Introduction

The selected company is Inspire Vision Property Management & Consulting (IVPM&C). A property management and service company that strives to provide trustworthy services to all of its customers throughout Oregon and Washington States. The company provides services to customers by managing multi-family, commercial, condominiums, and single-family properties. IVPM&C’s main office is situated at Vancouver, WA. The business has four employees who are in charge of managing about 20 properties in the Portland, OR and Vancouver, WA area (“InspireVision: Dedicated to your success” par 1). The company sells its management services to manage and maintain assets for property owners and such services include; janitorial, property maintenance, and collecting rent from current renters. Portland is a hot market for renters and with the increase in the building of properties; IVPM&C’s competition consists of other property management companies. These companies include; Bluestone & Hockley, Grid Property Management LLC, and Kerr Properties Inc. (“InspireVision: Dedicated to your success” par 1).

Organization Chart

The duties of the maintenance director include; maintenance and unit renovations, review of punch lists with outside vendors, monitoring work, creating schedules, attending staff meetings and safety meetings (“InspireVision: Dedicated to your success” par 2).

Success Factors and Future Goals

The main critical factors that contribute to the longevity of the company would be the company’s ability to provide superior customer service and their ability to retain clients/customers. The process would involve the monitoring of the market to maintain the occupancy levels above the market standards as well as continued offering of better products. Competition is very prevalent in the market of property management companies in the Portland/Vancouver area, and it is imperative to the life and survival of IVPM&C as a corporation. By providing excellent customer service to its current clients and customers, they are creating a strong reputation amongst their competitors, creating long-lasting, loyal customers, as well as attracting new customers who need property management services. The lack of great customer service would cause the company to struggle in retaining clients as well as building new business relationships.

The other critical factor would involve the company’s compliance with stipulated industry rules as well as legal laws. These regulations are quite essential for the survival of the business in the longer term. The company’s reputation would be negatively affected in the event that it faced litigations. Additionally, the company would lose a lot of money while handling litigation issues as well as trying to improve its corporate image. It is, therefore, critical for IVPM&C as a company to adhere to all set legal and industry regulations.

Primary Objectives

The primary objective for IVPM&C is for them to grow and expand their client base to a wider range within the Portland Metro/ Vancouver area. The process involves not only the number of properties the company manages, but also the expanding of their consulting services to more investors. This objective will ensure that the business gains a bigger market share in the property management industry as well as improving its levels of competition. The company would increase their network and marketing abilities to be able to reach a wider range of investors, thus leading to increased properties and portfolios. The company currently operates 23 portfolios. Furthermore, the expansion would make it easier for the company to obtain capital to make further extensions. This objective can be measured by the number of portfolios the company manages and the amount of properties that are included in each collection. In addition, by taking polls on how the client came to find about IVPM&C and whether it was by the word of mouth or coming across an advertisement (“InspireVision: Our company” par 2).

The second objective for IVPM&C is for the company to have additional properties as well as employees. These additional resources would assist the company in expanding its businesses to other places such as Washington. The resources would enable the company to increase its sales. This objective can be measured by reviewing the number of employees the company would have after operating for a few more years. Again, the issue of additional properties would be measured by checking company’s financial statements and establishing the trend in the changes of fixed and movable assets of the business over time (“InspireVision: Our company” par 2).

Mission

IVPM&C’s mission is to create partnerships and provide leadership that will result in successful business partnerships, successful residential and commercial communities, and an inspiring work environment (“InspireVision: Our company” par 1).They strive to create sustainable long-term value for their investors through strategic planning, increased profits, and streamlined management policies. Individually and collectively, the interest, goals and objectives of all owners, business partners, residents, vendors and suppliers are essential to the success of their company (“InspireVision: Our company” par 1).

- They conduct business with integrity, vision, and compassion

- They listen to the goals of their owners and align their vision to exceed those objectives (“InspireVision: Our company” par 1).

- They create an environment that inspires, reward and solves problems

- They are committed to work as a team to exceed industry standards (“InspireVision: Our company” par 1).

