Introduction

Corporate finance is an essential component of any given company. Some of the elements entailed in corporate finance include financial statements and equity financing (Demaria 2010). Consequently, this paper examines two of those elements in the context of two companies. Pet.Com and Hobby Horse (HH) are the two companies that will be used as case studies to explain equity financing and financial statements in this paper. To achieve this objective, the paper will be divided into two sections. The subdivision will help the author to analyze the various problems and proffer possible solutions.

In the first section, the paper will address equity financing and introduce various elements touching on this issue. The elements include Initial Public Offer (IPO), underwriting, and stock prices. The essay will describe what an IPO is and the purpose of engaging in such a process for a given company. The author will use the arguments made by such scholars as Collins (2013) to shed some light on matters to do with underwriting.

The various roles of underwriters and the various types of these professionals will be discussed. The aforementioned elements will be a build-up to a comprehensive analysis of the problem at Pet.Com. To this end, the author of this paper will proffer a solution by advising whether the company should stick to a low stock price or opt for a higher stock price.

The second section of the essay takes a look at financial statements. To this end, the author of this paper refers to the arguments made by such scholars as Kessler (2013) to illustrate some of the common problems associated with financial statements. In addition, the author will use the section to discuss rollover loans and the reason why they are adopted in corporate finance. The author of this paper will further examine the element of financial ratios. Using the financial statements provided by HH, the author will determine the problems the company seems to be experiencing. The author of this essay will also examine the various financial ratios and analyze whether they raise questions that need to be addressed or not. The paper will have a conclusion addressing both problems.

Equity Financing

Ramsinghani (2011) points out that any business outlet requires capital. Such capital may be used to start the said company or to expand the operations of an existing company. In most cases, proprietors are unable to raise the required funds on their own. To this end, companies are expected to raise the required funds in a process that is referred to as equity financing. Demaria (2010) defines equity financing as one of the strategies used to obtain capital for the expansion of an organization. The strategy allows investors to purchase a portion of the company. The equity referred to in this case is the stake that investors acquire in a company in exchange for the money they bring on board.

It is important to distinguish between equity financing and debt financing. According to Demaria (2010), the latter involves the process of obtaining credit to fund any intended expansion in a company. In such cases, a company is directly obliged to return the borrowed money with interest. On the other hand, equity financing allows the investors who acquired the company’s equity to become shareholders in the entity. In addition, the new shareholders are allowed to participate in the decision making process in the company.

Richards (2013) argues that equity financing is a way through which a company can expand its business without the need to make cash payments to a creditor. As such, the company avoids raising money by taking a loan. In addition, equity financing is an avenue through which the company’s ‘personal’ risk is reduced. The risk reduction is achieved through the acquisition of equity by investors.

In this regard, Richards (2013) argues that equity financing shields a company from bankruptcy and the burden of having to pay back debtors in the event that the business venture results in losses. In such cases, a company is not obligated to pay back the equity investors (Demaria 2010). Richards (2013) opines that equity financing is in itself a long-term solution with regards to capital injection in a company.

Initial Public Offering (IPO)

Equity financing entails providing the investors with an opportunity to purchase a portion of a given company. The said investors are usually individuals from the general public. An Initial Public Offering is the process through which a private company sells its stock to the public for the very first time (Harder 2012). Smaller companies rely on IPOs to raise the capital necessary for expansion. Larger companies that are privately owned similarly opt for IPOs in the event that they seek to trade publicly.

Also referred to as “going public”, an IPO allows a company to trade publicly. Members of the public are allowed to purchase a given amount of stock. The process of going public needs help from investment experts. As such, investment bankers are usually contracted to facilitate the process (InvestorGuide 2013). In this regard, the investment bank provides underwriting services to the company intending to sell some of its stock. Depending on the area within which the company is operating, there are different legal provisions touching on matters to do with security exchange. The provisions are enshrined in the country’s securities act.

A company wishing to go public must file a registration statement with the body mandated to oversee securities exchange (InvestorGuide 2013). In this phase of disclosure, a company is expected to give details of its financial position and its ownership. The securities body examines the documents at its disposal and indicates when the full disclosure is to be done. During this process, the underwriter engages with the shareholders on a suitable stock price.

