Introduction

The aviation industry will remain competitive and challenging for current operators. Many of the circumstances making its challenges are external; however, management issues and strategic positioning of individual airlines have a significant role to play in ensuring that airlines remain successful.

United Airlines, which is the subject of this report has had a history of turbulent times, however a recent merger with Continental Airlines and subsequent reforms by management have led to a return to profitability for the company. This report examines different facts about the airline before offering a SWOT analysis of the company.

Company’s name

This research covered United Airlines. The company began its operations in Boise, Idaho. The company operated from the Boise Airport from 1925 to 2003. In 1929, the company operated as United Aircraft and Transport Corporation. After the Air Mail Act of 1934, the company had to break into three parts.

The law prohibited the ownership of both airline services and airplane manufacturing services. United Air Lines airline group emerged from the breakup of the original company. The company grew by taking advantage of the strong economic growth after World War II that increased demand for airline transport. In 1968, UAL was formed as a holding company and with United Airlines as its wholly owned subsidiary.

Corporate headquarters

The corporate headquarters of United Airlines is in Chicago. The airline retained the headquarters after the merger with Continental Airlines.

Hubs and semi-hubs

Currently, United Airlines operates from two major hubs; the Chicago O’Hare Intentional Airport. This serves as the biggest hub when factoring in the number of flights that serve the Midwest area. The hub serves about 15 million passengers annually and this translates to about 41,414 people daily.

Going by the total number of passengers served by the airline, the Chicago hub is the busiest. After the merger, the airline added Houston George Bush International Airport. This was the biggest hub for Continental Airlines. Currently it serves about 16.1 million passengers and 78 percent of the number goes through the United Airlines.

Other hubs for the airline include the following. Denver Internal Airport has 10.3 million passengers annually, Los Angeles International Airport has 6.6 million passengers annually, and Newark Liberty International Airport has 12.2 million passengers, as is the third largest hub for the airline while San Francisco International Airport has 10.1 million passengers annually.

It is also the airline’s gateway to Asia. For East Coast and Europe, the airline uses Washington Dulles International Airport. Others are Guam A. B Won Pat International Airport and Narita International Airport in Tokyo, Japan. Previously, the airline used Cleveland Hopkins International Airport, Miami International Airport, Portland International Airport and Seattle-Tacoma International Airport.

Fleet mix and number of airplane in the fleet

The airline has 710 Aircraft with future orders being about 22 in the current year. The fleet includes Airbus A319, Airbus A320, Boeing 727, and Boeing 737. Other Boeing models in its fleet include 747, 757, 767, 777, and 787 Dreamliner. There are on average 150 Airbus models and about 558 Boeing models.

Flight or cargo network

The service area of United Airlines covers Asia, Australia, Europe and African. Meanwhile, its domestic routes that cover its seven hubs within the United States also extend to include Hawaii and the continental United States. The airline has hubs in Guam and Tokyo serving its internal routes.

Type of service(s) provided

The airline provides passenger travel services to local U.S. destinations. It also has international passenger destinations in the Pacific, Latin and Atlantic regions. It provides light cargo services and mainly concentrates on its passenger business. Passengers get a specified size of luggage allowed with every flight, they earn frequent flier miles and get connections to other airlines when travels beyond the routes covered by United Airlines.

Passengers on board a United Airlines flight get full on-board meals depending on their class and duration of flight. Additional features offered for passengers include options to travel with animals, which are mainly pets. In addition, the airline provides customized travel arrangements for passengers with special needs (United Airlines, Inc., 2015).

The year of establishment

The airline was established on 6 April 1926 and currently operates legally as United Continental Holdings Inc.

Short history about company background

From the incorporation of UAL in 1968, there were two decades of turbulent times for the United States airline industry. Between 1970 and 1989, the leadership turnover at United Airlines was very high. Six presidents led the company in this period. At the time, the federal government focuses on scrutinizing monopolistic practices of airlines also increased taxes for airline services. As a result, there were many mergers in the industry, as airlines sought to retain their competitive advantages (Ireland, Hoskisson, & Hitt, 2006).

