Introduction

The Coach Inc. began as a small family business that focused on the manufacture of leather goods. Its products were regarded as superior in terms of quality. This phenomenon earned the company a premium brand name in the 1980s. It was highly praised for innovating classic styles. In the 1980s, the firm expanded rapidly and established exclusive retail stores. It experienced rigorous growth that led to the enormous expansion. Numerous exclusive stores and boutiques were established as an expansion and diversification strategy. However, the company began experiencing a downturn in terms of trendiness as opposed to its competitors. As a result, its sales volume shrank. Nevertheless, in 1996, the company was revolutionized by establishing an affordable luxury brand.

The perception was that the price was a source of competitive advantage for the brand in the luxury market. It began operating in a public perspective. The global phenomenon of the Coach Inc. had a substantial impact on the company’s revenues that increased by a great effect by 2012. Presently, the company has the broadest portfolio of fine accessory products for both home and the global market. Its products include ornaments, colognes, footwear, bags, and lookouts among others. Besides North America, the company also conducts its operations in many countries such as Singapore, Japan, and Hong Kong among others. The business model of the company is based on multi-channel international distribution. The company has strived to maintain a sizeable competitive advantage amidst the concentration of luxury products in its areas of operation. This essay provides an analysis of the Coach Inc. by examining various dimensions such as the market structure, competitive environment, demand elasticity, and enterprise elements.

Analyzing the Coach Inc.’s Market Structure and Competitive Environment

In economics, market structures are categorized into four types depending on the number of firms, market entry, nature of products, and profit orientation. At the outset, it entails a monopoly market structure that involves single seller (Egner 3). The entry barrier is strictly very high. It is either government or technologically controlled. The existence of companies that offer similar products creates a competitive environment that can be risky for businesses that are not diversified. Market forces control the prices of products in this structure, and entry barriers are considerably small.

However, in a monopolistic competition market structure, the firms do not produce identical products (Egner 8). Despite the similarity, such products differ in aspects such as pricing, branding, and characteristics. However, these products have the same end use. Customer’s behavior is manipulated by the differences in advertisement of products in a monopolistic competition (Egner 4). Demand tends to shift with pricing. Where prices go high, demand diminishes for the products in favor of those of other producers serving the same purpose, but at favorably lowers prices. Finally yet importantly, market structure is oligopoly where firms are minimal. The entry into such markets is high. In addition, industry players control the prices of luxury products.

The Coach Inc. adopts a monopolistic market structure (Egner 12). This structure is seen as anticompetitive; hence, the company enjoys autocratic business models boost its sales volume. Recently, the industry recovered and developed rapidly (Egner 6). The company adopts a number of marketing strategies that have boosted its growth significantly. For instance, it has ventured into emerging markets by investing heavily in e-commerce. E-marketing has become a crucial aspect of the Coach Inc. This strategy ensures that the company captures a broad client base in the global arena. As a result, future business activities have become feasible amidst the prevailing competition in the luxury industry.

The Prada Company and the Louis Vuitton Inc. are among the leading rivals of the Coach Inc. Egner reveals that the rival companies also focus on the quality of their brands. This situation has increased the market competition significantly (15). Although the company has come up with a robust multi-channel distribution strategy, it still suffers stringent rivalry from these brands. For instance, the profit margin was still below the level achieved prior to the onset of the economic downturn in 2007. In addition, its share price had experienced a sharp decline during the first six months of 2012. Due to environmental dynamism and stiff competition that have arisen from globalization, it is unclear whether the company’s recent growth can be sustained. It is also uncertain if competitive advantage will hold in the face of newfangled and affordable luxury brands such as Michael Kors and Salvatore.

