Executive Summary

Automated accounting system offers a number of business solutions to various organizations. Many businesses have adopted this model in efforts to keep up with changes in the telecommunications sector. The solutions offered by accounting firms vary depending on the functions required. For instance, a given company may require solutions for billing, payroll, or the development of financial reports (Hall, 2001). Initially, such functions were carried out manually. However, the technology age has made it possible for such operations to be solved through an automated system. The current paper examines how such automations can be implemented in a hypothetical accounting agency.

The paper begins by introducing the problem at hand. A small accounting firm intends to expand its operations. Fortunately, the organization accesses a new client who brings more business to the firm. In the introduction, the author examines the details regarding the company as far as the name, personnel, and operations are concerned. The accounting firm in reference is Maidas. The new client is a home owners association that is in the process of acquiring a number of organizations. The acquisition will ultimately increase the size of the association. The introduction section addresses the importance of the large company with reference to the growth of Maidas.

The new client is bringing its operations to Maidas with the intentions of shifting to a single system. The companies acquired by the initial home owners association were already making use of an automated accounting system. More specifically, the other associations relied on Sage and QuickBooks to handle their accounting operations. Interestingly, some of the associations acquired simply relied on Microsoft Excel to carry out their financial activities. The need for a single accounting system is, as a result, justified. Midas is free to apply an accounting system of its own liking.

The second section of the paper delves into the proposed requirements of the system. To this end, the main functions that require accounting solutions are outlined. The section examines the billing, collection, payments, payroll, and financial reporting as the major accounting operations. The specific requirements of the said functions are discussed from the perspective of three main parameters. The input, output, and control requirements support the discussions regarding the system functions.

The author then proceeds to the outsourcing element of the whole operation. Evidently, Midas does not have the capacity to handle the demands of the new client. Consequently, outsourcing becomes a viable option. Specifically, the paper focuses on the billing function given the sensitivity of this functionality. Maidas will not outsource the entire billing system. The partial outsourcing is intended to ensure that the said functions are handled efficiently. The process will obviously be carried out by a highly experienced and capable firm.

The paper also examines the system selection. Three PC-based accounting solutions are assessed. Specifically, the author of the paper outlines Sage 50, Acclivity, and Intuit as the main accounting software. The three are used to provide accounting solutions. They are evaluated based on their respective strengths and weaknesses. After a thorough analysis, the Acclivity software is found to be the best for Midas. The program is best suited to the operations of the firm owing to its user friendliness and affordability.

