Introduction

Since every organization and its approach towards business operations matters to the entire business fraternity and the consumer world, strategic planning has become a necessity in almost all modern companies. According to Ajmal, Farooq, Sajid, and Awan (2012), each piece of skill, knowledge, technique, or a business strategy, which include business arrangement and structure, matters a lot to the operations of most contemporary companies. Business arrangement begins with an understanding of corporate culture and corporate structure, and the manner in which they interrelate in ensuring that business operations are meeting the predetermined expectations (Ghosh, Sharma & Mohabay 2011).

With corporate culture and corporate structure as important facets, change management has also emerged as an imperative business practice that modern businesses must regulate (Hassin 2010). Accepting, adopting, and implementing change are strategic planning techniques that organizations use to enhance operational techniques of modern organizations amidst corporate competition that is increasing steadily (Hassin, 2010). In the view of such notions, this report analyses change management in Dubai Holding.

Desired Change: The Oversee and Implementation Committee

Effective management systems and stringent rules of simply managing the organizational processes are not enough to ensure transparency and fraud control in financial organizations despite extreme firm auditing processes. A shocking fraud incidence involving the topmost officials of Dubai Holding in 2009 prompted serious public discourses and controversies, with a series of court processes and charges of corruption imposed against some major officials (Dubai Holding: About Dubai Holding 2014).

According to a report released on 24 October 2009, a senior law enforcement official released a series of bribery and corruption cases that marred Dubai Holding and made it lose approximately Dh200 million. Sources close to the investigation revealed that some senior officials of Dubai Holding faced detention of more than six months concerning their involvement in bribery and corruption cases involving a real estate sector (Dubai Holding: About Dubai Holding 2014). The situations prompted Emirati government to impose severe legal penalties on concerned fraudsters, but little seems to happen to the internal structure of Dubai Holding as remedies of mitigating fraud still lack.

Although modern organizations normally comprise all the operational departments necessary to ensure effective organizational planning and maintenance, they have continually failed, as planning needs proper implementation techniques (Ghosh, Sharma & Mohabay 2011). Most organizations fail because irrational decision-making and poor management of resources occurs during the operational processes involving certain production companies. When organizations have hierarchies in authoritative arrangement, where top managers have few overseers and departments to be answerable, prowling, mismanagement and infringement of laws and regulations may occur (Hassin, 2010).

Since hierarchies are normally barriers to effective development of company and managers have the ego to practice their supremacy as they wish, firms end up encountering colossal losses. Ensuring that everyone in an organization is answerable and responsible in their professional duties may place a modern organization ahead of others, given the increasing business uncertainties and intensifying corporate competition (Hassin 2010). Designing an implementation committee in an organization where all members are answerable in terms of daily operations and planned firm projects is essential.

Organizational management involves management of people and resources, classified as human resource management and business management respectively (Pieterse, Caniels & Homan 2012). It is common that most of the Asian and the Middle Eastern companies have organizational structuring based on hierarchical leadership where top down management of people and resources is normally eminent. Such hierarchical and authoritarian leadership arrangements are normally quite challenging for any effective change initiation and change management to prevail (Hassin 2010).

Dubai Holding is one of the major UAE organizations that are currently globalizing and has a heavily bureaucratic arrangement and management that often experience lapses that frequently lead to losses. It is a financial investment holding company dealing with financial assets (Dubai Holding: About Dubai Holding 2014). The power to control the organizational operations, the strategies, and planning of essential programs in Dubai Holding rests upon the mainstream management system. Since the organization has bestowed supremacy to the main management, overseeing the implementation of megaprojects to restrict corruption and manipulation seems very challenging.

Quiz 1: Sectors and Elements of the Environment that Would Influence Change

Corporate change is an integral aspect in most of the modern companies. As Dubai Holding prospects an outstanding global performance beyond the recent 24 countries it operates within, change would be paramount (Pieterse, Caniels & Homan 2012). However, several internal and external aspects associated with the organization prospecting for a change, normally influence the adoption and implementation change. According to Ajmal et al. (2012), change normally brings a significant impact on an existing organization and affects the structure and culture of the organization.

