Executive Summary

This study aims to analyze the aviation strategies; to do so, the paper focuses on thoroughly investigating the visions and individual policies of the aircraft producers, and the proceedings after the launch of B787 and A380 along with the reaction after the launch of B747-8 and A350. It would also methodically explore the present circumstances of the producers (Boeing and Airbus) and the industries (both the US aerospace industry and the European aerospace industry) in context to the concurrent economic and business environment. Also, the detailed discussions on these issues will be followed by an assessment of the future in the long-haul market, recommendations for the future, an appropriate summarization of the entire aviation research, together with a deep insight into the essential factors analyzed as well as the concluding observations.

Introduction

As two of the best players in the global aircraft manufacturing industry, both Boeing and Airbus possess a long understanding regarding the most suitable ways in which aircraft can be produced so that the rate of fuel consumption, hydrocarbon emission, and sound pollution can be lowered down to a considerable level. These are the most essential features that the airline companies want to perform better in terms of lower fuel costs, more efficient, and ecologically friendly service. The industry is becoming increasingly competitive in terms of the long-haul market; however, this research will gradually reveal how the manufacturers are reacting to gain competitive advantages over the giant rivals to sustain for a long-term, even in the business environment that seems to be increasingly volatile for the recessionary aftershock.

Visions and Respective Strategies Put In Place by the Manufacturers

Visions of Boeing

According to Linford (2011), Phillips (2005), and Boeing (2004), Boeing’s visions about the prospect of the long haul market is quite different from its major competitor; to specify, Boeing views to shift away from hub-to-hub flights towards the more delicately toured point-to-point routes; it believes that higher prospects are there for direct and non-stop transoceanic flights with smaller airports. Consequently, it possesses a view that mid-sized and long-distance aircraft are supposed to possess a better demand in the market resulting in boosts in profit margins and increasing market share for the long haul market. However, according to Boeing (2010), its long-standing objective has articulated in its planned corporate vision, which states “individuals are working together as a global enterprise for aerospace leadership”; moreover, this view is further corroborated by the operational assertion that ensues the belief “to be the leader amongst the foremost industrial concerns in terms of superiority, prosperity, and expansion.” Besides, it is important to argue that for succeeding, Boeing’s “Vision 2016” puts together all its core competencies, which would operate in accord to the aims; for instance, consumer awareness and attention together with the incorporation of extensive schemes at an international altitude by outsourcing and running a lean venture (Linford, 2011; Cole, 2001; and Boeing, 2010).

Visions of Airbus

According to EAD (2010) and Sachdev (2006), the visions of Airbus regarding the long haul market mainly focus on the hub-to-hub option; as a result, the company went on to come up with the A380, which is extremely suitable for providing such services. However, Airbus’s long-term strategic view is specified as ‘making the most excellent and safest airplane’; furthermore, this corporation pursues the idea ‘to convene requirements of airlines and operators by manufacturing the newest and all-inclusive plane contours in the entire industry, harmonized through the utmost benchmark of manufactured items’ – this vision of Airbus has helped it achieve its long-term goals. To enumerate this vision, Airbus would like to convey sturdy results constantly, whilst exploiting half of the earth’s business-related airplane marketplace throughout the long-term; besides, some of its other visions include globalization, concentrating on the key geographic industry, enlarging its consumer service presentations and reinstating its rivaled periphery by concentrating on elasticity and competence.

Respective Strategies of Boeing and Airbus

To attain the above-stated visions, both the companies have undertaken various strategies; some of these strategies have been outlined in the table below to better understand the conditions of the point-to-point and hub-to-hub options, as well as the policies, followed to launch the Boeing 787 and Airbus A380:

Table 1: Respective Strategies of Boeing and Airbus. Source: Self-generated from EPGL (2006), Jaworowski (2011), and Taylor & Tillmanns (2002).

Events since Launch of B787 & A380 and Reaction after B747-8 & A350

At this stage of the paper, it is important to examine all the events starting from the initiation of Boeing 787 and Airbus A380 airplanes as well as inspecting the reaction after Boeing initiating the B747 – 8 and Airbus initiating the A350. To analyze this more specifically, the experiences or events of the models have been discussed separately in the later segments of this section.

