Abstract

Differing rules that apply to different jurisdictions and under different systems apply different approaches to commodity pricing and indexation. This paper presents a discussion of the different approaches by exploring differences in the rules of commodity pricing and indexation between the conventional banking systems and the Islamic banking systems. In a bid to achieve this objective, the paper traces various forms and mediums of exchange in the pre-Islamic era to lay a foundation to determine the conventional systems’ economic ills that the Islamic banking system sought to resolve. The paper finds the concepts of gharar and riba applicable under the Islamic financial systems as major drivers for the desire to engage in commodity pricing and indexation practices leading to high gains with minimal or absolutely no effort input in the conventional system.

Introduction

Disguising conventional services and products as Islamic products constitutes a major area of concern to Muslim financial scholars. This challenge emanates from the view that over the years, Islamic institutions of finance have been recruiting their human resources from the market pool of people trained in financial management under conventional approaches to commodity pricing and indexation (Obaidullah, 2005). Solutions to this challenge encompass creating broad and detailed awareness among Islamic financial market players via training and research coupled with education on Islamic models of financial management. This research paper endeavors to achieve this goal by focusing its discussion on differences in the rules of commodity pricing and indexation between the conventional system and the Islamic system. This move helps in setting the fundamental background for differentiation of Shariah-compliant commodity pricing and indexation approaches.

The paper first discusses forms of exchange and mediums of exchange deployed before the Islamic period followed by various issues characterizing the barter trade system that prophet PBUH altered including usury and exploitation. It then discusses rules of exchange in the Islamic system, illustrates with examples and evidence the manner in which commodity index principle applies in today’s world, and how using a basket of commodities along with Fiat (paper money) constitute a necessary approach for inflation reduction. Other important subject areas in commodity pricing and indexation covered include an introduction of the concept of marking for the market, types of sale permissible and prohibited in the Islamic system, and hedging instruments and their permissibility in Islam paradigms of indexation. In the last section, the paper offers a brief discussion of riba-free business models to demonstrate and explain their relationship to the commodity pricing principle.

Forms of exchange and medium of exchange in the pre-Islamic period

Trade leads to the emergence of various forms and mediums of exchange in the medieval age. Before Islam came into existence, trade already had emerged in the Middle East. In all areas where cities were located, trade prevailed. Indeed, Prophet Mohammad was a trader. Changes in culture and political systems forced many regions to unite, which made Arabs gain immense power, thus making it possible to capture various civilizations. During such conquers, Arabs obtained precious metals such as gold and silver. These metals were measures of value and wealth, though they never found utilization as a medium of exchange then. However, metals were critical in fostering the rapid development and growth of the Arabs’ economy centered in Baghdad.

People have a major disadvantage since they are not self-sufficient. The only way to create self-sufficiency entails exchanging commonalities. The barter trade system was the main form of exchange before the emergence of Islam. Through barter trade, commodities and services were exchanged directly for other commodities and services (El-Gamal, 2006). Challenges associated with barter system, especially those related to the measure of value of a given the commodity to another or simply commodity pricing, emerged even before the rise of Islam. This aspect led to the development of other commodities representative of the value of the commodity exchanged. Hence, the concept of money as a medium of exchange existed even in the pre-Islam age. When Prophet Mohammad received a divine calling, Islam was born. The region received trade positively. Although in the early years of the establishment of Islam barter trade system was the main form of exchange, irrespective of the form of exchange or medium of exchange used, exchange of goods and services (trade) was embraced in the Islamic religious teaching if not characterized by fraud and interest.

Issues in barter trade system altered by Prophet PBUH

In the early years of 6th AD, when Islam was established, money not only formed an important aspect well known to different people especially in the highly developed communities, but also it helped to facilitate many transactions. The Arabs maintained high frequency and close contact with people from different nations. They used money in the form of coins to carry out business transactions on a daily basis. However, the largest bulk of transactions, particularly those involving agricultural commodities, involved barter trade, which occurred in the time and period in which prophet Muhammad (PBUH) engaged in the establishment of an Islamic state of al-Madinah.

