Abstract

This study aims to understand the impact of the fourth industrial evolution on automation processes in the insurance sector, relative to the industry’s preparedness to handle its effects on the job market. Data was obtained from secondary and primary research sources after sampling the views of employees working in various insurance firms and credible industry reports.

The findings revealed that the effects of automation on the insurance job market is fragmented with lower skilled workers and the less educated bearing the greatest burden of labor market shifts. Comparatively, other cadres of employees are better equipped to manage labor market changes because most of their tasks are not easy to program as they contain subjective elements of operation, which cannot be effectively captured in a simple algorithm. Therefore, employees who carry out simple tasks in an organization, which can be automated, suffer the highest risk of job losses.

Introduction

Background of Study

Technology is perhaps the most disruptive force of the 21st century. It has changed the way people do business by restructuring tasks and processes through automation (Hughes & Southern, 2019; Islam, 2018). Different economic sectors have been impacted by technology in varied ways but the insurance industry has been notably affected by the development, because automation makes it difficult to balance different stakeholder interests (McFall, Meyers, & Hoyweghen, 2020). Therefore, the insurance sector has been slow to integrate new technology to its mainstream processes (McKinsey and Company, 2020). Despite the slow adoption of automation in the sector, the trend has not stopped because most businesses are steadily integrating technology as a core business function.

These developments have increased over the last few years because process automation has been advocated as a solution for solving most of the problems affecting the insurance industry. For example, researchers support this statement by demonstrating how artificial intelligence has been used as tool for helping insurance firms to reduce their costs of operations and expand the value of their products and services (Drahokoupil & Jepsen, 2017; PwC, 2019). In this regard, automation has been highlighted as a tool for minimizing errors and increasing the pace of production and service delivery.

Although automation improves organizational processes, most insurance firms lack a firm foundation for integrating the technology. Part of the problem has been a lack of preparedness and understanding regarding the impact that automation would have on the current job market. Relative to these concerns, it is estimated that technology could cause up to 62% loss in jobs for most industries (McKinsey and Company, 2020).

These statistics concern business leaders and analysts who admit that without a clear plan on how to integrate automation in everyday business activities, employees could be adversely affected by the process. Stemming from this concern, there is a general agreement that there is a need to improve employee skill levels to better accommodate automated processes (Gallie, Felstead, Green, & Inanc, 2017). Furthermore, for most organizations to survive and thrive in today’s rapidly advancing economic space, organizations cannot continue to rely on traditional foundations of planning organizational processes because they would miss out on the numerous opportunities brought by technology to the workplace environment. However, to enjoy these advantages, it is vital to understand the effects of automation on the job market.

Research Gap

There is scanty literature explaining the effects of automation on the insurance industry. Particularly, few reports draw a link between automation and the insurance industry job market. Those that have attempted to do so have provided context-specific recommendations that make it difficult to be applied in other sectors of the economy that do not share the same dynamics as the insurance sector. For example, Berry and McDaniel (2020) have recommended that managers should pursue a robust training and development strategy to improve employee preparedness in handling most of the operational challenges that come from automation.

Investigations describing the effects of automation on the job market have also failed to focus on the insurance industry and the property casualty business as a unique segment of the industry. This is a significant gap the literature because the property casualty business accounts for about one-third of all insurance business and is responsible for more than $1.6 trillion in revenue, which translates to about 2% to the total Gross Domestic Product (GDP) in the US (McKinsey and Company, 2020). The main clients for property causality business include governments, large corporations and individuals. This type of insurance business offers financial protection against loss for its clients. It will be used as a basis for understanding how technology can be used to bridge employee skill gaps and meet stakeholder goals in the insurance industry.

Research Proposal and Rationale

This research aims to understand the impact of the fourth industrial evolution on automation processes in the insurance sector, relative to the industry’s preparedness to handle its effects on jobs

The objectives of the study are highlighted below:

- To review the history of the industrial revolution and its impact on the employment industry.

- To identify and critically analyze academic theory related to the effects of automation on the insurance industry job market.

- To understand the effects of the fourth industrial revolution on the job market.

- To investigate what employees are doing to upscale their skills to be relevant in an automated business environment.

- To assess the preparedness of business leaders regarding the impact of automation on jobs.

- To conclude the impact of automation on the insurance sector.

The research questions that will be answered in the investigation are also highlighted below.

- How has the history of the industrial revolution influenced the labor market?

- What academic theories or concepts explain the effects of automation on the insurance industry job market?

- What are the effects of the fourth industrial revolution on the job market?

- Which actions are employees taking to upscale their skills to be relevant in an automated business environment?

- How prepared are business leaders to address the impact of automation on jobs?

- What conclusions can be drawn regarding the impact of automation on the insurance sector?

As highlighted in the list of the aforementioned objectives, the goal of undertaking this study was to understand the impact of technology in bridging employee skill gaps and meeting stakeholder goals in the insurance industry. Appendix 1 summarizes the main tenets of the research proposal used to develop this report and appendix 2 outlines the overall research plan followed. The rationale for the investigation is rooted in the ease of applying the findings to the insurance sector because it remains a service-oriented industry and any impact on employees or jobs is likely to affect output. Therefore, the findings of this study would better help managers and employees to plan for the effects of automation on their overall job performance.

The importance of this study to the insurance industry is also rooted in the ongoing developments of the recent COVID-19 pandemic, which has made it difficult to rely on manual processes to complete business transactions because humans are predisposed to diseases. Particularly, it has exposed the danger that employees are exposed to by converging in one place to work and has magnified the importance of relying on automated processes to supplement such activities. Therefore, the findings of this investigation are timely because the insurance industry, like other sectors of the economy, may experience a surge in the demand for automated services and it needs to be prepared to meet it (Barry & Charpentier, 2020).

In the context of this discussion, it should be recognized that the recent COVID-19 pandemic has not necessarily changed the impact of the fourth industrial evolution on businesses but has hastened the pace of automation. Therefore, the findings of this study will be valuable to organizations because it will help them to better prepare for the effects of automation. To this end, it will be notably easier to understand or predict the future of the job market and the ensuing changes that are likely to occur because of the process.

Research Plan

This research investigation was undertaken over a period of three months. The scope of the research covered all aspects of automation, including the deployment of technological tools to monitor and control processes that improve service provision. As highlighted in earlier sections of this report, the scope of the investigation was limited to the insurance industry. The main limitation associated with this research technique is that the findings are indicative and do not necessarily represent actual situations in organizations. Therefore, one of the risks that could be associated with the use of this study’s findings is the overt reliance on the information published to mean actionable data that could be used to solve an organization’s specific labor problems.

The main topics that will be extensively mentioned in this investigation include labor skill gaps, the fourth industrial revolution, and academic theories or concepts underpinning the discussion. Primary data will be collected using surveys after sampling the views of 12 respondents who will be randomly sampled. To get accurate data, four key steps will characterize the research process: development of questionnaires, data collection, data analysis and presentation. The overall research process was guided by a code of ethics developed by the relevant educational faculty. Extra effort was paid to protect the rights of the respondents to voluntarily participate in the investigation and their views were sampled and recorded anonymously. Additionally, all data retrieved from the respondents were safeguarded using a password and protected by following all relevant laws and policies associated with data management.