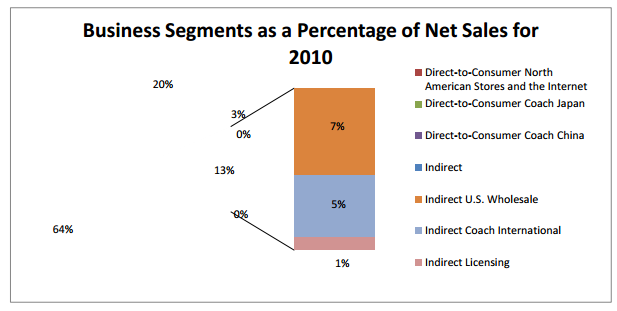

Enterprise Segments

Egner reveals that the Coach Inc. operates both direct and indirect enterprise divisions (21). In the direct segment, the company reaches customers by conducting uninterrupted circulation of products. The indirect approach entails various retail outlets that facilitate the delivery of the luxury goods. The figure below represents a sketch of the two segments of the Coach Inc.

Price Elasticity of Demand

The extent to which the receptiveness of a product in the market aligns with price fluctuation is regarded as the price elasticity of demand (Egner 12). It can be either elastic or inelastic. First, the demand for a product can be said to be very inelastic if consumers will pay almost any price for the product. In this case, the sellers can change the price of the product without having significant changes in its demand. Secondly, the demand for a product can be elastic. This situation implies that consumers only pay a particular range of prices beyond which the demand will drop (Egner 12).

Luxury goods are classified as Veblen goods whose increase in price gives the customers a perception of high value and prestige. Therefore, an increase in the prices of luxury goods attracts an elevated demand. Therefore, luxury goods have inelastic demand. However, in a market where stiff competition is evident such as in a monopolistic competition structure, the Coach Inc. does not enjoy price autonomy. The presence of rivals who offer substitutes of luxury goods at accessible prices, the company has no choice rather than to maintain lower prices to sustain its competitiveness. The company beats the tough challenge by undertaking unique marketing strategies. The company maintains its customer loyalty and emotional attachment through its legendary brand image and quality products.

Income Elasticity of Demand for the Coach Inc. products

Economics states that demand for luxury goods increases as income increases. As a result, the luxury goods are said to have high-income elasticity of demand. As people become wealthier, their tendency to buy more luxury goods increases. The opposite is also true in that a decline in income, demand for luxury goods diminishes. Unlike inferior goods, luxury goods correlate with price and high-income individuals. High pricing gives the product its prestigious nature. However, this marketing strategy works best where competition is substantially low, or where entry barriers are strictly high. The company’s products have high-income elasticity of demand, as consumers are willing to buy despite the expensive prices at which they retail (Egner 16). As consumers level of disposable income increases, demand for luxurious products intensifies.

The Coach Inc. Competitors

The Coach Inc. faces competition on a global scale with competitors ranging from top luxury makers such as Hermes, Gucci, Burberry, and Louis Vuitton to mid-tier producers including Michael Kors (KORS), Kate Spade, and Tory Birch. Nevertheless, Coach Inc. remains leading in the US market with its market estimated at 31. Recently the company has captured the second largest share of the Japanese market from a propounding thrust.

Regionally, Europe commands the greatest spending across the globe at 35% of industry sales. Due to its touristic phenomenon, European countries such as France and Italy have captured a significant amount of external spending especially from the Asian markets. In the wake of globalization and tech-savvy marketing strategies such as the online platforms, brand exposure has increasingly become a paramount undertaking as it continues to drive growth in luxury goods. E-commerce sales in the luxury industry have continued to grow at approximately 25% per annum. They represented an estimated $10 billion of total sales in 2012.

According to the data provided by Compete.com, a provider of online traffic data, the Coach Inc. was still the leading dealer in the US, amongst an active peer group including brands such as Gucci, Louis Vuitton, and Chanel. The launch of the e-commerce site in China has propelled the company towards success significantly, as it increased brand awareness and growth in that region. Despite the stiff competition that the Coach Inc. faces, study reveals that it has shown consistency in its competitive advantage especially from the legendary brand image that is highly optimistic. Having been dominant in the industry since 1941, the company can deal with any new changes as it did during the economic depression times. Therefore, the firm is likely to maintain the market share for a long time. The business has been exceptionally profitable over a substantial period, as it has maintained its revenue margin above what it pays to attract investment capital. The historical evidence shows that the Coach Inc. has a sustainable competitive advantage over its competitors.