During the 1970s, the airline served domestic routes only and The Deregulation Act of 1978 caused significant losses to the company. This was because United Airlines had to stop servicing many of its routes as they were previously receiving government subsidies. In 1985, the company gained a footing in the internal business when it acquired landing rights from Pan American Airways. The company also bought other rights by taking over Pan American Airways’ Pacific Division. It then served the Asia-Pacific markets.

Key expansion of the airline happened in the 1990s. The company bought Pan Am’s routes to London and it entered into an agreement with the UK government. The agreement let United Airlines to fly directly from Chicago to London.

In the Latin America and Caribbean region, the company took over Pan Am’s routes through a negotiated purchase. In 2010, United Airlines merged with Continental Airlines. The merger was supposed to improve the fortunes of the company and lead to better services for its loyal customers (Markham, 2015).

Chief Executive Officer’s name

The CEO of United Airlines is Jeff Smisek who also serves as the president and chairman of the company. Jeff joined united airlines after serving as the president and chairman of Continental Airlines, Inc. He ended up joining United Airlines after a merger of his former company with the present one. He retained the CEO position with expanded responsibilities. He attended Princeton University and Harvard University (United Airlines, Inc., 2015).

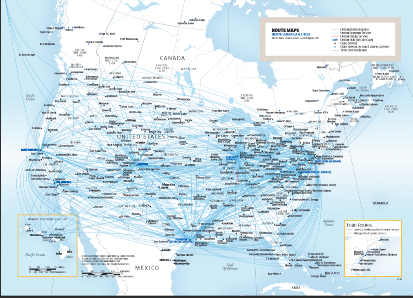

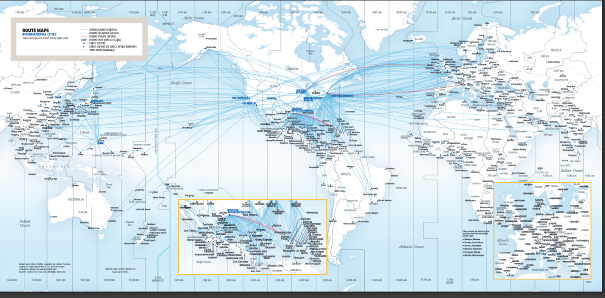

Network map

The following is a graphical representation of routes covered by the United Airlines in its domestic market and in its international market. There are 373 destinations, 235 domestic destinations, 138 international destinations, and 60 countries served by the airline.

Alliances and affiliated partners

United Airlines is a member of the Star Alliance. It is also enjoying partnership status in the United Express. Marketing agreements or code sharing agreements exist between the United Airlines and the following other airlines. Hawaiian Airlines, Silver Airways, Island Air, Jet Airways, Azul Brazilian Airlines and Aer Lingus among others (United Airlines, Inc., 2015).

The airline also has partnership agreements with major hotels around the world where its customers can redeem their reward points from its frequent flier program. The airline’s supply partners include Boeing, US Airways, Delta, Lufthansa Systems, Starbucks, Japan Airlines, Pratt & Whitney, Edelman and LSG (United Airlines, Inc., 2015).

Posted profit or loss last fiscal year

The holding company of United Airlines announced that it has earned record profits in the first quarter of the current financial year 2014. In the first quarter of 2014, the airline made a loss of $1 billion (Karp, 2015). The airline is expecting the second quarter of the current year to be profitable.

This is due to the increased investment in lower jet-fuel prices that are affecting the global airline industry. The company last year enjoyed a period of prosperity after it increased the size of planes. It is also experienced increased number of passengers leading to full planes. Overall, in 2014 the airline group reported a $2 billion profit (PR Newswire, 2015).

Load factor

The airline has enjoyed a domestic load factor 86 percent in 2014, which was a 0.3 percent increase from the previous year. In the international market, the airline had a load factor of 81.3 percent in 2014 against 81.9 in 2013. The figure remained stable throughout the Atlantic, Pacific and Latin routes. The consolidated load factor was 83.6 percent in 2014 against 83.6 percent in 2013 (PR Newswire, 2015).