Underwriters

As aforementioned, the process of going public involves the use of underwriting services. Stewart (2013) suggests that an underwriter offers professional advice to a company that intends to trade publicly. In this regard, underwriters act on behalf of a company during the sale of equity.

Like in any other venture, underwriters enter into a contract with a company. The contract has two parts (Stewart 2013). In the first part of the contract, the underwriters agree to purchase all the stock on offer and subsequently sell them off to the public. Stewart (2013) adds that the second part of the agreement is a guarantee by the underwriter that they will do their best to ensure that all the stock is sold. The company going public usually pays the underwriter a fee for their professional services.

Types of Underwriters

The venture of underwriting is a broad one. There are different types of underwriters depending on the nature of their work. They include, among others, those involved in insurance (Stewart 2013), loans, and IPOs (Collins 2013). Depending on the industry within which they are operating, the underwriters have specific roles. In the case of IPO underwriters, they analyze the market and develop a price at which the stock should be sold. As aforementioned, they also sell the stock to the general public on behalf of the company.

Issue Price in an IPO

When a company decides to go public, the shareholders must come up with a given price at which the initial stock is to be sold to the public. Underwriters offer advice to shareholders of a company on the suitable price at which to sell the stock in an IPO (Demaria 2010). The underwriters take into account several variables of the market in setting the price. Such variables include the demand for the company’s stock. Depending on the performance of the company, underwriters can advice on either a high stock price or a low stock price in an IPO.

Demaria (2010) suggests that a company should trade in low- priced stocks in an IPO. Demaria argues that such a price allows the public to buy more stock volumes. On the part of the public, Finkel and Greising (2009) are of the opinion that a low issue price has little risk and a high potential for growth. It allows investors to make a quick profit, which they can offset as fast as possible.

According to Demaria (2013), a low issue price ensures that a company does not lose money. The reason is that the trading volumes are usually high in such cases. However, an argument is raised that a low issue price has minimal returns as opposed to a high priced issue price. It is a fact that a low priced issue enables the company to sell large volumes of stock. However, the profits made are low. A high issue price achieves low sales volumes of stock. However, the amount of money raised is surprisingly high.

Analysis of the Problem at Pet.Com

Pet.Com is a company with a system meant to find potential buyers for pets that are no longer wanted by their owners. The company has been in existence for three years with annual profits of up to $3.4 million. It intends to go public to facilitate expansion. The status of the company notwithstanding, it has incurred its share of losses. But the losses have not deterred investors from owning a stake in the company. Pet.Com has three major shareholders who control 1.5 million shares of the company.

The proposed IPO would see the company offset 1.25 million shares. The estimated cost of the IPO is set at $1.3 million. The underwriters of the IPO entered into an agreement with the company to pay $1.25 for each share sold. Based on the demand that investors had expressed, the shareholders wanted the initial stock price to be $24 per share. However, the underwriters proposed a price of $18, arguing that $24 is too high. The problem arose when the financial manager insisted that the initial price should be $24, arguing $18 is an underpriced value.

Solution

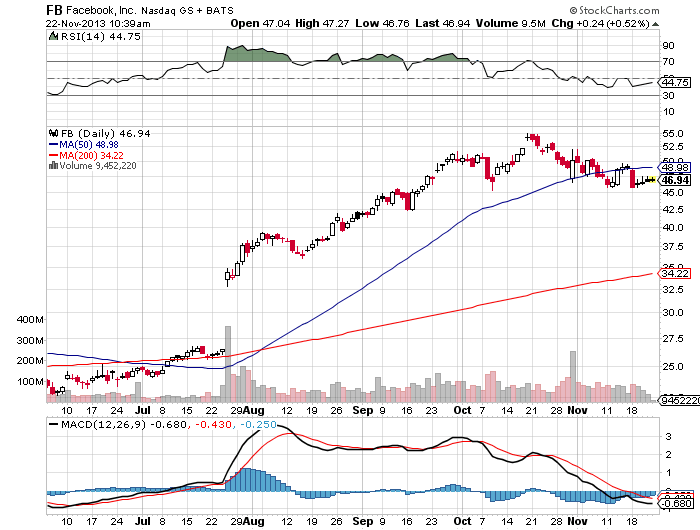

The author of this paper suggests that Pet.Com should stick to the advice given by the underwriters. The company’s IPO is similar to those of Facebook and Twitter. In both cases, the investors were eager to see to it that the issue price was set high. However, the two companies opposed the suggested price. Facebook opted for a high issue price (Schaefer 2012), whereas Twitter’s issue price was reasonably low (Hockenson 2013).

