Roku Captial Group(RCG)

The genesis of Roku Captial Group(RCG) was founded from an desire of a group of people wanting to invest into high growth businesses to derive increased financial performance for its group of investors. As an investor driven business, RCG group looks to engage acquisitions that will increase it’s entry into new markets both domestic, and international. Thus far, RCG has focused in investing into startups however is currently seeking to grow its M&A function and grow the business through core ausiations into its operations.

The firm was founded in Kansas City, MO where its headuators are located. However with a globally distributed employee base it allows its operations to have key representation in potential markets of expansion or exploration for businesses to invest in, or acquire. The Firm has a decentralized view on investing that spans several different industries.RCG holds investments in notable companies such as Sumsang, Walmart, Pepsi, as well as net entrants such as Hyvee, Koenigsegg, Renovo Auto.

Tesla

Tesla was founded in 2003 by a group of engineers who wanted to prove that people didn’t need to compromise to drive electric – that electric vehicle can be better, quicker, and more fun to drive than gasoline cars.

Tesla Inc (Tesla) is an automotive and energy company. It designs, develops, manufactures, sells, and leases electric vehicles. The company produces and sells the Model Y, Model 3, Model X, Model S, Cyber truck, Tesla Semi, and Tesla Roadster vehicles. These vehicles have also withheld the expectations of a luxury car. Examples of this include things such high-tech panorama roofing and a 17-inch touch screen dashboard. Tesla is a leader in selling online cars, a tactic they use to cut out people’s interaction with salespersons. Online Auto purchasing has become big since the beginning of the Internet and Tesla has used this to create a customer fueled purchasing environment online.

Tesla also installs and maintains energy systems and sells solar electricity; and offers end-to-end clean energy products, including generation, storage, and consumption. It markets and sells vehicles to consumers through a network of company owned stores and galleries. The company has manufacturing facilities in the US, Germany and China and has operations across Asia Pacific and Europe. Tesla is headquartered in Austin, Texas.

Tesla’s mission is to accelerate the world’s transition to sustainable energy.

Ford

Ford Motor Company was established in 1903 by Henry Ford (Ford, n.d.), a worldwide car manufacturing company known as the company that put the world on wheels (Ford, n.d.). The company that started with 10 employees currently has over 186,000 employees around the world (Ford, n.d.) and wants to connect people, shorter distances, and change the world as some of its goals (Ford, n.d.). Ford is a global company based in Dearborn, Michigan (Ford, 2021).

Ford is an innovative company that utilizes new tools and technology to the production and new releases, they also own Lincoln vehicles (Ford, n.d.). Ford provides services such as Ford Certified Collision Network, Ford Credit, Ford Parts, Ford Pass, Ford Protect, Ford Service, Lincoln Access Rewards, Lincoln Finance and Protect, Lincoln Service, Ford Motorcraft, and Omincraft (Ford, n.d.).

Ford’s mission is to drive human progress through the freedom of movement. Their vision statement is to create tomorrow, together (Ford, n.d.).

Qualitative Research

Tesla

Strategy

The strategy of Tesla is to enter at the high end of the market, where customers are prepared to pay a premium, and then drive down market as fast as possible to higher unit volume and lower prices with each successive model (Elon, 2006).

When it comes to electric car technologies, Tesla is a global powerhouse and leads other auto manufacturers from the front. In 2020, Tesla sold about one-quarter of all the electric cars worldwide. It is the leader with 16% of the plug-in market and holds 23% of the battery-electric car market.

Industry Analysis, Competitive Advantage and SWOT Analysis

Tesla’s vision is to Create the most compelling car company of the 21st century while driving the world’s transition to electric vehicles (Brianna, 2021).

Tesla’s corporate vision captured in the goal statement affirms its commitment to deliver high-quality EVs. It will leverage 21st-century technologies to build the best and safest car company and facilitate the adoption of renewable and sustainable energy globally.

Tesla has huge competitive advantages over other automakers in the US. Below are what I consider to be Tesla’s 5 biggest advantages over the competition.

- Tesla’s Battery Supply Chain: Tesla currently produces 4 all-electric vehicles — the Tesla Models S, X, 3, and Y, all of which require significant battery capacity. Tesla broke ground on its first battery “Gigafactory” in June 2014 outside Sparks, Nevada. Tesla currently produces more batteries in terms of kWh than all other carmakers combined. With the Gigafactory ramping up production and more coming online in time, Tesla’s cost of battery cells continues to decline through economies of scale, innovative manufacturing, reduction of waste, and the simple optimization of locating most manufacturing processes under one roof.

Tesla’s battery supply chain is a big part of Tesla’s business advantage, as its batteries are generally considered to be better than the competition’s. Why? To some degree, it is the quality of battery partner Panasonic’s cells. Add to that Tesla’s continual improvement of the packs and the battery chemistry

Tesla’s batteries extend beyond its all-electric cars and into the home and large grid applications. The Tesla Powerwall 2 is a DC energy storage system with a usable capacity of 13.5 kilowatt-hours per Powerwall. The Tesla Powerwall 2 is one of the most advanced residential energy storage systems in the world.

- Tesla’s Supercharger Network: Tesla’s proprietary superfast-charging stations create efficient recharging opportunities for Tesla’s electric vehicle drivers. Tesla’s current fleet of Superchargers range in power from 72 kW for Tesla’s Urban Superchargers up to 250 kW for the newest Superchargers being installed around the world. Once rolled right into the price of Tesla’s cars, the Supercharger Network is now a pay-as-you-go system. The biggest benefits of the Supercharger network, so far completely unmatched, are how widespread and well integrated the network is for road trips and how easy Supercharging is for Tesla drivers.

- Tesla’s Software Updates: Over-the-air updates — just like the ones we get on our smartphones, tablets, and computers — continuously improve Tesla’s all-electric vehicles. Updates come fairly frequently. In just the latest update from late June 2020, Tesla provided 7 new software updates: improved traffic light and stop sign control, backup camera improvements, dashcam viewer improvements, walkaway door lock improvements, TuneIn improvements, new language support, and cabin camera.

- Tesla’s Branding: Tesla has developed a reputation for producing superb products. The Tesla Roadster transformed the image of all-electric cars from small, slow vehicles to amazingly fast vehicles of desire. Tesla has built on the appeal in model after model. No other company has an electric car on the market that comes close to the performance/price ratio of the Tesla Model 3 and its in-house permanent magnet synchronous reluctance motor. Tesla sold almost three times more units of the Model 3 than the second best selling electric car in the world got in 2019.

The Tesla’s Model S sedan has won nearly every big auto award, setting the stage for the Model 3 and other subsequent models, and it has a 0 to 60 mph acceleration, not to mention 0 to 30 mph acceleration, that even beats the quickest supercars.

Tesla provides its customers with exceptional products and good service. While other automakers bemoan all-electric transportation, Tesla has created one of the strongest brands in the world (among all sectors), creating allure for electric cars like many didn’t think possible.

- Tesla AI: Tesla’s autonomous driving capacity, offered at its highest level in the “Full Self Driving” package, is getting better quarter after quarter, with more autonomous features regularly added. Tesla AI analyzes countless images from Tesla owners’ cars while they drive around and uses them to train the autonomous-driver neural nets Tesla keeps developing for its vehicles’ Autopilot/Full Self Driving features. Tesla is now rewriting its software for these features to get more out of the hardware. Extrapolating flat 2D video images out into 3D leverages the massive computing power of Tesla’s third-generation hardware to build out a dynamic, geometric world that can then be used for navigation (Brianna, 2021).