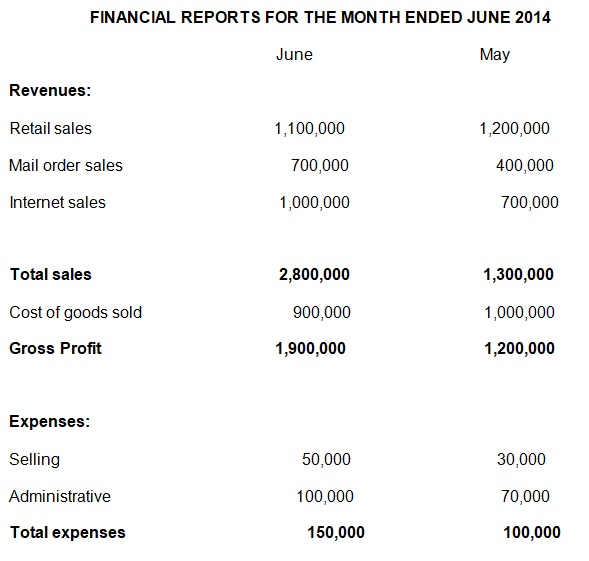

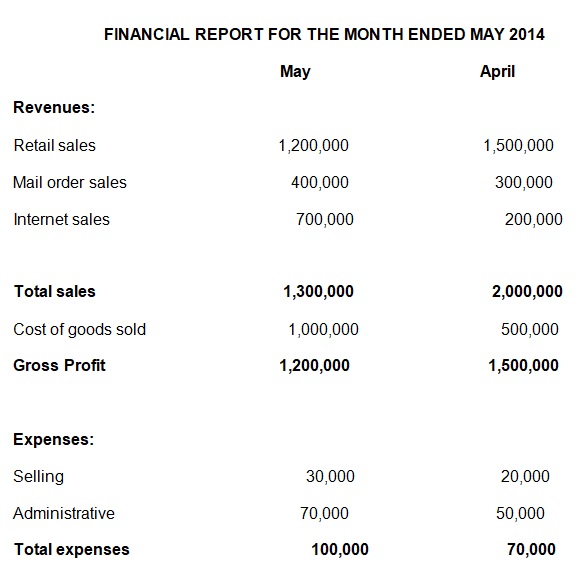

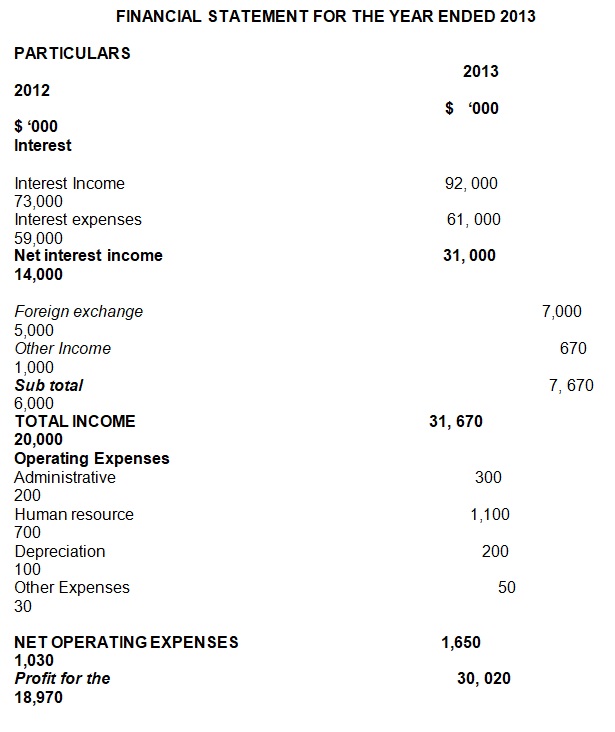

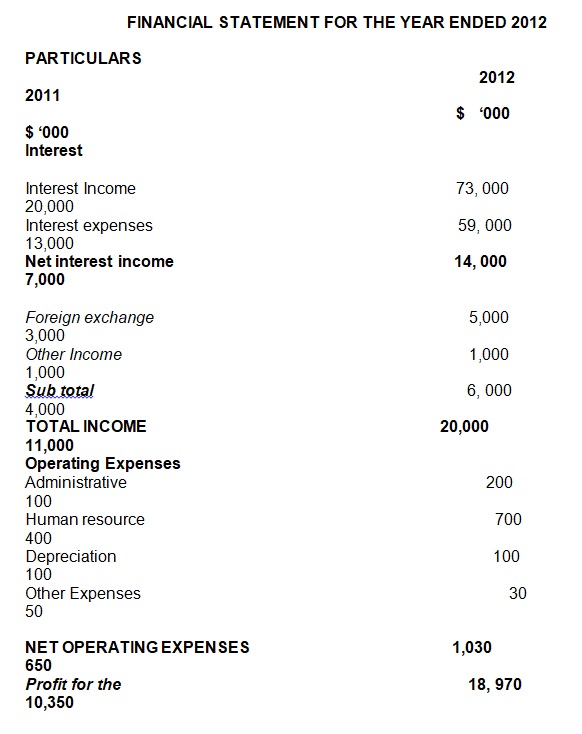

The paper concludes by highlighting the various challenges facing implementation of the project. Training is illustrated as the major obstacle. Secondly, the ‘usability’ of the software is discussed with focus on the complexity of accounting systems that are outlined. An appendix is provided at the end of the paper. The section illustrates sample reports for the firm.

