Introduction

The current economic recession has caused unprecedented turmoil for many economies of the world. The recession came soon after a boom leading to understandable confusion among the business as well as national governments across the globe. Elements of globalization, modernization as well as the development of international markets have seen the spread of the recession across all nations in a very short span of time.

An economic recession is a period in the economic cycle characterized by the slowdown of economic activities, deflationary pressures, reduced outputs and loss of employment for a significant portion of the employable workforce in the economy. It leads to deteriorating living standards and greatly hampers economic growth which is a critical prerequisite of economic development. It also raises security concerns due to the possible destabilization caused by the drastic increase in economically deprived members of the population. It therefore necessitates the intervention of government to avert such crisis.

The crisis has ruined markets across the world upon its inception in 2007 from the US financial market. It resulted from the failure of huge firms to manage risks and was aggravated by relaxed regulations. The housing market was the epicenter. Prices of homes continuously rose from mid 1990s to the year 2006. People thought that the prices would always be rising. Sub prime borrowers (borrowers with poor credit history or who have no proof of steady incomes) drastically increased accelerating the rise in prices. Investors became very innovative introducing new products such as the Adjustable Rate Mortgages (ARMs) which had low rates, no down payments and even the provision to postpone interests and add it to principal amounts.

The rise in price was however untenable. In 2007, the bubble finally burst. Sudden uncertainty in house prices made lenders cut on lending. Highly geared banks were severely vulnerable to plummeting asset prices yet they had very low capital base. This resulted to a credit crunch as mistrust among financial institution and later extending to other business entities became apparent. The hampered flow of credit sparked an economic slowdown as firms could no longer expand businesses. Incomes plummeted as unemployment rose spreading the effects globally through export markets and falls in asset prices.

The results of the have been devastating across the world. A world wide recession has clearly emerged. The unemployment levels have swollen to unprecedented scales, access to credit for consumption as well as investments has become a mirage, businesses have been edged out of the market and poverty has drastically risen especially in developing nations.

The responses accorded to the economy by different governments across the world have largely differed in magnitude but remain similar in principles. On this front, Malaysia has not been left out. The ravaging effects have been felt in almost all the sectors of the economy. However, the external orientation of the Malaysian economy was expected to overly expose the economy to the effects of the economy. Though this happened, the magnitude has greatly differed with the analysts expectations.

Country Economic Profile

Malaysia is a country located in Southeast Asia. It is a multi ethnic and multi religious nation ranked as well of the wealthiest countries in the region. Only two countries, Singapore and Brunei are the only ones surpassing Malaysia in GNP. It borders Indonesia, Brunei, Thailand and Singapore. The country has had a consistently well performing economy growing at rates beyond 5% since 1970s. In those early years the country was a producer of raw materials but consistent application of sound economic policies saw the transformation in to a multi-sectoral economy.

The current level of GDP calculated as per the Purchasing Power Parity is 191 billion. The per capita measure of GDP stands at 8,083. The last 15 years have seen the growth rate averaging at about 9% while the last two years growth rate was 7% in average. The main reason is the onset of the economic downturn. The main sectors of the economy are Agriculture which contributes about 7.2%, manufacturing contributing 33.6% of the GDP and the services sector contributing about 59.1% of the GDP. Interestingly inflation has been characteristically low remaining at levels below 5% for most of the last two decades.

Among these three main sectors, the services sector employs 49.5% of the entire labor force. Manufacturing employs 36% while Agriculture employs a paltry 14%. This represents a radical shift from the reliance on agriculture. The literacy levels are very high in comparison with neighbors such as Indonesia.

As has been mentioned above the Malaysian economy is export oriented. The most important export partners are the US, Japan, Singapore, South Korea and China. The main sources of income are Japan which brings in 16% of imports, USA 14.6%, Singapore 11.2% and China 9.9%. Others are Germany, Korea, Thailand and Taiwan (Helen, n. d, Par 4).