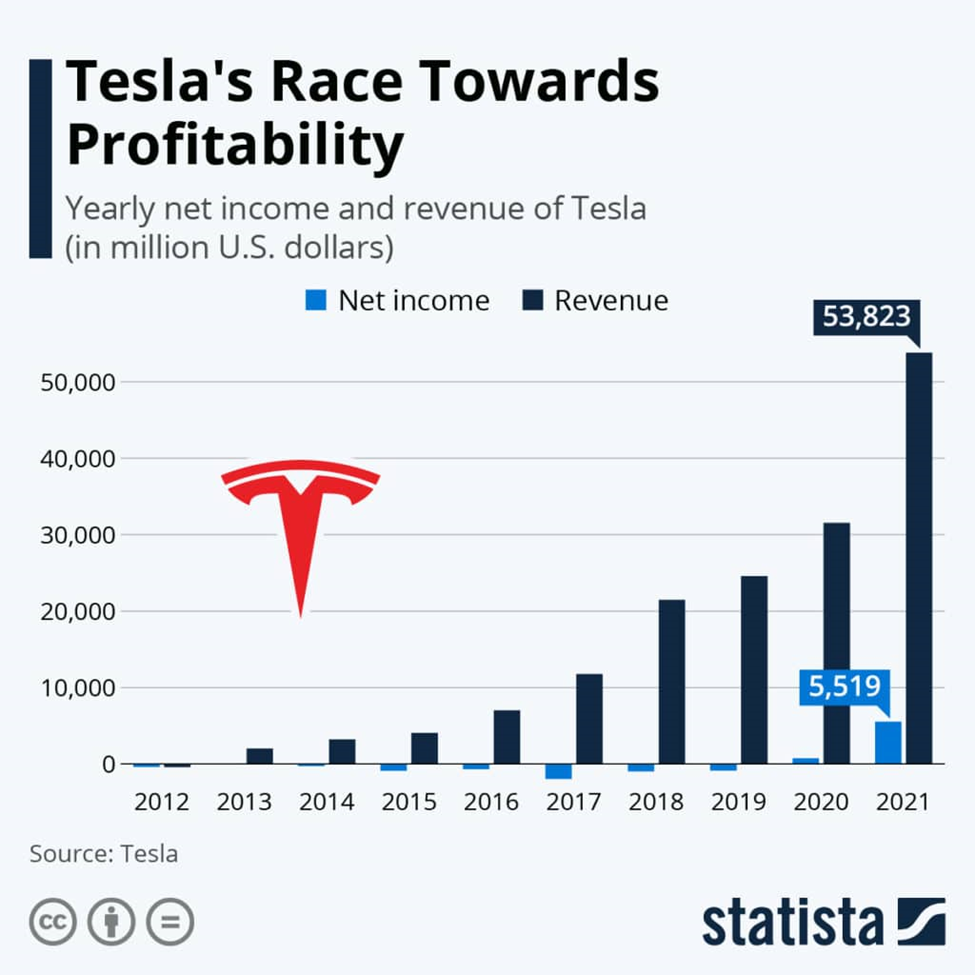

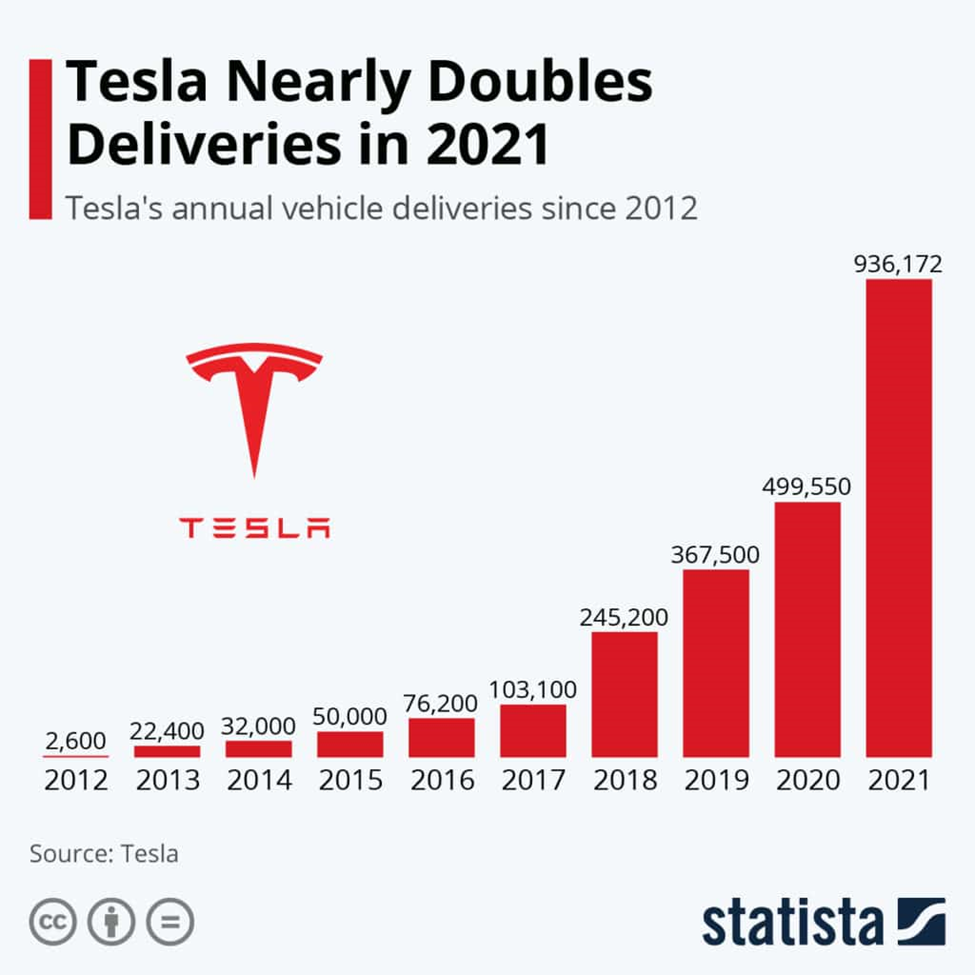

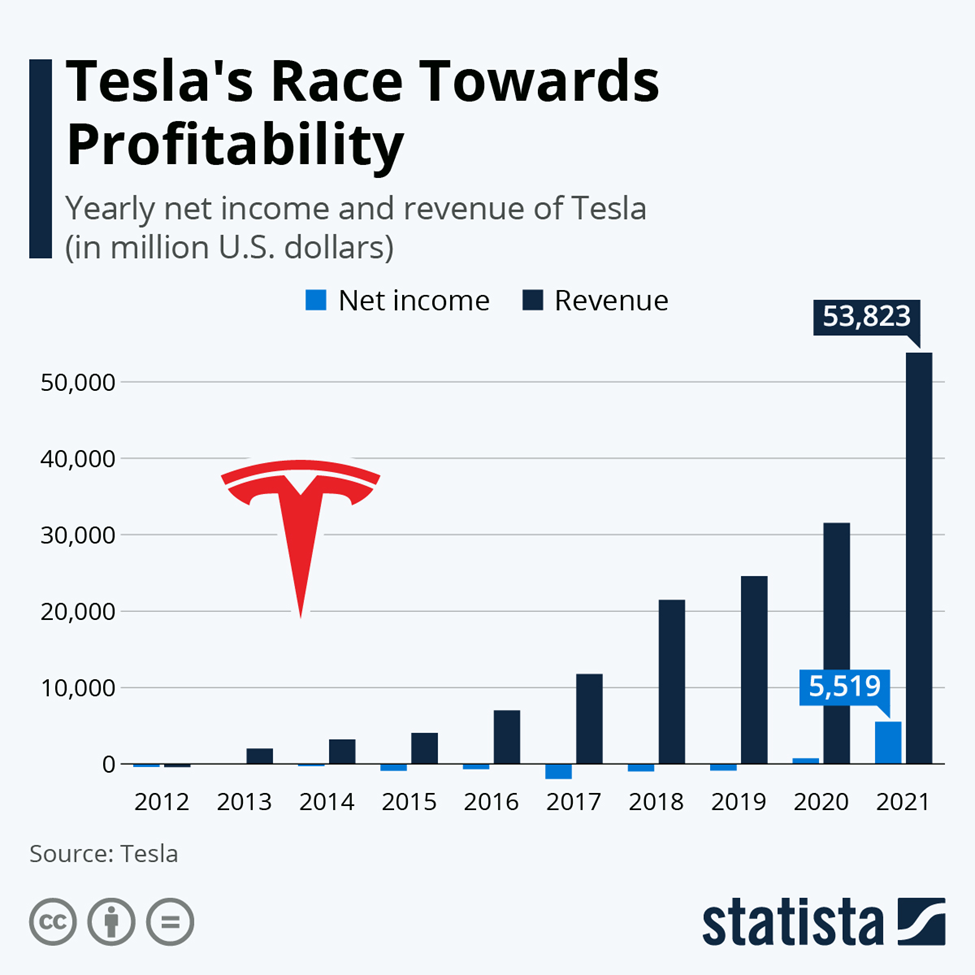

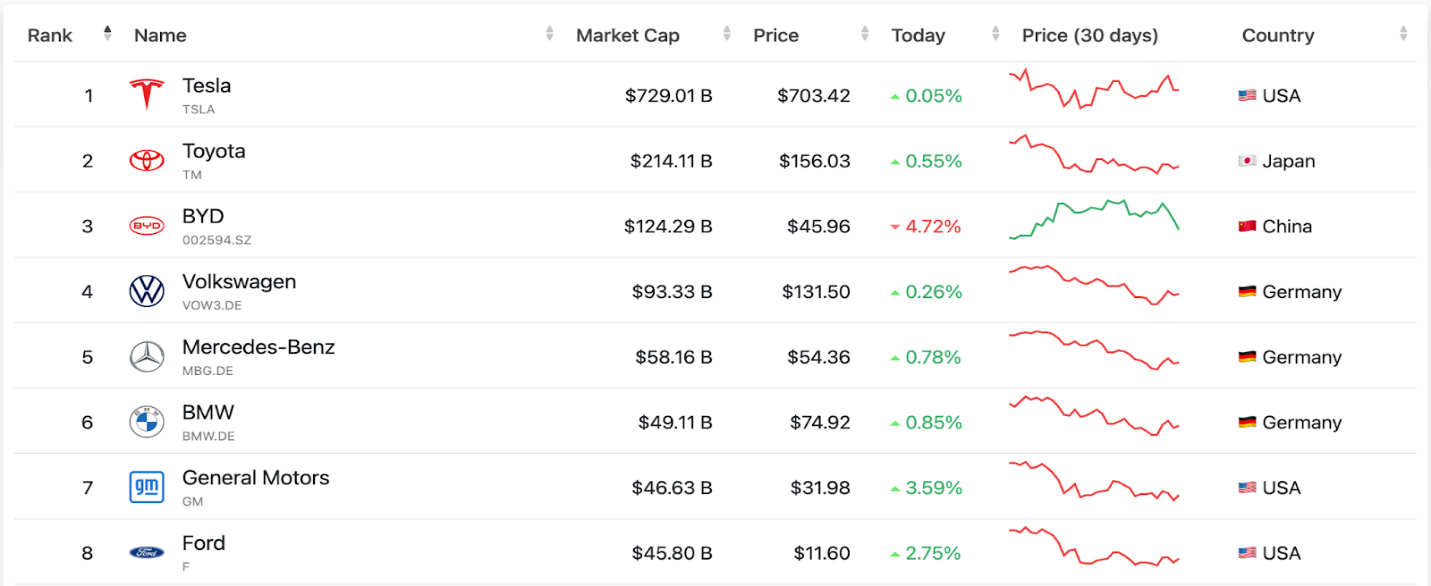

Tesla is the most valuable automotive company. Despite its issues, Tesla’s sales revenue was $53.8 Billion with 936,172 cars delivered to customers in fiscal year 2021. The increase in the number of deliveries and its profitability of $5.6 Billion pushed the company’s market capitalization to over $1 Trillion and surpassed the market cap of top 5 automaker (Toyota, Volkswagen, Daimler, Ford and General Motor) combined.

Tesla has now become the world’s most valuable automaker by market value.

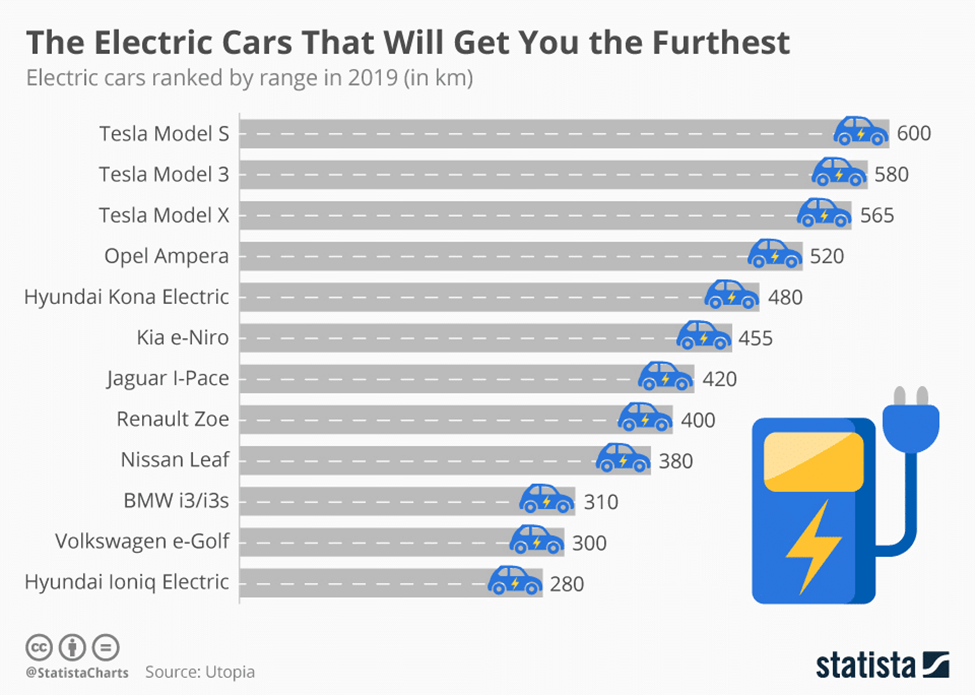

Tesla has left behind every other brand in the race of the finest electric cars. When compared by their range, Tesla’s electric cars have proven to be the best covering maximum distances. The recent