Following the establishment of Islam, its teachings established rules to guide the process of exchange of commodities in a manner compliant with the Islamic faith. The barter trade system particularly possessed various challenges. Prophet PBUH identified these challenges and made efforts to correct them by making various adjustments. Commodity pricing issues from Islamic approaches to commodity pricing and indexation, which concerned Prophet PBUH, included exploitation, usury, and injustice coupled with other ills experienced in the process of exchanging commodities (Rosly, 2005)

In the process of determination of value for commodities exchanged (commodity pricing) between the buyer and the seller through barter system, Prophet PBUH identified situations in which either the seller or the buyer acquired unjustified gains following an exchange involving commodities of similar kind, but in different quantities. Trade usury (riba-al-buyu) defines such gains (Obaidullah, 2005). In barter trade leading to riba-al-buyu, prophet PBUH advised his companions and Muslims in general to deploy money as a medium of exchange to avoid the riba. Islamic literature also describes riba-al-buyu and riba al-khafi. Riba al-khafi encompasses forms of disguised or the implicit riba (El-Galfy & Khiyar, 2012), which are opposed to jali (clear or the explicit) riba such as the riba al-duyun (Azhar, 2010).

In the pre-Islam period, exploitation and acts of injustices characterized riba. Where barter trade involved exchange of a commodity for a different payment with another commodity in future, riba encompassed doubling followed by redoubling of commodities (Munawar & Molyneux, 2005). In a bid to illustrate this kind of riba, which prophet PBUH was opposed to and considered it serving injustice in the sense that it encouraged exploitation, consider a situation where a person owes another person one goat in exchange for a commodity obtained by the creditor from the debtor sometime in the past. In the pre-Islam era, when one year passed before the debt was settled, the creditor would confront the debtor demanding payment failure to which the riba increased by doubling so that the new debt became two goats. For the next year, the debt would rise to four goats. This was not only an act involving taking an advantage of the failure of the debtor to pay the debt (exploitation) but also amounted to injustice to the poor so that the rich continued to become richer while the poor became poorer.

Rules of exchange in the Islamic system

Commodity pricing and indexation encompass the process of development of indexes to not only measure, but also monitor the performance of various commodities within a given period (Azhar, 2010). Under conventional approaches, this goal is achieved through speculation in rises in the future prices. Shariah prohibits such speculative investment since it entangles acts of deprivation. Shariah also guides the process of exchange of commodities to curtail unnecessary or unlawful gains on the side of either the seller or the buyer. According to Obaidullah (2005), prophet PBUH said, “sell gold for gold, silver for silver, wheat for wheat, barley for barley, date for date, salt for salt, in same quantities on the spot; and when the commodities are different, sell as it suits you, but on the spot” (p.23). This ahadith illustrates the rules for spot markets in commodity trade markets exchange under the Islamic system. The spot-market commodity exchange trade operates under the principle of cash-and-carry. As evidenced by the ahadith, Islamic exchange system supports the spot markets in financial systems

Although the Islamic exchange system supports spot markets, the conventional exchange system has future and forward markets as additional important systems of exchange, which are used especially in trading of stocks commodities in financial markets. Islamic exchange system has different rules applicable to these two markets. The rules prevent unnecessary gains or acts of taking money away from other people (Abdul-Rahman, 2010). For a conventional system of exchange, in case of future markets, commodity exchange involves selling in the present, but making delivery of the commodities at a future specified date in a specified place and quantity. Under the system of exchange, money is not paid at the time of entering into the contract apart in special cases where the contractual terms provide for the buyer to make deposits during the due date. On delivery of the commodity, the buyer pays promptly for the commodities. Under the system, prices for the commodities depend on the forces of demand and supply at differing dates of maturity.

