Introduction

The current globalized economy has left many companies struggling for their survival as many countries discontinue businesses in the rapidly changing market operations. Waweru, Kamasara and Anyagu (2003, p. 68) detail the reasons for these discontinuities as inadequate capital, poor management skills, and poor application of essential management practices. Since companies face constraints in efficiently using new management accounting practices, this study will affirm whether a strategic, accurate, and reliable management of accounting information is needed across all levels of an organization and industry.

Literature review

Many literatures portray the lack of relevance of management accounting to managerial needs, in light of the gap between management accounting practices and accounting theories (Smith 2009, p. 23; Ribeiro & Scapens 2006, p. 94). Other researchers claim that management accounting has not changed since the early twentieth century, arguing that it has lost relevance by failing to provide information that is applicable to the managerial needs of companies (Waweru, Kamasara & Anyagu 2003, p. 68). Responding to these concerns, significant information in management accounting has risen (Mills 2008 p. 43). To understand the trends in management accounting, particularly in the context of Saudi Arabia, this study will employ a contingency theoretical framework (Uyar 2010, p. 113).

It should be noted, though, that the effects of management accounting on the improvement of the company’s financial performance have been studied quite extensively. At present, most of the financial accounting methods, which are supposed to address the performance issues and improve the production process, as well as the organization’s annual income, boil down to carrying out a tight supervision of the key company’s processes in order to check whether the organization’s basic rules are followed, as Monroy, Nasri and Pelaez (2013) explains. Traditionally, lean accounting is identified as one of the most efficient tools in addressing the financial issues, which the company is forced to face due to the outside factors (Fullerton, Kenneddy & Wibener 2012). Researchers explain that the concept of lean accounting presupposes that the phenomenon of sustainability should be incorporated into the strategies and that the financial resources should be allocated based on lean models.

In addition to lean accounting, recent studies have been pointing at the need to implement the approach of cost accounting in order to address some of the financial issues, including costs. Therefore, the chances of the company’s revenues dropping due to the unexpected costs taken in the process of its operations are reduced significantly. Researches show that cost accounting also helps eliminate the threat of a company taking losses; however, apart from the issues in question, cost accounting also creates the premises for a consistent supervision of the key financial transactions and, therefore, eliminates the slightest threats of a financial fraud taking place in the organizational setting. Particularly, the attempts at financial fraud are detected at the earliest stages of the latter and prevented successfully with the help of the costs accounting approach.

Contingency approach

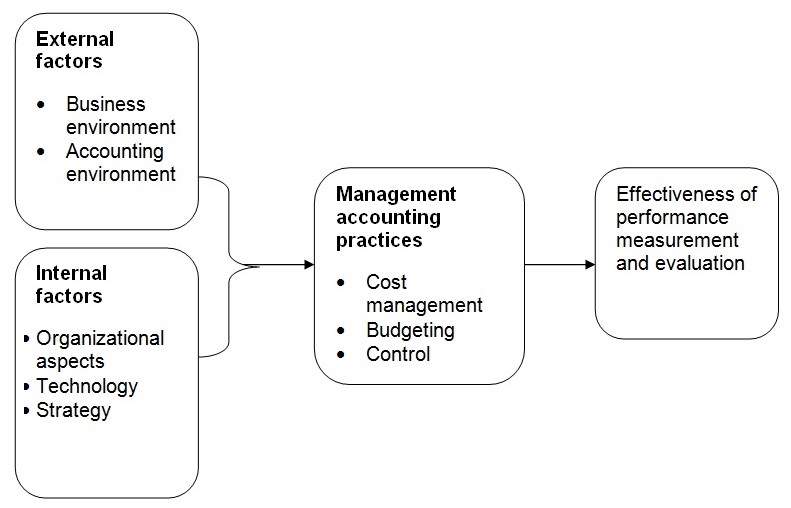

Contingency approach assumes that organizations are open systems concerned with their goals and do respond to internal and external pressures (Mills 2008 p. 43).

Research Aim

The aim of the study is:

- To define the management accounting approach that will suit the Saudi Arabian setting based on the current practices, the economic and political background, the sociocultural environment and the key external and internal factors, which affect the process of accounting on any level in the specified setting.

Research questions

The following research questions will guide this study.

- Is the management accounting going to develop towards the application of cost accounting or the adoption of the lean accounting practices in the Saudi Arabian environment during the next few years>

- What financial, economic, political and sociocultural factors that the leaders of entrepreneurships in Saudi Arabia are exposed to define the significance of adopting the management accounting approach in question?

- What contingency factors influence a company to adopt the lean acquainting and cost management accounting practices?

- Do the managerial decisions made in the Saudi Arabian organizations allow for a steady progress in the management accounting area and prevent the instances of financial fraud in the specified area? In what way are the methods employed in the accounting system in Saudi Arabia significant for the key accounting processes?

- Dos the management accounting method currently adopted in most Saudi Arabian organizations allow for a detailed analysis and a thorough supervision of the key financial transactions made in the entrepreneurship?

