Introduction

The fluctuation in the oil prices has the power to rock the entire world economy (Balassa, B., p23, 1985). The world has witnessed rapid fluctuations in the price level of oil over the last few decades and this fluctuation has drawn diverse affects on the economies of the world. It is believed that the global economic performance is derived by the oil hence the fluctuation in the price of oil also fluctuates the performance of the world economies (IEA, p7, 2004). Numerous attempts have been done to measure the impact of oil prices fluctuation on the economies of different countries and it is found that changes in the price level bring different developments in the economic conditions of different countries. The oil producing countries are generally benefited by the rise in the oil prices whereas the countries depending on the oil export to run their various industries have to pay more for oil and their energy expenditures are increased (Abeysinghe.T, p147, 2001).

This paper strives to looks at the effects of the fluctuations in the price level of oil on the economies of the Middle East countries and in this regard the economic performance of different Middle Eastern countries including UAE, Saudi Arabia, Oman, Jordan and Libya are studied to find the evidences about the effects of oil price fluctuation on the economic conditions of these counties over the last fifty years. The trends of oil prices over the last few decades are studied moreover the major reasons behind the oil prices fluctuation is also studied to get clear understanding of the issue. Thus the paper presents the case studies of the economies of different Middle East countries with reference to the oil price fluctuations and also discusses the impact of the oil change on the over all domestic political economies of Middle East.

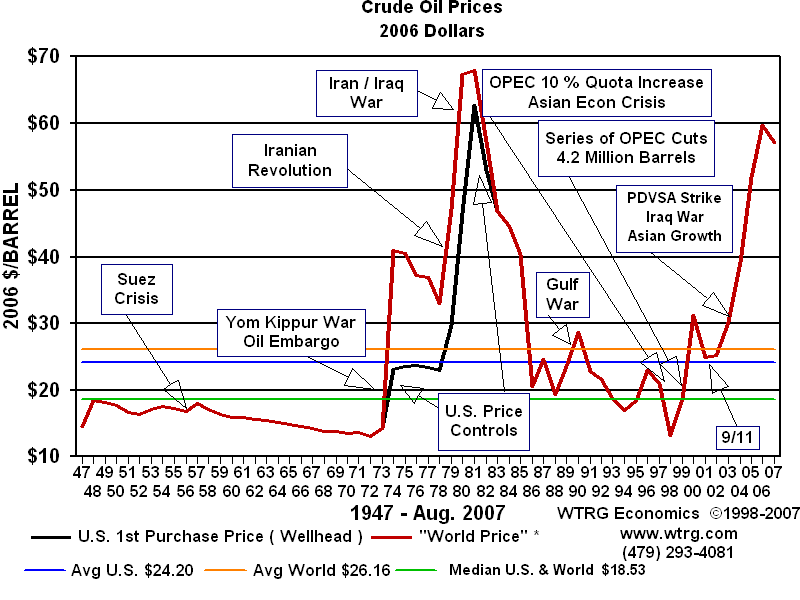

Oil Price History over the Half Century

There have been major changes occurred in the price level of the oil during the last century. The following chart explains the fluctuation in the price level of oil and the role of different international events on the price level.

Oil Prices and World Economies

The rapid changes occurring in the price level of oil has worried the people all over the world and the economies all over the world are also destabilizing due to this price change occurring at small intervals of period but there is little hope that there will be stability in the oil price level in the coming days also (Sherine Nasr, n.p, 2006). The global economies are much more effected by this fluctuation as the GDP growth of the world is also changes by taking effects of the changes in the oil prices (IEA, p7, 2004).The world has witnessed mostly a rise in the price of oil during last few years and the oil producers are affected by this change in a quite different manner from the oil consuming countries whereas for some countries rise in the oil prices has proved to be a mixed blessing.

The dependency of the economies on the oil based sector plays an important role in determining the role of price fluctuation on the economic conditions. The more countries depend on oil and oil products the more their economies are effected and the prices of other energy sources like gas also changes as a result of change in oil price, drawing important effects on the economies of the world (IEA, p7, 2004). As a result of increase in the oil price large amount of money is transferred from the oil importing countries to the oil exporting countries.