Since 1970 the economic prospect of Malaysia was drastically changed. Amendments to the country’s constitution led to the development of the New Economic Policy whose main objective was to promote national unity through eradication of poverty throughout the country and as well as societal restructuring to wipe out the racial tag to economic development issues. The export oriented production was chosen as the path towards industrialization in conjunction with a comprehensive rural urban program for development as the pioneer fiscal policies. The aim here was to establish clear channels of ensuring that revenues generated flow down to cause maximum impact in reducing poverty.

The 2ndobjective entailed attaining long term goals so as to improve share ownership of the limited liability companies by Malaysians. It also involved increasing the percentage of Malaysian employees working in various manufacturing companies.

Due to the low levels of capital available in the economy at the time, the government had to start by being directly involved in production. The governments set up Major Agricultural and manufacturing plants with most of the managerial positions held by Malaysians. The government also offered easier business opportunities mainly by biasing tenders to favor locals. When the state owned companies were privatized, locals were also privileged in allocation of the shares.Clear targets were set. The proportion of shareholding in limited companies was targeted to rise from 2% in 1970 to 30% in 1990. On the employment front, the aim was to improve the employment pattern in the rural areas to a level comparable with that of the urban areas especially on the racial perspectives (Elgar, 2009, Par 4).

The country then went to promoting heavy industries where it formed the Heavy Industries Corporation of Malaysia (HICOM). The company owned by the government was charged with the role of seeking foreign partnerships with better technologically endowed companies to set up heavy industries in the country. With such initiatives, heavy industries such as steel, cement, petrochemicals, general engineering, transport equipment, paper and paper products emerged. The main aim here was to build a strong foundation in the manufacturing sector and invoke the strength of linkages both forward and backward in developing other supportive industries such as banking and agriculture (Elgar, 2009, Par5).

Despite the rhetoric about export orientation approach towards development most of the projects chosen for government facilitation were geared towards import substitution strategy. The growing private sector had different views. It sought to exploit the high comparative advantage prevalent in Malaysia in terms of cheap skilled labor, improved infrastructure to build export oriented industries. The heavily subsidized industries resulted in just over 5000 direct jobs despite the heavy investments.

True some managerial and technical skills were acquired but the price paid for this was simply too high. By the year 1989, analysts observed that most state corporations offered no growth in total factor productivity (TFP). According to Menon (1998) the industries offering the most TFP growth were dominated by private companies and received minimal government help. They were largely labor intensive firms dealing in textiles, footwear, sports items toys and clothing. This led to a realization that the over protection of state enterprises was not helpful to the economy as it made the other upcoming industries pay higher prices for the products offered yet the intended effects on employment and GDP were dismal. This led to the belief among economists that much of the development in Malaysia was unintentional (Menon, 2000, p223).

The massive expansionary fiscal policies which saw the upcoming of numerous government investments put a strain to the current account deficits. Imbalances in macroeconomic environment coupled with the recession in the 1980s shook the economy. An economic contraction of 1.1% was witnessed in 1985 following a price collapse in the international market. This brought the need to rethink the fiscal policies.

The monetary policy in Malaysia remained largely conservative through these years. Authorities rarely used them to stabilize the economy except for two instances in mid 1970s due to inflationary pressures and the recession of mid 1980s. In the mid 70s the government shrunk money supply pushing up interest rates that slowed down inflation. The mid 80s saw restrictions of capital outflows to help boost local investments. Also, some restrictions in exchange markets were enforced in 1986 though on a temporary basis.

Deteriorating economic conditions build tension among the different races. The fear of the tensions escalating to fully blown violence pushed the enactment of reforms aimed at empowering the private sector and offering a better environment for export oriented strategy. This saw the drastic shift from NEP to National Development Policy (NDP) through the period between the years 1987 to 1997.

This economic regime erased some restrictions while the private sector had incentives boosted. Also some racial requirements were relaxed. The aim was to create wealth before redistribution. The aim was to create a more open way to deal with racial inequalities competitively through processes of entrepreneurship, development of skills and acquisition of managerial expertise. An aggressive privatization process was undertaken except for some sensitive ventures. Tariffs were reduced even further. In deed, by the year 1995, the import-value weighted tariff was a paltry 15% (Menon, 2008, Par 4).

