity it can be to be ‘face to face’ as it were, with their primary consumers to understand their needs in a way that could lead to developing and delivering superior products and services. Social media features that help track these interactions and what Salesforce do with them as well as suggesting new contacts will be transformative. From a branding and marketing perspective, this is extremely valuable, as customers become owners and advocates of the brand as well as the drivers and keepers of the social media community.

The Need for and Use of Centralised Data

While Big Data and the predictive analytics it promises is most certainly the future for CRM, the mining and security of which are hot topics today, for Salesforce, who have myriad and massive data, another big trend will be Centralized Data, without which integration, discussed further below, cannot truly deliver on the promises it heralds.

Centralised data will give another facet of the kind of data and consumer insight Salesforce should be aiming to realise from Social CRM. Centralisation of data will enable more effective and precise targeting and engagement of consumers such that they can be aligned with current offerings or have products built or modified to suit them. Moreover, centralised data will help to reduce the time of operations providing the company with an additional competitive advantage (Sinha & Iyer 2013).

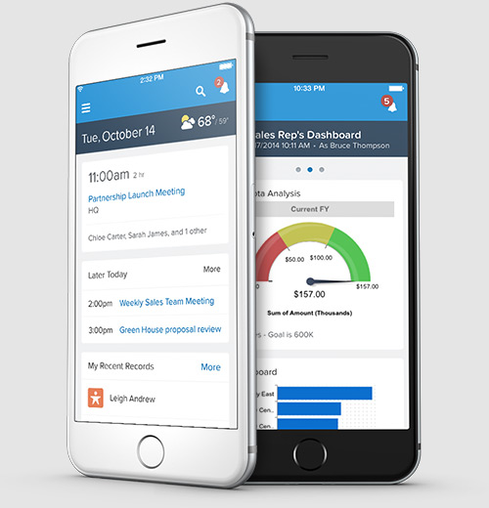

Mobility – Data on the Go

To succeed in the enterprise, solutions must prioritize the needs and behaviour of mobile workers in their design, to ensure they are connected wherever they are and can communicate and collaborate with colleagues back at the office. Consistent communication within the workforce is the main determinant of the enterprise’s efficient performance (Agnihotri et al. 2016).

Salesforce offers robust mobile CRM capabilities with its easy-to-use Salesforce1 mobile app and Chatter real-time collaboration app and support for iPhone, Android, Windows, and BlackBerry makes and built-in support for HTML 5, to support touchscreen capability, but Salesforce needs to ensure that their customers can access their support, relevant data and services from any device or platform wherever they are.

This has got to extend beyond simply the availability of a phone/handheld device version of their desktop offering to provide specific apps with features that encourage working effectiveness and interaction with the consumer, the environment and the ability to persist and record the knowledge gleaned in this interactions, with possible map interaction features which they can use to provide real-time data and comparisons to the people they are speaking to, such that Sales reps can rely on “mobile CRM to enable engagement with prospects as well as management – to give them access to real-time data such that they do not need to be in the office to be privy to info about up to date usage and service metrics or even an outstanding support ticket, or even new information about the prospect they are visiting or their competitors. Salesforce should imagine that sales teams out in the fields could use their devices to show interactive and dynamic demos and dashboards rather than relying on laptop delivered slide decks.

With mobile processing power and speeds going from strength to strength, this does bear truly developing a strategy around it as salespeople spend more time out of the office in sales meetings and travelling, and sadly some of the information gleaned in these meetings is misused, misreported, misremembered or misplaced.

Mobile apps created for the purpose could help CRM professionals bring up records, add notes and my facts and figures that could keep them relevant and closing deals.

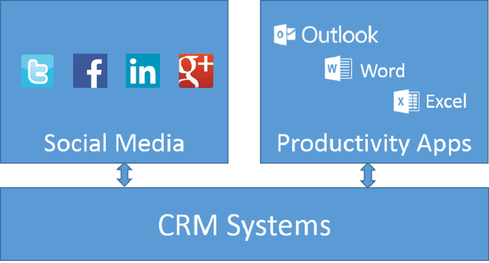

Integration, Flexibility and Open Source CRM

The capabilities of Salesforce can only be further enhanced if it could be integrated with what their clients are using for other functions using non-Salesforce solutions. While it has long been the trend in many areas to have one vendor cater for several or most organisations needs on their separate vendors, the reality is that customers use several vendors to meet different needs so Salesforce must seamlessly integrate with these platforms.

Salesforce will need to extend this but to help customers continue to work well on their existing infrastructure, Salesforce may need to create a platform that enables all of the software that drives sales and marketing, such that the inputs that come from sales and support who are interfacing with customers can make it over to technology and marketing creating a feedback loop that enables reduced waste and lost opportunities.

