Introduction

Every business organization has a number of objectives that it aims to achieve in the best way possible. There are organizations that are purely non-profit making while others only exist for the singular purpose of profit making. The not for profits aim at benefit maximization for target beneficiaries while the latter category has profit maximization as the overriding objective. To achieve objectives in either of the mentioned cases, performance measurement and management is critical

The Balanced Scorecard is one of the widely used performance management tools (Balanced Scorecard Institute, 1998). The adoption of this framework in financial institutions brings with it many difficulties in terms of implementation but in the end, if well implemented it yields enough benefits. The balanced scorecard has been singled out by many business leaders as one of the best methods of improving performance. Even though this framework existed even by 1980s, it was Dr. Robert S. Kaplan and his consultancy Nolan-Norton who gave it a new approach (Balanced Scorecard Institute, 1998). It is the modifications of Kaplan that made the framework applicable even in financial institutions as well as in other institutions. The balanced Scorecard presents four perspectives from which one is to view an organization (Balanced Scorecard Institute, 1998). Further, it provides guidelines in terms of how to metrics, acquire data, and finally analyze them in order to arrive at objectives of the organization (Balanced Scorecard Institute, 1998)

Designing Strategy for Implementation

Tri-Cities Community Bank has taken to the balanced scorecard with the singular aim of bringing into operation a model that could be used by a banking institution of its stature to increase its profitability and grow its market share (Albright et al, 2001). The penultimate measure of success based on use of the balanced scorecard is dependent on the financial results that emerge from its usage. The following table summarizes the basic objectives of a typical financial institution.

Table 1.1: Financial Goals and the Framework for implementation

Designing and implementation of a balanced scorecard begin in plotting organizations goals in a table as shown in table 1.1. Having looked at the table and taken note of the variables, the next step is to design causal chains linking together the objectives in such a way that the initial achievement leads to a series of achievements up the line until the ultimate goal, which is financial success is attained.

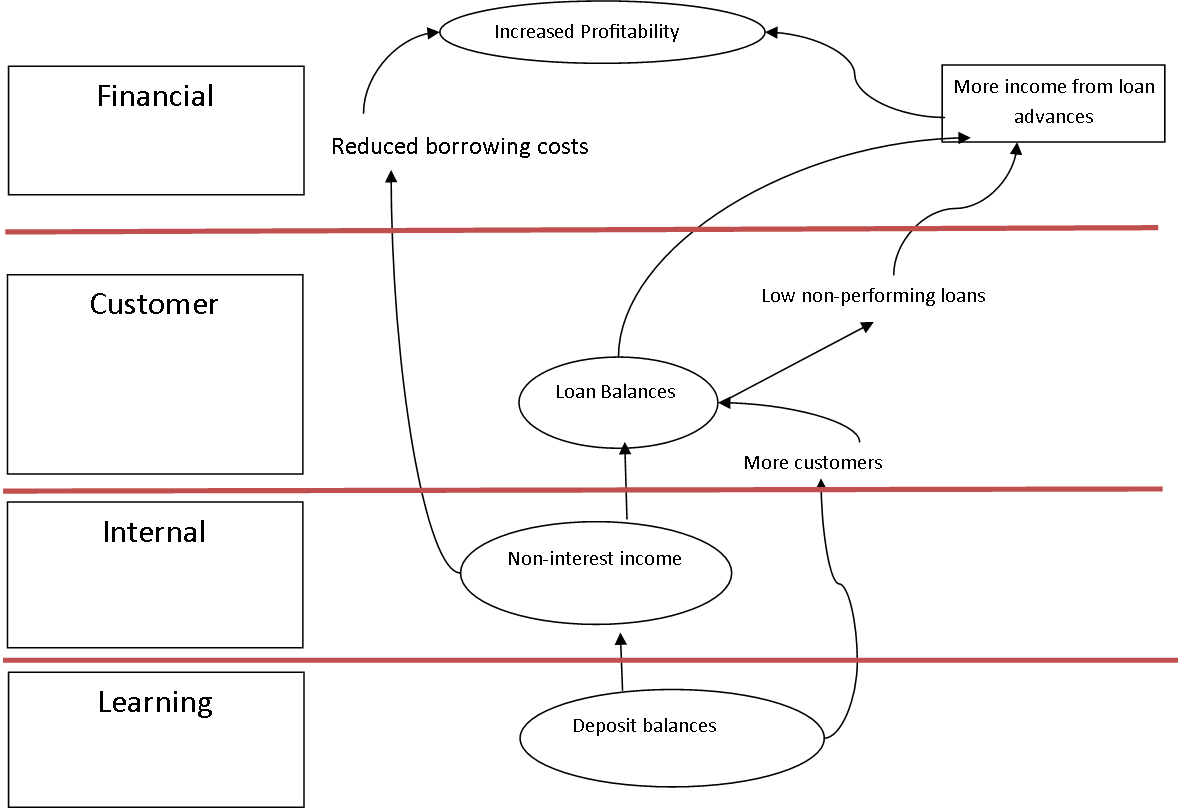

The figure 2.1 below represents the causal-chains and the various links that have been laid out based on various alternatives that exist within the banking sector:

From the figure 2.1, it should be clear that the first goal to be targeted is deposit balances. Primordial focus on deposit balances results from the bank’s intention to maximize its customer base. To achieve this, the management will conduct vigorous training of its employees through on-the-job training. Whereby employees will be updated on modern methods of keeping records, and responding to customers’ issues fast and professionally. Additionally, employees have to be trained to love and cherish customers thus giving them full priority whenever they come to the bank.