Total passenger and cargo flown during last year

In the fourth quarter of 2014, United Airlines was able to gain 3,219,000 dollars in passenger revenue. The onboard passengers for 2014 were 27,121,000 for the mainline and 13,818,000 for the regional market. The consolidated numbers was 42,939,000 in 2014 and the period was 43,218,000 in 2013 (United Airlines, Inc., 2015). Overall, the company served 138 million customers in 2014 (United Airlines, Inc., 2015).

Distribution channels (Supply-chain channels)

The airline heavily depends on third party providers. It has suppliers for its aircraft repair, maintenance, and others for aircraft fueling operations. It also relies on outside vendors for supply of food to flight crew, pilots and passengers. One such partner is Starbucks (United Airlines, Inc., 2015).

The company’s supply chain channels mainly relate to delivery of aircraft, maintenance and handling of customer relationships. The airline is in agreement with vendors over supply of different goods and services but it does not fully control their operations. Recently it terminated its contract with SkyWest that provided below-wing ground baggage handling at its hub in Denver (Keeney, 2014).

Total employees

The company continues to seek ways to cut its labor costs. About 13,000 employees of United Airlines are organized in the Association of Flight Attendants (AFA) (Vail, 2014). The airline intends to outsource labor in 28 airports so that it does not have to deal directly with employee affairs for the support staff (Laura, 2015).

In 2011, the company had 86,734 employees. There were 32,083 public contact employees; flight attendants were 21,284 and pilots numbered 9,944. Others are 8,577, engineers 195 and 267 dispatchers. Women represent 44 percent of the company and while ethnic minorities represent 39 percent of the company (United Airlines, Inc., 2015).

Other information that will profile the company

The airline received 36 new aircrafts in 2014, 30 being Boeing 737 models and 6 being Boeing 787 models. The company hopes to receive 22 Boeing 737 models and 10 Boeing 787 model by end of 2015. The plan to renew its fleet should end in 2017. The 737 models are replacing the 757 models used by the airline. Overall, the airline seeks to maintain a fleet plan of about 700 mainline aircraft (United Airlines, Inc., 2015).

CASM, RASM, ATM, RTM

Cost per Available Seat Miles (CASM) for the airline without factoring in third party business expenses increased 1.3 percent from 2013 to 2014. Meanwhile, the Passenger Revenue per Available Seat Mile grew by 1.6 percent in 2014 compared to 2013.

SWOT analysis

Strengths

The United Airlines brand has a long history. The company has weathered world wars, deregulation as some of the challenges that make it relevant in today’s market. It has also successful defeated threats by terrorist activities and price volatilities.

Although it continues to face challenges in a dynamic airline industry, there is considerable brand reputation built over the last few decades that should aid the company’s strategic management goals. The company has an excellent management team having sufficient experience in the airline industry and in leadership and management positions. It should be able to execute a number of strategies to ensure that the business achieves profitability and growth.

United Airlines has been able to make cost-cutting changes such as carrying out layoffs to realize savings of more than $500 million annually. The company is on the path to make additional saving changes by dumping 130 regional jets. These are in the 50-seat range. In their place, the airline will have bigger planes with a 76-seat capacity. They expect the bigger places to be more comfortable for passengers. Eventually, increased comfort should lead to better ratings for the airline and improved competitiveness.

In addition, the larger jets are also fuel-efficient and reduce the number of trips, thus saving the airline money in the end. In 2014, after earning $1.1 billion in the third quarter, the airline was able to increase its profitability prospects and announced that it was going to buy back $1 billion in shares. The news was positively taken by investors given that the airline hopes to realize the deal within the next three years (Sasso, 2015).

The marketing arrangements with various airlines around the world increase the target passenger population for the airline and sustain its passenger numbers. Membership status of star alliance also helps build the brand reputation of the airline and increases its opportunity of getting additional route collaboration agreements to grow its passenger reach.

The airline has been making reforms to focus more on the customer, and while the results of the reforms have yet to manifest, they should positively affect financial performance once they do. The current operation strategy is to focus on investment in tools and recurring training for employees, creation of customer service standards, empowerment and listening to employees as well as seeking of responsible joint collective bargaining agreements (United Airlines, Inc., 2015).