Competing Products Analysis: Substitutes and Complements

The aforementioned competitors namely Gucci, Burberry, Louis Vuitton, Michael Kors (KORS), and Kate Spade offer products that do not match the distinctive attributes of the Coach Inc. The company has built an unshakable reputation based on product quality, durability, functionality, and classic styling characteristics that boost customer satisfaction. The Coach Inc.’s products face little competition as customers have a strong emotional attachment to the company’s brand. For instance, luxury bags are purely made of leather in contrast with the materials used by the competitors. Customers also have a feeling that no other brand can give the value that is obtained from the Coach Inc.’s products. Since most of the consumers are high-income earners, they have no wish to buy cheaper products that do not match their status quo. As a result, the loyal customer base and a strong brand image gives the Coach Inc. a boasting phenomenon since there are neither close substitutes nor complements for their luxury products and accessories.

Indicators of Sustainable Profitability

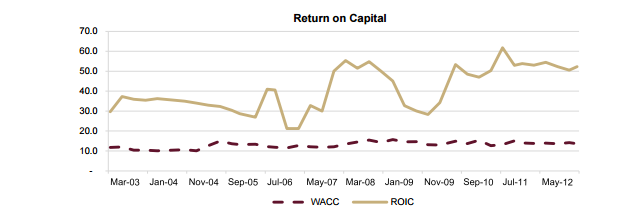

The Coach Inc.’s after-tax return on invested capital that averaged more than 15-25% over a decade ago is a clear evidence of sustainability. The company introduced a company logo in 1959 as a symbol of the company’s heritage of fine leather goods and American culture. As a result, the company’s market positioning, and brand loyalty have provided the company with a suitable platform to set prices for their products at competitive levels where consumers perceive incomparable value. Thus, it has been very difficult for its competitors to imitate this pricing mechanism. Consequently, the Coach Inc.’s market share remains high and stable as well as consistent and exceptional returns on capital. The company has increased its domestic market share ten points, from 18% to 28%, in the past five years.

There is an inevitable room for share growth abroad, especially due to its recent extension to Japan. The management of the Coach Inc. has maintained a commendable capital allocation record of accomplishment. In addition, the management operating efficiency has been regarded as the primary driver of the Coach Inc.’s strong financial results. Return on Capital has been astral and far surpasses present industry average of 16.5% besides exceeding the company’s own cost of capital.

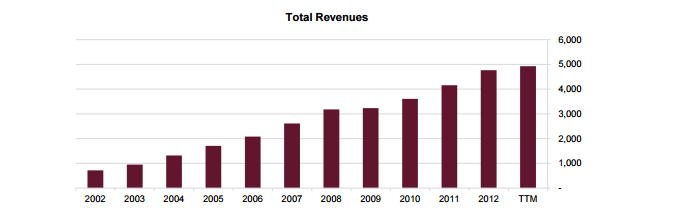

Since 2003, company’s return on capital has averaged 40% even during the 2008-2009 economic recessions when many firms in the luxury segment had an unsteady economic situation. The exceptional management still managed to return nearly 30% on capital deployed. Since 2013, the Coach Inc. has been generating over 50% ROIC on average. The following chart shows the steady growth in total revenues for the luxury company recorded annually from 2002 through the economic crisis of 2009 to 2012. As depicted by the chart, Coach’s profitability and sales have been stable and predictable over time.

Return on capital for the Coach Inc.

Growth Prospects and Demand for Luxury goods offered by the Couch Inc.

Demand for luxury goods is driven by general economic trends including changes in disposable income, consumer confidence, and consumer expenditure. The Coach Inc. is nearing full capacity for total stores in the US market. Therefore, growth within the US borders is limited. However, the company’s recent entry into foreign emerging markets such as China is a sure strategy to ensure sustainable demand and growth. For instance, luxury consumption in China, has realized a double-digit growth over the past few years due to rigorous economic growth and budding standards of living in the country.