Research method

The present research uses the contingency theory and an explanatory statistical analysis of various factors, which influence new managerial accounting systems in companies within the Kingdom of Saudi Arabia. According to the basic tenets of the contingency theory, a perfect organization of a corporation that can be used as a model for the rest of companies to comply with does not exist. Specifically, the design of the organization, including every single domain thereof, such as the organizational behaviour, the production process, the management of the accounting processes, etc., should be developed based on the unique set of strengths and weaknesses that a company possesses. When applied to the issue in question, i.e., management accounting, the contingency theory presupposes that the key tools for the management of the key financial transactions, the financial reports, the analysis of the current financial assets of the organizations, etc., must be conducted based on not only the models that have already been defined, but also on the specifics of the economic setting. To be more exact, the key characteristics of the Saudi Arabian economic and financial laws and regulations, principles that companies in Saudi Arabia are run according to, etc., must be integrated into the study along with the traditional elements and tools.

Survey instrument

To explore the role of new management accounting methods for development of financial performance, this study will adopt a survey as the main instrument for primary data collection.

Testing the instrument

The study will test the significance of variables by proposing hypothesis to test the relationship between independent and dependent variables as identified from the survey instrument. A regression analysis will test the coefficients that affect the adoption of new management accounting practices.

Sample population

To determine the practice under study, the researcher will contact manufacturing companies in Saudi companies. The sample population will include a purposive sample of 100 companies in various branches of manufacturing, including energy, food, chemical and metal industries.

Data Processing and Analysis

The statistical analysis employed in the survey includes a two-way analysis and Fisher’s exact text. The two-way analysis and Fisher’s exact text allows for the study to test the effects of new managerial accounting practices on the financial performance of companies.

Significance of the study

Research on new management practices in the Saudi Arabian context is missing as most literatures are fragmented and focused on different managerial aspects (Almahmoud, Husain & Khan 2015, 3). Few literatures also focus on managerial accounting within the Gulf Cooperation Council’s (GCC) context.

Justification of the research

Where huge bodies of academia research investigate new managerial accounting practices in firms, most research has focused on the context of developing countries (Aitken & Loftus 2009, p. 5). In the business context, this research will define the contingent management accounting practices adopted within the Saudi region.

Timetable for the proposal

Resource Requirements

Since the project requires extensive work in Saudi Arabia, financial strain on the resources could occur. The researcher will approach the school’s budget committee for the additional funds that may be required. Most of the secondary data will be easily accessed from the school library.

Conclusion

The failure of businesses to take on new management accounting practices or to experiment with new profit-oriented methods of control is a factor that has increased the failure rates of Saudi businesses. Although research on new management accounting practices with the Saudi context is fragmented and focused on different managerial aspects, the present study informs practices in the industry and academia.

References

Aitken, M, & Loftus, J 2009, Determinants of accounting policy choice in the Australian Property industry: A Portfolio Approach. Journal of Accounting and Finance, vol. 34, no. 2, pp. 1-20.

Almahmoud, S, Husain, S, & Khan, M 2015, An Appraisal Of Accounting Methods Adopted By Companies In Kingdom Of Saudi Arabia. International Journal of Economics, Commerce and Management, vol. 3, no. 3, pp. 1-6.

Fullerton, R R, Kenneddy, F A & Wibener, S K 2012, ‘Management accounting and control practices in a lean manufacturing environment,’ Accounting, Organizations and Society, vol. 38, no. 1, pp. 56–70.

Horngren, C., et al. 2009, Cost Accounting: A Managerial Emphasis, Upper Saddle River, New Jersey, Prentice Hall.

Islam, M, & Kantor, J 2005, The development of quality management accounting practices in China. Managerial Auditing Journal, vol. 20, no. 7, pp. 707-724.

Mills, A 2008, Essential Strategies for Financial Services Compliance, New York, US, John Wiley & Sons.

Monroy, C R, Nasri, A & Pelaez, M A 2013, ‘Activity Based Costing, Time-Driven Activity Based Costing and Lean Accounting: Differences among three accounting systems’ approach to manufacturing,’ 6th International Conference on Industrial Engineering and Industrial Management.XVI Congreso de Ingeniería de Organización, Vigo, Spain, pp. 401-408.

Ribeiro, J, & Scapens, R 2006, Institutional theories in management accounting change: Contributions, issues and paths for development. Qualitative Research in Accounting & Management, vol. 3, no. 2, pp. 94 – 111.

Smith, M 2009, Management Accounting for Competitive Advantage, Sydney, LBC Information Services.

Tayles, M, Pike, R, & Sofian, S 2007, Intellectual capital, management accounting practices and corporate performance: Perceptions of managers. Accounting, Auditing & Accountability Journal, vol. 20, no. 4, pp. 522 – 548.

Uyar, A 2010, Cost and management accounting practices: A survey of manufacturing companies. Eurasian Journal of Business and Economics, vol. 3, no. 6, pp. 113-125.

Waweru, N, Kamasara, V & Anyagu, M 2003, Management accounting practices in Kenya: A survey. University of Nairobi Journal of Management, vol. 6, pp. 67-90.