Schaefer (2012) indicates that investors were pushing for trading of the Facebook stock at above $46. They were predicting that the stock will rise to $60 on the first day. However, this was not to happen. The company achieved 1% of the issue price (see figure 1). Speculation forced shareholders to sell most of the shares. The high issue price is the reason behind the stock’s plummeting stock prices in the market (see table 1).

In the case of Twitter, the investors were piling pressure on the shareholders to set the issue price higher than that of Facebook (Hockenson 2013). However, the underwriters advised on a relatively lower issue price, which was set at $26. The stock traded in large volumes, closing at a price that was 73% higher than the opening offer (see figure 1).

Table 1. Significant price moves. Adapted from Schaefer 2012.

Pet.Com shares similar characteristics with Facebook and Twitter given that they are both in the e-market. In both cases, the demand for the stock was high, resulting in a higher stock price. However, as evidenced in the data presented in figure 1 and table 1 above, a high stock price is not a guarantee for high revenues. A look at the days of trading after Facebook went public reveals that the stock price is plummeting. To this end, it would be beneficial for Pet.Com to stick to a low issue price as suggested by the underwriters.

Analysis of the Problem at Hobby Horse

The company was founded in 1990 and deals with selling merchandise used for hobbies and crafts. Over the years, the company has grown and boasts of a chain of stores dealing with the same. Like any other organization, the company has experienced unforeseen losses due to an expansion program that was not very successful. The company sought a $45 million loan, but things are not looking good. Consequently, the creditors are required to determine the root of the problem ailing the company.

An analysis of the company’s financial statement is the best way to understand the company’s problem. Tables 2, 3, and 4 illustrate the said statement. From the financial statement, one can understand the problem given that the bank seems reluctant to offer a rollover loan to HH.

From table 2, it is evident that there is an increase in sales from the previous financial year. However, the earnings before interest tax (EBIT) have declined sharply. There is a sharp decline in the profits and the company’s equity. There is a worrying trend in the company’s spending since the cost of labor has gone up from the previous year.

The liabilities of the company are higher compared to the situation in the previous year. Despite an increase in the number of assets, the dividends have sharply declined. The same is an indicator that the trading of the company’s stock is not as good as it was expected. The company’s long term debt has shot up sharply. In the opinion of Fridson and Alvarez (2011), a company with high long term debt is not worth of credit. To this end, it would be ill advised for HH to take a rollover loan since the cost will continue to go up.

Financial Statements

Business organizations use finance as the backbone of their operations. To this end, it is expected that such companies should have an overview of the financial implications of their operations, hence the need for financial statements. Kessler (2013, p. 19) suggests that a financial statement is a record kept by a company to detail all its financial activities. The financial statement is designed in such a way that one can easily comprehend the financial information contained therein.

A financial statement comprises of three important elements (Kessler 2013). One of them is a balance sheet. It is an illustration of a company’s ownership equity. Also, the balance sheet illustrates the assets and liabilities of the company. A financial statement also has information on a company’s income. Within this income section, information about a company’s profits, losses, and expenditure is provided. Lastly, Kessler (2013) points out that a financial statement should illustrate how cash flows in a given company.

Financial statements play a significant role in the overall performance of a company (Kessler 20013). The issues covered in the statement are complex in nature. The complexity notwithstanding, such statements ought to be easily comprehended by persons with an understanding of business. They should be reliable and comparable to other such documents from different companies. Persons who read financial statements attach various functions to the document.

Kessler (2013) suggests that financial statements are used by the proprietors of an enterprise to make decisions touching on matters to do with general operation. Upon a thorough analysis of financial statements, the management of a company is able to make informed decisions and even give an account of the company’s performance. The report is given to the company’s shareholders. The financial statements are also beneficial to the staff of a given company. According to Kessler (2013), labor unions make use of the statements to determine appropriate remuneration for the staff.