comparison shows that Tesla occupies the top three places in terms of range. The Tesla Model S will get you the furthest – traveling up to 600 kilometers on a single battery charge. The nearest another brand has got is the Opel Ampera, with a range of 520 kilometers.

In 2021, Tesla delivered 936,172 vehicles, an 87% increase in vehicle delivery compared to 2020. Despite the supply chain challenges and shortage of chips, Tesla demonstrated incredible performance in 2021.

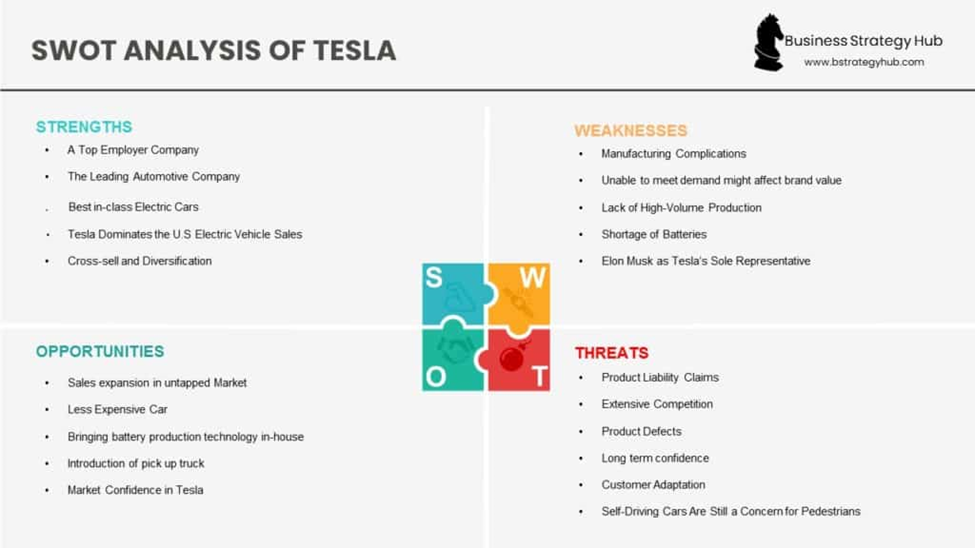

Tesla has emerged as one of the most discussed and analyzed companies among business enthusiasts. This SWOT analysis of the very organization will reveal all the significant insights regarding every factor of Tesla business model. Moreover, the overall results of this analysis also include strategic reforms considering all the SWOT factors, i.e., strength, weakness, opportunities, and threats.