The economic reforms laid focus on macroeconomic stability in variables such as inflation and real exchange rates as well as the need to drive up infrastructure in tandem with economic expansion. The government shifted spending from establishment of public companies towards building infrastructure to aide private sector development. The fiscal burden was significantly reduced (Mahani, 2002, p140).

The emphasis on achieving a target of 30% ownership of equity shifted to the acquisition of skills in management, technology and entrepreneurship. The historically disadvantaged Malay community was expected to stop reliance on the government but rather compete with others. Regulations on equity ownership were relaxed to the extent of allowing 100% foreign ownership on export oriented firms. The huge budget deficits were eliminated and a balanced budget achieved in 1993 (Mahani, 2002, p144).

Despite the effectiveness of the fiscal policies, some weaknesses emerged with the liberalization of capital markets. The liberalization was supposed to make Kuala Lumpur a financial hub. Foreign investors started chasing the high returns causing an influx of short term capital into the economy. This caused the appreciation of real exchange rates causing the loss of competitiveness of local goods in the international markets. Again, to stem the appreciation of the local currency restrictions were imposed on financial institutions restricting the sale of short-term instruments to foreigners. The measures were however later lifted causing the influx again

The Asian Financial Crisis

The crisis kicked off in Thailand and rapidly spread to the neighbors. In Malaysia, the first reaction was to restrict effects on the exchange rates though this was short lived. By the start of the year 1998 the ringgits value against the US dollar had fallen by 50%. Capital outflow was heavy. The Malaysian financial sector was however not overly exposed to foreign debt hence the ability to withstand. The official response by the government towards the crisis was through application of contractionary fiscal and monetary policies.

Government spending was reduced by 18%, a freeze to all new share issues and investment from public coffers was effected. Comprehensive restructuring of companies in was also conducted in addition to the ban on foreign investments by Malaysian firms.

These fiscal measures were accompanied by similar monetary measures. Bank rates were raised to 8.7% from 7.8% and up again to 11% by February. The aim here was to shrink monetary base available for lending so as to contain inflation. However, the measures were unpopular as they resulted to an unprecedented 7.4% shrinking in the GDP in the year 1998. The reason for the shrink is the application of contractionary policies during times of recession. The finance minister was clearly misguided on how to deal with the recession. Only the expansionary or stimulatory policies could lift the economy from the recession. The challenge was on how to apply economic stimulation in the face of inflation (Malaysian Institute of Economic Research, 2009, Par4).

This prompted the adoption of the Keynesian theory. Capital flows had to be regulated so as to avoid capital outflows likely to result from the lowering of interest rates in application of expansionary monetary policies. This was a deliberate measure to disconnect the links between international financial markets and the local market so as to effectively apply expansionary policies without destabilizing exchange rates.

Consecutive budgets increased budget deficits from 1.8% in 1998 to 34.4% in the year 2000. The monetary policy saw the statutory reserve requirement drop from 13.5% before the onset of the crisis to 4% by the end of 1998. Interbank lending rates dropped to 4% from a high of 11%. A host of other measures adopted increased liquidity in the economy. Indeed the expansionary measures accelerated the rate of economic turn around. In 1999, the growth rate was 5.4 up from a negative growth of 7.4%. In 2000, the country recorded an impressive 8.9% growth rate (Rasiah, 2003, p303).

Both fiscal and monetary policies have been carefully applied to support economic recovery, whilst preserving Malaysia’s economic fundamentals. In determining the size of the fiscal deficit, major considerations made included ensuring that revenue is able to meet operating expenditure and hence, that a surplus in the current account is maintained at all times; ensuring the availability of domestic and external financing without crowding out the private sector; ensuring that debt servicing does not exceed 20% of total operating expenditure. Overall, a legislated borrowing rule stipulates a ceiling for federal government debt to ensure that public debt remains at manageable levels.