A380

Airbus has undergone several experiences and events following the launch of its A380, as outlined in the table below:

Table 2: Experiences and Events of Airbus Regarding A380. Source: Self-generated from Donaldson (2009), Jaworowski (2011), and EAD (2010).

B787

On the other hand, according to Boeing (2010), in August 2010, the company has proclaimed that the anticipated day of launching the B787 has changed to the 1st quarter of 2011, which was about to be held on the 4th quarter of 2010; as a result, Boeing has not yet experienced any mass events after the launch of this aircraft. However, it is important to note that although Boeing has very recently launched the 787, it observed a few events as it was launching the aircraft, which are discussed in the table below:

Table 3: Experiences and Events of Boeing Regarding B787. Source: Self-generated from Flynn (2011), Boeing (2010), Linford (2011), and Jaworowski (2011).

Reaction after Launching B747-8 & A350

Whilst launching any new aircraft in the market, the reaction of the groups associated with the product can vary greatly depending on its success or poor performance. For the aircraft’s company, however, a good reaction largely depends on whether the product is enough money generating and whether it can get sufficient customers. It is important to note that B747-8 has been launched in February 2010, whereas A350 is scheduled to be launched in 2012; so, although the reactions of the customers and the company is available in the case of B747-8, the reactions are not available for A350, as it is not yet launched officially. Nevertheless, the paper will focus on data, for example, how many advance orders A350 is getting for analyzing the reactions of the customers.

In the case of B747-8, the reactions of customers were quite appreciative in terms of making purchases, and so, the reaction of the company was good as well; according to Boeing (2010), after the launch of B747-8, the earnings from operations for the financial year 2010 augmented by $3589m as compared with 2009 – this was mainly due to positive reaction from customers.

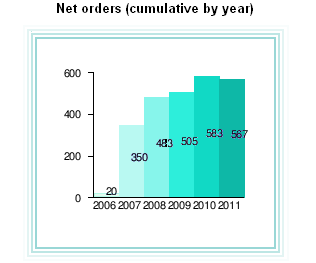

Conversely, though A350 has not yet launched, the reactions of customers are visible from the advance orders they are placing:

Table 4: Reactions of the customers expressed in terms of order placements. Source: Self-generated from data on EAD (2010).

The above reactions of the customers in terms of order placements are graphically represented below:

Analyzing the Current Situation

Current Situation of the Aircraft Manufacturers

It is essentially notable that both Boeing and Airbus had diverging views about the long haul market and therefore Boeing came up with the Boeing 787 and Airbus focused on the A380; moreover, after the achievement of B787, Airbus came up with the first version of the A350. Although the long-term visions and the strategic implementations of both the companies regarding the long haul market were quite different from each other; after the strategic implementations, it is significant to say that until now, the current situation of both the companies in terms of their overall performance had been quite stable.

However, due to the post recessional economic environment, it has been noticed that the current situations of both the companies were not so remarkable, as the majority of customers (like British Airways, Lufthansa, or Qantas) had lowered down the number of purchases of aircraft as they did in the past years. As a result, the diminishing purchasing power of the customers had led the aircraft producers to suffer from an unimpressive situation currently. The following table shows the current financial situation of Boeing as compared to the past years:

Table 5: Current Financial Situation of Boeing Compared to the Past Years. Source: Self-generated from Bloomberg Businessweek (2011).

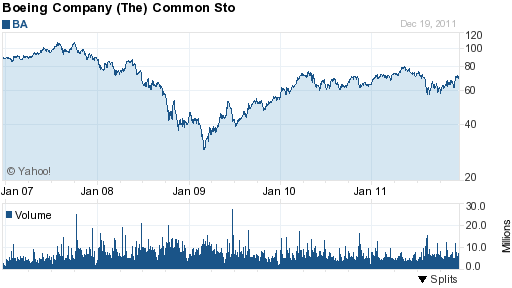

The stock chart below shows the current situation of the stock prices of Boeing after the execution of the long haul strategic implementations:

To analyze the current financial situation of Airbus in comparison to the past years, it is first necessary to see the position of the company for the previous financial years, as shown below:

The current financial situation of Airbus has been demonstrated below:

The following figure illustrates the current situation of Airbus in terms of global sales:

The basic chart below shows the current situation of the stock prices of Airbus after carrying out the long haul strategic implementations; notably, the orange-colored line in the graph represents the stock prices of Airbus, whereas, the other lines represent the stock prices of other subsidiaries of EAD:

It has been observed that due to the adverse impact of the post-global financial crisis, the aircraft producers are unable to judge whether their long haul strategies are working; the graph below shows the current situation of in terms the customer financing gross exposure of Airbus; it is noticeable that the rate has decreased from 2008:

Current Situation of the Industries

Current Situation of the US Aerospace Industry

Boeing is a player in the US aerospace industry; therefore, it is subjected to the current situation that this industry is confronting. ECORYS (2009) stated that the US has led the international aerospace manufacture for years; nevertheless, as the figure below demonstrates, the net sales of the US aerospace industry have scarcely developed throughout the current years and the total employment level has gone down as well; despite this, the US aerospace industry is still perceived as the earth’s leading performer:

However, in terms of production the European Union has trapped up with a standard real growth rate of 1.4 percent between 2001 and 2008; the respective growth rate for the US was 1.1 percent and total shipments attained in 2008 was a value of $152.3b; this equals to €113.0b in constant prices and an exchange rate of $1.3/€1.

The table below demonstrates the current situation of value-added, net-employment, evident-labor-productivity, and net-capital-expenditure for total-aerospace-manufacture, sub-sectors of airplane-production, airplane-engine-production, and aircraft-parts-production; airplane production accounted for almost sixty percent of the value-added and fifty-five percent of the overall employment; airplane parts manufacturing was the second most important sub-sector with around twenty-four percent share of value-added and twenty-three percent of employment. Correspondingly, airplane manufacturing accounted for the principal share of the entire capital expenses in the aerospace-sector; however, aerospace parts production had a superior virtual-share of the funds in contrast to the value-added-share; the evident labor productivity (calculated as value-added per worker in Euro thousands) was superior in FY2006 for the US with Euro 153.2 than for the €27 with €87.2:

Table 6: Current situation of value-added, net-employment, labour-productivity and net-capital-expense. Source: Self-generated from data on ECORYS (2009).

Current Situation of the European Aerospace Industry

Airbus is a France based aircraft producer in the European aerospace industry; as a result, it is subjected to the conditions and the current situations that this industry is facing. The aerospace industry in EU 27 was extremely concentrated in FY2006, whilst decentralization was going on; France, the UK, and Germany accounted for nearly eighty percent of the entire EU 27 aerospace-production and value-added and around seventy percent of total-service; nevertheless, whilst France had by far the uppermost production-value, it lies behind the UK in terms of value-added and employment-share. The chart below shows the situations of the industry in current years in terms of overall functional revenue per worker amongst the European Union’s twenty-seven member states (the figures in the chart are in € thousands, from the financial year 2001 to 2007):

The graph below illustrates the situations of overall functional income per worker amongst France, the UK, Italy, Denmark, Spain, and Germany:

As a European aircraft producing business, Airbus is more often affected by the current situations of the microeconomic performance inside the European aerospace industry as a whole; the trend of the current years is shown below:

Table 7: The microeconomic performance inside the European aerospace industry Source: – Self-generated from data on ECORYS (2009).

Future in the Long-Haul Market

In this increased pace of globalization, where economic growth of the highly populated countries like India, the Middle East, and China has increased the expenditure in the tourism sector because the per capita income of the residents is raising vastly, the public expenditure over the air traveling sector will likely rise as well. To specify, as a result of more purchasing power parity of the residents of the highly populated countries, they are expected to invest more in holiday packages – as a consequence, the number of long haul flights will increasing greatly, expanding the size of the global long haul flight industry and rising the revenue as a whole. According to Errard (2011), long-haul flights and air-traffics have anticipated doubling by next fifteen years, with a yearly growth rate of 4.8 percent; moreover, airplane-demand will increase by vibrant air-traffic-growth, particularly at greatly developing nations, by substitution of the airplane at work on grown-industries (the US and the EU), by sustained-growth of low-cost carriers, principally at Asia, and by constant market-liberalization.

