Introduction

Arsenal Holdings Plc operates a professional football club and is also engaged in the related commercial activities. There are a number of property development activities undertaken by the company after its relocation to the Emirates Stadium (Google Finance, 2009). The Company was founded in the year 1886 operates the foot ball club as one of top teams in English Premier League and the team is known as The Gunners. The club boasts 13 First Division and Premier League championships and 10 FA Cup titles (Yahoo! Finance, 2008).

Arsenal owns the home ground of the team at Emirates Stadium. From the Emirates Stadium the company carries on its commercial operations and operates it retail outlets. The Company derives most of its revenues from ticket sales and broadcasting fees. Arsenal is a closely held public company not quoted in the Stock Exchange.

This report presents an analysis of the management and performance of Arsenal Holdings Plc based on the information provided in the Annual Report of the Company for the year 2008 presenting the revenue and costs for the season 2007/08. The report will also take into account the information contained in the annual publication of Deloitte Football Money League on the first 20 richest football clubs of the world.

Fan Base

Arsenal maintains a large and loyal fan base with the tickets for all home matches selling out. Arsenal is proud of the second largest League attendance for an English Club with 60,070 fans attending a match in 2007-08 which was 99.5% of the available capacity. Arsenal also has affiliations from a number of other clubs both in the UK and abroad. As of 2007 Arsenal had 24 UK, 37 Irish and 49 overseas clubs affiliated to it increasing the fan base (Arsenal.com, 2007). A survey made Granada Ventures in the year 2005 estimated the total number of supporters at 27 million. Deloitte annual publication indicates that the club has season ticket waiting list of about 50,000 supporters.

Construction – Emirates Stadium

Emirates Stadium where the club has its own home ground was officially opened in October 2006. The Stadium was constructed in a total area of 17 acres to accommodate about 60,000 spectators at a time. An expected 1,140,000 spectators are expected to attend Premiership matches in the Stadium in one season. The Stadium was constructed with an overall project cost of £ 390 million. Arsenal has housed all its retail outlets in the Emirates Stadium and is carrying on its commercial operations from the Stadium (Arsenal.com, 2009).

Revenue Streams

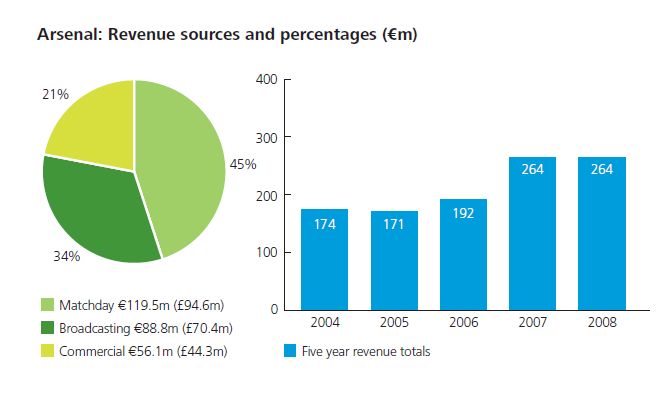

Arsenal has been steadily increasing its revenues over the years. The company was placed in the 6th position in terms of its revenues among the top twenty richest clubs by Deloitte Football Money League. The revenues as shown by Deloitte indicate that the club has recorded total earnings of £ 209.3 (Euro 264.4 million) as against the Real Madrid Club with Euro 365.8 million occupying the first position.

The main revenue streams comprises of Match day, Broadcasting and Commercial. Match day revenues represent the gate collections on the days in which matches are held together with season tickets and memberships. Broadcasting revenues represent the revenue from selling the broadcasting rights for the matches both domestically and internationally. Commercial revenues are the revenues from selling sponsorships and other merchandise like T-shirts. As the figure indicates 45% of the total revenue of Arsenal comes from the Match day revenues which imply a strong fan base for the club.

Year-wise earnings of the Company for the past years as reported in the Deloitte Football Money League are presented below.

Note: The revenue for the five year period has been calculated to the nearest Euro values.

Arsenal crossed the £ 200 million mark revenue for the first time in 2007/08 with an increase of £ 30.7 million (18%) increase to £ 207.7 million excluding the revenue from non-core football activities of £ 15.3 million which relate to property development. Profit before tax and exceptional items was at £ 39.7 million for 2008 as against £ 20.8 for the year 2007 (Arsenal.com, 2008, p 10).

