Tesla’s Overall Competitive Strategy

Tesla is a relatively new energy car company headquartered in Silicon Valley, USA. This is why Tesla’s differentiated competitive strategy coincides with the American culture of striving for individuality and protecting freedom. Whether in terms of industrialization or the development and application of Internet technology, the United States is at the forefront of the world. It is in the States that the conditions for Tesla’s innovative products and services are excellent.

Tesla has chosen a differentiated competition strategy, given the situation with the consumption of new energy vehicles in the domestic market. The most striking manifestation of the company’s differentiation strategy is innovation in products and services. This is reflected in many areas, such as industrial design, battery management, after-sales service, and smart grid. Compared to traditional fossil fuel cars and other brands, Tesla’s competitive edge is evident in these innovations.

Brand Positioning

Tesla is positioning itself as a brand representing an example of the new luxury. This concept implies that consumers abandon the principle of demonstrative consumption and switch to meaningful consumption. During the formative years of Tesla (2007-2010), there was a situation when there was nothing breakthrough in the market for buyers (Desjardins, 2017). Moreover, premium and luxury cars competed with each other through not particularly significant improvements. The nascent fashion for electric motors or hybrid units primarily included lower-end models. Tesla’s evolution took place against the backdrop of an active struggle for ecology and fuel economy. The new luxury philosophy implies the creation of luxury products responsive to social trends, which is exactly what Tesla produces.

Tesla uses mono-segment positioning, which means that the company adapts to the preferences of one market segment. Accordingly, the manufacturer of alternative fuel vehicles targets consumers concerned about the negative effects of oil and gas consumption on the environment. Tesla products are considered expensive for the average consumer, and therefore the target customer segment for the company is wealthy people. In addition, the electric car manufacturer is positioning its products and services for the low-turnover market segment, expecting turnover to grow in the future.

Competitors of Tesla

Tesla has certainly come a long way since it sold its first Roadster in 2008. Currently, most car companies are switching to electric cars and preparing models for sale and will offer more models in the coming years as consumers switch to clean energy. Still, the company is the market leader in electric cars. However, other companies in the automotive industry, such as Volkswagen, NIO, and other competitors, are beginning to catch up with Tesla.

Volkswagen, which accounts for about a quarter of Tesla’s market value, is the largest manufacturer by revenue globally. Volkswagen owns the MEB platform, an efficient and flexible electric vehicle system (Kane, 2022). It is built based on the concept of expanding and scaling battery storage space and is fully cost-competitive with Tesla (Kane, 2022). Another advantage the company has over its current electric car leader Tesla is its customer base. Conservative consumers are too cautious about trying new technologies. Therefore, they are more likely to accept the use of electric cars from a traditional car company.

Chinese electric car company NIO has a unique battery-as-a-service business model. According to the BaaS concept: consumers own the car, but NIO charges a subscription for its batteries. This helps reduce upfront costs for customers and increases the company’s profits. Its Air model has a slightly longer range than the Tesla Model S and offers faster acceleration and shorter charging times. In addition, Lucid Motors has an advantage over Tesla because its engineers have been able to develop a high-performance drivetrain.