Oil Prices Fluctuations – Causes and Effects

The fluctuation and continuous instability in the level of oil prices is affected and resulted from the supply management policies of OPEC (IEA, p7, 2004). It is also believed that changes occurred in the price level of oil due to demand supply relationship of oil (Reiji Takeishi, n.p., 2000). When there is unstable supply of oil then ultimately the oil prices went on rising because of rise in the demand of oil because in many countries of the world oil is used after passing though many stages like the transportation, refining and the sales of oil. Whenever these stages are delayed or affected by any factor the prices of oil went on spiking (Reiji Takeishi, n.p., 2000). The instability in the prices of oil occurs because the amount the oil supplies to the countries in not sufficient and then the oil importing countries face shortage of oil for producing different oil based products.

The reason behind the shortage of the oil supply is a consistent increase in the world demand for oil especially after 1990s there is expansion in the world economy and many of the countries like China and North America indicated rise in the demand for oil as their economies require more oil and oil based product to perform various industrial, manufacturing and other activities (Hiromi Kato, p2, 2005). The increase in the demand for oil in China has reached up to a level that it need 30 percent of the total global growth, due to this reason there is high rise observed in the oil imports by Chine whereas the over all demand of oil has increased from 1.8 millions to 20 millions bpd (Hiromi Kato, p2, 2005).

Several experts have attempted to find out the reason behind the fluctuation in the price of oil at very short intervals of time. The rise in the global demand of oil especially by the developing countries like India and China is considered as an important factor that directly affects the oil demand and ultimately cause rise in its price (Dr. Ibrahim ibn Abdul Aziz Al Muhannam, 2004).

Due to increased activities of these countries based on oil and oil based products the expected demand of the oil per year also exceeds the limits and during the year 2004 it was estimated by International Energy Agency that the world oil demand will be less then 80 millions barrel per day but later on it was predicted that there is rise in the demand of oil and according to the new expected figures 82.2 million barrels of oil per day were required by the world economies. At the same time some of the countries like Russia, Caspian Sea, West Africa and Iraq failed to increase the supply of oil in the world market due to which the overall supply of oil could not be increased (Dr. Ibrahim ibn Abdul Aziz Al Muhannam, 2004).

Along with these major reasons behind the fluctuation in oil prices there are some other factors also that contributed towards change in the prices of oil in the world market. These reasons include the political and social instability in some of the oil exporting countries like Iraq and Iran that leads to reduction in the oil production moreover the situation of the financial markets also plays a major role in changing the prices of oil. All the above described factors contributed towards the fluctuation in the oil prices and as a result of this fluctuation the total import expenditure of many countries are affected and more amount of income is transferred to the oil producing countries from the oil importing countries. The GDP growth of the oil producing countries is increased when they get more money for oil, on the other hand the GDP of the oil importing countries is dropped because they have to pay more for oil. The following tables shows the effects of oil price fluctuation on the exports and imports of the countries

Oil Price Fluctuations and the Economies of Middle East

The economic condition of Middle East are mostly affected by the changes in the price level of oil because many of the countries of the region are oil producing as well as their economies also depend upon oil based sectors (A. F. Alhajji, p21, 2001). Following is the description about the effects of oil price fluctuations on the economies of different countries of Middle East.

Fluctuations in Oil Prices and the Economy of Saudi Arabia

Saudi Arabia possesses the world’s largest oil reserves and it is the largest petroleum exporter of the world (Marco Venditti, n.p., 2006). The main source of income for the country is the revenues that come from the oil export and 95 percent of the export earnings are contributed by the petroleum sector. Fluctuations in the oil prices matter a lot for the economy of the Saudi Arabia and due to heavy dependency on the oil export revenue, the government of Saudi Arabia always like to have such situation where the oil prices went on rise so that the revenue coming to the country could also increase however the rise in the oil prices not always result in better performance of the Saudi economy because in case of higher oil prices the petroleum cost also went on rising and then there will be reduction the money investment in other sectors and the overall conditions of the global economy will become worst. Hence for Saudi Arabia growing world economy is ideal because in that case the demand for Saudi oil increases and the country gets more revenues. According to the statistics of IMF, in the year 2005 there was increase in the oil production, structures reforms and macroeconomic stability in Saudi Arabia and the main reason behind this impressive improvement was the rise in the oil prices. The real GDP growth of the country was raised by 6.6 percent whereas inflation declined and stayed at the level of just 0.7 percent (IMF Statistics, p108, 2006).