In this SWOT analysis for the company, we highlighted each of the strength, weakness, opportunity, and threat which Tesla faces in the market. To grow its market share and financial stability, Tesla needs to take vigorous actions.

Yet there is no doubt that despite the negative factors, the company is an ultimate symbol of progress and innovation.

Ford

Strategy

Ford’s goal is to become the largest electric vehicles manufacturer in five years (Olinga, 2022). The plan is to produce more than 2 million electric vehicles every year (Wayland, 2022).

Ford has invested over $1billion in Artificial Intelligence (Marr, 2019) and utilizes it to develop autonomous vehicles and to find connected car solutions (Marr, 2019). They utilize AI technology on new and used cars, on the new cars it can find wrinkles in car seats, and to develop cars that include AI in their system (Marr, 2019), such as making decisions faster than the human brain and switching to all-wheel drive if necessary (Marr, 2019), for used cars it can provide information on what makes that car unique (Marr, 2019). Ford is currently working on autonomous vehicles that are being tested in Detroit, Miami and Washington, D.C and planning on launching its self-driving car fleet (Marr, 2019).

Industry Analysis, Competitive Advantage and SWOT Analysis

Ford is ranked in 3rd place of most profitable car company in the world (McElroy, 2022) and in 4th place of making more profit per car sold (McElroy, 2022). It shows the company is in a good position however still has opportunity to grow.

The auto industry has faced many changes as new technologies became available, such as driverless cars and automated factories (Hofstatter et al, 2020), to be able to adapt to the new changes in the industry the brands must focus on digital media, opt to utilize recurring revenue streams, optimize asset deployment and a resilient supply chain (Hofstatter et al, 2020)

Most of the auto businesses do not have digital maturity and must adapt to the ways of selling such as remote (Hofstatter et al, 2020). Ford’s website currently allows the customer to build and price the car with the features they are looking for, however, to finalize the purchase the customer must go to a dealership.

As for recurring revenue streams, young generations prefer subscriptions-based models (Hofstatter et al, 2020) and a car purchase is a large up-front purchase which customers hesitate about it (Hofstatter et al, 2020), a solution for that is to also offer short term leases (Hofstatter et al, 2020), this is something that Ford currently offers.

To form partnerships with other brands can attract customers that are interested in that partner and also cut costs on looking for new technologies, this is a strategic way to optimize asset deployment (Hofstatter et al, 2020).

Since the COVID-19 pandemic the prices for electric cars raw materials have doubled (Wayland, 2022) also the chip shortage has impacted the car industry and Ford was one of them as the chips go to different components of the cars (Ford, n.d.). To be more independent from the global supply chain is a strategy to be ahead of the competition when those issues arise (Hofstatter et al, 2020). Ford has addressed that by partnering with GlobalFoundries to develop their own chips (Sorkin et al, 2021).

A study have shown that customers are willing to pay more for cars from brands that support sustainable driving (Garsten, 2021) and Ford was one of the brands that failed on the tests from this same study for “customer journey” (Garsten, 2021), the brands need to provide more incentive to sustainable drive after the car was sold (Garsten, 2021) as an example, adding to their navigation features of nearest charging station and also by adding charging stations (Garsten, 2021).

Ford has been facing issues with their most sold electric car, the mustang mach-E due to overheating (Wayland, 2022), the vehicles are not being sold while the issue is not resolved and recalls have been issued (Wayland, 2022), this could impact Ford’s profit for 2022 as this is their most sold electric car.

According to Ford’s Management Discussion and Analysis (Ford, 2021) the key trends and factors that affect Ford are the Supplier Disruptions, once there is a shortage it cannot be sourced by another supplier (Ford,2021), the impact of COVID-19 on consumer behavior (Ford, 2021), the global redesign of Ford operations (Ford, 2021), the Currency Exchange Rate Volatility (Ford, 2021), the decline of Excess Capability by 7 million units impacted by the COVID-19 production disruption (Ford, 2021), pricing pressure due to increased demand and supply shortages (Ford, 2021), commodity and energy price changes (Ford, 2021), vehicle profitability as the cost of the vehicles may increase more than the perceived benefit to consumers (Ford, 2021), trade policy and other economic factors (Ford, 2021).