The company discusses several critical items with the investors. This includes the way in which the corporation properties are financially performing, the overall maintenance program, the need for individual projects and the future forecasting of the business.

Accounting System

IVPM&C uses an online web-based software program that allows them to manage their business at the tip of their hand. QuickBooks are some of the accounting software used by the company in maintaining its accounting records. They use the system to perform many functions. The system is used for management purposes such as allowing data to be processed via mobile phone or the web. Besides, it is used in collecting rent online, mobile inspections, comparing rental prices, completing work orders as well as owner statements. The system is used to accomplish various marketing and leasing functions including; managing online rental applications, creating online rental lease agreements, screening residents and in the marketing and leasing of vacancies. The system is used in performing accounting roles such as doing bank reconciliations, passing payment transactions to owners and preparation of reports for the business. Vision Property Management & Consulting prepares financial statements on a monthly basis (“InspireVision: Our company” par 2).

Transaction Cycle Description

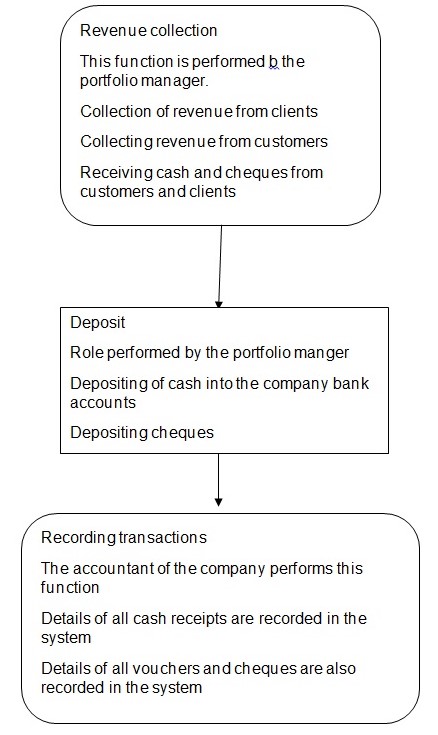

The transaction cycle, we carefully examined for the company was the revenue cycle. The function of the cycle entails the efficient collection of revenues by the business. After reviewing the company’s revenue cycle, we realized that it has a very short and easy to follow cycle. The roles associated with the revenue cycle included:

- Collection – This role involves the collection of revenues and compiling them in a chronological manner. The Portfolio manager is the one responsible for undertaking this action (“InspireVision: Dedicated to your success” par 1).

- Deposit – This action involves the depositing of revenues into the relevant bank accounts as provided by the management. The portfolio manager of the company performs this function.

- Recording – This process entails the recording of all relevant financial information for the enterprise. All information about the collection and depositing of revenues is recorded into the system. The process helps in keeping a buffer of the physical documents. The accountant of the company performs this function. The role also entails the proper storage and keeping of all financial records and other transactions (“InspireVision: Dedicated to your success” par 1).

Flowcharts

Controls

Strengths

Occurrence

The accounting department and the revenue cycle are independent of other departments. The process implies that other processes do not affect the revenue transactions of the company in the business. The revenue cycle differentiates services made to employees and COD services. The differentiation adds strength to the controls because the sales rendered to different groups of customers are recorded and separated from each other (Rittenberg, Karla and Audrey 518).

Completeness

After reviewing the revenue cycle, we established that the most of the transactions were complete. For instance, a review of the sales invoice showed that all the invoice blanks were correctly numbered. Additionally, after checking the sequence of the invoices, we realized that all the invoices were sequentially numbered, and nothing was missing (Whittington and Patrick 174).

Cutoff

Cutoff is one of the strengths of the control system of the company. The recorded revenue data showed that all the events and transactions were recorded in the correct accounting periods. The correct recording is helpful because it minimizes instances in which records are altered or manipulated by individuals. Additionally, this was in agreement with stipulated accounting standards such as the IFRS, which requires companies to record transactions to the periods in which they occur. Moreover, controls related to these actions ensure that accountants and other employees do not take advantage of the accounting system and misuse the company’s information (Trenerry 71).