Research Approach

Two main types of research approaches are used in academic studies: inductive and deductive reasoning. Researchers who use inductive reasoning often develop a common set of solutions or findings based on general data, while deductive reasoning uses generalized principles to develop one common conclusion about a research issue. In this paper, the latter approach was used to develop the findings of the study because the views of respondents gathered from multiple sources were used to make conclusions about the research issue. Stated differently, the findings of the sample population were used to make assertions about the insurance sector. Thus, the deductive approach was used as the main research approach.

Literature Review

Introduction

In this chapter, the literature relating to the topic under investigation will be reviewed based on their association with the research aim and objectives of this study. To recap, this study aims to understand the impact of the fourth industrial evolution on automation processes in the insurance sector, relative to the industry’s preparedness to handle its effects on jobs. Collectively, the research objectives focus understanding the history of the industrial revolution, critically analysing relevant academic theory, and drawing conclusions regarding the impact of automation on the insurance sector. To meet these objectives, it is first important to understand the theoretical and conceptual foundations of industrial revolutions and their effects on the labor market.

Theoretical Foundation

There has been debate regarding the effects of automation on the job market. Relative to this discussion, PwC (2019), did a survey on 1,246 businesses among human resource leaders in more than 70 countries to investigate the future of jobs in an automated business environment. Their findings affirm an increase in the speed of technological integration around the world mainly in the fields of robotics, artificial intelligence and genetics (PwC, 2019). According to Frey and Osborne (2013), automation will drive the next phase of industrial revolution. In line with this assertion, they believe that 47% of all jobs will be automated through computerization. In this regard, there is a strong foundation for understanding the theoretical premise of this evolution

The above findings are domiciled within text in extant literature that suggests the presence of a rapid rate of automation of non-routine tasks. These findings align with the views of economist John Maynard Keynes, which suggest that most job market problems are brought by the commodification of labor, which has seen its supply outstrip demand, thereby making it difficult to find new uses of employees in a rapidly digitizing economy (Skidelsky & Craig, 2020). Automation has further worsened this process because it further diminishes the need for human labor, thereby creating a crisis in the job market.

In 1821, David Ricardo explored the effects of automation on the labor market and suggested that the widespread use of technology in business processes could bring cost reductions and increased resource efficiency (Kishtainy, 2017). It was also speculated that the cost reduction would eventually lead to an increase in the production of low-cost products. For many nations, this argument has been regarded as a basis for economic development because policymakers have been led to believe that globalization would lead to an increase in employment opportunities (Kishtainy, 2017). From these insights, Ricardo concluded that automaton was a positive addition to the field of business and its widespread adoption was inevitable.

Adam Smith is another economist who has also given his insights on the effects of automation in the job market. He argues that accumulated capital is the foundation of the economic system and automation has helped to bolster the purpose of the “invisible hand,” which is human labor, in supporting the entire capitalistic structure (Kishtainy, 2017). Therefore, similar to the views of Ricardo highlighted above Smith also suggested that automation was inevitable because it had more advantages than disadvantages (Skidelsky & Craig, 2020). Collectively, these authors suggest that automation is aligned with capitalistic principles of profit maximization and efficiency improvements.

Industrial Revolutions and Their Impacts on Job Markets

As highlighted in the first chapter of this report, the fourth revolution refers to the increased adoption of automation techniques in product and service delivery processes. While this force continues to shape organizational processes, its impact on the job market is relatively underexplored. This is because most researchers have extensively investigated prior revolutions that have caused instability in the labor market (Northern Ireland Council for Voluntary Action, 2018).

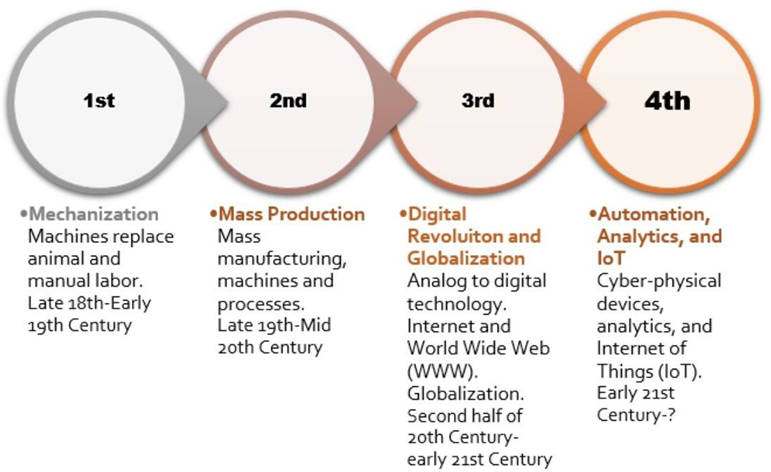

For example, the first revolution brought significant changes to the agricultural sector, transportation and industry, which further paved the way for the 18th century industrial revolution in England. This period is regarded in many literatures as a “disruptive gap,” in business because it brought numerous changes to people’s practices, societal growth and economic development. Its effects are broadly described in figure 2.1 below, which shows that the first revolution to ever occur was in mechanization. This was perhaps the first ever source of instability in the labor market.

First Wave

The first revolution saw the replacement of animal and manual labor in place of a mechanized process of production. For example the invention of new machines in the textile industry, which did the work skilled workers could do in a fraction of the time, received backlash from people and agencies who supported human labor despite the existence of overwhelming evidence, which showed that a machine could do a better job. During the 18th century, the “Luddites,” a small group of people, organized themselves around this cause and went ahead to destroy textile machines as a way of protest (Northern Ireland Council for Voluntary Action, 2018).

Their main contention was the feared job losses that would occur because of automation because their opposition never changed the automation trend. Consequently, technology brought changes to consumer tastes, increased competition due to globalization, and changed social employment policies as new jobs were created. The estimated timeframe for this revolution was between the late 18th and early 19th centuries and it led to a significant shift in wealth from what is known today as third world nations, such as India and China, to western nations, such as the US, France and the UK.

Second Wave

The second wave of industrial revolution occurred between the late 19th century and mid-20th centuries. It involved the mass production of goods using machine and mechanized processes. This development made it possible to fulfill the demand of goods and services using economies of large scale, thereby creating new opportunities of wealth creation that were previously inconceivable in the business world (Northern Ireland Council for Voluntary Action, 2018). The most common example of the effects of the second revolution was the popularization of the mass-produced automation model for the automobile industry developed by Henry Ford and the Ford Motor Company. Through mechanization, they proved that cars could be manufactured affordably, thereby lowering production costs and making them more affordable to the “masses”. From the success of such projects, mechanization has increasingly favored skilled workers.

Third Wave

The second phase of industrial development paved the way for the third evolution in business, which is linked to digital evolution and globalization. Researchers associate this period with the growth and development of electronic computers as a basis for managing business operations (Hughes & Southern, 2019). The use of these machines had a profound impact on production because it increased the number of process cycles managed by computerized processes. At the same time, it had a profound impact on the job market because it elevated the role of a skilled labor in managing computerized systems.

The movement from analogue to digital technologies also characterizes the third evolution where the internet is the center of commerce and business activities. It is also during this period that there has been a wide scale popularity of the worldwide web (www) and its dominance in trade is presently felt. From the early 21st century, automation, analytics and the Internet of Things (IoT) have characterized the fourth wave of evolution. The use of cyber analytics and cyber-physical devices have become widely popular with this wave of development and automation is at the center of the change.