The Chinese market has become the largest luxury market. Egner reveals that it covers an estimated 23% of the world market (37). Being an emergent market, it provides remarkable growth potential. This potential growth is the tapping focus by the Coach Inc. with its recent expansion into the Chinese market (Egner 26). Other emerging markets encompass Brazil, South Asia, and Central Asia, which will experience approximately 25-30% surge in spending on luxury goods in the coming years as personal wealth, spending capacity and fashion perception augments. An empirical study shows that the Coach Inc. is already benefitting from the increasingly prosperous Chinese consumers’ demand for foreign luxury brands to manifest their status. This fact coupled with minimal regulation and interference from the Chinese government has leveraged the company’s rapid penetration and growth of the firm in the country.

Furthermore, the company has avoided direct competition with luxury brands such as Louis Vuitton and Gucci through its differentiated marketing strategy as an affordable luxury company, as opposed to absolute luxury. In addition, new product development and innovations, which the company does in time and pace with what consumers demand is a key driving force for the company’s growth.

The Coach Inc. international growth is strongest where fashion conscious men in countries such as China, Korea, France, and the UK (Egner 18). The US men market is anticipated to expand at a low double-digit pace for several years ahead, and the Coach Inc.’s research team expects men’s sales to pass the $1.5 billion mark in the near future. The company continues to expand men’s line through introducing enhancements and additions to clothes, accessories, and bags. The company has in recent years rolled out dual gender stores and upgrades of old ones as well as new stores with a third of their domestic stores to increase exposure of the new trend to reach large prospective customer base. To attain the optimum range, the targeted marketing campaign in the US, China, and Japan plays a vital role. Through the company’s directly operated businesses in Japan, China, Singapore, Taiwan, Malaysia, and South Korea, the Coach Inc. is leveraging a significant opportunity in this important region contributing a significant effect to the anticipated growth in demand.

Employee Innovation and Training

The Coach Inc. values innovation and employee training on new production changes notable in the industry. Employees are taken through periodical training and refresher courses to ensure technological and skills nurturing. This fundamental HR role is crucial for a luxury industry that remains highly sensitive and fragile. With the contemporary business environment dynamics, characterized by rapid changes in technology and global culture, the company acknowledges the importance of employee training. It also conducts extensive and rigorous consumer research that promotes the company’s active consumer orientation even at product design stages.

The Coach Inc. expects the consumer’s needs to change uncertainly. As a result, the company assesses consumer behavior to predict the future of its market share. Therefore, the company keeps product assortment fresh and relevant to the prevailing consumer desires and behaviors (Egner 33). This strategy helps the Coach Inc. to induce and sustain demand for its products. It leverages its growth because it does not only pull in consumers through product innovation but also it helps to retain repeat consumers.

Recommendation and Conclusion

The Coach Inc. operates in a monopolistic completion besides boasting of a robust and unique brand. Its products are characterized by inelastic price demand due to the company’s high bids. Nonetheless, consumers continue to buy them since they have emotional attachments to its brands. As its customers’ wealth increases, the demand for its products grows. Therefore, the products have elastic income elasticity of demand. The expansion of the Coach Inc. into new categories and regions outside of their core base of leather goods is likely to pose a challenge difficult for the company if not executed properly. The company also risks diluting its exceptional brand besides damaging the core business.

The company should also maneuver cautiously to avoid dilution of the historical luxurious brand that is fundamentally responsible for the company’s success. Although, the luxury company benefits from unparalleled brand loyalty, entrant brands threaten to attack the incumbent’s niche day by day. Therefore, there is a need for the management to reinvent itself technologically and culturally among other perspectives to maintain leadership in the luxury industry.

Work Cited

Egner, Thomas. Strategy Analysis: Coach Inc. Munich, Germany: GRIN Publishing, 2009. Print.