ERP is becoming more versatile, providing deeper integration with procurement, human resources and customer service software. That increased integration and depth will continue to blur the lines between enterprise software systems and help organizations derive greater value from their IT investments. Historically ERP and CRM have been viewed as two separate systems of engagement.

However many businesses are starting to realize the immense value in eliminating distinctions between the front and back-office process, bringing ERP to the forefront. Rather than continuing to allow vital customer information to be scattered among various pieces of a business. Companies will begin to merge ERP and CRM into one single system of customer engagement, so they can better support the entire customer journey, from initiation of interest to the delivery of a product. Those organizations that will manage to align the benefits of both tools will gain a sustainable competitive advantage in terms of data management (Ruivo et al. 2014).

Salesforce CRM is closely integrated with Microsoft Outlook, Word, and Excel, so workers don’t have to toggle between the Salesforce and Microsoft productivity applications and email tools, as well as with popular social networking portals like Facebook, Twitter, LinkedIn, and YouTube. Salesforce also comes with Chatter and Radian6, which enable better productivity and insights across social channels pitted against Microsoft’s integrated social listening, social analytics, and social engagement, and Oracle’s Social Media Connector for Siebel CRM. Of course, LinkedIn Connected is the industry standard the best social media integration but Salesforce integrates with this.

With the recent surprise announcement of a platform partnership of Microsoft and Salesforce.com – Salesforce will realise far superior integration with Microsoft Office, extremely desirable, while can become ever more relevant in the CRM world and potentially opens new avenues to explore with its Azure hosting service. These two fierce CRM competitors will now collaborate and control a larger share of the Enterprise market but are still exposed in the Small Business sector, discussed below.

While Salesforce may seem to have gotten the most immediate, marketable benefit out of this partnership, Microsoft wins the long game, as although a key Microsoft selling point for MSDynamics CRM product – tight integration to Office and Office365, Microsoft can now access and enter into dialogue with Salesforce customers. Microsoft can no longer boast to being the only CRM that integrates natively with Office, while Salesforce can no longer position themselves as a Microsoft alternative.

Software as a service (SaaS) has always been Salesforce’s strong point – Microsoft’s Azure platform is quickly becoming a strong play in the SaaS/cloud arena, and the next generation of Dynamics products are poised to fully leverage this. Microsoft will no doubt seek to explore and exploit further synergies by encouraging the use of Azure rather than Amazon Web Services (AWS).

Subscription pricing for enterprise software

Salesforce products can be procured on a per-user subscription basis billed annually, similar to other cloud-based vendors. Starting at $25 to $250 per user per month, it is apparent that Salesforce.com is the highest priced product in the Cloud CRM industry, and this does not even come with a standard SaaS Service level agreement (SLA).

In terms of revenue growth, from 2013 to 2014 Salesforce grew the fastest among all the primary CRM competitors, with a pace of 28.2% growth in worldwide revenue, followed by Microsoft (21.7%). However, going forward, CRM will probably increasingly need to offer a value add for the additional premium customers face or reduce pricing. The need for a strategic change is explained by the constant change of the market environment along with the transformation of consumers’ needs (Moatti et al. 2014).

Making customers a source of innovation

By bringing interactivity and involvement of clients to bear in coming up with fresh ideas and improvements, current be a huge source of innovation and insights into possibility, and this, of course, can be fully underpinned by the embrace of Social CRM. The idea of turning the consumer feedback into the source innovation is relatively new in CRM practice – therefore, its realization implies good chances to gain additional competitive advantage (Agnihotri et al. 2016).

Opportunities lie in making key related areas, better integrated. Thanks to social media and increasing interaction between people and products online, customers’ opinions about the products or services they use have become a business driver.

Cloud CRM

Salesforce.com is delivered as software-as-a-service (SaaS), meaning customers need not purchase, install, update, or maintain dedicated hardware or software for it; Salesforce strategically has no option available for using their software within an on-premises environment, even though their competitors do. As the trend continues to move towards a fully Cloud computing stance, Salesforce is in a strong position.

Numerous studies provide evidence for the efficacy of the shift to clouding platforms (Crnkovic 2013). We know that Salesforce is currently using and deploying this model and they should enhance this and look for ways to simplify their product suite and offerings using this model – simplifying CRM using Cloud Computing, and reducing the costs of support, upgrades and infrastructure.

Vertical CRM

Salesforce.com caters for industry verticals – financial services, healthcare, life sciences, communications, retail, media, government, manufacturing, automotive, higher education, and non-profit, however competing vendors have similar target industries, including NetSuite’s SuiteApp.com, SAP’s CRM Systems, and Microsoft’s Dynamics. Other midrange vendors also have a few common target industries. For instance, SugarCRM is inclined towards business services, consumer goods and retail, financial services, insurance, government, amongst others.