Fourth Wave

The fourth wave occurred in the 20th century and was characterized by the introduction of the office machine. This stage of evolution saw the growth of white-collar workers and professions, which have, in some instances, outstripped the demand for their services (Hughes & Southern, 2019). This development also led to inequality gaps in the labor market as it was reported that most people who use a computer to undertake their work duties earned considerably higher wages than those who did not use the same machine (Northern Ireland Council for Voluntary Action, 2018).

The increase of wage inequalities between skilled and unskilled labor is also partly driven by a significant increase in returns from education that was reported between 1915 to 2005 (Northern Ireland Council for Voluntary Action, 2018). Broadly, the fourth revolution is characterized by significant changes in the composition of the employment sector from predominantly manufacturing-based to a service-oriented one.

The recent decline in the cost of computers has made it possible for organizations to integrate machines as part of their daily operational equipment. Their production efficiencies have also improved with increased flexibility brought by the use of computers. Currently, the industry is undergoing further transformation as organizations seek effective ways of improving their production and service delivery processes using advanced automation and data management techniques. In this regard, the fourth revolution can be described as a transformational age where automation has been accepted as a mainstream operational activity.

Although the main tenets of the fourth industrial revolution are hinged on automation, its critics argue that it is only an improvement of the third revolution and consequently does not need a special categorization (Hughes & Southern, 2019). However, industry experts and credible publications, such as the Boston Consulting Group and Accenture, believe that the fourth industrial revolution should be distinctively characterized as a new group because it has had significant implications on economies, businesses and the labor market (Northern Ireland Council for Voluntary Action, 2018).

The opposing views can be traced to the commonality between the third and fourth revolutions based on their shared reliance on technology. However, the fourth revolution is unique from the third revolution, which is based on digitization because automation has created agile information and network management flows that integrate, thereby decreasing the need for human labor and intervention. This statement explains the basis for the use of automation as the basis for understanding how the fourth industrial revolution affects the job market in the insurance industry. However, to have a better understanding of how this can happen, there is need to understand the threat of automation on the job market.

The Threat of Automation

In the context of this review, the threat of automation is largely credited to the need to comprehend the effects of the fourth industrial revolution on employees. Several researchers have reported the negative effects of automation on the labor market (Skidelsky & Craig, 2020; Hughes & Southern, 2019). However, most of their discussions have been developed to highlight automation as a substitute of jobs, which is not necessarily the case. Frey and Osborne (2013) have tried to demystify this fact by explaining the effects of automation on the labor market. Both scholars support the view that automation significantly reduces the need for employees in the workplace because it either reduces the time needed to employ human labor in production processes or effectively eliminates their contribution to production processes.

Frey and Osborne (2013) have also argued that the threat posed by automation to the job market should be analyzed from the lens of their effects on routinized and non-routinized processes. Using this definition, they contend that most parts of a job task can be effectively automated but also acknowledge that some tenets of job tasks cannot be automated in the near future because of the lack of algorithms to substantiate qualitative elements of assessment.

To affirm their views, researchers Frey and Osborne (2013) have explored the impact of advanced technologies, such as artificial intelligence, robotics and machine learning, on workplace processes. However, advances made in machine learning which have proved that automated processes can give nearly the same results, if not better, than non-automated processes, have encountered resistance from critics of automation.

For example, Frey and Osborne (2013) used the example of machine learning to make driverless cars as an example of how technology can change reality. From this augment, they suggest that machine learning can adapt and perfect human processes, thereby yielding better results than people can achieve (Frey and Osborne, 2013). These views show that the threat to automation has largely been viewed from the perspective of their effects on tasks that can be routinized and those that cannot.

Although several researchers have investigated and highlighted the effects of automation on businesses, it is not possible to understand their threat levels without acknowledging resistance to change. Stated differently, the ability for some industries, organizations or departments to adopt new technology significantly influences the effects that such changes would have on the job market. Broadly, the research conducted by Frey and Osborne (2013) reveals that the above-mentioned benefits of automation potentially put several jobs at risk. In the US alone, it is estimated that about 47% of all jobs are at risk of being automated (Frey and Osborne, 2013).

The expected timeframe for the full effects for automation to be felt remains unclear but observers estimate that it may take a decade or two to see the complete results (Frey and Osborne, 2013). Despite these projections, full automation is only possible if human beings can program procedural tasks and develop, contingency plans incase automation fails.

A report prepared by the Organization for Economic Corporation Development (OECD) further claims that the true effects of automation can be potentially predicted by breaking down jobs into specific tasks and analyzing how each one of them will be impacted by the trend (McKinsey and Company, 2020). Using this methodology, the OECD estimates that only about 9% of tasks can be fully automated, as opposed to the 47% proposed by Frey and Osborne (2013) above.

However, to further understand differences in the views of both researchers, it is essential to comprehend the methodologies adopted by the two organizations in coming up with their findings. The findings of Frey and Osborne (2013) were developed after sampling the effects of automation on 632 occupations in the US. These organizations were ranked according to skill levels using three categories: low, medium and high. The selection process was based on an assessment of existing knowledge, skills and ability required to complete tasks in each job category. The lowest job category was that of a recreational therapist, while the highest was a mathematical technician.

The findings mentioned above are consistent with those of other researchers who have investigated the impact of technology on the job market by demonstrating that low-skilled workers are the most vulnerable people. Those in low-wage occupations are also disproportionately affected by automation. Figure 2.2 below shows a summarized version of the estimated effects of the trend on different job categories.

Although the diagram above shows that different professions suffer varied risks levels due to automation, the process does not necessarily lead to job losses; instead, it should lead to a paradigm shift in business, social engagement and educational growth – processes that could then lead to the generation of new jobs. However, it should be noted that temporary structural unemployment could occur because of the shift, as some jobs are rendered obsolete while others are created. Therefore, technology has a positive effect on industries and not a negative one as proposed by some of the studies explored in this chapter. The potential positive effects of automation on people and processes should then outweigh fears that it would be detrimental to the growth of the job market.

Slow Adoption of Technology in the Insurance Business

For a long time, the insurance sector has been one of the slow adopters of technology, relative to other businesses in the financial sector. The widespread use of manual based data processing systems has also meant that the industry is operating on archaic platforms for providing goods and services. These issues have created complacency among insurance companies because most of them do not face competition like other businesses located in other sectors of the economy. It is suggested that the property casualty business is one of the main reasons for the slow adoption of technology (McKinsey and Company, 2020).

This ranking means that this insurance product has created monopolies in the market with only about ten entities laying claim to 47.7% of the market share. This trend has existed for a long time, with historical records showing that up to five companies control more than 60% of the market (McKinsey and Company, 2020). However, changes have since occurred in the industry and such numbers have diminished overtime.

Part of the reasons provided for the slow adoption of technology in the insurance industry has been attributed to strict regulations that govern the sector. For example, in non-progressive legal environments, firms that embrace automation can be criticized for adopting counterproductive systems and processes. For example, in the last decade, insurance companies have been blamed for identifying prime processes for automation and transferring them to low-cost systems as opposed to developing legacy systems that can handle them.

The debate has been characterized by arguments for and against Business Process Outsourcing (BPO), which currently accounts for about $130 billion in market value (McKinsey and Company, 2020). BPO has also accounted for a reduction in production costs, which has partly contributed to the success of mass-produced goods and services.