Hedging encompasses the main driver of the forward markets system of exchange. Conventional exchange systems justified the system based on the argument that it enables people, for instance farmers, to plan on ways of controlling costs. Through forward markets processors for raw materials, it develops the ability to make production schedules in future coupled with the ability to make future commitments for delivery of finished products. Conventional banking systems also recognize hedged stocks coupled with raw materials as essential collateral in awarding of loans. In making agreements, amounting to a contract in forwarding markets, objects of exchange do not exist. By employing normal rules on exchanges under Islam rules, such contracts are void since there is no exchange of commodities taking place on the spot. On realization of the benefits that may accrue from certain forms of contracts based on the concept of forwards market, the Islamic rules on commodity exchange make certain provisions through rules such as bay’al istisna, bay’al-salam, bay’al-mua’jjal coupled with bay’al-istijrar (Ayub, 2002).

Under the rule of bay’al istisna, a supplier and a buyer can agree on exchange of non-existing commodities. However, this aspect applies in a situation where the supplier requires some time to manufacture the commodity in a manner that meets the right quality standards so that the price of the commodity agreed upon represents both the quantity and quality of the products. Bay’al-salam imposes conditions to parties engaging in the forward market form of commodity exchange to make full payment of the commodities so that delay in delivery of the products does not amount to gains on one party (Zahan & Kenett, 2012). Such gains would occur in a conventional system of exchange where determination of the price takes place during the time of delivery of the commodity depending on market forces of demand and supply. From an Islamic law perspective, any agreement for sale under forwarding markets encompasses a promise to sale, but not an actual sale (Warde, 2000). This aspect means that such an agreement does not amount to contract enforceable under Islamic law. Under conventional exchange system, such agreements amount to contracts enforceable by appropriate civil law provisions within a given jurisdiction.

In the future markets, the actual delivery of commodities does not occur. The commodity exchanged does not only exist, but also its physical change of hands does not take place. Successive exchanges take place while no single party can claim ownership at any particular moment of the transactions of the commodity. For this reason, while some exceptions under Islamic rule exist to permit the operation of forwarding markets forms of commodity exchange, Shariah comes out clearly on the issue of future markets.

All forms of transactions involving large gains in the form of the future market exchanges are unlawful. Islamic law makes justification for this illegalization on the rationale that several intermediaries in the future markets make huge sums of money while not adding any kind of utility such as form or even placing utility on various commodities traded (Iqbal & Mirakhor, 2011). Therefore, it follows that those parties in the future markets forms of commodity exchange make monetary gains without iwad (recompensing). Charging riba, without recompensing, compares to such a situation.

The application of the commodity index principle in today’s world to reduce inflation when using fiat (paper money)

The commodity index comprises the index, which tracks commodities’ baskets in an attempt to measure the manner in which they perform in different markets. Trading in commodity indexes occurs in the exchange markets by permitting investors to gain quick access to various commodities without the necessity of engaging in the future markets. Various prices of commodities are based on specific commodity characteristics so that mechanics trade similar to those of stock exchanges. Apart from physical commodities, such as precious metals, agricultural products, and even energy commodities, financial commodities such as debts are also indexed. Inflation rates form a major factor determining pricing and indexation of these commodities.

One of the major issues attracting controversy entails how to treat the aspect of debt indexation under the Islamic law. The Islamic law provides various justifications for deviations of its approaches to the time value for money in relation to debts. In particular, the Islamic system prohibits future gains especially where the gain disadvantages the debtor in the future through taking the position of various acceptable forms of riba. One important argument that remains insufficiently addressed covers inflation coupled with the resulting decrease in the value of money in the future payable to an agreement made for a commodity exchanged in the past (Obaidullah, 2005). Under the conventional system of exchange, repayment for debt in the future includes provisions for reduction of the purchasing power of the money paid for the commodity due to the consistent rise in inflation. Hence, where payment is different, inflation has the implication of making debtors gain in the future while the creditor loses. Such a gain occurs since the debtor will pay for commodities acquired in the past at some amount, which cannot buy similar quantities of commodities of equal quality. The question is how exactly such creditors may be compensated for these losses through indexation principle by using a basket of commodities along with Fiat (paper money).