Ford’s SWOT Analysis

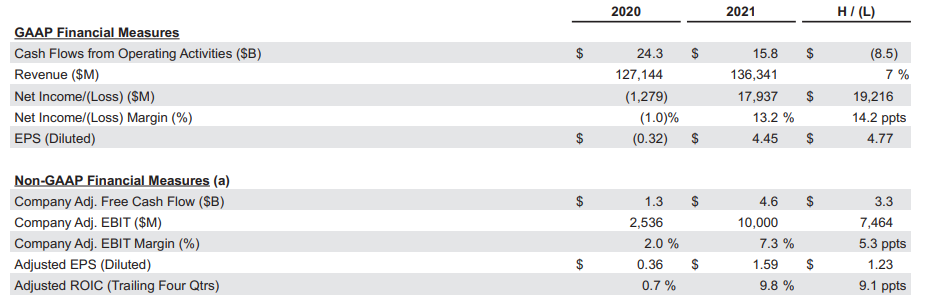

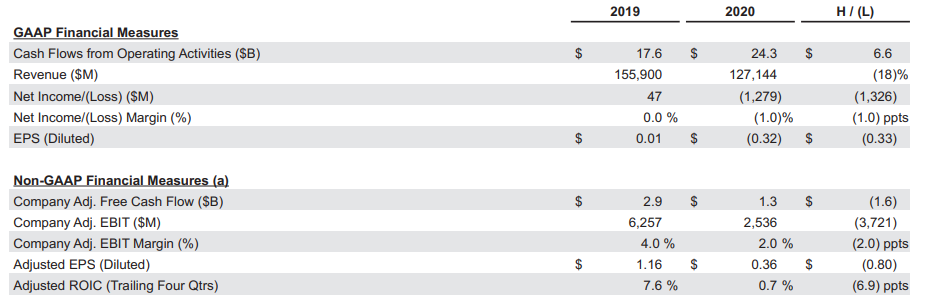

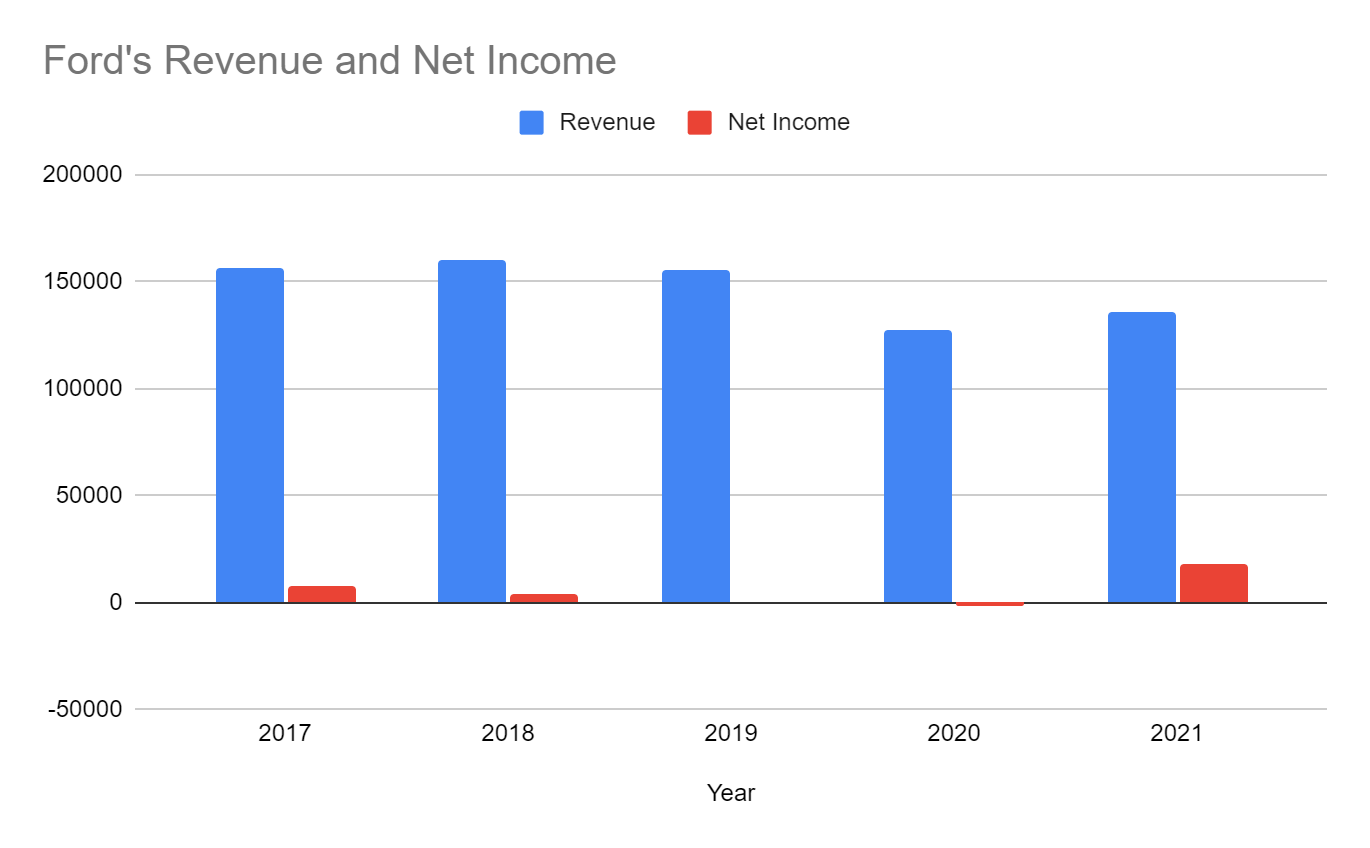

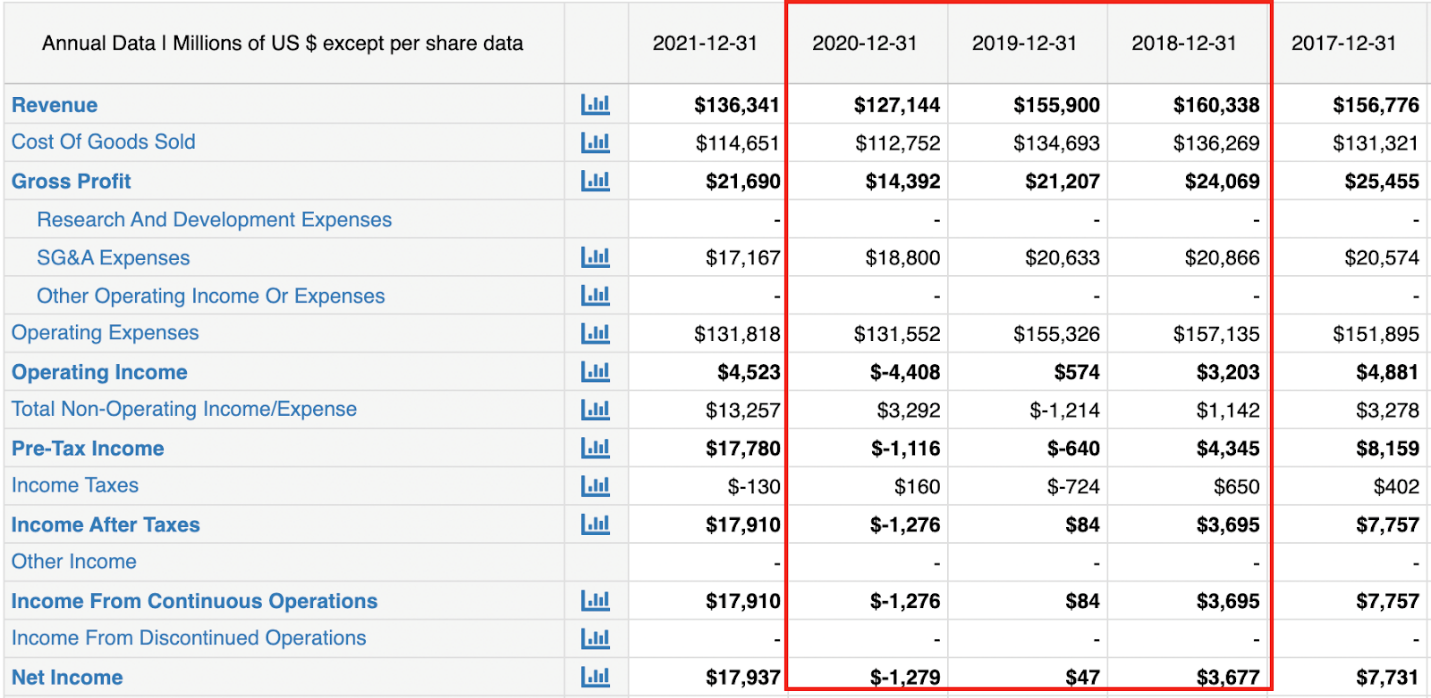

Ford’s Key Metrics shows the company had a 7% revenue increase between 2021 and 2020 and also increased their net income by $19,216 (in millions) (Ford, 2021). The inventory shortage in 2021 impacted Ford’s total net receivables, decreased by $14 billion (Ford, 2021). The key metrics comparison between 2019 and 2020 shows that the company’s revenue decreased 18% in 2020 (Ford, 2021). However, looking at the graphic below and comparing the past 5 years of Ford’s revenue and net income we can see that the net income has been fluctuating to finally a higher increase in 2021.