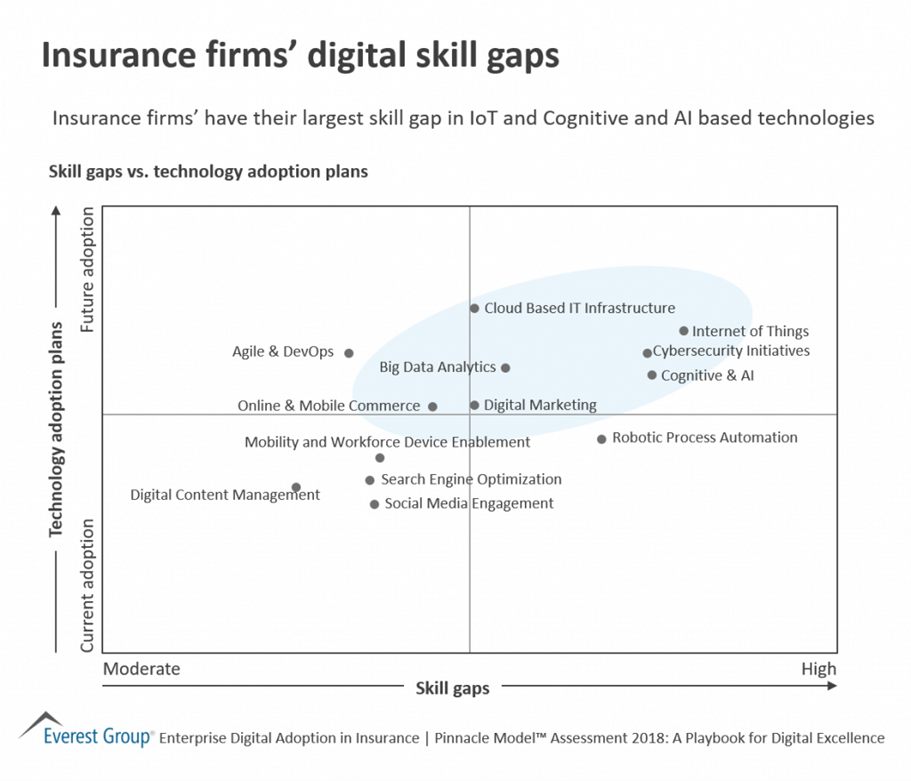

Only a small proportion of the property casualty business in the insurance sector is supported by digital technology. Furthermore, findings from Deloitte suggest that only 1.3% of insurance companies have made plans to integrate technology into their organizational plans (McKinsey and Company, 2020). Recent reports authored by the Everest Group (2018) established that most insurance businesses (up to 61%) have been unprepared in managing the shift towards automation. This finding was developed after sampling the views of professionals and business experts from 3,000 firms (Everest Group, 2018). These statistics mean that up to one in three firms are unsure of how to attract the best talents in digital operations management. This statement also means that most insurance companies have significant digital skill gaps. Figure 2.3 below suggests that most of these gaps largely exist in the areas of IoT, cognitive and AI-based technologies.

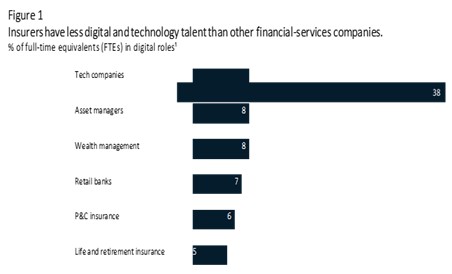

Part of the reason why there is a slow adoption of technology in the insurance sector is the low levels of preparation for employees to manage the challenges of automation, relative to other businesses in the financial sector. Similarly, according to figure 2.4 below, professionals in the insurance industry have less digital and technology talent compared to their counterparts in the tech industry, asset management sector, wealth management industry and retail banks.

Changing customer expectations and widespread alterations to the digital management process have seen the decentralization of knowledge emerge as a cornerstone of the insurance casualty business. The growth has mostly occurred on the worldwide web (www) and the development of mobile-based applications, which have given, companies unfettered access to consumers.

This development has also seen an upsurge in the number of insurance-tech businesses, which has consequently increased competition among industry players. Deficit insurance experts who have used technology to segment portions of the underserved market have primarily driven the growth (McKinsey and Company, 2020). Consequently, they have left mainstream insurance companies to focus on traditional customer market segments, while tech addresses the underserved markets.

Overall, the insurance industry needs to think of creative ways of bridging the gap that exists between the desired level of technological adoption and the existing skills in the industry. To this end, there may be need to acknowledge that automation may lead to the replacement of some jobs and skills. However, organizations can only enjoy the benefits of automation if they can match the employee skills required to conduct such processes. In this regard, there is little doubt that organizations will reap the full benefits of digitization if they can match existing skill requirements.

Summary

In this chapter, the researcher has explored the evidence presented by other scholars in understanding the effects of automation on the job market. The fourth evolution, which is hinged on the integration of automated processes in organizational processes using robotics, artificial intelligence and such tools outline the foundation of this analysis. While other researchers have pointed out the potential positive and negative effects of this force on the labor market, there is scanty evidence that their recommendations are useful to the insurance sector, or appeal to unique dynamics of the industry, such as the heavy focus on customer satisfaction and service delivery. Therefore, there is a gap in the literature, which will be filled by the present study because the analysis will be skewed towards understanding the effects of automation and the fourth industrial revolution in the insurance field and particularly in the property casualty business.

Research Design and Methodology

Introduction

In this chapter, the techniques used to answer the research questions will be explored. To recap, the main objectives of the study are to review the history of the industrial revolution and its impact on the employment industry, identify and critically analyze academic theory regarding the effects of automation on jobs and conduct primary and secondary research on the subject to draw conclusions on the effects of automation on the job market.

Additionally, part of the objectives of the study involved developing a survey to understand the preparedness of business leaders regarding the impact of automation on jobs and concluding these findings to make objective recommendations on how the insurance industry could better prepare for automation. Key sections of this chapter will explain the research philosophy, approach, and overall plan associated used to carry out the investigation. Therefore, in the chapter, information relating to the data collection technique, data analysis processes, sampling procedures and the sample population will be explained.

Research Design

The importance of planning in research cannot be overlooked because it determines the integrity of information that will eventually be developed and disseminated to users. In the context of this study, planning was essential in determining the overall direction that the researcher followed when undertaking the study. The process was integral in developing the research aim and objectives as well as research questions that were answered at the end of the investigation.