The graph below shows that the long haul flight industry has shown a trend to double every 15 years; as a result, it is expected to keep doubling in the next 15 years period, whilst the global yearly air- traffic growth rate will remain 4.8 percent for twenty years:

At the same time, in this twenty-year growth trend, the long haul flight industry will observe massive expansion from highly developing nations who possess a growing market for the reason that the people of those nations will make more holiday trips in long haul distances; the figure below categorizes this picture with the high growth countries at the top:

Conversely, the long haul market will grow further in the future if the economic development of India and China continue to see the increasing trends in terms of gross domestic product, per capita income, rising employment rates, as well as good living standards. If, as a resultant effect of this, one billion Indians and one billion Chinese flies in the long haul annually, then it is anticipated that this would activate approximately a tripling of airplane demand in these nations by the next twenty years period, as illustrated in the graph below:

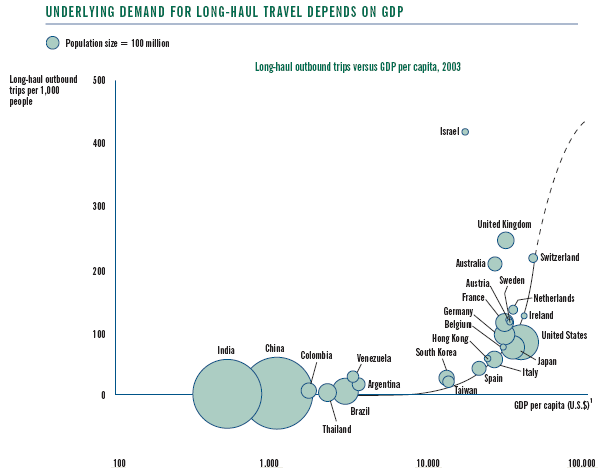

The fact that whether the long haul flight industry will observe better opportunities for expansion and long-term profitability in the future in a global context largely depends on the question of economic trends of the countries. There is no doubt that with countries that possess rising trends in gross domestic product, per capita income, employment rates, and living standards, the number of long haul trips made will keep on increasing. This has illustrated with examples of several countries below:

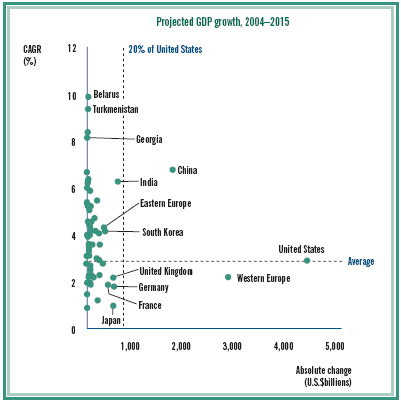

Because of the reason stated above, the future opportunities of the long haul flight industry is much better in Japan, the US, and the 27 member states of the European Union than it is in India and China; this is because as the present trends show, the GDP of these countries are higher than India or China. Moreover, the projected GDP growth rate of Japan, the US, and the European nations for the upcoming years is prospective as well, indicating a positive drift for the long haul market:

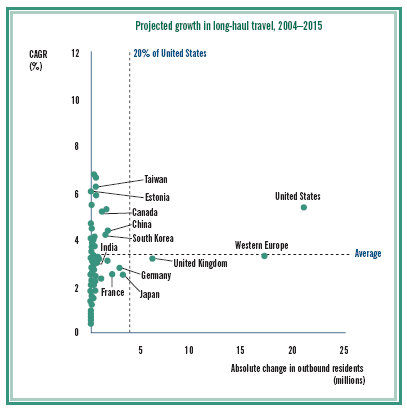

The graph below shows the projected long haul growth rate in the above-stated countries:

Moreover, some other analyses about the future of the long haul flight industry have been discussed below:

Table 8: The future of the long haul market. Source: Self-generated.

It is important to say that although the present trends and growth rates are showing that the long haul flight industry will keep on booming, this may not be the case in real life. Some critics suggest that the developed world (which is the most buoyant market for the long-haul industry) is about to experience another severe economic turmoil that will result from the current recession and the Eurozone crisis in the European Union’s member states. The Eurozone crisis has generally considered a sovereign debt crisis, which surely relates to Greece; however, in Ireland, this happened when a banking crisis actively altered into a sovereign crisis; the crisis in two tangential markets become universal as the financial-system of the Eurozone is overextended and highly-integrated; so, this led to a disaster of confidence for all European-corporations. If this Eurozone crisis continues to develop in long run, this will not only adversely affect the European long haul industry but also decline the growth rate of the American and Asian markets. To keep up the expansion rate and prevent the industries from potential losses, the respective governments must focus on undertaking relevant policies and bailout packages for the key players at different levels in the global long haul markets.