In a bid to illustrate how the commodity index principle can be useful in today’s world, consider a situation where the purchasing power of money reduces by 3 percent after two years. Supposing also that interest (riba) of 2 percent is acceptable within this period of time in which debt will be fully settled. After the two years, this illustration implies that if the transaction were to be referred to time in which the commodities were acquired and used by the debtor, the creditor will have lost by an aggregate of 1 percent. This scenario plays out for the interest will have been superseded by the reduction in purchasing power of the amount of money paid for the commodities after two years.

Although the 2% riba is prohibited under sharia, even on its consideration in the context of higher inflation rates than riba rates, it evidences a scenario of a clearly prohibited gain under Sharia on the part of the creditor. The best possible way to eliminate this unfairness entails completing the transaction on the spot. However, the commodity index principle can be useful in today’s world using a basket of commodities along with Fiat (paper money) to reduce inflation by “linking a debt directly to purchasing power of the currency or unit of account as measured by a macro-economic commodity price index” (Obaidullah, 2005, p.28). Through this approach, which involves the use of fiat and/or a basket of commodities, nominal value adjustment of the debt value accompanies decrease in the nominal value of the medium of exchange.

Making the above adjustments makes it possible to capture the effects of inflation leading to gain on the part of the creditor in exchanges involving deferred payments. While this aspect may be important in the modern world financial markets and other markets involving the exchange of commodities, the application of the indexation principle this way finds little acceptance under the rules of riba and shariah. The Islamic system of exchange defines inflation to encompass a problem developed by people. Hence, modification of rules of riba or any other rule applicable to exchange of communities to accommodate such problems is unacceptable. Solution only lies in the deployment of appropriate macro-economic policies in an effort to curb inflation.

Inflation entails a general rise in price of commodities with time. This assertion implies that a certain amount of commodities bought today with a given amount of money (Fiat) may not be possible to buy in the future. This aspect suggests that pricing and indexation for commodities can aid in the reduction or management of inflation. High demand for a commodity having low supply levels may cause the commodity prices to go up. Where many of the commodities traded in the marketplace go up, inflation emerges. Considering that the amount of commodity in the supply may not change, changes in money supply amongst different players in the marketplace determine pricing and indexation for commodities to ensure they are fully consumed without deficits or surpluses. For instance, suppose a barrel of crude oil costs $80 and the total output capacity annually within a nation is 1 million barrels and the price index changes to $85, yet 1 million barrels are sold without surplus and deficits at this new market price. Taking a hypothetical case for a market where oil encompasses the only product traded, it implies that in the market, there is an increase of $5million in money supply, which implies an inflation of 6.25%. For reduction of inflation, in this example, it is important to ensure limited or absolutely no increase in money supply through adoption of an appropriate monetary policy.

Indexing and pricing commodities highly may also create the necessity of increasing money supply in the marketplace. When prices of products increase, employees demand more money from their employers in form of salaries and wages to increase their purchasing power. Excessive growth in disposable incomes due to money growth takes several quarters or years to indicate existence of inflation. These reasons evidence the importance of using commodity indexation and prices as important indicators and hence a reliable mechanism of reducing inflation. This link between inflation and commodity prices may be exemplified by an example of increasing rubber prices, which leads to increasing costs of cars and prices of trucks. In fact, global markets have been experiencing increasing commodity prices over the last three years. This escalation may truncate into increased prices of housing, financial commodities including loans, and manufactured and processed goods among other consumables.