The implementation of fiscal stimulus packages made the government spending rise from 22% of the GDP by 1997 to an average of 25% of the GDP in the period between 1998 and 2001 with the 2001 proportion standing at 30%. Revenues remained high offering flexibilities in development expenditure. The tax buoyancy as well as increases in revenues from the high oil prices was the main causes of improvement in the receipts part of the equation (World Bank, 1993, Par 4).

Debts were always maintained at sustainable levels. The government constantly sought adherence to rules related to fiscal balance. Historically, the budget deficit has been kept at levels below 6% of the GDP while the overall government debt is maintained below 50% of the GDP. This enabled the debt servicing burden ton remain low at 14% of the operating expenditure.

According to analysts, the success of these unorthodox measures was determined on three factors. First, is the fixing of the exchange rate at a very low level leading to high competitiveness of exports in the international markets? Secondly, the government was successful in convincing foreign investors that the controls were purely short term. This ensured continuous inflows even during the implementation of the controls. Finally, there was highly credible policy implementation in addition to the high level of integrity in the institutions involved. This was to ensure that no political forces influenced the allocation of monies in projects.

A Theoretical Analysis

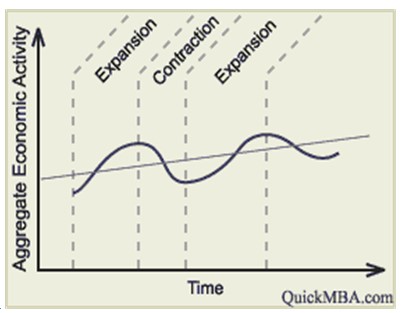

Looking back at the application of policies in the stabilization of the economy, several economic principles applied. An illustration of business cycles is as follows (Quick MBA, 2009, Par5).

Periods of expansions are characterized by economic growth above the general trend of the economy.

Business cycle

Production of levels and other economic activities are rising at a high rate. This comes with growth in employment levels and inflationary pressures in the economy. The rise in employment level is a positive outcome while the inflationary pressures if extreme may derail prospects for further growth.

The governments aim is always to stabilize the growth path of the economy. In the boom experienced in Malaysia in the period leading to 1980s, the country employed expansionary fiscal policies which characterized the massive expansion of the public sector. However, the focus on expanding the public sector instead of concentrating on building infrastructural facilities may have been counter productive for the nation. These led to the realization of the ineffectiveness of these policies. The rethinking of the policies in the late 1980s saw the upcoming of a more efficient mode of application of expansionary fiscal policies. Applying government funds in expanding infrastructural activities and expansion of social services not only served to reduce costs of production but also proved effective in expanding aggregate demand in the economy which prompted the pushing up of the production capacities among producers leading to the realization of higher outputs (CliffsNotes. com, 2009, Par2).

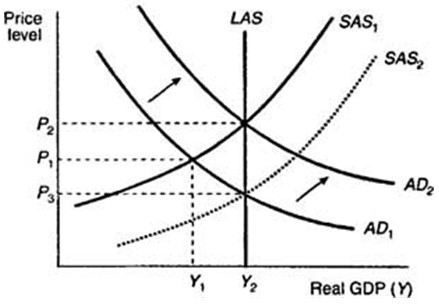

The interaction of the aggregate supply and aggregate demand resulting from the application of the policies is illustrated by the curves below.

In this curve, there is an assumption that the economy is not operating in full capacity. This means that the resources available are not fully utilized meaning that there is room for further growth. Under such a case, the aggregate demand curve cross the aggregate supply curve at a point where the two equate for market stability. Increased government spending causes a shift in the AD curve outwards. The increased demand causes stirs production levels in the economy. The stirred production results in a rise in the level of supply levels (CliffsNotes. com, 2009, Par3).

The rise in AS following the rise in AD results in the realization of a new level of GDP as illustrated by the graph below.

It is this continued trend which leads to the upward trend in the business cycle described above.

The monetary policy in Malaysia remained conservative. However the handling of the Asian crisis had to be different. The detachment of the international financial markets prevented the interplay of the effects of interest rates to attract short term foreign capital. Lower interest rates would mean that capital afforded lower levels of returns locally in comparison to the international rates. This means that the lower rates meant to stimulate the economy would actually not have the intended effect due to the outflows in search of better returns outside the country (Ismail, n. d, Par4).