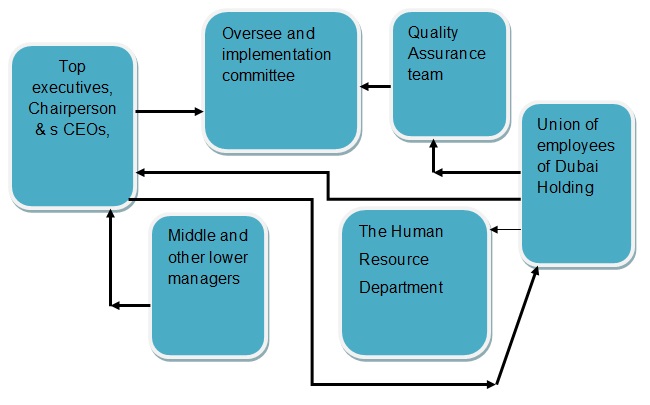

The launch and implementation of the overseer and implementation committee within the organization would affect numerous departments, but mostly the Dubai Holding top executives. The change directly associates with the topmost management, extending downwards to the junior officials, as Dubai Holding seems heavily bureaucratic. The oversee and implementation committee would be an independent team of managers, lawyers, firm auditors, business analysts and experts, who will oversee company operations and assess the consistency, transparency and formalness of recommendations or reprimands.

PEST and the desired change in the organization

Figure 1 is a representational diagram that depicts the manner in which the overseer and implementation committee would fit into the organization. PEST is an organizational diagnostic instrument that seeks to analyse Political, Economical, Social, and Technological aspects that may influence an implementation of a program in an organization (Mahara 2013). Since the departmental change targets top officials, the change will be consequential to the topmost executives, who may fear reprimand and condemnation in their fraud practices.

As described initially, the topmost officials of the Dubai Holding have historically practiced financial fraud and political issues are likely to influence the intended change management (Mahara 2013). Decisions are top down in Dubai Holding and receiving substantial support from the top executives in the implementation process of the change idea would be really challenging. The command, communication, and coordination of the process regarding the integration of the proposed overseer and implementation committee may suffer subjugation from senior officials, who would wish to maintain the fraudulent team.

In the PEST model, economic issues in an organization may hamper an effective implementation or integration of a program in an organization (Mahara 2013). It would deem significant to implement an overseer committee than to lose millions through fraud. Although Dubai Holding is a national organization, the integration and implementation of the desired committee may suffer financial deficits following the internal political power existing within the officials of the organization.

A high wage bill and employee retention may rise as per the arguments in the organization. Social issues are also likely to rise, since the communication breakdown between the hierarchies and the implementation community may instill fear to most of the employees (Mahara 2013). The manner of communicating employee issues may remain affected if internal politics and power influence the existence of the overseer and implementation committee. Under PEST, according to Mahara (2013), information technology is one aspect that would determine the influence of the committee as enhanced technology might overpower the existence of the committee.

PEST analysis: table on issues that would influence change

Table 1

Quiz 2: The advantages and disadvantages of the change

Benefits of the desired change

As a prospected change, developing and integrating the overseer and implementation committee in Dubai Holding has its advantages and disadvantages. Corporate change is an effective practice since change integration and management makes a firm realize operational lapses and provide possible efficient fixes. The greatest advantage of the overseer and implementation committee would be mitigating financial loss that occurs through fraudulent activities in Dubai Holding.

Losing over $55 million through fraudulent activities is likely to have massive effects on the operations of Dubai Holding and the Dubai government since it oversees various financial services and other lucrative estate investments, relied by the Dubai government. Controlled flow of corporate activities would be another significant benefit that Dubai Holding would witness, since a high sense of accountability would emerge, as the overseer and implantation committee would be putting executives and employees on extra devotion towards their professional mandates. An organization with a responsible workforce that understands the virtues and corporate culture excels.

Since fraud cases marred the organization and affected its operational techniques, market status, Dubai Holding will recover its market reputation and consumer trust, following a high level of fraud detection and control. The team of experts would possess the legal mandate of prosecuting policy breakers, subsequently instilling faith and confidence of employees regarding the behaviours of their superiors. With the reduced authoritative supremacy, the concept of individual competency and fairness becomes in inherent among the departments and workforce, subsequently influencing the performance of Dubai Holding.

If employees within a department or organization increase their individual competence regardless of power within the corporate operations, coordination of work increases among the workforce. Generally, the overseer and implementation committee will enable organizations to increase their efficiency in terms of financial control, human resource practices, and technical operations and in maintaining approach towards globalization. Since the committee would ensure proper implementation of laws, regulations, and megaprojects. Evidently, such approaches would enhance universal performance.

PEST analysis: table about the advantages of the change

Table 2

Limitations of the Intended Change

Modern organizations are fighting against excess labour turnover, as excess employment increases the compensation package for employees. Setting up an overseer and implementation committee would probably increase the wage bill that Dubai Holding would use to compensate its workforce. Restructuring of organizations also requires some finance that would support the operations of the newly devised department and thus would probably increase the budgetary allocation for management and maintenance of the departments.