Ford’s Electric Cars

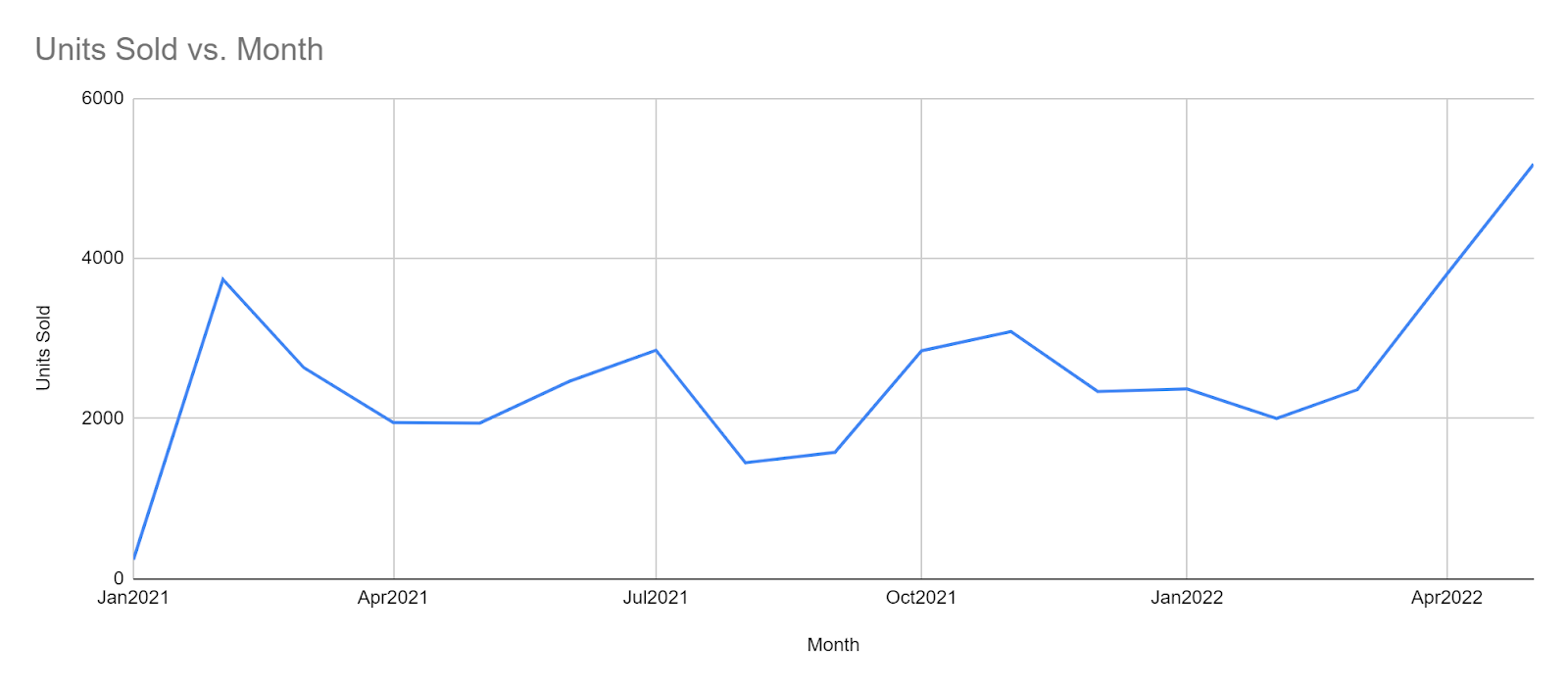

Ford currently offers 1 option of full electric SUV and 2 hybrid options, an option of full electric van, 1 option of full electric truck and 2 hybrid trucks. While Ford saw a decrease units of gas sourced vehicles sold in May 2022, which was justified by the chip shortage and supply chain constraints(Foote,2022), they had an increase of units of power sourced vehicles sold in the same month (Foote,2022), an 222% increase when comparing to May 2021 (Foote,2022). By selling 6,254 electric vehicles units in May 2022 (Centeno,2022), Ford shows that is growing 4 times faster than the electric vehicle segment (Centeno,2022), the company is now in second place on electric vehicle sales right behind Tesla (Centeno,2022).

As per graphic below, Ford’s most sold electric car, the Mustang Mach-E, had a sales increase of 266% when compared to the same period last year. It was named the “Electric Vehicle of the Year” by Car and Driver magazine (Ford, 2022) it was also the second best-selling full electric SUV in 2021 (Ford, 2022).

Ford Mustang Mach-E Units Sold in the USA

Quantitative Analyses

Tesla

A group of engineers founded Tesla in 2003 with the goal of demonstrating that driving an electric automobile didn’t need sacrificing power and that it could be faster, better, and more enjoyable than a gasoline-powered vehicle. With Tesla building its most affordable car yet, Tesla continues to make products accessible and affordable to more and more people, ultimately creating the advent of clean transport and clean energy production. Electric cars, batteries, and renewable energy generation and storage already exist independently, but combined are even more powerful. (Tesla) With a growth rate over 157 percent in 2021, Tesla was the fastest growing brand worldwide. Most models are electric cars with plans to release its first light duty truck in 2022 are underway. Tesla has been on top of the trend towards alternative powertrains in the passenger vehicle industry. Tesla revenue is climbing to over 31.5 billion dollars. The company’s market valuation set new records in 2020, reaching 442 billion U.S. dollars in September 2020, by March 2021, the brands market capitalization had climbed further, up to 641 billion dollars, over sixfold its March 2020 market cap. (statista.com)

With a net income attributable to shareholders of $2.3 billion this past quarter and a total of $5.5 billion in 2021, Tesla has not only surpassed analysts’ expectations but also reached the end of a decade-long journey towards real profitability and getting out of the red on its own terms. Looking more depth at the 2020 earnings of 721 million reveals that the automaker still needed a leg up to turn a profit though. Without the sale of regulatory credit valued at roughly $1.6 billion, the company would again accrue a loss. However, 2021 is different with a 85 percent spike in vehicle delivery, a reduction of cost per model and a stellar year at the stock exchange enabled Tesla to reach a 25% gross profit. (Statista)

Tesla fiscal year is January-December all values are in USD millions. In 2017 sales/revenue for Tesla was 11,759, in 2018 21,461, 2019 24,578, 2020 31,536 and in 2021 53,823. Tesla sales growth you see starts in 2018 with 82.51%, 2019 14.52%, 2020 28.31% and in 2021 70.67%. The cost of goods sold (COGS) incl. D&A in 2017 9,542, 2018 17,419, 2019 20,509, 2020 24,906, and in 2021 40,217. COGS excluding D&A in 2017 7,906, 2018 15,518, 2019 18,355, 2020 22,584, and in 2021 37,306. Depreciation & Amortization expense in 2017 1,636, 2018 1,901, 2019 2,154, 2020 2,322, and in 2021 2,911. The COGS Growth started in 2018 with 82.56%, 2019 17.74%, 2020 21.44% and in 2021 at 61.48%. The Gross income for Tesla in 2017 2,217, 2018 4,042, 2019 4,069, 2020 6,630, 2021 13,606. SG&A Expense in 2017 3,855, 2018 4,295, 2019 3,989, 2020 4,636, and in 2021 7,110. The Interest Expense 2017 471, 2018 663, 2019 685, 2020 748, and in 2021 371. The Interest Expense Growth started in 2018 40.70%, 2019 3.31%, 2020 9.20% and in 2021 -50.40%. Net income in 2017 (1,961), 2018 (976), 2019 (870), 2020 690, and in 2021 5,524. Net Income Growth started in 2018 50.23%, 2019 10.87%, 2020 179.31%, in in 2021 700.58%. (WSJ) Tesla automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits.

Ford

Ford Motor Company is a brand staple within the American economy, and arguably one of the few transportation companies that can state playing an integral role in the process of developing American infrastructure. Though its genesis was specific to transportation with the invention of the Ford Motor Car in 1896, over the last century, the Firm has diversified its offerings to go beyond. In its current state, the Firm’s operations account for manufacturing several different consumer, and commercial products, to financing other areas that have reinforced their product lines as it relates to their vehicles across many different markets.