The concept of the marking to market

The concept of marking to market finds central application in both the conventional markets and the Islamic market systems. In the conventional market systems, it encompasses the valuation of commodities, especially securities, liabilities, and assets as par their fair value. Fair value reflects the current value of commodity as opposed to the commodity’s book value (Munawar & Molyneux, 2005). The purpose for this valuation in a conventional market system clings to the rationale that under unfavorable economic conditions, investors become fearful of losing their investments. Therefore, they consider selling their securities in fear of expected future losses (speculation). On the failure of marking for market, investors may end up selling their securities and other commodities in the financial markets at much lower prices in comparison to the fair value. The overall effects cover reduction of shareholder’s equity.

The concept of fair price ensures that inventors do not lose or engage in activities, which may make them lose their funds. An example of how the concept of market-to-market plays out in the conventional systems is 2008/2009 global financial crisis. Financial institutions encountered challenges in evaluating the various securities held in the financial institution’s balance sheets due to market disappearance. However, FASB authorized basing pricing of securities on paradigms of received prices in the market, which was orderly opposed to forced liquidation. This measure ensured that securities could not be priced below fair value. This example suggests that market prices for financial commodities may fluctuate due to changing economic conditions making investors susceptible to risks of losing their investments in future. Although, marking to market concept in the conventional systems exposes buyers coupled with sellers to challenges of inability to determine accurate way of valuation of anticipated expenses coupled with incomes due to unreliability of information or high optimisms or pessimistic anticipations in the future, under the Islamic system this challenge is not evident.

Investments in financial systems under the Islam financial systems are based on the shariah law of prohibition of riba and gharar. Rather, a deal involving a pact of sharing of loss and profits is permitted under the rules of mudaraba and the musharaka (Obaidullah, 2005, p.47). Under the mudaraba arrangement, two parties enter into an agreement. One provides the necessary capital while the other engages in the management of business. Sharing of gains or losses is based on some pre-agreed ratios with an exception of in the events of negligence and or terms of contract violations. In such cases, the capital provider bears all losses. Under musharaka, capital providers share profits based on some agreed ratios while losses are shared based on the proportion of capital contributions by each partner. While this approach eliminates riba, it also ensures that depending on the prevailing market conditions, not all parties to an agreement or contract incur losses. In financial investments, the capital providers are the individual investors while the manager is the financial institution.

Compared to the conventional markets, the marking for market concept follows a different paradigm in the Islamic market systems. An ahadith illustrates this concept. Bilal visited an Allah’s messenger while possessing some dates of superior quality. When Prophet PBUH made inquiries about the origin of the dates, Bilal informed that he had traded some dates of low quality with the high-quality dates. Hearing this, the prophet replied, “This is precisely the forbidden riba, do not do this, instead, sell the first type of dates, and use the proceeds to buy the other” (Obaidullah, 2005, p.23). This alhadith clearly sets the rule for the exchange of commodities of differing quality, sizes, and quantities under the Islamic system. In the context of the system, the marking for market principle serves similar functions to those it serves in the conventional systems of exchange of commodities. Commodities need fair pricing in accordance with their market value in the bid to avoid incidences of deception (Gharar) or misrepresentation. The Islamic system prohibits Gharar as it leads to making people lose value of a commodity.

Kinds of sale permissible in the Islamic system and prohibited sale methods used prior to Islam

Business activities and conducts of parties in businesses are legitimate only within the confines of the teachings of the Holy Quran as the basis of Shariah law. In contrast with the conventional systems, Shariah takes control over any business undertakings conducted by Muslims to ensure free and fair market. Prophet Muhammad placed emphasis that legitimization of a sale rests on mutual consent between the seller and the buyer (Warde, 2000). Virtues of truthfulness and trustworthiness embrace aspects encouraged in any Islamic business enterprise to ensure fair treatment and legal gains.

The eventual aim of the Islamic principles in business is to build and nurture cohesion among the trading parties. The Islamic system permits transacting on credit if the seller and the buyer arrive at a common agreement. Such a transaction is considered lawful unless the seller opts to raise the price at hearing the buyer’s intention for deferred payment. Other kinds of permissible sales include advance payments, deferred delivery (salam), manufacture sale (istisna), recurring sale (istijrar), and benevolent loan (qard) (Zahan & Kenett, 2012). Unlike in the pre-Islamic period, the Islamic system allows payment in advance where delivery of a certain amount of commodity of a specified price takes place at a particular time in the future.