Without a proper definition of mandates for top executives and the implementation committee, and without proper policy development of hierarchical power, role conflict may arise from the organization. Executive wrangles arising from the company may further affect the operations of the entire company, as leadership is important in ensuring smooth running of organizational operations. The line of command may remain altered, resulting in ambiguities that spur management problems that subsequently influence the general performance of the organization.

PEST analysis: Table about the Advantages of the change

Table 3

Quiz 3: Why it is realistic for managers to change organizational culture

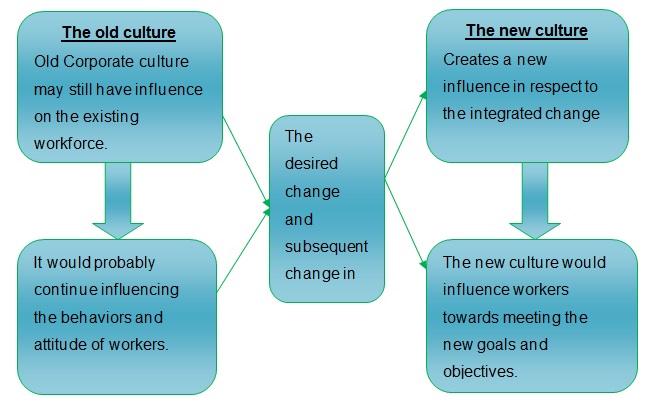

Organizational culture often involves the shared values, espoused beliefs, assumptions, and convictions about the manner in which members of organizations should behave, practice, and operate (Dibella 2007). Organizational culture is a strong binding factor that influences behaviours and attitudes of workers towards certain practices and operations in a workplace. Initiating an organization would therefore require disintegration of the old values and integrating new values that would spur the desired change (Dibella 2007).

Change management is challenging, especially when trying to break the cultural norms that organizational members have intrinsically nurtured and trusted. Several business models argue that technology, demographics, and globalization are factors that most likely to influence changes in organizational structures and cultures (Dibella 2007). The breakdown of the old culture is imperative, as it creates a backdrop towards creating awareness about the desired change to the workforce. Aspects of organizational culture, such as vision, mission statements, and corporate objectives act as communication tools, and altering them would be the first step towards communicating the desired change.

Diagram: changing culture as part of communicating change.

Conclusion

As corporate competition within modern organizations and the demand for exemplary services and consumer preferences intensify with technological influence, integration and management of change are essential. Corporate change normally revamps the lost corporate image, enhances efficiency in organizational operations, and instills motivation among stakeholders, top managers of an organization and the workforce fraternity.

Nonetheless, change management itself is a rigorous process that requires proper analysis of determinants of effective corporate change and cultural factors that influence change. Changing a corporate culture that organizational members have intrinsically adopted and nurtured is the greatest challenge in change management, but the first and the foremost approach that change managers should understand and implement. Change integration and management should also consider the financial situation, human resource issues, and the interest of stakeholders.

Recommendation

- Organizations should implement change effectively in a gradual and a transformative manner to avert lose of their values and collapse (Gilley, Gilley & McMillan 2009).

- Change integration and management should reflect the interest of stakeholders, especially the business owners, but not the interests of the top managers (Gilley, Gilley & McMillan 2009).

- Research on organizational change should improve understanding of change and the essence of doing away with the conformist ideologies.

References

Ajmal, S, Farooq, M, & Sajid, Awan, N 2012, ‘Role of Leadership in Change Management Process’, Abasyn Journal of Social Sciences, vol. 5, no. 2, pp. 111-124.

Dibella, A 2007, ‘Critical perceptions of organizational change’, Journal of Change of Change management, vol. 7, no. 3, pp. 231-242.

Dubai Holding: About Dubai Holding 2014, Web.

Ghosh, S, Sharma, H & Mohabay, H 2011, ‘Analysis, and Modelling of Change Management Process Model’, International Journal of Software Engineering and Its Applications, vol. 5, no. 2, pp. 123-134.

Gilley, A, Gilley, J & McMillan, H 2009, ‘Organizational Change: Motivation, Communication, and Leadership Effectiveness’, Performance Improvement Quarterly vol. 21, no. 4, pp. 75– 94.

Hassin, A 2010, ‘Effective diagnosis in organizational change management’, Journal of Business Systems, Governance and Ethics, vol. 5, no. 2, pp. 23-29.

Mahara, T 2013, ‘PEST- Benefit/Threat Analysis for selection of ERP in Cloud for SMEs’, Asian Journal of Management Research, vol. 3, no. 2, pp. 365-372.

Management, vol. 7, no. 3, pp. 231-42.

Pieterse, J, Caniels, M & Homan, T 2012, ‘Professional discourses, and resistance to change’, Journal of Organizational Change Management, vol. 25, no. 6, pp. 798-818.