Matchday Earnings

The matchday earnings represent 45% (£ 94.6 million) of the total revenues for Arsenal. This has shown an increase from £ 90.6 million from the year 2007 and has remained the most important component of revenues for the club. The second season in Emirates Stadium with an average sell out of 60,100 attendees has helped the club to earn the maximum matchday earnings. Proposed modest increases in ticket price would help the club to sustain the matchday revenue for the year 2008-09. With the reported waiting list of 50,000 supporters the revenue under this head should improve in the future.

Broadcast Revenue

Another key driver of the enhanced revenue for the club is the broadcasting income which increased from £ 44.3 million in 2007 to £ 68.4 million in 2008. The increase was because of the new Premier League domestic and international TV deals. Deloitte reports that new Premier League broadcast deals and a third placed position resulted in an increase of £ 18.1 million which finally increased the central distribution to £ 47 million. In the League matches the performance of the club in reaching the semi-finals of Carling Cup and the quarter-finals of the UEFA Champions League has enabled the club to maximize the revenue from broadcasting deals. Arsenal could claim an increase of £ 18.4 million from the UEFA Champions League match.

Commercial Revenue

There was only a slight increase in the commercial revenue in 2008 as compared to the last year. The commercial revenue increased by £ 2.7 million during the year 2008 totaling to £ 44.3 million. Long-term Stadium naming rights running until 2020-2021 and shirt sponsorship deals entered with Emirates running up to the year 2013-2014 were the main contributors of revenue under this head. These deals are worth £ 90 million. In the year 2008 the revenue from these sources accounted for £ 13.1 million and the merchandise included new second and third choice Nike kits. However the commercial revenue for the year 2008 for Arsenal is less by £ 17 million of Chelsea and £ 19.7 million less than that of Manchester United (Deloitte, 2009).

Costs

The most important element of cost for a football club is the operating expenses in terms of the salaries payable to the players. The efficiency of the club can be measured as a ratio of operating expenses to the total revenue of the club. Deloitte has worked out the percentage of salaries at 55% to 70% of the total revenues as ideal for an efficient club. In comparison with this percentage the salary cost of Arsenal is only 48.8% (£ 101.3 million) as compared to the cost of £ 89.7 million (2007 – 50.6% of the revenue). Improvement and extension of key players and entering into better management contracts have helped the club to achieve efficient cost control on salaries to players (Deloitte, 2009).

Profitability

The club has registered a significant growth in the profitability during 2008. Increased matchday revenues and commercial revenues have resulted in operating profit before depreciation and player trading of £ 59.6 million. The operating profit at this level has registered a growth of 41.2% over the previous year profit of £ 42.2 million. Stricter control over player salaries and the revenue addition due to the construction of Emirates Stadium has contributed to the increased profitability of the club. The profitability has improved because of the profit on disposal of player registration to the extent of £ 26.4 million which took the profit before taxation to £ 39.7 million (2007 – (0.54million).

Balance Sheet and Cash Flow

The balances relating to football division are shown under intangible fixed assets. Net book value of player registration is comprised of cost of player registration and the amortization of the player registration costs during the year. The net book value as of 31st May was at £ 55.6 million as against the value of £ 64.6 million as at the end of 2007. However this value do not reflect the current market value of the players and the directors are of the opinion that the value of the intangible fixed assets with respect cost of players would be significantly greater than the value shown by the books (Arsenal.com, 2008, p 41).

Out of the total net cash inflow £ 19.4 million for the group, the football division of Arsenal has contributed a net operating cash flow of £ 4.0 million as receipts from the sale of players during 2008 were more than the payments. The club has received an amount of £ 32.0 million as against which the club has paid £ 28.0 million during 2008. For the year 2007 there was a net cash outflow of £ 8 million because of excess payments for purchase of players (Arsenal.com, 2008, p 51).

Conclusion

Continued commercial revenue growth together with improved on-pitch performance in the Premier League as well as Champions League has helped the club to achieve a strong financial situation. Combined with this a consistently full Emirates Stadium is expected to be the key drivers for a sustained growth in revenues for the club in the future. This may result in the change in the ranking of the club among the top twenty list of Deloitte. However, the economic downturn and a boardroom power battle has made Arsenal having a most enviable financial model slip down in its finance accumulating more debt during 2008. This is also due to the property transactions undertaken by the Company.

References

Arsenal. 2007. Fans Report 2006. Web.

Arsenal. 2008. Annual Report 2008. Web.

Arsenal. 2009. Emirates Stadium. Web.

Deloitte, 2009. Lost in Translation – Football Money League. Web.

GoogleFinance, 2009. Arsenal Holdings Plc. Web.

Yahoo!Finance, 2008. Arsenal Holdings Plc – Company Profile. Web.