Introduction

When Chancellor Alastair Darling delivered his budget speech for 2009, he confirmed much of the speculation about the UK’s debt crisis. This was also coupled with the recognition that the severe recession is plaguing the country’s financial stability. Although there are a range of approaches that have been proposed, the paper will dwell on the most common ones employed by government i.e. tax increments and reduced expenditure; their feasibility will also be assessed.

Whether the budget deficit should be allowed

The one hundred and sixty billion pound deficit has sent financial stakeholders in a panic mode as they grapple with what needs to be done in such a situation. Some analysts have asserted that the latter deficit should not have been allowed in the first place as the country’s financial policies and instruments could have been used to tackle the problem before it became so enormous. The Bank of England declined to react to the housing crash from 2007 as they were afraid of causing inflation. They also carried out a wrong move by choosing to give loans to bankrupt financial institutions that were unlikely to repay them thus curving out a path towards greater financial distress in the country. (Price Waterhouse Coopers, 2009)

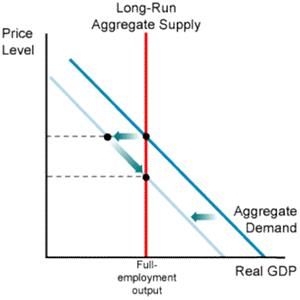

The government has certain monetary instruments within its hands that can assist in the process of reducing a budgetary deficit and this is what should have been done in the first place. It can employ the balanced budgetary multiplier which will be critical during a recessionary period such as the current one. In this case, the government ought to increase expenditure by the difference between equilibrium levels and full employment levels of output and income. In this regard, a situation will arise where the country’s taxes and expenditure will go up by equal quantities thus causing no rise in the budgetary deficit. For a graphic representation of how this works, please refer to the appendix. (Sloman and Hinde, 2007)

The UK public is likely to be confronted with the problem of reduced public services (due to lower public expenditure) and increased taxes for some time to come merely because the UK government poorly managed the economy over the past few years. The government has been setting budgetary targets that would have prevented the current deficit is they had been met. They are therefore changing goal posts by attempting to alter the rules. In other words, transference of this economic burden is an indication that lawmakers and administrators failed in their duties of providing a secure and stable financial environment for the people of the UK. (Jenkins, 2009)

Whether spending should be reduced and/or taxes increased

The introduction of a tax increment could spell disaster for both income earners as well as consumers. Increases in income taxes are likely to distort economic behaviour or investment decisions as most entrepreneurs may be discouraged from pursuing their ambitions. Aside from that, tax changes in pension contributions are likely to dampen the tendency to save using this form. All the latter changes will be felt on a micro scale level. (Walayaat, 2009a)

A macro analysis on the situation reveals that tax increments are likely to cause very minimal changes to the country’s debt problem yet this is the reason why they were enacted in the first place. In 2009, analysts predicted that an income tax rate of fifty percent (which is substantially high by all standards) is likely to lead to an increase in slightly over one billion pounds to the GDP. As it has been stated earlier, the budget deficit was one hundred and sixty billion pounds. So the tax changes are likely to contribute a meagre 0.06255 percent towards the debt problem. This means that such a strategy may not be able to achieve the purpose for which it had been initiated.

As if the latter is not enough, increased taxes are likely to send the wrong messages to international investors. The United Kingdom prides itself in its attractiveness as a place of business. One cannot overemphasise the importance of maintaining this image to the rest of the world as it makes the difference between who leaves and who stays. Tax increments would be a large disincentive to investment in an economy that badly needs a fresh injection of activity.

Economists often agree that the best solutions towards any economic problem are always the long term ones. Tax increases merely focus on short term perspectives yet this kind of thinking is what got the UK into its economic problems in the first place. The government had stated that its major intention within the financial sector was to simplify the tax system so as to reinforce simplicity within the market. This was supposed to encourage more long term investments as business persons would be engaging in a system that was not too tumultuous. But tax increases are indicating that the government is now moving further away from the latter mentioned strategy and it is the country that will suffer.