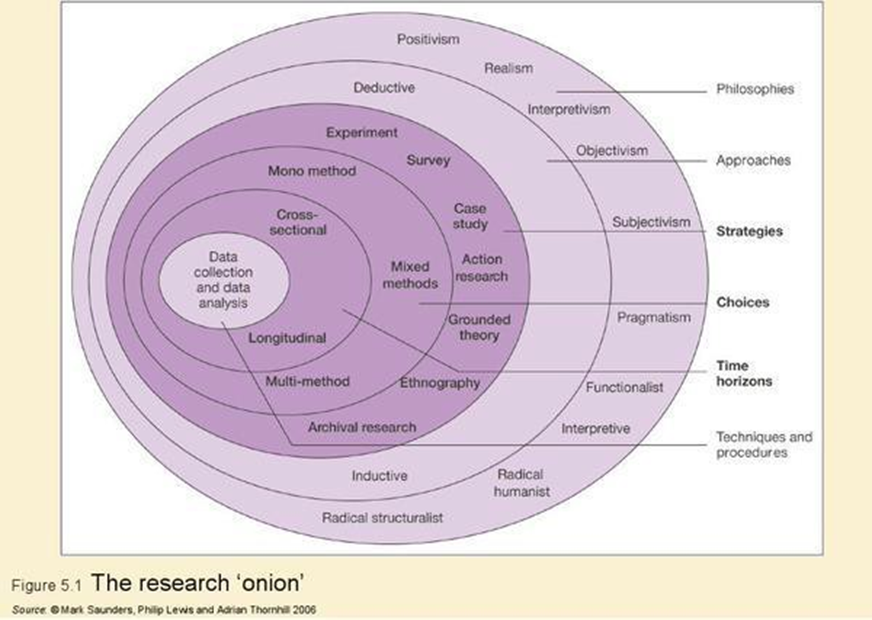

Developing the research design was a key part of the planning process. It involved the evaluation of strategies adopted by a researcher to fulfil a set of research objectives. In the context of this analysis, a research design refers to the blueprint followed by a researcher in collecting and analysing data to address the research problem effectively. The design used to carry out this research plan was borrowed from Saunder’s research “onion” described by Stokes (2017). In figure 3.1 below, the research “onion” has five layers, which describe philosophies, approaches, strategies, choices, and time-horizons for completing the study.

According to figure 3.1 above, there are ten philosophies used in research investigations. They include interpretivism, realism, positivism, radical structuralism, radical humanism, interpretive technique, functionalist method, pragmatism, subjectivism and objectivism. In this study, the interpretive research philosophy was used to inspire the development of all data management processes and procedures because of the underlying belief held by the researcher that reality is multifaceted.

Again, as highlighted in figure 3.1 above, the main research approaches used in academic studies include the inductive and deductive reasoning. The inductive technique differs from the deductive method based on the frame of arguments espoused. The inductive reasoning uses one position to draw generalizations from a set of responses, while the inductive reasoning frames a conclusion based on a collection of generalized ideas (Research Gate, 2020). In this paper, the deductive reasoning was used as the main approach for concluding the findings (Sekaran & Bougie, 2016). The technique will be used because the researcher relied on multiple sources of information to conclude a specific research issue.

Research Methodology

The choice of research method to use largely depends on the nature of an investigation and the intention of the researcher in collecting different types of information. In recognition of this fact, data will be sourced from multiple sources, including interviews and surveys. Later, the researcher will develop findings to conclude the impact that automation has had on the insurance job market. In this framework, the process of deducing findings from multiple sources will be completed using the deductive reasoning approach.

To this end, researchers have an array of different choices to pursue in designing their investigations, including the mono-method, mixed method, and multi-methods (Patten & Newhart, 2017). The mixed method approach was used in the present study because the researcher evaluated qualitative and quantitative aspects of the research issue by collecting both types of data. Interviews were the main sources of qualitative data, while surveys were sources of quantitative information.

Sampling

As highlighted in this chapter, two strategies were used in data collection: surveys and interviews. These two techniques of data collection involved the implementation of two types of sampling strategies. In the first one, participants who took part in the survey were randomly selected from a group of participating organizations. This sampling strategy was adopted because it minimizes bias by giving all employees an equal chance of participating in the study (Sekaran & Bougie, 2016). Using this sampling formula in research also means that there was little room for the researcher to be biased when choosing whom to participate in the study.

Participants who took part in the interviews were identified using the snowball sampling method, whereby an initial contact was used to connect with other people, who later joined the research group as informants. The researcher was familiar with the initial research contact who gave personal contacts of departmental heads in various insurance firms who later agreed to participate in the study. This snowball sampling method was used in the study because managers are hard-to-reach populations.

However, the snowball sampling strategy helped to identify employees who headed the property casualty business in various insurance firms because it was difficult to access them using any other technique, such as the random sampling method, which does not work well in a population that is often too busy for interviews. Consequently, the convenient sampling technique emerged as the best method to use in selecting respondents because it was comprised of people who were often too busy to respond.

Data Collection Methods

A research methodology refers to a collection of techniques used by a researcher in undertaking a study. The main research methods used to collect data include experiments, surveys, case studies, action research, grounded theory, ethnography and archival research (Kara, 2015). In the present study, the researcher used a combination of three techniques: archival research, surveys and interviews to come up with the findings. Primary research was obtained using interviews and surveys, while secondary research data were retrieved from archival research developed by reputable organizations and agencies, such as the OECD database and the European labor market.

Data was also obtained from the Office of National Statistics (ONS), while additional secondary data were retrieved from the latest publications developed by McKinsey and Company (2020), the World Economic Forum (2016), and PwC (2019). The data obtained from secondary sources were used as supplementary data for comparing and contrasting the primary research findings. Therefore, it helped the researcher to get a deeper understanding of the overall findings.

Primary research findings developed from surveys were obtained by sending questionnaires to 84 respondents who, in turn, completed and emailed them back to the researcher. The surveys were administered by giving the respondents an online questionnaire developed from Survey Monkey. The respondents’ views were captured and sampled using simple “yes” or “no” responses (see appendix 3).

They were provided with a link to the survey via email, which allowed the researcher to get their views on the research issues. The link was distributed to informants who worked in the property casualty business only. Initially, 100 respondents were sought to participate in the study, but 84 completed questionnaires were submitted. The survey was open for three weeks, starting from 12th November 2020 to 30th November 2020. Primary data was also collected using interviews after sampling the views of 12 respondents who worked as departmental heads. Appendix 4 shows a set of leading questions used to structure the interrogation.

Implementation

The data collected in this study were analyzed using the Microsoft Excel Software. The information was first captured in excel format and later converted to comma-separated values (CSV) for further analysis. Different sets of responses were captured in the investigation, including the collection of views from those who provided complete data to those who provided partial or inaccurate information. The main justification for documenting all these forms of data is to provide transparency in data collection. Comparatively, interview findings were analyzed using the thematic and coding method, which helps researchers to identify common patterns in responses, which could be used to answer the research questions.

Overall, the informants’ views were also presented anonymously in this report to protect their identity. This was done by delinking their views and identities from the organizations they worked for to prevent them from experiencing repercussions associated with participating in the study. All respondents who took part in the investigation also did so voluntarily, meaning that they were not given financial incentives or coerced into taking part in the study. All these ethical provisions were consistent with standards of conducting research outlined by Chichester University.

Findings and Analysis

Introduction

As highlighted in chapter three above, the researcher implemented a set of techniques to obtain data from the respondents. In this chapter, the findings related to this process will be presented and collated to understand how they have helped to meet the research objectives and answer the research questions. The first step in doing so is o report on the findings of the sure.

Survey Results

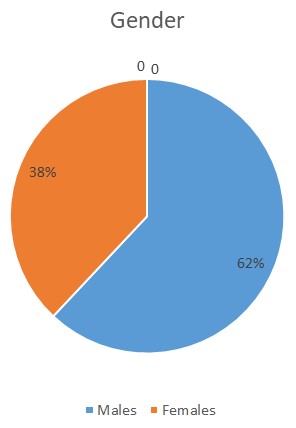

As highlighted in chapter three, the researcher initially intended to get the views of 100 respondents but only 84 of them sent back completed questionnaires. This figure translates to a response rate of 84%, which is an acceptable measure of survey results as stipulated by Sekaran and Bougie (2016). The first question posed to the respondents related to their gender and the findings is highlighted in figure 4.1 below.