Over the last few decades there is consistent rise in the oil prices and the economy of Saudi Arabia is benefited in form of high export revenues however in case of reduction in the oil prices, the economy of the country is stable enough to remain consistent for a period of time but despite this fact the fluctuation in the oil prices accounts for the economic instability in the country and due to this reason the government of Saudi Arabia is also encouraging the growth of non oil sectors so that dependency of the country on oil revenue could be declined and fluctuations in the oil prices could not cause economic instability in the country (Meir Javedanfar, n.p, 2005)

Fluctuations in Oil Prices and the Economy of Jordon

Jordon is a small country of Middle East with respect to its population size (US Department of States, 2007). The country possesses very little natural resources and the economy of Jordon was very weak before 1970s and many commodities are products were imported in Jordon from other countries due to which a large amount of money was paid for the import bill however by the late 1980s there was enormous rise in the GDP growth of the country and Jordon secured a stable economic position in the region but this growth was contributed by phosphate export and performance of the manpower; the oil prices remained a huge expenditure for the country.

The increase in the oil prices in the 1980s draws negative effects on the economy of the country and there was reduction in the remittances and regional trade activities due to high oil prices (Van Hear, N, pp. 352, 1995). Though three oil wells were discovered in the country in late 1980s but that discovery was insufficient to fulfil the country’s requirements and Jordon still had to export oil from Saudi Arabia and Iraq in order to meet the energy needs (Géraldine Chatelard, n.p, 2004). Jordon has to pay a very large bill for the import of the oil and the fluctuation is the price of oil results in change in the oil expenditures of the country as well. Over the last decades, most of the time the prices of oil went high and as a result Jordon also has to pay more for the import of oil from other countries (US Department of States, 2007). The change in the domestic political and social conditions of the oil producing countries also affected the economy of Jordon because it depends on these countries for the export of oil.

In short the effect of the oil price fluctuation on the domestic economy of Jordon can b summed up with a n inverse relationship between oil price and economic growth because when the oil price went on rising, Jordon has to pay even more for the export of oil and the expenditures of the country are increased and in case of low oil prices the oil export bill also wend down for Jordon and ultimately the economy of country is benefited in form of less expenditures for more oil that results in export of more oil and non oil based products of the country (Van Hear, N, pp. 352, 1995).

Fluctuations in Oil Prices and the Economy of Iraq

Oil is considered as the backbone of the Iraq economy and the history of the country witnesses that the revenues came from the oil export contribute towards the economic stability of the country (Basu, P. and D. McLeod, p.89, 1991). Iraq possesses second largest oil reserves of the world after Saudi Arabia (Hamilton, J. D, p.228, 1983). According to EIA report about Iraq economy, after the Iran Iraq war the economy of Iraq was badly affected and the GDP growth of the country was also declined to a very low rate however the dependency of the country on the oil revenue supported the economy and as a result of high oil prices the GDP growth in Iraq went on rising in the flowing years.

There was rise of 12 percent in the GDP growth of the country in 1999 and in the year 2000 the GDP rose by 11 percent (Balassa, B, p23, 1985) however after the American invasion on Iraq the economy went down again and not only the rate of inflation was increased but the GDP growth rate was also declined. hence the fluctuation in the oil prices are not affecting the economy of Iraq now day due to worst social and political instable conditions however over the last few decades the oil price fluctuation has played significant role in the economic development of the country. in 1973 when the world witnessed the first oil shock in form of rise in oil prices, the oil revenues for Iraq reached to the level of $1.8 billion and as a result of second oil shock in 1978, Iraq received $23.6 billion from the export of the oil. during the time period of 1973 to 1980 the GDP growth rate was also in double figures that shows that rise in price benefited the economy of Iraq (Hamilton, J. D, p 228, 1983).

Fluctuations in Oil Prices and the Economy of Libya

Libya is an oil producing country of Middle East that hugely depends upon the revenues from the export of oil and oil based products (Bahgat, G, p373, 2004). The country possesses a stable position in the world oil market. As the oil prices fluctuate in the world oil market the economy of Libya is also significantly affected by these price changes because of the dependency of the country over the export of oil and oil products (Abosedra, S. S., n.p., 1984).

It has been observed that the economic growth and performance of the country is accelerated due to rise in the price of oil in the world oil market because Libya get more money against the import of oil in case of rise in the oil prices and ultimately the GDP grown and overall economic conditions of the country become better (Altunisik, M. B, p49, 1996). On the other hand fall in the price of oil results in the decline of the oil revenues. It has been discovered that the oil revenues have played a leading role in the growth and development of the country and as a result of fluctuation in the price of oil the expenditures of government and the flow of money in the country is also affected (Abosedra, S. S., n.p., 1984).

In short being an oil producing country, the economy of Libya heavily depends upon the oil prices and the fluctuation in the oil price make major changes in the revenues, government expenditures and money flow in the country. In case of rise in the oil prices the country enjoys more revenues and the economic conditions also become better for the country.

