The business field has always been exposed to ethical issues and challenges, but in the modern digital world, the type and scope of the problem have changed. According to Nuseir and Ghandour (2019), the globalization and the digitalization of data have contributed to the complexity of ethical issues. In particular, the connection between data breaches and the company’s value can be observed.

Ethical issues in finance constitute a broad theme and subject to research for many scholars (Garonna & Spaolonzi, 2016; Sugimoto, 2018). This paper focuses on the case of the Facebook–Cambridge Analytica data breach, providing an in-depth understanding of the connection between ethics threats and companies’ reputation. This study aims to discuss the Facebook (FB) – Cambridge Analytica (CA) data breach as a case supporting the claim that ethics violations will reduce the firm value, all else equal.

The Background of Facebook – Cambridge Analytica Data Breach

First, it is crucial to consider the background of the Facebook – Cambridge Analytica data breach case. As Rehman (2019) reports, in 2018, a scandal occurred when Christopher Wylie, a former Director of Research at CA, revealed that the personal data of millions of Facebook users was used without their contest. The accounts’ personal information was collected and utilized for political purposes, namely, in the U.S. Presidential elections in 2016 and the Vote Leave Brexit campaign (Rehman, 2019). This data breach raised questions regarding FB users’ privacy and the firm’s ability to protect its customers’ identifiable information.

As for the financial aspect, the FB case study allows for investigating the effect of data breaches on the organization’s value. FB not only faced lawsuits and a boycott campaign among its users. According to Yu and Huarng (2020), the company also experienced a drop in stock price that resulted in $50 billion of market capitalization within the first three days after the data breach revelation. A week after the scandal, FB’s shares decreased by about a quarter (Yu & Huarng, 2020). Hence, the unprecedented consequences suggest a direct relationship between the data violation and the corporation’s market value.

Data Collection

A case study is the primary data collection method for this research. FB is considered the subject of the case, and the connection between the company’s data violation and market value is investigated. The results of this research can be useful for organizational change and development. In this regard, it is necessary to obtain data for analysis and consider the conclusions regarding the FB scandal made by other researchers.

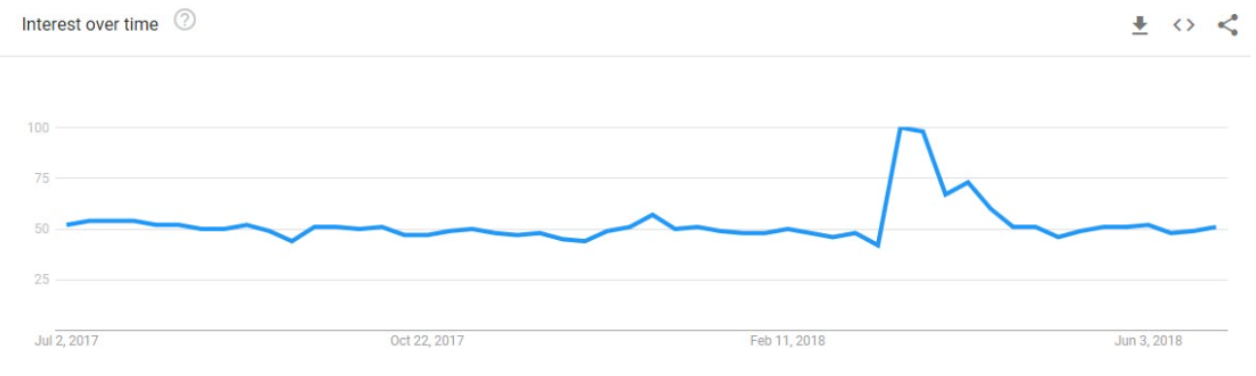

The experience of FB indicates the platform users’ significant concern about their personal information misuse. As Larson and Vieregger (2019) state, the incident resulted in a movement #DeleteFacebook and endangered the platform’s reputation. However, as can be seen in Figure 1, a surge in the interest in deactivating FB accounts went back to the normal levels relatively fast, and most users stayed despite the scandal.

Note. This figure indicates that the interest in the search ”delete facebook” increased after the Facebook data breach in 2018 but flattened back to the average level soon.