According to the pie chart above, more men took part in the study compared to women. Indeed, the percentage of male workers who participated in the investigation was 62% compared to 38% of the female population. These statistics highlight the need to evaluate the findings from a gender perspective in the sense that the views presented in this chapter may be disproportionately skewed towards representing the opinions of male workers in the insurance industry.

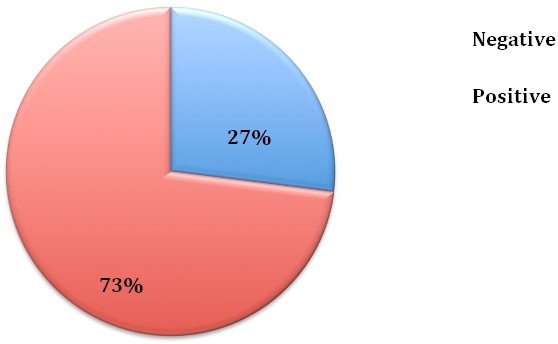

One of the research issues explored in the study was advanced automation, which related to questions 2-8 of the survey questions. In the first question (2), respondents were asked to state whether automation would have a positive or negative impact on their jobs and most of them (73%) believed that it would have a positive effect, while 27% disagreed with this opinion. The findings are presented graphically in figure 4.2 below.

The above findings reveal that most employees did not feel threatened by automation because they believed it would have a positive as opposed to negative impact on their personal and professional lives. This view is consistent with the results of the literature review findings highlighted in chapter 2, which showed that automation should have a positive as opposed to negative effect on businesses.

By extension, this statement implies that the finding of the respondents from the insurance sector are similar to those of informants sampled in other industries as well. Therefore, it could be deduced that the intricacies surrounding the effects of automation in the insurance labor market could be similar to the views sampled in other industries as well.

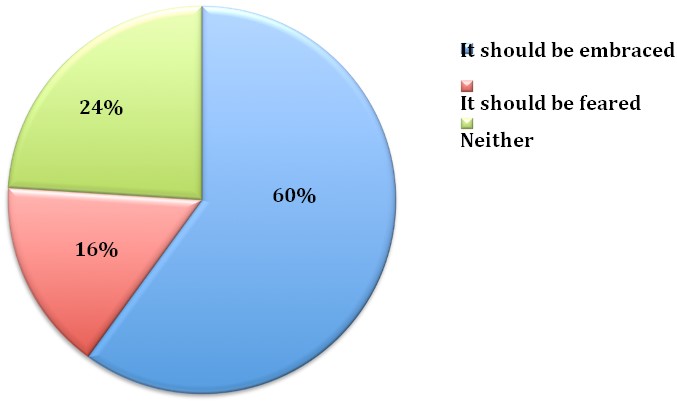

Question 3 in the list of survey questions sought to understand the respondents’ views regarding the impact that automation has on their fears of job losses. As highlighted in figure 4.3 below, most of the respondents (60%) believed that it should be embraced, while 24% of the respondents argued that it should neither be feared nor embraced. Only 16% of the respondents said it should be feared, meaning that the deductions made above are factual because most employees were unafraid of automation. Stated differently, only a minority of workers in the insurance sector were fearful of automation.

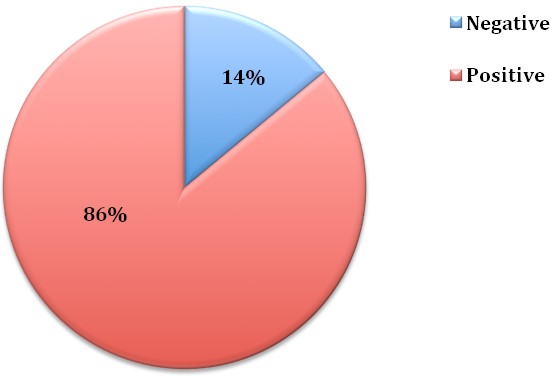

The next line of questioning posed to the respondents related to an assessment of the effects that advanced automation would have on their work and the results were consistent with the above-mentioned findings, because 86% of the respondents believed it would have a positive effect, while only 14% had contrary opinions. The findings are summarized in figure 4.4 below.

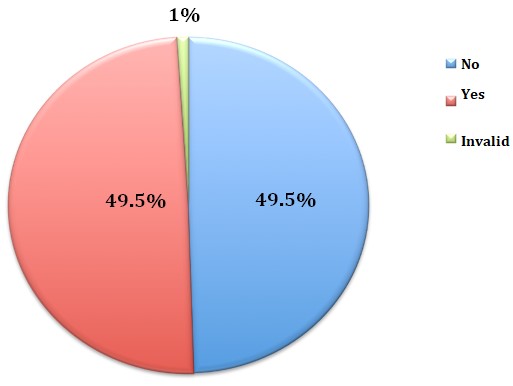

The above findings suggest that employees did not feel that automated or advanced techniques would have a negative impact on the industry. Therefore, regardless of the level of automation that as occurred, it was believed that its effects would be positive. The next level of questioning to the respondents was linked to the same topic because a question was posed to the respondents to sample their views regarding the effects that advanced automation would have on high skilled jobs. According to figure 4.5 below, an equal number of respondents agreed and disagreed with this position, while only 1% of them held neutral views. The findings are demonstrated in figure 4.5 below.

The above responses relate to the impact that advanced automation techniques has on different high-skilled professions in the insurance sector, such as underwriting, actuarial science, and claims adjustments. The findings reported above suggest that an equal number of respondents believed that automation would replace the above-mentioned skilled jobs as opposed to preserving the same. This even split in responses means that there is still a scanty understanding of the effects that automation would have on high-skilled jobs in the insurance industry.

The above findings are consistent with the views of Frey and Osborne (2013), highlighted in the literature review section of the study, which suggested that the effects of automation should be understood within the classification of job cadres. In other words, task categories were instrumental in understanding the effects of automation on the job market. While low-skilled workers are most venerable to the effects of automation, high-skilled employees are better protected from its effects. This observation could explain why there was a divided set of responses explaining the effects of automation on jobs.

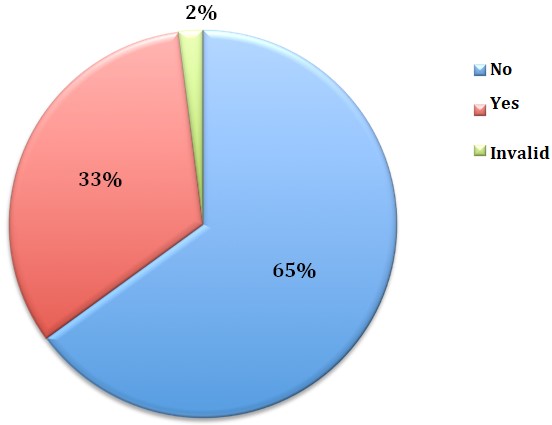

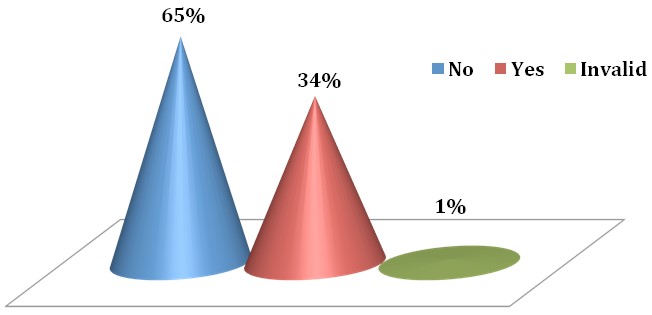

The next question posed to the respondents concerned the use of automation in their work. Specifically, they were asked whether they used the process in their work activities and the findings are highlighted in figure 4.6 below.