Deferred delivery sale (salam) involves an agreement where the sold merchandise is paid immediately on delivery at a specific future date and venue. Istisna is an agreement for manufacture of a commodity as specified by both parties at a specific price and specific period within which payment is done in fractions (Iqbal & Mirakhor, 2011). Islamic banking embarks on istisna contracts especially in building and construction where the customer pays in installments as per the pact. Istijrar or recurring sale involves the sale of a commodity, but in different amounts from one seller with payment deferred to a future date in the confines of an agreement. Qard encompasses another financial package used in Islamic banking in lending systems, which are interest free and have no extra increment involved. The repayment includes the loan plus bank expenses did at once or in part in the future. In the conduct of the permissible type sod sale, as opposed to the pre-Islam era, under the Islam age, the parties involved cooperate to avoid unacceptable practices such as riba and gharar.

Hedging instruments, their permissibility in Islam, and their relationship to indexation

Preferences coupled with investments need to influence intermediaries and investors to make certain hedging decisions. Both Islamic and conventional systems of trading in commodities in financial markets deploy differing hedging instruments (Zahan & Kenett, 2012). Important hedging instruments encompass “interest rate swap and profit rate swap” (Zahan & Kenett, 2012, p.60). Although the instruments are available under both the conventional and the Islamic systems, their permissibility is based on different legal principles. In the Islamic system, the principle entails the application of shariah. While widely used in conventional systems, interest rate swap in the Islamic system leads to violation of Gharar, riba, and the Maisir shariah laws guiding the operation of the Islamic banking system. Even in the conventional system, interest rate swap attracts debates among financial scholars on the necessity of classification of derivative agreements as gambling.

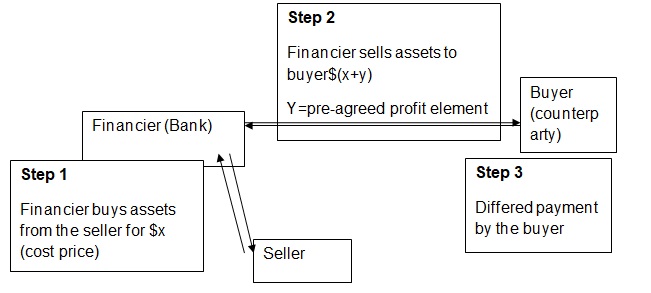

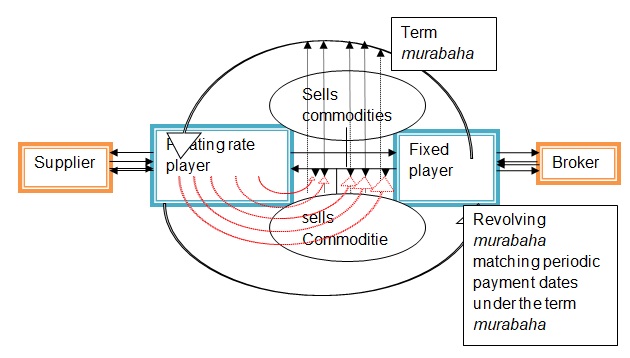

With the prohibition of interests rate swap as a hedging instrument under the Islamic system, the alternative option entails the profit rate swap. According to Zahan and Kenett (2012), this instrument “seeks to achieve Shariah-compliance by using reciprocal Murabaha transactions: commercial arrangements long accepted by Shariah scholars” (p.60). From the context of Murabaha transactions, parties engage in agreements involving the sale of assets, which complies precisely with the shariah law.

The agreement should involve immediate delivery of commodities (assets) while making payments in the future. This way, the hedging instrument of the profit rate swap becomes permissible under the Islamic rule so that both price determination and commodity delivery cannot be done on deferred terms. Fig.2 above illustrates the fundamental structure of Murabaha while fig.3 above shows complete structure for rate swap permissible in an Islamic system.