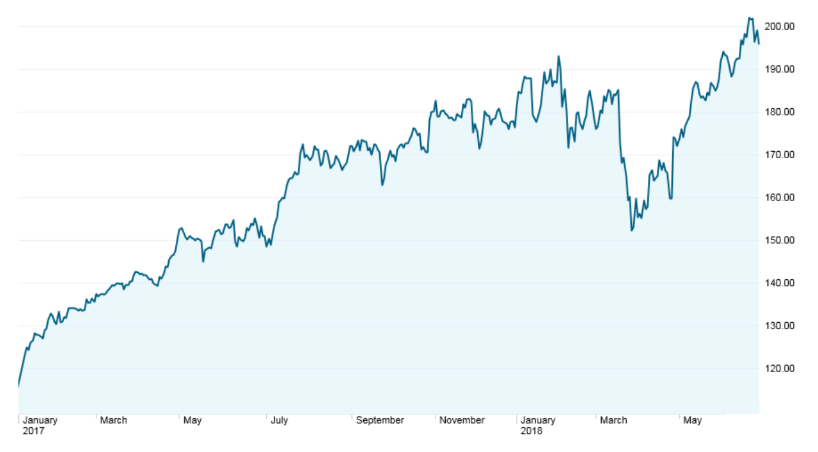

Another kind of data relevant to this research involves the effects on the market valuation of the company. According to Larson and Vieregger (2019), the CA scandal negatively impacted FB’s share price in the short term. As shown in Figure 2, the share price level before the incident accounted for about $185 in March 2018 and dropped to approximately $150 on March 27, 2018. Nevertheless, the price before the CA scenario was restored by June 2018 and continued climbing (as indicated in Figure 2).

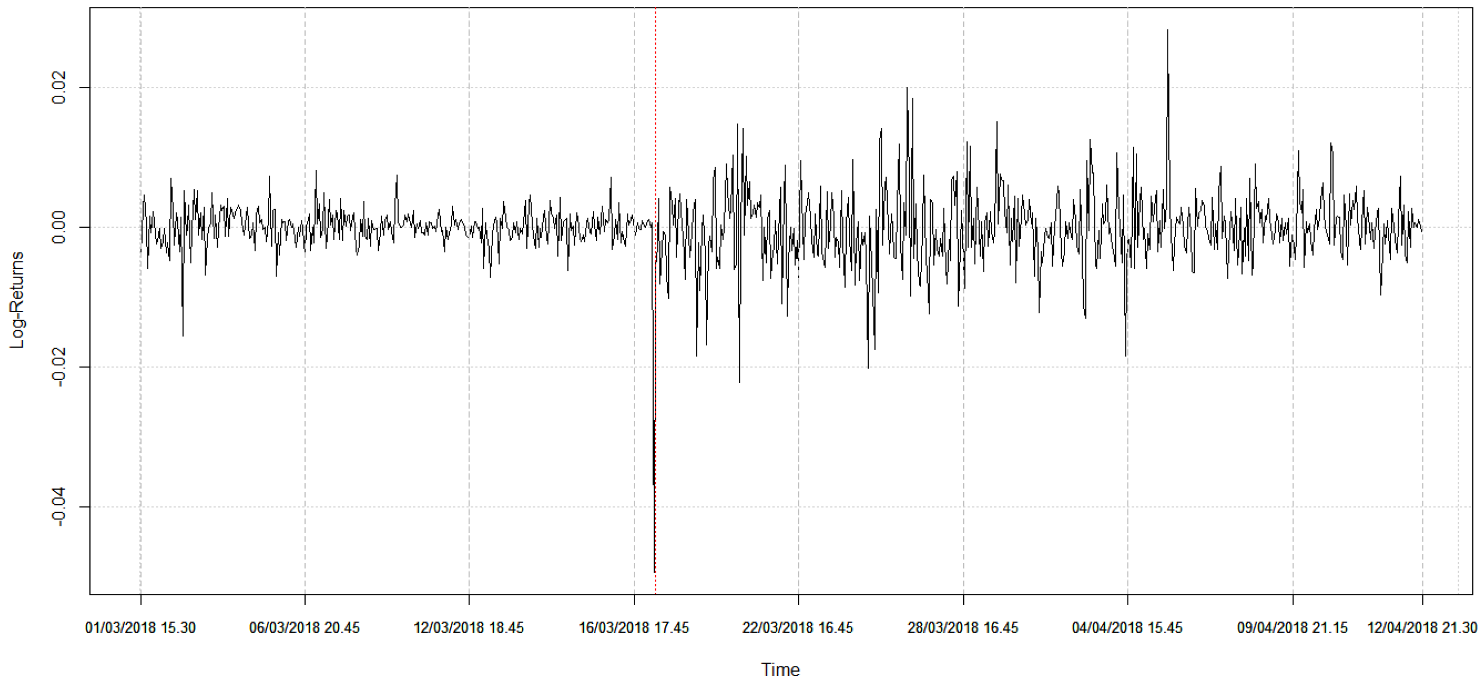

At the same time, Peruzzi et al. (2018) studied not only the stock price but also the log-returns after the event. Figure 3 presents the log-returns of the FB shares as of March and the beginning of April 2018. According to Peruzzi et al. (2018), ”a ∼165% increase in FB volatility and a ∼15% increase in the average volatility for all the assets considered” can be observed (p. 765). Hence, it is evident that the data breach scandal resulted in a decrease in Facebook stock price and an rise in its volatility.