Fluctuations in Oil Prices and the Economy of Oman

Oman possesses modest oil reserves as compared with other countries of the middle east region however the economy of the country is based on oil and oil based products. In the economy of Oman oil secures great importance and the GDP growth of the country also depends upon the revenues collected from the export of oil (CIA World Fact book, 1993). Since the year 1980, 30 percent of the total GDP was contributed by oil. As a result of the fluctuation in the prices of oil, the economy of Oman receives positive impacts and the GDP growth of the country rises with the increase in the oil price (US Department of State, 2004).

At the time of Iraq invasion of Kuwait the prices of oil were increased and during that time there was increase of 38 percent in the oil revenues of Oman. During the time period of 1993 to 1993 there was rise in the oil prices and the GDP growth rate of Oman also rises from 4.4 percent to 6.2 percent whereas in the year 1998 when there was decline in the oil prices the GDP growth rate of the country was also declined to 2.9 percent (CIA World Fact book, 1993). In the year 2004 the oil revenues of Oman have a share of 66.9 percent in the government revenues and 39.2 percent in the overall GDP of the country (US Department of State, 2004).

It can be concluded that the fluctuation in the oil prices has resulted in the fluctuation in the economic condition of Oman also and the rise in the oil price benefited the country in form of high oil revenues and high rate of GDP growth whereas in case of oil prices decline the GDP rate and the export revenues also decline due to which the economic instability prevailed in the country and to overcome this instability the government of Oman is planning to rise the economic dependency on the non oil sectors as well (CIA World Fact book, 1993).

Fluctuations in Oil Prices and the Economy of UAE

United Arab Emirates is an important oil producing country of the Middle East region. It possesses 97.8 billion barrels of crude oil that is about 8 percent of the world total reserves. It is revealed by the Central Bank of United Arab Emirates that the country is moving rapidly to secure high rate of GDP growth and during the year 2005 there was rise of 25.6 percent in the GDP of the UAE (Global Research UAE, p32, 2007). An important reason behind the economic growth of the country is sought as high prices of oil that contribute to a rise in the oil export revenues of UAE. the oil and gas sector has the share of 35.7 percent in the total economy of UAE. The economy of UAE is flourishing due to a number of factors among which the rise in the oil price is am important one. (Global Research UAE, p32, 2007)

When there is fluctuation in the prices of oil in the world oil market the share of oil revenues also fluctuate in the economic growth of the country and ultimately the entire economic condition is affected. However the government of UAE is concentrating towards non oil sector also and as a result the non oil sectors like banking and IT are also playing major role in the economic development of the country. In the year 2000 there was decline of 14.3 percent in the oil prices that contribute towards the decline of oil sector production in UAE. the oil sector production dropped to Dh. 48.0 billion from Dh. 51.3 billion and as a result the GDP of the country also declined from Dh. 23.9 per cent to Dh. 22.1 per cent (Global Research UAE, p32, 2007) but later the GDP was increased due to indirect effects of rise in the oil prices. In this way the economy of UAE continues to face ups and downs due to fluctuation in the oil prices in the world market and being an oil producing country, UAE is always benefited from rise in the oil prices.

Analysis & Discussion

The case studies of different countries of the Middle East regions unfold different aspects related with the impact of oil price fluctuation on the domestic economies of Middle Eastern countries. It is observed from the cases of these countries that fluctuation in the oil prices have major role to play in the economic development of these countries. Oil is an important component of world economy and the middle eastern countries being either oil producing or oil importing countries have great concerns with the changes occurring in the price level of oil in the world market.

The fluctuation of oil prices brought different impact on different economies depending upon the level of the reliance on the oil and oil based products by the countries. The oil producing countries like Saudi Arabia, Iraq and UAE etc are benefited from the rise in the oil prices because these countries get more revenues from the export of oil. the contribution of the oil revenue also increases in the total GDP and ultimately the entire economic growth is accelerated due to rise in the oil prices. The sound economic development of UAE, Saudi Arabia and other oil producing countries is example of positive effects of oil price increase but the oil importing countries have to pay more for oil bills and as a result their expenditures are increased and economic growth is slow down. In the same way the decline in the oil price result in low export revenues to the oil producing countries and the oil importing countries get some relief in their oil import bills.

It is revealed from the case studies of the middle east countries that the fluctuation in the oil price causes fluctuation the economic growth of these countries as well. This is because most of the Middle East countries are highly dependent on the oil sector either for getting revenues from export or importing it to fulfil the energy needs of the country and due to this reason the change in the prices of oil affects the economies of these countries very mush. The instability in the world oil market has causes instability in the economic conditions of the Middle Eastern countries also and in order to cover this instability many of the countries of Middle East are planning to encourage growth and production in non oil sectors also.