Apart from the owners and staff of a company, financial reports are beneficial to external actors like investors. Lake and Lake (2000) argue that financial statements have implications on investors. For example, potential investors will rely on the information depicted on the statements. In addition, credit lending institutions like banks make use of a company’s financial statement to determine whether they can grant credit or roll over on loans. The same happens due to a company’s intent to expand. In the first section of this paper, debt financing was elaborated upon. What this means is that financial statements enable a financial organization determine whether a company can qualify for credit or not.

Analyzing Financial Statements

As mentioned earlier, financial statements are used by credit lending institutions to determine the viability of a company. Such a determination is necessary when the company is seeking credit or an extension in the event of a roll over.

A financial statement comprises of three important elements (Kessler 2013). The document requires a balance sheet, which is an illustration of a company’s ownership equity. In addition, the document illustrates the assets and liabilities of the company. A financial statement also contains information about a company’s income. Within this section of the statement, information about a company’s profits, losses, and expenditure is illustrated.

According to Fridson and Alvarez (2011) lending institutions examine certain aspects of a financial statement to determine whether or not to give credit to a company. Companies whose financial statements are faulty or whose numbers do not reflect growth are usually not granted credit (Fridson & Alvarez 2011).

The approach adopted in analyzing a given financial statement involves an assessment of specified components (Demaria 2010). Primarily, a company should outline its debts in the statement. There are certain financial statements that do not indicate the debt in the balance sheet section. Such a situation was witnessed in many banks that had offered mortgages in the recent global financial meltdown. The figures were staggering (see figure 2). Interestingly, the debts were not indicated in the balance sheets. Many companies hid this information in hedge funds.

The other segment of a financial statement that is analyzed by a credit institution is the one detailing expected earnings potential. Demaria (2010) points out that the investments that a company makes are not easy to comprehend by looking at the organization’s current value. The author suggests that a forecast of the company’s earning potential is the best way of understanding its investment portfolio. A case in point is a bank willing to credit a company like Facebook Inc. Such a bank needs to look at the performance of Facebook’s stock on the securities exchange (see figure 3). Such information should be included in a company’s financial statement as part of the notes.

As aforementioned, a financial report must also include information about the company’s assets. There should be information about the physical property of the organization. In addition, a financial statement should indicate the assets that were acquired through debt. According to Fridson and Alvarez (2011), financial statements that do not make such disclosures usually contain hidden assets. Thus they are usually not given access to credit owing to their inability to be honest.

Ratio Analysis

A financial statement has different ratios that are taken into consideration when evaluating a company’s performance. According to Demaria (2010), representation of information on a financial statement through a ratio system implies how certain figures are related to others. For instance, the profitability ratio of a company takes into account a number of other ratios. Some of them include gross profit ratio, net profit ratio, and return on equity capital. Other important ratios include price earnings ratio and expense ratios. Together with dividend yield ratio, the two are used to review the performance of a given company.

The other computations usually calculated from a financial statement include liquidity ratios. The calculations of such ratios enable a company to meet its recurrent obligations and sustain its operations. In this regard, the liquidity ratio is a combination of other two rations. The two are current and quick ratios. Demaria (2010) points out that a current ratio is obtained from the quotient of a company’s current assets and its current liabilities. A quick ratio is a quotient of quick assets and current liabilities. The formulae are given below:

- Current ratio = Current Assets/ Current Liabilities.

- Quick ratio= Quick assets/ current liabilities.

In the case of HH, Current Ratio = 669/680 = 0.9838. Beck (2013) explains the implications of current ratio values. According to the scholar, a value that is greater than 1 suggests that a company has adequate cash to pay its bills. However, in the case of HH, the current ratio stands at 0.9838, which is less than 1. The value implies that HH is unable to pay its bills.

A financial statement enables one to calculate activity ratios. Using these kinds of ratios, one is able to determine the extent to which the resources of a company are engaged. When such ratios are computed, one can estimate the rate at which assets are converted to sales. According to Demaria (2010), activity ratios are made up of a number of other ratios. They include inventory, creditors, fixed asset, and working capital turnover ratios.

Beck (2013) further points out that the debt-to-asset ratio provides a potential investor or a credit facility with critical information. Using the value, the parties can get an idea on a company’s indebtedness. If the value is greater than one, then the company has a positive net worth. The following is the formula for this ratio:

Debt-to-asset ratio= Total Assets/total liabilities.