Current global recession

The current economic recession outlined above has not spared the Malaysian economy. Key sectors for growth are recording a slowdown in rates of growth. The extent of the effect may not be as grave as first thought for Malaysia but nevertheless there has been credible evidence of negative impact on the economy. The Malaysian capital markets have dropped by a whooping 27%. This has greatly affected investor confidence. The fact that the US is the biggest export market for Malaysian goods the plummeting of incomes in the US meant a blow to the Malaysian exports. The growth prospects of the Malaysian economy have however been impressive considering the global environment. Achieving a growth rate of 7.1% amidst a recession is never a mean achievement. The main reason is the high level of diversification in the sectors that drive the economy. The increase in export of petroleum products as well as scientific and optical equipments compensates for the huge drop in exports for manufacturing goods which account for 78% of exports.

However, look at the effect of the crisis on an industry level shows the most important areas that require attention. Malaysia is a top exporter of oil palms and rubber. The markets of these products shrunk with decreased demand. The situation was worsened by the high prices of food and agricultural products immediately prior to the recession which had already distorted the market. Recently, the price of palm oil has fallen to unprecedented levels causing huge losses to farmers. In response to the distress of the palm oil farmers, the government committed a sum of RM 5.6 billion under the National Food Policy for the period between 2008 to 2010.The intention is to offer incentives to investors and more importantly seek ways of reducing production costs and improve quality of agricultural output(Avanti, 2009, Par 6).

The automobile industry remains a crucial sector in the Malaysian economy employing a sizeable proportion of the workforce. Both Proton and Perodua are significantly exposed to the international despite their heavy reliance on domestic markets which may not be acutely experiencing the turmoil. A stimulus package for the industry to the tune of RM200 million was injected to the Automotive Development Fund. In addition a deduction of RM5000 was offered to those willing to do away with cars older than ten years and purchase new ones from local companies.

Also the government imposed a 100% import duty on new hybrid cars coming from outside the countries while at the same time offering 50% excise duty on new hybrid CBU cars with engine capacity below 2000cc for a period of two years so as to prepare for the local assembly of such cars. The aim here is to stimulate growth by encouraging the setting up of more businesses dealing with automotive.

The Malaysian housing development industry is not overly exposed to the financial collapse due to the non-existence of sub-prime lending. The effect is flowing in form of reduced new investments and reduction in consumer confidence which affects decisions and response of players in the property market. The prices of construction materials remain high despite the fall in oil prices. Again, financial institutions are more strict in lending which has seen access to finance for property development reduce

In response, the government intervened by reducing regulations for housing purchases and also set aside about RM 7 billion sourced from savings made in fuel subsidies to be used in expanding housing development.

The tourism industry is also a vibrant industry in Malaysia. The country has beautiful sceneries and an expansive shoreline a favorite for tourists. There has been a notable decrease in tourist arrivals globally. The main reason is the dwindling incomes as well as the minimized expenditures resulting from the uncertainties among the western nationals who constitute the highest percentage of tourists. Analysts have reported an approximately 4% contraction in international visitors arrivals over the year. The Malaysian government has expressed intention to move in with a stimulus package aimed at minimizing the impact of the recession on the local tourism industry.

The government’s stimulus package focuses on improving the number of international arrivals. This is by improving the of technology such as the internet, increasing value added services extension of brands in promotion and emphasizing on niche products like youth travel, sports, music, volunteer tourism, eco-tourism and gastronomic tourism. It also seeking to establish strategic alliances and incorporating icons such as celebrities as marketing strategies.

In addition, the government is enhancing the issuance of soft loans by banks and other financial institutions for tourism projects across the country. The loans have lesser conditions and lower interest rates as compared to the normal loans. The country is luring more airlines to operate on her soil. On this front, a rebate of 50% on the landing fees is available for a period of two years starting from 1st April 2009 for all airlines operating in the country.