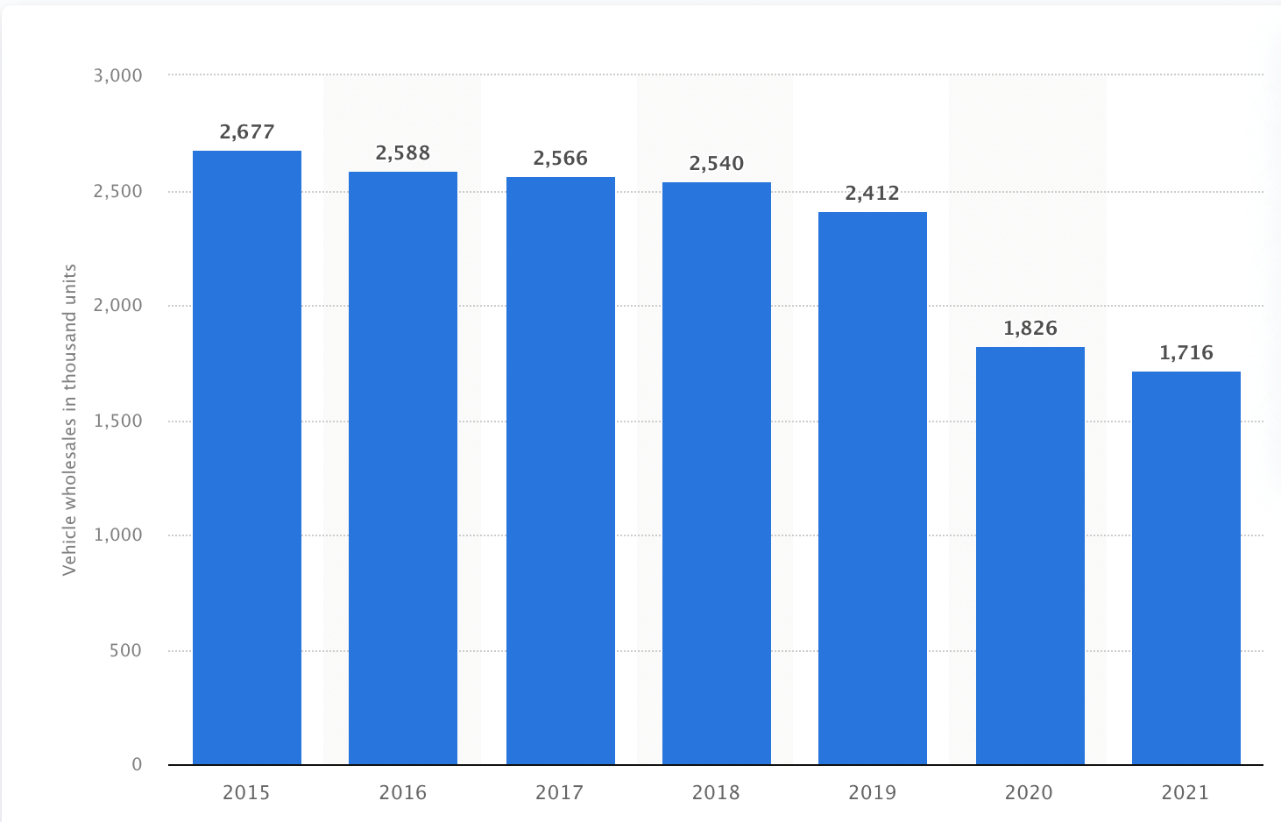

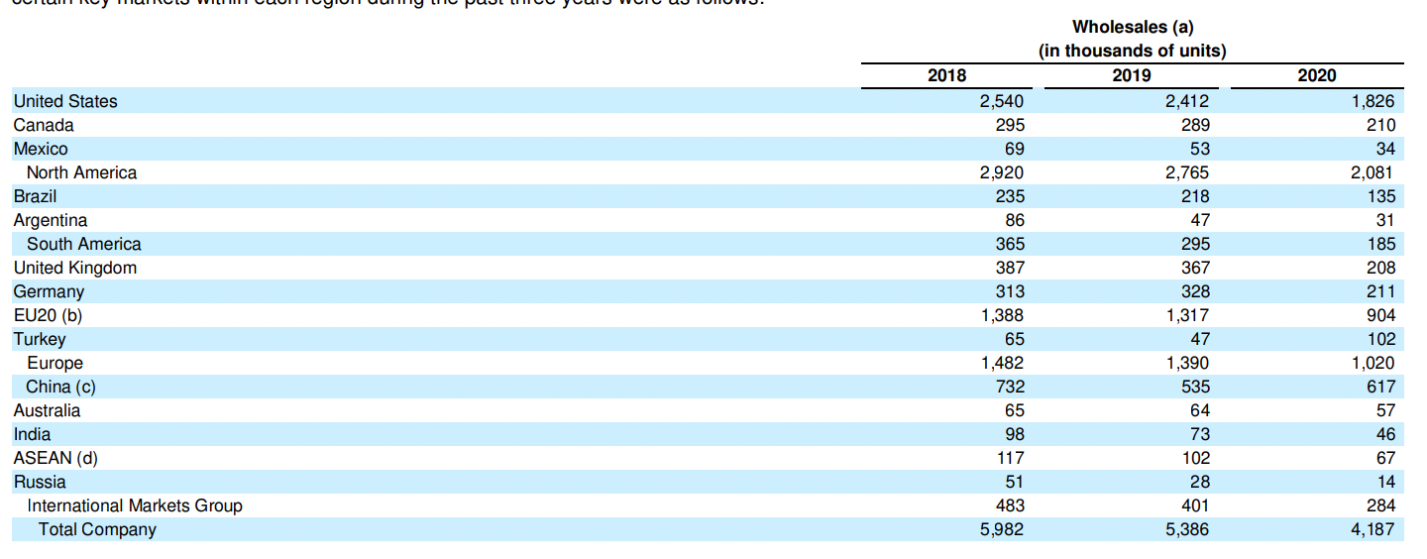

Such markets include, domestic in America Europe, Africa, and Asian countries as an example. While they have seen a downard trend since 2015 in their global sales figure for vehicles, they have consistent sold muliplt units in the millions in each year since 2015, while some of their competitors have performed far less. According to Statista, in the year 2021, the Firm saw a near 7% fall in their vehicle sales as the Firm struggled on delivering on its production goals due to supply-chain issues regarding materials critical to their production processes. This an also be seen in the following infographic on a global scale:

Additionally, in this analysis we have to remain cognizant that for Ford, their dependence on any “single customer or a few customers to the extent that the loss of such customers would have a material adverse effect on our business”, is not a true point. This is as captured in their 2020 annual report where for years 2018, 2019, and 2020, we continued to see the same decline trend in their wholesale business as shown before for their direct to consumer side.

An aligned review of their sales, volume, and market share in each region and in what they consider to be key operational markets during the above 3 year period also shows us a steady decline in their market share that is lost to competitors like Toyota, and others. This is due to a historial dip in their Market capitalization rate that has now, as of 2022 ranked Ford as 8th on the list of largest auto manufacturers by Market cap.

With current marketshare ranking being Further suggesting that across the board, the firm is underperforming its pre 2018 fiscal years by a nearly ~10% decrease.