According to Karp (2015), the airline is planning to increase the number of economy seats through a strategy of switching to slimmer seats than the current package. This tactic will allow it to increase its economies of scale and be able to address challenges posed by low cost carriers, whose main competitive edge is their low prices.

Weaknesses

Besides its rich history, the company has not been able to realign itself and get rid of costly operations. It remains financial vulnerable because of a weak balance sheet, and high labor costs party created by perpetual union issues by its staffs. After going through bankruptcy, the airline should have recovered with robust structures like its peers. However, it has not embarked on cost reduction measures. Therefore, it remains vulnerable to future bankruptcy threats.

An undermining feature of the excellent leadership capabilities of the airline is its continuous loss-making streak. The leadership has failed to abandon past practices to reflect necessary changes for survival in the increasingly competitive airline industry.

After merging with Continental Airlines, United Airlines management seems to have concentrated on improving their bottom line and to ensure that the company’s stock price rises (Sasso, 2015). However, focusing on the stock price has come at a price to customer service, which has failed to improve more than four years later into the merger of the two companies.

Failure to revamp customer services will eventually lead to poor performance by the company. This will affect investor perception of its profitability and lead to a drop in United Airline’s share price. Besides that, other gains expected from the merger with Continental Airlines have been slow and investors are getting worried about the new company. Their sentiments negatively affect the credit worthiness of the company.

Employee relations at the company have been weak. In 2012, there was a negotiation agreement for a new joint contract for pilots and it was expected to last long into the future. However, the agreement failed to deter the employee group from raising additional concerns that affect work productivity.

The pilots and management of the company argued over meals because the pilots were not going to get meals like first-class passengers. The petty argument on how meals should be served to pilots raises question about the capabilities of management to attend to employee relationship needs effectively. Such petty arguments can increase in scale and cause ripple effects that lead to bigger losses for the company.

Opportunities

The company has been reducing its costs and seems to have started turning around its financial performance since the merger with Continental Airlines. However, there is more room for improvement. The airline can add more fuel efficient planes to cut its costs of fuel and reduce its exposure to turbulent fuel prices in its major destinations.

Increase the pace of cutting costs and improve investor confidence in the company and lead to better stock price performance. Currently, many investors wonder whether cost reduction is due to reducing fuel prices across the industry or the company’s management efforts.

At the same time, opportunities in improving customer services abound. The airline has to improve its customer service ratings beyond those of its rivals. In addition to embracing the best practices for travel and hospitality, it has to think about placing additional services for its passengers such as onboard Wi-Fi for internet access.

The company also needs to embrace changes faster. Presently, it takes very long to create companywide improvements in service and such a pace will not allow it to effectively catch up with rivals and create competitive capabilities in the customer service area. Current plans are for the airline to upgrade its food and drink services in premium cabins but the success of the program will depend on management commitment and speed of implementation (Sasso, 2015).

Given that United Airlines is a large organization, leadership plays an important role in sustaining its strategic movements. The current structure of the company is good but there is room for leadership improvement to make organizational changes happen faster (Sasso, 2015).

After the merger with Continental Airlines, each airline maintained its operations under contractual agreement. The purpose of the separate operations was meant to prevent confusion in management of flight attendants (Painter, 2013). However, as the mergers begins to prove successful, there is need to consider merging the flight attendant services as this can increase the perception of service improvements for the company’s customer service reputation.

As the airlines works on cutting costs by matching aircraft capacity with its routes, it must also consider reshuffling flight attendants to reflect their strengths in the different routes served by the two airlines before their merger. In the current arrangement, the crews will follow the new planes based on their current routes. However, this would be an opportunities to also review performance of crew to align them with strengths of particular routes.

The airline has an opportunity to keep giving customers value for money and attract them to the airline. For example, its economy-plus seats that provide more leg room for the price of an ordinary ticket. Continuing this trend should enable the airline to continue cutting costs and still benefit from increased passenger numbers (Karp, 2015).

Threats

United Airlines faces a threat of regulatory control that can impede its ability to achieve competitive capabilities. An illustration of this fact comes from the company’s experience in the aftermath of the September 11, 2001 terrorist attacks in the United States. The entire airline industry of the country was negatively affected. The airline had to declare bankruptcy because it faces runaway expenses yet it was earning losses from its operations.