Recommendations

The aircraft manufacturers are strongly recommended to maintain the growth rate and prevent themselves from possible losses by focusing on the issue that the airlines can get aircraft, which can help them for the expansion of long haul routes; moreover, the aircraft should be more fuel-efficient so that the airlines can lower down the flight charges. This will in turn increase the demand the aircraft of both Boeing and Airbus; however, some other recommendations include the following:

Speeding up the production-procedure of new aircraft that the loyal clients/ airlines of the companies demand the most

The aircraft producers should serve all aviation markets with a range of product-portfolio having the most superior designation, excellence, ecological-safety, and smart-features; they should continue to construct aircraft-momentum, pierce one of the most productive periods of new product and technology introductions in the industry, and improve quality through a renewed commitment that touches every aspect of the production process

Focusing on continuous improvements regarding regular organizational performances

The aircraft manufacturers should enhance the supplier base, support the policies and schemes of the company using adequate finance, and improve the income statement; they should focus on revenue inducement through reformation at the present demand and altering model-mix, and developing product-quality

The aircraft manufacturers should reorganize the efforts within the organizations professionally as a single team to lift-up their international assets

The organizations should be applying a well-organized business policy to reassess business-environment, risks/opportunities, and strategies/plans identifying the areas of arrangements that need particular consideration by encouraging frankness, leadership, dependability, accountability, decision-making, cooperation, and by driving continuous enhancement

Summary

The fact that the long-established rivalry between Airbus and Boeing has turned out to be more aggressive through the past couple of years indicate the reason why both these industry giants have moved forward with a different strategic vision for the long haul market that ultimately resulted in the production of some groundbreaking aircraft in the history of the aerospace industry. Whilst Boeing possesses an observation that mid-sized and long-distance aircraft are supposed to possess a better demand in the market resulting in augments in annual revenues and increasing market share for the long haul market, Airbus adopted a different approach regarding the same market.

It is fundamentally remarkable that both Boeing and Airbus had prepared strategic directions about the long haul market and therefore Boeing came up with the Boeing 787 and Airbus focused on the A380; moreover, after the triumph of B787, Airbus came up with the first edition of the A350. Boeing is a player in the US industry, whereas Airbus is a France based aircraft producer; therefore, both are subjected to contemporary circumstances that these industries are confronting; moreover, whether the long-haul industry will observe better expansion opportunities depends on the question of economic trends of the respective countries. However, despite some optimistic statements in regards to the future of the long haul market discussed in the uppers extracts of the paper, the expected future growth of the market is still doubtful. This is mainly because although the international economy has recovered from the global financial crisis of the 2008 to 2010 period, this does not mean an end to the probability of another financial downturn.

Conclusion

After analyzing the aviation strategies of the companies as well as the expected future opportunities of the long haul flight industry in a global context, it can be suggested that both companies can observe future growth.

Reference List

Bloomberg Businessweek (2011) Boeing CO/THE (BA:New York). Web.

Boeing (2004) Boeing Focuses on Passengers for Long Haul, Twin-Aisle Jetliner Strategy. Web.

Boeing (2010) Annual report 2010. Web.

Cole, A. (2001) Boeing’s long shot switches targets. Web.

Donaldson, A. (2009) The Effect of the Airbus A380 on Runway Passenger Throughput. Web.

EAD (2010) Annual report 2010. Web.

ECORYS (2009) FWC Sector Competitiveness Studies – Competitiveness of the EU Aerospace Industry with focus on: Aeronautics Industry. Web.

EPGL (2006) Will size matter for Boeing and Airbus? Emerald Group Publishing Limited, 22(6): 8-11.

Errard, N. (2011) Credit Suisse Conference in September 2011. Web.

Flynn, D. (2011) Qantas reaffirms commitment to Boeing 787 for Red Roo fleet. Web.

Jaworowski, R. (2011) Two Competing Visions. Web.

Linford, A. (2011) Long-haul Flights: Hub-to-hub or Point-to-point? Web.

Phillips, D. (2005) Airbus and Boeing: Dueling visions. Web.

Sachdev, A. (2006) Airbus redesigns its strategy for long haul. Web.

Taylor, S. & Tillmanns, C. (2002) Airbus vs. Boeing. Web.

Yahoo Finance (2011) Basic Chart. Web.