Introduction

Maidas is a small CPA practice operating in downtown Manhattan, New York. The firm has 6 employees, all of whom are Certified Public Accountants (CPA). Over the past five years, Maidas has provided its clients with services related to tax and other financial elements. The venture has been successful and the management feels that it is time for an expansion program. One of the ways such a firm can expand its business is through the acquisition of a larger client base. Fortunately, the company’s new client is a home owners association with a membership of 1000. The new client intends to acquire other home owners associations that will see its membership triple.

Maidas’ role as an accounting organization is to ensure that the transaction is successful. The company will achieve this objective by providing suitable accounting solutions. According to Romney and Steinbart (2006), the technology age requires automated solutions to various business challenges. The home owners’ association prefers a single automated accounting information system. Romney and Steinbart (2006) suggest that such technology helps organizations to handle billing, collections, payments, and other accounting solutions. The home owners association contracted Maidas to carry out these activities given its (Maidas’s) capabilities.

Automated accounting systems are essential in the process of making business decisions. The acquisition mentioned earlier is set to increase the responsibilities of the home owners association. Under such circumstances, automated systems ensure that all relevant financial information is consolidated for evaluation at a later date (Romney & Steinbart, 2006). The automation helps to make sure that all the relevant calculations and analyses are carried out in a correct and accurate manner.

The new system is an important aspect in financial process management. According to Romney and Steinbart (2006), it helps to monitor the expense and income accounts of a given enterprise. There are various reasons why the home owners opted for Maidas as the preferred accounting agency. One of them is the fact that the company has offered solutions to the association’s collections and payments needs. The members of the group usually make monthly contributions. The automated system will hasten the processing of these contributions. They will be carried out electronically. In line with this, the company intends to create an automated billing system that ensures members remit payments in due time.

Automation of financial services helps an organization to monitor its expense accounts, as already mentioned. The home owners have a number of items in their expenses list. Romney and Steinbart (2006) point out that the most common expense item brought to accounting firms involves payments. The association has intimated that it would prefer a system that will help it cater for the payments it will be making. Most of these processes range from office supplies to the day-to-day running of the company. With the help of the automated system, Maidas will ensure that the objective is achieved.

Large organizations, such as the home owners association, opt for accounting solutions to deal with the issue of payrolls. Effective management of the 3000 members requires an able workforce whose payment must be enforced. Romney and Steinbart (2006) argue that an automated system ensures that the payroll is made in a timely manner. The client indicated that the 50 employees will require bi-weekly payments. Consequently, an efficient accounting procedure will guarantee all the employees are paid. Other benefits of the system include the coalescing of information that will eventually be used in the development of financial reports.

Proposed System Requirements

The automated accounting system envisioned by Maidas is expected to respond to a number of the demands and requirements expressed by the client. According to Hall (2001), single automated financial programs help an organization to carry out a number of functions. Such processes range from billing and payments to payrolls. The homeowners association is convinced that Maidas can handle the processes required to enhance the operations of the firm. Maidas has the capabilities to meet these objectives. It has a history of offering some of the best accounting solutions in the region. In this section, some of the system requirements for the proposed project are discussed in detail. The discussion outlines the necessary inputs, outputs, and control requirements.

Billing

Input requirements

It is noted that the billing will be carried out on a monthly basis. Simkin and Rose (2013) are of the opinion that an organization is required to outline the period within which bills for income and expenditure accounts should be submitted. Such an arrangement makes it possible to carry out financial accounting processes for the firm. The clients for Maidas in this case are the homeowners who are members of the organization. To handle such a base of client, a monthly billing system is required. The installation of such a system is in line with the monthly requirements of tenancy. Table 1 is an illustration of the data required to achieve this objective:

Table 1: Data required.

The relevant information will be entered into the rows and columns in the table above. There are 6 parameters that constitute the data to be used to meet the input requirements. The individual homeowner will be identified using a unique code. An example is H.O.1, which appears in table 1 above. As already indicated in this report, the association has a membership of 3000 homeowners. As such, the code for the last member will be H.O.3000. From table 1, it is apparent that it will be important to include the date that the payment is made. The aim is to ensure that defaulters can be fined accordingly. In addition to the details of the individual members, the type of house and location must be included as the other elements of input requirement.