A strategic move that would save the airline by creating economies of scale options would be a merger with U.S. Airways. United Airlines had become unprofitable because of its previous move to give its employees a 55 percent ownership interest and the increase in wages and labor costs. Eventually, when the company declared bankruptcy because it was denied the opportunity to merge with a rival airline, it was considered as the biggest bankruptcy in history (Markham, 2015).

Besides regulatory limitations, the airline also faces terrorism threats. It may not be a direct target of an attack but it can be a major casualty because of loss of demand for a particular route due to terrorism threats. Due to the concern for future terrorist attacks, airlines all over the world face increased insurance premiums for their aircraft and other property (Markham, 2015).

Developments in technology and proliferation of consumer technology devices to access internet managed services allow consumers to compare prices for seats and other services provided by airlines. As a result, they are able to choose the best package for their needs. In this regard, low cost airlines and other legacy carriers that provide competitive prices are threatening to the success of American Airlines.

Other rival airlines like Delta and Southwest are seeking to improve their customer service delivery to remain sustainable. They pose a big threat to United Airlines because of their extensive direct route networks and collaborations with other airlines around the world (Sasso, 2015).

The airline still faces major challenges in its labor relations. As long as there are labor issues, the efficiency of operations in the company will continue to suffer. Based on this realization, management must work hard at creating buffer systems and eliminating labor relations tension that has been a fixed feature in the company’s history since the 1990s.

Currently, the company has an incompatible leadership style, which does not resonate with employee demands. As long as the leadership style used remains the same, then it will be a threat to the success of the company. Given that United Airlines is a large organization, leadership plays an important role in sustaining its strategic movements. The current structure of the company is good but there is room for leadership improvement to make organizational changes happen faster.

The power of alliances as a defense against weak industry performance is weaning. Airlines have to also develop strong internal competitive capabilities to succeed. At the same time, the opportunity for merging is not always available. Based on this facts, increased costs of doing business caused by taxation, increased competition that necessitate additional need for marketing, and increases in fuel prices will continue to affect airlines business negatively.

In addition to the above concerns, severe cost cutting efforts can cripple the airline’s ability to respond to changes in its market condition. For example, it may not be able to adapt to route change demands with the same fleet of aircraft and with long-term purchase agreements; it may not be able to get additional services. If the airline goes deep into debt as it tries to keep its financial position afloat, it may expose itself to high interest payment costs that can jeopardize its future programs of being self-sufficient.

Foreign currency pressures negatively affect earnings affect the airline industry and this will continue being a threat in future (Karp, 2015).

Conclusion

The facts presented in this report reveal the current position of United Airlines and provide historical context for understanding current performance. The SWOT analysis revealed that United Airlines is still facing significant threats to its success. For example, the external environment can turn negative against the company and cause its costs of operations to increase significantly. However, many problems of the airline are internal.

The failure to use fully a strategy that increases its focus on customers may end up hurting its future performance. Currently, there are efforts to increase comfort and at the same time reduce costs of operations. With leadership as a key strength of the company and innovation being the second valuation, thing, the next factor is innovation. Continuous enhancement of these factors based on the SWOT analysis should enable the company to sustain the current profitable run.

References

Ireland, R. D., Hoskisson, R., & Hitt, M. (2006). Understanding business strategy: Concepts and cases. Mason, OH: Thomson South-Western.

Karp, G. (2015). United Airline expects another record profit in 2nd quater. Web.

Keeney, L. (2014). 650 people let go as United dumps SkyWest as Denver baggage handler. Web.

Laura, K. (2015). United Airlines moves to outsource labor at 28 airports. Web.

Markham, J. W. (2015). A financial history of modern U.S. corporate scandals: From enron to reform. Abingdon, OX: Routledge.

Painter, K. L. (2013). United Airlines is one big company, but not yet one happy family. Web.

PR Newswire. (2015). United reports december 2014 operational performance. Web.

Sasso, M. (2015). United Airlines left wondering why it hasn’t realized merger benefits. Web.

United Airlines, Inc. (2015). Airline partners and global alliances. Web.

Vail, B. (2014). United Airlines gets tough on flight attendants union. Web.