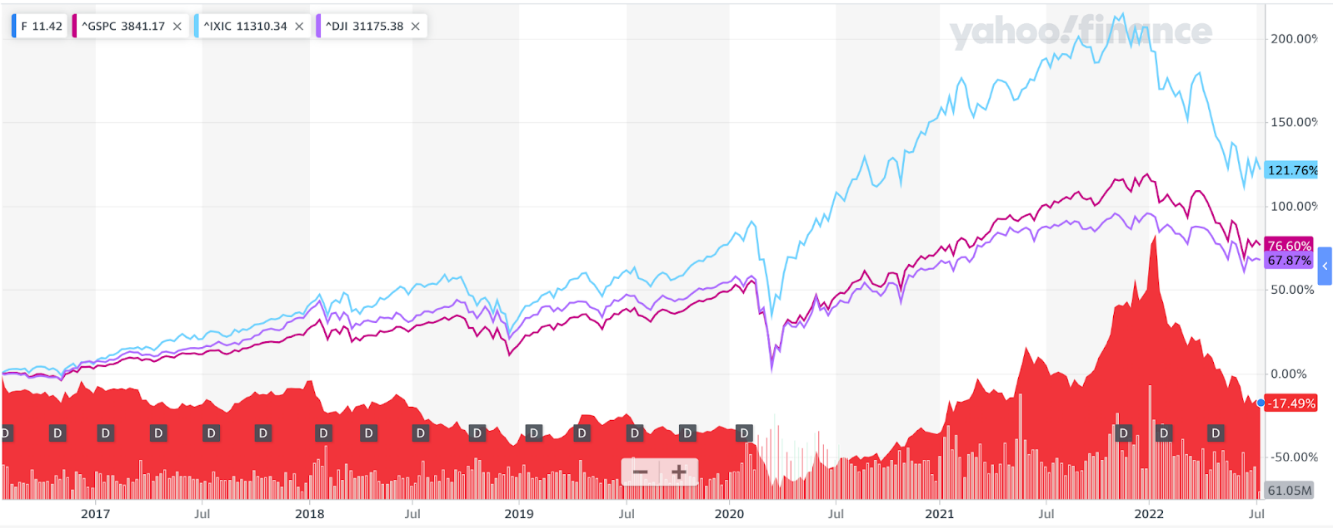

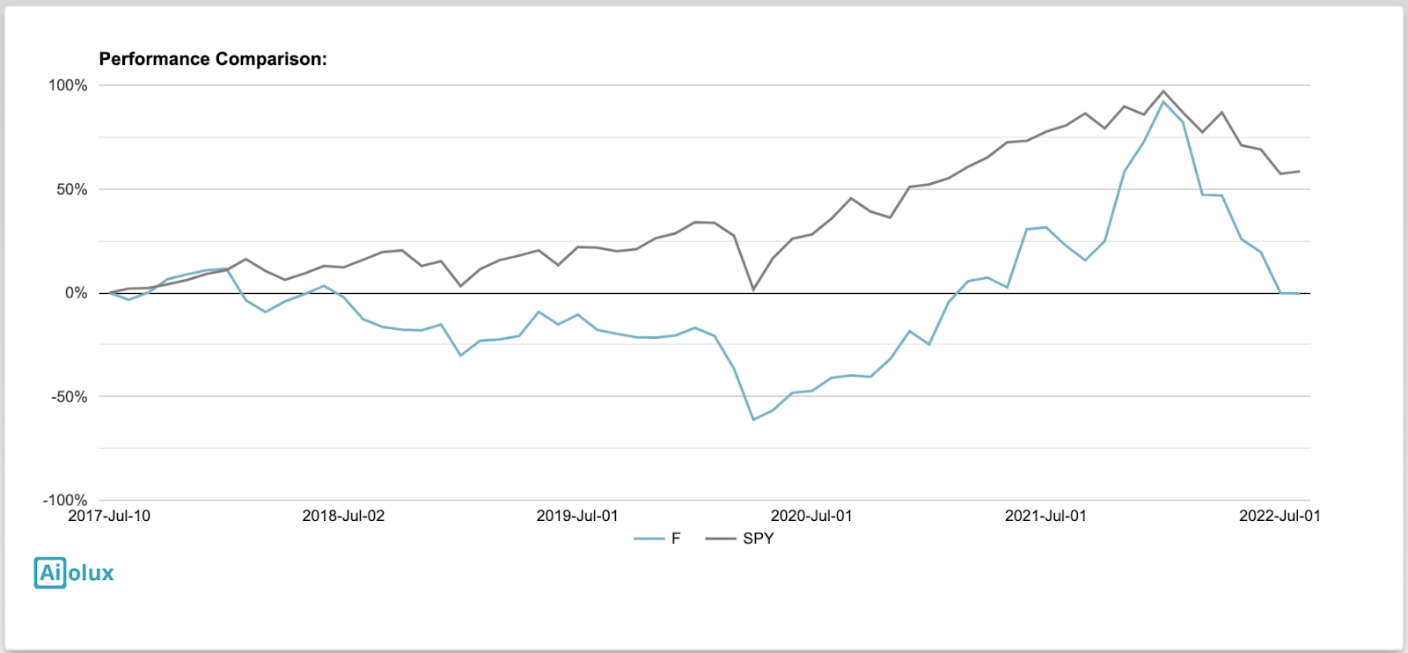

Conversely, when we look at the market performance of Ford stock, we can see that overall it underperforms when compared to the S&P 500, NASDAQ, and Dow Jones. Performance that can be attributed to the start of, the Covid pandemic, as well as general shortages between 2017 and 2021 as it relates to manufacturing materials that impacted the companies production outputs in most of their regions.

However as most firms do underperform against these exchanges, how erratic their performance is is indicative of how effective they are in their operations. In this case for 2018, 2019, 2020 fiscal years, Ford appears to have had steady performance against these markets.

Their market performance juxtaposed against their financial performance shows that for fiscal years 2018, 2019, and 2020, the following were true, a decline in general revenues of ~2.78% from 2018 into 2019, and a significant decrease of ~18.45% from 2019 to 2020. This compared to the ~1.16% decrease in Cost of Goods Sold from 2018 to 2019, and ~16.28% decrease from 2019 to 2020. There performance during this three year period shows decreased effectiveness and strength in their Operational strategy however it appears the firm is on a recovery as in 2021 fiscal year end, the firm saw a net income growth of ~1502.42% showing better performance gained with low COGS, and higher revenues. Overall, the firm appears to be an upward recovery trend.

Report of Findings with Recommendation

The consideration comes down to which company demonstrates more long-term potential and prospects in the current market and how it has demonstrated its financial success. With a well-established public record and plenty of news articles and promises, Tesla may initially seem like the clear winner between the two, taking technology innovation to its logical conclusion. However, it is essential to consider what is shaping Tesla’s current direction and how management influences it.

When comparing the financial statements of the two organizations and the details of their accounts, it is clear that Ford makes its information much more segmented, accessible, and easy to understand (“Ford Motor Company,” n.d.). The division of the financial report into quarters and sections makes it easy for investors and employees to track Ford’s achievements and spending over time. Tesla, by comparison, provides a single document that is difficult to navigate and apply when analyzing quarterly expenses (Annual Report, n.d.). In addition, the public figure of Tesla CEO Elon Musk is controversial. This man was able to draw a lot of attention to his organization’s work, but he also ensured that Tesla faced a fair amount of controversy daily.

Despite a fair amount of controversy, both companies have similarities in business strategies. Both Tesla and Ford focus on attracting investors who play a significant role in the company’s well-being. Both organizations are aimed at creating an innovative product that can interest potential customers. Tesla seems to be much more innovative, but Ford also keeps up with modern society’s demands and focuses on producing environmentally friendly cars. In addition, both Ford and Tesla are similar in their vision of the mission of the contemporary automobile company. Both firms focus on facilitating travel, establishing connections between distant regions, and providing maximum driving comfort. These strategies make it possible to call both companies attractive to investors and customers.

However, there is concern about the CEO’s ability to use Tesla stock as a form of cash investment. Many have doubt Musk’s ability to run Tesla, his vision for the company, and his record of promises. He has been found to use his social position to manipulate the market for financial gain, which indicates a lack of commitment to quality or good business practices (Bonifacic, 2022). By comparison, Ford seems like a much safer option, capable of delivering long-term sustainable success.

References

Foote, B. (2022). Ford EV Sales Growing Faster Than Overall Segment. Web.

Ford (2022) Notice of 2022 Virtual Annual Meeting of Shareholders and Proxy Statement. Web.

Ford Authority (2022). Ford Mustang Mach-E Sales Numbers. Web.

Ford (n. d.). About Us. Web.

Ford (n.d.). Our Brands. Web.

Ford (n.d.). Our History. Web.

Ford (n. d.). Electrictrified Vehicles. Web.

Ford (n.d.). How will the global semiconductor chip shortage impact my Ford vehicle order? Web.

Ford (2021). 2021 Annual Report. Web.

Ford (2020). 2020 Annual Report. Web.

Ford (2019). 2019 Annual Report. Web.

Garsten, E. (2021). Study Reveals Automakers Not Using Sustainability To Competitive Advantage. Web.

Hofstätter, T., Krawina, M., Mühlreiter, B., Pöhler, S., Tschiesner, A. (2020). Reimagining the auto industry’s future: It’s now or never. Web.

Marr, B. (2019). The Amazing Ways The Ford Motor Company Uses Artificial Intelligence And Machine Learning. Forbes. Web.

McElroy, J. (2022). The Numbers Tell the Story: Who’s the Best Car Company in the World? Web.

Olinga, L. (2022). Ford Is About to Make a Big Strategic Decision. TheStreet. Web.

Sorkin, A., Karaian,J., Kessler, S., Gandel, S., J. de la Merced, M., Hirsch, L. Livni, E. (2021). Ford Has a D.I.Y. Plan for Computer Chips. Web.

Wayland (2022). Ford issues stop-sale of electric Mustang Mach-E crossovers due to potential safety defect. Web.

Wayland, M. (2022). Raw material costs for electric vehicles have doubled during the pandemic. Web.

Wayland, M. (2022). Ford plans to produce 2 million EVs annually, generate 10% operating profit by 2026. CNBC. Web.

Annual Report. (n.d.). Tesla Investor Relations. Web.

Ford Motor Company. (n.d.). Ford Motor Company – Investors – Overview. Web.

Elon, M. (2006). The Secret Tesla Motors Master Plan (just between you and me). Web.

S.K., G. (2019). Tesla SWOT Analysis (2022). Web.

Carolyn, F. (2020). Tesla’s 5 Biggest Competitive Advantages. Web.

Brianna, P. (2021). Tesla Mission Statement, Operational Goals, & Culture. Web.

Zandt, F., & Richter, F. (2022). Infographic: Tesla’s race towards profitability. Statista Infographics. Web.

Bonifacic, I. (2022). Tesla investors say a judge found Elon Musk’s ‘funding secured’ tweet was misleading. Engadget. Web.

Centeno, D. (2022). U.S. Ford Motor Company Sales Down 4.5 Percent In May 2022. Web.

About Tesla. Tesla. (n.d.). Web.

About Tesla. Tesla. (n.d.). Web.

Tesla Inc. Overview. (n.d.). Web.