Output requirements

The output requirements for the billing function reflect the information fed into the system as input. According to Romney and Steinbart (2006), the output elements are a mirror image of the input requirements for the new system. In essence, the data that constitutes the output parameters is similar to the one used in the input requirements illustrated in table 1. However, subtle discrepancies between the two sets of data are evident. For instance, the number of persons who have remitted their payments and the common dates of remittance will be additional aspects of the output requirements. The two sets of information (individuals who have paid and the day the settlement was made) are unique to the output side of the system. They are not part of the input requirements.

Control requirements

The billing process can fail to materialize for a number of reasons. For example, the system may fail in the event that proper measures are not put in place to secure the input and output procedures. According to Simkin and Rose (2013), control requirements enhance the success of a given accounting function. In the case of Maidas and the homeowners association, the accounting element in question is the billing system under review. The first regulatory condition involves the application of an antivirus. Using an antivirus software will ensure that the data entered into the system is not lost. The second control measure is the creation of a back up database. The back-up is meant to safeguard the data in case of loss or damage to the system. It is important to note that technology is vulnerable to failures and other forms of hazards. For example, the hard disc can be damaged through an accident. A back-up plan ensures that the data in such damaged hard discs can be retrieved.

Collection requirements

Input requirements

The collection requirements involve the payment details of each of the members affiliated to the association. Under such circumstances, an accounting firm is required to carry out a number of procedures to enhance the management process. For example, the firm is expected to generate a profile for each of the member. Yoshikawa (2001) suggests that such profiling can be carried out by tabulating the particulars of the individuals who are supposed to effect payment. In this case, the data for all the 3000 members will be tabulated. Table 2 below is an illustration of the specific data necessary to meet the input requirements for the collections function:

Table 2: Data required in meeting the input requirements.

Table 2 indicates 6 parameters that make up the data for the input element with respect to collections. Hall (2001) suggests that when it comes to collection, vital information relating to the client should be recorded. The information will help the firm or party managing the collection process to execute the function. The profiling of individuals creates a direct interface with the client. As a result, the collection process becomes easy. The specific member of the association is identified by a unique code, making this requirement similar to that of the billing function. The physical location of the member is recorded so that the collections can be channeled electronically. Alternatively, the collections can be carried out physically. To achieve this objective, the physical address of the member comes in handy. It allows the party charged with the responsibility of collecting debt to issue the individuals with a reminder for payment in case they delay.

Output requirements

The collection aspect of the proposed system is unique given that it gives the organization the opportunity to interact with the members. For example, the firm will come into contact with the individuals in the process of collecting payments. To this end, it is important to put in place measures to ascertain that the collection was indeed carried out. The data for the output requirements is almost similar to that used in the input function. The only difference in the parameters is that the output data indicates the members whose collections have already been received. The rest of the particulars remain the same.

Control requirements

The data representing the collection requirements is very sensitive. As illustrated in table 2, the particulars depict the exact location of the members of the homeowners association. Consequently, there is a need to safeguard the said information. To this end, the main control requirement is the introduction of stringent security measures. Such measures must ensure that the said data does not get into the wrong hands. At all times, the privacy of a company’s clients must be guaranteed.

Payment Function

Input requirement

The automated accounting system is expected to generate a total of 100 checks. The payments are intended to cater for a variety of expenses. An accounting firm should settle for a preferred cycle of payments (Romney & Steinbart, 2006). The cycle can be monthly or quarterly. The selected option depends on, among others, the agreement between the various stakeholders involved. Maidas intends to honor monthly payments to the homeowners association. Table 3 below is an indication of the data pertaining to the payment requirements:

Table 3: Input data for payment requirements.

The homeowners association has 6 main expenses. Table 3 indicates the expenses as office supplies, rent and utility expenses. Additional expenses included maintenance of the lawn and handling of refuse and the disposal of waste together with snow. According to Yoshikawa (2001), such payment is made either in cash or through checks. The first column in table 3 is dedicated to the amount paid in correspondence to the service being paid for.