Salesforce has a wide breadth, in terms of the sectors and types of businesses they serve, but there is a definitive trend towards building knowledge bases and industry subject matter expertise for specific sectors into CRM and then differentiate on that basis and Salesforce are not differentiated to specific business sectors. The lack of differentiation might hurt general performance (Agnihotri et al. 2016).

CRM is not just for Big Businesses!

Many small companies use CRM and it is expected that their take up will only continue to increase. According to experts’ estimations, most of the market players will soon shift to this pattern (Agnihotri et al. 2016). The problem is many small companies generate less than $10 million in revenue, so Salesforce will need a clear strategy on this demographic as their numbers are predicted to rise, bearing in mind that they will have a lot of competition from smaller CRM providers and Freemium players.

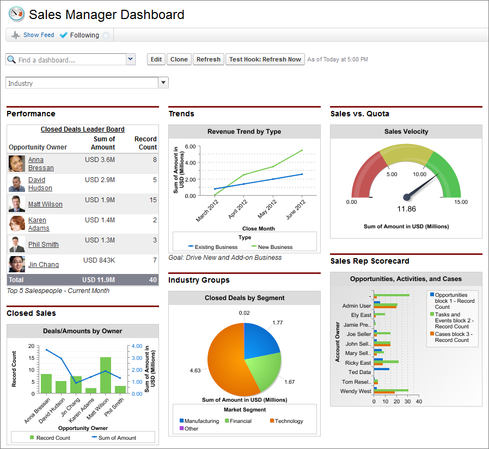

MI, Reporting and Analysis

Business Intelligence software will be characterised by ease of use and becoming more visual, to enable users to use, decompose and understand their data intuitively by rendering data in easy to read graphs and charts, breaking down the barriers between people and their data.

Salesforce.com offers customizable reports and dashboards that empower sales managers and executives with instant access to real-time data and analysis, and appear way ahead in this game. Support for multiple ready-to-use analysis scenarios, such as sales pipeline analysis, win-loss analysis, and historical trend analysis, is backed up with real-time views of sales data, enabling managers to instantly access the information they need to complete a sales and marketing report. A few advanced features such as territory management and predictive forecasts help in preparing estimates based on revenues, quantities, or geographies. As a result, corporate analysts receive substantial support for their decision-making (Ruivo et al. 2014).

However, to remain competitive, they should amp up interactive reporting capabilities like SAP CRM, and develop the ability for users to generate reports without much need for technical knowledge, like Oracle CRM.

Conclusion

Salesforce’s innovation and simplicity have already earned it a majority share in the CRM solution business. According to Gartner’s Magic Quadrant for Sales Force Automation, Salesforce leads the market both in terms of having a sound future vision and the ability to execute and fulfil their promises to customers.

There is no doubt, then, about the importance of Salesforce in this sector, but there are ever more players entering the sector, many of which offer free, some components Salesforce charge for. Meanwhile, the analysis shows that the company has sustainable competitive advantages within the relevant segment (Cusumano 2010).

Already leading the way with Cloud CRM, genuine issues remain, with the emergence of Vertical CRM, so Salesforce must harness the power of Social CRM and focus on the integration opportunities that could be created by enabling the interoperability of their offering with the key platforms they can expect their key users to be used for the next 10 years.

Reference List

Agnihotri, R, Dingus, R, Hu, MY & Krushd, MT 2016, ‘Social media: Influencing customer satisfaction in B2B sales’, Industrial Marketing Management, vol. 53, no. 1, pp. 172-180.

Cusumano, M 2010, ‘Cloud computing and SaaS as new computing platforms’, Communications of the ACM, vol. 53, no. 4, pp. 27-29.

Crnkovic, J 2013, ‘The Future of CRM is UX’, Business Systems Research Journal, vol. 4, no. 1, pp. 4-13.

Mathiesen, P & Fielt, E 2013, ‘Enterprise social networks: a business model perspective’, in 24th Australasian Conference on Information Systems (ACIS), RMIT University, Melbourne, pp. 1-12.

Moatti, V, Ren, CR, Anand, J & Dussauge, P 2014, ‘Disentangling the performance effects of efficiency and bargaining power in horizontal growth strategies: An empirical investigation in the global retail industry’, Strategic Management Journal, vol. 36, no. 5, pp. 745-757.

Sinha, S & Iyer, V 2013, ‘Building effective customer strategies using CRM analytics’, SIES Journal of Management, vol. 9, no. 1, pp. 30-43.

Zilber, SN & de Araújo, JB 2012, ‘Small Companies Innovations in Emerging Countries: E-Business Adoption and its Business Model’, Journal of Technology Management & Innovation, vol. 7, no. 2, pp. 18-24.