RM200 million was established to promote tourism in Malaysia. The implications of the above described expansionary fiscal policies are yet to be felt in a more comprehensible scale in Malaysia. However, signs of improvements are visible in most of the sectors mentioned above. It is not clear yet whether the improvements are a direct result of the government’s actions or not.It also aims at improving home stay programmes which are increasingly becoming popular among tourists. According to KPMG (2009), the immediate response to the recession in the Asia Pacific region is largely by the cutting of costs by businesses. This not only means the reduction in expenditures which boost other businesses but also the cutting down of the number of employees hired.

The social implications are thus grave especially for multi-ethnic nations with potentially explosive divisions. Research findings showed that most people felt that the recession was affecting the in a unique way and more importantly that they did not have the requisite experience to assist them deal with the recession in the best possible way. Company management was thus inclined towards cutting costs to cope with the current situation and in waiting for the situation to improve. They also showed signs of better appreciation of the government’s action in directly intervening in the market in a bid to stimulate the economy. Indeed, this provided the political p-platform in which the government could boldly come up with intervention measures to act directly in the economy despite the capitalist ideologies followed by the country (Par4).

It is however the expectation of most economic analysts that the government has developed very effective plans to support the most important sectors of the economy. Unlike in the 1970s and 1980s when response to economic recession was the expansion of the public sector in the economy, the current focus on education, infrastructure and investment incentives is more effective in stimulating the long run growth of the economy. Expanding the public sector only serves the short term interests. Infrastructural expansions however have large multiplier effects with the potential to have long term stimulatory effects. This is because they have minimal crowding out effects.

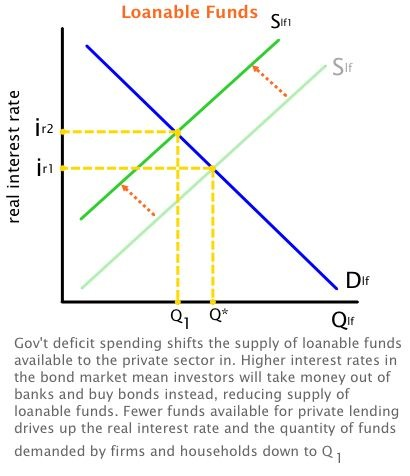

Crowding out effects in application of fiscal policies occurs in the reverse side where the expenditure is financed through the expansion of the level of government debt. Issuing bonds and bills enables private investors opt for them as they are more secure especially in times of high economic uncertainties presented by the recession. The preference for bonds by private investors undoubtedly leads to the reduction of capital available to fund private investments. This is a dreaded outcome as it puts to risk growth of the long term production capacity an important prerequisite for economic development. The high appetite for high short term earnings will always drive the investors. The supply of finances from financial institutions thus drastically reduces. The graph below shows the crowding out effect on the supply of financial capital from these institutions.

Since the nations potential output is mainly determined by the endowment in supply of labor, stock of productive capital as well as productivity, the expansion of budget deficits is meant to expand the production possibility frontier. This expands the production levels with the ultimate outcome being the lifting of the economy from the recession (Welker, 2009, Par 3).

Recommendations

The response efforts made by the Malaysian government are economically sound in many ways and ultimately seek to reinstate the level of economic growth prior to the downturn while at the same time minimizing the effects of the recession on the local economy. Expansionary monetary policies are very effective. However, energies have to also be applied in other areas of the economy so as to guarantee positive results. The most important is the restoration of confidence in the local economy.

The start of the crisis in the US was the loss of confidence. This led to the burst of the housing bubble implicating Wall Street dealers. The resultant loss of confidence by investors is what drove down credit availability globally leading to the drastic declines in investment levels. Expectations drive economic boom and cause bursts. The period beginning in 1990s saw a continuous positive expectation in the US housing markets. It is the collapse of these positive expectations that generated the collapse of the credit market. Finding recovery should be through the same route.