In the case of HH, the debt to asset ratio = 1592/1592=1. Consequently, the company lacks a positive net worth and is not suitable to invest in.

Solutions

Debt financing, as aforementioned, usually brings on board credit lending institutions. In such instances, companies enter into an agreement with a lending organization and agree to obtain a certain amount of money. The company that obtains the loan agrees to repay after a certain period of time. However, there are instances where a company is unable to repay the credit due to unforeseen circumstances, hence a rollover. Udo (2013) suggests that a rollover loan is one that is renewed at a given point. The renewal depends on the loan agreement entered into between a lending institution and a company.

According to Udo (2013), there are various types of rollover loans that are different from each other. However, the principle behind each of the various rollovers is the fact that the loans are renewable. What usually happens is that the loan given to a company is renewed after an agreed duration of time. The assumption made in such instances is that the money is paid and then re-borrowed upon each renewal.

One of the ways to address the company’s financial tribulations is to cut on spending. The long term debt margin between the two years illustrated in the financial statement indicates that the company should seek revenue to reduce loans. It should reduce spending in wages. The increase in staff results in an increase in the company’s wage bill. Consequently, the company should consider downsizing its staff so as to repay the debts (Udo 2013).

Rather than increasing debt, Kessler (2013) suggests that companies should look for strategies to cut on spending. The author suggests that a company should consider liquidating assets as an avenue of raising revenue. In the case of HH, the financial statements indicate an increase in both assets and liabilities. The company’s management the management at HH should consider liquidating some of the assets to raise revenue and clear debt. Such a move would be a better option as opposed to seeking a rollover loan.

Conclusion

In this paper, the element of corporate finance formed the central theme of the arguments brought forward by the author. The paper used two case studies to illustrate debt financing and equity financing. In both cases of financing, a company is required to raise capital to fund expansion projects. In the case of equity financing, a company is not tied to its financiers since they become part of it. However, in the event that a company resorts to credit as source of financing, it remains connected to its creditors (Kipper 2009).

In the case of equity financing, it is always better for a company to have a low issue price. The argument in favor of this opinion is that low price enables the company to sell more stock through an IPO. Once the stocks are fully bought, their demand increases in the securities market. Consequently, the prices of the stock go up. In the case of Pet.Com, this paper recommends that the company should stick to the underwriter’s advice of having a low issue price for the IPO (Brandt 2013).

In the case of HH, the company is heavily indebted and has not made profits for a number of years. It would be advisable for the company to offset its liabilities and some of its assets to spur a growth pattern. Seeking for a rollover loan is not the best way to resolve the financial crisis. From experience, it is evident that debt financing is not the way to go.

References

Beck, C. 2013. Implications of financial ratios. Web.

Brandt, M. 2013. Twitter makes an entrance to the NYSE. Web.

Collins, J. 2013. Loan – role of an underwriter. Web.

Demaria, C. 2010. Introduction to private equity. Wiley, London.

Finkel, R and Greising, D. 2009. The masters of private equity and venture capital. McGraw-Hill, New York.

Fridson, M and Alvarez, F. 2011. Financial statement analysis: a practitioner’s guide. Wiley, London.

Harder, U. 2012. What is IPO stock. Web.

Hockenson, L. 2013. Twitter IPO: live tracking the price. Web.

InvestorGuide. 2013. Initial public offering. Web.

Kessler, P. 2013. Common problems in financial statements, Amazon, London.

Lake, R and Lake, R 2000. Private equity and venture capital: a guide for investors and practitioners. Euromoney Institutional Investor, London.

Kipper, D. 2008. Japan’s new dawn. Web.

Ramsinghani, M. 2011. The business of venture capital: insights from leading practitioners in the art of raising a fund, deal structuring and exit strategies. Wiley, London.

Richards, D. 2013. Equity financing – is it right for your small business. Web.

Schaefer, S. 2012. Facebook’s fall: slide carves $ 21B off market cap in 7 trading days. Web.

Stewart, D. 2013. Types of underwriters. Web.

Udo, J. 2013. 7 reasons to roll over your 401k. Web.