Output requirements

The output requirements depict whether the payments have been effected. To this end, the information presented in table 1 is a reflection of the output requirements. According to Yoshikawa (2001), an automated accounting system is expected to evaluate payments and the same can only be realized once there is sufficient information pertaining to the payments. To this end, the output requirements include a comparison of such expenses from previous months

Control requirements

The expenses outlined are only carried out under the express authority of the client. Consequently, an automated accounting system must ensure that the unauthorized expenses are not executed. Under such circumstances, Yoshikawa (2001) advices that strict measures need to be put in place to ensure that only authorized payments should be made. Effectively the payments system must be set not to exceed a certain limit. The limit is set based on projected expenditures.

Financial Reporting Requirements

The performance of a company is evaluated courtesy of the financial reports. In the current paper, it has been intimated that an automated system is best suited for the auto generation of financial report. However, Hall (2001) suggests that financial reporting is based on a number of factors like the operating capital, assets and the profits made by a given organization. Also included in the financial statement is the tax information. Hall (2001) insists that taxation is a requisite in business outlet. The input requirements will include a number of data sets, which are illustrated in table 4 below:

Table 4: Data needed for financial report.

Table 4 indicates seven different categories associated with the input requirements. Hall (2001) indicates the primary data of a financial report is the revenue base. To this end the aspect of taxation, sales and interest make up for the revenues an organization makes. The second aspect that constitutes the input requirements is the expenses. A financial report requires the total expenses in terms of cost of goods and services, loss on asset sales and interest accrued due to financing. Additional data on that front involves all forms of subsidies, benefits or grants.

Financial reports require information involving assets. To this end, the input requirements involve financial assets and on-financial assets. Hall (2001) further suggests that additional input requirements include liabilities. Under this category, data on a company’s debt and employee provisions are outlined. Additional input requirements include accumulated results and reserves and contingent liabilities. The input requirements also incorporate a series of years upon which the input material is compared.

Output requirements

The output requirements make up for the information depicted in the financial reports. The actual figures that relate to the data presented make up for the output material. For instance if the liabilities for the 1st year are x, then that constitutes the output date on the subject. To this end, the parameters listed in table 4 are used to generate the actual output requirements in relation to the financial reports.

Control requirements

Financial reports are quite sensitive. A slight error can result in misrepresentation. To this end, a suitable formula is developed to carry out the calculations. According to Hall (2001), manual calculations should be avoided at all costs. The errors that result from such computations have a direct impact on the analysis that will be made with reference to the company in question.

Payroll Requirements

The homeowners association intends to engage the services of 20 full time employees. Given the magnitude of work to be carried out, there is a need for part time employees. Hall (2001) insists that companies engage the services of part time employees to minimize the cost of a bloated workforce. The wages of the employees will be remitted twice a week. The requirement of a payroll system is that money for that purpose is kept in a payroll checking account. Table 5 is an illustration of the input material to this effect:

Table 5: Data for the payroll.

Table 5 illustrates the general details in relation to the payroll system. The input data includes the category of employee and amount paid per half week. Table 5 is condensed in such a way that the respective row for the employees is split into the number of employees. The two other columns represent the bi weekly payment for each other the categories of employees. The input data is presented as illustrated in table 5 owing to the need to have an estimate on the recurrent expenditure I terms of the wage bill of the organization

Output requirements

The output requirements in this case refer to the data regarding the wages paid to the employee. Table 5 indicates the spaces that ought to be filled out to represent the wages of the employees. Once the said information is incorporated into the table then the same can be seen as the output requirements. The same will provide a detailed analysis on the position of the company to engage more human resource.

Control requirements

Similar to the financial report, the payroll is prone to errors. To this effect, it is imperative that a foolproof security system is installed. Hall (2001) envisions a scenario where the payroll delays and workers fail to get their wages. The resultant effect is a demoralized workforce. A control measure to that effect would be timely processing of the wages.

Proposed Outsourced Functions

An accounting firm provides a number of financial solutions to its clients. However, in the interests of efficiency, there are a number of functions which are outsourced. The element of outsourcing formed the basis of a study by Gandja and Degos (2012). The study examined the strategies that a company can use to outsource certain accounting functions. Gandja and Degos (2012) based their study on the fact that most small scale accounting firms do not have the full capacity to handle multiple accounting functions. Outsourcing becomes a viable option in the event that an accounting intends to satisfy their customers’ demands.