It should be notable that the restoration of confidence in all the market segments cannot be hollow. This is because it is this false confidence which build up irrational hopes leading to the collapse. Before attempting to build the substance on which to base, the confidence, a sound self evaluation process of the economy has to be undertaken so as to identify the weaknesses and the harsh realities facing the economy.

In recent times Malaysia has been unable to achieve the high economic growth level witnessed in the periods before the Asian economic crisis. The main reason is the upcoming of China and India as economic powers to challenge the Authority of Malaysia in the competitiveness arena. The country seems to be caught in a middle income trap. The fact is that the factors of production are no longer cheap enough to compete favorably with countries such as India and China (Hamzah, 2009, Par 2).

It has been established that labor markets in the world have been extensively integrated and the benefits for the rich and poor countries are immense. The middle income countries find themselves in a dilemma. Their workers are neither cheaper nor smarter in comparison with the poor countries. This has lead to the stagnation of wages in Malaysia in an economy rising costs of living. This is evident from a report by World Bank which indicates that the service sector contributed an approximate 46.2% to the country’s GDP in 1987. Twenty years later, the service sector contributed 46.4% to the country’s GDP.

Considering this argument, the most correct path to recovery that will lead to high and sustainable growth rates in the future is focus on increased productivity. This has remained the formidable engine to Chinas continuous high growth. In this endeavor the country should seek to produce top niche professionals in all fields relevant to the economy. Growth in levels of skills remains a very vital avenue towards this endeavor.

This is because, foreign investors always determine the countries in which to invest based on the value of costs incurred in doing business. Acting to reduce the wage rates applicable in the economy is not an economically sound idea. The option thus remains that of upgrading the level of skills available from the local labor force. The highly skilled workers will attract higher wages hence growth will be realized.At the same time the real wage rate for workers rose by a paltry 2.8% between 1994 and 2007 for those working in export oriented industries including the services sector (Hamzah, 2009, Par 4).

Conclusion

The Malaysia experience in handling economic recession can be success fully teach valuable lessons to other countries which adopt rigid response systems which may not be effective in achieving desired results. The Malaysian economic decision making process is very pragmatic. The ingenuity applied in solving upcoming economic challenges is impressive. The political leadership has also been responsive to the economic situation facing the economy. Prime ministers have always spearheaded the development of economic policies.

The country is well endowed in resources including oil which have contributed immensely to the funding of crucial developmental projects leading to the emergence of a middle income country. Continued application of sound policies will ensure sustainable growth.

Reference list

Avanti K., (2009). Malaysian PM promotes greener, high-income economy for ‘1Malaysia’: Budget 2010. Web.

CliffsNotes.com (2009). Fiscal Policy. Web.

CliffsNotes.com (2009). Monetary Policy. Web.

Elgar, E., (2009). The Malaysian Economy: Past Successes, Future Challenges. Web.

Hamzah, T., (2009). How Malaysia Can Cope With and Overcome the Effects of the Global Economic Crisis. Web.

Helen, E., (n.d). Accommodating Global Markets: Malaysia’s Response to Economic Crisis. Web.

Ismail, M., (n. d.). Fiscal Policy and Structural Adjustment: The Malaysian Case. Web.

KPMG, (2009). Asia–Pacific leading Europe in response to global recession. Web.

Mahani Z., (2002). Rewriting the Rules: The Malaysian Crisis Management Model, Prentice Hall, Petaling Jaya.Web.

Malaysian Institute of Economic Research, (2009). Institut Penyelidikan Ekonomi Malaysia (149064-U). Web.

Menon, J (2000). ‘How open is Malaysia: An Analysis of Trade, Capital and Labor Flows’, The World Economy, 23 (2).

Menon, J., (2008). Macroeconomic Management Amid Ethnic Diversity: Fifty Years Of Malaysian Experience. Web.

Quick MBA, (2009). The Business Cycle. Web.

Rasiah, R. (2003). ‘Industrial Technology Transition in Malaysia’, in Lall and Urata (Eds).

Welker, J., (2009). Archive for the ‘Production possibilities curve’ Category. Web.

World Bank (1993). The East Asian Miracle: Economic Growth and Public Policy, Washington DC.