According to the above-mentioned pie chart, most of the respondents (65%) stated that they did not use automated techniques in their work processes while 33% said they did. These findings refer to some of the observations made in the literature review section of this paper, which showed that there was a low adoption of technology in the insurance sector, relative to other players in the financial industry. Therefore, the low percentage of informants who used automated processes could be a reflection of this fact.

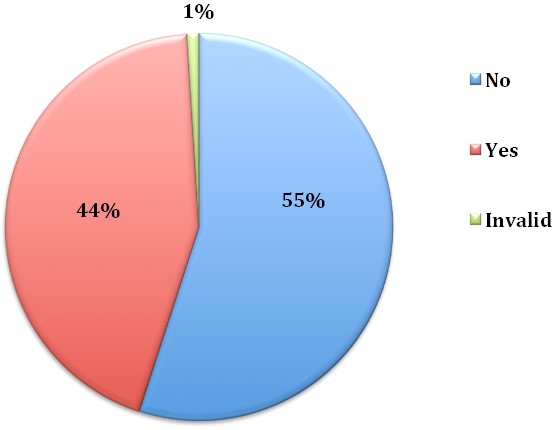

To understand the effects of automation on the insurance sector, the respondents were also asked to describe whether technology had caused a replacement of jobs in their profession and the results are highlighted in figure 4.7 below.

According to figure 4.7 above, 55% of the respondents feared that automation would cause job replacements in their professions, while 44% polled otherwise. One percent of the responses were invalid, meaning that a majority of the informants were of the view that automation was a threat to their jobs. This finding contradicts the views sampled from the literature review process, which stipulated that automation affected businesses positively. The discrepancy could be because of the belief that digitization equates to job replacement as opposed to an improvement of organizational processes.

This argument was advanced in the literature review section of the study where researchers pointed out that the fear of automation is unfounded because organizations stand to benefit from the technology as opposed to being negatively impacted by it. In this regard, there is a disconnect between what employees believe to be the real impact of automation on their lives and the perceived benefits that firms would enjoy from the process. Therefore, there is a clash between stakeholder and employee interests, which could account for the variation in findings noted above. To get a clearer understanding of the respondents’ views, they were asked to describe their feelings about the impact of automation on their jobs and their responses are summarized in figure 4.8 below.

According to the data highlighted above, most of the respondents believed that technology did not have a negative impact on their jobs and was thus not fearful of its impact. However, 34% of them argued otherwise by saying that they were fearful that automation would have a negative impact on their jobs. Again, these views highlighted the real and perceived dangers of automation on jobs.

Interview Results

Interview was one of the techniques used to gather data in this study alongside the survey method highlighted above. The questions posed to the respondents were based on three key pillars: historical review of the industrial revolution and its impact on the job market, effects of automation on the insurance industry, and the need to address digital skills gaps as preparation to address the impact of automation.

Historical Review of the Industrial Revolution and Its Impact on the Job Market

All the respondents who took part in the study acknowledged the effects that the industrial revolution had on the labor market. Of particular importance was the consistent assertion that it led to the integration of women in the workforce because men traditionally dominated the labor market, thereby changing the dynamics of the industry. In this statement, the respondents had a standard set of views, which suggested that the industrial revolution was an important change factor in the development of the labor market. However, their views differed when it came to the impact of the fourth industrial revolution on the market as highlighted below.

Effects of Automation on the Insurance Industry

Three of the respondents interviewed in the study believed that automation had a significant impact on the job market and that employees should be worried about it. However, one of them made a disclaimer and argued that employees who oversaw administrative activities were the most vulnerable to automation because most of their tasks are programmable. However, those who had jobs with subjective qualities, such as underwriting, had a lower degree of exposure to its effects.

This scattered impact of automation on different job groups highlights the same premise used by scholars, sampled in the literature review section, to describe the impact of automation on various job categories. To recap, they said that low-skilled workers faced the greatest threat of automation. The interviewees amplified the same view because they argued that some job groups stand a higher risk of exposure to automation relative to others.

Four of the respondents held a contrary view from the above statement and argued that employees should not fear automation as it only seeks to improve efficiency and not replace their jobs. To this end, they believed that technology has forced people to rethink their role in the job market – a process that does not necessarily mean the loss of a job. To substantiate this claim, one of the respondent said,

You see…. automation does not seek to make jobs obsolete – people will always be important. However, what I am saying is that people need to think of the new jobs that will be created from automation as opposed to reminiscing over lost jobs, or those that are on their way out. Therefore, for lack of a better term, I think automation upgrades the skills levels needed in the job market and those who have matching competencies will survive to demonstrate their understanding of these dynamics.

From the above statement, automation was seen as a complementary process as opposed to a destructive one.

Addressing Digital Skills Gap

All the respondents who took part in the study argued that there was a digital skills gap in the industry. However, their views differed on how to solve the problem. For example, one respondent said that people who have a higher educational qualification could easily fill the gap compared to those who are not knowledgeable about it. Seven of the respondents also highlighted the need to revisit all learning and training programs to make sure that they comply with new educational standards and policies. The exercise may force a rethink of the professional training approaches that have been used in the past and how they can be improved for better performance.

Preparation for Addressing the Impact of Automation

When asked to explain the preparedness levels for business leaders regarding automation, all the respondents, except for one, said that most managers were unprepared to address the effects of automation. The problem was traced to the low understanding of the impact of technology in the workplace. Particularly, it was reported that most employees took advantage of some of the benefits of technology to become lazy and complacent because they delegated most of their decision-making powers to technology and automation. In this regard, the preparedness of industries towards technology was largely context-specific.

Secondary Research Findings

Secondary research was the third method of data collection used in this study. It involved an assessment and review of the information collected from multiple research sources, including credible websites, reports, books and journals. The researcher paid special attention to the findings of reports prepared by PwC (2018) and McKinsey and Company (2020), which were instrumental in understanding changes in the labour market and the influence that automation has had on it. Through a careful review of these documents, three themes emerged in the study: historical role of industrial evolution and its effects on the job market, digital skills gap and preparation for the effects of automation on the job market (PwC, 2019; McKinsey and Company, 2020).

Excerpts of reports that discussed the historical context of the effects of the industrial revolution on the job market supported the respondents’ views of the research topic because there was a common understanding that technological changes have had a significant impact on the job market.

Comparatively, articles that talked about the digital skills gap also presented opposing views with some arguing that the digital skills gap was more prevalent among sections of workers in specific industries, such as insurance, and less common in others, such as the information and technological sectors (PwC, 2018; PwC, 2019; McKinsey and Company, 2020). These findings support the view that the effects of automation affect different cadres of workers based on the industry or organization they work for. Therefore, it could be deduced that the effects of automation are proportional across different groups of works in multiple and unrelated industries. Again, these findings also support the views of respondents sampled through the survey and interview processes.