Classification

The transactions and other events were correctly recorded in the correct books of accounts. Correct books of account demonstrate the strength of the control measures of the company. The result shows that the revenue cycle is maintained as per the set rules of the business. Additionally, this demonstrates that the business had strong internal controls on the recording of accounts for the enterprise (Whittington and Patrick 174).

Proper Storage

After assessing the way the company stored its records and other information, we realized that there were adequate controls in place that ensured that records were kept in order. Moreover, the revenue cycle had adequate cabinets for storing physical documents that supported the occurrence of transactions (Graham 86).

Weaknesses

Lack of double authorization processes

The company’s revenue cycle does not have a double approval process. The lack of the process is a weakness of the control system because such loopholes may lead to manipulations of information. Additionally, one individual who then authorizes and passes transactions may interfere with information, thereby exposing the company data (Whittington and Patrick 174). Besides, one individual reviews each of the roles in the revenue process, and this may be vulnerable to the business. This is because individuals may conceal critical information and it would be difficult for the business to establish the truth of the matter (Graham 86).

Accuracy problems

Inaccuracy is a potential weakness to the revenue cycle of this company. The prices of services did not follow the set terms and standards. The cause of this was because some customers were charged lower prices, and there were no attached documents to support the same. Besides, the cycle was prone to arithmetical inaccuracies of period data because there was no clearly defined statistical analysis of the information (Graham 86).

Lack of clear guidelines for handling cash

The portfolio manager is the one responsible for handling cash in the organization. The internal controls require adequate processes of monitoring the receipt of cash and how it’s managed. Poor monitoring is a weakness to the revenue cycle and can lead to the business losing large amounts of money. Additionally, the poor management of cash can create loopholes through which frauds may be undertaken in the enterprise (Rittenberg, Karla and Audrey 518).

Conclusion

In summary, from the analysis of the revenue cycle of the company, it can be concluded that the transaction cycle achieves a reasonable level of control for the corporation. The paper discussed the Vision Property Management & Consulting (IVPM&C) organization. It is a property management and service company that strives to provide trustworthy services to all of its customers. The company provides services to customers by managing multi-family, commercial, condominiums, and single-family properties. The critical factors that contribute to the longevity of the business would be the company’s ability to provide superior customer service and their ability to retain clients/customers. The other critical factor would involve the company’s compliance with stipulated industry laws as well as legal laws. The main objective for IVPM&C is for them to grow and expand their client base to wider range. The second objective for the company is to increase their network and marketing abilities to be able to reach a broader range of investors. The company uses an online web-based software program that allows them to manage their business at the tip of their hand. Some of the roles of the revenue cycle include the collection of revenue, depositing, recording and storage of transaction information. Some strengths of the control system include the proper occurrence of transactions, completeness of transactions, correct cutoffs and correct classification of transactions and storage of records. Some of the weaknesses of the internal control system of the revenue cycle comprise of the lack of double authorization processes, accuracy problems and Lack of clear guidelines for handling cash.

Works Cited

Graham, Lynford. Internal Controls: Guidance for Private, Government, and Nonprofit Entities. Hoboken, N.J: John Wiley & Sons, 2008. Print

InspireVision: Dedicated to your success 2015. Web.

InspireVision: Our company 2015. Web.

Rittenberg, Larry E, Karla M. Johnstone, and Audrey A. Gramling. Auditing: A Business Risk Approach. Melbourne, Vic.: South-Western Cengage Learning, 2012. Print.

Rittenberg, Larry E, Karla M. Johnstone, and Audrey A. Gramling 2014, Auditing the revenue cycle. Web.

Trenerry, Alan R. Principles of Internal Control. Sydney, N.S.W: UNSW Press, 1999. Print.

Whittington, Ray, and Patrick R. Delaney. Wiley Cpa Exam Review, 2007-2008: Volume 1. Hoboken, N.J: John Wiley & Sons, 2007. Print.

Whittington, Ray, and Patrick R. Delaney. Wiley Cpa Exam Review 2012. Hoboken, N.J: John Wiley & Sons, 2012. Print.