At present the government of Saudi Arab, UAE and Oman etc are planning many projects to promote production in the non oil sector so that the economies of these countries could be prevented from the ongoing fluctuations in the oil prices. The performance of UAE in the non oil sectors like telecommunications, banking and IT has proved to be a great step towards promotion of non oil sector performance so that the economy of the country can bear the impact of oil price changes.

Conclusion

The case studies and analysis of the economic performance of the Middle Eastern countries proved that more a country relies on the oil revenues, more its economy is affected by the fluctuation in the oil prices. The domestic economies of the Middle East countries are also affected by the fluctuation in the oil prices. There are several reasons behind the fluctuation in the oil prices and it is not expected in coming future that all the factors affecting the oil prices will be in control and the prices of oil will use to be stable for long time period. Hence in this context the better strategy of the Middle east countries should be to decrease the reliance on the oil sector and to increase the production in the non oil sector so that despite the changes in the oil prices in the world market, the economies of these countries continue to grow with same pace.

Work Cited

Abosedra, S. S. (1984), a simulation study of the impact of the world oil prices on the development of the Libyan economy, United States – Colorado, University of Colorado at Boulder.

Altunisik, M. B, A Rentier State’s Response to Oil Crisis: Economic Reform Policies in Libya, Arab Studies Quarterly, and 18(4):49, 1996.

A. F. Alhajji, Middle East politics still dictate oil prices – Brief Article, World Oil, p. 21, Thomson Gale Publications, 2001.

Abeysinghe, T., “Estimation of direct and indirect impact of oil price on growth,” Economics Letters 73(2): p.147, 2001.

Basu, P. and D. McLeod, “Terms of trade fluctuations and economic growth in developing economies,” Journal of Development Economics 37(1-2): 89, 1991.

Balassa, B., “Export, Policy Choices and Economic Growth in Developing Countries After the 1973 Oil Shock.” Journal of Development Economics 18: 23-35, 1985.

Bahgat, G, “Oil Terrorism and Weapons of Mass Destruction: The Libyan Diplomatic Coup.” The Journal of Social, Political, and Economic Studies 29(4): 373, 2004.

Balassa, B., “Export, Policy Choices and Economic Growth in Developing Countries After the 1973 Oil Shock,” Journal of Development Economics 18: 23-35, 1985.

CIA World Fact book, Oman Public Finance and the Five-Year Development Plans. The Library of Congress Country Studies; 1993. Web.

Dr. Ibrahim ibn Abdul Aziz Al Muhannam, Oil Price Hike: Reasons and Impacts, Arab news, Issue, 2004.

Géraldine Chatelard, Jordan: A Refugee Haven, Robert Schuman Center for Advanced Studies, European University Institute, 2004.

Global Research – UAE Economic & Strategic Outlook, UAE, Global Investment House, 2007.

Hiromi Kato, Effects of the Oil Price Upsurge on the World Economy, IEEJ, p2-7, 2005.

Hamilton, J. D. , Oil and the macro economy since world war II, Journal of political Economy:228-248, 1983.

IMF Statistics, IMF Executive Board Concludes 2006 Article IV Consultation with Saudi Arabia, Public Information Notice (PIN) No. 06, p. 108.

IEA, Analysis of the Impact of High Oil Prices on the Global Economy International Energy Agency, 2004, p.7.

Meir Javedanfar, Saudi Arabia – Economic Snapshot, Meepass Saudi Arab country profile, 2005.

Marco Venditti, Saudi Arabia: Climate For Change, Stretched To Capacity Published in International Spotlight Saudi Arabia, 2006.

Reiji Takeishi. Background of the Increase in Oil Prices and Prospects for the Future. Fujitsu Research Institute, 2000. Web.

Sherine Nasr, The domino effect, Oil and gold prices are skyrocketing as Middle East tensions persist, Published in AL-AHRAM, Issue No. 805, 2006.

US Department of States, Country Profile – Jordon, 2007.

Van Hear, N, “The Impact of the Involuntary Mass ‘Return’ to Jordan in the Wake of the Gulf Crisis”, International Migration Review, Vol. 29, Issue 2, pp. 352-374, 1995.

US Department of State, “Doing Business In Oman”. International Copyright, U.S. & Foreign Commercial Service And U.S. Department Of State, 2004.