Reduced spending will also create the same effect as tax increments as this is likely to propagate the deficit problem and thus plunge the region into a double recession. This is because the next government will be under pressure to minimise the country’s debt crisis. It is likely that they more go for quantitative easing which is increased printing of money designed to boost the number of government bonds that can be purchased. The effect of such an approach is that the value of the pound will go down and the country will be worse of then than it is now economically.(Jenkins, 2009)

Another reason why tax increments are unlikely to yield the effects for which they were intended is the fact that the UK public will be prompted to reduce their expenditure. Economists agree that this is especially the case when it comes to taxes placed on commodities such as VAT. In the end, this will make no change to the economy and will only cause the crisis to worsen.

The government is already in a position where it has to juggle a series of issues ranging from improving the economy to reducing government borrowing. Analysts assert that trying to deal with all these matters at once will lead to a situation in which the economic recovery process will become more sluggish. In fact it has been asserted that this immense pressure being faced by the government to improve the recession may cause the government to pursue two common strategies which include reduction in public expenditure and also increased taxes. These are both deflationary policy instruments that could lead to diminished demand for services and commodities. In the end, economic recovery will be sluggish. Some current analyses are showing that the British public is already moving towards saving yet a flow of money and goods needs to be encouraged in order to turn the tides of the economy. Therefore, the country may find that its ability to recover may be undermined by the adoption of all these deflationary strategies (Walayaat, 2009a).

Deflationary pressures are further compounded by high unemployment levels in the country which could cause more consumers to reduce their consumption of certain commodities and this may again impede economic growth. Unless the government finds a way of curbing the current levels of unemployment then it will be fruitless to increase income taxes as the revenue streams from this approach would be quite narrow. It should be noted that it may be quite difficult for the government to manoeuvre its way out of diminished income revenue tax rates by overcharging the population all at once. Trying to do such a thing would only cause a decrease in the GDP as it is always advisable to increase taxes gradually rather than within a short period of time.

In order to fully understand why the latter issues can arise, it is critical to look at the aggregate demand and aggregate supply (AD/AS) affecting the UK at this time. Aggregate demand is a combination of all the consumer spending, government spending, company investments, expenditure on imports and foreign resident spending within the UK for services and goods purchased. Increasing the aggregate demand has the effect of creating a gap that causes suppliers to act in order to bridge that gap i.e. through more production. In terms of the supply side, it is likely that increases in investments would lead to greater levels of potential output and hence greater levels of capital productivity. Taxation would be a disincentive to the aggregate demand because it is likely to lead to a scenario in which earnings will be dramatically reduced. Also, it would cause business incomes to go down as well and this is coupled by a decrease in any investments that depend on the latter incomes. This implies that increasing taxation would contribute towards a lower aggregate demand. Most businesses consider taxes as a cost of production and this may eventually cause a decrease in aggregate supply. In the end, the economy will be worse of with increased taxation than it would have if it had not implemented such a policy. (Sloman and Hinde, 2007)

Conclusion

The budget deficit should not have been allowed as tax increments and reduced government spend only serve to reduce investments and expenditure yet these are instrumental in economic recovery. Consequently, the government should embark on long term strategies that address the root cause of the budget deficit and the recession.

Appendix

References

Sloman, J. & Hinde, K. (2007). Economics for Business. London: McMillan.

Jenkins, S. (2009). Alarm sounds for budget deficit. The Guardian. 2009, p29.

Price Waterhouse Coopers (2009). Making sense of the budget 2009/ 2010. Web.

Phillips, K. (2009). Bad money and Global crisis of capitalism. London: Penguin publishers.

Walayaat, N. (2009a). UK budget deficit for 2009. The Market Oracle. 2009, p 6.

Walayaat, N. (2009b). UK deficit could reach 200 billion pounds. The Market Oracle. 2009, p 14.