Secondly, the employees will have to focuss on speedy handling of customer cases. Due to increased speed and efficiency on the part of employees, many customers will open accounts and deposit their funds without further inconvenience. Other ways of encouraging customers to deposit include creating a highly secure system of paperless banking in which customers do not have to quee in order to deposit their money. Such a development will lead to increased number of customers as well increased funds for use within the bank for its operations.

The second section or goal to focus on relates to internal business processes and aims at devising ways of maximising non-interest income. Under this section, as a result of the increased amount of customer deposits within the bank, the amount of money available for borrowing will be increased. Therefore, the internal operations will involve the proper accounting of the various records to ensure that each transaction is properly accounted for. As a result, an array of non-interest income streams will emerge. Such income streams include ATM withdrawal fees, Insurance policy fees, lock boxes, annuities, and account checking, brokerage fees, travellers’ checks, as well as CDs fees (The Balanced Scorecard Institute, 2001).

Following from the benefits of encouraging deposits and maximizing internal income, the costs incurred in borrowing funds from the Central Bank will decline drastically. There will be increased funds available for lending i.e. From customer deposits, and non-interest income. This will in turn lead to level or section three, which involves customer evaluation.

The customers are evaluated in terms of how the perceive the bank in its efforts addressing their needs. If they are satisfied with the bank, they could most certainly continue with the bank. Definitely, based on the improved internal processes related to turnaround time, customers will always feel supported, and their issues responded to in a timely manner. In fact, most people who take up loans first consider the amount of time they could take completely close the transaction. The bank, due to increased funds for borrowing, should decide to offer loans at reduced interest rate. This will attract more customers for lending, and the amount of non-performing loans will decline tremendously by a combination of proper accounting systems and flexible methods of acquiring loans. Customers who have accounts with the bank could also decide to take up loans at a much cheaper interest rate or at better terms and little documentation, given that the bank already has their details from the already existing accounts. Tremendous effort at this stage should be directed towards ensuring that there is customer satisfaction. Customer satisfaction should not be the concern of the customer representatives only but rather the whole organization i.e. it should concern sales agents, risk assessors, as well as other managerial staff members. Their contribution at this stage will attract more customers and thus lead to more loan advances.

The banks could also adopt a loan top-up mechanism in order to ensure that customers who already have loans acquire more loans. This could be instrumental and ensuring that proper records are kept could assist in making follow-ups and inquiries as to whether these customers could like to take up more loans. As customers take more loans, less non-performing loans will be recorded, and the costs incurred in borrowing from central bank could be reduced. Consequently, the net earnings from the various operations will increase. Due to increased profitability, stakeholders will receive better earnings on their investments. Employees on the other hand could be entitled to employee share-ownership-plan, or bonus compensations, hence increasing their level of satisfaction.

Implementation and Consequences

The Balanced Scorecard is regarded as a very effective management approach that addresses various indicators in order to observe the progress in achieving organizational objectives (Kaplan & Norton, 1996, p. 53). For effective monitoring and evaluation, both non-financial and financial results are compared with a target value established by the bank, and by whose value employees are graded and rewarded accordingly.

The first step in the implementation of a balanced scorecard is the translation of the organizational vision into operational commodities (Silverthorne, 2008). Under this approach, the organizational leaders should ensure that every employee is aware of the organizational mission. In addition, they should be aware of the fact that the organization in general, wishes to increase its profitability and market share.

As already discussed, the need to increase profitability and market share by a financial organization will translate into focus on deposit balances. In working on this, tellers, and other credit officers should be educated on faster and better methods of dealing with customers in order to enable them open accounts with the bank. Customer service representatives also have to be kept abreast on information regarding the bank’s products so that they may internalize the knowledge and relay it to customers efficiently. The bank could also train marketing executives who will conduct a highly spirited campaign across the region in order to win more customers. Branding efforts that could include merchandising, distributing gifts such as caps, T-shirts, and even porches, and market communication avenues such as billboards may be considered. This could be a seasonal campaign but has the potential of effectively bringing in more customers to the bank. At the internal level, various processes could be improved ranging from the loan application turnaround time, to checks processing and proper documentation strategies.

Conclusion

Conclusively, in order to achieve the overall objectives, the organization has to focus on scaling the competence of the staff, and then the customers’ access to information. On the internal perspective, the main activities or factors such as turnaround time for customers depositing and withdrawing funds have to be looked into. From the foregoing discussions, it is clear that adopting a balance scorecard in managing performance towards achievement of organizational objectives is a welcome move. By adopting this framework, the management will be equipped with better mechanisms for evaluating the overall progress, hence optimizing performance.

References

Albright, T., Davis, S. & Hibbets, A. (2001). Tri-Cities Community Bank: A Balanced Scorecard Case. Strategic Finance, 83(4), 54-60. Web.

Balanced Scorecard Institute, (1998). Balanced Scorecard Basics. Web.

Kaplan, R.S., and Norton, D.P. (1999). Linking the Balanced Scorecard to Strategy, California Management Review: Fall 1996; Vol.39 No.1: 53-79

Silverthorne, S. (2008). Executing Strategy with the Balanced Scorecard. Web.