Market Share

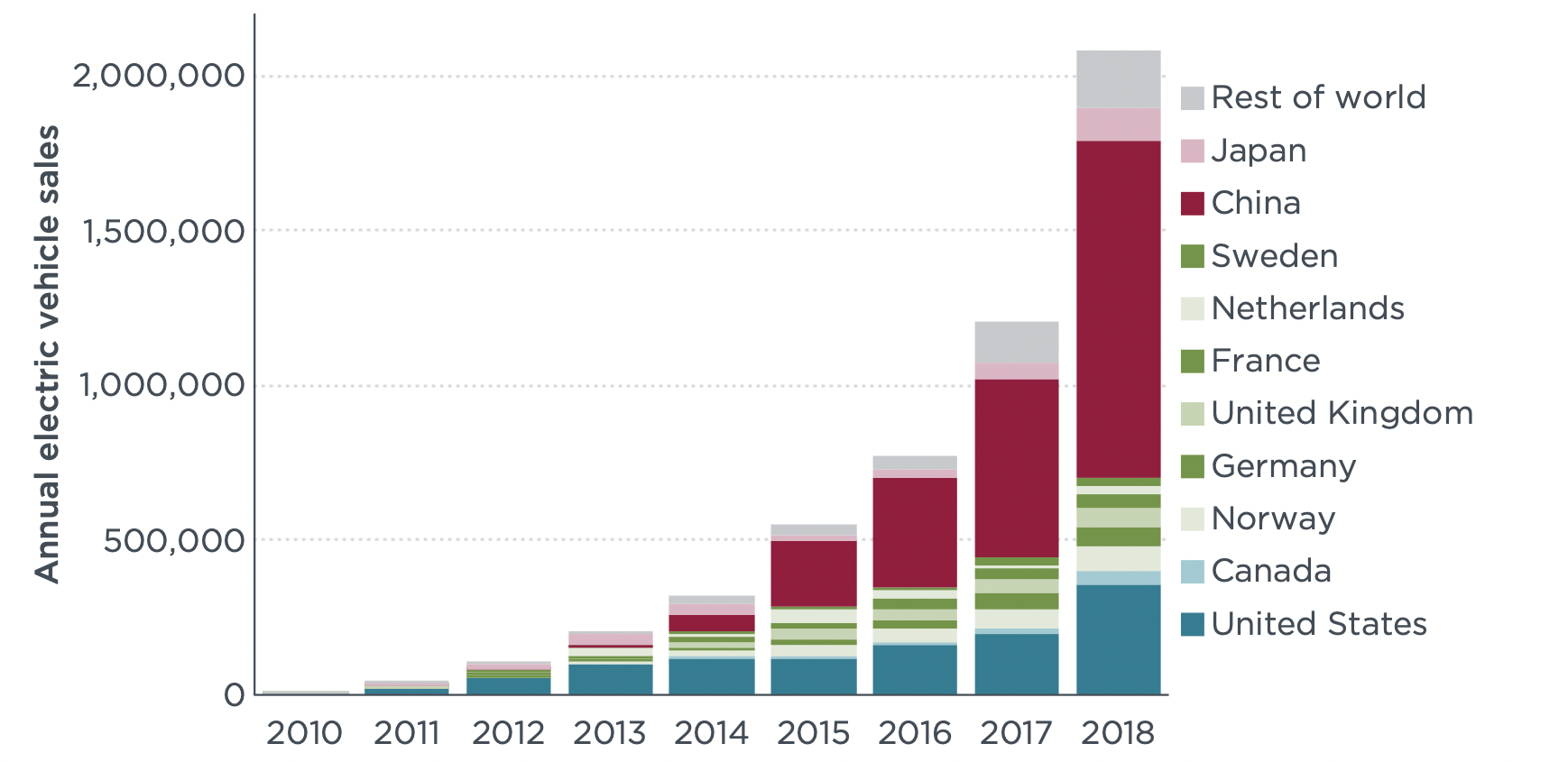

Tesla is still well ahead of other car groups in terms of all-electric vehicle sales. However, its market share has declined from 23% in 2019 and 2020 to 21% in 2021 (Kane, 2022). The main factor holding back even faster growth in the electric car market is the higher cost of owning a car than conventional cars. Despite lower costs compared to classic cars and subsidies from states, the cost, especially of batteries, makes electric cars more expensive than cars with internal combustion engines. However, there has been a steady growth in sales of electric cars around the world (Figure 1). Factors that inhibit the spread of share in the overall market are some Tesla models’ insecurity (Isidore, 2021). According to research results, the most problematic is the Tesla Model S (Wayland & Kolodny, 2020). Owners encounter problems ranging from faulty fog lights to defective suspension arms and control systems. Officially, Tesla has already had to recall all of its defective models, which have problems with the suspension.

Note. From Update on electric vehicle costs in the United States through 2030, by N. Lutsey and M. Nicholas, 2019, p. 1, The International Council on Clear Transportation.

Porter’s Five Forces

Porter’s Five Forces analysis describes the industry in which a company operates and facilitates the search for new sources of competitive advantage. Purchasers would like lower prices for electro cars and improved safety of vehicles. The personality of Elon Musk himself is also important to buyers – what statements he makes can influence their decision to buy. Chevrolet Bolt and Kia Niro EV are just some of the many models that are on the electric car market right now. The pressure of existing competitors reduces the growth rate of Tesla, and therefore the company should try to create truly unique cars. The coronavirus caused losses at the company – Tesla underproduced 40,000 cars because of the lockout (Bloomberg News, 2022). There were difficulties with deliveries due to the destruction of supply chains. In addition, there are more and more new competitors, which is due to the development of markets in China and the start of production of electric cars in existing automobile groups.

SWOT Analysis

Tesla’s strengths are its innovation and visibility, as well as its high share price. The company’s key weaknesses include the lack of a smooth production process and consumer attitudes – they still do not perceive electric cars as ordinary cars. In addition, Tesla cars are unequally popular – models 3 and Y are popular, but the S and X models are less popular (Isidore, 2021). The company’s opportunities include the global trend to protect the environment and explore new markets. However, the threats are growing competition and an increase in the number of legal risks, which could lead to a loss of reputation.

PESTLE Analysis

In terms of technological factors, it should be noted that Tesla was the first to launch electric cars into mass production. The company maintains its leadership by creating a new trend in the automotive industry. The legal changes that are currently taking place around the world show that more and more countries are taking a stand to support the production and consumption of electric cars. The use of Tesla cars is also good for the environment, as they are much less harmful. The social trend now is to reduce the carbon footprint, and therefore Tesla has no dangers in terms of public reaction. However, there is a risk that conservative politicians will oppose the operation of electric cars, which could cause a hindrance to the company’s growth.

References

Bloomberg News. (2022). Tesla staring down 40,000 lost EVs due to Shanghai lockdown. Web.

Desjardins, J. (2017). The story of the rocky early days of Tesla. Business Insiders. Web.

Isidore, C. (2021). Elon Musk admits Tesla has quality problems. CNN Business. Web.

Kane, M. (2021). Meet Volkswagen’s MEB-small platform. InsideEVs. Web.

Kane, M. (2022). World’s top 5 EV automotive groups ranked by sales: 2021. InsideEVs. Web.

Lutsey, N., & Nicholas, M. (2019, April 2). Update on electric vehicle costs in the United States through 2030. The International Council on Clear Transportation.

Wayland, M., & Kolodny, L. (2020). Consumer reports is no longer recommending Tesla’s Model S and is panning the reliability of the new Model Y. CNBC. Web.