Note. This figure shows a drop in the stock price to about $150 observed on 2018. However, steady growth to about $200 can be seen by 2018.

Note. This figure shows the log-returns of the Facebook stock before and after the data breach and indicates that the volatility of the stock increased after the incident.

Analysis and Discussion

Considering the case study data is crucial for understanding how investors react to data violations by companies. In particular, the analysis of the stock price behavior and its volatility, or the fluctuations of the log-returns, indicates the adverse influence of the data breach even on the company’s value, ceteris paribus. As shown in Figure 2, FB’s value dropped once the news was released and available to investors. Despite the steadily growing price, the company’s shares fell and required immediate reaction and relevant strategy to recover within two months.

In the case of Facebook, a strong connection can be observed between the data privacy ethical violation and the company’s stock returns, all else equal. As Peruzzi et al. (2018) claim, the ”higher volatility seems to persist for several hours following news release” (p. 765). Despite the platform’s high performance, it suffered from its users’ mistrust after the data leakage. Besides, media coverage also plays a vital role in the post-event consequences for the company (Rosati et al., 2019). In particular, media highlights of the FB scandal contributed to the behavior of investors (Peruzzi et al., 2018). Hence, multiple aspects of the event need to be considered in regard to the company’s market value.

Consequences for the Company

As for the consequences for FB, they can be divided into two major aspects: financial outcomes along with the market value and legal repercussion. According to Rehman (2019), the company suffered an over $100 billion financial blow after the event since FB’s global market value plummeted. Besides, as the company breached data protection laws, legal consequences involved the imposition of an about $660,000 fine by the UK’s Information Commissioner’s Office (ICO) (Rehman, 2019). Hence, the outcomes for the company endangered not only its financial performance but also its reputation, which implies the need for immediate action from FB’s side.

Facebook’s Response to the Data Breach Scandal

In this regard, the company’s reaction appears crucial in further impacts on its market value and investors’ behavior. According to Hall (2020), the company’s CEO apologized for the data breach, and FB launched an apology campaign in 2018. Besides, Zuckerberg’s Congressional testimony was evaluated as a positive influence on the company’s stock price (Hall, 2020). Despite the social tension, the organization’s market value recovered and continued to grow after the CA data breach (as shown in Figure 2). Hence, FB’s action plan contributed to its financial recovery, getting the investors’ trust back.

To conclude, the Facebook – Cambridge Analytica data breach case can be seen as an example that proves the adverse role of ethics violations in the company’s value, ceteris paribus. The experience of the social media platform shows that data privacy breach resulted in decreased stock price and increased volatility. Therefore, the case of Facebook proves that an immediate connection between the company’s ethical violations and market value can be observed.

References

Garonna, P., & Spaolonzi, F. (Eds.). (2016). Ethics in finance, finance in ethics: New approaches to financing and solidarity. Luiss University Press.

Hall, K. (2020). Public penitence: Facebook and the performance of apology. Social Media+ Society, 6(2). Web.

Larson, E., & Vieregger, C. (2019). Strategic actions in a platform context: What should Facebook do next?. Journal of Information Systems Education, 30(2), 97-105. Web.

Nuseir, M. T., & Ghandour, A. (2019). Ethical issues in modern business management. International Journal of Procurement Management, 12(5), 592-605. Web.

Peruzzi, A., Zollo, F., Quattrociocchi, W., & Scala, A. (2018). How news may affect markets’ complex structure: The case of Cambridge Analytica. Entropy, 20(10), 765. Web.

Rehman, Ikhlaq ur. (2019). Facebook-Cambridge Analytica data harvesting: What you need to know. Philosophy and Practice, 2497. Web.

Rosati, P., Deeney, P., Cummins, M., Van der Werff, L., & Lynn, T. (2019). Social media and stock price reaction to data breach announcements: Evidence from US listed companies. Research in International Business and Finance, 47, 458-469. Web.

Sugimoto, S. (2018). Ethics in responsible investment: How to incorporate ethics into investment analysis. Revue Roumaine de Philosophie 62(1), 15-22. Web.

Yu, T. H. K., & Huarng, K. H. (2020). A new event study method to forecast stock returns: The case of Facebook. Journal of Business Research, 115, 317-321. Web.