The last theme that emerged from the review involved the preparation of managers or organizations about the effects of automation. In this assessment, the findings of the secondary review showed that the extent of preparation for the effects of automation moderated the effects of technology on the job market (PwC, 2018; PwC, 2019; McKinsey and Company, 2020). For example, managers who prepared their employees to participate in additional training to equip them with digital management skills helped them to improve the value of their skills in an automated work environment. These outcomes also support the survey and interview findings, which also highlighted the importance of management preparedness to accommodate changes brought by automation in the insurance industry.

Summary

As highlighted in this report, data was gathered from three sources: interviews, surveys and secondary research. Based on the findings presented in this chapter, the secondary research findings supported the survey and interview data. Therefore, there was consistency in responses across all three platforms of data collection and assessment.

Conclusion and Recommendations

Conclusion

This study aimed to understand the impact of the fourth industrial evolution on automation processes in the insurance sector, relative to the industry’s preparedness to handle its effects on jobs. Data was obtained from secondary and primary research sources with the findings revealing that the effects of automation on the insurance job market is fragmented with lower skilled workers and the less educated bearing the greatest burden of labor market shifts. Comparatively, other cadres of employees are better equipped to manage labor market changes because most of their tasks are not easy to program as they contain subjective elements of operation, which cannot be effectively captured in a simple algorithm. Therefore, employees who carry out simple tasks in an organization, which can be automated, suffer the highest risk of job losses.

Key trends that are informing the above changes to the insurance industry stem from years of job market evolutions that have seen insurance firms, through their property causality businesses, look for cheaper and more effective ways of carrying out their processes and activities. Automation and digitization are the biggest trends underpinning the change and concerns about efficiency and profitability seem to be overshadowing concerns about the negative impact that such changes would have on the job market. The connection between these themes in this research report was explained through the consistency of interview, survey and secondary findings.

The findings derived from the three sources of information highlighted above helped to address the research aim and objectives of the study. For example, the secondary research findings were useful in explaining the theoretical framework and historical context of the effects of automation on the job market. These explanations helped to contextualize the primary research findings within developments in the job market that have been previously covered by extant theories or researchers who have previously studied the effects of automation on other industries. The use of three sources of data collection highlighted in this paper also helped to meet the first two objectives of the study, which were predicated on conducting a primary research to understand the key effects of the industrial evolution on the job market and secondary research to comprehend what employees are doing to update their skills. Particularly, the survey process helped to understand the preparedness of business leaders regarding the impact of automation on jobs and by integrating primary and secondary research findings, conclusions about the impact of automation on the insurance sector have been drawn. This was also one of the objectives of the study.

The information presented in this document can be improved by expanding the scope of the analysis to encompass other industries besides the insurance field. Doing so would help to compare the impact of automation on the industry, relative to others in the financial sector, which have similar dynamics. The review would help to broaden their understanding of the effect that automation has on the job market. At the same time, the exercise could help stakeholders in the insurance industry have a broader understanding on how to better prepare or improve their adoption of automated techniques in their organisational processes.

Coming up with the above-mentioned findings was a daunting task because the researcher had to coordinate the data collection and analysis processes to have a broader understanding of the main research issues involved in the use of technology to bridge employee skill gaps and meet stakeholder goals in the insurance industry. This process was time-consuming because of the need to schedule interviews to align with the respondents’ convenience timing and the importance of undertaking a member-check technique to affirm the credibility and validity of information provided. These key steps of the data collection and analysis consumed most of the time involved in preparing this report.

Furthermore, to deliver the project on time, it was essential for the researcher to omit incomplete data, or information that was not submitted on time. Overall, the findings presented in this document are indicative, meaning that they contain abstract elements involving the use of technology to bridge employee skill gaps and meet stakeholder goals in the insurance industry. Therefore, they should be cautiously used to improve organizational processes in the industry because they are not organization-specific.

Recommendations

This study has highlighted the importance of using technology to bridge employee skill gaps and meet stakeholder goals in the insurance industry. The evidence gathered has also been used to refer to multiple aspects of technological development, including artificial intelligence, robotics and the likes. Future research should focus on exploring the effects of key aspects of technology, such as artificial intelligence on the insurance industry. This investigation could help to contextualize the findings of this report in a technologically specific manner to avoid making generalizations about the impact of the technology on the industry.

The above-mentioned recommendations are realistic because the insurance industry is undergoing significant transformation and changes based on the use of multiple technological processes. Identifying the specific impact of one type of technology on the industry could help to better understand its effects on the labor market. The relevance of doing so is hinged on the need to train employees to use specific technologies because they have different capabilities and impacts on the industry.

This next phase of research should be undertaken in recognition of the multiple options available for business leaders to understand the ramifications of different types of technologies on their business practices. Particularly, the information collected from this new area of study needs to be integrated into the training and development policies of insurance firms to better equip their employees with the skills needed to manage different types of technologies.

References

Barry, L., & Charpentier, A. (2020). Personalization as a promise: Can big data change the practice of insurance? Big Data & Society, 4(2), 1-10.

Berry, C., & McDaniel, S. (2020). Post-crisis precarity: Understanding attitudes to work and industrial relations among young people in the UK. Economic and Industrial Democracy, 4(1), 1-10.

Drahokoupil, J., & Jepsen, M. (2017). The digital economy and its implications for labour. Transfer: European Review of Labour and Research, 23(2), 103-107.

Everest Group. (2018). Insurance firms digital skills gap. Web.

Frey, C., & Osborne, M. (2013). Improving technology now means that nearly 50 percent of occupations in the US are under threat of computerisation. Web.

Gallie, D., Felstead, A., Green, F., & Inanc, H. (2017). The hidden face of job insecurity. Work, Employment and Society, 31(1), 36-53.

Hughes, C., & Southern, A. (2019). The world of work and the crisis of capitalism: Marx and the fourth industrial revolution. Journal of Classical Sociology, 19(1), 59-71.

Islam, I. (2018). Automation and the future of employment: Implications for India. South Asian Journal of Human Resources Management, 5(2), 234-243.

Kara, H. (2015). Creative research methods in the social sciences: A practical guide. New York, NY: Policy Press.

Kishtainy, N. (2017). A little history of economics. London, England: Yale University Press.

McFall, L., Meyers, G., & Hoyweghen, I. V. (2020). Editorial: The personalisation of insurance: Data, behaviour and innovation. Big Data & Society, 9(2), 1-11.

McKinsey and Company. (2020). Transforming the talent model in the insurance industry. Web.

Northern Ireland Council for Voluntary Action. (2018). The impacts of the fourth industrial revolution on jobs and the future of the third sector. Web.

Patten, M. L., & Newhart, M. (2017). Understanding research methods: An overview of the essentials. London, England: Taylor & Francis.

PwC. (2018). Preparing for tomorrow’s workforce, today. Web.

PwC. (2019). The macroeconomic impact of artificial intelligence. Web.

Research Gate. (2020). Research onion. Web.

Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach (7th ed.). London, England: John Wiley & Sons.

Skidelsky, R., & Craig, N. (Eds.). (2020). Work in the future: The automation revolution. New York, NY: Springer Nature.

Stokes, P. (2017). Research methods. London, England: Palgrave Macmillan.

World Economic Forum. (2016). The future of jobs. Web.