Companies generally outsource functions that have a high cost of operations, in relation to the normal operations. Romney and Steinbart (2006) issue a disclaimer regarding outsourcing to the effect that the same should be done by an experienced firm. Given the magnitude of work to be handled by the new firm such functions like billing and payroll are significant roles which cannot be effectively handled by Maidas. Maidas’ capacity is not yet up to par to handle multiple functions as aforementioned.

As far as billing is concerned, the clients prefer a system that will generate an itemized bill which is to me remitted t each of the members in the association. Presently, the system at Maidas is capable of handling up to 1700 bills. Given the short duration in which the client wants the bills relayed to the members, it becomes necessary to outsource a portion of the billing to a more capable firm. Gandja and Degos (2012) recommend partial outsourcing of a given function. In so doing a company demonstrates goodwill in executing the said function.

Maidas intends t outsource the billing function out of all the functions required by the client. As already illustrated, the high number of members in the homeowners association makes it difficult for the firm to effectively carry out the said function. Gandja and Degos (2012) cite a similar conundrum in their study. The crux of the matter is the inability to handle varying amounts of bills. The fees are set to vary between $100 and $200 per month. The variance is based on the location and type of home. The billing is also required to incorporate defaulters. Late fees attract a 20% fine of the normal monthly charges. Given the mailing requirements of the 25th of every month, Maidas might not be able to beat the said deadline. Consequently, outsourcing becomes a viable option.

The proposed outsourcing is intended to be of benefit both to Maidas and to the clients. Gandja and Degos (2012) point out that outsourcing frees and organization to take up more work. As already illustrated, the new client’s project is expected to eat up into the company’s operations. However, by outsourcing certain accounting functions the productivity of the accounting firm is ensured. Consequently, such an outlet is free to take on other responsibilities, which may include new clients. In the case of Maids, the outsourcing allows them to meet their expansion objective by accepting other clients while still retaining the ones they have.

The homeowners association brought their business to Maidas. The company is expected to provide solutions to the accounting functions illustrated. By outsourcing some the billing function, Maidas ensures that, its client gets their money’s worth. Gandja and Degos (2012) recommend that any function, proposed for outsourcing, ought to be carried out by experienced accounting firms. To this end, the client is assured of quality, in terms of billing.

System Selection

In the introduction of this paper, the benefits of an automated accounting system were vividly illustrated. Yoshikawa (2001) reiterates the importance of automated accounting to an organization, arguing that it saves a company a multiple business working hours. The said benefit cannot be realized without a suitable PC-based accounting system. In this section of the paper an evaluation of the same is carried out basing on the available technology. 3 PC=based technologies are assessed based on their strengths and weaknesses. Consequently a preferred system is recommended based on the assessment.

The various desktop-based accounting systems provide a number of accounting solutions. Hall (2001) argues that most systems, available in the market, can carry out a number of functions. The functions include bookkeeping, taxes, payrolls and even preparing financial reports. Depending on the nature of information required, a system can yield expected results in a shorter time compared to an experienced accountant. However, that doesn’t imply that the human interface is rendered redundant. The diversity I technology presents a number of accounting systems which can be used depending on a company’s preference.

In the current accounting climate, there exist a number of PC-systems, which are essentially software. Romney and Steinbart (2006) posit that technology in the industry has advanced to a point where actual installation of such software is not necessary. All that an accountant required is a web-based subscription. That notwithstanding, a desktop system is most preferred by a number of companies (Romney & Steinbart, 2006). However, there is still a considerable number of companies that prefers to rely on cloud services for their accounting solution services.

The three PC-based systems, evaluated, include Sage 50 Complete 2013, Intuit QuickBooks Premier 2012 and Acclivy AccountEdgePro 2012. As envisioned in the introduction, Maidas’ new clients require accounting solutions like payroll financial reports and tracking of incomes and expenses. Simkin and Rose (2013), also cite the three systems affirming their ability to provide the said solutions. However, through a comprehensive evaluation of the three, a suitable package will be selected for applicability by an organization like Maidas.