Reba free (RF) business models

Riba-free business models avoid moneymaking multiplication effects without labor or engaging in risk. Capital creation and profit-taking also comprise important aspects avoided by riba-free business models. The capacity of labor to lead to the creation of economic values underlines the emphasis on the necessity of labor in relation to capital in the Islamic business models (Rosly, 2005).

A person giving a piece of land to a peasant farmer to cultivate under mutual agreement terms may highlight and explain how riba-free economic model. For the agreement to amount to a riba-free business model, the owner needs to provide necessary inputs such as water, manure or fertilizers, and seeds. In a bid to ensure that in case of occurrence of natural calamity, the peasant farmer does not incur any decrement in money due to providing uncompensated labor, the owner also needs to offer protection against natural calamities through equal distribution of ushr arising forthwith.

The peasant farmer should work honestly while ensuring good land care and preventing wild animals from invading the land. On harvest, the farmer sells the products at fair market prices (marking to market) and then ensures distribution of profit with the land’s owner equally. This model exemplifies the relationship between riba-free business models and the commodity pricing principle. The principle advocates for the pricing of commodities based on measurable quantities such as weight, size, or even volume like in the case of a barrel of oil. Comparably, the riba-free business model advocates for distribution of proceeds relative to the levels of risk exposure of capital or the level of labor input.

Conclusion

Capitalistic markets encourage free deals while the Islamic frameworks prohibit any form of interest, which eliminates the possibility of people making money without recompensing. The Islamic system also requires transferring (delivery) of the commodity of exchange in each sale to discourage the flourishing of the future markets driven by speculations in the conventional system. The Islamic system treats money as only a medium for exchange as opposed to a commodity of trade. This aspect hinders the emergence of possibilities of earning riba via transactions involving foreign exchange. These three differences give the Islamic system a high ability to foster employment coupled with the flourishing of trade while also ensuring dilution of magnitudes of fluctuation in the supply and prices under future unforeseen conditions. When the world’s conventional system struggles with the interrogation of sustainability of economic and financial structures’ stability, the Islamic framework can perhaps offer a substantive response to these challenges through the resolution of prevalent economic ills in the conventional system and approaches to commodity pricing and indexation.

References

Abdul-Rahman, Y. (2010). The art of Islamic banking and finance: Tools and techniques for community-based banking. New York, NY: John Wiley & Sons.

Ayub, M. (2002). Islamic banking and finance: Theory and Practice. Karachi, Pakistan: State Bank of Pakistan Press.

Azhar, R. (2010). Economics of an Islamic Economy. Leiden, Netherlands: BRILL.

El-Galfy, A., & Khiyar A. (2012). Islamic banking and economic growth: A review. The Journal of Applied Business Research, 28(5), 943-956.

El-Gamal, M. (2006). Islamic finance: Law, economics and practice. Cambridge, UK: Cambridge University Press.

Iqbal, Z., & Mirakhor, A. (2011). An introduction to Islamic Finance: Theory androgen Practice. New York, NY: John Wiley & Sons.

Munawar, I., & Molyneux, P. (2005). Thirty years of Islamic banking: History, performance, and prospects. New York, NY: Palgrave-Macmillan.

Obaidullah, M. (2005). Islamic Financial Services. Jeddah, Saudi Arabia: Islamic Economics Research Center.

Rosly, A. (2005). Critical issues on Islamic banking and financial markets: Islamic economics, banking and finance, investments, Takaful and financial planning. Bloomington, IN: Author House.

Warde, I. (2000). Islamic Finance in the Global Economy. Edinburg, TX: Edinburgh University Press.

Zahan, M., & Kenett, S. (2012). Hedging instruments in conventional and Islamic finance. Electronic Journal of Applied Statistical Analysis, 3(1), 59-74.