Sage 50 Complete

A suitable accounting system is one that is universally compatible. Hall (2001) argues that accounting firms tend to vary in terms of size among other factors. To this end, PC-accounting systems are required to fit into any organization. Sage 50, in a 2012 review, was found to have the best fit, particularly among small businesses (Gandja & Degos, 2012). The element of compatibility has always been a thorny issue among small business holders. However, this particular system overcomes other stereotypes by addressing the universal compatibility issue.

Automated accounting systems are required to exhibit diversity in terms of the accounting functions required. Gandja and Degos (2012), while outlining the reviews of the Sage 50, point out to its versatility. The system has a wide array of reporting options coupled with a number of inventory functionalities. Gandja and Degos (2012) recommend the use of this particular system among small companies since it is user-friendly. The user-friendliness eliminates extra costs of training personnel.

In point form, the following are the strengths associated with Sage 50:

- It is characterized by multiple –marketing options that help in promoting the services offered by the company.

- The system allows for an upgrade. As such, it reduces the costs of acquiring a new one.

- It has several reporting options.

- The system has a targeting messaging service.

Like any other system, the Sage 50 has a number of weaknesses that limit its usability. The following are some of the limitations associated with the software:

- The system does not support more than one currency.

- It has a single location inventory.

- The software is not compatible with the Mac operation system.

Acclivity AccountEdge Pro 2012

One major principle of doing business is ensuring that operating costs are kept at an all time law. Yoshikawa (2001) argues that many small accounting agencies have a challenge in automating their services owing to the high cost associated with most accounting software packages. However, Yerdena (as cited in Simkin and Rose, 2013) quotes the purchase price for single-user software at $ 299. The price for an additional user is reduced to $149 with an upgrading being priced for only $159.

As mentioned earlier, the risk factor associated with accounting systems is brought about by the usability. Romney and Steinbart (2006) argue that most accounting systems are so complex that the end-users find it intimidating. Interestingly, the AccountEdge Pro 2012 overcomes this usability hurdle. According to Yerdena (as cited in Simkin and Rose, 2013), this particular software allows a user to tackle it in chunks. For instance, when one wants to set up a company profile the system provides a step-by-step template of all the details that are required. The system’s only shortcoming is its restriction to windows operating systems only.

Intuit QuickBooks Pro 2012

The market for small businesses is growing, with the notable increase in such businesses. Yoshikawa (2001) posits that accounting systems find acceptability among small businesses owing to their increasing numbers. The most common reason as to why the system is mostly used among small businesses is the affordability and usability. According to Yerdena (as cited in Simkin and Rose, 2013), the Intuit software can be used by people with little knowledge on accounting. That notwithstanding, the system does not reduce the working requirements of a standard accounting system

The Intuit QuickBooks Pro 2012 is fast. Yerdena (as cited in Simkin and Rose, 2013), rates its speed as being similar to top notch systems. Once fired up, a user can start incorporating information in less than 30 seconds. In addition, the system is designed in such a way that the user can have multiple screens. The systems allows for synchronization of account details making the processing of information even faster. Unfortunately, the system is only applicable for windows uses. The same makes it incompatible for other operating systems.

Having evaluated the three respective accounting systems it is important to appreciate the fact that all three can be used by any organization. Maidas, by virtue of being a small sized accounting firm, does not have the resources to spend on expensive systems. The company only uses Windows operating systems making all three systems suitable for use in the company. However, when it comes to cost, Sage 50 is the most expensive followed by Intuit. On the cost front, Acclivity has an upper advantage. Also, the system is suitable for a growing company like Maidas owing to the versatility it exhibits.

Challenges to Automation

The automation of accounting systems has great benefits to a given company. The same benefits extend to the clients who subscribe to the accounting solutions offered by the company in reference. However, the implementation of the accounting systems is not devoid of certain challenges. According to Simkin and Rose (2013), most accounting firms fail to adopt the automated system wing to the myriad of challenges that are presented. In this section, some f the challenges are outlined. The objective of outlining the challenges is to allow discussions on how they can be overcome for the benefit of the company.

The first challenge to automation is the aspect of training. The automated accounting system requires a professional touch. According to Simkin and Rose (2013), holders of CPA certificates, in many cases, have a theoretical perspective to the operation of the system. Consequently, when the system is introduced into an organization, unskilled personnel will not realize the full potential of such systems. A company that adopts such a system is thereby required to train the personnel on the handling of the system.

The automated accounting system is a complex procedure. In most cases, companies engage the services of the system providers for the aforementioned training. Simkin and Rose (2013), suggests that the cost of training is often too high that small accounting firms are unable to meet. Consequently, such firms end up missing on the benefits that are found in implementing the automated system.

Also, training a company’s employees is not a guarantee that they will retain their services in that organization. When the trained workforce seeks employment elsewhere, a company is required to train others. Such situations inhibit the implementation of the accounting system, particularly among small accounting firms (Gandja & Degos, 2012). The expense of recurrent training is too high for such small firms.

System operation is also another challenge with respect to the automation of accounting systems. A similar perspective on challenges to automation is highlighted in the study by Gandja and Degos (2012) wherein sentiments of authenticity, security and accessibility are mentioned. The operation of the system is expected to yield authentic results. The information depicted from the reports, calculations and analyses, ought to be original. Any form of duplication and counterfeiting reduces the authenticity of an accounting system. Given the electronic nature of the system the same is prone to external interference. By the click of a button, calculations can be manipulated to suit a particular interest.

The authenticity conundrum presents another challenge to the implementation of an automated accounting system. Simkin and Rose (2013) argue that the possibility of tampering with the originality of certain financial reports, raises integrity issues around the entire system altogether. The end-users raise questions as to whether the information provided can be trusted. Such doubts create skepticism, which forces certain companies to shun the system altogether (Simkin & Rose, 2013). To this end, much sensitization on the importance of the system ought to be carried out to ensure rumors do not end up inhibiting the uptake of this lucrative system.

The risk factor associated with the automated accounting system, is one of the challenges it faces in its implementation among various accounting firms. The electronic nature of the automated accounting system, presents damage risks to the financial information being handled (Simkin & Rose, 2013). For instance, Maidas’ handling of the payroll for the homeowners association presents a scenario where the information can be lost in the event of a slight error in the system. A restoration of the error might be inconclusive, resulting in wrongful payment. Such risks inhibit the general applicability of the system.

Organizations that intend to implement an automated accounting system must ensure that a comprehensive risk assessment is carried out. Simkin and Rose (2013) suggest that depending on the variables present, the risk can either be high or low. A high risk is presented in scenarios where the accounting system is part of a larger intricate system. The same is common among many large corporations. Also, a high risk presents itself when an organization fails to provide adequate back–up for the information stored in their system. A high risk can also result in cases where companies use extremely high-end systems due to the diversity of technology in the market but fail to invest in the skilled labor.

The low-risk, mentioned, results in cases where a system is characterized with an extremely small number of interfaces. According to Simkin and Rose (2013), most small-sized firms lack the ability to carry out disaster recovery procedures thereby resulting in low-risk scenarios with reference to the automated systems. Low-risk scenarios are also evident in cases where an organization is unable to adopt the new technologies in the market. Consequently, its performance is reduced by the ineffective technologies. The risk factors reduce the viability of an accounting system, thereby presenting a challenge in terms of the performance.

References

Gandja, S., & Degos, J. (2012). Outsourcing strategies of accounting functions in a developing economy: A study of the determinants by a triangulated approach. African Journal of Accounting, Auditing, and Finance, 1(4), 319.

Hall, J. (2001). Accounting information systems (3rd ed). New Jersey: South-Western Publishing.

Romney, M., & Steinbart, P. (2006). Accounting information systems (10th ed.). Upper Saddle River, N.J.: Pearson Prentice Hall.

Simkin, M., & Rose, J. (2013). Accounting information systems (12th ed.). Singapore: Wiley.

Yoshikawa, E. (2001). Framework for automation of accounting systems. Tokyo: Ashunze.

Appendix

Appendix 1: Financial Statements

Appendix 2: Financial Reports